- Kyiv School of Economics

- About the School

- News

- 11th issue of the weekly digest on impact of foreign companies’ exit on RF economy

11th issue of the weekly digest on impact of foreign companies’ exit on RF economy

25 July 2022. Release №11

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 18-24.07.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

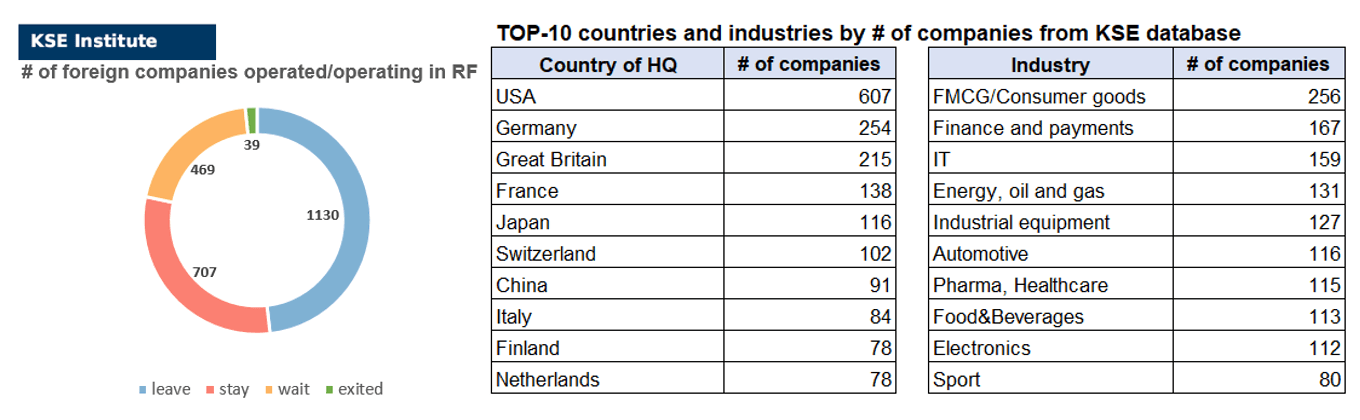

KSE DATABASE SNAPSHOT as of 24.07.2022

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 707 (-3 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 469 (-2 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 130 (-27 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 39 (new category)

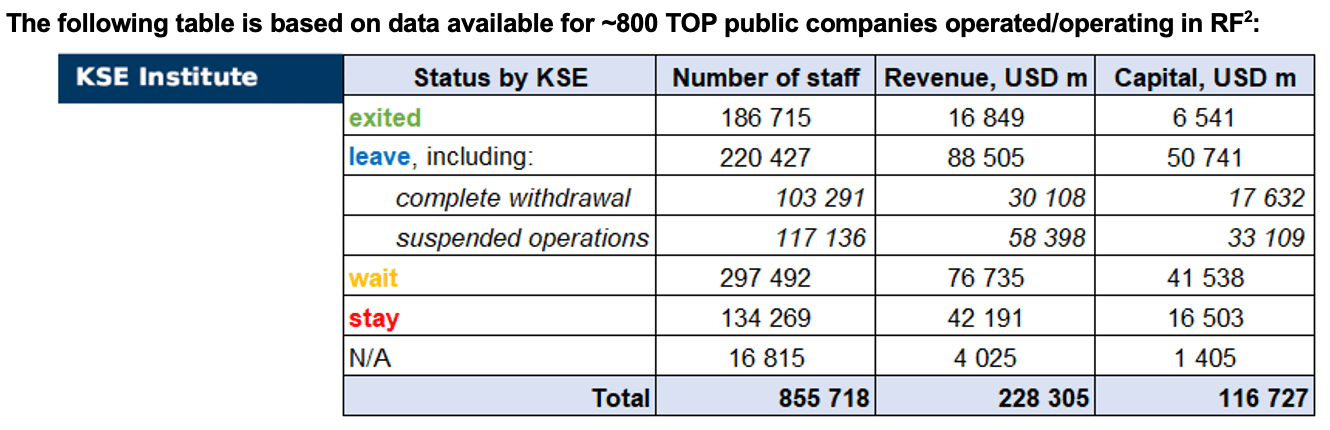

As of July 24, we have identified about 2,345 companies, organizations and their brands from 78 countries and 56 industries and analyzed their position on the Russian market. About half of them are public ones, for ~ 800 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity), which allowed us to calculate the value of capital invested in the country (about $116.7 billion), local revenue (about $228.3 billion), as well as staff (about 0.855 million people). 1,638 foreign companies have reduced, suspended or ceased operations in Russia. Also, this week we added information about 39 companies that have completed the sale of their business in Russia. The information collected from the official registers is already available and systematized in the form of a new KSE’s status “exited” and presented below in the “Weekly focus” section.

