- Kyiv School of Economics

- About the School

- News

- 40th issue of the weekly digest on impact of foreign companies’ exit on RF economy

40th issue of the weekly digest on impact of foreign companies’ exit on RF economy

13 February 2023

This is the last weekly digest and we will continue to provide updated information on a monthly basis from now on.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 06.02-12.02.2023.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we became partners with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia just by scanning barcodes.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

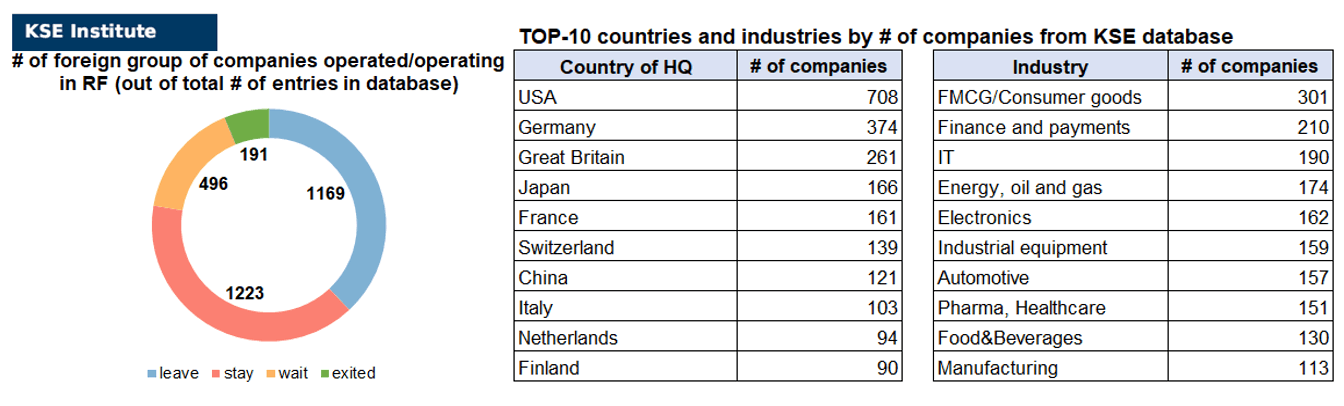

KSE DATABASE SNAPSHOT as of 12.02.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 223 (+3 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 496 (+2 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 169 (+11 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 191 (+8 per week)

