- Kyiv School of Economics

- About the School

- News

- 37th issue of the weekly digest on impact of foreign companies’ exit on RF economy

37th issue of the weekly digest on impact of foreign companies’ exit on RF economy

23 January 2023

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 16-22.01.2023

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we became partners with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia just by scanning barcodes.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

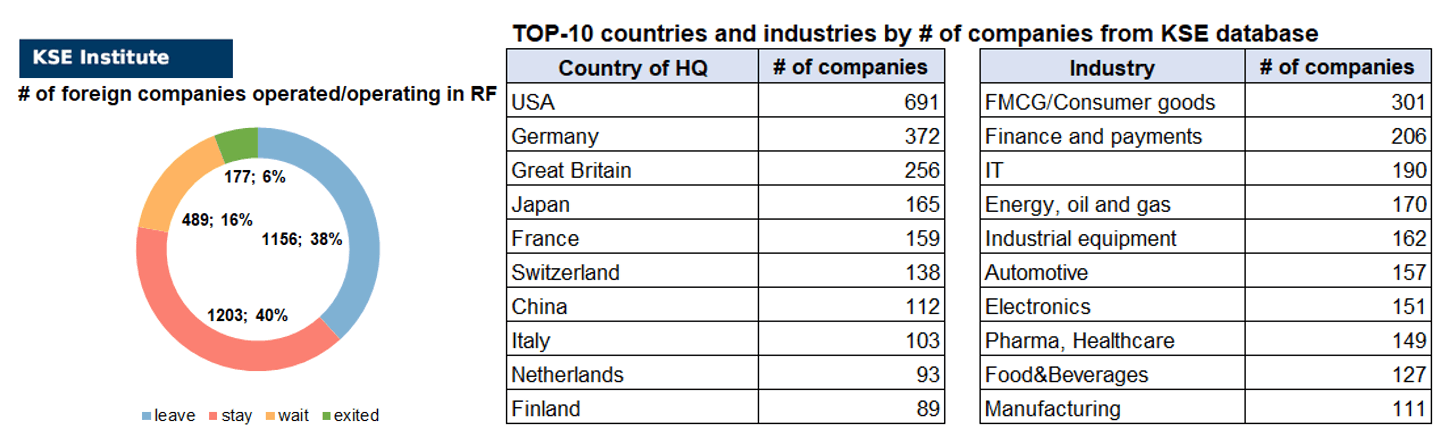

KSE DATABASE SNAPSHOT as of 22.01.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 203 (+1 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 489 (-4 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 156 (-7 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 177 (+17 per week)

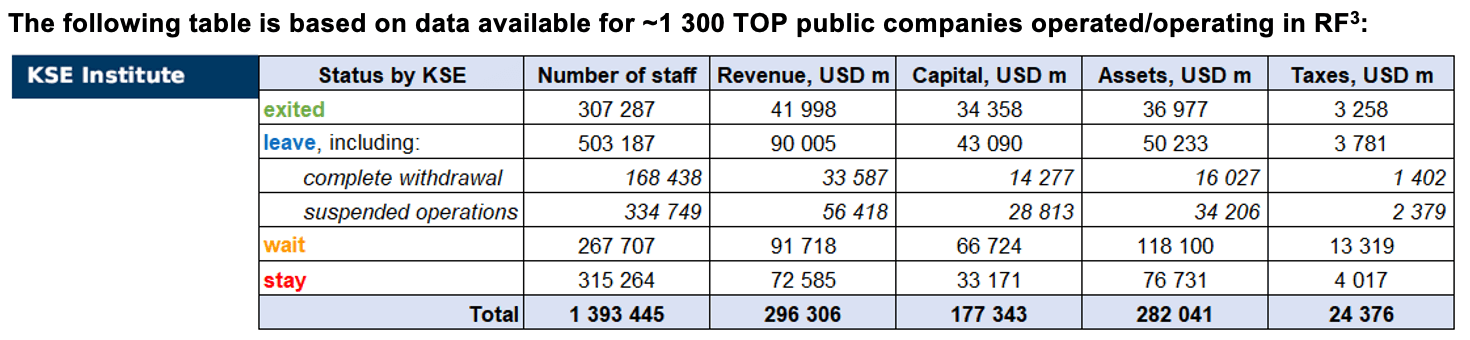

As of January 22, we have identified about 3,025 companies, organisations and their brands from 87 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $177.3 billion), local revenue (about $296.3 billion), local assets (about $282.0 billion) as well as staff (about 1.393 million people) and taxes paid (about $24.4 billion). 1,645 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 177 companies that have completed the sale of their business in Russia based on the information collected from the official registers. This week we reconciled data from the University of St.Gallen latest Paper on 120 exits and verified it with EGRUL whether there were real sales. As a result, 7 new companies and 13 full exits were identified.

