- Kyiv School of Economics

- About the School

- News

- 16th issue of the weekly digest on impact of foreign companies’ exit on RF economy

16th issue of the weekly digest on impact of foreign companies’ exit on RF economy

29 August 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 22-28.08.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

KSE DATABASE SNAPSHOT as of 28.08.2022

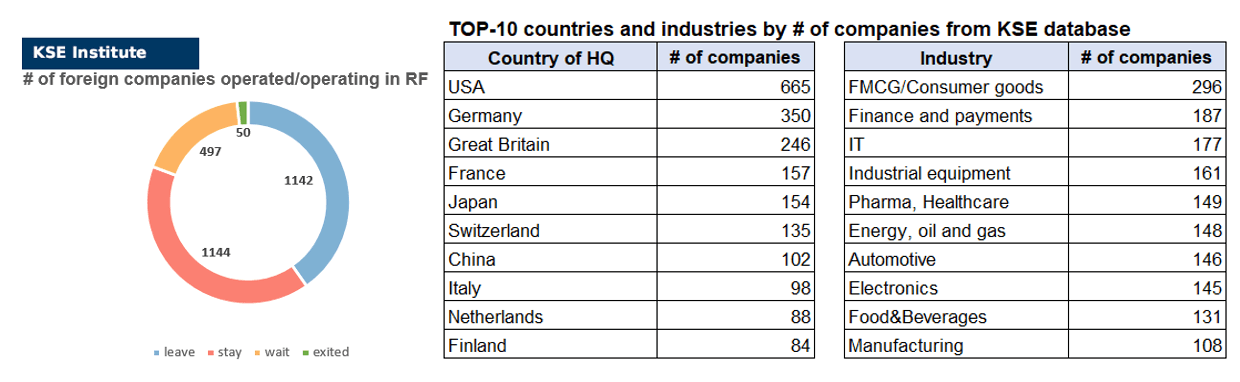

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 144 (+395² per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 497 (+19 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 142 (+11 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 50 (+2 per week)

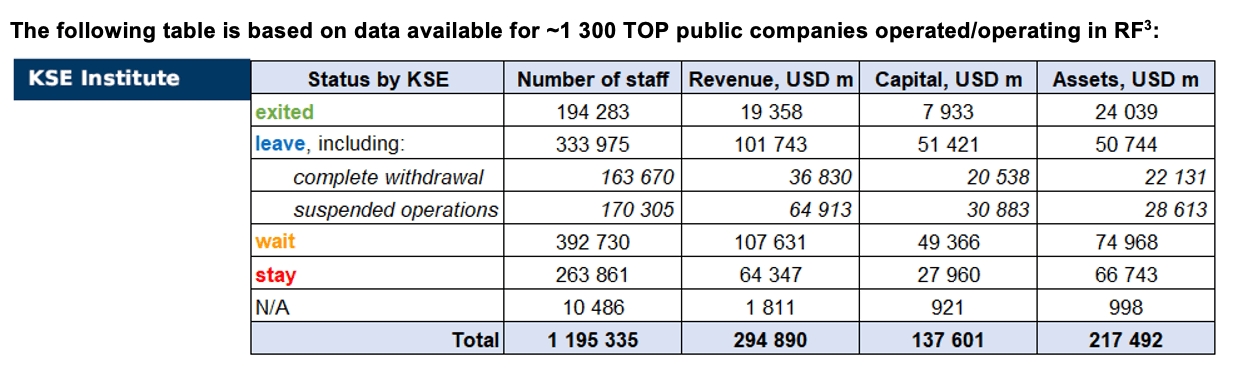

As of August 28, we have identified about 2,833 companies, organizations and their brands from 83 countries and 56 industries and analyzed their position on the Russian market. About half of them are public ones, for ~ 1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $137.6 billion), local revenue (about $294.9 billion), local assets (about $217.5 billion) as well as staff (about 1.195 million people). 1,689 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 50 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, As of August 28, companies which had already completely exited from the Russian Federation, had 194,300 personnel, $19.4 bn in annual revenue and $7.9 bn in capital; companies, that declared a complete withdrawal from Russia had 163,700 personnel, $36.8bn in revenues and $20.5bn in capital; companies that suspended operations on the Russian market had 170,300 personnel, annual revenue of $64.9bn and $30.9bn in capital.

