- Kyiv School of Economics

- About the School

- News

- 32nd issue of the weekly digest on impact of foreign companies’ exit on RF economy

32nd issue of the weekly digest on impact of foreign companies’ exit on RF economy

19 December 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 12-18.12.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 18.12.2022

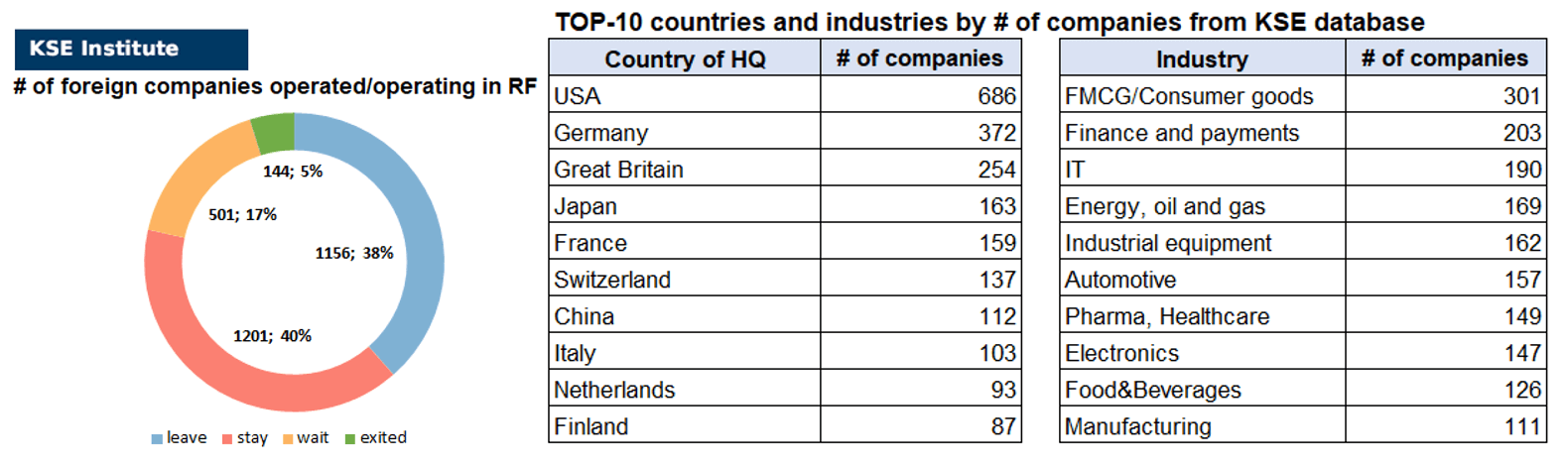

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 201 (+10 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 501 (+2 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 156 (+6 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 144 (+1 per week)