As can be seen from the tables below, as of January 22, 177 companies which had already completely exited from the Russian Federation, had at least 307,300 personnel, $42.0 bn in annual revenue, $34.4bn in capital and $37.0bn in assets; companies, that declared a complete withdrawal from Russia had 168,400 personnel, $33.6bn in revenues, $14.3bn in capital and $16.0bn in assets; companies that suspended operations on the Russian market had 334,700 personnel, annual revenue of $56.4bn, $28.8bn in capital and $34.2bn in assets.

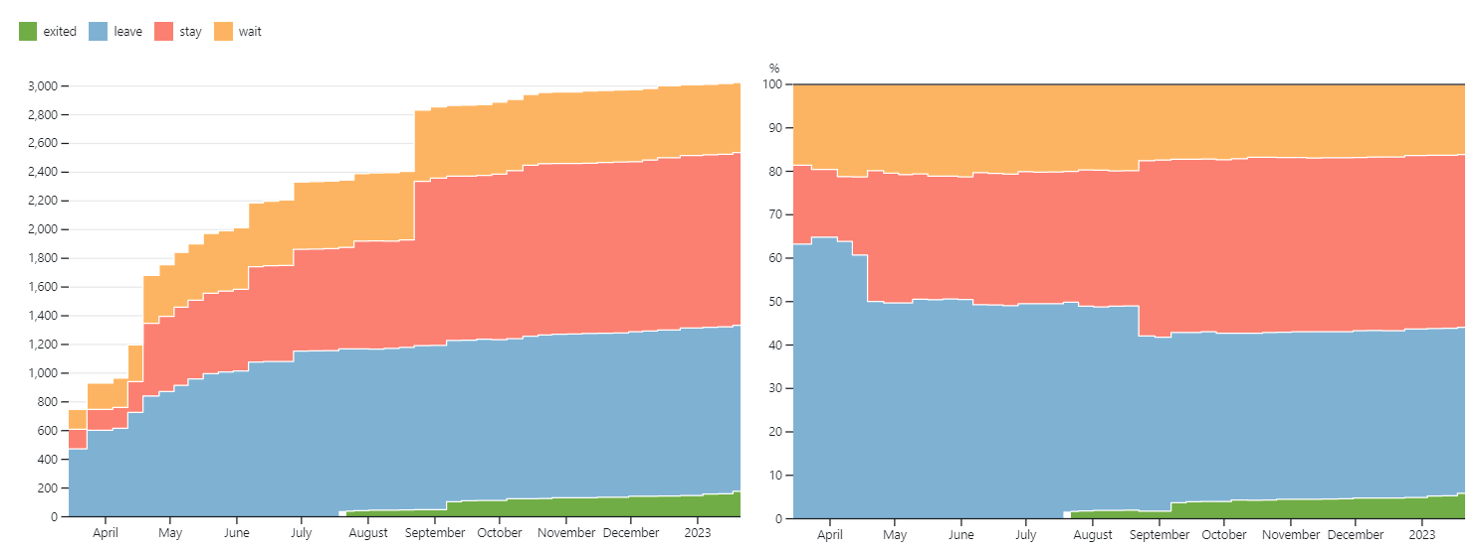

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last 4 months the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 38.2% of foreign companies have already announced their withdrawal from the Russian market, but another 39.8% are still remaining in the country, 16.2% are waiting and only 5.9% made a complete exit⁴.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 177 companies that completely left the country, since they employed 22.1% of the personnel employed in foreign companies, the companies owned about 13.1% of the assets, had 19.4% of capital invested by foreign companies, only last year they generated revenue of $42.0 billion or 14.2% of total revenue and paid $3.3 billion of taxes or 13.4% of total taxes paid by the companies observed. Data on 1,300 TOP companies is presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Analysis on Swedish companies and their positions in Russia

It is believed that Russia and Sweden as neighbouring countries are objectively interested in the development of mutually beneficial economic ties. Economic cooperation between Russia and Sweden is more than a dozen years old. Sweden and Russia have a long history of trade and investment, but over time the nature and level of investment has changed as the world’s political and economic circumstances change.

