- Kyiv School of Economics

- About the School

- News

- 35th issue of the weekly digest on impact of foreign companies’ exit on RF economy

35th issue of the weekly digest on impact of foreign companies’ exit on RF economy

10 January 2023

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 01-08.01.2023

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 08.01.2023

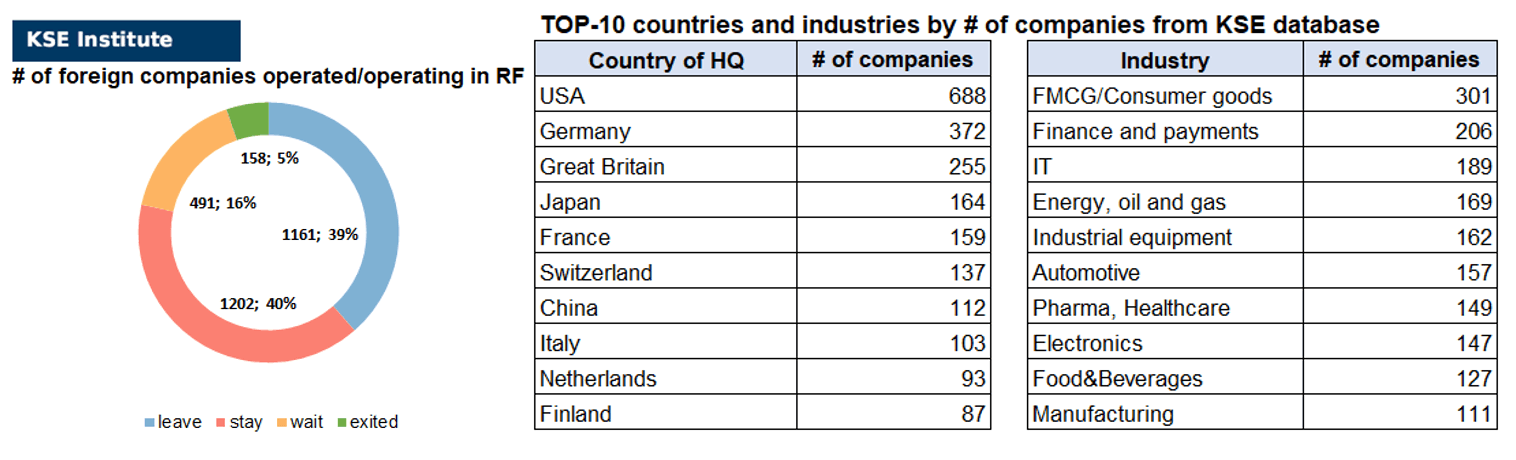

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 202 (-2 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 491 (+1 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 161 (-6 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 158 (+11 per week, +16 per month)

