- Kyiv School of Economics

- About the School

- News

- 39th issue of the weekly digest on impact of foreign companies’ exit on RF economy

39th issue of the weekly digest on impact of foreign companies’ exit on RF economy

6 February 2023

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 30.01-05.02.2023

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we became partners with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia just by scanning barcodes.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

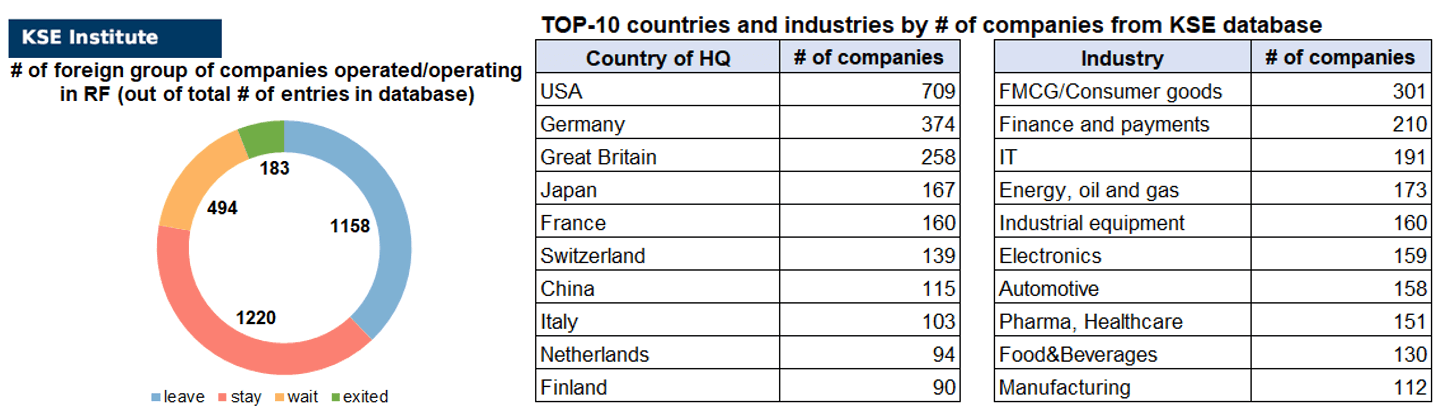

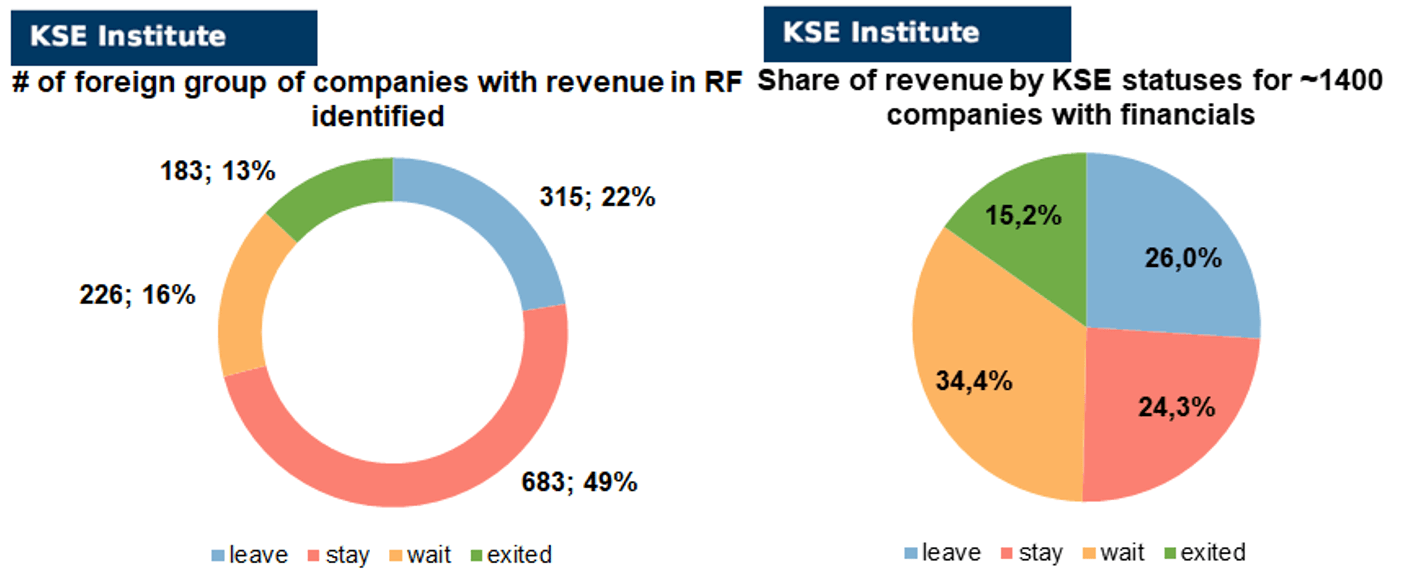

KSE DATABASE SNAPSHOT as of 05.02.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 220 (+2 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 494 (+3 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 158 (-1 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 183 (+4 per week; +25 per month)