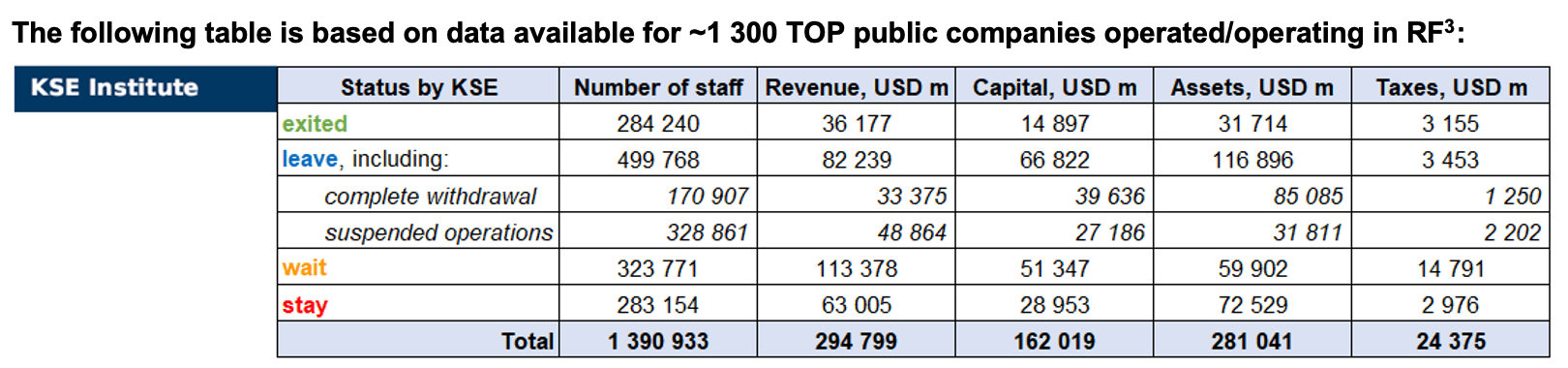

As of December 18, we have identified about 3,002 companies, organisations and their brands from 86 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $162.0 billion), local revenue (about $294.8 billion), local assets (about $281.0 billion) as well as staff (about 1.391 million people) and taxes paid (about $24.4 billion). 1,657 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 144 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of December 18, companies which had already completely exited from the Russian Federation, had at least 284,000 personnel, $36.2 bn in annual revenue, $14.9bn in capital and $31.7bn in assets; companies, that declared a complete withdrawal from Russia had 170,900 personnel, $33.4bn in revenues, $39.6bn in capital and $85.1 bn in assets; companies that suspended operations on the Russian market had 329,000 personnel, annual revenue of $48.9bn, $27.2bn in capital and $31.8 bn in assets.

