- Kyiv School of Economics

- About the School

- News

- 29th issue of the weekly digest on impact of foreign companies’ exit on RF economy

29th issue of the weekly digest on impact of foreign companies’ exit on RF economy

28 November 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 21-27.11.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

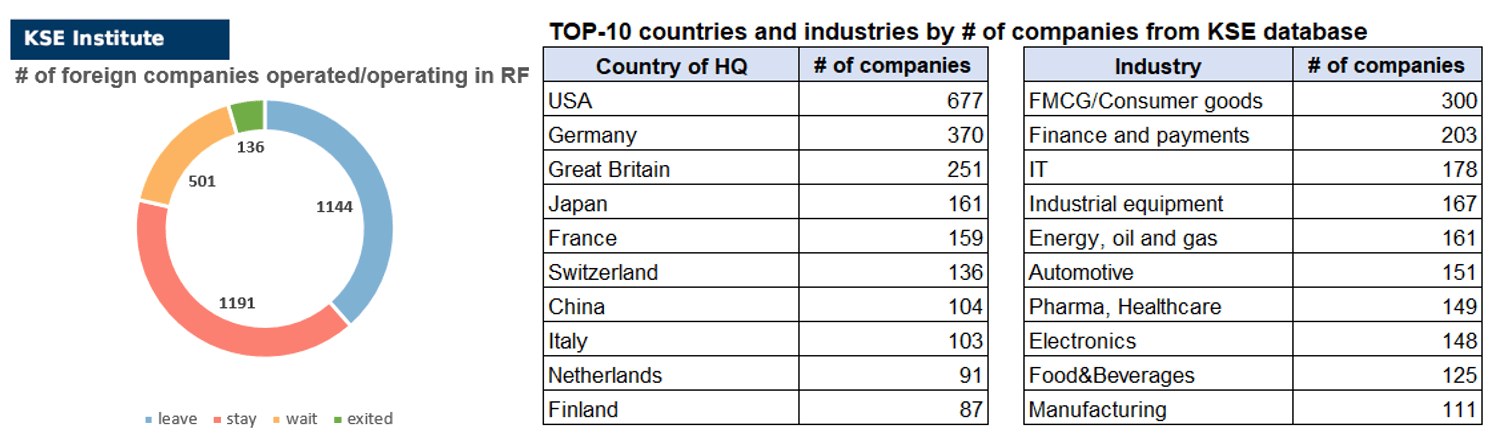

KSE DATABASE SNAPSHOT as of 27.11.2022

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 191 (+2 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 501 (0 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 144 (0 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 136 (+1 per week)

