- Kyiv School of Economics

- About the School

- News

- 31st issue of the weekly digest on impact of foreign companies’ exit on RF economy

31st issue of the weekly digest on impact of foreign companies’ exit on RF economy

12 December 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 05-11.12.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 11.12.2022

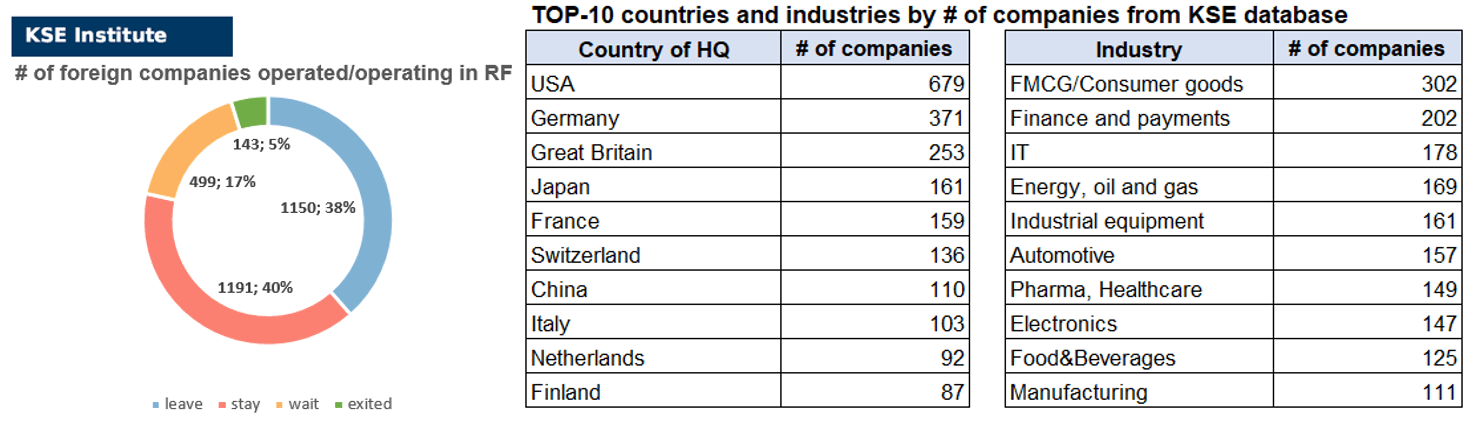

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 191 (+6 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 499 (-2 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 150 (+4 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 143 (+1 per week)

