- Kyiv School of Economics

- About the School

- News

- IMPACT OF FOREIGN COMPANIES SELF-SANCTIONING ON RF ECONOMY

IMPACT OF FOREIGN COMPANIES SELF-SANCTIONING ON RF ECONOMY

22 June 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors; 13-19.06.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains 40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

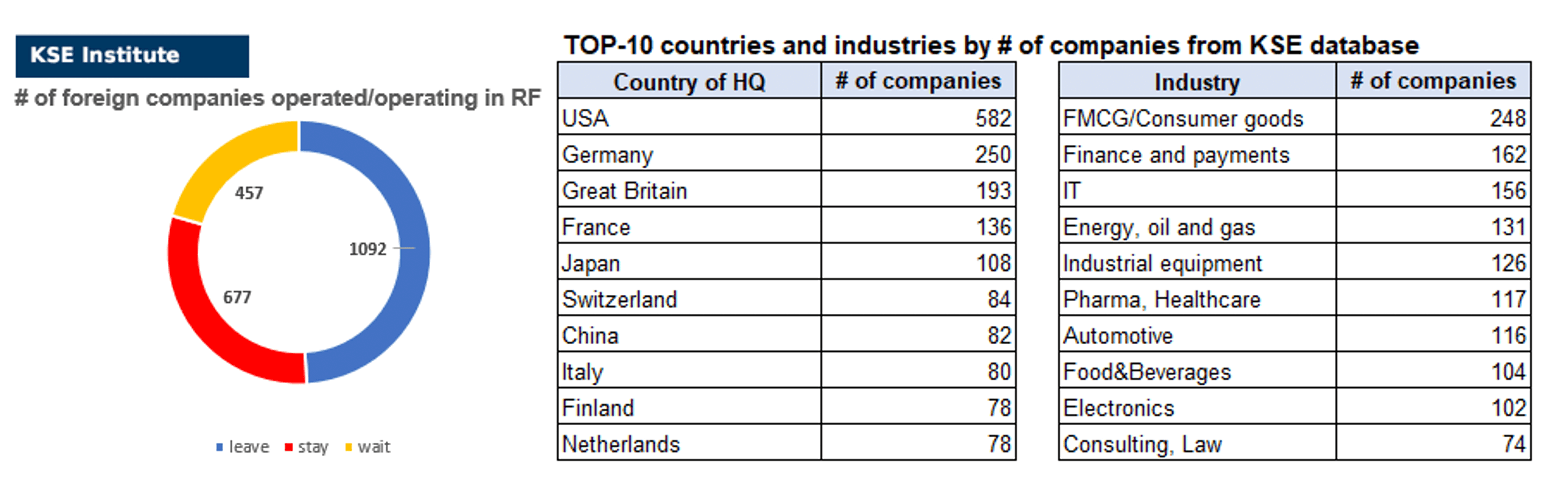

KSE DATABASE SNAPSHOT as of 19.06.2022

Number of the companies that continue Russian operations (KSE’s status “stay”¹ ) – 677 (+2 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status “wait”) – 457 (0 per week)

Number of the companies that have curtailed Russian operations (KSE’s status “leave”) – 1 092 (+3 per week)

