- Kyiv School of Economics

- About the School

- News

- 13th issue of the weekly digest on impact of foreign companies’ exit on RF economy

13th issue of the weekly digest on impact of foreign companies’ exit on RF economy

07 August 2022. Release №13

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 01-07.08.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

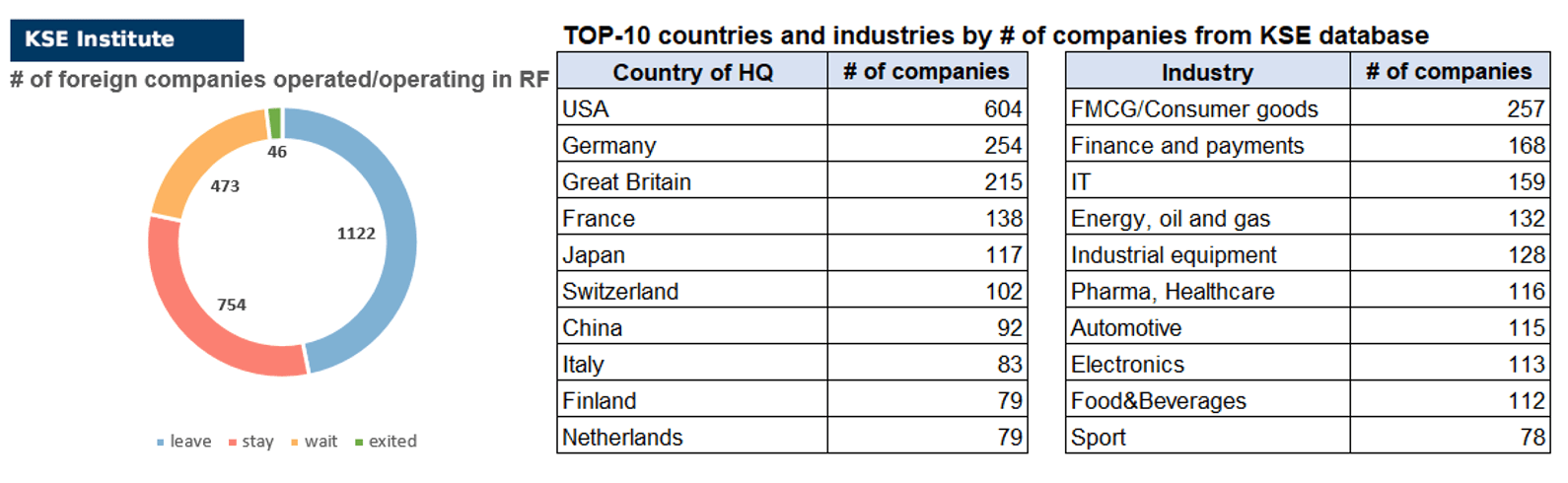

KSE DATABASE SNAPSHOT as of 07.08.2022

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 754 (+4 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 473 (+3 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 122 (-5 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 46 (+3 per week)