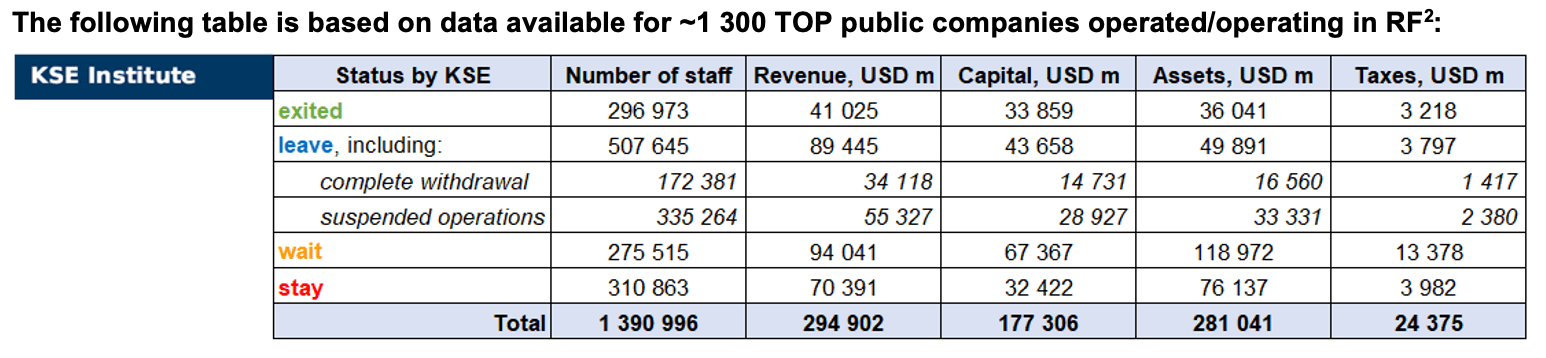

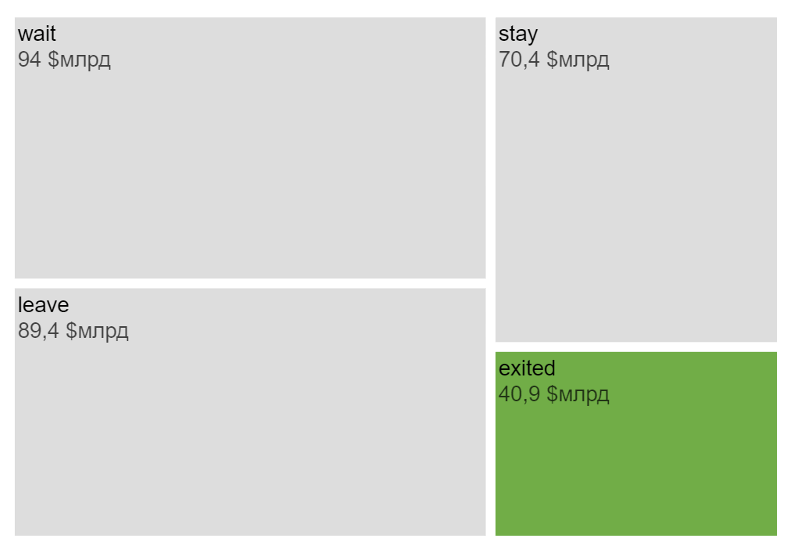

As of January 08, we have identified about 3,012 companies, organisations and their brands from 86 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $177.3 billion), local revenue (about $294.9 billion), local assets (about $281.0 billion) as well as staff (about 1.391 million people) and taxes paid (about $24.4 billion). 1,652 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 158 companies that have completed the sale of their business in Russia based on the information collected from the official registers (December update this week allowed us to identify another 16 exited companies).

As can be seen from the tables below, as of January 08, companies which had already completely exited from the Russian Federation, had at least 297,000 personnel, $41.0 bn in annual revenue, $33.9bn in capital and $36.0bn in assets; companies, that declared a complete withdrawal from Russia had 172,400 personnel, $34.1bn in revenues, $14.7bn in capital and $16.6 bn in assets; companies that suspended operations on the Russian market had 335,300 personnel, annual revenue of $55.3bn, $28.9bn in capital and $33.3 bn in assets.

