- Kyiv School of Economics

- About the School

- News

- 21th issue of the weekly digest on impact of foreign companies’ exit on RF economy

21th issue of the weekly digest on impact of foreign companies’ exit on RF economy

2 жовтня 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 26.09-02.10.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 02.10.2022

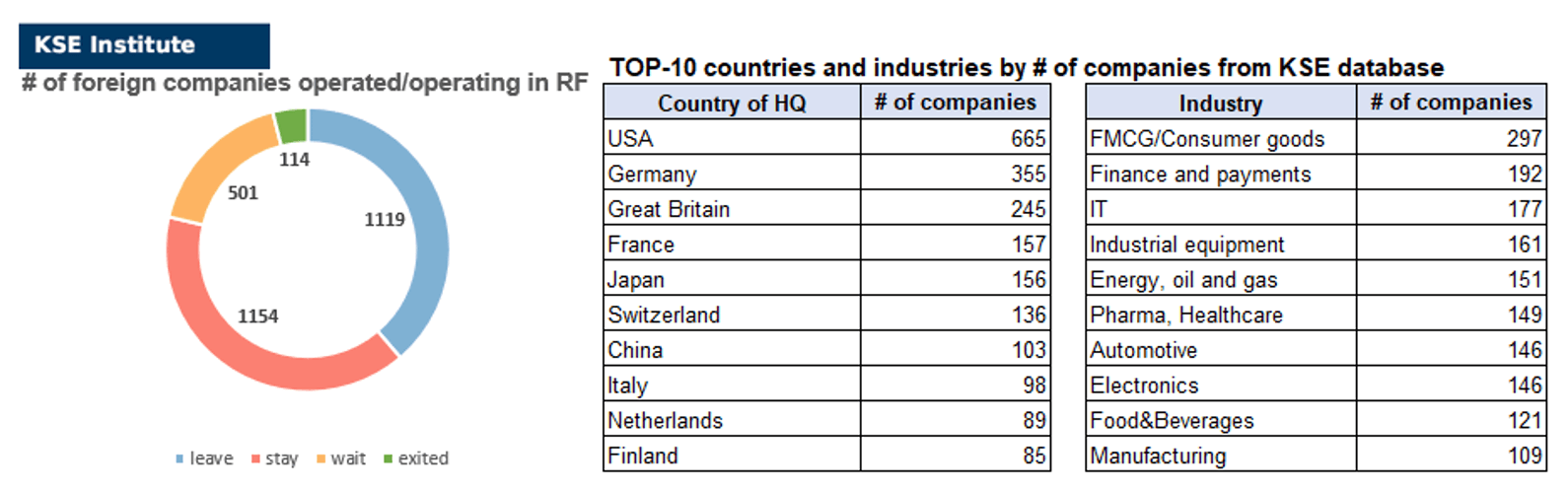

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 154 (+13 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 501 (+8 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 119 (-3 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 114 (0 per week)

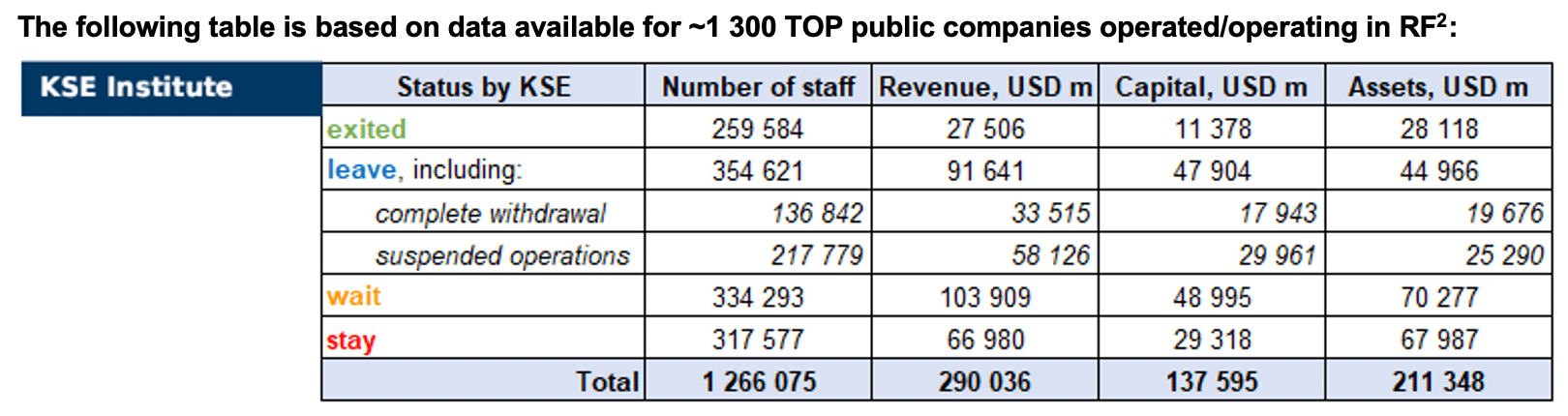

As of October 02, we have identified about 2,888 companies, organisations and their brands from 85 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $137.6 billion), local revenue (about $290.0 billion), local assets (about $211.3 billion) as well as staff (about 1.266 million people). 1,620 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 114 companies that have completed the sale of their business in Russia based on the information collected from the official registers (a new update is planned for the next week).