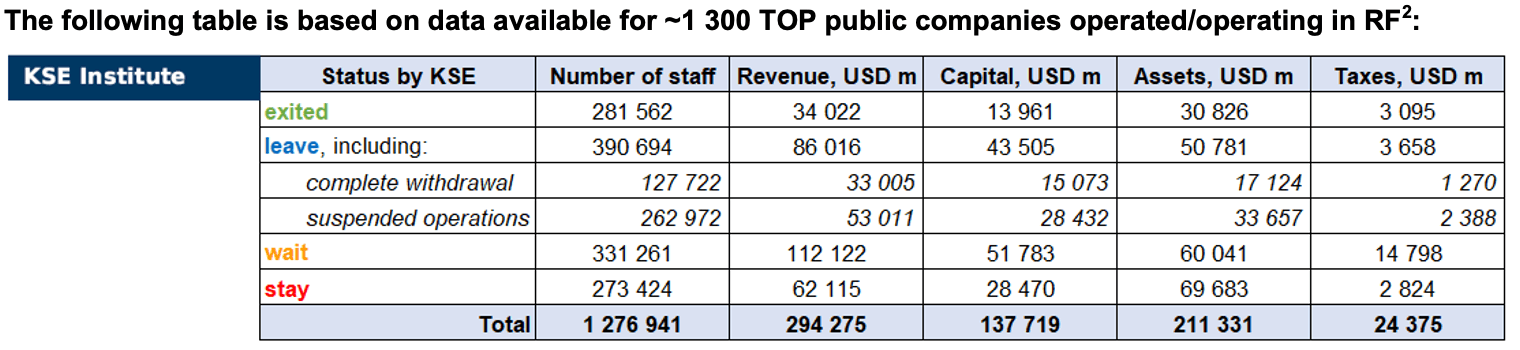

As of November 27, we have identified about 2,972 companies, organisations and their brands from 86 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $137.7 billion), local revenue (about $294.3 billion), local assets (about $211.3 billion) as well as staff (about 1.277 million people) and taxes paid (about $24.4 billion). 1,645 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 136 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of November 27, companies which had already completely exited from the Russian Federation, had at least 282,000 personnel, $34.0 bn in annual revenue, $14.0 bn in capital and $30.8 bn in assets; companies, that declared a complete withdrawal from Russia had 127,700 personnel, $33.0bn in revenues, $15.1bn in capital and $17.1 bn in assets; companies that suspended operations on the Russian market had 263,000 personnel, annual revenue of $53.0bn, $28.4bn in capital and $33.7 bn in assets.

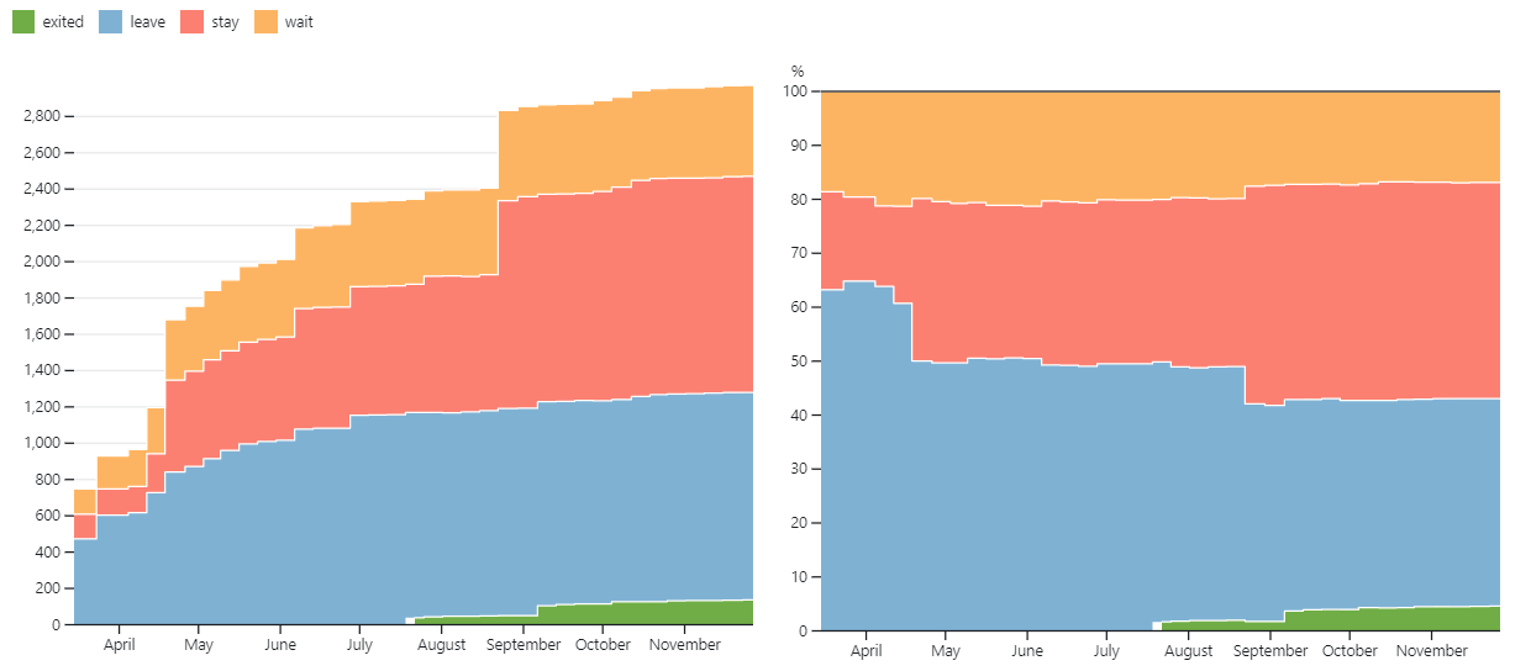

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 38.5% of foreign companies have already announced their withdrawal from the Russian market, but another 40.1% are still remaining in the country, 16.9% are waiting and only 4.6% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 136 companies that completely left the country, since they employed almost 22.0% of the personnel employed in foreign companies, the companies owned about 14.6% of the assets, had 10.1% of capital invested by foreign companies, only last year they generated revenue of $34.0 billion or 11.6% of total revenue and paid $3.1 billion of taxes or 12.7% of total taxes paid by the companies observed. Data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Another reason why companies should not stay in the Russian Federation