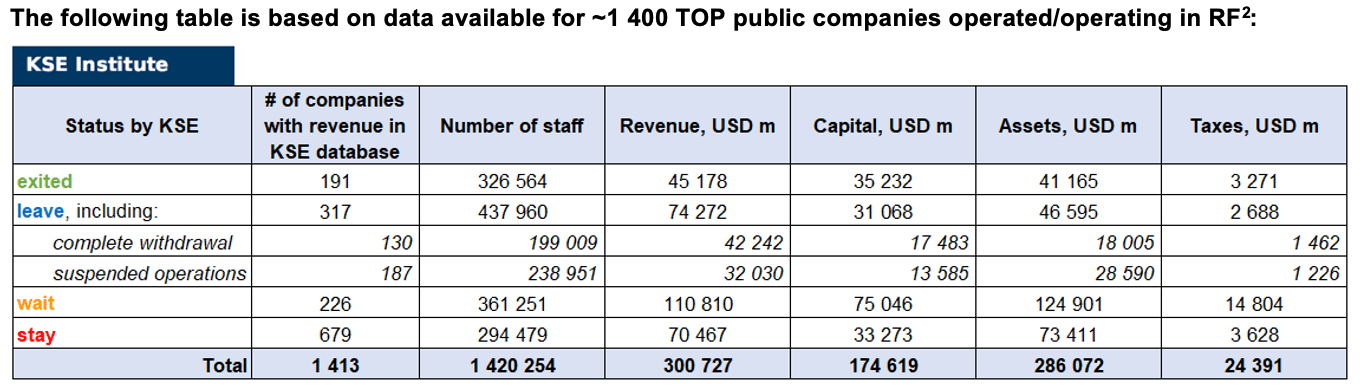

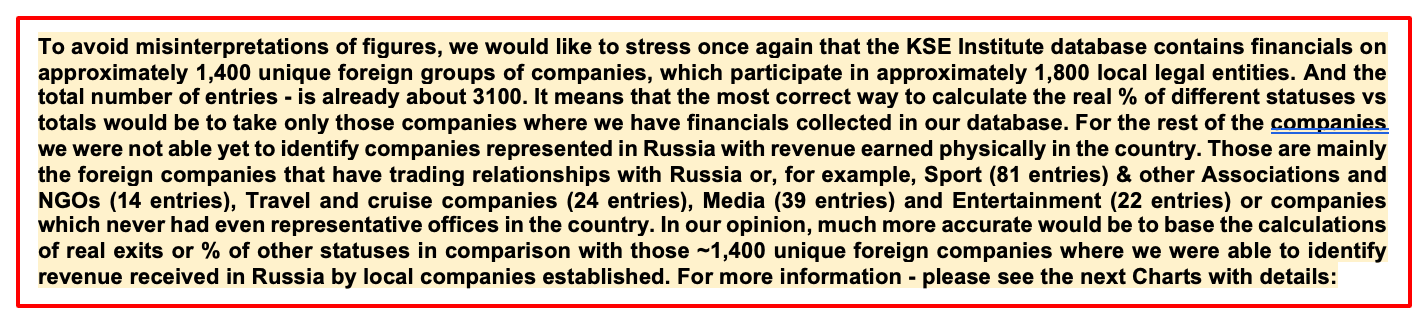

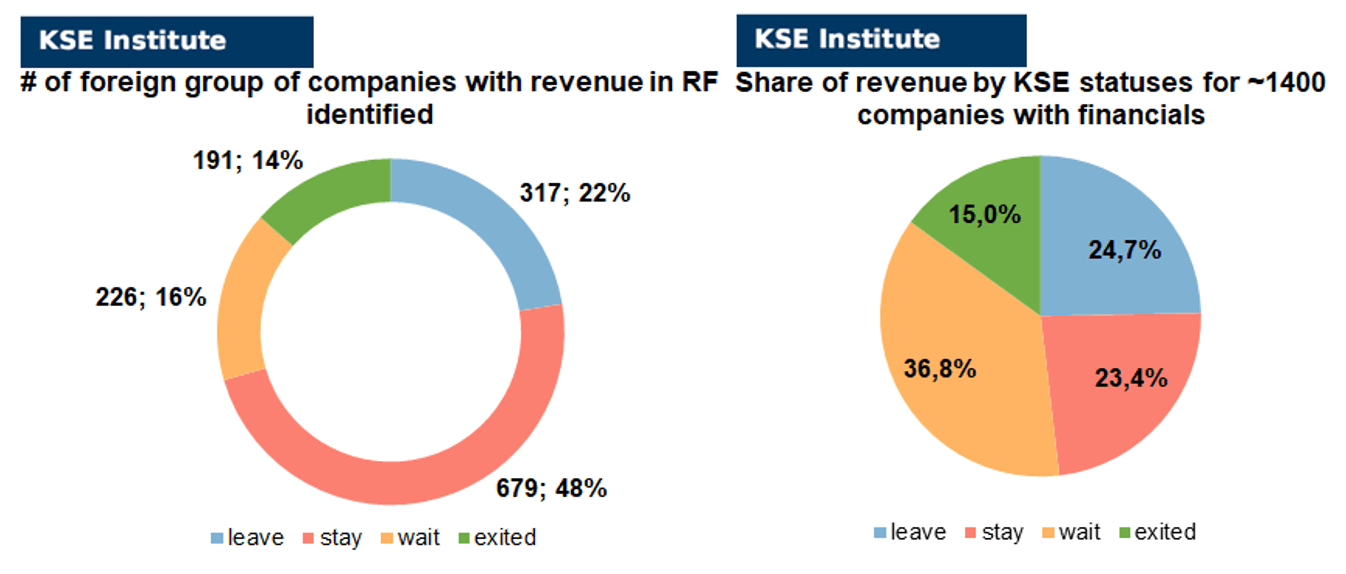

As of February 12, we have identified about 3,079 companies, organizations and their brands from 88 countries and 57 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 400 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $174.6 billion), local revenue (about $300.7 billion), local assets (about $286.1 billion) as well as staff (about 1.420 million people) and taxes paid (about $24.4 billion). 1,665 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 191 companies that have completed the sale of their business in Russia based on the information collected from the official registers. Also this week we added a few new companies identified by Yale SOM and deleted another few where double entries were found.