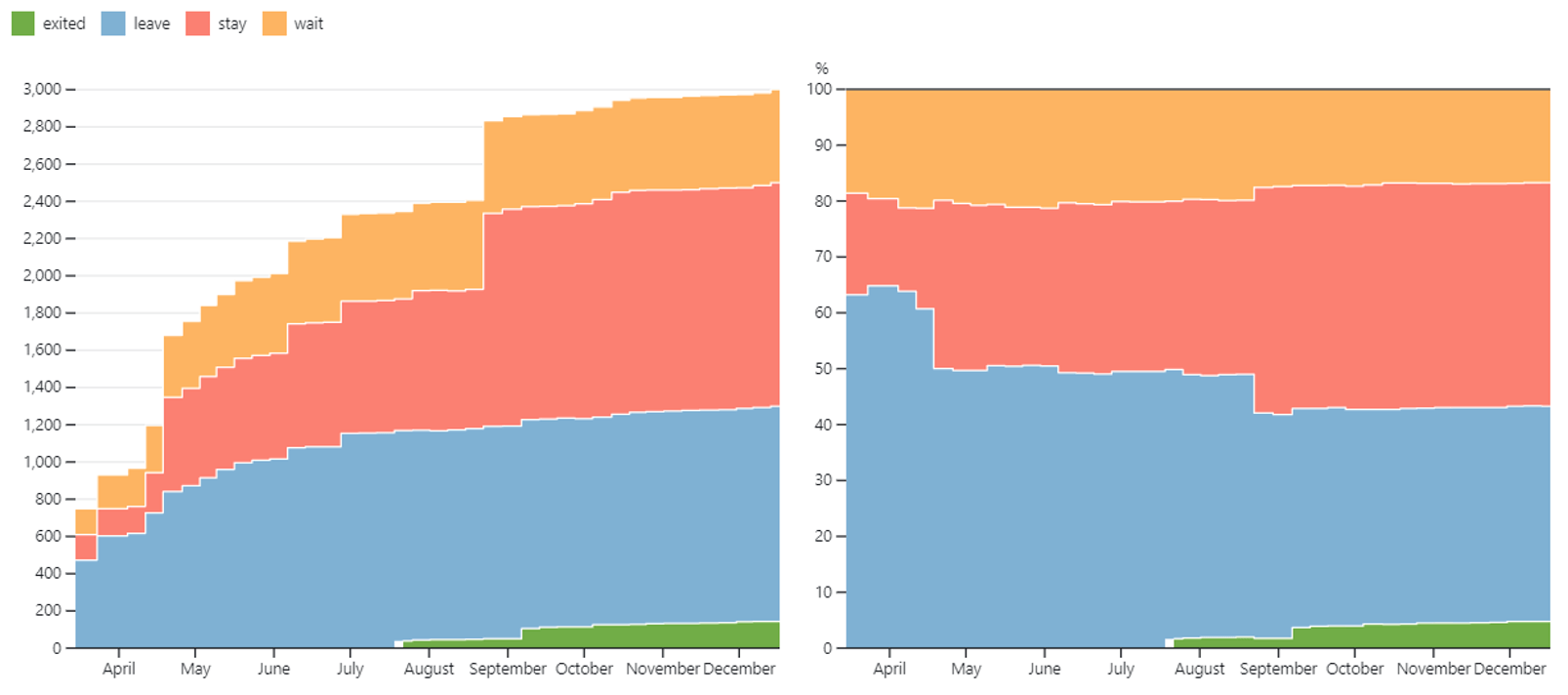

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 38.5% of foreign companies have already announced their withdrawal from the Russian market, but another 40.0% are still remaining in the country, 16.7% are waiting and only 4.8% made a complete exit⁴.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 144 companies that completely left the country, since they employed almost 20.4% of the personnel employed in foreign companies, the companies owned about 11.3% of the assets, had 9.2% of capital invested by foreign companies, only last year they generated revenue of $36.2 billion or 12.3% of total revenue and paid $3.2 billion of taxes or 12.9% of total taxes paid by the companies observed. Data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: New Year & Christmas spendings in Russia will be significantly affected by exit of foreign companies from the country

In connection with the introduction of Western sanctions against Russia, existing earlier supply chains of goods traditionally ordered by Russians in connection with the New Year holidays have been disrupted this year.

After the introduction of Western sanctions, Russians, instead of ordering New Year’s goods in the West, began to massively order New Year’s gifts in Chinese online stores, while there is a delay in receiving their parcels from China on time. The delay in the shipment of these cargoes, for example, by rail, is also connected with the fact that now the priority is given to the shipment of Russian coal and wood to China, since Russia is gradually becoming a raw material appendage of China⁵.

In connection with the sanctions imposed by the West against Russia, New Year’s gifts for Russians became more expensive by 20% compared to last year, including due to the fact that it was necessary to establish cooperation with other suppliers of New Year’s gifts to Russia.

Also, a constant and beloved attribute of winter holidays – a live Christmas tree – may not be found in every Moscow apartment. In connection with the Western sanctions, it turned out that a certain proportion of Christmas trees, which were previously sold on the Russian market, were imported and supplied mainly from Europe. Now, when the logistics chains have been disrupted and supplies have significantly decreased, there is a shortage of Christmas tree products on the Russian market and its price has risen significantly⁶.

It is quite expected that Russians will have to spend 15-20% more on setting the New Year’s table than last year.

The inflationary shock caused by the sanctions led to an increase in the cost of almost all products that are part of the traditional New Year’s holiday dishes. The price of meat and fish delicacies increased the most, namely by 40%. Now you will have to pay 18-23% more for the main ingredient “herring under a fur coat”, and 12% more for caviar. Raw meat and fish, as well as cheese, increased in price by more than 10%. Imported alcohol (+30%), which is now imported mainly under the schemes of “grey” imports, will hit the wallets of the families of the occupiers hard. Russians will not be able to save on sweets either. According to Rosprodsoyuz, only chocolates rose in price by 23%. Also, the cost of carbonated drinks increased by 22%.

The most noticeable changes in the New Year’s menu will affect representatives of the middle class, these people usually buy high-quality products and use high-level services, but in the crisis period they have to cut costs, and when they lose income, they sharply lose their usual level of consumption. In general, due to a decrease in the purchasing power of Russians, stores will sell 10-15% less products in December 2022 compared to last year. And according to the survey of the All-Russian Center for the Study of Public Opinion, 35% of the population of Russia has already reduced their spending on food⁷.

Another economic problem faced by ordinary citizens of Russia was the suspension of the MasterCard and Visa payment systems in Russia, which led to obstacles in Russians’ New Year’s shopping.

