- Kyiv School of Economics

- About the School

- News

- 33rd issue of the weekly digest on impact of foreign companies’ exit on RF economy

33rd issue of the weekly digest on impact of foreign companies’ exit on RF economy

26 December 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 19-25.12.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 25.12.2022

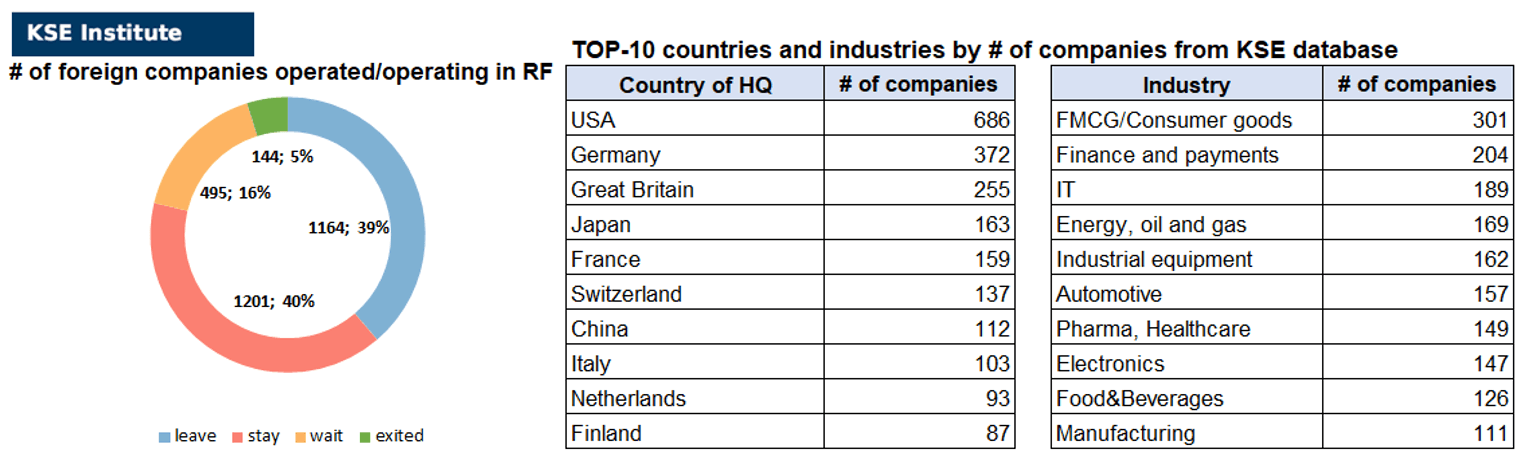

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 201 (0 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 495 (-6 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 164 (+8 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 144 (0 per week)