As of November 24, our database includes slightly more than 3,000 companies and organisations, for each of which we have determined one of four statuses, depending on their future plans to work with Russia.

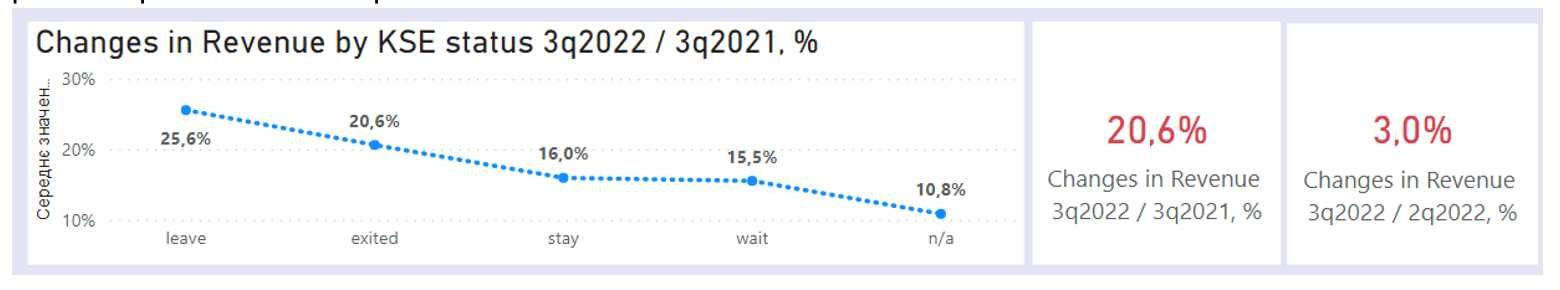

1.3 thousand are public companies. For them, we additionally collect dozens of financial and statistical indicators. You can get acquainted with them on the page https://leave-russia.org/uk/bi-analytics. Here is also a special interactive dashboard with an analysis of the dynamics of revenue of parent companies, which you can familiarise yourself with at this link https://leave-russia org/revenue. Among other things, we already have information there about revenue in Q3 2022 (compared to Q3 2021 and Q2 2022) for nearly 800 companies. So, you can, for example, look at the changes that took place compared to the same period in 2021. See the screenshot below:

At first glance, the conclusion is obvious that the revenue of those companies that have decided to leave or have already left Russia has increased more compared to those that are staying or waiting.

Can we trust these results?

The first quick exercise we can do is to divide companies not depending on their status, but depending on the simple fact: whether they have business in the Russian Federation and how significant it is. For example, we have about one and a half hundred companies that have their own legal entity in the Russian Federation and revenues in this market brings more than 2.5% of global revenue.

Wouldn’t it be surprising to assume that this could have an impact on the financial performance of a global corporation?

Well, it’s not.