It should be noted that several Russian cities are suspending New Year’s celebrations in order to redirect funds to the Russian army, as Russia continues its shameful war in Ukraine and is forced to increasingly dig into the “pockets” of local budgets. Officials in St. Petersburg, Yaroslavl, Kaluga, Nizhny Novgorod, Tomsk Region of Siberia and the Republic of Sakha cancelled the celebrations. In Moscow, Mayor Serhii Sobyanin announced that the capital would celebrate in a more relaxed tone, abandoning the usual fireworks and mass concert. According to him, events and celebrations will still take place, and part of the profits will be directed to the needs of the military⁸.

The professional services network Deloitte, before its exit from the country, published annual reports on expected budget planning, purchases and purchasing behaviour of Russian consumers on the eve of the New Year. According to Deloitte data, in other years, in general, Russians were ready to spend 17,600 rubles or ~$270 per person on vacation. The dream gift for many Russians is money – 69% preferred it (and now, probably, it is even more relevant). Travel (41%) and smartphones (37%) were also on the wish list. But the majority of Russians will receive candy or cosmetics (now, mainly of domestic production), and only 31% will receive money. And if you want to know where you can meet Russians, apart from Russia, the most popular winter destinations were Thailand, the United Arab Emirates and Turkey (the last 2 countries still receive Russian tourists). But many Russians plan to spend New Year’s holidays at home⁹.

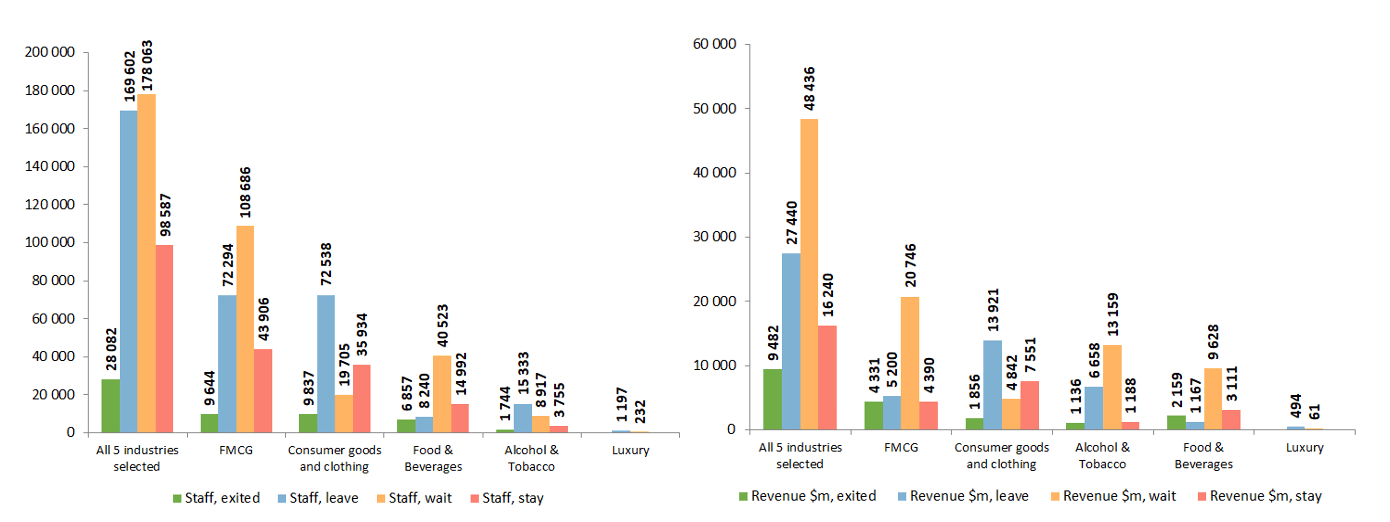

KSE Institute has analysed 5 key industries that are directly related to retail sales, which are particularly active during the New Year and Christmas period, namely:

• Consumer Goods and Clothing – 208 companies

• FMCG – 93 companies

• Food & Beverages – 119 companies

• Alcohol & Tobacco – 40 companies

• Luxury – 28 companies..