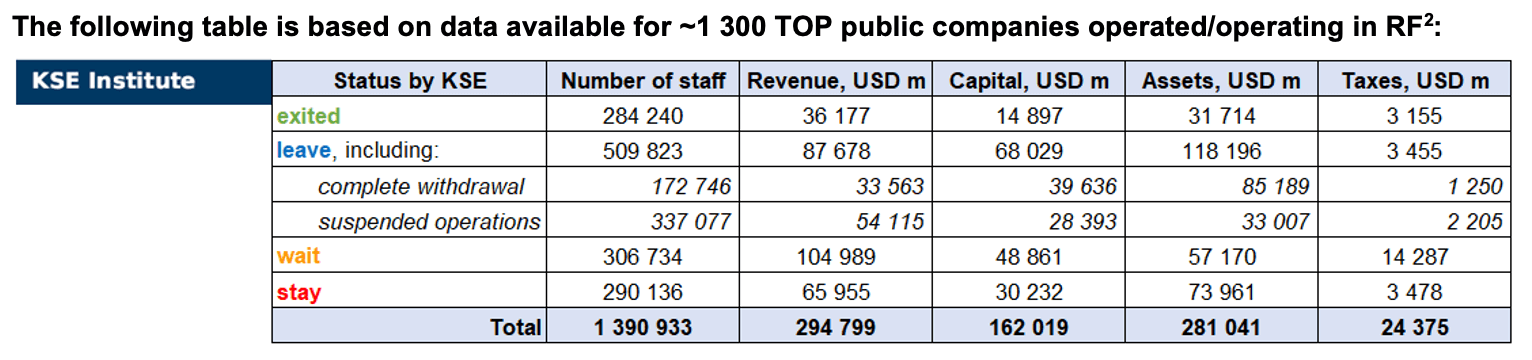

As of December 25, we have identified about 3,004 companies, organisations and their brands from 86 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $162.0 billion), local revenue (about $294.8 billion), local assets (about $281.0 billion) as well as staff (about 1.391 million people) and taxes paid (about $24.4 billion). 1,659 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 144 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of December 25, companies which had already completely exited from the Russian Federation, had at least 284,200 personnel, $36.2 bn in annual revenue, $14.9bn in capital and $31.7bn in assets; companies, that declared a complete withdrawal from Russia had 172,700 personnel, $33.6bn in revenues, $39.6bn in capital and $85.2 bn in assets; companies that suspended operations on the Russian market had 337,100 personnel, annual revenue of $54.1bn, $28.4bn in capital and $33.0 bn in assets.