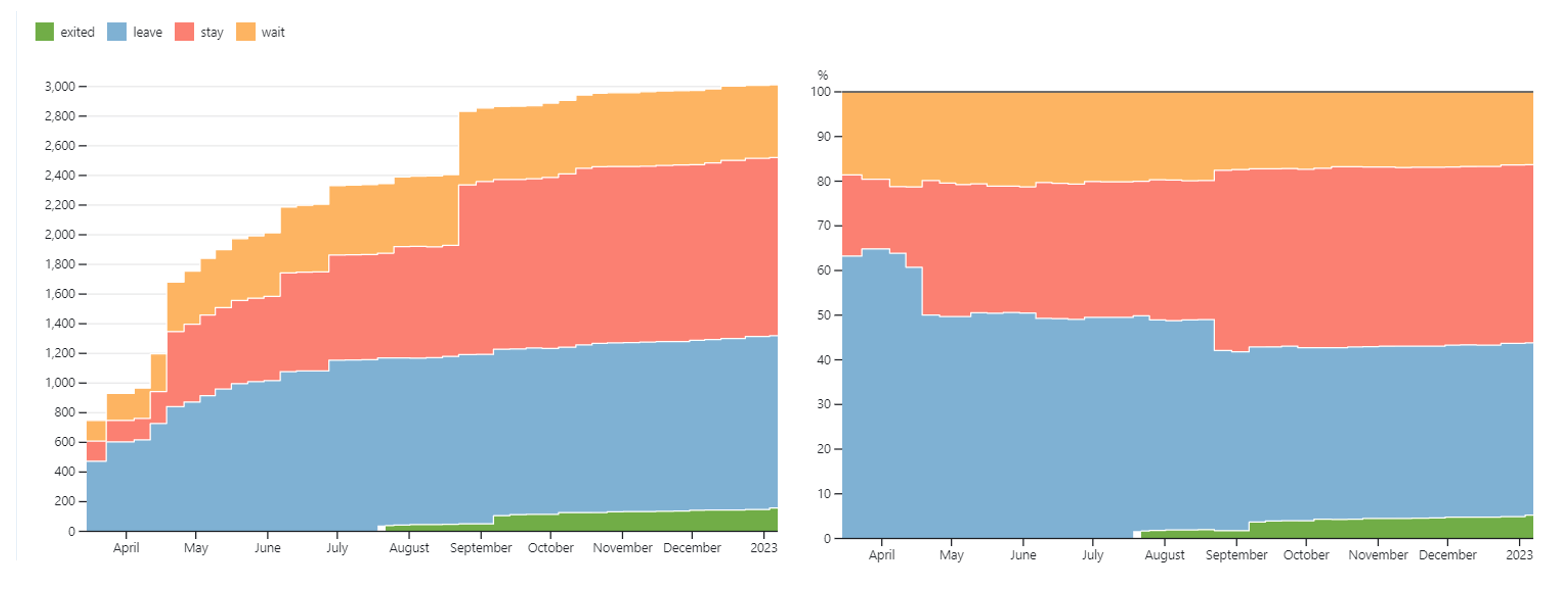

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last 4 months the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 38.5% of foreign companies have already announced their withdrawal from the Russian market, but another 39.9% are still remaining in the country, 16.3% are waiting and only 5.2% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 158 companies that completely left the country, since they employed 21.3% of the personnel employed in foreign companies, the companies owned about 12.8% of the assets, had 19.1% of capital invested by foreign companies, only last year they generated revenue of $41.0 billion or 13.9% of total revenue and paid $3.2 billion of taxes or 13.2% of total taxes paid by the companies observed. Data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: On leaving the Russian Federation. Results of December 2022

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

There are about 1.3 thousand of them with a revenue of more than 290 billion US dollars. And at least 158 of them have already been sold by local companies and left the Russian market.

In this digest, we will summarise the results of December 2022.

Automobile corporations became the main newsmakers in December. At the end of November, Nissan sold its plant in the Russian Federation, and on December 13-14, Volkswagen-associated companies MAN Truck & Bus SE and Scania AB sold MAN Truck and Bus RUS LLC and Scania – Rus LLC in favour of local partners. Before that, MAN and Scania occupied 12% of the commercial vehicle market in the Russian Federation.

On December 8, the Swedish Group Volvo closed an agreement on the sale of some assets (it sold VOLVO FINANCE VOSTOK LLC, VOLVO COMPONENTS LLC and others). At the same time, the company Ferronordic, which belongs to Volvo, sold LLC “Ferronordic machines”, which deals with industrial and special machines. Volvo still has a couple of legal entities in the Russian Federation. The exit was also partially completed by the Japanese Mazda Motor, which in mid-December closed an agreement on the sale of its share in the joint venture Mazda Sollers Manufacturing Rus (MSMR) in Vladivostok to a Russian partner. Mazda is still owned by MAZDA MOTOR RUS LLC.

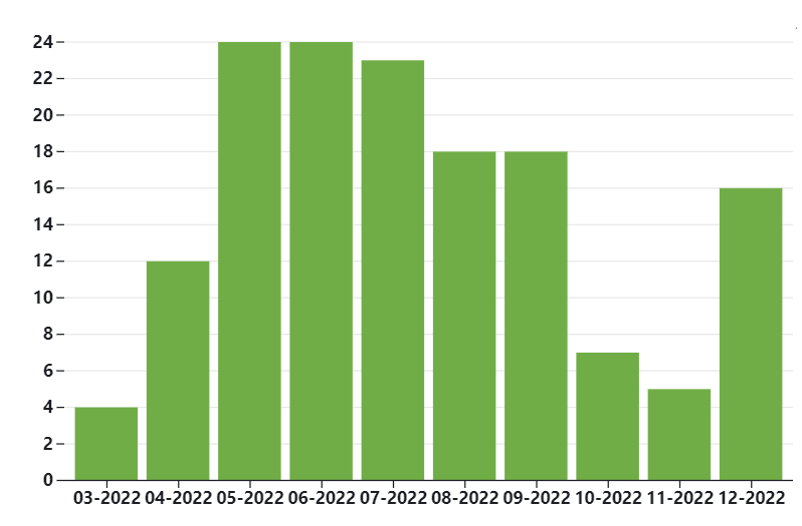

Number of business sales

by foreign companies in Russia

In addition to automobile corporations, several packaging and printing manufacturers made a simultaneous exit in December.

Thus, Mayr-Melnhof Group announced the sale of the Russian enterprises it owns, MM Packaging, producing cardboard packaging – MM Poligrafofromlennya Packaging and MM Poligrafofromlennya Rotogravyur. The buyer was the investment company Granelle. The amount of the agreement, approved by the state authorities, was 134 million euros.