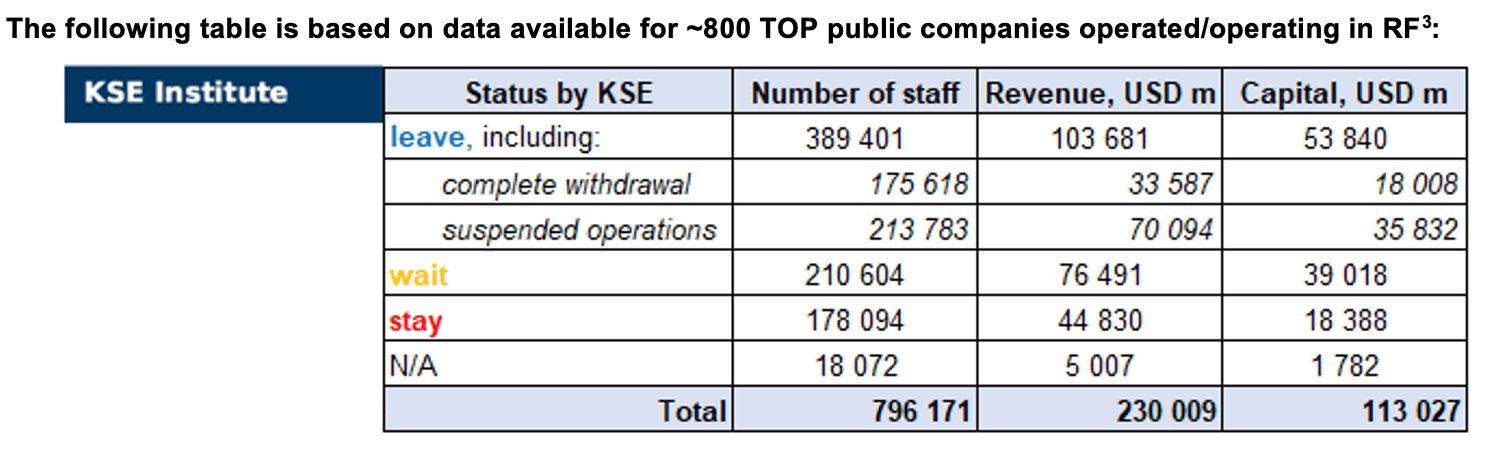

As of June 19, we have identified about 2,226 companies, organizations and their brands from 75 countries and 55 industries and analyzed their position on the Russian market. About half of them are public ones, for ~ 800 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity), which allowed us to calculate the value of capital invested in the country (about $113 billion), local revenue (about $230 billion), as well as staff (almost 0.8 million people). 1,549 foreign companies have reduced, suspended or ceased operations in Russia.

As can be seen from the tables below, As of June 19, companies that declared a complete withdrawal from Russia had $33.6bn in revenues and $18.0bn in capital; companies that suspended their operations on the Russian market had yearly revenue of $70.1bn and $35.8bn in capital. TOP-70 companies-the largest taxpayers paid ~ $20,2bn of taxes annually – haven’t completely withdrawn yet, although suspended or scaled back.