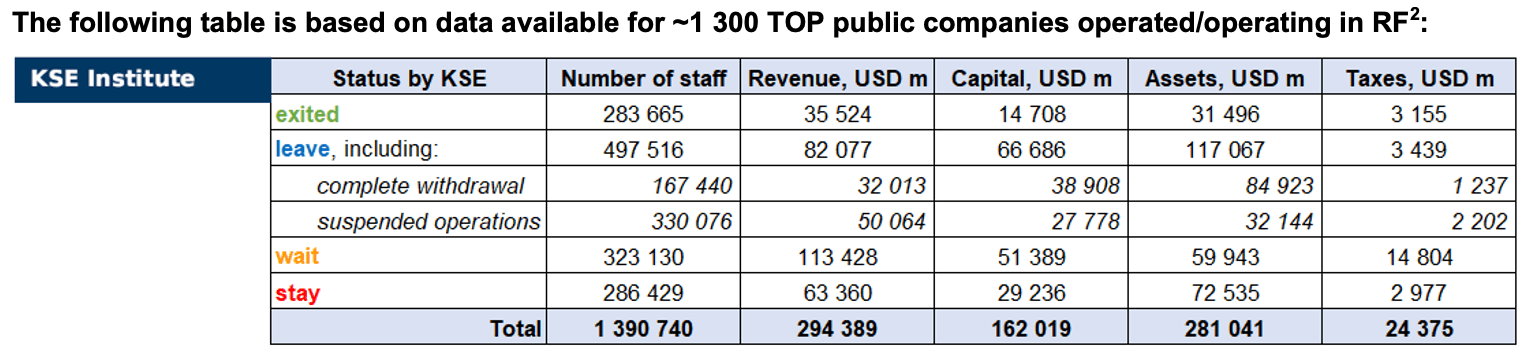

As of December 11, we have identified about 2,983 companies, organisations and their brands from 86 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $162.0 billion), local revenue (about $294.4 billion), local assets (about $281.0 billion) as well as staff (about 1.391 million people) and taxes paid (about $24.4 billion). 1,649 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 143 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of December 11, companies which had already completely exited from the Russian Federation, had at least 284,000 personnel, $35.5 bn in annual revenue, $14.7bn in capital and $31.5bn in assets; companies, that declared a complete withdrawal from Russia had 167,400 personnel, $32.0bn in revenues, $38.9bn in capital and $84.9 bn in assets; companies that suspended operations on the Russian market had 330,000 personnel, annual revenue of $50.1bn, $27.8bn in capital and $32.1 bn in assets.