Until the beginning of 2014, Russian-Swedish economic relations developed dynamically. By the volume of direct investment, Sweden, if we do not take into account offshore and countries that are traditionally used for “tax optimization”, is among the top ten foreign investors on the Russian market. The value of assets of Swedish companies in Russia as part of direct investments amounted to about 7.5 billion US dollars in 2017. This represented approximately two percent of all Swedish assets abroad. Until recently, about 500 Swedish companies operated in Russia⁵.

In pre-war times, Sweden’s exports to Russia traditionally amounted to approximately 1.3%. Traditionally, the main items of Swedish exports were machine-building products (about 60% of Swedish exports to Russia) and food products (5%). Imports from Russia to Sweden traditionally amounted to about 3% (the share of Sweden’s total imports in 2016). Significant articles of import were oil and petroleum products (about 74% of Swedish imports from Russia)⁶.

Russia’s actions in Ukraine have become one of the most urgent foreign policy problems for relations between Sweden and Russia. In 2014, Sweden, together with the USA and EU countries, supported the introduction of sanctions against Russia because of the war it started in Ukraine. At the same time, the activity of bilateral economic cooperation between Sweden and Russia began to decline. But, despite this, Swedish companies continued to work on the Russian market against the background of the tense international situation and economic sanctions against Russia due to the war it started in Ukraine. Trade and economic relations between the two countries continued in the “business as usual” format. Swedish companies that have been working in Russia for a long time did not want to immediately stop their activities, and some even expanded them⁷. For example, Ikea – despite the problems that arose (although later it was forced to change its position to the opposite)⁸. But, over time, they were forced to revise their positions and accelerate their exit from the country, in a certain way setting an example for many other countries.

For reference: Russia’s trade with Sweden in 2021 amounted to 3.6 billion US dollars, an increase of 19.94% compared to 2020. Russian exports to Sweden in 2021 amounted to 1.7 billion US dollars, an increase of 2.69% compared to 2020. Russia’s imports from Sweden in 2021 amounted to 2.5 billion USD, an increase of 29.27% compared to 2020. The trade balance of Russia with Sweden in 2021 was negative in the form of 1.5 billion US dollars. Compared to 2020, the negative balance increased by 60.68%. Sweden’s share in Russia’s foreign trade turnover in 2021 was 0.5%. Sweden ranked 38th in terms of share in Russian trade in 2021 (33rd in 2020). The share of Sweden in Russia’s exports in 2021 was 0.2% against 0.3% in 2020. Sweden ranked 57th in terms of share in Russian exports in 2021 (52nd in 2020). Sweden’s share in Russia’s imports in 2021 was 0.8%. In terms of share in Russian imports in 2021, Sweden took 24th place (26th place in 2020)⁹.

In 2022, with the beginning of Russian large-scale military aggression against Ukraine, Sweden instantly reacted to this event and supported Ukraine. Sweden introduced extensive sanctions against Russia. They concern, for example, the financial, energy and transport sectors, manufacturing, as well as the issuing of visas. At the same time, Sweden is already feeling the negative economic consequences of the sanctions imposed against Russia, including due to rising prices for raw materials such as gas and oil. Therefore, Sweden’s direct economic vulnerability is limited, but the country suffers indirectly from Russian invasion of Ukraine, in particular, there is turbulence in capital markets, rising food prices, etc¹⁰.

It can be noted that some large Swedish corporations have invested significant sums in their Russian markets and provide significant job opportunities to local communities. The decisions taken by some of the largest Swedish companies to stop, suspend or change their operations in Russia are indeed significant. Such decisions indicate a new level of awareness of how business interacts with the geopolitical landscape. However, Russia’s counter-sanctions are hurting Swedish companies that want to leave the Russian market. At the same time, Swedish companies are concerned about their assets in Russia and are taking measures to protect their own physical and intellectual property in Russia¹¹.