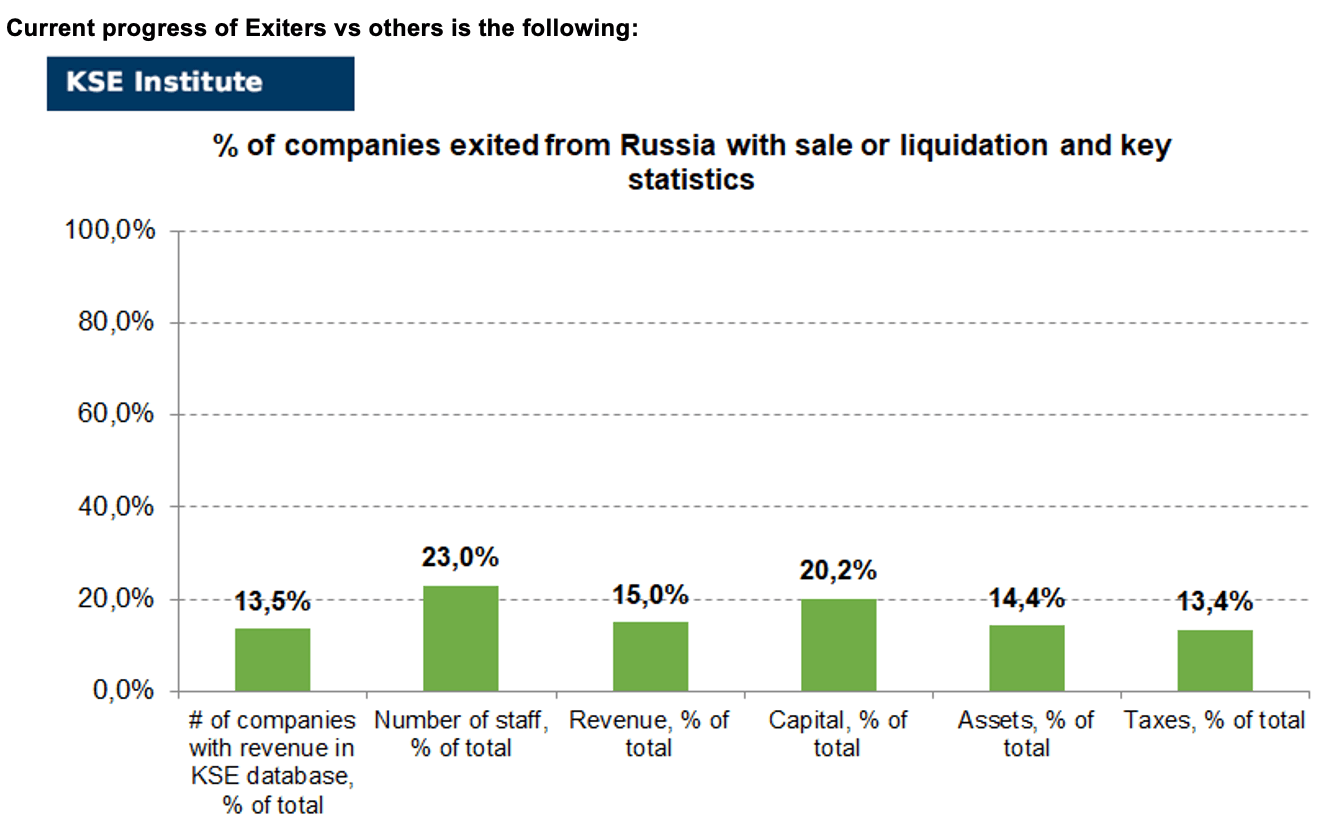

As can be seen from the tables below, as of February 12, 191 companies which had already completely exited from the Russian Federation, had at least 326,600 personnel, $45.2 bn in annual revenue, $35.2bn in capital and $41.2bn in assets; companies, that declared a complete withdrawal from Russia had 199,000 personnel, $42.2bn in revenues, $17.5bn in capital and $18.0bn in assets; companies that suspended operations on the Russian market had 239,000 personnel, annual revenue of $32.0bn, $13.6bn in capital and $28.6bn in assets.

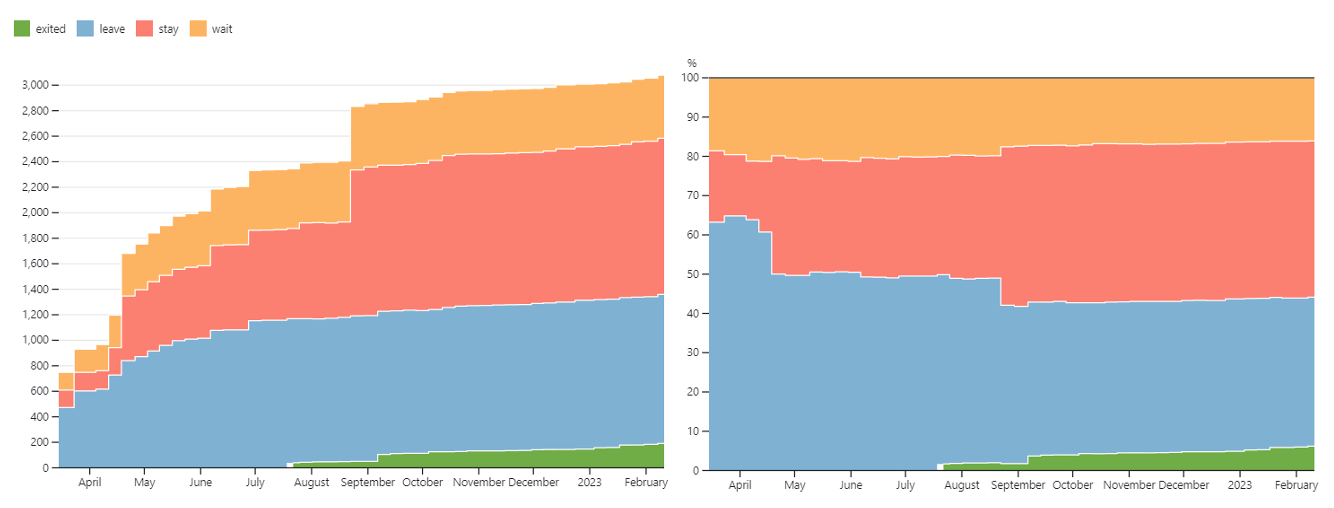

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last 5 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database). However, if to operate with the total numbers in KSE database, about 38.0% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 39.7% are still remaining in the country, 16.1% are waiting and only 6.2% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 191 companies that completely left the country, since they employed 23.0% of the personnel employed in foreign companies, the companies owned about 14.4% of the assets, had 20.2% of capital invested by foreign companies, and in 2021 they generated revenue of $45.2 billion or 15.0% of total revenue and paid $3.3 billion of taxes or 13.4% of total taxes paid by the companies observed. Data on 1,400 TOP companies is presented in the table above.