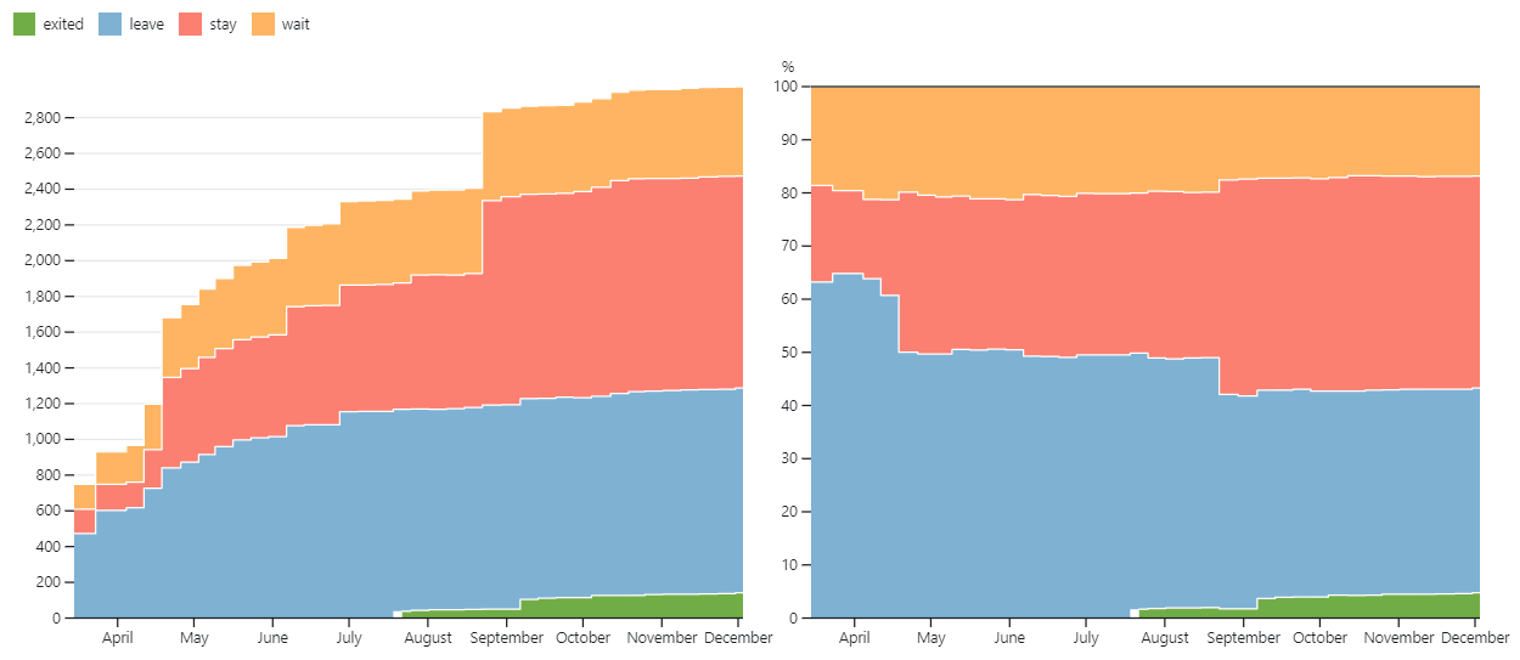

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 38.6% of foreign companies have already announced their withdrawal from the Russian market, but another 39.9% are still remaining in the country, 16.7% are waiting and only 4.8% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 143 companies that completely left the country, since they employed almost 20.4% of the personnel employed in foreign companies, the companies owned about 11.2% of the assets, had 9.1% of capital invested by foreign companies, only last year they generated revenue of $35.5 billion or 12.1% of total revenue and paid $3.2 billion of taxes or 12.9% of total taxes paid by the companies observed. Data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Analysis on Dutch companies and their positions in Russia

The Kingdom of the Netherlands is one of the most stable and competitive economies in Europe and in the world as a whole, which is of great importance in the global economy.

For many years, the Netherlands has been one of the world’s key suppliers of science-intensive goods, services and management technologies for Russia, a transit country and a logistics hub for Russian exports, as well as an important partner in the field of cross-border investments. At the same time, since 1990-th, the Netherlands has been a tax and financial hub for large Russian companies, both private and state companies.

The Netherlands is traditionally one of the largest trading partners of Russia (third in the world after China and Germany, second in Europe after Germany), its share in Russia’s total trade turnover before the COVID-19 pandemic was at the level of 6-7%. Until 2020, the Netherlands was the second largest investor in Russia after Cyprus in terms of accumulated direct investment. In many branches of the Russian economy, Dutch investments played a significant role. As of 2020, about 200 companies with the participation of Dutch capital were registered in Russia. Among the priority areas of Dutch investment in Russia are natural resource conservation, industrial use of secondary raw materials, green energy, new technologies for livestock and crop production⁴.

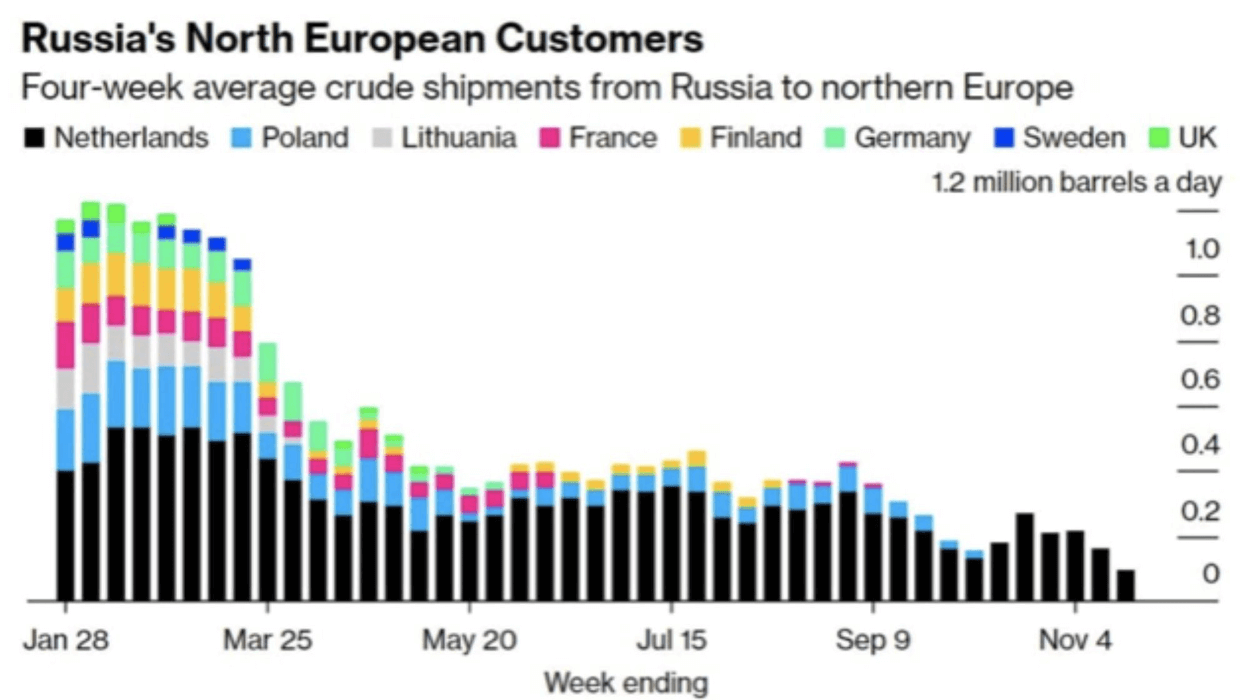

At the same time, Netherlands as of middle of November 2022 was the only country continuing shipments of the crude oil from Russia to northern Europe:

Source: https://twitter.com/EerikNKross/status/1595519237933654021

Since the beginning of Russian aggression against Ukraine in 2014, as well as since the introduction of EU sanctions against Russia on March 17, 2014, including the Netherlands, as well as after June 17 of the same year, when the Malaysian Boeing plane crash occurred, investment activity between the Netherlands and Russia has been frozen.

For reference: as of 2014, trade between Russia and the Netherlands amounted to 73.2 billion US dollars. The volume of Russian exports to the Netherlands amounted to almost 68 billion US dollars, and the share of the Netherlands in Russian foreign trade was 9.4 percent. Russia ranked eighth among partners of the Netherlands with a share of 3.3 percent in the foreign trade turnover of the Netherlands. Dutch exports to Russia amounted to 0.9% (5.2 billion US dollars). At the end of 2014, the volume of accumulated investments of Dutch origin in the Russian economy amounted to more than 68 billion US dollars (17.8% of all foreign investments), of which almost 24 billion US dollars were direct investments⁵.

Taking this into account, the financial sphere of the Netherlands suffered indirect losses related to the reduction or termination of cooperation with companies that have come under EU sanctions, as well as the reduction of agreements with counterparties in Russia and the increase in financial risks of lending to export-oriented clusters of the economy of the country of accreditation – Russia.

However, despite external factors, Russia and the Netherlands remained important partners in the trade and investment sphere.

For reference: in 2021, Russian trade with the Netherlands amounted to 46.4 billion US dollars, an increase of 62.52% (17.9 billion US dollars) compared to 2020. Russian exports to the Netherlands in 2021 amounted to 42.2 billion US dollars, an increase of 69.83% (17.3 billion US dollars) compared to 2020. Russian imports from the Netherlands in 2021 amounted to 4.3 billion US dollars, an increase of 14.17% (531.5 million US dollars) compared to 2020⁶.

In 2021, more than three thousands of Dutch companies exported goods to Russia and almost two thousand companies imported goods from Russia. In 2021, Dutch companies exported over 5 billion euros worth of goods to Russia⁷.