As can be seen from the tables below, as of October 02, companies which had already completely exited from the Russian Federation, had at least 259,600 personnel, $27.5 bn in annual revenue, $11.4 bn in capital and $28.1 bn in assets; companies, that declared a complete withdrawal from Russia had 136,800 personnel, $33.5bn in revenues, $17.9bn in capital and $19.7 bn in assets; companies that suspended operations on the Russian market had 217,800 personnel, annual revenue of $58.1bn, $30.0bn in capital and $25.3 bn in assets.

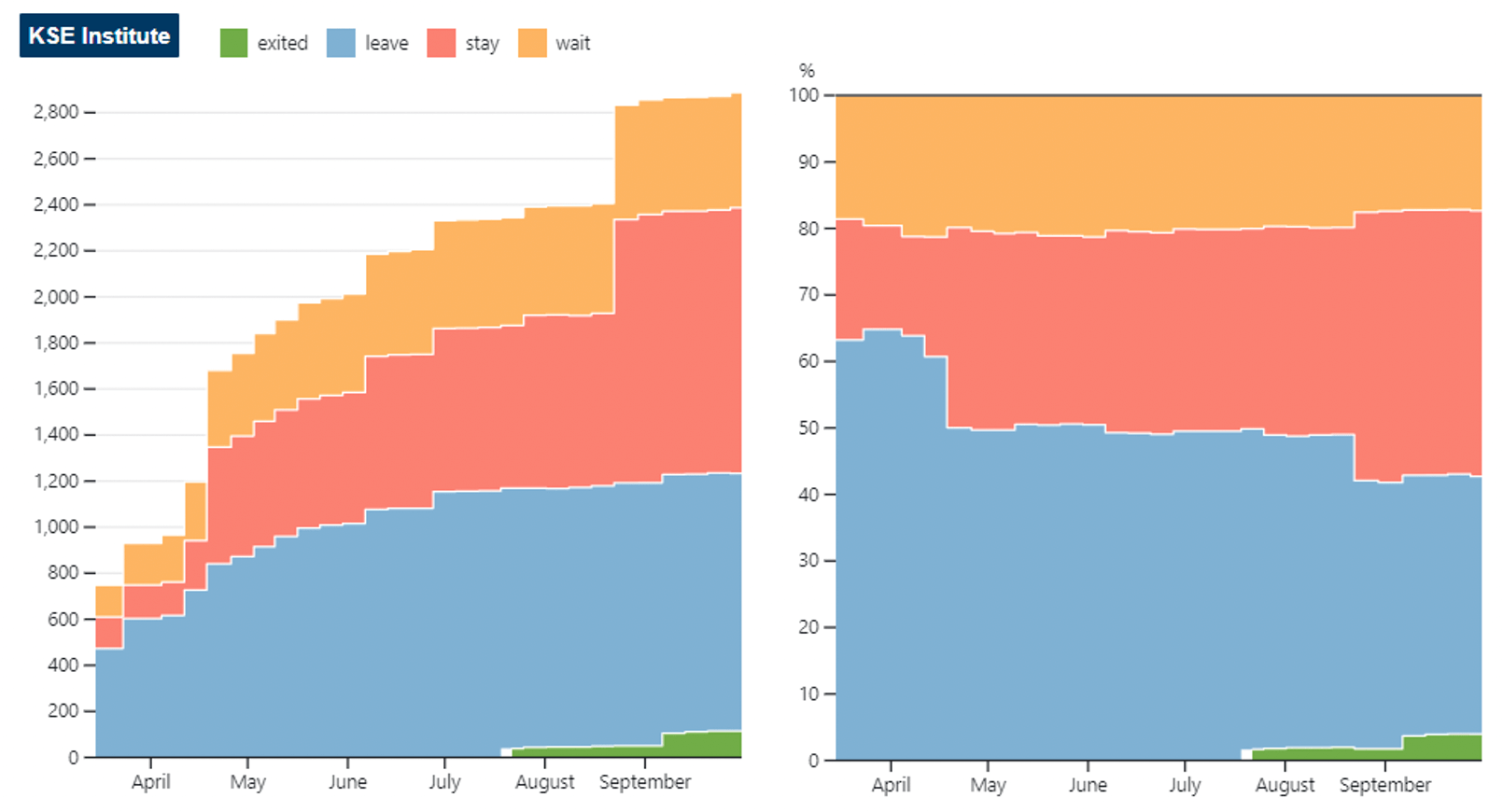

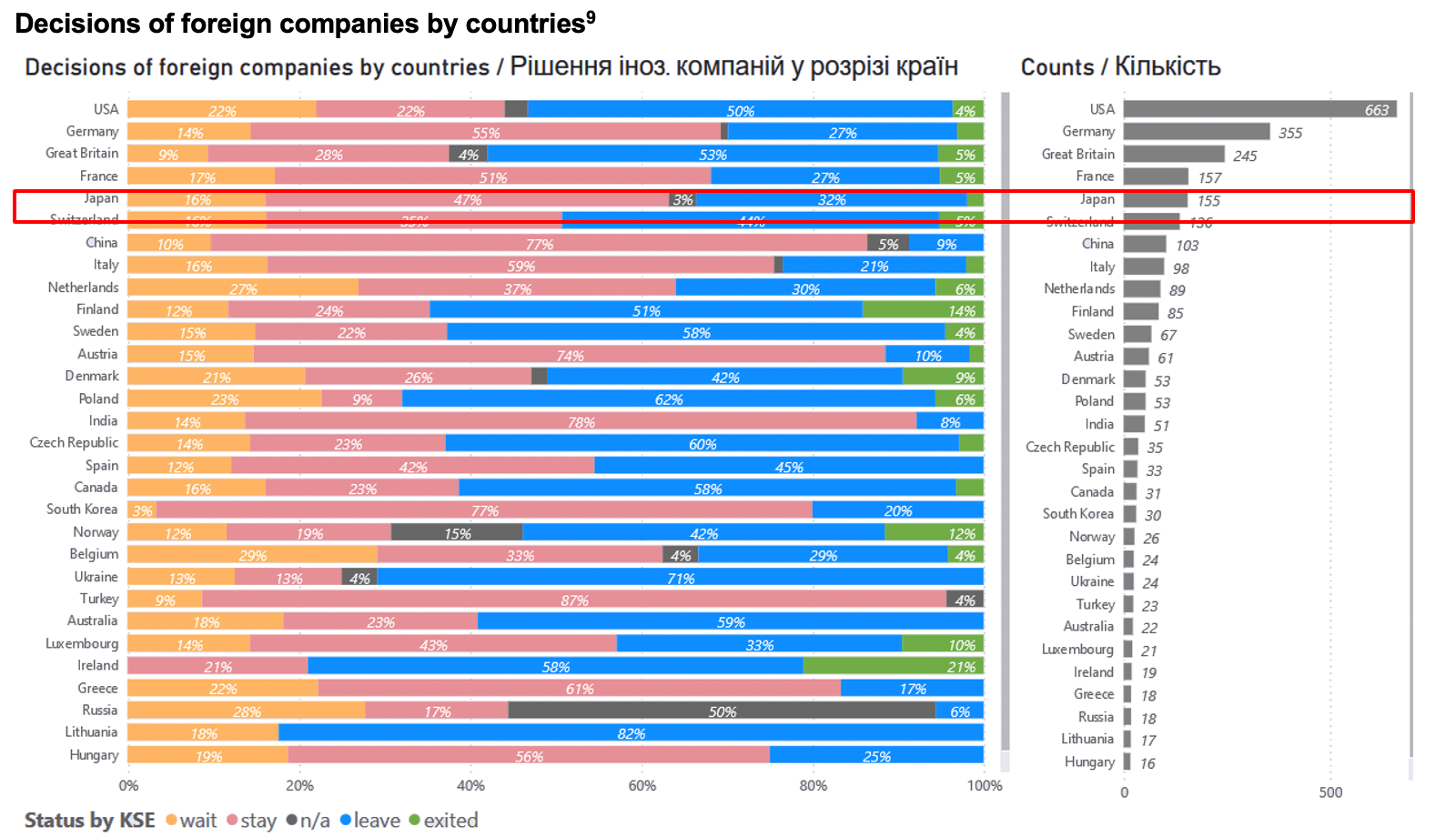

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 38.7% of foreign companies have already announced their withdrawal from the Russian market, but another 40.0% are still remaining in the country, 17.3% are waiting and only 3.9% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 114 companies that completely left the country, since they employed almost 20.5% of the personnel employed in foreign companies, the companies owned about 13.3% of the assets, had 8.3% of capital invested by foreign companies, and only last year they generated revenue of $27.5 billion or 9.5% of total revenue, data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Analysis on Japan companies and their positions in Russia as of 30/09/2022

How many Japanese companies are in Russia?