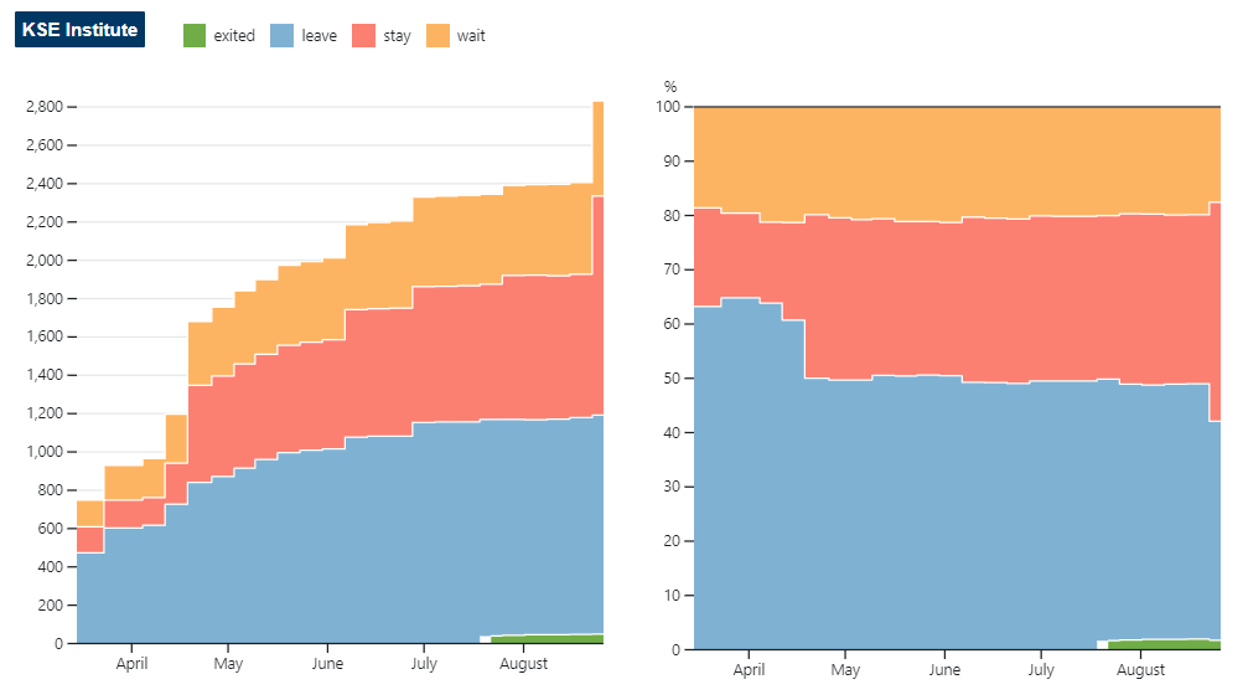

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 40.3% of foreign companies have already announced their withdrawal from the Russian market, but another 40.4% are still remaining in the country, 17.5% are waiting and only 1.8% made a complete exit⁴.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

THE KSE DATABASE HAS BEEN SUBSTANTIALLY UPDATED, DESCRIPTION OF THE MAIN CHANGES

This week, KSE Institute significantly expanded the list of companies, adding 422 new ones. Where do new records come from and how do we expand the database?

There are hundreds of thousands and millions of companies in the world. Everyone has heard of a small part of them – Apple, Google, Microsoft, McDonald’s, etc. Probably almost every person on the planet has heard of them. Also, when Russia launched its unprovoked barbaric invasion of Ukraine on February 24, 2022, the world’s largest and most socially responsible companies began to independently make statements in which they at least condemned military aggression, and at most – declared their intention to leave the market in the Russian Federation in response. For some of them it is easy to do (such as Taiwan’s TSMC, which did not directly work in the Russian market, but expressed strong solidarity with Ukraine), for others – it is more difficult (such as Finland’s Nokian Tires, which has a legal entity in the Russian Federation, a tire production plant and generally receives about half of its global revenue in the Russian Federation).

Lists of companies and their decisions then began to be tracked and collected by many organizations, including the KSE Institute. But at some point we realized that our greatest efforts should be directed at identifying those international firms that have physical assets in the Russian Federation (legal entities, personnel, receive revenue, pay taxes, have production, etc.).

In order to identify and rank the TOP-largest foreigners in the Russian Federation, we started with a list of several dozen legal entities in the Russian Federation with non-resident owners. This list is formed according to the statistics codes from Rosstat (OKOGU Code 4210011 Household companies and partnerships with the participation of foreign legal entities and (or) natural persons, as well as stateless persons). However, the majority on this list are not real foreigners. Often, it is the property of the Russians themselves (for example, Yandex, Evraz, Pyaterochka and others) registered to foreign structures, sometimes offshore. Each record had to be checked by hand. After processing a couple of thousand items, we were able to create a TOP-350 list from scratch in the spring of 2022 and rank them by the amount of revenue received directly in the Russian Federation. We continued to gradually process new entries from open registers and data from Russia’s EGRUL and gradually add new corporations, expanding their list to about 800 as of the end of July.