As it is visible on the charts above, roughly similar % of exited is obtained based on number of companies (14%) and on share of revenue withdrawn (15%). At the same time, a totally different picture is for those who are still staying – 48% of companies represent 23% of revenue and 16% of waiting companies represent 37% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Summary of our work results for the last 11 months

In this digest, we will summarize our work results since May 2022 (when the first issue of our digest was released) and, in general, since the beginning of the project, which began in the first days of the war.

As of now, we made in-depth analysis of such industries and important topics as:

Also, we made detailed reviews of 15 TOP (in terms of presence in Russia) country profiles:

| USA | Japan | China | Finland | Poland |

| Germany | France | Italy | Sweden | Canada |

| Great Britain | Switzerland | Netherlands | Austria | South Korea |

Several interesting digest issues have been produced with analytical reviews on the following topics:

- Do companies really exit the market when they claim so?

- How often do companies change their positions and in which direction?

- Why do some foreign companies remain in Russia?

- Another reason why companies should not stay in the Russian Federation: quarterly revenue analysis dynamics of parent companies depending on their statuses

- New Year & Christmas spendings in Russia will be significantly affected by the exit of foreign companies from the country.

Also, we devoted 4 issues to the results of the exit of companies from Russia by month:

- Deeds not words – analysis of the first 40 companies which have already managed to close business in Russia

- Results of November – companies exited from Russia in November 2022

- Results of December – companies exited from Russia in December 2022

- Results of January 2023 and since the beginning of the war.

Since the beginning of the project, our team has given dozens of interviews to TV channels and radio stations, many blogs and articles have been published in the mass media, and our work has been cited in more than 350 articles of the best Ukrainian and foreign media.

Our website https://leave-russia.org/ is visited daily by more than a thousand users from different parts of the world, about 2,000 users subscribed to the Twitter accounts of the SelfSanctions project and Twitter of website leave-russia.org. Also, the audience that reads Company News @ Leave-russia.org and uses the Telegram bot of the project is constantly growing.

BI analytics @ Leave-russia.org, https://leave-russia.org/banks and https://leave-russia.org/revenue already has more than 10 convenient and informative dashboards.

We would like to say “Thank you!” to all our readers who have stayed with us since the beginning of the project or joined recently. The next review of “exited” companies and their deals for February 2023 will be available in the beginning of March.

Also please visit section “Company news” on the project website https://leave-russia.org/ or subscribe to our Telegram-bot to follow up daily updates and keep up with the latest news.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)⁴

05.02.2023

05.02.2023

*Analog Devices (USA, Electronics) Status by KSE – stay

*NXP Semiconductors (Netherlands, Electronics) Status by KSE – stay

*Infineon (Germany, IT) Status by KSE – stay

The Rostekh’s kamikaze drone turned out to be assembled from parts for vapes and children’s toys

*Rolls Royce (Great Britain, Automotive) Status by KSE – wait

The Rolls-Royce Cullinan crossover has returned to the Russian market.

Premium foreign cars began to appear on sale at Russian dealers. Cars are imported into the country under the scheme of parallel import.

06.02.2023

*Siemens Energy (Germany, Energy, oil and gas) Status by KSE – wait

Siemens Energy continues to cooperate with Rosatom in a consortium with the French company Framatome.

https://www.fr.de/meinung/gastbeitraege/werkzeug-des-kreml-92069433.html

*China Taly Aviation Technologies Corp. (China, Aircraft industry) Status by KSE – stay

*Poly Technologies (China, Defense) Status by KSE – stay

*Fujian Nanan Baofeng Electronic Co. (China, Electronics) Status by KSE – stay

*Fujian Baofeng Electronics (China, Electronics) Status by KSE – stay

*AVIC International Holding Corp. (China, Defense) Status by KSE – stay

*Sinno Electronics (China, Electronics) Status by KSE – stay

Chinese companies are transferring technology to equip the Russian army, trade data shows

*Havas (Turkey, Air transportation) Status by KSE – stay

Turkey’s Havas may stop services to Russian airlines’ U.S.