At this time, the development of Russian-Japanese economic relations is hindered by the crisis situation in Russia. Most of the Japanese companies that worked in Russia before its invasion of Ukraine ignore calls to leave the Russian market, because the companies prefer profits, not bloodshed in a “too distant” country. The Russian leadership clearly overestimated Japan’s readiness to completely stand aside in light of the Russian-Ukrainian war, while underestimating the weight of the territorial issue with Tokyo. After Russia’s invasion of Ukraine, Japan introduced sanctions along with the USA and the EU.

As of August 2022, according to Teikoku Databank Ltd⁴ only 74 out of 168 listed Japanese firms in Russia will mothball their facilities or exit the market there, in particular, this is 44% of the total and only few of them, including the energy company ENEOS, NTT Data and Fanuc, completely left Russia. In comparison, 27% of US firms have completely pulled out of Russia, along with 33% of Canadian and 46% of British businesses.

At the same time, it is worth noting that such large Japanese companies as Uniqlo, Nintendo, Hitachi, Mitsubishi Electric, Japan Tobacco and Toridoll Holdings united to suspend their own business in Russia.

Against this background of the Russian-Ukrainian war, the economic losses of Japanese companies on the Russian market may be more serious in the long term, and despite this, it is worth noting the turbulent dynamics of the Russian-Japanese trade balance. Thus, according to the Ministry of Finance of Japan, Japanese exports to Russia in July 2022 increased to 54,495 million yen compared to 40,751 million yen in August 2021⁵. Already in August 2022, in connection with the increase in global energy prices, Japan’s trade with Russia increased by 31% – the import of Russian liquefied natural gas to Japan increased by 211% compared to August 2021 and by 386% in monetary terms, respectively.

Given the fact, it can be concluded that Japan is unlikely to stop buying Russian energy due to its dependence on imported energy, the rapid increase in energy prices and the competitive price of Russian energy. According to the Center for Research on Energy and Clean Air (CREA)⁶ in 2022 Japan bought Russian energy carriers worth 2.6 billion US dollars.

According to Jiji Press and Nippon.com⁷, as of the beginning of April 2022 up to 15,287 companies in Japan had deals or indirect business ties with Russian firms, according to a survey report by credit research company Teikoku Databank Ltd.

These companies will inevitably be affected by economic sanctions imposed on Russia over its invasion of Ukraine, possibly being forced to scale down or cancel their deals due to trade restrictions or to procure products from alternative suppliers, the report said.

As of March 2022, 338 firms in Japan had direct export or import deals with Russian companies and they had business ties with 14,949 companies in Japan.

Many of those engaged in exports to Russia were companies handling automobiles, machinery parts or electronic components. Teikoku Databank predicted in the report that demand mainly for production of Russia-bound automobiles, totaling over 100,000 units a year, will be gone for the time being.

Among the importers, the most widespread were wholesales of lumber and those of seafood.