In August, we developed an automatic algorithm that was able to independently process almost ten thousand records of legal entities, and thus we managed to expand the list to almost 1,300 largest foreign companies in the Russian Federation with a minimum revenue of 3.7 million US dollars. Currently, as far as we know, this dataset has no analogues in the world (the largest one close to it is the rating of the Russian Forbes TOP-50 foreign companies in the Russian Federation).

This explains the fact that this week we simultaneously expanded our database of companies by 422 new positions. As of now, the list of those for whom we have found assets in the Russian Federation already includes a little more than 1,300 companies, and our database contains almost 2,900 records (companies, organizations, services, etc., for which the position is known, but some of them do not necessarily directly conduct business in Russia).

For 422 of these “newly arrived” companies, we also tried to automatically find their press releases or news in the media about their relationship to the war and plans to work on the Russian market. But for the absolute majority, it was not possible to do this. Therefore, taking into account the fact that they have an active business in the Russian Federation, with some exceptions, all of them received the status of those who stay to work and do not leave: 394 – stay, 12 – leave, 16 – wait.

Of course, we are open to comments and are ready to revise the position of any company if we receive more information not previously available to us (please do it via the Feedback Form at the https://leave-russia.org/ website).

WEEKLY FOCUS: SMARTPHONE MARKET IN RUSSIA AFTER WORLD’S LEADING BRANDS DEPARTURE

Phone sales in Russia have decreased by 50% in July year-on-year. While Apple and Samsung have stopped shipments, Chinese brands are taking over the market. Gray import is slowly rising as well.

Samsung and Apple suspended their shipments. Parallel import allowed by Russia facilitates importing the most expensive and best-selling models but does not replace the entire line of products. Apple halted sales in Russia on March 1 2022. Moreover, the company restricted the Apple Pay service. The share of the company in July fell to 7%⁵.

In early March, Samsung suspended its shipments as well. The company used to have the largest share of sales on the market, and then its share fell from 30%l to 8.5%. Media reports that the company creates ways of gray imports into Russia to directly bypass sanctions⁶. Samsung keeps its R&D center in Russia and hires staff. The market is waiting for whether the company will return to the market.

The exit of Samsung and Apple created a favorable situation for the commercial activity in Russia of Xiaomi and its two other brands, Redmi and Poco. In July, their share reached 42% of the Russian smartphone market, while in February its share was close to Samsung’s one. Wall Street Journal wrote⁷ that Xiaomi cut shipments to Russia, but Russian media report that their products are widely available⁸.

Another Chinese brand that gained market share⁹ was realme, a BBK Electronics brand with a 17% share in the number of phones sold. The figure is higher than Samsung and Apple together. Another brand that gained market share was Tecno (7.5% of the market in July).

Huawei is losing its market share⁹ due to the absence of Google services in most modern Huawei smartphones and a substantial reduction in the manufacturer’s assortment. Honor, another brand of Huawei, stopped supplying smartphones to Russia¹⁰.

At the same time, a new brand entered the Russian market. Wiko, a French brand of Chinese company Tinno Mobile Technology, started sales in August¹¹. It is another example of a Chinese company replacing the brands’ products, which refused to supply smartphones to the Russian Federation.

The Russian smartphone market fell significantly, but the media reports some signs of slow recovery¹². Chinese companies are replacing the world’s leading brands. There are risks for some of Samsung to return to the market. Constant public attention is required not to allow it.

You can also contribute by spreading the status of the company with a call to leave Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)¹³

22.08.2022

*Robert Bosch (Germany, Electronics) Status by KSE – wait

Bosch is looking for buyers for its Russian assets

https://news.finance.ua/ua/bosch-shukaye-pokupciv-na-svoi-rosiys-ki-aktyvy

23.08.2022

*IMAX Corporation (Canada, Telecom) Status by KSE – leave

Russian cinemas cannot show films in IMAX due to the company’s withdrawal from the Russian Federation

https://www.epravda.com.ua/news/2022/08/23/690709/

*Crocs (USA, Consumer goods and clothing) Status by KSE – wait

Crocs stores are reopening in Russia

https://news.finance.ua/ua/mahazyny-crocs-vidnovlyuyut-robotu-u-rosii

*Storytel (Sweden,Entertainment) Status by KSE – leave

The Swedish electronic and audiobook service Storytel will leave the Russian market on October 1, funds for unused subscription days will be returned to customers

https://www.rbc.ru/business/22/08/2022/6303c3d69a7947cb9dcddf6e

*Lindab (Sweden, Construction & Architecture) Status by KSE – exited

As of August 1, Lindab has no operations in, sales to, or purchases from Russia. Russian subsidiary has been sold to the company’s local Managing Director

https://www.lindabgroup.com/media/news-media/press-releases/press-release/71BDAB7C5810F90C

*Ansell (Australia, Manufacturing) Status by KSE – leave

Ansell halted production at Russian factory in June, 23/08 decision being to exit both commercial and manufacturing operations

24.08.2022

*Taipower (Taiwan, Energy, oil and gas) Status by KSE – leave

Taiwan’s state-owned utility Taipower has made its last payment for Russian coal under a deal signed before the war in Ukraine and it will not enter into any new purchase agreements with Russia, a company spokesperson said on Wednesday.

