- Kyiv School of Economics

- About the School

- News

- 17th issue of the weekly digest on impact of foreign companies’ exit on RF economy

17th issue of the weekly digest on impact of foreign companies’ exit on RF economy

5 September 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 29.08-04.09.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

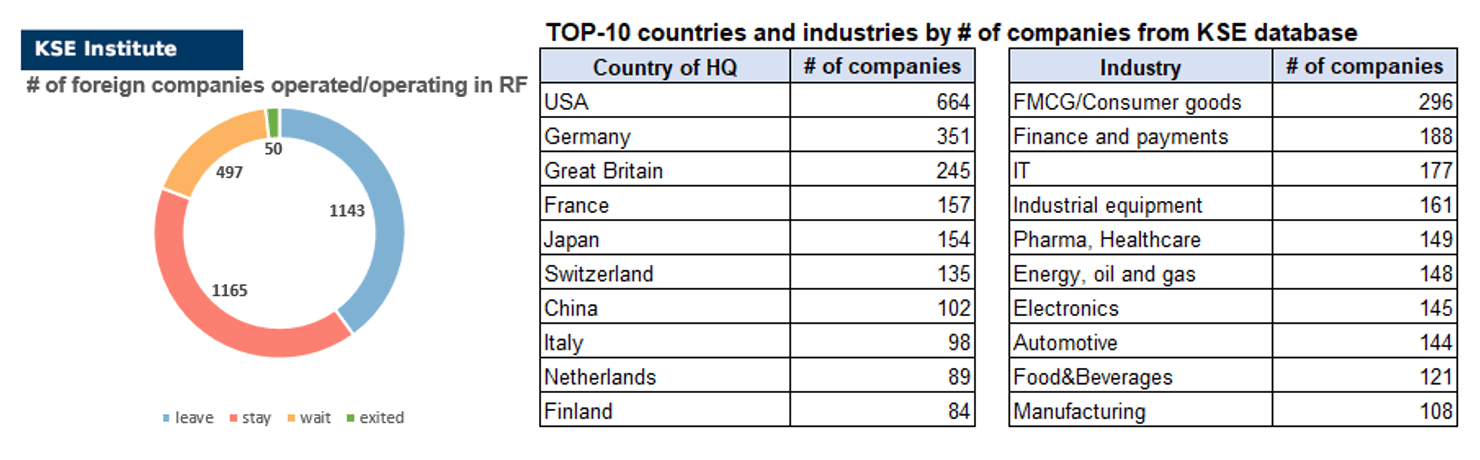

KSE DATABASE SNAPSHOT as of 04.09.2022

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 165 (+21² per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 497 (0 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 143 (+1 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 50 (0 per week)