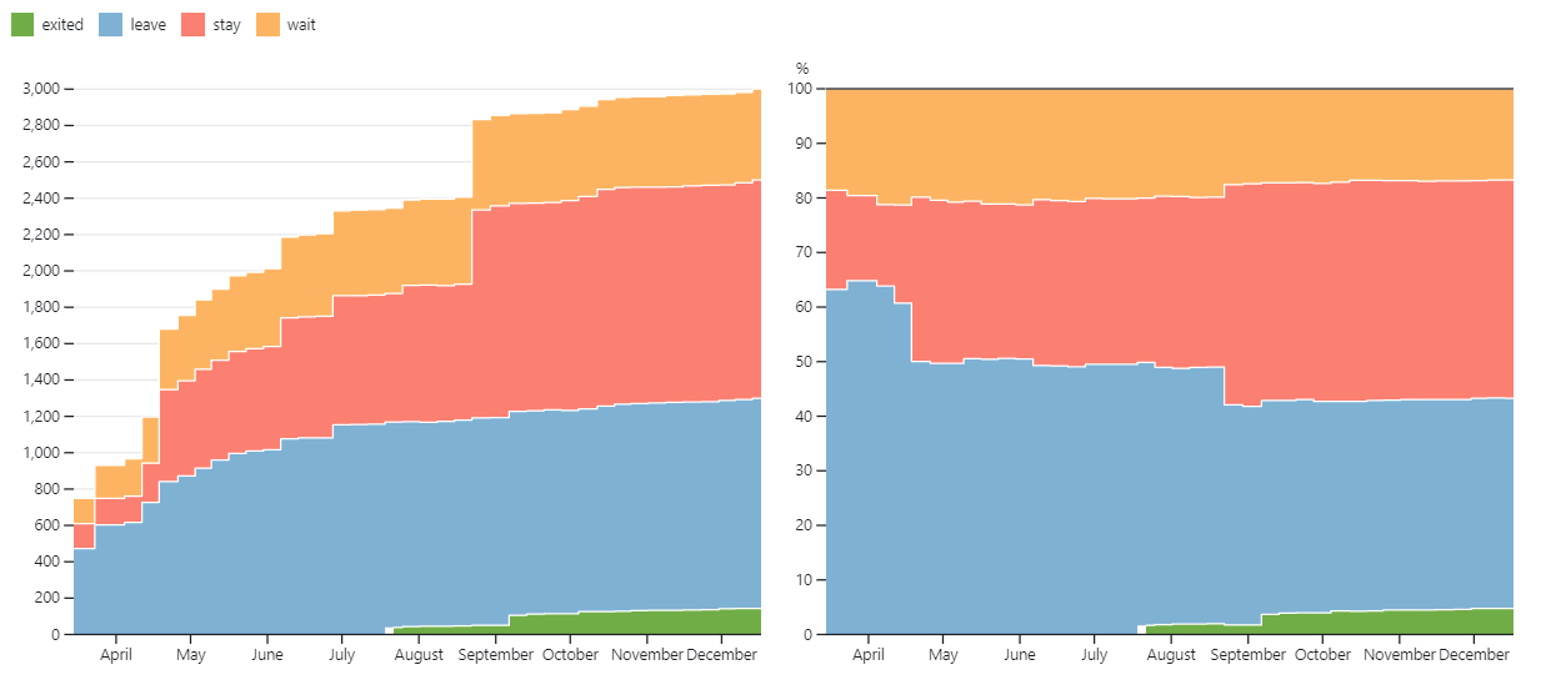

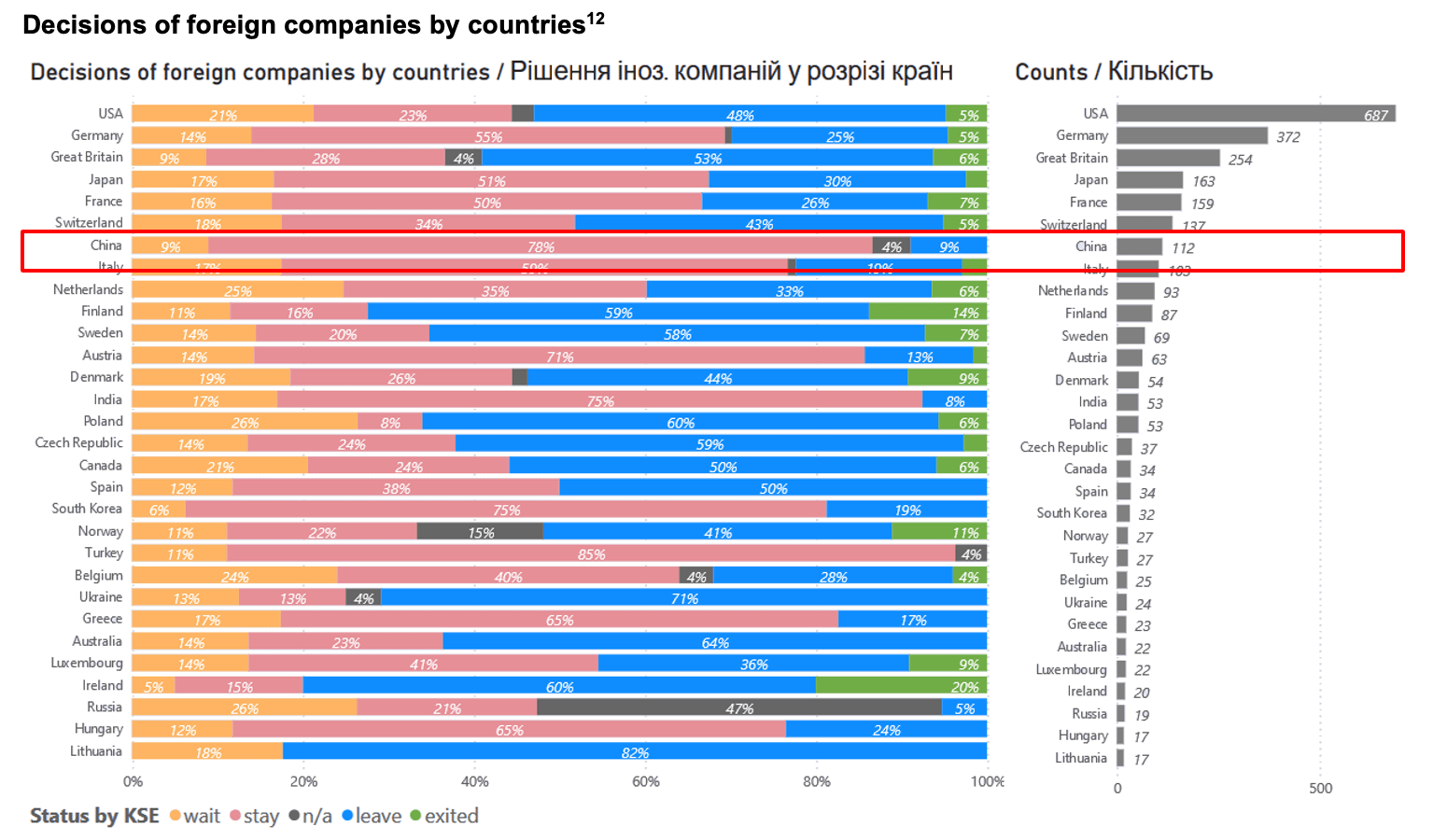

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last 3 months the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 38.7% of foreign companies have already announced their withdrawal from the Russian market, but another 40.0% are still remaining in the country, 16.5% are waiting and only 4.8% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 144 companies that completely left the country, since they employed almost 20.4% of the personnel employed in foreign companies, the companies owned about 11.3% of the assets, had 9.2% of capital invested by foreign companies, only last year they generated revenue of $36.2 billion or 12.3% of total revenue and paid $3.2 billion of taxes or 12.9% of total taxes paid by the companies observed. Data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Analysis on Chinese companies and their positions in Russia

Communization of China was the last great achievement of Stalin on the international stage, which almost determined the further development of humanity in the XXI century. The foundation for the beginning of Russian-Chinese economic relations was the signing on February 14, 1950 of the Treaty between the USSR and the People’s Republic of China on friendship and cooperation. Russian-Chinese relations were on the rise until 1959, but dramatic events in China in the second half of the XX century enslaved Russian-Chinese economic relations until the beginning of their recovery in the 90s of the last century.

After the collapse of the USSR in the 90s of the last century, it was the beginning of a boom in Russian-Chinese economic relations. Currently, the structure of Russian-Chinese trade is being formed against the background of the economic crisis in Russia, which can be overcome, according to the Russian leadership, with the help of China’s domestic needs for Russian raw materials.

After the Russian annexation of Crimea in 2014, Western countries imposed numerous sanctions on Russia. Russia has turned to China to reduce the impact of Western sanctions and has begun accelerating de-dollarization efforts. Today, China is Russia’s largest trading partner.