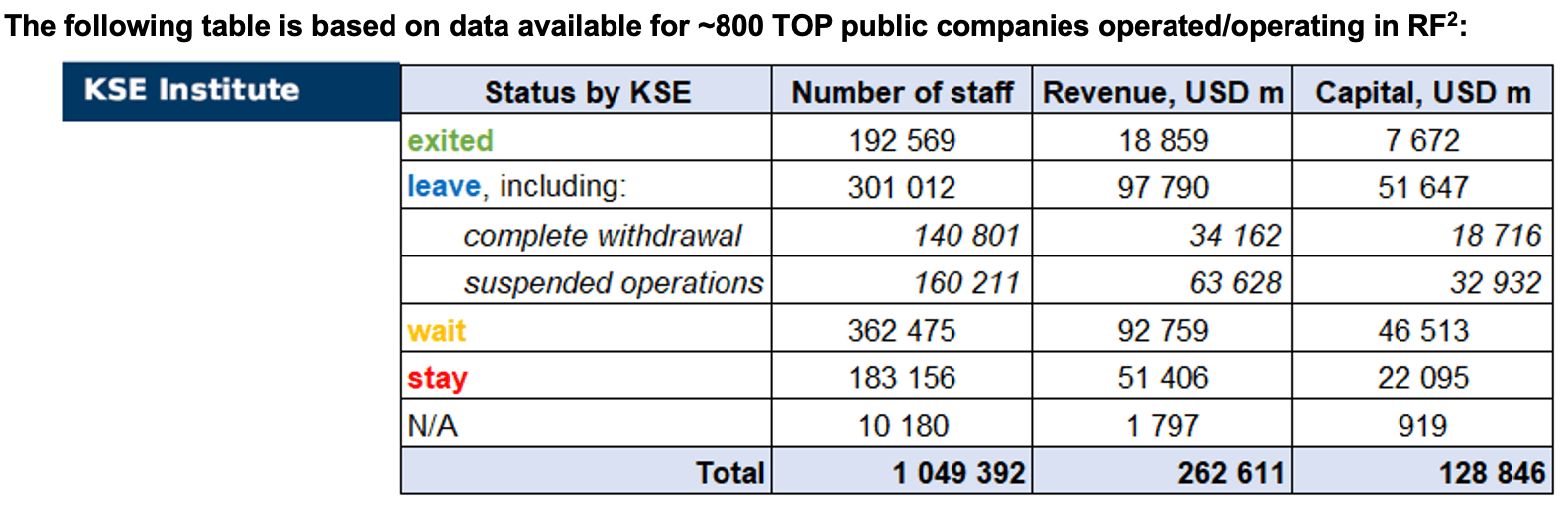

As of August 07, we have identified about 2,395 companies, organizations and their brands from 78 countries and 56 industries and analyzed their position on the Russian market. About half of them are public ones, for ~ 800 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $128.8 billion), local revenue (about $262.6 billion), as well as staff (about 1.049 million people). 1,641 foreign companies have reduced, suspended or ceased operations in Russia. Also, recently we added information about companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, As of August 07, companies which had already completely exited from the Russian Federation, had 192,600 personnel, $18.9 billion in annual revenue and $7.7 billion in capital; companies, that declared a complete withdrawal from Russia had 140,800 personnel, $34.2bn in revenues and $18.7bn in capital; companies that suspended operations on the Russian market had 160,200 personnel, annual revenue of $63.6bn and $32.9bn in capital.