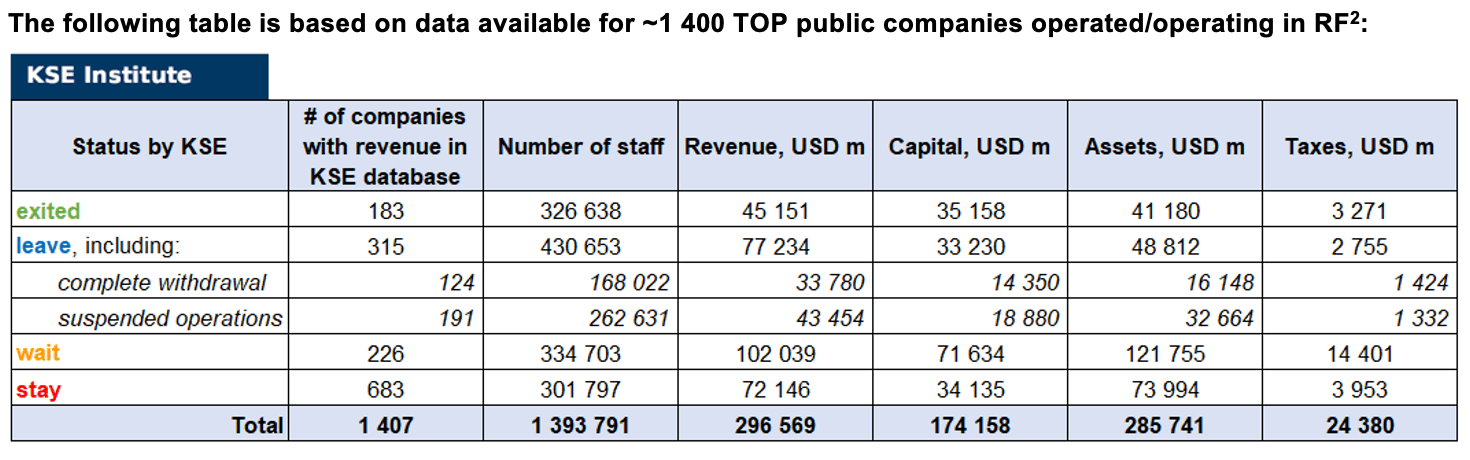

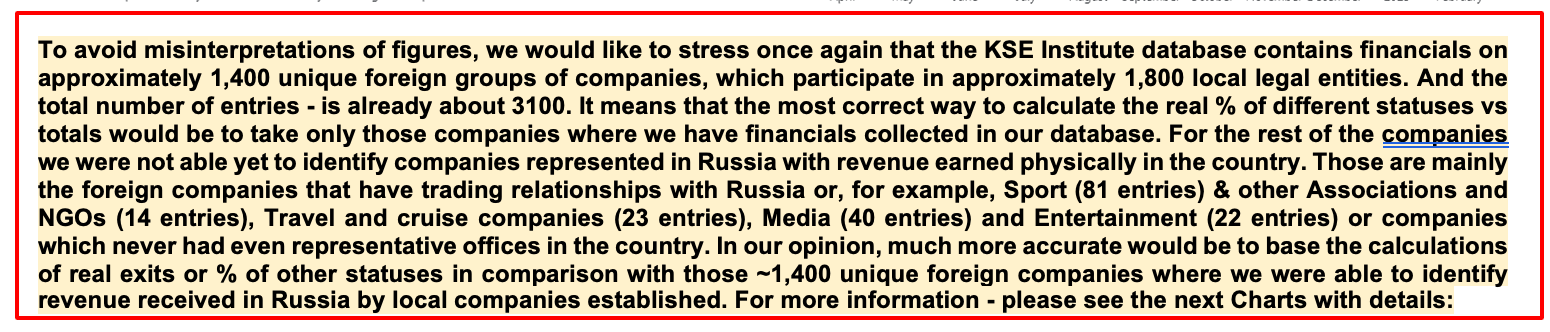

As of February 05, we have identified about 3,055 companies, organizations and their brands from 88 countries and 56 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 400 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $174.2 billion), local revenue (about $296.6 billion), local assets (about $285.7 billion) as well as staff (about 1.394 million people) and taxes paid (about $24.4 billion). 1,652 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 183 companies that have completed the sale of their business in Russia based on the information collected from the official registers (update in January allowed us to identify another 25 exited companies).