https://www.reuters.com/business/aerospace-defense/turkeys-havas-may-stop-services-russian-airlines-us-made-planes-letter-2023-02-03/

*Turkmenistan Airlines (Turkmenistan, Air transportation) Status by KSE – stay

Turkmenistan Airlines Resumes Regular Flights To Russia’s Kazan Airport From Ashgabat

https://simpleflying.com/turkmenistan-airlines-flights-russia-kazan-airport/

07.02.2023

*Framatome (France, Energy, oil and gas) Status by KSE – stay

The French nuclear conglomerate Framatome has so far refused to end its cooperation with Rosatom

https://www.framatome.com/medias/framatome-and-rosatom-sign-long-term-cooperation-agreement/

*Sanderson Design Group (international, Luxury) Status by KSE – leave

Brand product takings were down 1% to £83.4mln, with a 17% decline in Europe due to an exit from Russia, while third-party revenue fell 3% to £22.2mln.

*Danone (France, FMCG) Status by KSE – wait

Danone can sell part of its assets in the Russian Federation with the possibility of repurchase

https://www.kommersant.ru/doc/5799193

*VEON (Netherlands, Telecom) Status by KSE – leave

The Russian government commission on foreign investment has approved the sale of VimpelCom to Russian management on the condition that at least 90% of bonds issued by its Dutch parent’s company Veon are in favor of Russian investors, reported the state-owned news agency RIA.

https://www.digitaltveurope.com/2023/02/06/russia-approves-vimpelcom-sale-on-condition/

*BP (British Petroleum) (Great Britain, Energy, oil and gas) Status by KSE – wait

British energy giant BP posts annual loss on Russia exit

*Mercedes-Benz (Germany, Automotive) Status by KSE – leave

A German company is selling a site in the Russian Federation

https://www.kommersant.ru/doc/5526634

*Energizer (USA, Consumer goods and clothing) Status by KSE – leave

ENERGIZER HOLDINGS, INC. Management’s Discussion and Analysis of Financial Condition and Results of Operations

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Shell completes Salym exit but reserves action on Sakhalin 2

*Nvidia (USA, IT) Status by KSE – exited

The shortage of Nvidia video cards can slow down Yandex’s projects on the development of drones and AI

*State Bank of India (SBI) (India, Finance and payments) Status by KSE – stay

Indian refiners pay traders in dirhams for Russian oil

https://www.reuters.com/business/energy/indian-refiners-pay-traders-dirhams-russian-oil-2023-02-03/

*Turkish Airlines (Turkey, Air transportation) Status by KSE – stay

Turkish Airlines started accepting Russian cards

08.02.2023

*Haier (China, Electronics) Status by KSE – stay

One of the largest Chinese manufacturers of household appliances, Haier, decided not to open an official representative office of the Machenike gaming laptop brand in Russia and to arrange direct deliveries. Haier itself has no plans to leave the Russian market. In the summer of 2022, Haier announced plans to expand the production of household appliances in Naberezhnye Chelny. The brand’s fourth factory will be built here.

*Nissan (Japan, Automotive) Status by KSE – exited

The Russian car manufacturer “AvtoVAZ” closed the deal on the acquisition of a share of the former Nissan plant in St. Petersburg: a 99% share was transferred to the company for a symbolic price of €1.

http://info.avtovaz.ru/press-releases/121027.html

*VEON (Netherlands, Telecom) Status by KSE – leave

VEON today announces receiving Russian regulatory approval for sale of its operations.

https://twitter.com/VEONGroup/status/1623277065754509312

*KION Group (Germany, Industrial equipment) Status by KSE – leave

Quarterly Statement Q3 2022: KION Group intends to withdraw from all business in Russia

https://reports.kiongroup.com/2022/ir/3/business-performance/highlights-of-q1-q3-2022.html

09.02.2023

*Dubai Aerospace Enterprise (United Arab Emirates, Air transportation) Status by KSE – leave

