- Kyiv School of Economics

- About the School

- News

- 12th issue of the weekly digest on impact of foreign companies’ exit on RF economy

12th issue of the weekly digest on impact of foreign companies’ exit on RF economy

1 August 2022. Release №12

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 25-31.07.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

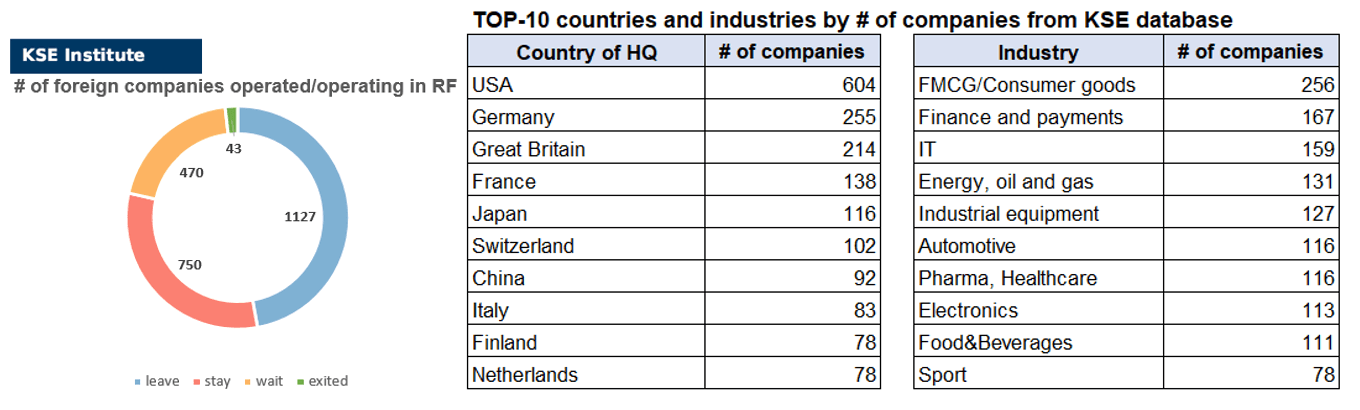

KSE DATABASE SNAPSHOT as of 31.07.2022

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 750 (+43² per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 470 (+1 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 127 (-3 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 43 (+4 per week)

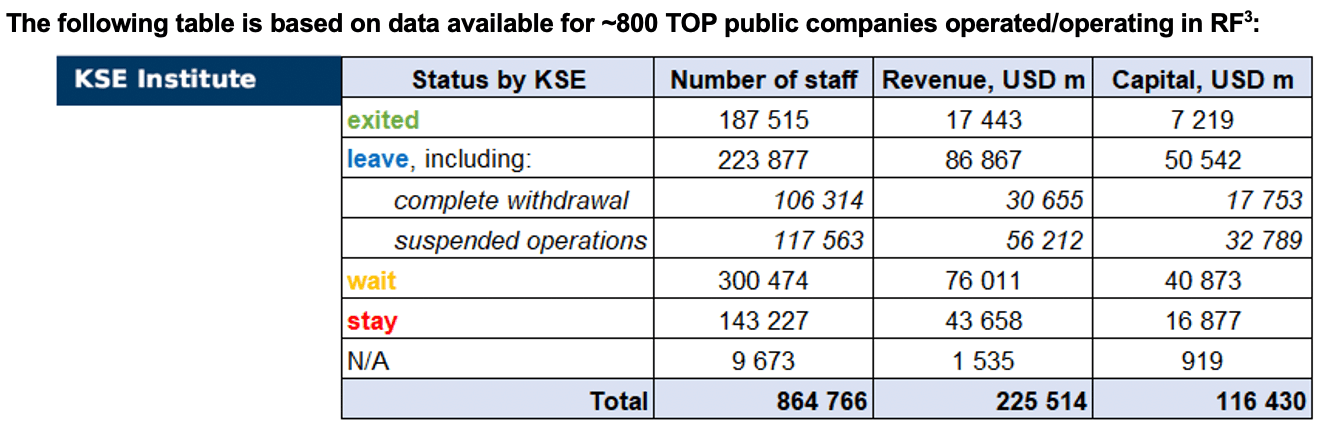

As of July 31, we have identified about 2,390 companies, organizations and their brands from 78 countries and 56 industries and analyzed their position on the Russian market. About half of them are public ones, for ~ 800 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity), which allowed us to calculate the value of capital invested in the country (about $116.4 billion), local revenue (about $225.5 billion), as well as staff (about 0.865 million people). 1,640 foreign companies have reduced, suspended or ceased operations in Russia. Also, last week we added information about companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, As of July 31, companies which had already completely exited from the Russian Federation, had 187,500 personnel, $17.4 billion in annual revenue and $7.2 billion in capital; companies, that declared a complete withdrawal from Russia had 106,000 personnel, $30.7bn in revenues and $17.8bn in capital; companies that suspended their operations on the Russian market had 117,000 personnel, annual revenue of $56.2bn and $32.8bn in capital.