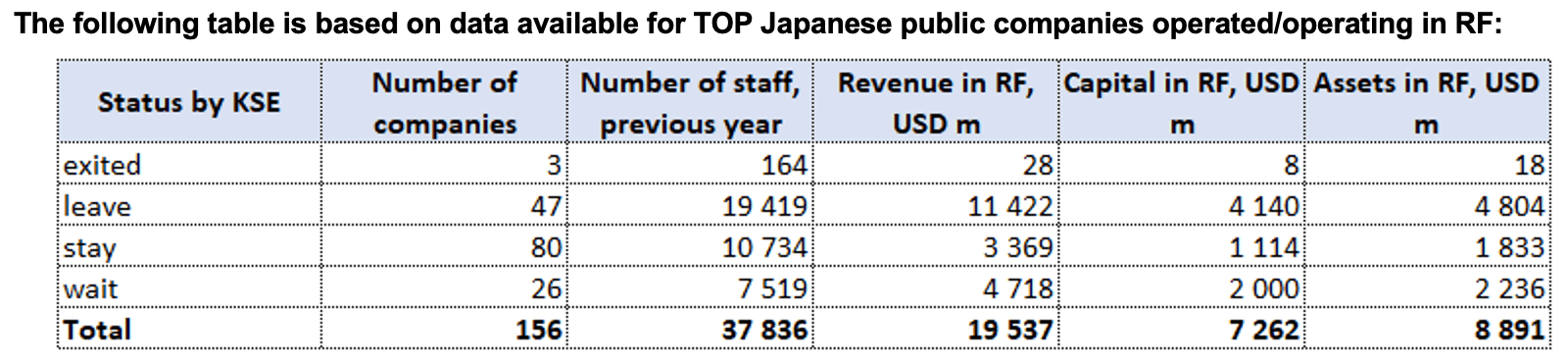

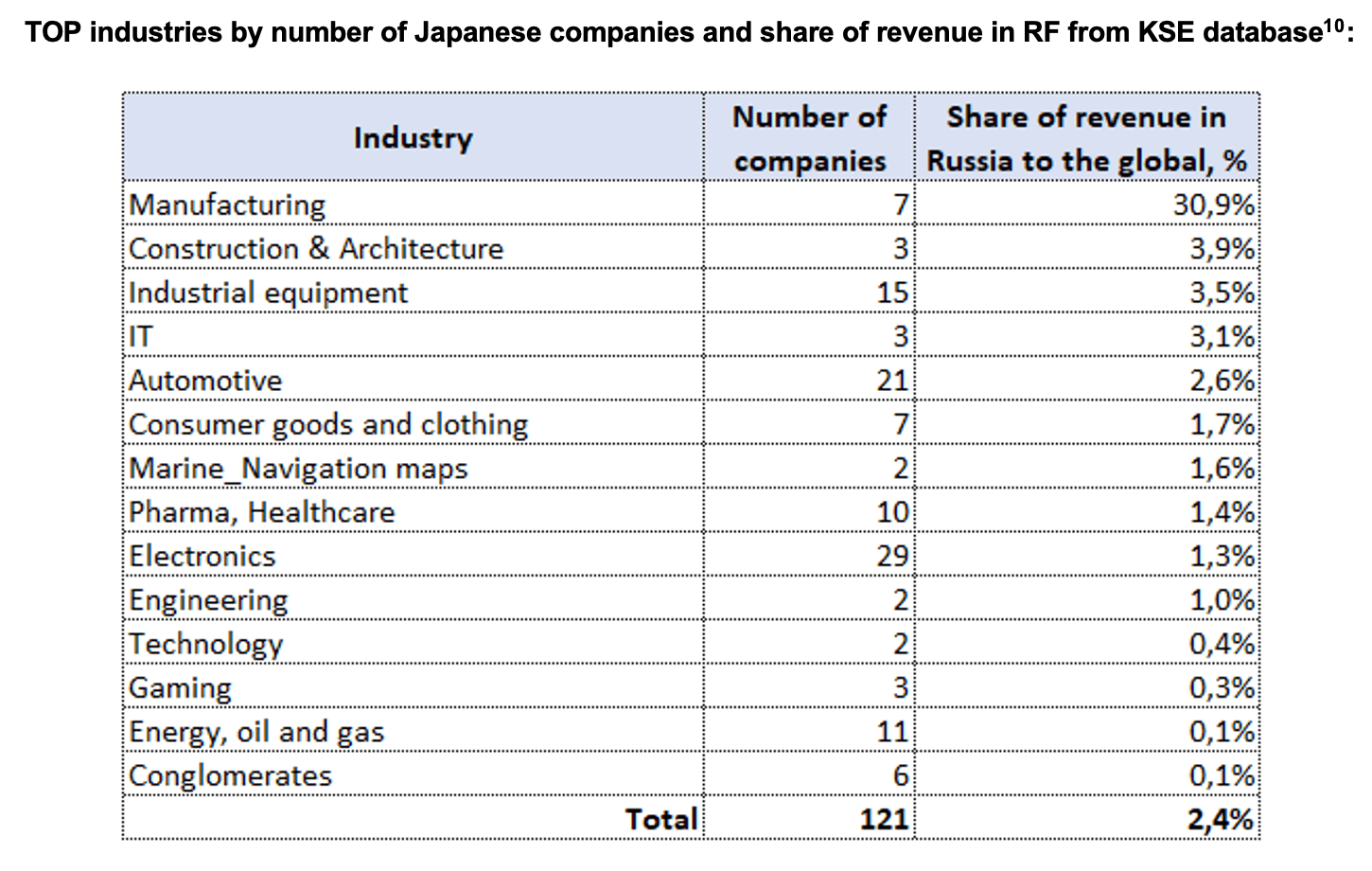

According to data collected by the KSE Institute⁸,in 2021 156 Japanese companies provided jobs for at least 37,800 people, those companies generated $19.5 bn in annual revenue, had $7.3 bn in capital and $8.9 bn in assets.

Only 3 companies have already exited Russia with selling of their stakes (namely NTT DATA, Mitsubishi Logisnext and Furuno), another 47 companies have suspended their activities or announced their withdrawal in the nearest future.

The most “dependent” on Russia in terms of revenue share (more than 3%) in this country are Japanese companies in 4 industries: Manufacturing, Construction & Architecture, Industrial equipment and IT.

How are Japanese companies reacting?

Out of 156 companies in the KSE database, 51% of Japanese companies still stay in Russia, 17% are waiting and somewhat limit their activities and another 30% have announced leaving. Some of the French companies are among the examples of clean breaks from the Russian market, while others defy demands for exit despite pressure.

Clean breaks

According to KSE data as of September 30, only 3 companies with HQ located in Japan have completely exited Russia, namely NTT DATA, Mitsubishi Logisnext and Furuno. LLCs which were registered in Russia changed their names and were sold to an individual/individuals.