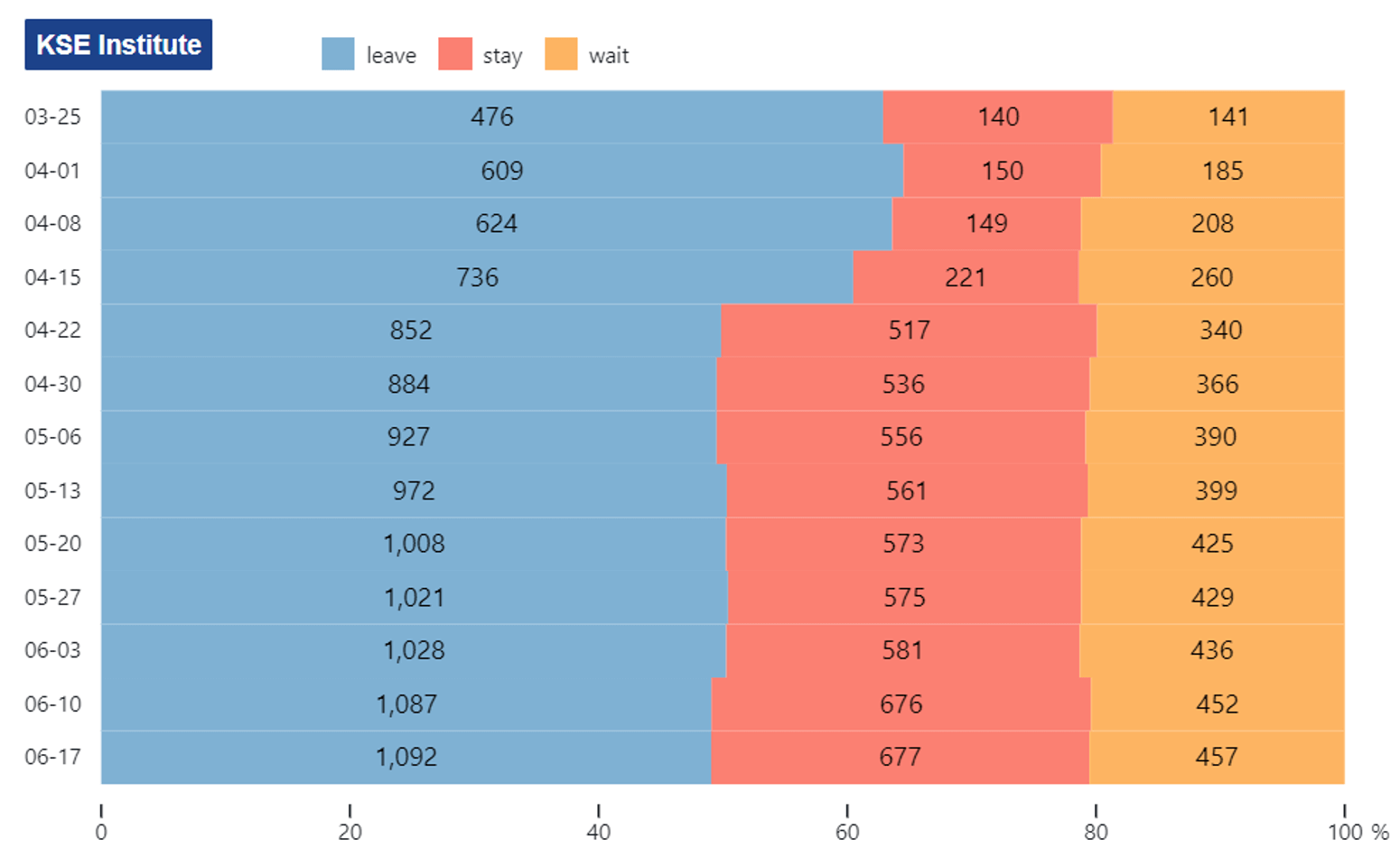

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about a half (49.0%) of foreign companies have already announced their withdrawal from the Russian market, but another 30.4% are still remaining in the country.

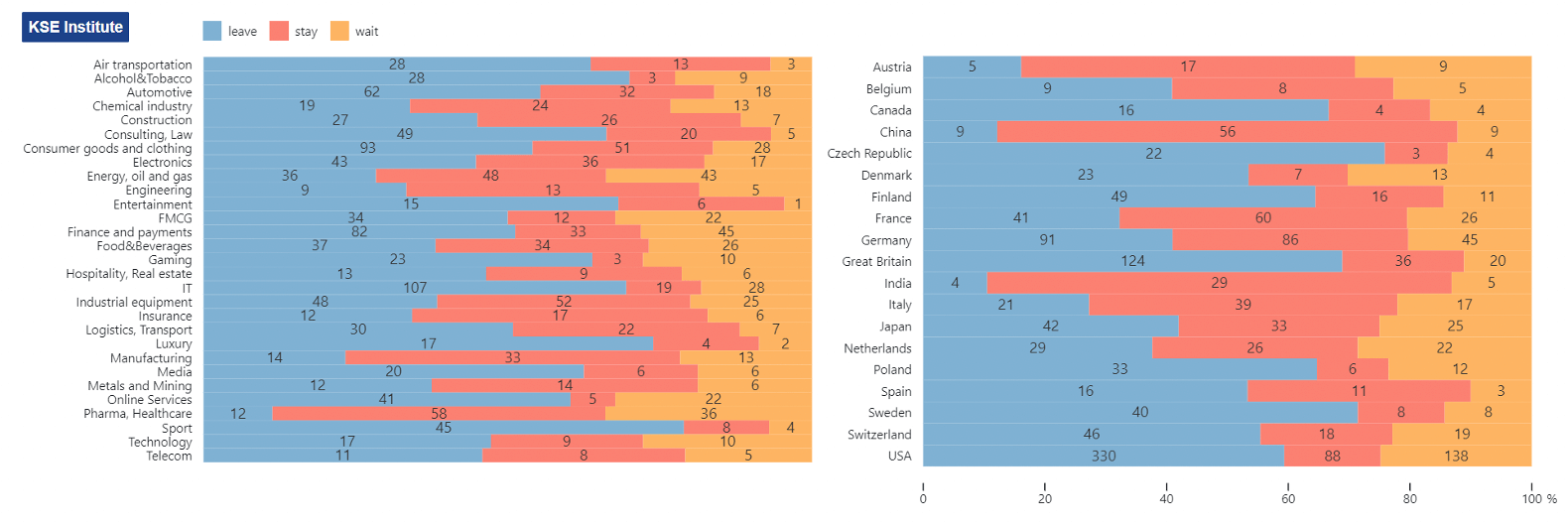

The actions of companies by sector (based on the KSE database, with at least 50 companies representing the industry and with at least 40 companies per country) are shown in the graphs below.

Decisions of Western companies by country and sector:

WEEKLY FOCUS. BEARINGS

Although Russia has more than two dozen bearing manufacturers, 60% of bearings are still imported. As the largest Western bearing manufacturers have left Russia, the industry is struggling to adapt to new conditions. In particular, a great shortage of bearings used for the production of railway cars and locomotives leads to a halt in production.