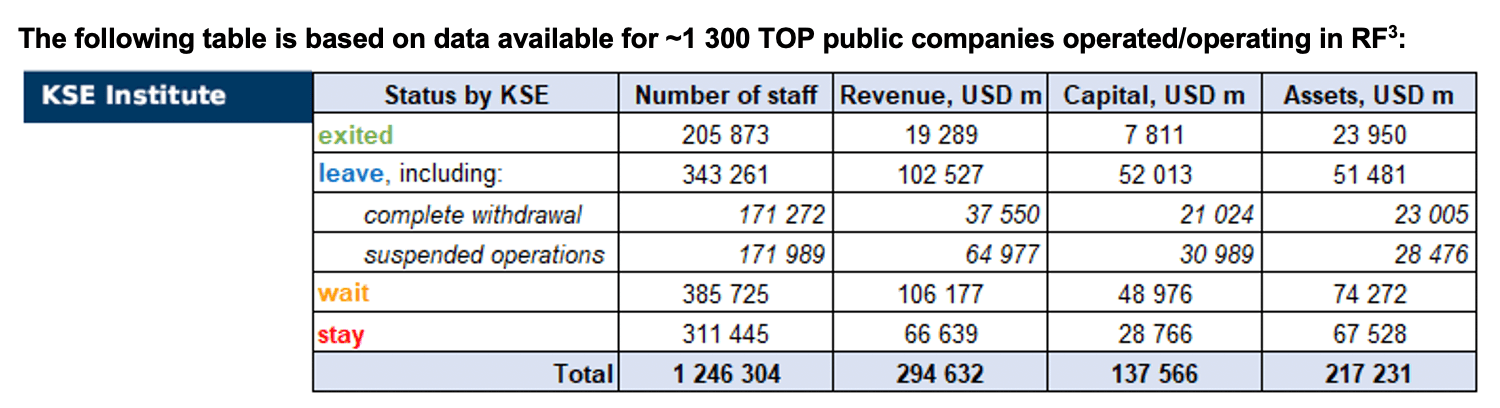

As of September 04, we have identified about 2,855 companies, organizations and their brands from 83 countries and 56 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~ 1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $137.6 billion), local revenue (about $294.6 billion), local assets (about $217.2 billion) as well as staff (about 1.246 million people). 1,690 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 50 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of 04/09/2022, companies which had already completely exited from the Russian Federation, had 205,900 personnel, $19.3 bn in annual revenue and $7.8 bn in capital; companies, that declared a complete withdrawal from Russia had 171,300 personnel, $37.6bn in revenues and $21.0bn in capital; companies that suspended operations on the Russian market had 172,000 personnel, annual revenue of $65.0bn and $31.0bn in capital.

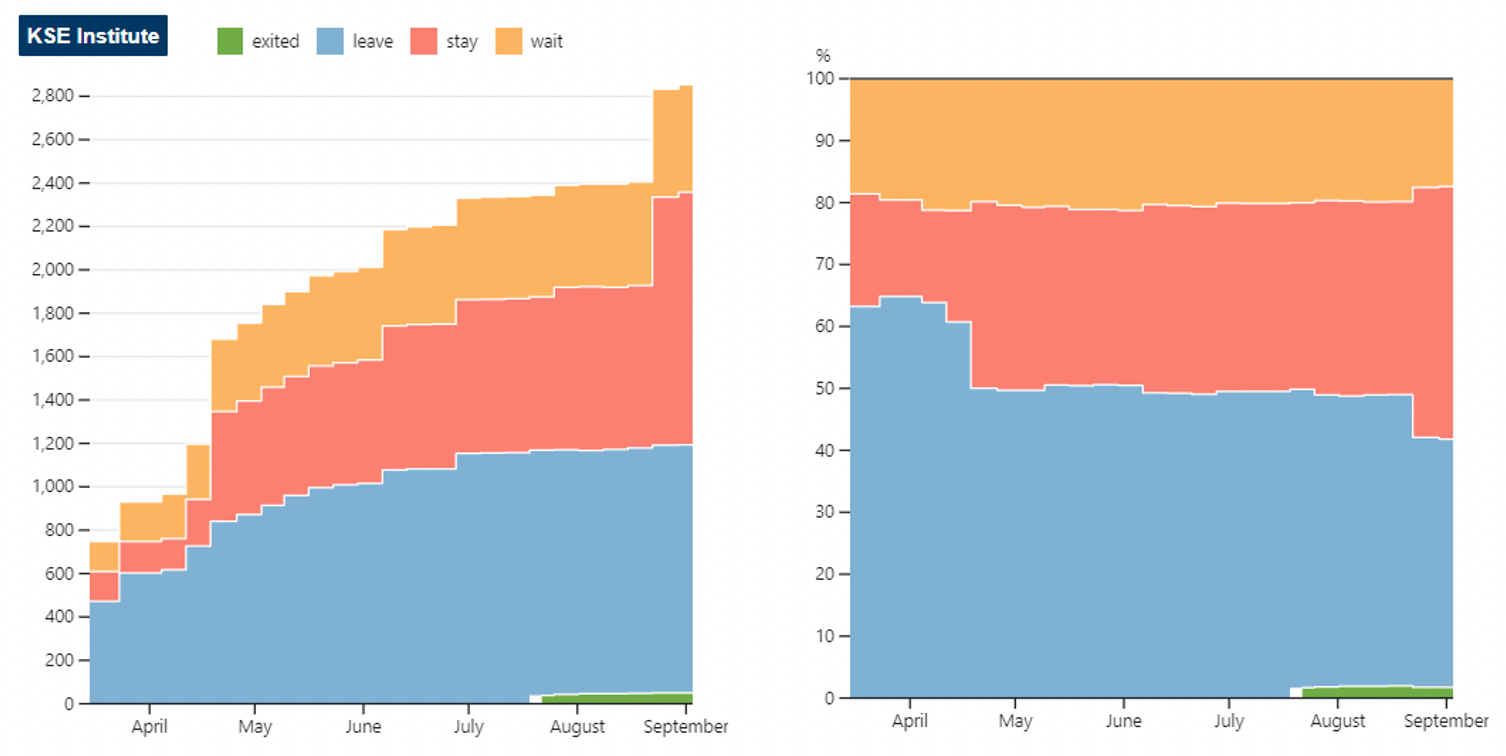

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 40.0% of foreign companies have already announced their withdrawal from the Russian market, but another 40.8% are still remaining in the country, 17.4% are waiting and only 1.8% made a complete exit⁴.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: PARALLEL IMPORTS