Selected industries analysis

Automotive:

Automotive is one of the leading sectors in terms of companies presence in Russia, 21 companies are/were represented, including 11 with KSE’s status “leave”. For most of these companies operations in Russia were suppressed, but they did not succeed completely.

The following TOP-5 Automotive companies in 2021 generated $10.627bn of revenue in Russia (or 54% of all 156 companies represented in KSE database):

Mazda – $1.196bn

Mitsubishi Motors – $1.299bn

Nissan – $1.371bn

Komatsu – $1.606bn

Toyota – $5.155bn

Bridgestone Tire (Status by KSE – leave) is suspending its manufacturing operations in Russia until further notice. The decision entered into force on March 18, after the necessary preparatory work. The company also decided to freeze any new investment and stop all exports to Russia with immediate effect. “We continue to care for our more than 1,000 employees in our passenger tire production plant in Ulyanovsk, Russia and our sales offices. Therefore, we will support our employees financially at this time” – the company’s statement reads.

Komatsu (Status by KSE – leave) As announced in its news release of March 30, 2022, Komatsu decided to suspend shipments to Russia against the background of the confusion of its supply chain and uncertain financial and economic conditions. At present, Komatsu has suspended the shipments and production at its manufacturing subsidiary in Russia.

Toyota (Status by KSE – leave) The Japanese automaker Toyota is stopping production in Russia – the company’s plant in Shushary (Petersburg) has been operating for 15 years and the company had the biggest number (168) of car dealerships in Russia. Toyota decided to lay off the employees of the Russian office and pay them 12 salaries. Toyota Motor Corp. became the first major Japanese automaker to announce an exit from car production in the country.

Mazda Motor Corp. (Status by KSE – leave) is considering a permanent exit from Russia after its invasion of Ukraine put a halt on the Japanese carmaker’s production in the country. In March 2022, Mazda stopped exporting auto parts to its plant in the far eastern Russian city of Vladivostok, which it operates in conjunction with local manufacturer Sollers, and shut down the plant. It also has 70 car dealerships in Russia.

ISUZU (Status by KSE – leave) decides to suspend vehicle production in Russia. The Japanese automobile concern Isuzu is considering the possibility of stopping the production of cars in the Russian Federation, following Toyota and Mazda.

Honda Motor (Status by KSE – leave) back in the spring, Honda Motor announced that it would stop exporting cars, motorcycles and other products to Russia. It has 5 car dealerships in RF.

Infiniti (Status by KSE – leave) company temporarily suspended the delivery of cars to Russia.

Subaru (Status by KSE – leave) suspended exports to Russia due to distribution challenges.

Yamaha Motor Company (Status by KSE – leave) halted shipments of bikes, snowmobiles and outboard motors.

Denso (Status by KSE – leave) suspended all shipments to Russia.

Kubota Corporation (Status by KSE – leave) cancelled production of Russian equipment orders. Made a statement of support for Ukraine and donated ~$850K of humanitarian aid for relief organisations.

5 Automotive companies are staying in Russia, namely:

Lexus, Yazaki, KYB Corporation, Mitsuba Corporation, NGK – there are no company statements and information about their real position.

Another 5 Automotive companies are waiting in Russia, namely:

Suzuki (Status by KSE – wait) manufactures automobiles, motorcycles, all-terrain vehicles (ATVs), outboard engines, wheelchairs, and a variety of other small internal combustion engines.

The Hungarian Suzuki plant has suspended the export of cars to Russia and Ukraine from March 2022. The company said it was halting exports of new cars to Russia and Ukraine, which were estimated to reach around 10,000 cars by the end of 2022. “Our company does not have direct suppliers in the affected areas,” said Zhuzhanna Bonnar-Chonka, the press secretary of the plant, referring to Russia and Ukraine. “However, we constantly monitor the entire supply chain”¹¹

Nissan (Status by KSE – wait) also recently decided to extend the suspension of its plant in St. Petersburg for three months until the end of December. “Production is suspended at St Petersburg until the end of December¹² and employees have been informed. We continue to monitor the situation closely and will take actions as needed” a Nissan spokesperson said.

Yokohama (Status by KSE – wait) decided to renew production in Russia despite previous announcements to halt production. The official declined to comment on why Yokohama Rubber had decided to recommence production in Russia, the importance of the market to its operations or future plans in the country.

Mitsubishi Motors (Status by KSE – wait) has stopped production at its Kaluga plant in Russia until further notice. Due to the logistical difficulties, vehicle exports and parts supply to Russia have been suspended since March.

Hino Motors (Status by KSE – wait) a subsidiary of Toyota, the Japanese manufacturer of trucks and buses Hino Motors has abandoned plans to put its Russian plant into operation in Khimki, Moscow region.

Electronics:

The following famous Japanese companies have stopped production and deliveries:

Canon (Status by KSE – leave) In March, Canon EMEA suspended all product deliveries to Russia.