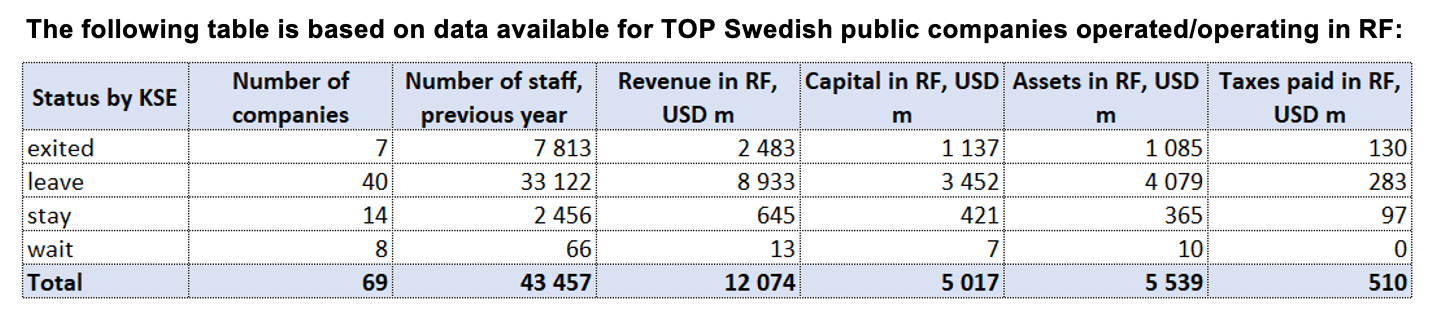

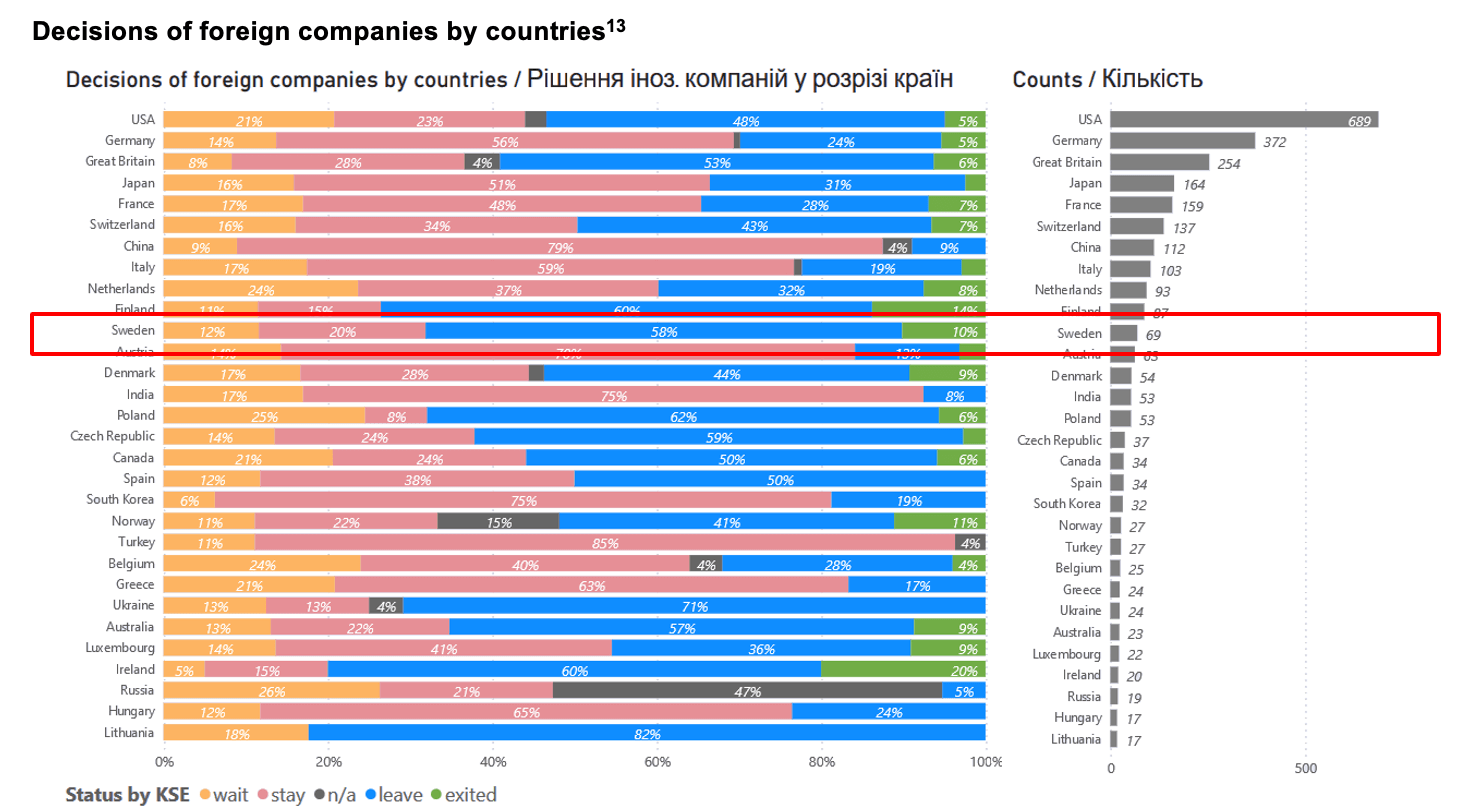

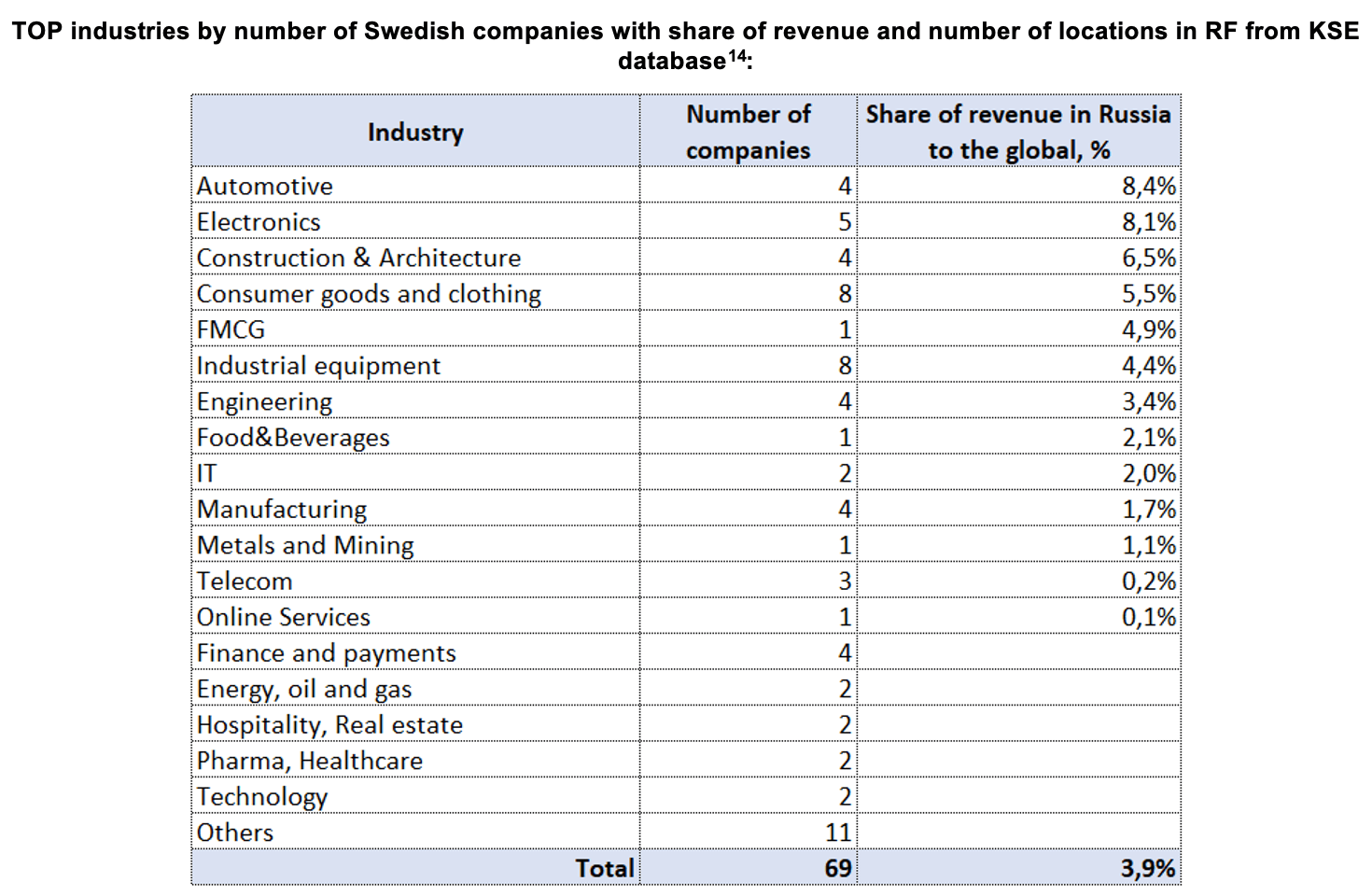

According to data collected by the KSE Institute¹², in 2021 69 Swedish companies (with share in capital 50+%) provided jobs for at least 43,450 people in Russia, those companies generated $12.1 bn in annual revenue, paid $510 mn of taxes, had $5.0 bn in capital and $5.5 bn in assets.

7 companies (10%) have completely left the Russian market and sold their shares, 40 companies (58% of 69 companies observed) have announced plans to leave Russia, in 2021 they employed 33 122 people (it need to be noted that a lot of companies are trading ones and don’t have staff or offices in the country), generated $8.9 bn (74%) in annual revenue, had $3.5 bn in capital and $4.1 bn in assets. But some Swedish companies (at least 14 or 20%) are still staying and 8 companies (12%) are waiting and limiting their investments. These 2 groups generated a relatively minor portion of the revenue ($658 mn or 5%) received by Swedish companies in Russia and employed 6% of staff.

The most “dependent” on Russia in terms of revenue share (5%+) in this country are Swedish companies in the following industries: Automotive, Electronics, Construction & Architecture and Consumer goods and clothing/FMCG.

How are Swedish companies reacting?