The bearing is an important part of many mechanisms. It serves to support the elements in the machinery without blocking their movement, reduces friction and ensures the movement of the object with low resistance. There are many types of bearings and without them no mechanical engineering is possible. In Russia, there are more than two dozen bearing producers, but they do not meet all market needs – about 60% of bearings in value terms are imported. The share of imports varies in different industries. Foreign companies can hardly enter the defense industry – Russian bearings account for 83% in this sector. At the same time, their share in the manufacturing sector is only 30%. The main suppliers of imported bearings in Russia are Kazakhstan, Germany, Japan, Malaysia, China, Italy, USA and others.

The most noticeable problem in Russia began with cassette bearings for the construction of innovative railway cars and locomotives. Previously, such bearings were produced in Russia by EPK-Brenco LLC (JV with the American Amsted Rail), SKF LLC (Swedish SKF plant) and Timken OVK LLC (JV with American Timken). In terms of revenue, the share of these three plants in Russia is about half of all bearings manufacturers. In early March, the United States banned the export of bearings to Russia. Amsted Rail, SKF and Timken left the market. The supply of foreign components has stopped creating a shortage in the Russian market and the risk of a prolonged shutdown of production and repair of railway cars. Timken OVK LLC has ceased operations, and EPK-Brenko is trying to continue production. SKF LLC was transferred to the local management and renamed to TEK-KOM manufacturing. There are reports that all three plants have currently stopped production due to a lack of spare parts.

Not all foreign manufacturers have left Russia. No statements were made by the German manufacturer Schaeffler Group, whose production in Russia is operating. HTH bearings (China), Koyo Seiko (Japan), and Asahi Seiko (Japan) made no statements as well.

It is possible to close the shortage of bearings with Chinese products, but there are also some difficulties. First, providing greater market access for Chinese products will contradict the goals to grow domestic production. As a protective measure against Chinese producers, there has been an anti-dumping duty of 41.5% in Russia since 2011. The Ministry of Industry and Trade of the RF does not consider it necessary to abolish the anti-dumping duty on imports of cassette bearings from China. In addition, time-consuming certification of products is required. Another solution that the government is trying to achieve is the full localization of production, but it will also take several years.

The shortage of bearings is a significant problem for the Russian engineering industry, as the industry is dependent on imports. The exit of Western companies and the ban on exports to Russia led to a shortage of certain types of bearings. Businesses are looking for options to replace components from other countries, including China, but it takes time.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)

13.06.2022

*Quacquarelli Symonds (QS) (Great Britain, Events, Education) KSE status – wait

QS Ranks Russian Universities, Contrary to Original Plan

https://www.reddit.com/r/QtFramework/comments/tvjf91/qt_open_source_and_russia/

14.06.2022

*Wikimedia Foundation Inc. (USA, Online Services) Status by KSE – leave

The Wikimedia Foundation, which owns Wikipedia, has filed an appeal against a Moscow court decision demanding that it remove information related to the Russian invasion of Ukraine, arguing that people have a right to know the facts of the war.

*Goldman Sachs (USA, Finance and payments) Status by KSE – leave

*JPMorgan (USA, Finance and payments) Status by KSE – leave

JPMorgan, Goldman Halt Russian Debt Trading After US Tightens Ban

*Oracle (USA, IT) Status by KSE – leave

Oracle revenue, profit top estimates on cloud boom. Oracle warned of a $100m hit per quarter in fiscal year 2023 as a result of suspending services in Russia.

https://www.rte.ie/news/business/2022/0614/1304686-oracle-quarterly-results/

*Wargaming (Cyprus, Gaming) Status by KSE – leave

Wargaming opening new studios in Poland and Serbia to reinforce its global operations

https://gameworldobserver.com/2022/06/14/wargaming-opening-new-studios-in-poland-and-serbia-to-reinforce-its-global-operations

*Fortum (Finland, Energy, oil and gas) Status by KSE – leave

*Uniper (Germany.Energy, oil and gas) Status by KSE – leave

Fortum to sell Russian power assets by July according to Komersant

15.06.2022

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – leave.