For reference: during the visit of the President of Russia to China in May 2014, the bilateral agreement was signed on the supply of energy carriers from Russia to China under the project “Power of Siberia”. In the context of the sanctions conflict with the USA and the EU, Russia has seen in China its largest partner, which is not part of the anti-Russian sanctions coalition, unlike other Asian countries, in particular, Japan and South Korea, which, due to their alliance obligations to the USA, are forced to walk in the fairway American politics. In 2021, trade between Russia and China increased by 35.8% compared to 2020, to 146.8 billion US dollars⁴.

On December 17, 2022 Russian state company Gazprom broke the historical record for daily supplies of Russian gas to China via the “Power of Siberia” gas pipeline. The excess of Gazprom’s daily contractual obligations provided for in the gas purchase agreement amounted to 16.6%. Gazprom met the request of the Chinese side to increase daily gas supplies in December 2022 relative to the previously approved schedule for 2022. The deliveries are made within the framework of a bilateral long-term gas purchase and sale agreement between Gazprom and the Chinese National Petroleum Corporation (CNPC). Russia’s Gazprom and CNPC transfer payment for supplies through the Power of Siberia gas pipeline in rubles and yuan⁵.

In 2022, with the start of Russia’s large-scale military aggression against Ukraine, China’s economic relationship with Russia deepened as Russia found itself embroiled in a grueling war and its economy hit by Western sanctions. In this regard, Russia has a thousand reasons to seek better relations with China. As an example, at the beginning of the war, Chinese companies were the least active in withdrawing from Russia. Thus, in March, of the 178 companies that completely stopped working with Russia or simply left the country, almost every one of them came from Europe or North America and none from China, with the exception of two large Chinese banks – ICBC and AIIB⁶.