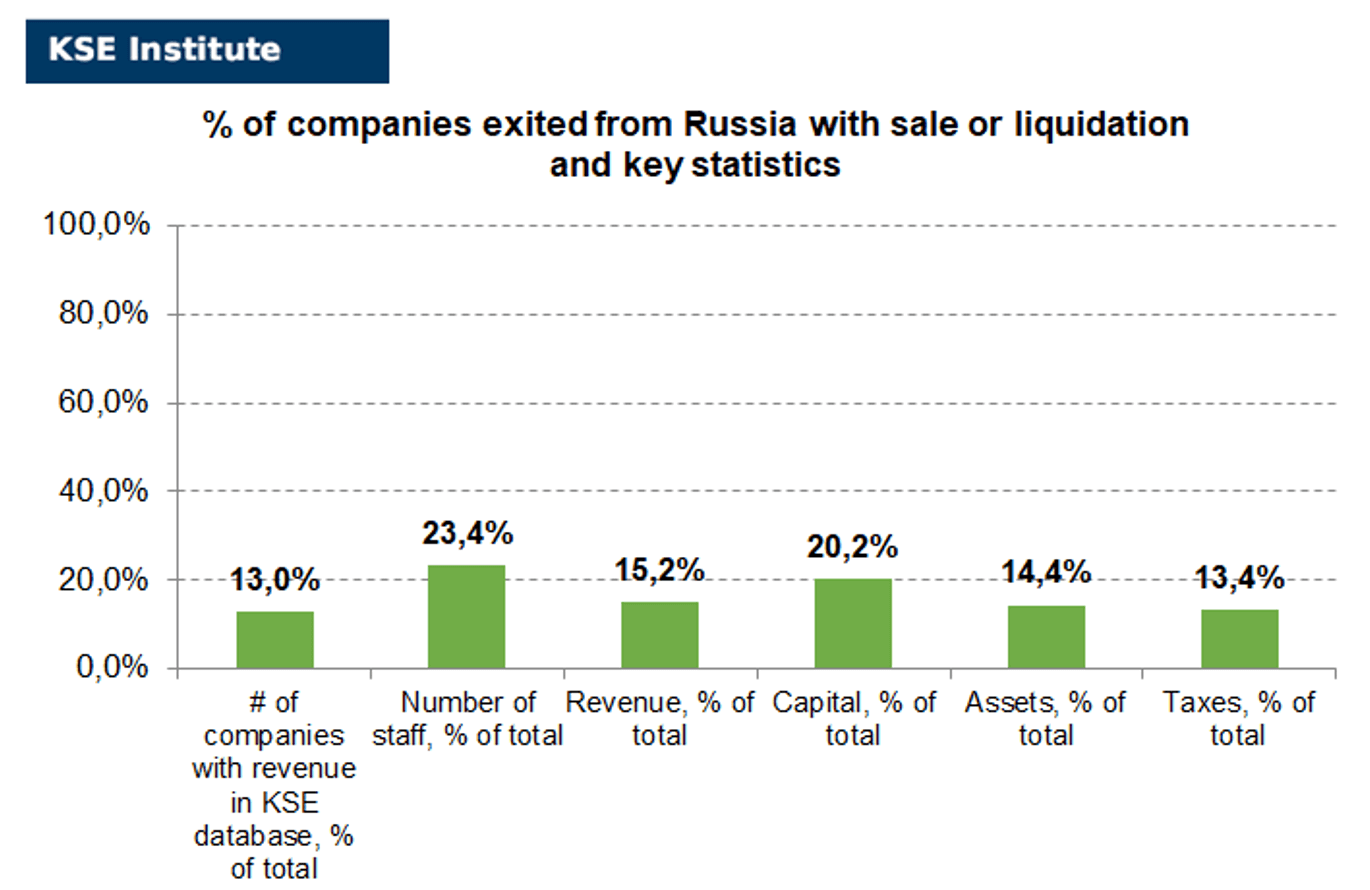

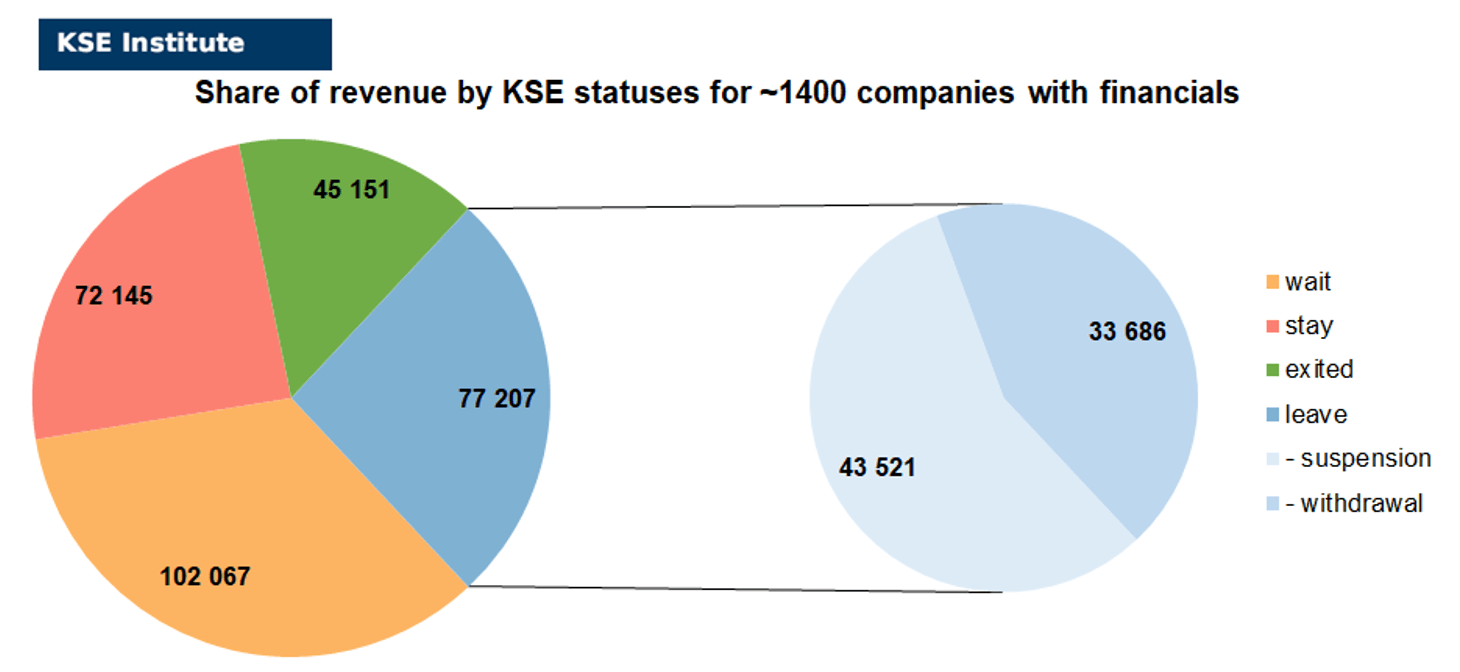

As can be seen from the tables below, as of February 05, 183 companies which had already completely exited from the Russian Federation, had at least 326,600 personnel, $45.2 bn in annual revenue, $35.2bn in capital and $41.2bn in assets; companies, that declared a complete withdrawal from Russia had 168,000 personnel, $33.8bn in revenues, $14.4bn in capital and $16.1bn in assets; companies that suspended operations on the Russian market had 262,600 personnel, annual revenue of $43.5bn, $18.9bn in capital and $32.7bn in assets.