Out of 69 companies in the KSE database, only 20% of Swedish companies stay in Russia, another 12% are waiting and somewhat limiting their activities, while 58% are leaving and 10% have already left with the sale of their shares. Some of the Swedish companies are among the examples of clean breaks from the Russian market, while others defy demands for exit despite pressure.

Clean breaks

7 Swedish companies (or 10%) included in the KSE database have completely left the Russian market and sold their shares (all of them have “exited”¹⁵, status by KSE, legally there are no Swedish beneficiaries anymore):

AB Electrolux (Electronics, Status by KSE – exited) Deciding to exit Russia and transfer business to local government by selling its Russian subsidiary, Electrolux Professional subsidiary is selling its Russian business. 09/09/2022 “Electrolux Rus” LLC was sold to the general director in the Russian Federation.

Scania (Automotive, Status by KSE – exited) Scania AB is a large Swedish manufacturer with headquarters in Södertelje, specialising in commercial vehicles, including heavy trucks, trucks and buses. Already in March, Scania decided to stop deliveries of both trucks and spare parts to Russia and stopped production in St. Petersburg. In 2021, approximately 6% of the Group’s net sales came from Russia. Volkswagen partners MAN Truck&Bus SE and Scania AB closed sales agreements.

SKF (Automotive, Status by KSE – exited) a Swedish company for the production of bearings and seals. The company manufactures and supplies bearings, seals, lubricants and lubrication systems, maintenance tools, and mechatronics. products, power transmission products, condition monitoring systems and related services worldwide. The company stopped sales and production in Russia.

Tetra Pak (FMCG, Status by KSE – exited) Tetra Pak has reached an agreement to divest its Russian business to local management, with the intention of enabling business continuity for its customers, minimizing the impact on employees, and continuing to support consumers’ access to essential food. LLC in Russia was sold.

FERRONORDIC (Construction & Architecture, Status by KSE – exited) Ferronordic is a service and sales company in the area of construction equipment and trucks. Ferronordic on 23 December 2022, sold its main Russian subsidiaries Ferronordic Machines LLC, Ferronordic Torgoviy Dom LLC, Ferronordic Torgovaja Kompanija LLC and Ferronordic Arkhangelsk LLC.

Lindab (Construction & Architecture, Status by KSE – exited) Lindab is a leading ventilation company in Europe with solutions for energy efficient ventilation and a healthy indoor climate. As of August 1, Lindab has no operations in, sales to, or purchases from Russia. The Russian subsidiary has been sold to the company’s local Managing Director.