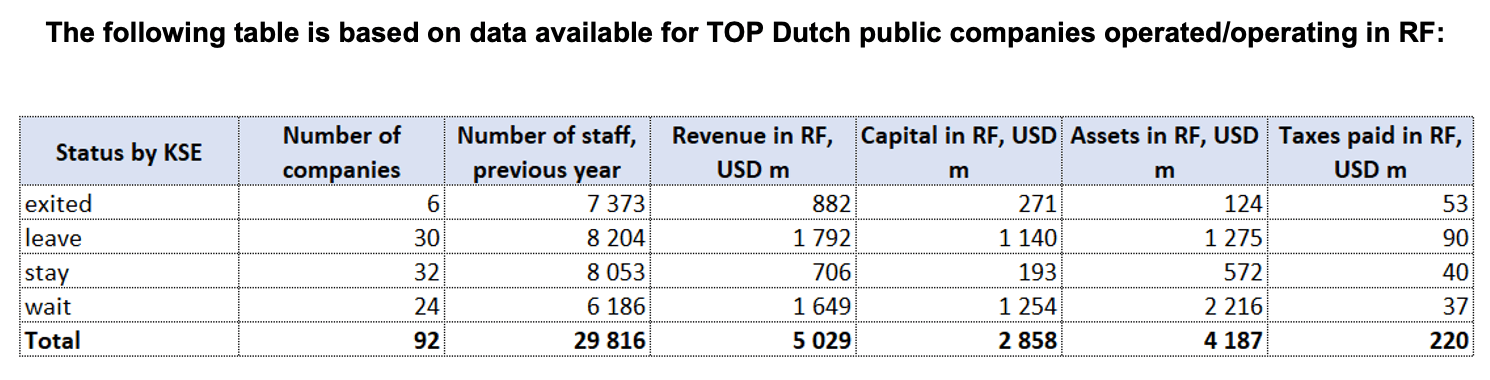

According to data collected by the KSE Institute⁸, in 2021 92 Dutch companies (with share in capital 50+%) provided jobs for 29,800 people, those companies generated $5.0 bn in annual revenue, paid $220 mn of taxes, had $2.9 bn in capital and $4.2 bn in assets.

6 companies (7% of 92 companies observed) have already completely exited Russia by selling their shares, about 25% of employees have already left or will soon leave their previous jobs due to their exit. Another 30 companies announced plans to leave Russia, in 2021 they employed 8 200 people, generated $1.8 bn (36%) in annual revenue, had $1.1 bn in capital and $1.3 bn in assets. But at least 32 companies are still staying and 24 companies are waiting and limiting their investments.