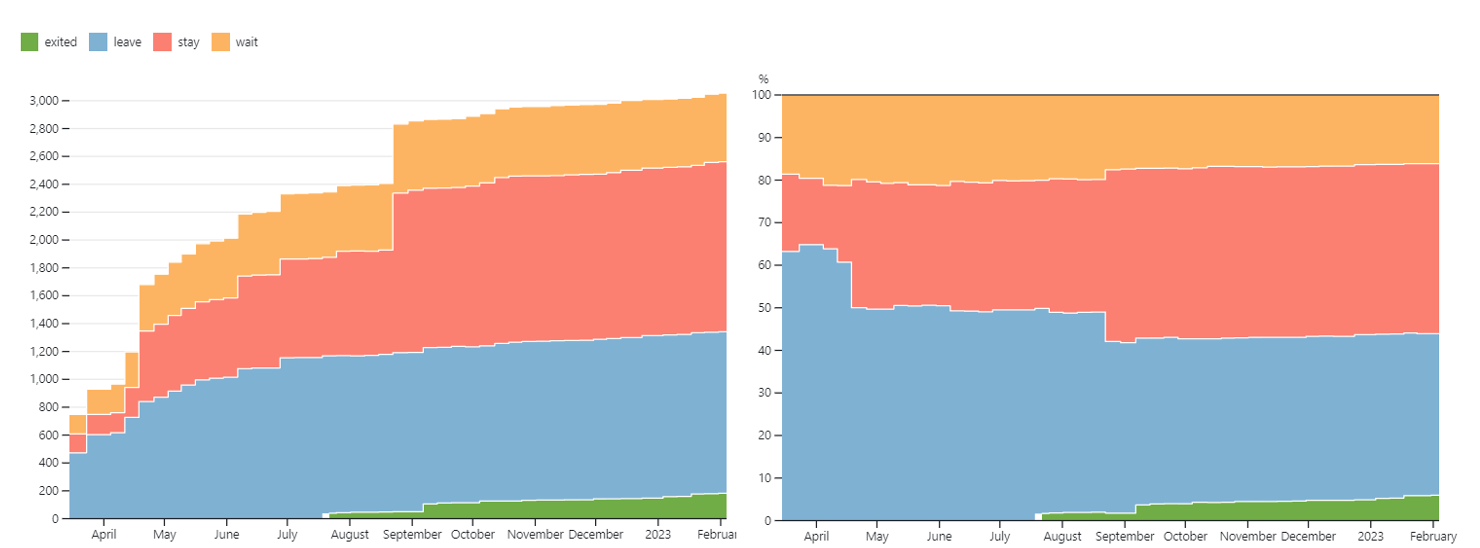

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last 5 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database). However, if to operate with the total numbers in KSE database, about 37.9% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 39.9% are still remaining in the country, 16.2% are waiting and only 6.0% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 183 companies that completely left the country, since they employed 23.4% of the personnel employed in foreign companies, the companies owned about 14.4% of the assets, had 20.2% of capital invested by foreign companies, and in 2021 they generated revenue of $45.2 billion or 15.2% of total revenue and paid $3.3 billion of taxes or 13.4% of total taxes paid by the companies observed. Data on 1,400 TOP companies is presented in the table above.

As it is visible on the charts above, roughly similar % of exited is obtained based on number of companies (13%) and on share of revenue withdrawn (15%). At the same time, a totally different picture is for those who are still staying – 49% of companies represent 24% of revenue and 16% of waiting companies represent 34% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: On leaving the Russian Federation. Results of January 2023

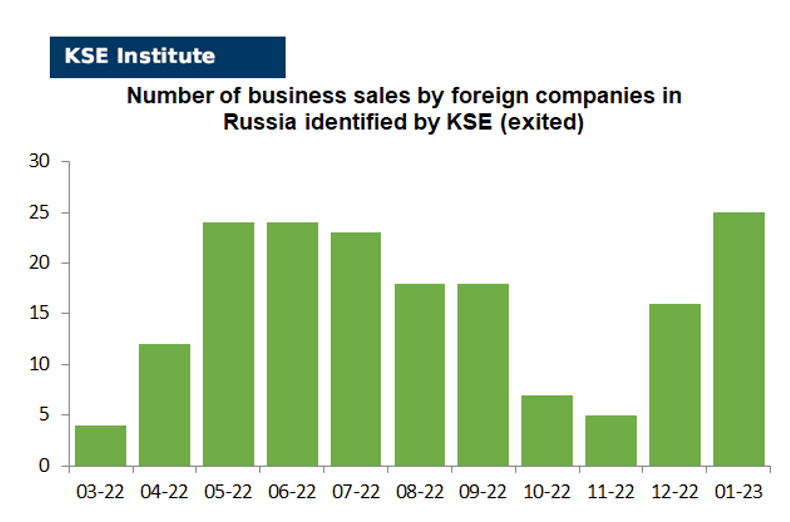

In this digest, we will summarize the results of January 2023 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies).

There are about 1.4 thousand companies identified in the KSE database with revenue data available of more than $290 billion. And at least 183 (more than 13%) of them have already been sold by local companies or were liquidated and left the Russian market. In January 2023 KSE Institute identified a record number observed since the beginning of invasion of +25 new exits⁴.

On the chart below, share of exited and other statuses based on revenue allocation is shown. It is worth mentioning when we analyze status “leave” also pay attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 15% based on revenue allocation, those who are leaving represent 26% of total revenue (with 56% share of suspensions and 44% of withdrawals sub-statuses), % of staying companies represent 24% of revenue and 35% are waiting companies based on revenue generated in Russia in 2021.