NCAB Group AB (Electronics, Status by KSE – exited) “After taking into consideration future opportunities and risks, NCAB has decided to completely cease its operations in the country. NCAB does not consider that the Russian subsidiary has any value in the current situation and has decided to sell it to the local company management for 1 Ruble” – the statement said¹⁶.

Companies that ignore the exit

Essity (Consumer goods and clothing, Status by KSE – stay) Essity’s conditions to pursue business in Russia have worsened. As a result, the company’s assets in Russia were impaired by approximately SEK 1.4bn. In 2021, Essity’s net sales in Russia amounted to approximately SEK 2.8bn, corresponding to about 2% of total consolidated net sales in 2021. In 2022, the Swedish Essity (brands Libresse, Zewa, Tork and Tena) localised the production of more than 70 products in Russia, the production of which is “maximum independent” of imported raw materials.

Alfa Laval (Manufacturing, Status by KSE – stay) is engaged in the production of specialised products and solutions for heavy industry.Alfa Laval sells heat exchangers to copper and nickel producers. These are products used to capture heat from the melting process and use it for other heating purposes. Alfa Laval received the right to export goods to Russia by the decision of the Swedish court. According to the company, their actions do not contradict the sanctions imposed by the EU. The Administrative Court believes that the ownership relations are not such as to affect the scope of the application of sanctions – Roman Abramovich and Oleg Deripaska own only a minority of shares in this company.

Companies that are leaving Russia

Volvo Cars (Automotive, Status by KSE – leave) Automaker Volvo Group will reduce employees in the Russian Federation during the year. The company produced trucks at the plant in Kaluga, which is currently idle. 30/08/2022: Ferronordic and Volvo CE agree to terminate the dealer agreement for Russia.

Sweco (Construction & Architecture, Status by KSE – leave) is a European consulting company active in the fields of engineering consulting, environmental technology and architecture. Sweco does not have any employees working in Russia or Ukraine. Sweco has decided not to undertake new projects in Russia and is currently assessing and ensuring compliance with EU, US and UK sanctions.

H&M (Hennes and Mauritz) (Consumer goods and clothing, Status by KSE – leave) is a Swedish company and Europe’s largest clothing retailer. Swedish retailer H&M, which has been operating in Russia since 2009, confirmed the closure of all Russian stores. “We confirm that all H&M Group stores in Russia are closed,” H&M said¹⁷.

IKEA (Consumer goods and clothing, Status by KSE – leave) is a multinational conglomerate that designs and sells ready-to-assemble furniture, kitchen appliances and home accessories, among other goods and home services. IKEA announced the suspension of business in Russia and Belarus after the start of hostilities in Ukraine. In mid-August, the company announced its intention to sell all four Russian enterprises in the Leningrad, Kirov and Novgorod regions. IKEA stores owner Ingka Group said in response to speculation that it might resume sales in Russia that it was open to returning one day but the conditions were not in place right now.

Systemair (Industrial equipment, Status by KSE – leave) is a Swedish ventilation company with operations in 50 countries across Europe, Asia, North America and Australia. Systemair has been operating in Russia since 1990. The company’s sales in Russia and Belarus correspond to approximately 4.5% of the Group’s sales. Due to the geopolitical situation in Ukraine, Russia and Belarus, Systemair is temporarily discontinuing all deliveries to Russia and Belarus.

Sandvik (Engineering, Status by KSE – leave) is a Swedish multinational engineering company specialising in metal cutting, digital and additive manufacturing, mining and construction, stainless and special steel alloys, and industrial heating. On February 28, Sandvik suspended its operations in Russia due to Russia’s war in Ukraine. Since then, the company has constantly evaluated and adapted to the situation and made a decision to wind down its activities in Russia. The winding down process is ongoing and progressing in a controlled manner, during which Sandvik strives to act responsibly towards its employees and adhere to applicable regulations and sanctions. Depending on the progress of winding-up procedures, additional costs may be incurred in subsequent quarters. In 2021, about 3.6 percent of Sandvik Group’s revenues came from Russian customers.

Summary

Sanctions have hit the business and financial system of Sweden, but political considerations in this situation come first. The main negative impact on Sweden is indirect, in particular as the rate of growth of the Russian economy decreases¹⁹.