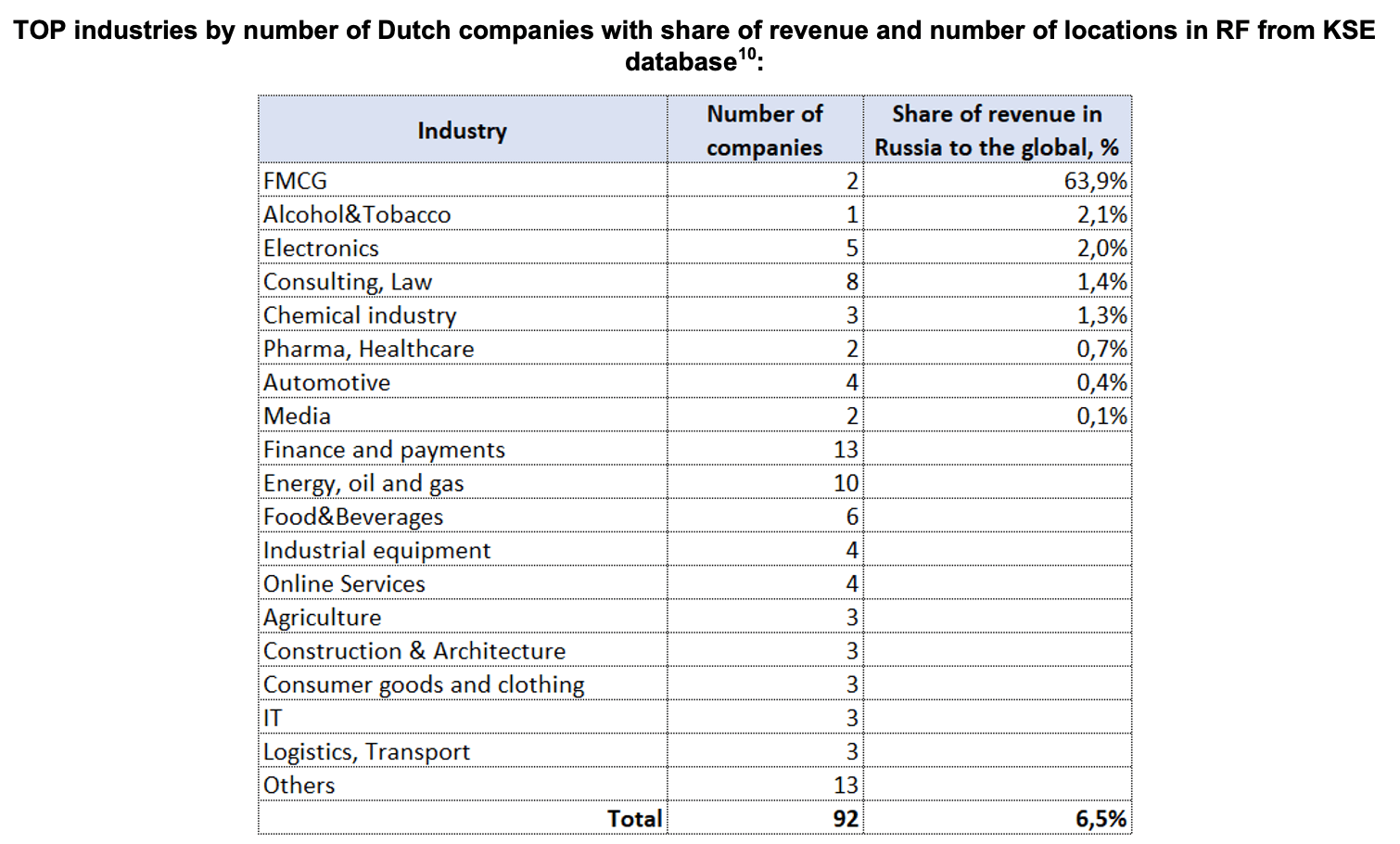

The most “dependent” on Russia in terms of revenue share (more than 2%) in this country are Dutch companies in 3 industries: FMCG, Alcohol & Tobacco and Electronics.

How are Dutch companies reacting?

Out of 92 companies in the KSE database, 35% of Dutch companies stay in Russia, another 26% are waiting and somewhat limiting their activities, 33% are leaving and 7% have already left with the sale of their shares. Some of the Dutch companies are among the examples of clean breaks from the Russian market, while others defy demands for exit despite pressure.

Clean breaks

6 Dutch companies (or 7%) included in the KSE database have completely left the Russian market and sold their shares (all of them have “exited”¹¹, status by KSE, legally there are no Dutch beneficiaries anymore):

KPMG (Consulting, Law, Status by KSE – exited) In the spring, a spokesperson for KPMG International said:

“We believe we have a responsibility, along with other global businesses, to respond to the Russian government’s ongoing military attack on Ukraine. As a result, our Russia and Belarus firms will leave the KPMG network. KPMG has over 4,500 people in Russia and Belarus, and ending our working relationship with them, many of whom have been a part of KPMG for many decades, is incredibly difficult. This decision is not about them – it is a consequence of the actions of the Russian Government.” In June, the entry about the founder was deleted from the register, and in July KPMG JOINT STOCK COMPANY was renamed KEPT JOINT STOCK COMPANY.

Prosus (Online Services, Status by KSE – exited) The Dutch-registered company Prosus, part of the South African investment holding Naspers, which is also the parent company of the OLX Group, has entered into an agreement to sell its stake in one of the most popular Russian classifieds services Avito to the local company Kismet Capital Group (Kismet) for 151 billion rubles ($2.4 billion).Prosus Gives Up $403 Million Stake in Russia’s VK Social Network. Prosus NV gave up its stake in Russia’s largest social network for nothing, walking away from a company run by an executive under US sanctions.

Home Credit (Finance and payments, Status by KSE – exited)Home Credit B.V. — an international non-banking financial institution founded in 1997 in the Czech Republic with headquarters in the Netherlands. Home Credit announced the signing of an agreement to sell their Russian banking assets and subsidiaries to a group of individual investors led by Ivan Tyryshkin. The acquisition of Home Credit and Finance Bank (HCFB) and its subsidiaries by the aforementioned group will lead to a divestment of Home Credit Group from the Russian market. The structure of the Czech group Home Credit left the capital of KhF Bank, transferring its share of 49.5% to it, as it follows from the data of EGRUL.

SPAR (FMCG, had 466 supermarkets and received almost 64% of its revenue from Russia, Status by KSE – exited), Nutreco (Food & Beverages,Status by KSE – exited), Brunel International (Consulting, Law, Status by KSE – exited) – companies that completely stopped cooperation with Russia.

Companies that ignore the exit

Swinkels Family Brewers/Bavaria (Food & Beverages, Status by KSE – stay) Bavaria believes it does not violate any rules with the current contract with the Russians. According to parent company Swinkels Family Brewers, there is a licensing agreement with Russian brewery Moscow Brewing Company that allows them to brew beer under the name Bavaria. This agreement does not fall under the sanctions introduced against Russia due to the war in Ukraine. The current agreement with the Moscow Brewery Company on the production of beer under the name Bavaria is still being implemented. Earlier, Swinkels Family Brewers stopped deliveries to Russia until further notice. Financial transactions with the country were also reviewed.