Dubai’s DAE records 2022 loss on Russian write-offs

*British American Tobacco (Great Britain, Alcohol&Tobacco) Status by KSE – leave

BAT said it was in advanced discussions with a “joint management distributor consortium” on the sale of its businesses in Russia and Belarus, but did not reveal the identity of the party or divulge further details on the talks.

https://finance.yahoo.com/news/bat-complete-sale-russian-business-072125180.html

*Fortum (Finland, Energy, oil and gas) Status by KSE – stay

Fortum to record additional pre-tax impairments of approximately EUR 990 million related to its Russia segment

*Smurfit Kappa (Ireland, Packaging) Status by KSE – leave

Smurfit leads Iseq multinationals when counting costs of retreat from Russia – The Irish Times

Smurfit Kappa, revealed on Wednesday, February 8, 2023 that it has agreed to sell its Russian assets – comprised of three plants in and around St Petersburg and a corrugated packaging plant in Moscow – to local management subject to the nod from Russian authorities.

09.02.2023

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – wait

IOC hints at punishing Ukrainian athletes for boycotting Olympics

https://www.pravda.com.ua/eng/news/2023/02/9/7388706/

https://twitter.com/hajoseppelt/status/1623663954806407169

*Smart Impex (Germany, IT) Status by KSE – stay

Components for Putin’s weapons?

https://www.tagesschau.de/investigativ/monitor/russland-ukraine-sanktionen-101.html

*Spotify (Sweden, Online Services) Status by KSE – leave

Spotify has started the liquidation of its legal entity in Russia

https://www.epravda.com.ua/news/2023/02/9/696892/

https://tass.ru/ekonomika/17010975

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – wait

Unilever flags risk it may have to halt Russia operations

*Tik Tok (China, Online Services) Status by KSE – leave

TikTok blocked a network of accounts spreading Russian propaganda

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

On February 8, Euroclear will forcefully convert clients’ ruble balances

https://quote.rbc.ru/news/article/63e339399a79477df5fbd1b1

*Western Union (USA, Finance and payments) Status by KSE – leave

The Company’s fourth quarter revenue of $1.1 billion declined 15% on a reported basis, or 6% on a constant currency basis excluding the contribution from Business Solutions, compared to the prior year period. The suspension of operations in Russia and Belarus negatively impacted revenue by approximately three percentage points.

https://s21.q4cdn.com/100551446/files/doc_financials/2022/q4/4Q22-Press-Release-Final.pdf

*Uniqlo (Japan, Consumer goods and clothing) Status by KSE – leave

The Japanese clothing manufacturer and seller Uniqlo, which suspended operations in Russia in the spring of 2022, probably decided not to resume work in the country. The company terminated the leases for some shopping centers, and it may take several months to wind down the entire business. The vacated areas may be occupied by department stores or clothing chains of the mass segment.

https://www.kommersant.ru/doc/5812630

*Metro AG (Germany, FMCG) Status by KSE – stay

Metro AG continues operations in Russia, despite falling sales

https://biz.liga.net/all/fmcg/novosti/gendirektor-metro-my-hotim-ostatsya-na-rossiyskom-rynke

The CEO of Metro AG, Steffen Groibel, said on Thursday that the company intends to continue operations in Russia.

*GE (USA, Industrial equipment) Status by KSE – wait

GE suspended Russian operations after the Ukraine invasion a year ago. Here’s why it hasn’t fully departed Russia.

*JOMA (Spain, Consumer goods and clothing) Status by KSE – stay

Spanish JOMA, a manufacturer of uniforms for football teams, continues to work

ECB piles pressure on banks to exit Russia even as window for sale closes

https://www.ft.com/content/d8d41114-55ec-4078-93c3-6b05033ef697

KSE Institute and Yale School of Management issued last week a joint paper named “The Russian Business Retreat – How the Ratings Measured Up One Year Later” at the Social Science Research Network (or SSRN) – TOP world’s repository of scholarly research in the economy, social sciences, humanities, life sciences among others. Here is the link with this work:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4343547

Also, last week we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site