As can be seen from the tables below, As of July 24, companies which had already completely exited from the Russian Federation, had 187,000 personnel, $16.8 billion in annual revenue and $6.5 billion in capital; companies, that declared a complete withdrawal from Russia had 103,000 personnel, $30.1bn in revenues and $17.6bn in capital; companies that suspended their operations on the Russian market had 117,000 personnel, annual revenue of $58.4bn and $33.1bn in capital.

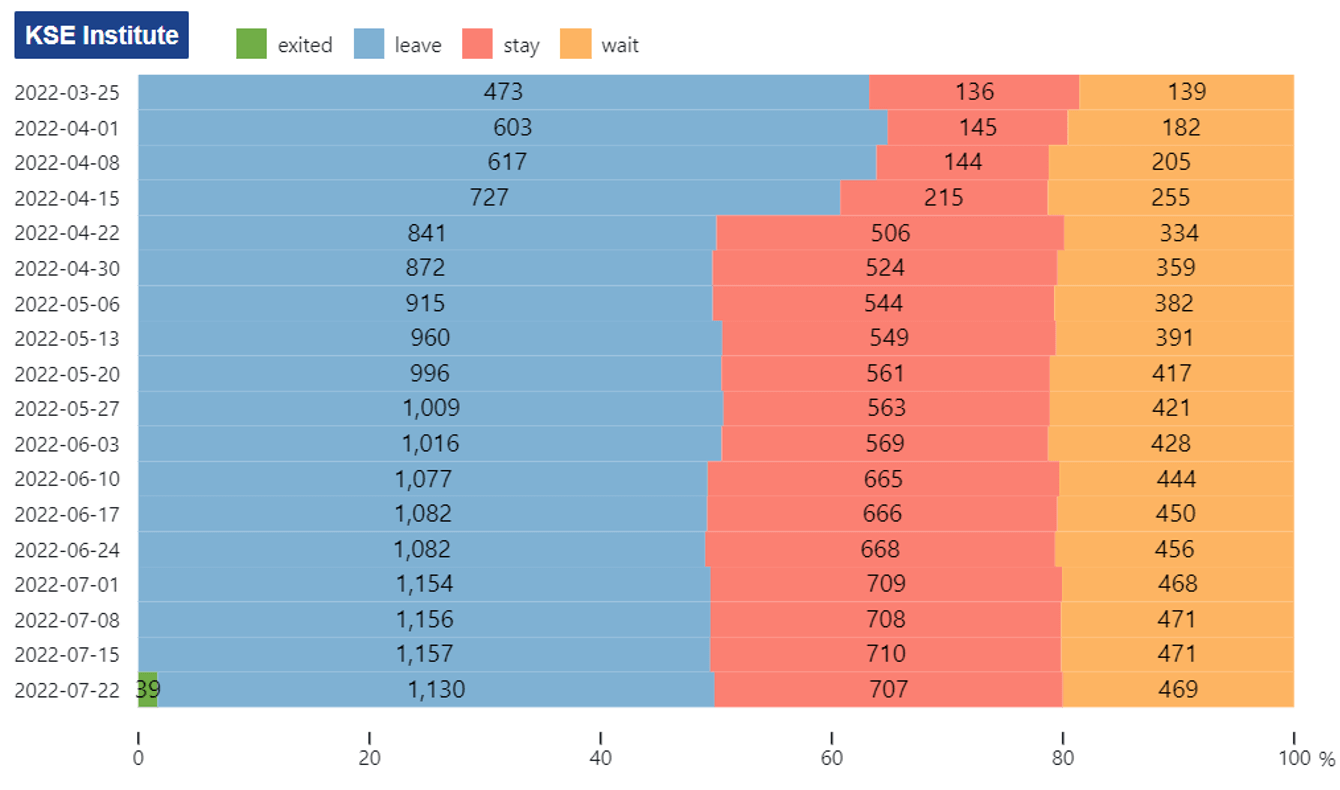

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about a half (48.2%) of foreign companies have already announced their withdrawal from the Russian market, but another 30.1% are still remaining in the country and only 1.7% made a complete exit.