Amcor has announced that it has sold its three factories in Russia to Russian investor HS Investments after receiving all necessary regulatory approvals and cash proceeds. The value of the compensation without cash and debt is 370 million euros.

In December, several more foreign companies completed the sale of their assets. Thus, the American manufacturer of construction materials Owens Corning sold Russian assets to the structure of DK “Rosatom” Umatex. The largest independent oil trader Vitol Group sold a stake in Shkid Oil LLC, which implements one of Rosneft’s largest projects in the north of Russia’s Krasnoyarsk Territory. And the Israeli military manufacturer Plasan sold the Russian subsidiary of LLC Orion Komposit, which was engaged in technical support, etc.

The next review of deals for January 2023 will be available in a month.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)⁴

02.01.2023

*CMA CGM (France, Logistics, Transport) Status by KSE – leave

CMA CGM will exchange its 25% stake in Russia’s Yanino Logistics Park and Moby Dik ocean terminal for an additional 25% stake in Finnish terminal operator Multi Link Terminal.

*Dentons (Multinational, Consulting, Law) Status by KSE – wait

Law firm Dentons completes formal Russia exit but keeps business ties

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

BP (British Petroleum) (Great Britain, Energy, oil and gas) Status by KSE – wait

HSBC (Great Britain, Finance and payments) Status by KSE – wait

BP, Unilever, and HSBC have failed to properly exit Russia

https://www.cityam.com/bp-unilever-hsbc-have-failed-to-properly-exit-russia-new-report-warns/

*Vitol Group (Switzerland, Energy, oil and gas) Status by KSE – leave

Vitol today announces that it has divested its interest in Vostok Oil LLC.

https://www.vitol.com/vitol-divests-interest-in-vostok/

*UEFA (Switzerland, Sport) Status by KSE – leave

Russian Football Union Votes to Remain in UEFA Despite Ongoing Ban

*KFC (USA, Public catering) Status by KSE – leave

Former KFC restaurants in Russia are reportedly in turmoil as re-branding entails a drop in revenue, according to sources.

*Alfa Laval (Sweden, Manufacturing) Status by KSE – stay

Alfa Laval har fått rätt att exportera varor till Ryssland efter avgörande i en svensk domstol.

https://www.dagensps.se/foretag/bolaget-vinner-i-ratten-far-exportera-till-ryssland/

03.01.2023

*Gaztransport & Technigaz (GTT) (France, Engineering) Status by KSE – leave

Following an in-depth analysis of European sanction packages N° 8 and 9 notably prohibiting engineering services with Russian companies, the Group announces that it is ceasing its activities in Russia.

https://gtt.fr/news/ukraine-russia-update-gtts-exposure

*Euroins (EIG) (Bulgaria, Insurance) Status by KSE – leave

Bulgaria’s Euroins Insurance Group (EIG), part of Eurohold Bulgaria said that it has agreed to dispose of its wholly-owned subsidiary in Belarus and to shed its 48.61% equity stake in a Russian business as part of its strategy to focus only on key markets with a positive growth outlook.

https://seenews.com/news/bulgarias-euroins-insurance-group-to-exit-russia-belarus-810166

*Linde (Germany, Chemical industry) Status by KSE – wait

Russia freezes Linde assets worth $488 mln

https://www.reuters.com/markets/europe/russia-freezes-linde-assets-worth-488-mln-2023-01-02/

04.01.2023

*AMCOR (Australia,Consumer goods and clothing) Status by KSE – leave

Amcor announced it completed the sale of its three factories in Russia to HS Investments, a Russian-based investor, after receiving all necessary regulatory approvals and cash proceeds, including receipt of closing cash balances

*BP (British Petroleum) (Great Britain, Energy, oil and gas) Status by KSE – wait

BP Still In Spotlight Over Incomplete Russia Exit

https://oilprice.com/Energy/Energy-General/BP-Still-In-Spotlight-Over-Incomplete-Russia-Exit.html

05.01.2023

*Tennis Australia (Australia, Sport) Status by KSE – stay

Tennis Australia is standing by its position to allow Russian and Belarusian players to compete at this year’s Australian Open, despite calls for them to be banned.

*MOLGroup (Hungary, Energy, oil and gas) Status by KSE – stay

MOL to continue shipping LNG from Russia

06.01.2023

*Grundfos (Denmark, Engineering) Status by KSE – leave

Grundfos finally withdraws from Russia

*PwC (Great Britain, Consulting, Law) Status by KSE – exited

Former PwC Cyprus staff launch firm to serve Russia-linked clients.

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site