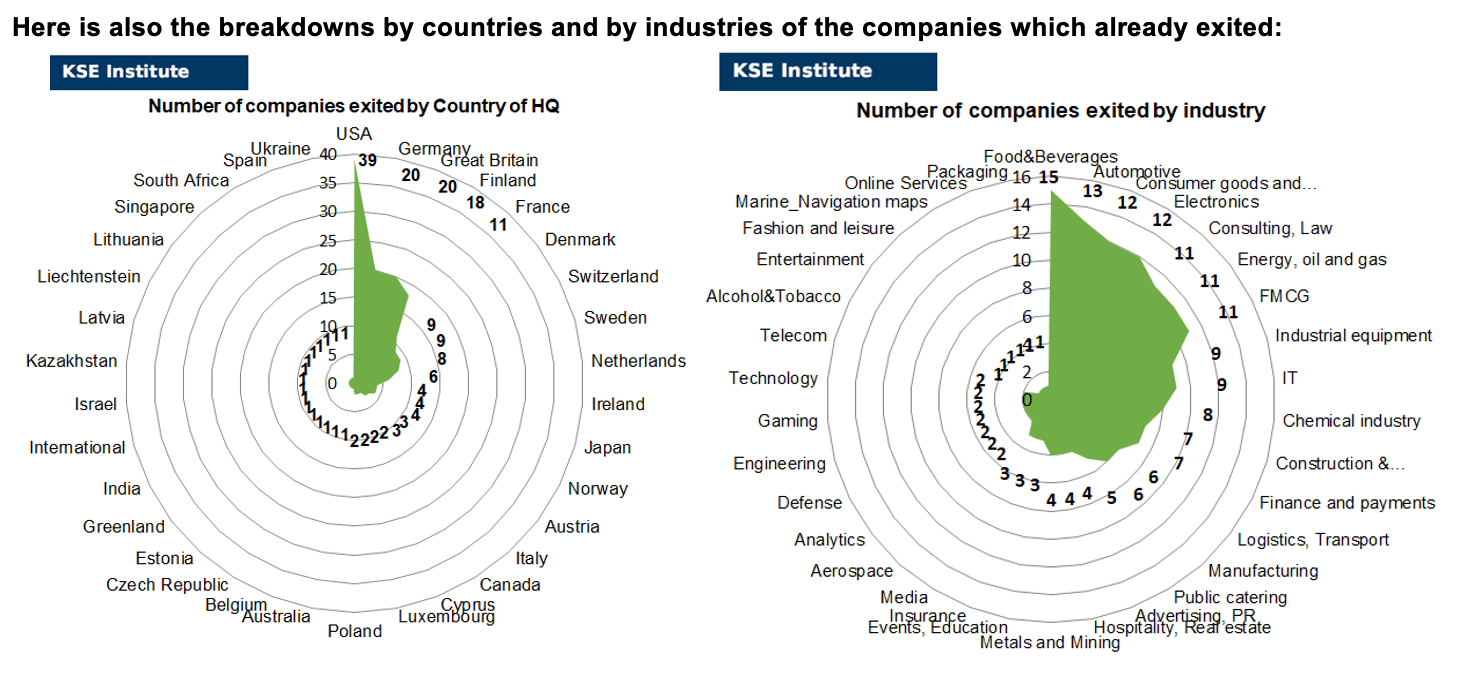

So, as of the end of January 2023, companies from 33 countries and 34 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Great Britain and Finland and operated in the “Food & Beverage”, “Automotive”, “Consumer goods and closing” and “Electronics” industries.

Here is the list of “exiters” that we were able to identify recently⁵: AMCOR, AmRest, Bonava, Breitling SA, Caverion, DLL Group, Goodvalley, Huhtamaki, Jabil, Jones Lang LaSalle Incorporated, Kantar Group, Kemira, Linas Agro Group, Maersk, MAN, Marsh McLennan, Mayr-Melnhof, Morgan Advanced Materials, Pentair, Plasan, Scania, Sony Music Group, Valio, Vitol Group, YIT.

Also, we are not yet in a hurry to assign “exited” status to dozens of companies that are literally on the verge of exit, although have not yet finalized this process.

Here are just some of them: IKEA, Mondi Group, AGCO, Volvo Cars, Lindström Group, Ikano Bank, HAVI (the owner of McDonald’s former restaurants in Russia, Alexander Govor, is buying privately-owned Russian logistics company HAVI⁶), S-Group (Sokos hotels were sold but Prisma stores in St. Petersburg continues to operate⁷).

These examples, like dozens of others, unite the fact that despite the complex procedure for sale of business in Russia and all the formalities required a lot of companies were already able to successfully pass these complex procedures and leave Russia. We understand that the process of final exit is not so simple⁸. Although inevitable. Because companies don’t just pay taxes. They create value chains, and most importantly, they compete and innovate in the market and keep it in a state of development. And assets, received by oligarchs connected to the Kremlin, are worthless without competition.