IKEA takes the next step to scale down in Russia and Belarus

*Biosphere Corporation (Ukraine, Consumer goods) Status by KSE- leave

The production of the brands of Biosphere Corporation in the Russian Federation was to be completely stopped on May 30, and by June 15 all stocks were to be sold and work with these trademarks was to be completely stopped

https://ua.interfax.com.ua/news/economic/839042.html

*Inditex (Spain, Сlothing) Status by KSE – leave

Russia’s Wildberries selling Zara clothes online despite Inditex halting operations

16.06.2022

*Kinross Gold (Canada, Metals and Mining) Status by KSE- leave

Kinross has completed the sale of Russian assets. Kinross Gold Corporation announced that it has completed the sale of 100% of its Russian assets to Highland Gold Mining. Following the approval and completion of the sale, Kinross has lost all its interests in Russia and has no obligations or obligations in the country.

https://kinross-com.translate.goog/?_x_tr_sch=http&_x_tr_sl=en&_x_tr_tl=uk&_x_tr_hl=uk&_x_tr_pto=sc

*Game Insights (Lithuania, Gaming) Status by KSE- leave

Developer and publisher of mobile games Game Insight leaves Russia and fires developers.

https://habr.com/ru/amp/post/671654/

*Engie (France, Energy, oil and gas) KSE status – wait

German energy giant Uniper SE said Wednesday it had received 25% less gas than contracted from Russia after Moscow curbed supplies via its biggest pipeline to Europe. Gazprom has cut gas supplies to Italy, state-controlled oil giant Eni SpA said the same day.

*Wintershall Dea AG (Germany, Energy, oil and gas) KSE status – wait

BASF subsidiary profits from Germany’s Russian gas addiction

*Wienerberger (Austria,Construction) Status by KSE- leave

Wienerberger AG said Wednesday that it will sell its Russian operations and exit the country as a result of the war in Ukraine. Local management will take over the business through a buyout, the Austrian brick maker said. The purchase price wasn’t disclosed.

*Ponsse PLC (Finland,Automotive) Status by KSE- leave

Ponsse decides to divest its operations in Russia. The signing will be completed in the near future, and it will be announced separately.

*Kinross Gold (Canada, Metals and Mining) Status by KSE- leave

Kinross Gold completed sale of its Russian assets at half the agreed price.

*Enel (Italy,Energy, oil and gas) KSE status – wait

Enel is close to a deal to sell its assets in Russia. Enel has two wind farms and three gas-fired power plants in Russia and had announced in March it was exploring options for those assets after Russia’s invasion of Ukraine.

*Decathlon (France,Consumer goods and clothing) Status by KSE- leave

Decathlon suspends stores, claiming its temporary due to logistics problems. They keep employees. At the same time, Decathlon announced in March on the website that in strict compliance with international sanctions, DECATHLON notes that the supply conditions are no longer met to continue its activity in Russia. DECATHLON has to suspend the operation of its stores. In accordance with our commitments, we will continue to support our 2,500 Russian teammates

17.06.2022

*Google (USA, Online Services) Status by KSE – wait

Google Russia files for bankruptcy

18.06.2022

*BitRiver (Switzerland, IT) Status by KSE – stay

The third largest oil producer in Russia, Gazpromneft, is partnering with Swiss-based bitcoin mining firm BitRiver to build out mining operations located at oil fields according to a memorandum from the St. Petersburg International Economic Forum. BitRiver was previously sanctioned by the U.S. for reportedly assisting Russian avoidance of sanctions. BitRiver provides hosting services and turnkey solutions for large-scale cryptocurrency eco-mining, data management, blockchain and artificial intelligence operations to institutional investors around the world

https://bitcoinmagazine.com/business/gazpromneft-partners-with-bitriver-to-mine-bitcoin

*CERN (Європейська організація з ядерних досліджень),(Switzerland,Energy, oil and gas), Status by KSE – leave

CERN Council declares its intention to terminate cooperation agreements with Russia and Belarus at their expiration dates in 2024

https://home.cern/news/news/cern/cern-council-cooperation-agreements-russia-belarus

*Aramco (Saudi Arabia,Energy, oil and gas) Status by KSE – stay

Saudi Aramco is set to take TotalEnergies’ place in Arctic LNG 2

*Enel (Italy, Energy, oil and gas) Status by KSE – leave.

Italian energy giant Enel leaves Russia – sells assets of Lukoil and Gazprombank fund. Enel sells its entire 56.43% stake in PJSC Enel Russia

More details on daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

² +400 new public groups of companies added a total of approximately + $ 30 billion in annual revenue and +114 thousand staff as of 19/06/2022

³ As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. More details will be available soon once we analyze more data/information and find the reputable sources for verification.