In this connection, Russian-Chinese trade has reached a record level, as China buys up oil and coal to overcome the energy crisis that has developed at this time in the world. China’s spending on Russian goods rose 60% in August this year compared to August 2021, reaching 11.2 billion US dollars, surpassing the 49% increase in July respectively. Also, deliveries of Chinese goods to Russia increased by 26% to 8 billion US dollars in August compared to July this year. In the first eight months of 2022, the total trade in goods between China and Russia increased by 31% to 117.2 billion US dollars, a record. At the same time, Russia accounts for 2.8% of the total volume of Chinese trade and 16% of Russian trade, respectively. The war in Ukraine has led to a sharp rise in demand for Chinese yuan in Russia, as Western sanctions have largely cut off Moscow from the global financial system and limited its access to US dollars and euros. Yuan trading on the Moscow Stock Exchange accounted for 20% of the total trading volume of major currencies in July 2022, compared with 0.5% in January of the same year⁷.

In this context, China is not just a supplier of sensitive goods to the Russian market, but probably a supplier to Russia’s military industry in general, providing 57% of semiconductors⁸. At the same time, China claims that it does not provide military aid to Russia, but data from Chinese customs showed an increase in the export of raw materials for Russia’s military needs. In the first five months of 2022, Chinese chip shipments to Russia more than doubled from 2021 to 50 million US dollars⁹.

For reference: from January to November 2022, trade between Russia and China increased by 32% to a record 172.4 billion US dollars. In 11 months of 2022, China supplied goods to Russia worth 67.3 billion US dollars. This is 13.4% more than in the same period of 2021. In November, the trade turnover of the two countries amounted to 18.3 billion US dollars. Russia imported goods to China worth 10.5 billion US dollars, China to Russia – 7.7 billion US dollars¹⁰.