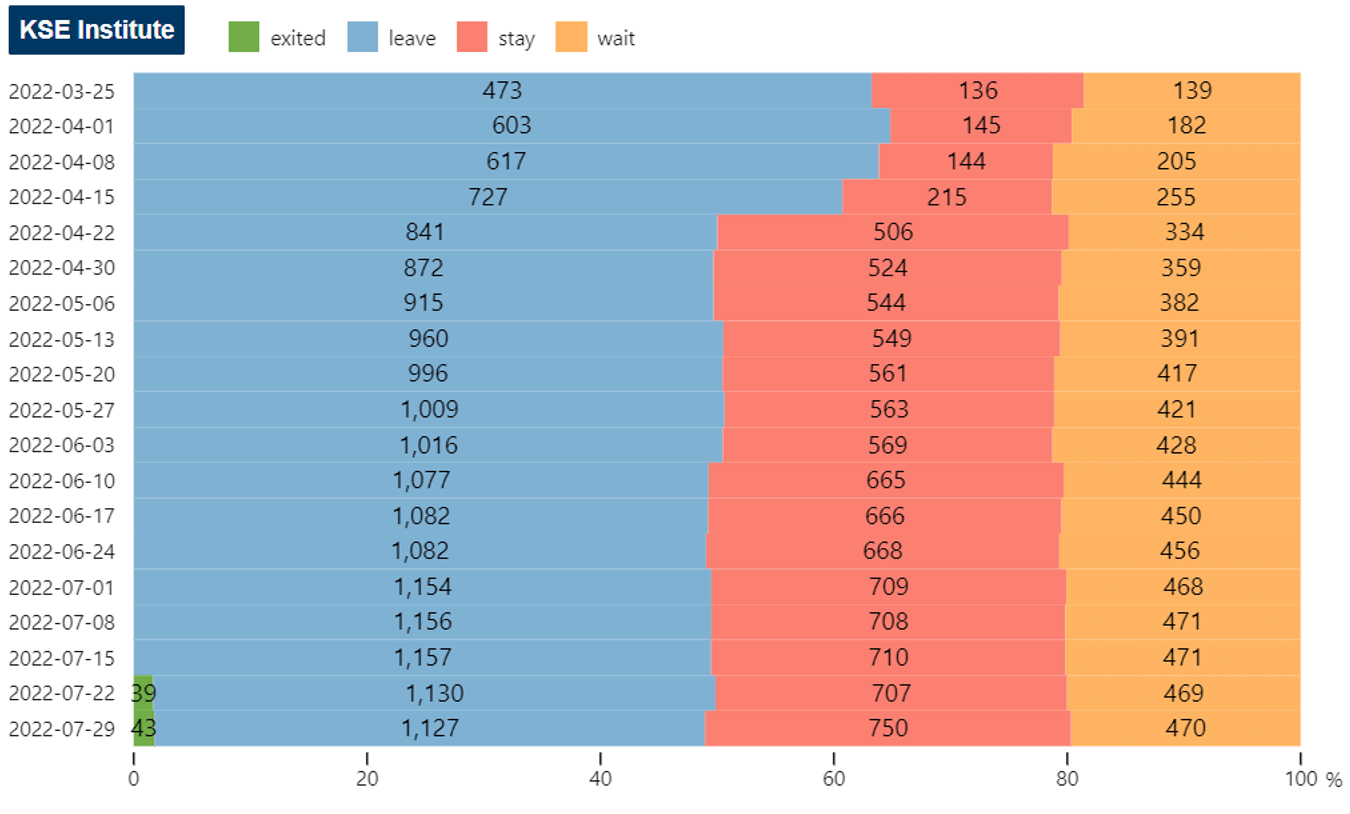

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about a half (47.2%) of foreign companies have already announced their withdrawal from the Russian market, but another 31.4% are still remaining in the country and only 1.8% made a complete exit.