Epson (Status by KSE – leave) suspended exports to Russia & Belarus.

Mitsubishi Electric (Status by KSE – leave) Corporation has stopped shipments to Russia and donated €1m to support relief efforts in Ukraine. In a press statement, the Japanese multinational electronics and electrical equipment manufacturing company said: “Due to the current logistics and finance situation, Mitsubishi Electric has suspended its shipments to Russia and is facing difficulties to continue its sales”.

Panasonic (Status by KSE – leave) In March, a statement appeared on the company’s website that due to economic, logistical and other practical problems, the company decided to suspend operations with Russia.

Ricoh Group (Status by KSE – leave) As a result of the conflict, Ricoh has taken the decision to suspend shipments of all devices to Russia. “We will continue to fully comply with all sanctions imposed on Russia”.

But at the same time a lot of electronics producers are still staying and continue to sell their products to Russia with no public statements done, for example: Fujifilm Corporation, Pioneer, Brother, Yamaha Corporation, OKI, Yamabiko Corporation, Casio, Horiba, JVC Kenwood, Riso Kagaku Corporation, Roland Corporation, Seiko, Toppan.

Energy, Oil & Gas

Kyushu Electric Power (Status by KSE – stay) In April, the company decided to suspend imports of Russian coal used as fuel for thermal power plants this fiscal year. In fiscal year 2020, Kyushu Electric Power accounted for 7% of coal imported from Russia, but it has already secured procurement sources from other countries and will not affect power supply. But already in August, Electric Power Co. announced that it has extended its contracts for the purchase of liquefied natural gas from the Sakhalin-2 oil and gas project in Russia.

JERA (Status by KSE – stay) has signed a deal with the new operator of the Sakhalin-2 energy project in Russia to maintain long-term deliveries of liquefied natural gas (LNG).

Toho Gas (Status by KSE – stay) has renewed its contract to purchase liquefied natural gas from the Sakhalin 2 oil and gas project in Russia.

HIROSHIMA GAS Co. (Status by KSE – stay) signed a contract with the new operator of the Sakhalin-2 Russian liquefied natural gas (LNG) production project for the supply of this LNG.

Conglomerates

Mitsubishi Corp (Status by KSE – stay) announced in August that its 10% stake in the Sakhalin-2 project had been approved by Moscow. The same was reported by Mitsui & Co (Status by KSE – stay), whose share is 12.5%.

The Japanese government supported both firms in continuing the project.

Other companies in RF

Pilkington (Status by KSE – wait) – is a Japanese glass manufacturing company that includes several legal entities and is a subsidiary of the Japanese company NSG Group.

In March 2022 NSG Group took the following actions regarding commercial operations in Russia: With respect to NSG Group’s Russian joint venture (Pilkington Glass LLC), suspension of all glass trading arrangements between it and The Group and suspension of approval of significant new growth investment. Suspension of all other commercial trading with Russian companies. These commitments will remain in place for as long as Russia continues with its invasion of Ukraine and is accordingly isolated by the international community. It has 390 employees in Russia.

Summary

Officials at other companies that have also remained in Russia are extremely cagey about their policies there. “For most Japanese companies, their operations in Russia are comparatively small and they could quit,” said one executive at a Japanese firm, who declined to be named. “We chose not to do that because we have excellent employees in Russia, they have worked for us for decades and our operations there have no impact on the war or sanctions,” he said. “To pull out would only mean that our employees there lose their jobs”. He admitted that Japanese companies that had chosen to stay in Russia had done “a terrible job” of communicating reasons that could be considered positive, and had instead elected to simply say nothing to avoid scrutiny, both at home and abroad, where support for sanctions was strong.

Given the above, it should be noted that the further development of Japanese-Russian economic relations is hindered by the geopolitical crisis in Europe, which leads to the lack of serious economic interest of Japan in Russia. In addition, it should be added that these relations will probably improve after the signing of a peace treaty between the two countries following the Second World War (which has not yet been signed), and this is possible only under the conditions of resolving the territorial issue, in particular regarding the dispute over the Kuril Islands. As for a significant number of Japanese companies, as we can see above, unlike the majority of companies from China and India working in Russia, there is usually no question of leaving the aggressor country at the moment. Of course, this issue also depends significantly on the industry in which the company operates (for example, in the “Energy, oil and gas” sector there is a very high dependence on the import of energy carriers from Russia), the amount of investments already made and the share of revenue which was received there.

You can also contribute by spreading the status of the company calling for the exit from Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)¹³

26.09.2022

*Total Energies (France, Energy, oil and gas), status by KSE – wait

On September 24, signed an agreement to expand production of liquefied natural gas (LNG) in Qatar.