In these 5 industries, in 2021, at least 488 companies (with a capital share of 50+%) worked in Russia, employing at least 474,000 people, these companies received $101.6 billion in annual revenue, paid $14.9 billion in taxes, had $45.3 billion in capital and $49.0 billion in assets.

About 28,000 employees worked in companies from these sectors, which have already completely exited Russia by selling their shares, and another 170,000 people worked in companies that announced plans to leave Russia. All these people have already left or will soon leave their previous place of work in connection with their exit and will be forced to look for a new, lower-paid job or register at employment centres. Also, in 2021, companies that have already completely left the country received $9.5 billion in annual revenue, and those companies that announced their intention to leave Russia generated $27.4 billion in annual revenue. Here is the details by sectors:

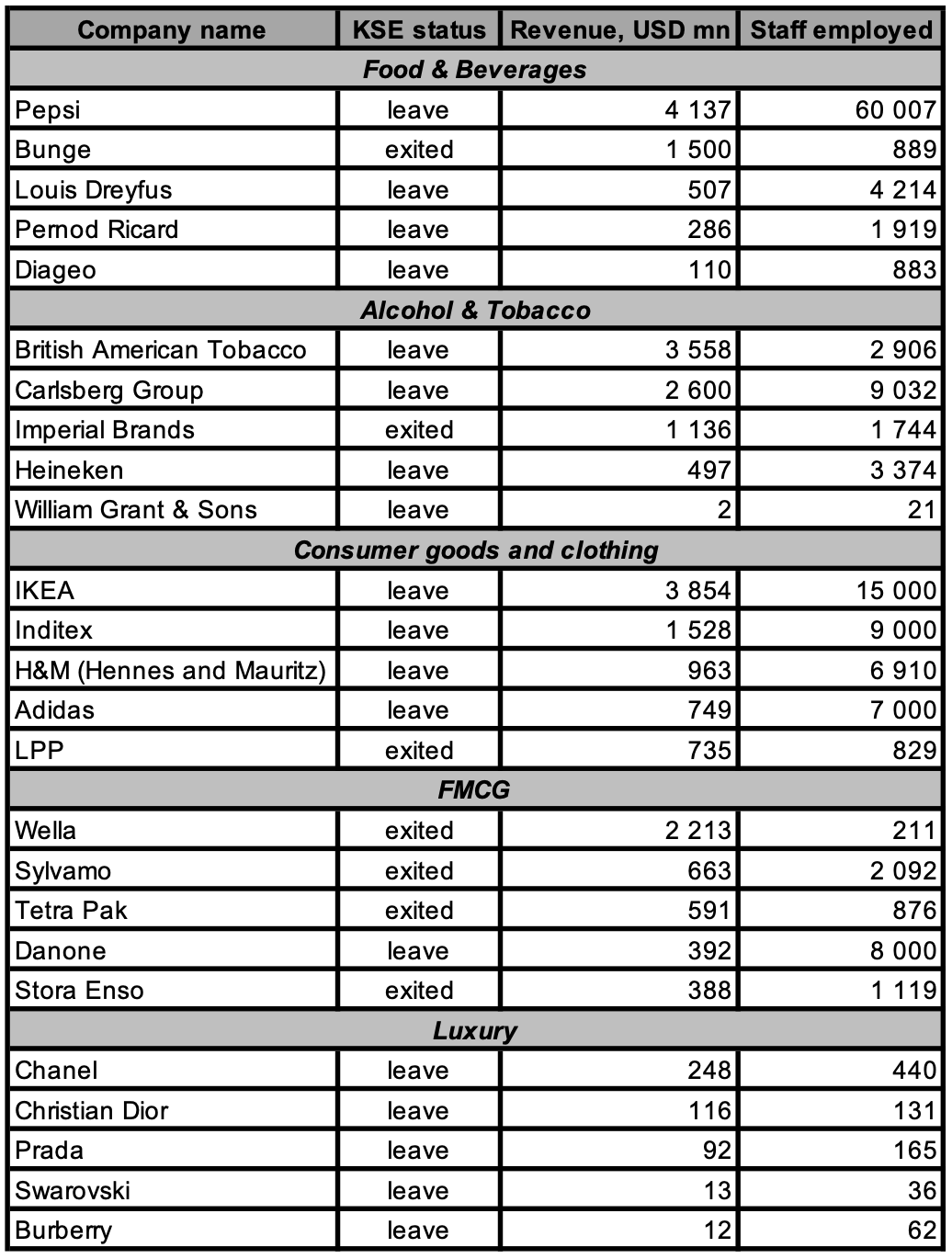

Below you can see the list of TOP companies which announced plans to leave Russia or already left it by revenue received in 2021 (see Appendix 1 for the amount of revenue received and the number of personnel employed). Their leaving will significantly affect consumption habits of Russians.