GasTerra (Energy, oil and gas, Status by KSE – wait) In March, a statement appeared on the company’s website: “As a company and as employees, we are stunned, concerned and angry about the war started by Russia in Ukraine. We are aware of the seriousness of the situation, so our actions in this crisis are a top priority. GasTerra also buys some of its gas from Russia, but we cannot make any independent decisions about this because of its importance to the gas supply. If the government imposes sanctions that affect our business, they will be enforced. We are in contact with the government regarding this”. Dutch gas trader GasTerra has decided not to comply with Gazprom’s one-sided payment requirements. These payment requirements are set out in a decree passed by Russian President Vladimir Putin regarding payment for the supply of Russian gas. In response to GasTerra’s decision, Gazprom declared to discontinue supply with effect from 31 May 2022.

Selected industries analysis

Alcohol & Tobacco

Heineken (Status by KSE – leave) The Dutch brewing corporation Heineken N.V. said it plans to reach an agreement on the sale of Russian assets, valued at a total of 475 million euros, in the second half of 2022. “On March 28, Heineken announced its decision to exit Russia. We are making significant progress to ensure an orderly transfer of our business to a new owner in full compliance with international and local laws, and expect to reach an agreement during the second half of this year,” the statement said.

Chemical industry

LyondellBasell (Status by KSE – wait ) “Effective immediately, LyondellBasell will not enter into any new business transactions or relationships with Russian state-owned entities. We also intend to discontinue business relationships with Russian state-owned entities to the extent legally possible. We are in the process of assessing how this will affect our operations, including feedstocks, utilities, supply chain providers, and customers. Additionally, we are complying with all U.S. and international sanctions which have been put into place as a result of this crisis.” – the company announced in the spring.

Public catering

DP Eurasia (Status by KSE – wait) which manages the Domino’s Pizza brand in Turkey and Russia, for the first four months of the year there was a 1.5% decrease in sales in Russia, which is relatively insignificant. “It is still too early to talk about the opening of new establishments (in Russia). But … our Russian business is sustainable,” told analysts director of DP Eurasia Aslan Saranga, noting that “the group has good relations with its franchisees in the country”. In April, the general director said that half of the group’s establishments in Russia are franchised, and even if the company wants to close them, it will not be able to. Note that this company is also in Ukraine and still works despite the war.

Telecom

VEON (Status by KSE – leave) Dutch mobile operator Veon may spin off its Russian assets from the wider company. Dutch telecommunications operator Veon Ltd has said it is looking to sell its Russian units, which account for more than half of its revenue and earnings.

Energy, oil and gas

Bellona (Status by KSE – leave) Bellona was active in Russia for more than 30 years. Now those activities have ceased, and Bellona has established a new office in Vilnius, Lithuania, where Bellona’s experts, relocated from Russia, will continue their work. “We have been keen to retain our expertise and will use it to assist Ukraine, while at the same time we must prepare for the increased security risk at Russian nuclear installations and waste storage facilities,” says Bellona founder Frederic Hauge.

Резюме

In 2022, with the beginning of Russian large-scale military aggression against Ukraine, the Netherlands, together with other Western allies, imposed financial restrictions on Russia.

For reference: in 2022, the Dutch Government has frozen Russian financial assets in the amount of 646.4 million euros and blocked transactions related to the Russian side in the amount of 574.7 million euros. At the same time, the current trade turnover between the Netherlands and Russia is 2 billion US dollarsА¹³.

However, despite the geopolitical crisis in Europe, according to the OECD¹⁴, economic growth in the Netherlands will be 4.3% in 2022 and economic growth is forecast to slow to 0.8% in 2023 respectively.