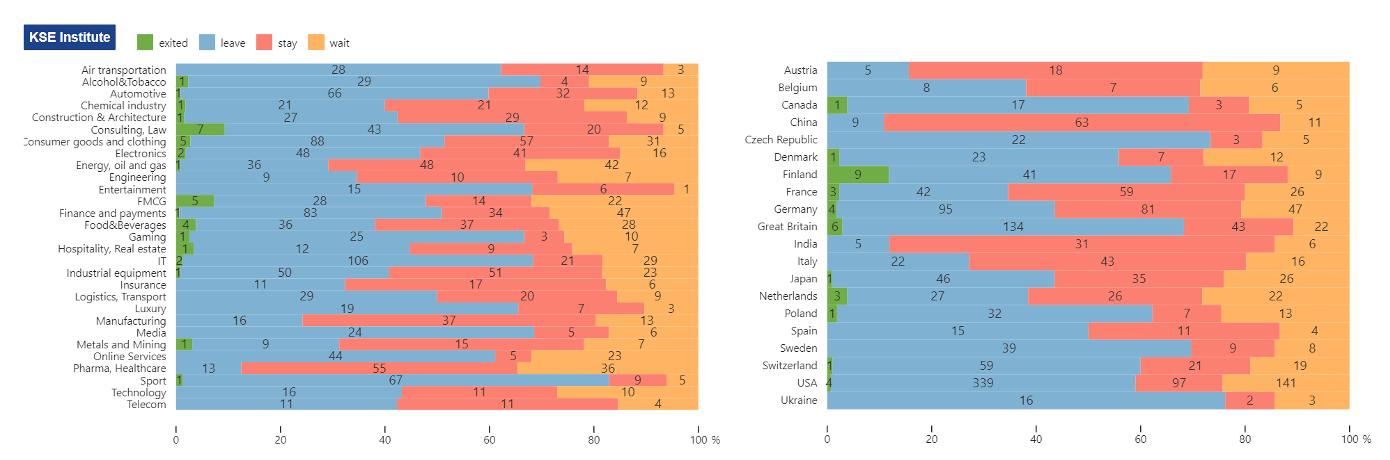

The actions of companies by sector (based on the KSE database, with at least 20 companies representing the industry or country) are shown in the graphs below.

Decisions of foreign companies by country and sector:

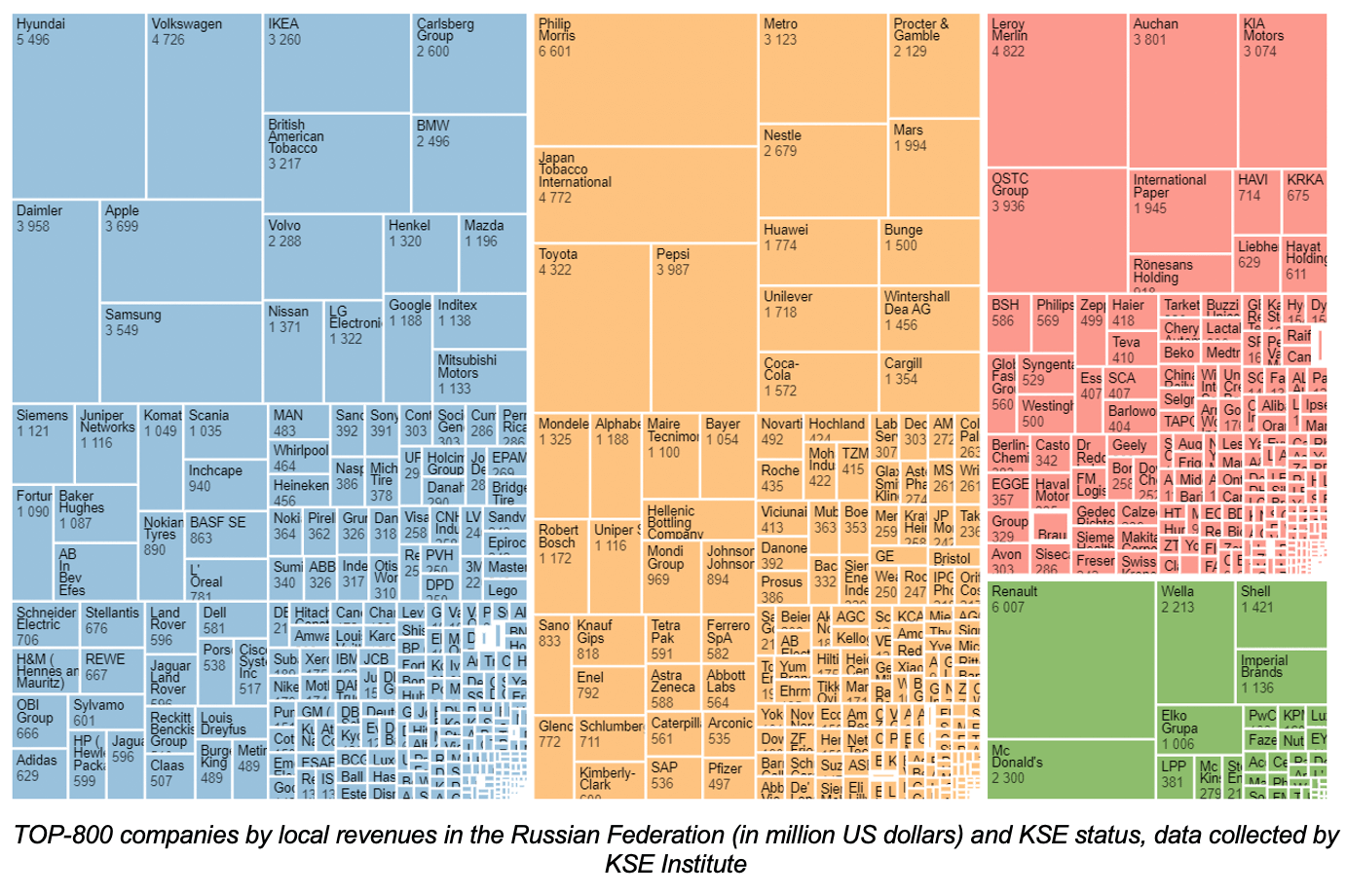

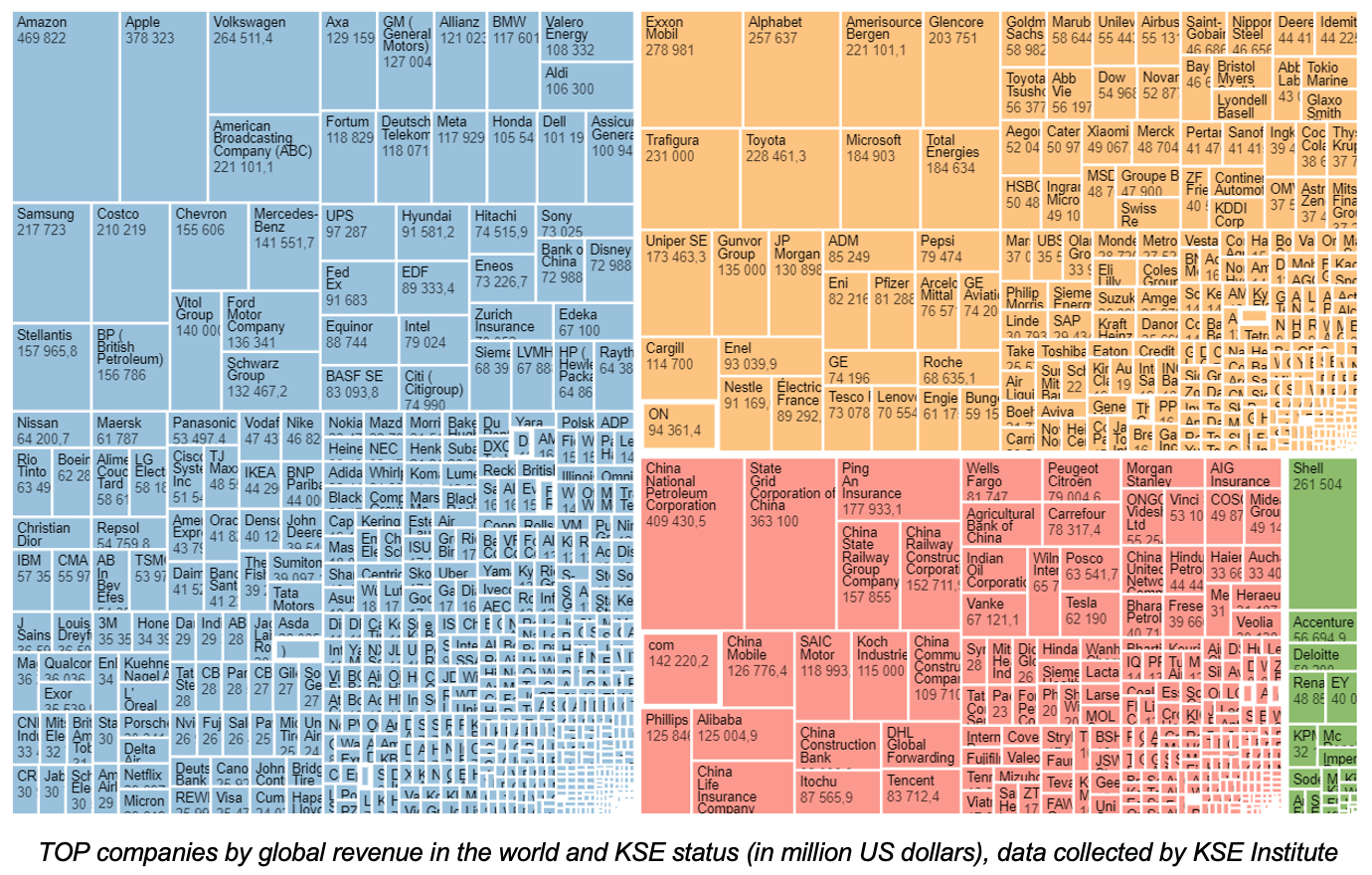

Decisions of TOP foreign companies in terms of local and global revenue³:

WEEKLY FOCUS. DEEDS NOT WORDS – MORE THAN 40 COMPANIES HAVE ALREADY MANAGED TO CLOSE BUSINESS IN RUSSIA

While more than four hundred companies have announced their plans to leave the Russian market, and more than seven hundred have suspended their activities, only about 40 companies have completed their withdrawal from Russia. To exit, companies give up their assets for free, sell them at a considerable discount, and transfer them to the companies’ management.

According to Dmytro Kuleba, “For comparison: during apartheid in South Africa, for more than 20 years, it was only about 200 companies. In 140 days of barbaric aggression, almost six times more pulled out of Russia⁴”. However, for many companies exiting the market can take years.

Philip Morris CEO Jacek Olczak said how difficult it is to exit in a Bloomberg Television interview: ” We are working hard to conclude our presence in Russia but I don’t think it’s going to happen in the time frame of the next quarter […] it’s a pretty complicated process⁵”.

Despite the difficulty, some companies have taken decisive steps, including McDonald’s in public catering, Societe Generale in the banking sector and Renault in the automotive industry. McDonald’s became one of the most famous cases of the company’s exit from Russia, attracting much attention. The company sold its restaurants to its franchisees. Societe Generale sold Rosbank to Volodymyr Potanin’s Interros⁶. The group’s net loss amounted to 3.2 billion euros⁷. At the same time, HSBC, Citi and Unicredit are in talks to sell their Russian business, but to no avail.