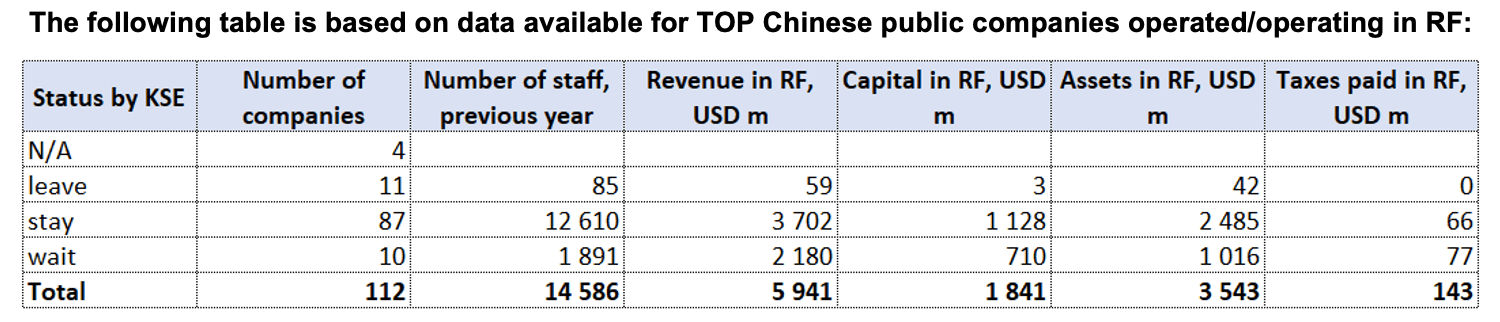

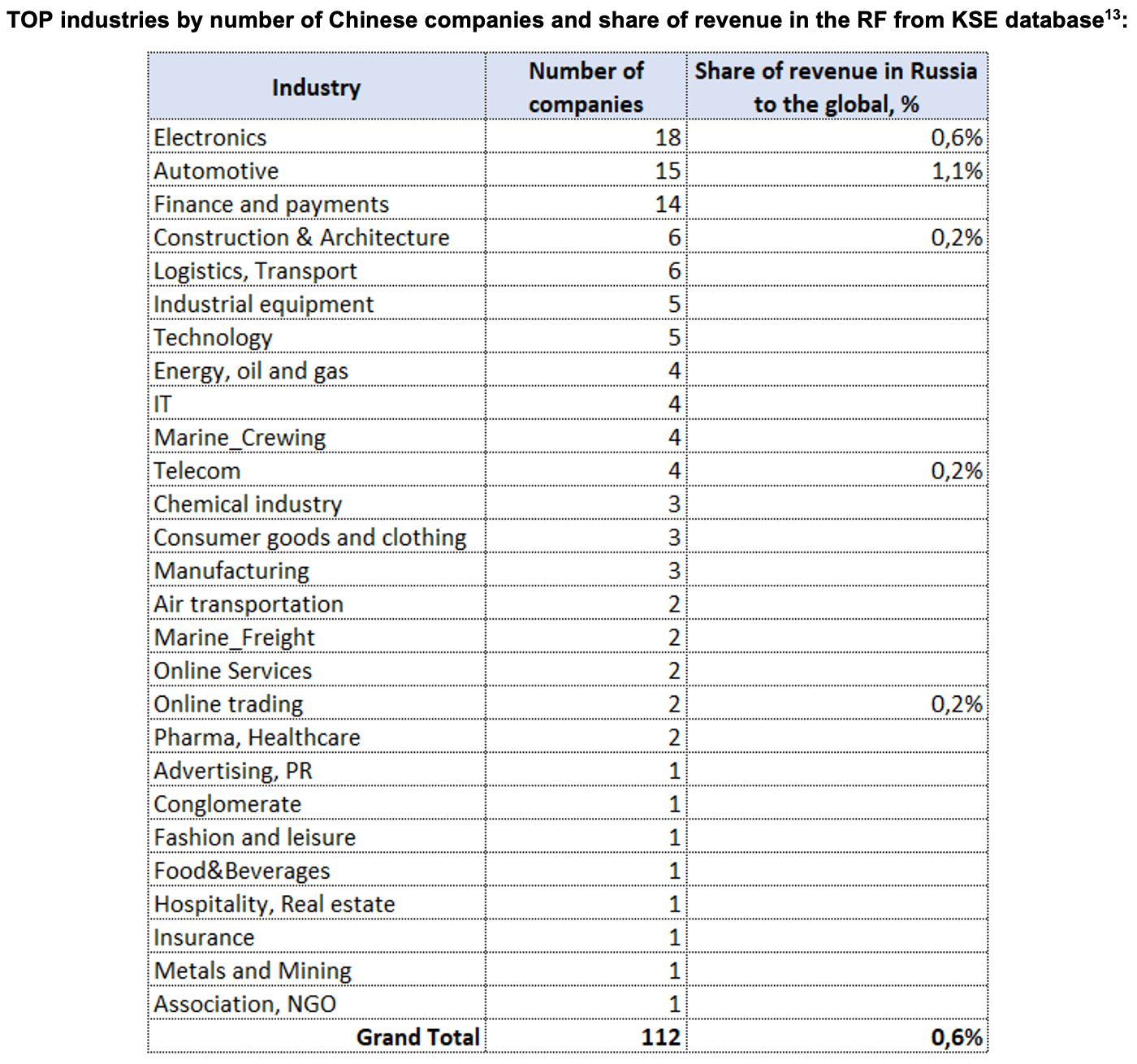

According to data collected by the KSE Institute¹¹,in 2021 122 Chinese companies (with share in capital 50+%) provided jobs for at least 14,600 people in Russia, those companies generated $5.9 bn in annual revenue, paid $143 mn of taxes, had $1.8 bn in capital and $3.5 bn in assets.

11 companies (only 10% of 112 companies observed) have announced plans to leave Russia, in 2021 they employed only 85 people (it need to be noted that a lot of companies are trading ones), generated $59 mn (1%) in annual revenue, had $3 mn in capital and $42 mn in assets. But most of the Chinese companies (at least 87 or 78%!) are still staying and 10 companies (9%) are waiting and limiting their investments. These 2 groups generated a significant part of the revenue ($5.88 bn or 99%) received by Chinese companies in Russia.

The most “dependent” on Russia in terms of revenue share in this country are Chinese companies in the following industries: Automotive, Electronics, Construction & Architecture, Telecom and Online trading.