Considering the above, it is worth noting that the Netherlands strongly condemns Russian attack on Ukraine, for which Russia will pay a high price. The Netherlands is in close contact with the EU, NATO and other allies regarding the implementation of appropriate sanctions against Russia. The Dutch response to the Russian invasion of Ukraine should be viewed against this background. Indeed, in addition to strongly condemning the Russian attack on Ukraine, the Dutch government responded in a number of ways. It provides humanitarian, economic and military support to Ukraine.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)¹⁵

05.12.2022

*RWE (Germany, Energy, oil and gas) Status by KSE – wait

German energy firm RWE has initiated arbitration proceedings against Russia’s Gazprom over missing gas deliveries, a spokesperson for RWE said, without providing further details.

*Komatsu (Japan, Automotive) Status by KSE – stay

Komatsu Ltd the world’s second-largest construction machinery maker after Caterpillar Inc has no immediate plan to withdraw from its Russian operations

https://www.reuters.com/business/komatsu-ceo-no-immediate-plan-withdraw-russia-2022-12-05/

*Binance (China, Finance and payments) Status by KSE – wait

The world’s largest cryptocurrency, Binance, said it did not exit the Russian market because there are no “global sanctions” against it.

*DWS (Germany, Finance and payments) Status by KSE – leave

DWS to terminate Russia ETF after MSCI axes underlying index

https://www.etfstream.com/news/dws-to-terminate-russia-etf-after-msci-axes-underlying-index/

06.12.2022

*Rockwool (Denmark, Construction & Architecture) Status by KSE – stay

Now Rockwool products have appeared on a construction site in Russian-occupied Mariupol

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – leave

The International Olympic Committee (IOC) has no immediate plans to lift sanctions on Russia and Belarus even though the qualifying process for the Paris 2024 Summer Olympics goes into full swing next year

07.12.2022

*H&M (Hennes and Mauritz) (Sweden, Consumer goods and clothing) Status by KSE – leave

Swedish retailer H&M, which has been operating in Russia since 2009, confirmed the closure of all Russian stores.

08.12.2022

*KFC (USA, Public catering) Status by KSE – leave

Madrid-based restaurant operator AmRest said on Tuesday it agreed to sell its KFC restaurant business in Russia for at least 100 million euros ($104.48 million) to Russian restaurant and entertainment company Almira.

09.12.2022

*ATP Tour (Great Britain, Аssociation, NGO) Status by KSE – stay

*Lawn Tennis Association ((Great Britain, Аssociation, NGO) Status by KSE – leave

ATP fines Lawn Tennis Association for banning Russian, Belarusian players

Wimbledon set to lift ban on Russian and Belarusian players to avoid ATP removal

*Total Energies (France, Energy, oil and gas) Status by KSE – stay

TotalEnergies Decides to Withdraw Its Directors From Novatek And Will No Longer Equity Account for Its Stake in Novatek and Record a 3.7 b$ Impairment in Q4

*Cargill (USA, Food & Beverages) Status by KSE – wait

*Viterra (Netherlands,Agriculture) Status by KSE – stay

Uralchem wants to buy grain assets from Viterra, Cargill if they ever leave Russia

10.12.2022

*Foton (China, Automotive) Status by KSE – stay

*GAC Group (China, Automotive) Status by KSE – stay

*Exeed (China, Automotive) Status by KSE – stay

*Changan (China, Automotive) Status by KSE – stay

* Dongfeng (China, Automotive) Status by KSE – stay

*FAW Group (China, Automotive) Status by KSE – stay

*JAC Motors (China, Automotive) Status by KSEv stay

*Haval (China, Automotive) Status by KSE – stay

*Geely (China, Automotive) Status by KSE – stay

*Chery Automobile (China, Automotive) Status by KSE – stay

Russian car dealers have told how many brands are left on the market

https://ria.ru/20221209/brendy-1837364309.html

*Eutelsat (France, Telecom) Status by KSE – stay

In the Eutelsat case, the Council of State rules in favour of RSF v Arcom

11.12.2022

*Lexus (Japan, Automotive) Status by KSE – leave

Lexus sees ‘tough year’ after hit from chip crisis, Russia exit

https://europe.autonews.com/automakers/lexus-sees-tough-year-after-chip-crisis-russia-exit

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

¹¹ The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities.

¹⁵ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site