Analysis of companies’ actions in certain industries

Food & Beverages

Pepsi (USA, Status by KSE – leave) In September 2022 PepsiCo Inc stopped making Pepsi, 7UP and Mountain Dew in Russia nearly six months after the U.S. company said it would suspend sales and production after Moscow sent tens of thousands of troops into Ukraine.

Bunge (USA, Status by KSE- exited) Bunge Ltd. sold its sunflower-crushing plant in Russia, marking the biggest oilseed processor’s exit from the country in response to the invasion of Ukraine.

Louis Dreyfus (Netherlands, Status by KSE – leave) Louis Dreyfus Company (LDC), one of the world’s largest agricultural commodity merchants, has suspended its operations in Russia. LDC operates a grain export terminal on the Azov Sea, with annual capacity of about 1 million tonnes, and exports 1.5-3 million tonnes per year in total from Russia, according to its website. The Azov Sea has been closed to shipping due to the war. Russian ports on the Black Sea remain open but traders say international companies and ship owners are reluctant to use them because of the war and related sanctions.

Diageo (Great Britain, Status by KSE – leave) Spirits company Diageo the maker of Smirnoff vodka and Guinness, has paused exports to Ukraine and Russia. “Our priority is the safety of our people in Ukraine and the wider region,” a spokesperson said.

Alcohol & Tobacco

British American Tobacco (Great Britain, Status by KSE – leave) is a multinational company that manufactures and sells cigarettes, tobacco and other nicotine products. In the spring, the company concluded that BAT’s ownership of the business in Russia is no longer sustainable under current conditions.

The company has begun the process of quickly bringing its Russian business into full compliance with international and local legislation. After completion, BAT will no longer be represented in Russia.

Carlsberg Group (Denmark, Status by KSE – leave) In connection with Carlsberg Group’s decision to withdraw from the Russian market, which was announced on March 28, the company recorded a loss of 8.6 billion Danish kroner in the first half of the year. “We are satisfied with the results for the first half of the year in the context of serious challenges related to the war in Ukraine, rising prices for raw materials and energy, as well as the pandemic,” commented Carlsberg Group CEO Kees et’Hart.

Imperial Brands (Great Britain, Status by KSE – exited) Imperial Brands transferred its Russian business to investors based in Russia. Imperial’s operations included sales and marketing, as well as a plant in Volgograd.

Heineken (Netherlands, Status by KSE – leave) HEINEKEN stopped new investments and exports to Russia, ended the production, sale and advertising of the Heineken brand, and announced that they will not accept any net financial benefits or profit from our business in Russia. Heineken N.V. said it plans to reach an agreement on the sale of Russian assets, valued at a total of 475 million euros, in the second half of 2022.

William Grant & Sons (Great Britain, Status by KSE – leave) In connection with the tragedy in Ukraine, the company suspended all deliveries to Russia. The top priority is to ensure the safety and well-being of our people around the world, especially in the affected region.

Consumer goods and clothing

IKEA (Sweden, Status by KSE – leave) IKEA has decided to liquidate its “daughter”, which manages the stores of the Swedish retailer in Russia. The application for the liquidation of the legal entity was submitted on the last day of the final sale of goods from IKEA warehouses in Russia.

Inditex (Spain, Status by KSE – leave) Inditex, which halted sales in Russia back in March after the invasion of Ukraine, is selling its 500-plus Russian stores to the United Arab Emirates-based Daher Group.