With the full-scale Russian invasion of Ukraine, Western companies began to limit their activities in Russia and withdraw from the Russian market. In late March, Russia allowed so-called parallel imports to smooth out the impact of sanctions and the exit of businesses. It means that it is now possible to import goods into the territory of Russia without the producer’s permission, while this practice is usually prohibited.

In order No.1532⁵, as of April 19, 2022, the Ministry of Industry and Trade of the Russian Federation approved the list of goods allowed for parallel import. The list included goods such as ferrous metals, inorganic compounds, medical and other equipment, ships, spare parts for railways and auto components, consumer goods such as electronics and household appliances, clothing, footwear and cosmetics. In particular, the brands mentioned in the order included Apple, Samsung, Hewlett Packard, ASUS, Cisco, Dell, Microsoft, Mercedes-Benz, General Motors and others.

Goods are imported directly to Russia and through countries “friendly” to the Russian Federation or countries of the Eurasian Economic Union – Armenia, Kyrgyzstan, Kazakhstan, Turkey, UAE, etc. Since April, Russia has stopped publishing foreign trade statistics. According to the announcement, parallel imports in May-July reached USD 6 billion, and according to the forecast, they will reach USD 16 billion by the end of the year, which will be 4% of imports in 2021⁶.

Brand owners cannot control the sale of all their goods, so they cannot stop parallel imports. For example, MicroTik, a Latvian manufacturer of network equipment, stopped supplying its goods to the Russian Federation after the start of military aggression against Ukraine⁷. But in May, sales of MicroTik equipment in the Russian Federation resumed⁸. The company’s representative did not even remove the certificate of the official reseller from the website. On the other hand, there are separate reports that some companies facilitate parallel imports after their exit and are looking for ways to return to the market. In particular, Samsung still hires people in Russia and is reported to create ways for parallel imports⁹.

Not everything is simple with parallel import. The disadvantages of gray imports are the lack of warranty service and rising prices. Prices increase due to more expensive logistics and various documents and regulations, which an official representative no longer handles. For unofficial representatives, it is longer and often causes many difficulties, and sometimes it is not even possible. Parallel imports usually carry a limited set of best sellers or the most profitable products, such as the most expensive cellphone models.

The higher the technical barriers, the more difficult it is to import goods. An example here can be cars. Despite the permit, parallel imports remain limited. The market has fallen to a record low in the last 20 years; 80% of new car imports are from Chinese and Korean brands¹⁰. The import of cars is complicated by the norms of the Technical Regulation of the Customs Union “On the safety of wheeled vehicles”. In particular, legal entities could not obtain the manufacturer’s Vehicle Type Approval. It also made no sense to import cars officially imported to countries of the Eurasian Economic Union because such vehicles are not allowed to operate in Russia. Accordingly, imports were minimal. However, over time, the requirement for Vehicle Type Approval was simplified¹¹. We see that, if necessary, restrictions on parallel imports are gradually being resolved.

In some cases, they even import goods that are not allowed for parallel import. For example, on the shelves of supermarkets, you can find Coca-Cola produced in Poland¹² or the USA¹³.

Parallel import does allow to bypass some sanctions and reduce the impact of companies exiting the Russian market. Manufacturers of goods can’t stop the parallel import, and some companies are even interested in it. There are also many obstacles to gray imports, which can be solved over time if necessary.