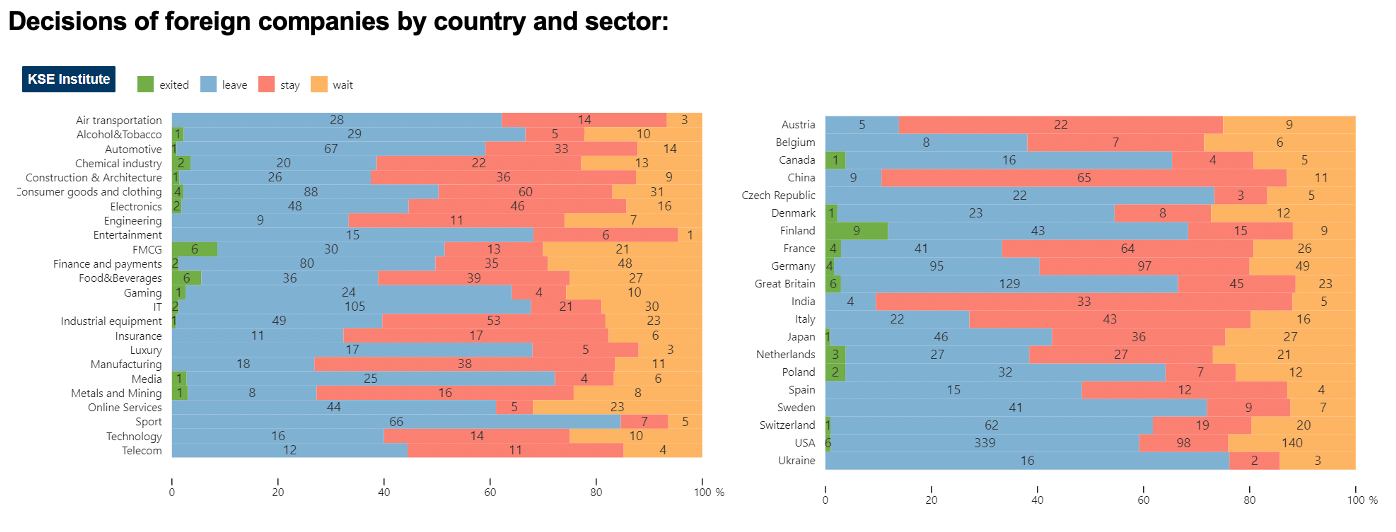

The actions of companies by sector (based on the KSE database, with at least 20 companies representing the industry or country) are shown in the graphs below.

Decisions of foreign companies by country and sector:

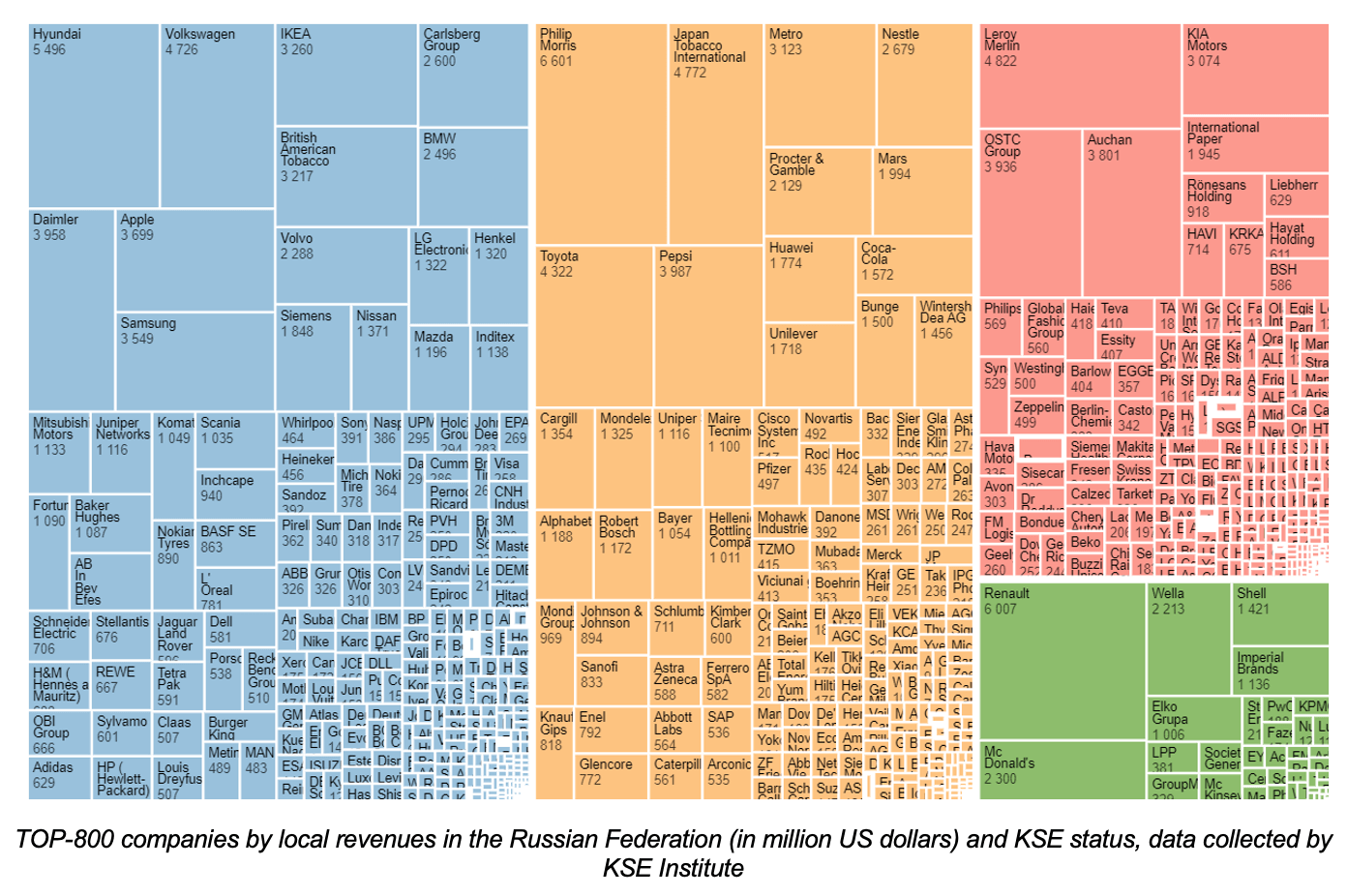

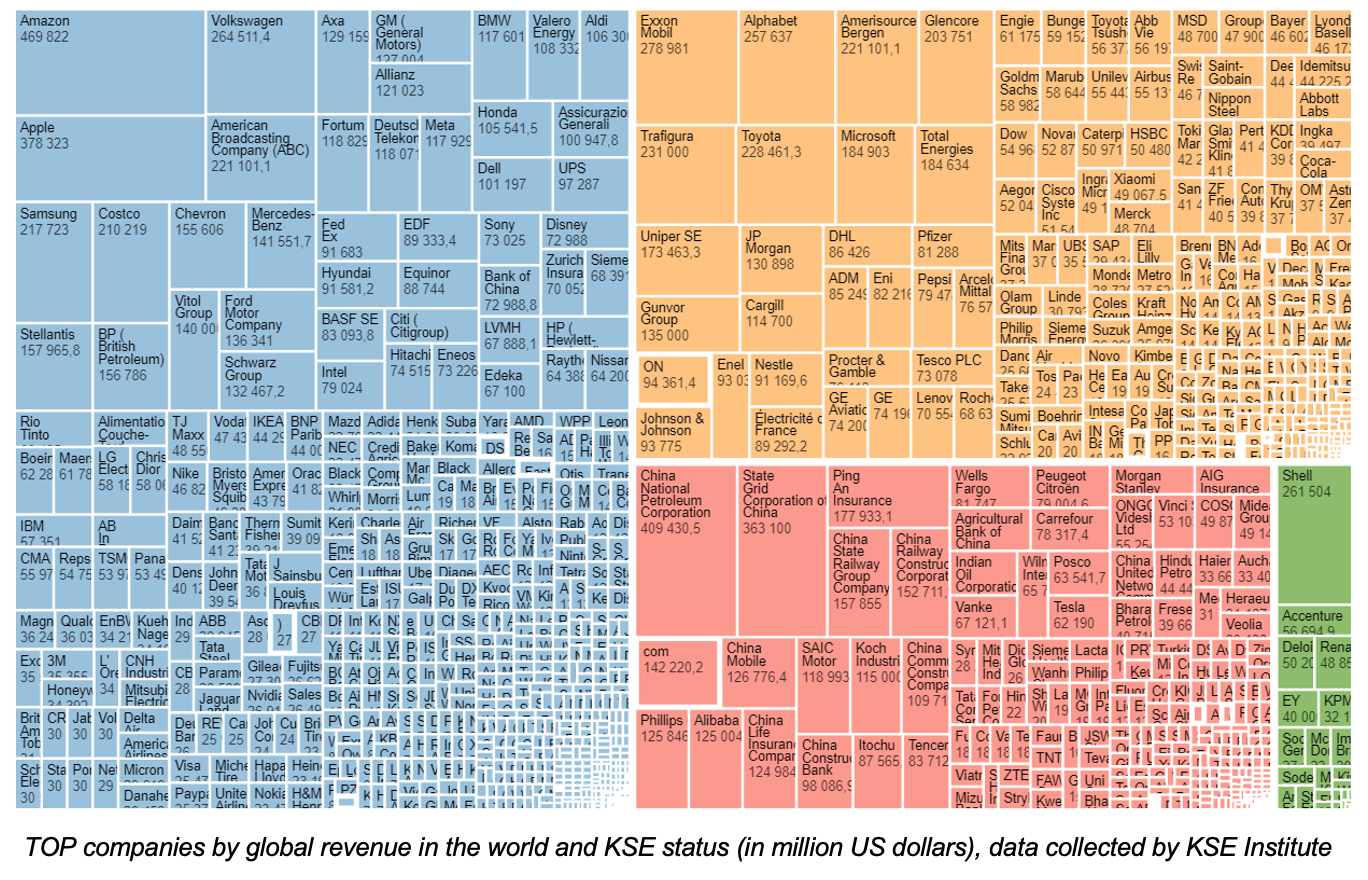

Decisions of TOP foreign companies in terms of local and global revenue⁴:

WEEKLY FOCUS. DO COMPANIES EXIT THE MARKET WHEN THEY CLAIM SO?

On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/.

Last week we introduced the new status in our database, “exited”, which looked at the company’s announcement and included actual actions following the announcement. We published about 39 companies that left the Russian market and finalised their exit by transferring the ownership of their legal entities in Russia. After the publication, we received a few comments, which we appreciate, and we would like to clarify the status and also state the limitations of the analysis.

The primary issue with tracking companies’ exit is that companies’ announcements and even changes in ownership of Russian business of international companies do not guarantee the actual exit of the company. Sometimes only public attention and insider information can clarify the situation. But it is not often available for the companies, especially those less covered by the media.

One of the popular strategies of companies’ exit to transfer or sell Russian business to local management raises suspicion the most. This is the strategy of professional services companies and many others. Here is an example of what can be wrong with such an exit. In early March, WPP, the owner of the GroupM advertising agency, announced the decision to discontinue operations in Russia⁵. In May, the company’s name changed to Group4Media. Still, this is what has been reported by СЕО Group4Media Maria Kolosova: “As before, we remain in touch with our foreign colleagues, continue to work in accordance with accepted international and Russian standards and fully fulfil our obligations to our clients and partners.“⁶.

This question is whether GroupM left Russia or is just a false front. As companies transferred to local management continue to operate, the question of whether they are entirely disconnected remains.

Another example is L’occitane. The company announced the closure of stores in April, though it still paid salaries to its employees⁷. In May, the company announced its intention to exit Russia entirely and not to supply its products to Russian retailers⁸. In June, the ownership was transferred to local management and the shop’s name is now transliterated to Cyrillic. Shops resumed operations, and L’occitane products are available in shops according to media reports⁹.

Grey imports are another example. In March, Russia allowed parallel imports of goods. This means that goods can be imported to Russia without the agreement of their producer. There was news that stores started to sell grey imports.¹⁰.

The role of the producer is questionable. For instance, the Samsung plant in the Kaluga region, which produced televisions and household appliances, was reported to resume work at the beginning of June partially. These products cannot be sold directly in Russia, but they can be exported to CIS countries, after which they can be imported under the parallel import scheme.¹¹.