The next review of deals for February 2023 will be available in a month.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)⁹

30.01.2023

*Nexperia (Netherlands, Electronics) Status by KSE – stay

*NXP Semiconductors (Netherlands, Electronics) Status by KSE – stay

Microcircuits of mainly large Dutch manufacturers, such as NXP and Nexperia, reach Russia

https://www.epravda.com.ua/news/2023/01/29/696475/

*Agent Provocateur (Great Britain, Consumer goods and clothing) Status by KSE – stay

*Paul Smith (Great Britain, Consumer goods and clothing) Status by KSE – stay

*Rolls Royce (Great Britain, Automotive) Status by KSE – leave

Paul Smith and lingerie brand Agent Provocateur still have stores open in Moscow, while Rolls-Royce has new cars for sale in the country but claims it does not know how they got there.

https://www.dailymail.co.uk/news/article-11685551/The-luxury-goods-famous-UK-brands-sale-Moscow.html

https://twitter.com/guyadams/status/1619247507510562816/photo/1

*Baker Hughes (USA, Energy, oil and gas) Status by KSE – exited

Baker Hughes, the multinational oilfield services giant, sent oil and gas drilling equipment to Russia from Scotland despite calls from the Scottish government for businesses in the country to stop trade with Russia

*Goldman Sachs (USA, Finance and payments) Status by KSE – wait

Goldman Sachs restructures Russian asset holdings

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Czech Raiffeisen will stop transferring funds to Russia and Belarus from February

*Mastercard (USA, Finance and payments) Status by KSE – leave

Mastercard lost $30 million in 2022 due to the suspension of operations in Russia

https://www.gazeta.ru/business/news/2023/01/26/19585711.shtml

31.01.2023

*Glencore (Switzerland, FMCG) Status by KSE – wait

Commodity trader Glencore has delivered 40,000 tonnes of Russian aluminum to London Metal Exchange-approved warehouses in the South Korean port of Gwangyang

*Hyundai (South Korea, Automotive) Status by KSE – wait

Hyundai Motor Co. to Lay off Employees of Its Russian Plant

http://www.businesskorea.co.kr/news/articleView.html?idxno=108566

*Hitachi Energy (International, Energy, oil and gas) Status by KSE – exited

Hitachi Energy sold business in Russia to local management

*Rolls Royce (Great Britain, Automotive) Status by KSE – wait

The Rolls-Royce Cullinan crossover has returned to the Russian market.

Premium foreign cars began to appear on sale at Russian dealers. Cars are imported into the country under the scheme of parallel import.

01.02.2023

*Hitachi Energy (International, Energy, oil and gas) Status by KSE – exited

Hitachi Energy sold business in Russia to local management

*Geox (Italy, Consumer goods and clothing) Status by KSE – stay

Geox products are distributed in Russia through 80 mono-brand stores and more than 350 multi-brand stores: everyone has benefited from this “patience strategy”.

https://www.laconceria.it/calzatura/ecco-perche-per-geox-la-russia-e-diventata-una-miniera/

*China Construction Bank (China, Finance and payments) Status by KSE – leave

*ICBC (China, Finance and payments) Status by KSE – leave

*Bank of China (China, Finance and payments) Status by KSE – leave

The largest Chinese state banks – Bank of China, ICBC, China Construction Bank – refuse to accept payments from banks from the Russian Federation that have come under sanctions.

https://minfin.com.ua/ua/2023/02/01/100001002/

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

Our Strategy to Simplify: Lessons from Our Divestiture Journey

*ExxonMobil (USA, Energy, oil and gas) Status by KSE – leave

The Russian General Prosecutor’s Office is asking a court to recover 15.5 billion roubles ($220 million) in allegedly unpaid taxes from U.S. oil major ExxonMobil

https://www.oedigital.com/news/502573-u-s-major-exxonmobil-faces-220m-tax-claim-from-russia

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – leave

IOC stands by sanctions against Russia and Belarus

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Shares of the banking group Raiffeisen Bank International (RBI) decreased in price by 6% against the background of Ukraine’s introduction of sanctions against the leasing company, the Russian subsidiary of RBI.

https://www.epravda.com.ua/news/2023/01/30/696524/

Austria’s Raiffeisen Bank International, one of the European banks most exposed to Russia, earned more than half of its profit last year from Russia, a market it is considering exiting after the invasion of Ukraine.

https://www.reuters.com/business/finance/austrias-rbi-earns-growing-share-profit-russia-2023-02-01/

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

The net profit of the UniCredit group from operations in Russia (here is Unicreditbank) in the fourth quarter of last year amounted to 16 million euros

02.02.2023

*Paul Smith (Great Britain, Consumer goods and clothing) Status by KSE – leave

Paul Smith said it was pulling out of Russia almost a year after most western brands stopped trading in the country following the invasion of Ukraine.