Planned suspension

China is one of the few countries in the world whose parent companies have not yet made a legal decision to leave Russia. Only 10 Chinese companies (or 9% of the total number observed) included in the KSE database have the KSE status of “Suspension” and only 1 Chinese company (Lifan) has the KSE status “Withdrawal“.

Lifan (Automotive, Status by KSE – leave) The Chinese car manufacturer Lifan stopped selling new cars on the Russian market, not selling a single car in 2022. The “hotline” telephone indicated on the brand’s official website does not answer, and dealers, according to Autonews.ru, have confirmed the lack of Lifan cars in stock and in the near future.

DJI (Technology, Status by KSE – leave) “DJI is internally reassessing compliance requirements in various jurisdictions. Pending the current review, DJI will temporarily suspend all business activities in Russia and Ukraine. We are engaging with customers, partners and other stakeholders regarding the temporary suspension of business operations in the affected territories.” – according to the company’s statement in the spring. And already in autumn, the company announced: “DJI has gone above and beyond to make our point clear about combat drone use: We stand alone as the only drone company to clearly denounce and actively discourage use of our products in combat, including suspending all business operations in Russia and Ukraine to try to keep our drones out of the conflict.”

Loongson (IT, Technology, Status by KSE – leave) The Chinese government banned the supply of Loongson processors based on its own LoongArch architecture to the Russian Federation. The decision is due to the fact that the technology is recognized as strategically important and is used in China’s military-industrial complex.

UnionPay (Finance and payments, Status by KSE – leave) The large Chinese payment system UnionPay has limited work with Russian acquirer banks that are under sanctions. The Chinese payment system UnionPay, on its own initiative, limited partnerships with sanctioned banks both in terms of acquiring and issuing.

TikTok (Online Services, Status by KSE – leave) The Russian division of TikTok has cut most of its employees. TikTok’s press service confirmed that the company has cut “the number of employees in Russia.” After the announcement of partial mobilisation, the employees of the Russian TikTok office were offered to move to Kazakhstan, Armenia or Kyrgyzstan for remote work. After the start of the war in Ukraine, TikTok suspended the access of users from Russia to conducting live broadcasts and posting new content. The company explained this decision by the law on fakes, which was adopted shortly after the beginning of the invasion.

Companies that ignore the exit

Binance (Finance and payments, Status by KSE – wait) Binance has not left the Russian market because there are no “global sanctions” against it. This was stated by the top manager of the crypto exchange Chagri Poyraz. According to him, Binance works in the Russian Federation with restrictions. “We are very closely monitoring transactions related to Russian oligarchs, politicians and their entourage, and have blocked the cryptocurrency accounts of relatives of Kremlin officials… They will not be able to use their accounts to sell, purchase or transfer crypto-assets,” he said.

Bybit (Finance and payments, Status by KSE – stay) Cryptocurrency exchange Bybit has no intention to introduce restrictions for Russian traders, despite a recent reminder by the Monetary Authority of Singapore (MAS) about the obligations of crypto providers in that respect. According to a crypto media report, the platform shared its position in correspondence with partners.

Chery Automobile (Automotive, Status by KSE – stay) The Chinese car concern Chery, which has a localization project with Sollers Avto (the group includes UAZ), decided to abandon the idea of producing cars at the site of the Ulyanovsk Automobile Plant. A Chinese concern can occupy the site of any of the Western automakers if they decide to leave.

Also, the following automotive companies did not leave the Russian market: Geely (Automotive, Status by KSE – stay), FAW Group (Automotive, Status by KSE – stay), SAIC Motor (Automotive, Status by KSE – stay), Haval Motor (Automotive, Status by KSE – stay), Great Wall Motor Co. (Automotive, Status by KSE – stay), JAC Motors (Automotive, Status by KSE – stay), Dongfeng (Automotive, Status by KSE – stay), Changan (Automotive, Status by KSE – stay), Exeed (Automotive, Status by KSE – stay), GAC Group (Automotive, Status by KSE – stay), Foton (Automotive, Status by KSE – stay).

Summary

It is worth noting that despite the geopolitical crisis in Europe, according to the OECD¹⁴, the GDP of China will grow by 5.1% in 2022.