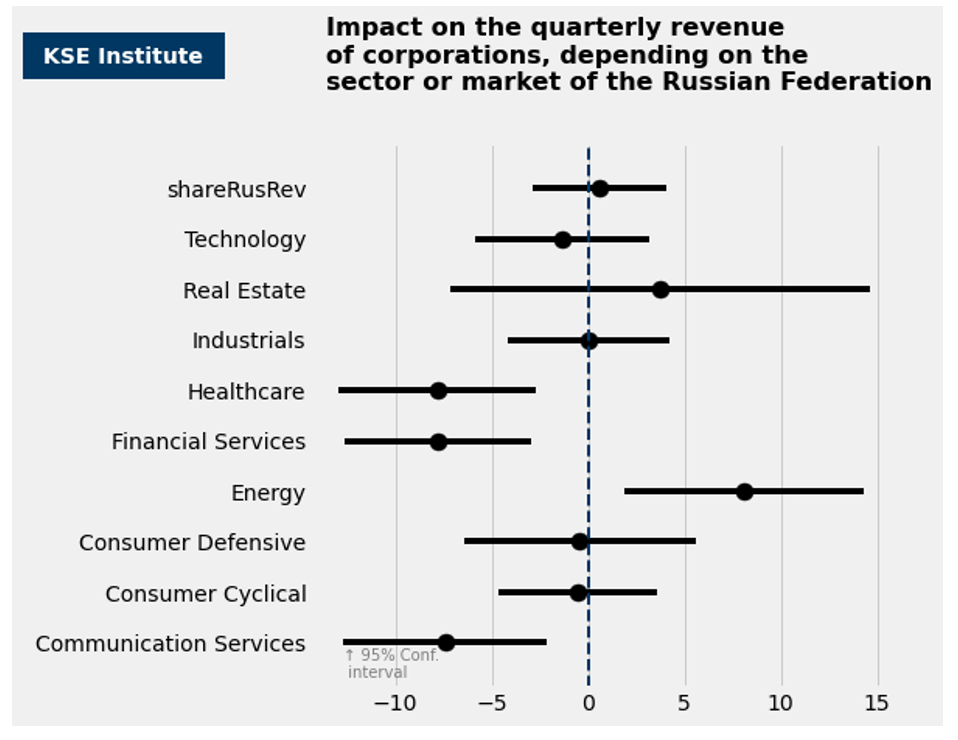

Our quick analysis shows that the differences of the sector in which the company operates are statistically significant. The communications and finance sectors fell the most, while energy sector companies increased their revenue the most. So Russia’s war against Ukraine has an obvious impact on Western corporations due to the increase in energy prices.

But the fact whether the company operates on the market of the Russian Federation or not, what decision it made (to stay or leave this market), as well as the share of the business in global revenue, etc. – are not so important statistically.

The lack of impact on global revenues of any events in the Russian market has a simple explanation: although this market is dynamic (the revenue of companies operating in it increased in 2021 by more than 20% compared to 2020), its share in the global revenues is minimal. The median share in the global revenue is about 3%. Yet another convincing argument why foreign companies should not hold on to this market.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)⁴

21.11.2022

*HDFC Bank(India, Finance and payments) Status by KSE – stay

*Canara Bank (India, Finance and payments) Status by KSE – stay

India’s central bank has allowed HDFC Bank Ltd and Canara Bank Ltd to open a special “vostro account” for trade in rupees with Russia

*Alcoa (USA, Metals and Mining) Status by KSE – leave

Alcoa lobbying US, LME to sanction Russian aluminium

https://www.fastmarkets.com/insights/alcoa-lobbying-us-lme-to-sanction-russian-aluminium-company

22.11.2022

*Huawei (China,Electronics)Status by KSE – wait

Chinese telecoms giant Huawei is separating its corporate division in Russia and Belarus from other CIS countries

24.11.2022

*Uniper SE (Germany,Energy, oil and gas) Status by KSE – wait

Germany’s largest energy company Uniper is facing some $53 billion (51B euros) in extra costs for nationalization after Russia cut gas supplies to the struggling company

25.11.2022

*Nissan (Japan, Automotive) Status by KSE – exited

Nissan has formally completed the sale of its Russian legal entity to NAMI, the Central Research and Development Automobile and Engine Institute

https://www.automotiveworld.com/news-releases/nissan-completes-sale-of-russian-operations/

*BP (British Petroleum) (Great Britain, Energy, oil and gas) Status by KSE – leave

BP still hasn’t sold its stake in Russian oil giant Rosneft – despite pledging to exit nine months ago

*Eutelsat (France, Telecom) Status by KSE – stay

Eutelsat hit by demands over Russia links

https://advanced-television.com/2022/11/25/eutelsat-hit-by-demands-over-russia-links/

*VEON (Netherlands, Telecom) Status by KSE – leave

VEON enters into agreement to sell its Russian operations

26.11.2022

*International Ice Hockey Federation (Switzerland, Sport) Status by KSE – leave

IIHF reprimands Russian Ice Hockey Federation over pro-war ‘propaganda’

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site