*OMV (Austria, Energy, oil and gas) Status by KSE – wait

The Austrian oil and gas concern OMV wrote off assets in Russia for a total of 2.5 billion euros, the head of the company, Alfred Stern, said at a press conference.

https://www.finam.ru/publications/item/omv-spisala-aktivy-v-rossii-na-25-mlrd-evro-20230202-1656/

*Volkswagen (Germany, Automotive) Status by KSE – leave

A structure close to businessman Ihor Kim wants to buy the factoring company of the German concern Volkswagen.

https://www.interfax.ru/business/884217

*Samsung (South Korea, Electronics) Status by KSE – wait

*LG Electronics (South Korea, Electronics) Status by KSE leave

*Robert Bosch (Germany, Electronics) Status by KSE – wait

A number of Russian and Chinese vendors are negotiating the lease and purchase of Russian factories of Bosch, LG and Samsung, which have limited work in the country after the start of the military operation in 2022

https://www.kommersant.ru/doc/5797778

*GM (General Motors) (USA, Automotive) Status by KSE – leave

General Motors wrote off $657 million in connection with the termination of business in the Russian Federation in 2022

https://www.interfax.ru/business/884051

*VEON (Netherlands, Telecom) Status by KSE – leave

A Russian government commission has approved the sale of telecoms company Vimpelcom to senior managers by its Dutch owner Veon

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Shell 2022 profit more than doubles to record $40 bln

https://www.reuters.com/business/energy/shell-makes-record-40-billion-annual-profit-2023-02-02/

Shell’s stake in Russian Salym oil project went to Gazprom Neft

The energy giant Shell signed documents with the Russian company Gazprom Neft regarding the sale of 50% of Salim Petroleum Development LLC (SPD), which is engaged in the development of fields in Salim in western Siberia.

03.02.2023

*Analog Devices (USA, Electronics) Status by KSE – stay

*NXP Semiconductors (Netherlands, Electronics) Status by KSE – stay

*Infineon (Germany, Electronics) Status by KSE – stay

*Semtech (USA, Electronics) Status by KSE – stay

*Silicon Labs (USA, Electronics) Status by KSE – stay

The kamikaze drone “Lancet” (owner of the UAV manufacturer “Rostec”) turned out to be assembled from parts for vapes and children’s toys as well as electronic components of few companies

KSE Institute and Yale School of Management issued this week a joint paper named “The Russian Business Retreat – How the Ratings Measured Up One Year Later” at the Social Science Research Network (or SSRN) – TOP world’s repository of scholarly research in the economy, social sciences, humanities, life sciences among others. Here is the link with this work:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4343547

Also, this week we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ As it was mentioned earlier KSE Institute reconciled data from the University of St.Gallen latest Paper issued in January on 120 exits and verified them with EGRUL whether there were real sales. As a result, 7 new companies were identified and added to KSE’s database and 13 new exits confirmed.

⁵ Telia Company was deleted from the database as they left Russia before the invasion

⁷ https://www.rbc.ru/rbcfreenews/6221fbc79a79471b05ebfd35

⁸ On April 8, 2022 the Russian Parliament introduced a draft law allowing the Russian government to expropriate the property of foreign nationals/companies from “unfriendly countries”. So far, this bill was not voted into law and is being reconsidered. Based on various press reports and general sentiment of Russian commentators, there are grounds to believe that similar law can be adopted in the near term. The draft law stipulated the following:

- • Russian courts are authorized to appoint an ‘external administrator’ of a foreign-owned Russian company if 25% or more of that company’s shares are owned by foreign shareholders from “unfriendly” states, and the company has either exited Russia or taken actions to terminate its business in Russia;

- • A Russian state entity, or other Russian entities can be appointed as external administrators;

- • The external administrator shall have a mandate to liquidate the company and transfer all of its assets to a new company;

- • The shares and assets of the new company would then be transferred and disposed of by way of public auction;

- • The original shareholders shall not be admitted to the auction;

- • If no bidders submit their proposals, the Russian government may purchase the shares, at a price to be set by the Ministry for Economic Development;

- • The bill explicitly stipulates that original shareholders’ right of ownership over the company is to be annulled;

- • The bill further states that the confiscation shall be carried out without any compensation.

PRACTICAL STEPS IN DIVESTMENT FROM RUSSIA are described in the recent analysis prepared by Anna Vlasiuk and Nataliia Shapoval.

⁹ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site