Taking this into account, it is worth stating that Russia’s confrontation with the Western world only accelerates the rapprochement between Moscow and Beijing, and Western sanctions, although they create problems for Russian economic ties, are becoming another factor in closer Russian-Chinese interaction.

The authoritarian character of both regimes is growing due to Western criticism of the foreign policy actions of Moscow and Beijing. At the same time, China, by all metrics, is becoming a major power, close to the United States in terms of the comprehensive power of its own economy, armed forces and technological sector, while Russia, still remaining a big player, is beginning to become an economic appendage of China. Russia’s invasion of Ukraine is taking place against the background of a deepening friendship between Moscow and Beijing, while Chinese companies continue to supply the Russian army with key technologies¹⁵.

Considering the above, it should be noted that the Russian-Ukrainian war is the last Russian “adventure”. A weak, insignificant Russia, having lost its footing in the West, can quickly become a colony of China, which, in turn, will not miss the opportunity to take advantage of its weakness against the background of growing huge military expenditures. Chinese companies servicing Putin’s senseless war in Ukraine should be named and shamed by the Western World with application of sanctions to them in the future.

You can also contribute by spreading the status of the company calling for the exit from Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)¹⁶

19.12.2022

*Nokian Tyres (Finland, Automotive) Status by KSE – leave

Nokian Tyres replaces some Russian production with China subcontractor

https://www.reuters.com/business/autos-transportation/nokian-tyres-

20.12.2022

*Corteva Agriscience (USA, Agriculture) Status by KSE – leave

Seedmaker Corteva cuts U.S. jobs while exiting Russia

https://www.reuters.com/business/seedmaker-corteva-cuts-us-jobs-while-exiting-russia-2022-12-19/

*Henkel (Germany, Chemical industry) Status by KSE – leave

Henkel spins off its Russia business

https://www.reuters.com/markets/europe/henkel-spins-off-its-russia-business-2022-12-16/

*Hyundai (South Korea, Automotive) Status by KSE – wait

Hyundai lays off staff after idling Russian plant since March

21.12.2022

*PKN Orlen SA (Poland, Energy, oil and gas) Status by KSE – leave

The Polish concern Orlen will not renew the contract for Russian oil, which will expire in January

https://www.eurointegration.com.ua/news/2022/12/21/7152857/

*Huawei (China, Electronics) Status by KSE – wait

Huawei disbands enterprise business team in Russia in further pullback amid Western sanctions

22.12.2022

*Kellogg (USA, Food & Beverages) Status by KSE – leave

The American company Kellogg, which had previously stopped supplying the popular Pringles chips to Russia, decided to completely leave the country

*Eutelsat ( France, Telecom) Status by KSE – stay

Eutelsat said in a statement it had now ended all involvement in the broadcast of three Russian channels, Rossiya One, Pervyi Kanal and NTV, after France’s Arcom television regulator urged the company to do so.

*COSCO (China, Logistics, Transport) Status by KSE – wait

Oil Tanker Owners Show Signs of Shunning Russia’s Asian Crude

*Eurasia Mining (Great Britain, Metals and Mining) Status by KSE – stay

Eurasia Mining PLC has said it continues to work towards selling its Russian assets although, at no present, there is no guarantee that the company will enter into any binding agreements regarding the sale of these assets.

*Henkel (Germany, Chemical industry) Status by KSE – leave

Henkel aims to complete sale of Russia business soon

https://www.reuters.com/markets/deals/henkel-aims-complete-sale-russia-business-soon-nzz-2022-12-22/

23.12.2022

*FERRONORDIC (Sweden, Construction & Architecture) Status by KSE – leave

Ferronordic sells Russian business for $126 mln, shares soar 60%

https://www.nasdaq.com/articles/ferronordic-sells-russian-business-for-$126-mln-shares-soar-60

*Kellogg (USA, Food & Beverages) Status by KSE – leave

Kellogg Signs Disposal Deal For Russian Business With Local Snacks Producer Chernogolovka

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

¹⁶ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site