The above examples show just another evidence of how important it is to keep public attention and pressure on companies for them to exit the market as some companies comply with sanctions formally and look for ways to continue operations.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)

26.07.2022

*Tetra Pak (Sweden, FMCG) Status by KSE – leave

Tetra Pak has now reached an agreement to divest its Russian business to local management, with the intention of enabling business continuity for its customers, minimizing the impact on employees, and continuing to support consumers’ access to essential food.

https://www.tetrapak.com/about-tetra-pak/news-and-events/newsarchive/Tetra-Pak-to-exit-Russia

27.07.2022

*McCormick (USA, Food & Beverages) Status by KSE – leave

The Kamis seasoning manufacturer may leave the Russian market

https://www.epravda.com.ua/news/2022/07/27/689671/

*UBS (Switzerland, Finance and payments) Status by KSE – wait

UBS reduced its exposure to the country and continues to do so. At the end of June, UBS had a direct country risk exposure to Russia of $300 million, down from $400 million at the end of the first quarter, and half of the $600 million exposure at the end of last year, UBS said in its second-quarter report.

https://www.retailnews.asia/ubs-retreats-from-russia-in-small-steps/

28.07.2022

*Otis Worldwide (USA, Industrial equipment) Status by KSE – leave

Otis will sell 100% of the business to Ice Development.

https://news.finance.ua/ua/naybil-shyy-vyrobnyk-liftiv-otis-u-sviti-prodaye-sviy-biznes-v-rf

https://www.otis.com/en/us/news?cn=otis-enters-into-agreement-to-sell-its-russia-business

*Iveco (Italy, Automotive)Status by KSE – leave

Final exit update, not visible in the registry yet – On 20th July, Iveco Group N.V. executed a dissolution agreement with the Russian JV, IVECO AMT, also formally presenting its withdrawal from the legal entity. Accordingly, the Iveco Group stake (33.3%) was returned to IVECO AMT.

*British American Tobacco (Great Britain, Alcohol&Tobacco )Status by KSE – leave

Exit update: initiated the process of transferring its Russian business

*Volkswagen (Germany, Automotive) Status by KSE – leave

Volkswagen is looking to sell its car assembly plant in the Russian city of Kaluga and a Kazakh auto maker could be a potential purchaser, Russia’s Vedomosti newspaper reported on Wednesday.

29.07.2022

*Kraft Heinz (USA, Food & Beverages) Status by KSE – wait

American food manufacturer Kraft Heinz, the largest shareholder of which is Warren Buffett’s Berkshire Hathaway, is putting up its business for the production of baby cereals, purees and other baby food for sale

https://www.epravda.com.ua/news/2022/07/29/689772/

https://www.kommersant.ru/doc/5482348

*Guardian Industries (USA, Manufacturing) Status by KSE – leave

Guardian Industries sold its business in Russia to Vladimir Alexandrovich Voronin, President of FSK Group

https://news.kochind.com/en-us/news/2022/koch-responds-crisis-ukraine-statements

*Technip Energies (France, Engineering) Status by KSE – wait

Technip Energies’ exit from the Arctic LNG 2 project in Russia is due to complete in a few months, according to chief executive Arnaud Pieton; no update on Yamal LNG

*OMV (Austria, Energy, oil and gas) Status by KSE – wait

Significantly reduced its exposure to risks related to importing Russian gas later this year

30.07.2022

*DHL (Germany, Logistics, Transport) Status by KSE – wait

Suspended all shipments to Russia in March. Will stop domestic services within Russia, effective September 1st, 2022.

https://www.dhl.com/global-en/home/global-news-alerts/global-messages/ukraine.html?back=1

*Latvijas Gaze (Latvia, Energy, oil and gas) Status by KSE – stay

Continues to buy Russian-made gas after statements about the refusal of direct supplies, fuel is purchased from an intermediary. Stated by the head of the company Aigars Kalvitis.

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² The sharp increase over the last week is explained by the migration of some companies from the “Status not determined” group to the “Stay” group.

³ As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The first collected information is already available and systematized in the form of a newKSE’s status “exited”.

⁴ KSE Institute started to develop new BI analytics module with a lot of dashboards, the first one is already available at the https://leave-russia.org/ website soon, stay tuned for further updates

⁵ https://www.wpp.com/news/2022/03/wpp-announces-decision-to-discontinue-operations-in-russia

⁶ https://adindex.ru/news/agencies/2022/05/17/304322.phtml

⁷ https://group.loccitane.com/sites/default/files/2022-04/220415_LOCCITANE_Press_Release.pdf

⁸ https://group.loccitane.com/sites/default/files/2022-05/220519_LOCCITANE%20Russia%20Statement_en.pdf

⁹ https://iz.ru/1346815/2022-06-08/magaziny-loccitane-vozobnovili-rabotu-v-rossii