*Mazda (Japan, Automotive) Status by KSE – leave

Mazda in talks to end Russia production, following Toyota exit

*Ericsson (Sweden, IT), status by KSE – wait

Ericsson CEO Borje Ekholm Says Reports on Russian Exports Misleading

27.09.2022

*Texas Instruments (USA, Electronics), status by KSE – stay

Iran-made Shahed-131 kamikaze drones contain processors manufactured by Texas Instruments, the U.S. company.

https://news.yahoo.com/american-cpus-found-iran-made-122325552.html

*ISUZU (Japan, Automotive), status by KSE – leave

The Japanese automobile concern Isuzu, which has production facilities in Ulyanovsk, is considering the possibility of stopping the production of cars in the Russian Federation

https://www.epravda.com.ua/news/2022/09/27/691906/

https://ru.investing.com/news/economy/article-2185812

*Mazda (Japan, Automotive), status by KSE – leave

Mazda could soon sell Its stake In Russian joint venture

https://www.carscoops.com/2022/09/mazda-could-soon-sell-stake-in-russian-joint-venture/

*Citigroup (USA, Finance and payments), status by KSE – wait

Citigroup appoints Carson to manage Russia as a separate entity

*Emerson Electric (USA, Manufacturing; Electrical equipment; Energy, oil and gas), status by KSE – leave

Emerson to sell Russia business to local management

https://www.reuters.com/markets/europe/emerson-sell-russia-business-local-management-2022-09-27/

*Microsoft (USA, IT), status by KSE – wait

Microsoft restricted Windows 11 update for Russians

https://mezha.media/en/2022/09/27/microsoft-restricted-windows-11-update-for-russians/

*Dushanbe City Bank (Tajikistan, Finance and payments), status by KSE – leave

https://www.rferl.org/a/tajikistan-bank-russia-mir-payments/32054393.html

28.09.2022

*AFRY (Sweden, Engineering), status by KSE – leave

AFRY divests its operations in Russia

https://www.lesprom.com/en/news/AFRY_divests_its_operations_in_Russia_104759/

*Apple (USA, IT), status by KSE – leave

Apple kicks Russia’s Naspers-linked social media platform VK off the App Store

https://www.businessinsider.co.za/apple-boots-biggest-russian-social-media-app-vk-2022-9

*Goodvalley (Denmark, Food & Beverages), status by KSE – leave

Pig company Goodvalley sells Russian branch

*FIFA (Switzerland, Sport), status by KSE – stay

FIFA accused of ‘ignoring’ Ukraine and urged to scrap Russian TV deals

https://theathletic.com/3630344/2022/09/28/exclusive-fifa-ukraine-russia-tv-deals/

*Forbes Media LLC (USA, Media), status by KSE – stay

Russian Forbes bought a new domain in case of license revocation

https://thebell.io/rossiyskiy-forbes-kupil-novyy-domen-na-sluchay-otzyva-litsenzii

29.09.2022

*London Metal Exchange (Great Britain, Finance and payments), status by KSE – wait

LME Takes First Step Toward Possible Russian Metal Ban

*Finnair (Finland, Air transportation), status by KSE – leave

Finnair could cut 200 jobs as Russia remains off limits

https://simpleflying.com/finnair-200-job-cuts/

*H&M (Hennes and Mauritz) (Sweden, Consumer goods and clothing), status by KSE – leave

H&M posts big quarterly drop In profit after Russia exit and surging cost

https://www.barrons.com/news/h-m-posts-big-quarterly-drop-in-profit-after-russia-exit-01664434507

https://www.ft.com/content/96d71548-1267-4e31-8325-32e9d7377654

30.09.2022

*Apple (USA, IT), status by KSE – leave

Apple apparently has moved their Russian employees to Kyrgyzstan, London and Dubai.

https://www.vedomosti.ru/business/articles/2022/09/30/943199-apple-vivezla-rossiiskih-v-kirgiziyu

https://www.epravda.com.ua/news/2022/09/30/692060/

*DP Eurasia (Netherlands, Public catering), status by KSE – wait

Pizza group DP Eurasia sharpens Turkish focus as Russia risk high

https://www.reuters.com/markets/europe/pizza-company-dp-eurasia-posts-h1-sales-growth-2022-09-30/

*Enel (Italy, Energy, oil and gas), status by KSE – exited

Putin authorises Enel to sell Russian unit to Lukoil

https://www.reuters.com/markets/deals/putin-authorises-enel-sell-russian-unit-lukoil-2022-09-30/

*ExxonMobil (USA, Energy, oil and gas), status by KSE – wait

Russian mobilisation creates new opportunities for Exxon Mobil. As Russia escalates its war in Ukraine, this is more than likely to benefit Exxon Mobil, as the supply disruptions would be able to keep oil and natural gas prices at relatively high levels.

*Toyota (Japan, Automotive), status by KSE – leave

Toyota ends Russian manufacturing

https://www.mbtmag.com/video/video/22471850/toyota-ends-russian-manufacturing

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematized in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/.

¹³ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site