H&M (Hennes and Mauritz) (Sweden, Status by KSE – leave) Swedish retailer H&M, which has been operating in Russia since 2009, confirmed the closure of all Russian stores. “We confirm that all H&M Group stores in Russia are closed,” H&M said.

Adidas (Germany, Status by KSE – leave) German sportswear company Adidas AG is closing its stores in Russia and suspending its online shop, joining a raft of Western businesses that have pulled out of the country.

LPP (Poland, Status by KSE – exited) The Polish retailer LPP (Reserved, Cropp, Mohito and Sinsay brands) transferred its stores in the Russian Federation to a company registered in the UAE and its top manager.

FMCG

Wella (Germany, Status by KSE – exited) The German cosmetics company announced its withdrawal from Russia. Wella no longer manufactures and sells products under its brands in Russia, and ownership of the business has been transferred to a local team of top managers.

Sylvamo (USA, Status by KSE – exited) Sylvamo, the world’s paper company, is announcing it reached an agreement and completed the sale of its Russian operations to Pulp Invest Limited Liability Company for $420 million.

Tetra Pak (Sweden, Status by KSE – exited) is a multinational company of Swedish origin. The company manufactures packaging, packaging machines and liquid food processing equipment, as well as group packaging equipment.Tetra Pak has reached an agreement to divest its Russian business to local management.

Danone (France, Status by KSE – leave) is a French food company, a well-known manufacturer of dairy products and other food products. Suspend new investment in Russia. Announced Transfer: the company seeks new operator for dairy, plant-based operations.

Stora Enso (Finland, Status by KSE – exited) is a manufacturer of pulp, paper and other forest products, headquartered in Helsinki, Finland. The company has sold three of its packaging plants located in Lukhovitsy, Arzamas and Balabanovo to local management.

Luxury

Chanel (Great Britain, Status by KSE – leave) is a French luxury fashion house. Chanel wrote on LinkedIn: “Given our increasing concerns about the current situation, the growing uncertainty and the complexity to operate, Chanel decided to temporarily pause its business in Russia”. Chanel has announced a policy to refuse to sell to Russians shopping abroad unless proven they don’t reside there or bring the goods for use there.

Prada (Italy, Status by KSE – leave) “Prada Group suspends its retail operations in Russia. Our primary concern is for all colleagues and their families affected by the tragedy in Ukraine, and we will continue to support them. The Group will continue to monitor further development,” – the company said in a statement

Swarovski (Austria, Status by KSE – leave) is an Austrian company specialising in the production of loose crystals, jewellery, crystal figurines and the cutting of synthetic and natural gemstones. The company suspended all sales in Russia. The site is closed for sales in the Russian region.

Burberry (Great Britain, Status by KSE – leave) is a British company that manufactures clothing, accessories and perfumes. Burberry has become the latest luxury brand to temporarily shut its stores in Russia following Moscow’s invasion of its neighbour Ukraine. The British fashion brand has three stores in the country, including one run by a franchisee and one in Moscow’s famous Red Square. Its decision to cease shipments to the country “due to operational challenges” had already effectively shut its online operations across the country.

Summary

In general, residents of Russia are more likely than other Europeans to reduce holiday spending for Christmas and New Year. On average, according to previous research, the Christmas expenses of Europeans practically did not decrease and amounted to approximately 513 euros per family. In Russia, the holiday budget is expected to decrease by 7% to 217 euros¹⁰.

According to TGM Global Christmas Survey 2021¹¹

(we believe that last year’s trends will not change significantly this year) most Russians will spend New Year’s and Christmas at home for dinner (74%) and visiting family and friends (63%). More than half of the respondents planned to take a walk (56%), watch movies and TV shows (55%), cook (71%) and decorate the house (71%). Only 1-2% plan to visit other countries. 54% of respondents will spend the main New Year’s budget on food and gifts for loved ones and children and decorating their homes.

In contrast to Russians, according to a survey recently conducted by the Deloitte (which was one of the first in Big4 to leave Russia at the beginning of the war), more than 60% of Ukrainians will spend part of the New Year’s budget to help the Armed Forces.