*Total Energies (France, Energy, oil and gas) Status by KSE – wait

TotalEnergies’ answer to questions from Le Monde newspaper dated 08/24/2022

No, TotalEnergies does not produce kerosene for the Russian military.

25.08.2022

*Samsonite International (USA, Consumer goods and clothing) Status by KSE – exited

Samsonite has been sold to its local management for an undisclosed sum. One of the options is to continue to sell Samsonite luggage but as a parallel import

*Mitsubishi Corporation (Japan, Conglomerate) Status by KSE – wait

Mitsui & Co. (Japan, Conglomerate) Status by KSE – stay

Keep its shares in new Sakhalin-2 Russian operator

https://asia.nikkei.com/Business/Energy/Mitsubishi-set-to-join-new-Sakhalin-2-Russian-operator

26.08.2022

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – wait

wind down its consumer banking and local commercial banking operations in the country starting Q32022

https://www.citigroup.com/citi/news/2022/220825a.htm

*JERA (Japan, Energy, oil and gas) Status by KSE – stay

JERA, a of 50-50 joint venture between TEPCO Fuel & Power and Chubu Electric Power, signed a deal with the new operator of the Sakhalin-2 energy project in Russia to maintain long-term deliveries of liquefied natural gas (LNG).

*Grundfos (Denmark, Engineering) Status by KSE – leave

The decision to fully close business in Russia and Belarus is reflected in the upcoming announcement of Grundfos’ half-year results. A significant one-off cost of DKK 851m related to the closing of business in Russia and Belarus will be reported.

https://www.grundfos.com/media/latest-news/grundfos-closes-its-business-in-russia-and-belarus

*Chery Automobile (China, Automotive) Status by KSE – stay

The Chinese car concern can start assembly at another Sollers plant or buy out the assembly facilities

https://www.vedomosti.ru/auto/articles/2022/08/26/937690-sanktsii-pomeshali-chery

*Mercedes-Benz (Germany, Automotive) Status by KSE – leave

Mercedes-Benz wants to sell its Russian car assembly plant

27.08.2022

*Home Credit (Czech Republic, Finance and payments) Status by KSE – leave

The structure of the Czech group Home Credit left the capital of KhF Bank, transferring its share of 49.5% to it, it follows from the data of EGRYUL

https://www.forbes.ru/finansy/475413-struktura-cesskoj-home-credit-vysla-iz-kapitala-hkf-banka

*Dell (USA,Electronics) Status by KSE – leave

The American corporation Dell is finally leaving Russia, dismissing the entire staff

https://www.cnews.ru/news/top/2022-08-25_krupnejshij_postavshchik_serverov

*Trafigura (Singapore, Metals and Mining) Status by KSE – wait

Trafigura Sells Russian Fuel to Ecuador as EU Ban Approaches

*Coca-Cola HBC AG (Switzerland, FMCG) Status by KSE – wait

Coca-Cola bottler starts making ‘Dobry Cola’ in Russia

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² Including new ones added to the database with the following statuses: 394 – “stay”, 12 – “leave”, 16 – “wait”

³ As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 07/08/2022, we have updated data for some companies on personnel, revenue, and capital for 2021 (and will continue to do so as new data is processed). Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The first collected information is already available and systematized in the form of a newKSE’s status “exited”.

⁴ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/.

⁵ Media report similar estimates of market shares. Figures in this article are based on publication by Kommersant on July sales as a share in number of phones sold https://www.kommersant.ru/doc/5503808

⁶ https://ukranews.com/en/news/871297-sanctions-futile-samsung-continues-to-work-in-rf-media

⁹ https://www.ixbt.com/news/2022/08/03/huawei-na-rynke-smartfonov-rossii-opuskaetsja-vsjo-nizhe.html

¹⁰ https://www.vedomosti.ru/technology/articles/2022/06/30/929137-honor-prekratila-smartfonov

¹¹ https://www.ixbt.com/news/2022/08/12/apple-samsung-wiko.html

¹³ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site