Sanctions significantly impacted the automotive industry – most car factories were forced to stop. However, most manufacturers remain in the Russian Federation and pay their employees. Only Renault transferred its share of the carmaker Avtovaz to an auto research institute for free⁸.

Looking at the completely exited companies by sector, many companies come from professional services, particularly consulting, accounting, advertising and legal services. This is not surprising, given that introduced sanctions contributed to their exit (except for legal services). Companies that left include the Big Four auditing companies Deloitte, EY, KPMG, PwC, the law firm McKinsey, advertising companies Ogilvy & Mather, GroupM, etc. For these companies, the most common strategy is to set the Russian business as an independent entity that has no connection to the previous owner and is no longer able to use the company name.

A large share of companies that exited Russia belongs to the FMCG sector, including ten manufacturers of food products, beverages, alcoholic beverages and tobacco, two manufacturers of cosmetics and a manufacturer of packaging. In particular, Arla Foods, Nutreco, Sodexo, Raisio, Hortex, Primo Water, Fazer, Paulig, Tchibo, and Imperial Brands left the market. Three clothing manufacturers, LPP, Marks & Spencer, and Brav, also exited the market.

Heavy industry companies are much less represented in the list as it is more difficult for them to exit the market. On the other hand, industrial companies’ exit has the most significant impact on the Russian economy. Since the withdrawal of companies can take years, it is essential to continue to pressure businesses, not allowing companies to resume operations but to proceed with exit.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)

18.07.2022

*H&M (Hennes and Mauritz) (Sweden, Consumer goods and clothing) Status by KSE – leave

H&M is selling its business in Russia. The brand’s stores will temporarily open to sell off leftovers.