Thus, 61% of Ukrainians, despite the war, do not plan to give up New Year’s shopping, and more than 60% of Ukrainians will spend at least part of their shopping budget to help the Armed Forces or war victims. “The majority of Ukrainians (61%), despite everything, are planning New Year’s and Christmas shopping, although they will buy fewer goods than in 2021,” says Deloitte.

At the same time, the budget of almost half of Ukrainians (49%) for shopping in the New Year and Christmas period ranges from 1 to 5 thousand UAH. It is noted that the focus of shopping is the most necessary – food products, goods for children, clothes and shoes. When making purchases, consumers will primarily consider the availability of discounts, as well as their own previous experience, according to the study.

And “63% of Ukrainians will not buy goods if their manufacturer or seller has not left the Russian market,” the results of the survey show. At the same time, offline will prevail over online. According to the survey, large supermarkets and shopping malls will be the main place for New Year’s and Christmas shopping this year shopping centres/department stores.In third place – shopping on the Internet.

In the conditions of high uncertainty caused by the war, the shopping of Ukrainians is postponed until the second half of December, Deloitte adds.

Considering the above, it should be noted that the Western sanctions against Russia closed its economy from most of the world trade, which led to the fact that Russians began to panic buy basic food products, such as sugar and buckwheat, orders became significantly less – people became save more on holidays. Currently, for economic reasons, private individuals and organisations refuse lavish celebrations and save heavily on New Year’s paraphernalia, including Christmas trees and corporate parties. It is likely that Russians will not be in a festive mood during the New Year holidays. The current situation in Russia is in many ways reminiscent of the survival regime of the distant Soviet times.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)¹³

13.12.2022

*Disney (USA, Entertainment) Status by KSE – leave

Disney Channel Russia stops broadcasting, replaced by local kids’ TV channel

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

Uralsib completes purchase of Citi’s Russian consumer loan portfolio

*Boeing (USA, Aircraft industry) Status by KSE – leave

Ditching Russia, Boeing’s Engineer Search Intensifies in India, Brazil

14.12.2022

*Airbus (Brazil, Aircraft industry) Status by KSE – leave

Airbus Commit To Stop Buying Russian Titanium

https://travelradar.aero/airbus-commit-to-stop-buying-russian-titanium/

*Holcim Group ( Switzerland, Construction & Architecture) Status by KSE – leave

Holcim divests business in Russia

https://www.reuters.com/markets/deals/holcim-divests-business-russia-2022-12-14/

*Inditex (Spain, Consumer goods and clothing) Status by KSE – leave

Inditex third-quarter sales rise despite cost inflation, Russian operations charge

15.12.2022

*Fenner Dunlop (Great Britain, Industrial equipment) Status by KSE – leave

Fenner Dunlop: Hull firm closing as Russia sales end over Ukraine war

https://www.bbc.com/news/uk-england-humber-63948652

*Ericsson (Sweden, IT) Status by KSE – leave

The new owners of the business, which has some 40 employees, come from the management of Ericsson’s Russian subsidiary, the company said in a statement.

*Mondi Group (Great Britain, FMCG) Status by KSE – wait

UK’s Mondi to sell three Russian packaging converting operations

16.12.2022

*Global Fashion Group (Singapore, Fashion and leisure) Status by KSE – exited

Global Fashion Group (GFG) announces it is exiting Russia following the sale of its Lamoda business to retail fashion investor Lakov Panchenko.

https://www.just-style.com/news/global-fashion-group-exits-russia-following-lamoda-sale/

*Shell ( Great Britain, Energy, oil and gas) Status by KSE – exited

Russian court asked to offer Shell an exit route from Salym joint venture

*Meraki (USA, IT) Status by KSE – leave

Cisco Systems Inc (USA, IT) Status by KSE – wait

The Meraki company, owned by the American corporation Cisco, will turn off all its routers and cloud access points in Russia and Belarus from December 21 in compliance with sanctions

*TikTok (China, Online Services) Status by KSE – leave

TikTok is making massive layoffs at its Russian office

*Apple (USA, Electronics) Status by KSE – leave

Apple decided to close its headquarters in Russia

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

³ As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

⁴ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

¹³ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site