It is worth noting that against the background of the geopolitical crisis in Europe, according to the OECD, production in Sweden will decrease in the near term, resulting in an annual growth of 2.9% in 2022 and a projected decrease of 0.6% in 2023

Also, as of the beginning of November 2022, almost 49 000 Ukrainian refugees have arrived in Sweden²⁰.

Considering the above, it should be noted that even with limited direct trade and financial sanctions impacts, Russia is waging an aggressive war against Ukraine, which affects the Swedish economy, mainly due to higher energy prices and low growth rates in important trade areas with Russia. At the same time, the position of the Swedish government is clear: support for Ukraine, sanctions against Russia and a stronger Sweden. Sweden helps the Armed Forces of Ukraine by providing military equipment and medical supplies, and also increases humanitarian aid to Ukraine²¹.

You can also contribute by spreading the status of the company calling for the exit from Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)²²

17.01.2023

*CAPRI Holdings (Versace, Michael Kors, Jimmy Cho) (USA, Consumer goods and clothing) Status by KSE – wait

The American clothing and accessories brand Michael Kors is leaving the Russian market

*Microsoft (USA, IT) Status by KSE – wait

Russian media has claimed that Intel and Microsoft have started up their business in Russia and Belarus once again following an initial stop as a result of the former’s invasion of Ukraine and the subsequent sanctions imposed on the country.

https://www.techradar.com/news/intel-and-microsoft-are-operating-in-russia-once-again

18.01.2023

*Viasat World (USA, Media) Status by KSE – stay

The Orion group of companies and pay-TV company Viasat have signed a series of new partnership agreements.

https://www.broadbandtvnews.com/2023/01/17/russias-orion-and-viasat-expand-cooperation/

*Wintershall (Germany, Energy, oil and gas) Status by KSE leave

The Wintershall Dea Supervisory Board approved a principle decision by the Management Board to exit Russia.

https://wintershalldea.com/en/investor-relations/ir-23-01

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

Just one more excuse: Unilever boss tries to justify continuing to sell Cornettos in Russia

*Tennis Australia (Australia, Sport) Status by KSE – stay

Australian Open bans Russian, Belarusian flags after incident with fans

https://www.washingtonpost.com/sports/2023/01/17/australian-open-russian-flags/

*Osaka Gas (Japan, Energy, oil and gas) Status by KSE – stay

Osaka Gas signs LNG contract with new operator of Russia’s Sakhalin 2

*Aspo (Finland, Online trading) Status by KSE – wait

Aspo’s subsidiary Leipurin divests its Russian, Belarusian and Kazakh operations

https://uk.finance.yahoo.com/news/inside-information-aspo-subsidiary-leipurin-120000028.html

19.01.2023

*Schlumberger (USA, Energy, oil and gas) Status by KSE – stay

SLB wins Russia business as oilfield rivals exit after Ukraine invasion

20.01.2023

*Bonava (Sweden, Construction & Architecture) Status by KSE – leave

Sell or build: what was the Russian buyer of the Swedish firm Bonava in St. Petersburg afraid of?

*Compass Mining Inc. (USA, Finance and payments) Status by KSE – leave

Compass Mining severed ties with Russian hosting provider Bit River and did not return Bitcoin mining equipment to its customers.

*BASF SE (Germany, Chemical industry) Status by KSE – leave

BASF investors said that Wintershall Dea’s oil and gas business exit from Russia, though painful, clears the way for plans to take it public and for BASF to focus on its chemicals operations.

Extensive data demonstrates that a vast number of firms headquartered in the European Union (EU) and G7 continue to operate and invest in Russia – University of St.Gallen Paper.

https://www.unisg.ch/en/newsdetail/news/war-in-ukraine-many-firms-continue-to-operate-in-russia/

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

³ As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

⁴ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁵ https://vodanews.info/shvecija-vhodit-v-pervuju-desjatku-inostrannyh-investorov-na-rossijskom-rynke/

⁶ https://www.business-sweden.com/campaigns/the-war-in-ukraine/how-big-is-swedens-trade-with-russia/

⁷ https://tass.com/economy/914463

⁸ https://www.kommersant.ru/doc/5748843

⁹ https://russian-trade.com/reports-and-reviews/2022-02/torgovlya-mezhdu-rossiey-i-shvetsiey-v-2021-g/

¹⁴ https://leave-russia.org/uk?flt%5B131%5D%5Beq%5D%5B%5D=453

¹⁵ The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities.

²² Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site