19.07.2022

*NIOC (Iran, Energy, oil and gas) Status by KSE – stay

Iran and Russia’s Gazprom sign primary deal for energy cooperation

20.07.2022

*Mothercare (Great Britain, Consumer goods and clothing) Status by KSE – leave

The British brand of children’s goods and clothing Mothercare may leave Russia – the owner of the company, the Kuwaiti Alshaya Group, has started looking for buyers for the business, but the option of selling off the remaining goods and closing the retail network is not excluded.

https://www.epravda.com.ua/news/2022/07/20/689368/

https://www.vedomosti.ru/business/articles/2022/07/19/932112-mothercare-mozhet-uiti

*Mondi Group (Great Britain, FMCG) Status by KSE – wait

British packaging company Mondi also said it would end its ties to Russia over the invasion of Ukraine. However, it actually stayed and even doubled down on its business, helping fund the Russian War Machine.

*Polymetal (Great Britain, Metals and Mining) Status by KSE – wait

Polymetal Plans to Sell Russian Assets to Avert Sanctions Risk

21.07.2022

*ABB (Switzerland, Electronics) Status by KSE – leave

ABB has decided to exit the Russian market due to the ongoing war in Ukraine and impact of related international sanctions. When the war broke out, ABB stopped taking new orders in Russia. At the same time, it has been fulfilling a small number of existing contractual obligations with local customers, in compliance with applicable sanctions

https://new.abb.com/news/detail/93368/abb-to-exit-russian-market

*Wargaming (Cyprus, Gaming) Status by KSE – exited

FROM AUGUST, THE ORIGINALLY BELARUSIAN COMPANY WARGAMING, WHICH MAKES WORLD OF TANKS GAMES, WILL STOP ADVERTISING IN RUSSIA AND BELARUS

*Edrington (Great Britain, Alcohol&Tobacco) Status by KSE – leave

*Beam Suntory (USA, Alcohol&Tobacco) Status by KSE – leave

Edrington, along with Beam Suntory, has reached an agreement to sell the Maxxium Russia joint venture business to members of the local management team; all shipments to Russia remained suspended

https://www.edrington.com/en/news/edrington-and-russia

https://www.beamsuntory.com/en/news/Beam-Suntory-Russia-Statement

22.07.2022

*Wartsila (Finland, Industrial equipment) Status by KSE – exited

Wärtsilä completes Russian market exit

https://www.wartsila.com/media/news/21-07-2022-wartsila-completes-russian-market-exit-3130664

*HSBC (Great Britain, Finance and payments) Status by KSE – wait

HSBC agrees deal to sell Russian unit to Expobank

*McCain Foods (Canada, Food & Beverages) Status by KSE – leave

Canadian French fry giant McCain Foods Ltd. has sold its Russian potato production facility, completing the company’s exit from Russia.

*Philip Morris (USA, Alcohol&Tobacco) Status by KSE – wait

Philip Morris plans to leave Russia by the end of 2022

https://news.finance.ua/ua/philip-morris-planuye-pity-z-rosii-do-kincya-2022-roku

https://www.bloomberg.com/news/videos/2022-07-21/philip-morris-wants-out-of-russia-ceo-says-video

*Primo Water (USA, Food & Beverages) Status by KSE – exited

PRIMO WATER CORPORATION EXITS RUSSIA

*FIFA (Switzerland, Sport) Status by KSE – leave

Russian national team and Russian clubs won’t be featured in FIFA 23

https://dotesports.com/fifa/news/russian-national-team-and-russian-clubs-to-be-banned-in-fifa-23

23.07.2022

*Kuehne + Nagel AG (Switzerland, Logistics & Transport) Status by KSE – leave

Kuehne+Nagel sold its business in the Russian Federation, Azerbaijan, Belarus and Kazakhstan to its Managing Director effective July 20, 2022. This follows Kuehne+Nagel’s announcement on March 1, 2022, to suspend all shipments to/from the Russian Federation.

https://home.kuehne-nagel.com/-/news/update-on-ukraine-and-russia

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The first collected information is already available and systematized in the form of a newKSE’s status “exited”.

³ KSE Institute started to develop new BI analytics module with a lot of dashboards, the first one is already available at the https://leave-russia.org/ website soon, stay tuned for further updates