You can also contribute by spreading the status of the company with a call to leave Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)¹⁴

29.08.2022

*Logitech (Switzerland, Electronics) Status by KSE – leave

Logitech leaves the Russian market and lays off all employees. Insider sources from Russia.

https://www.rbc.ua/ukr/news/logitech-uhodit-rossiyskogo-rynka-uvolnyaet-1661764465.html

*Ericsson (Sweden, IT) Status by KSE – leave

Ericsson will gradually wind down business activities in Russia over the coming months

30.08.2022

*Nokian Tyres (Finland, Automotive) Status by KSE – leave

Nokian Tires has put its factory in Russia up for sale. This is her main enterprise

https://biz.liga.net/all/all/novosti/nokian-tyres-vystavila-na-prodaju-svoy-zavod-v-rossii-eto-ee-osnovnoe-predpriyatie

*ExxonMobil (USA, Energy, oil and gas) Status by KSE – wait

Exxon Escalates Dispute With Russia Over Barred Exit From Giant Oil Project

31.08.2022

*VR Group (Finland, Logistics, Transport) Status by KSE – wait

The Finnish state railway company VR Group has written off all Allegro trains running between St. Petersburg and Helsinki. The company wrote off all rolling stock and spare parts for Allegro for a total of 45.4 million euros. VR Group has also started negotiations on the sale of subsidiaries related to freight transportation in the eastern direction.

https://www.sttinfo.fi/announcement?publisherId=69819374&announcementId=2757&lang=fi

*Riol Chemie GmbH (Germany, Chemical industry) Status by KSE – stay

The chemical company is at the center of an investigation by public prosecutors, who suspect that executives at the firm exported toxic substances and special laboratory material to Russia in more than 30 instances over the past three and a half years without obtaining the necessary permits.

https://www.tagesschau.de/investigativ/ndr-wdr/durchsuchung-dual-use-103.html

01.09.2022

*Infineon (Germany, IT) Status by KSE – leave

Germany stops supplying chips for Russian passports

02.09.2022

*Equinor (Norway, Energy, oil and gas) Status by KSE – leave

Equinor completes exit process from Russia

https://www.equinor.com/news/20220902-completes-exit-process-from-russia

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – leave

The brewing company Carlsberg Group has published its financial report for the first half of 2022. In general, an organic growth of volumes by 8.9% was recorded. At the same time, in the region of Central and Eastern Europe, which includes Ukraine, the increase is 0.3%.

https://www.epravda.com.ua/news/2022/08/18/690568/

*UnionPay (China,Finance and payments) Status by KSE – wait

The largest payment system UnionPay has limited work with sanctioned Russian banks.

*Air Liquide (France, Energy, oil and gas) Status by KSE – leave

Intention to withdraw from Russia – signed a Memorandum of Understanding with the local management team to transfer its activities in Russia in the framework of a Management Buy Out

*Petro Welt Technologies (Austria, Energy, oil and gas) Status by KSE – leave

PeWeTe sold and transferred its participatory interests held directly and indirectly in its participations in Russia to a Russian company, which is held by a group of Russian top managers of the Petro Welt Group.

https://www.pewete.com/wp-content/uploads/2022/09/PeWeTe_AG_Press_Release_Russian-assets_2022-1.pdf

03.09.2022

*AB Electrolux (Sweden, Electronics) Status by KSE – leave

Decided to exit Russia and divest the business to local management through a sale of its Russian subsidiary.

https://www.electroluxgroup.com/en/electrolux-has-decided-to-exit-russia-34511/

*Huhtamaki (Finland, FMCG) Status by KSE – leave

Sold its operations in Russia to Espetina Ltd, a holding company owned by Alexander Govor and Iury Kushnerov, for 151 million euros.

https://www.reuters.com/markets/deals/finlands-huhtamaki-sells-russia-business-151-mln-2022-09-02/

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² Companies migrated from the status “n/a” to “stay” based on financial data available

³ As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematized in the form of a newKSE’s status “exited”.

⁴ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/.

⁵ Order of the Ministry of Industry and Trade of the Russian Federation of April 19, 2022 No.1532 “On approval of the list of goods (groups of goods) concerning which provisions of subitem 6 of article 1359 and article 1487 of the Civil code of the Russian Federation are not applied subject to introduction of the specified goods (groups of goods) in turnover outside the territory of the Russian Federation by the right holders (patent owners), and also with their consent” https://www.advokat-kk.ru/2022/04/parallelnyy-import.html

⁷ https://twitter.com/mikrotik_com/status/1500806788727386114

⁹ https://ukranews.com/en/news/871297-sanctions-futile-samsung-continues-to-work-in-rf-media

¹⁰ https://www.vedomosti.ru/auto/articles/2022/08/17/936477-parallelnii-import-legkovushek

¹¹ https://www.autostat.ru/editorial_column/52155/

¹² https://mobile.twitter.com/amenka/status/1556333267703447552

¹⁴ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site