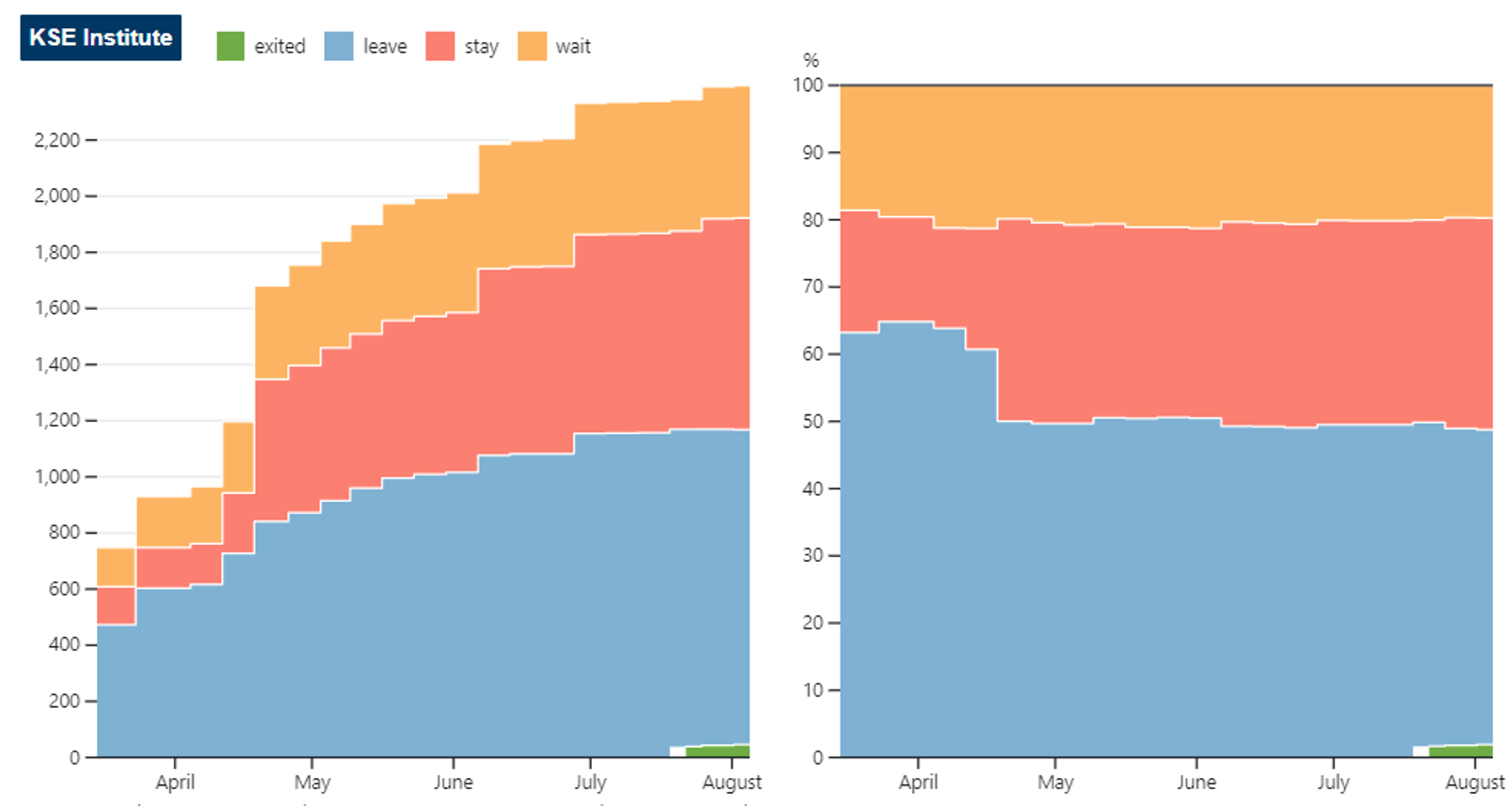

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about a half (46.8%) of foreign companies have already announced their withdrawal from the Russian market, but another 31.5% are still remaining in the country and only 1.9% made a complete exit³.

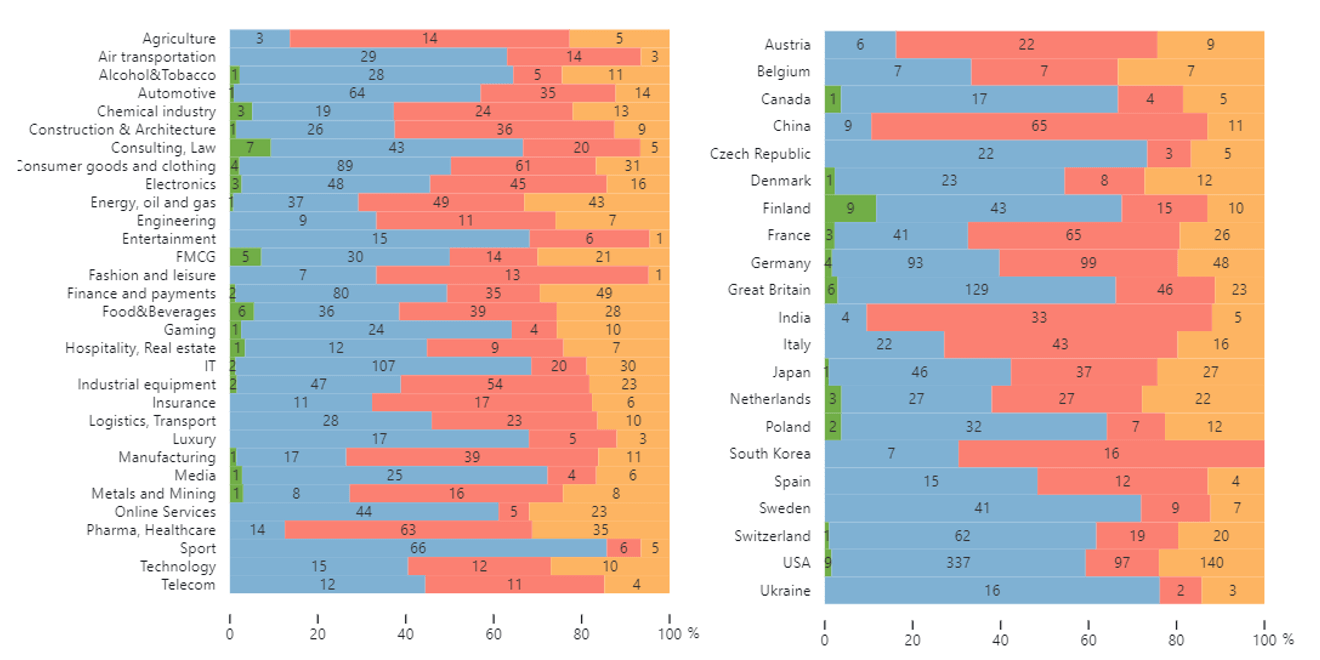

The actions of companies by sector (based on the KSE database, with at least 20 companies representing the industry or country) are shown in the graphs below.

Decisions of foreign companies by country and sector:

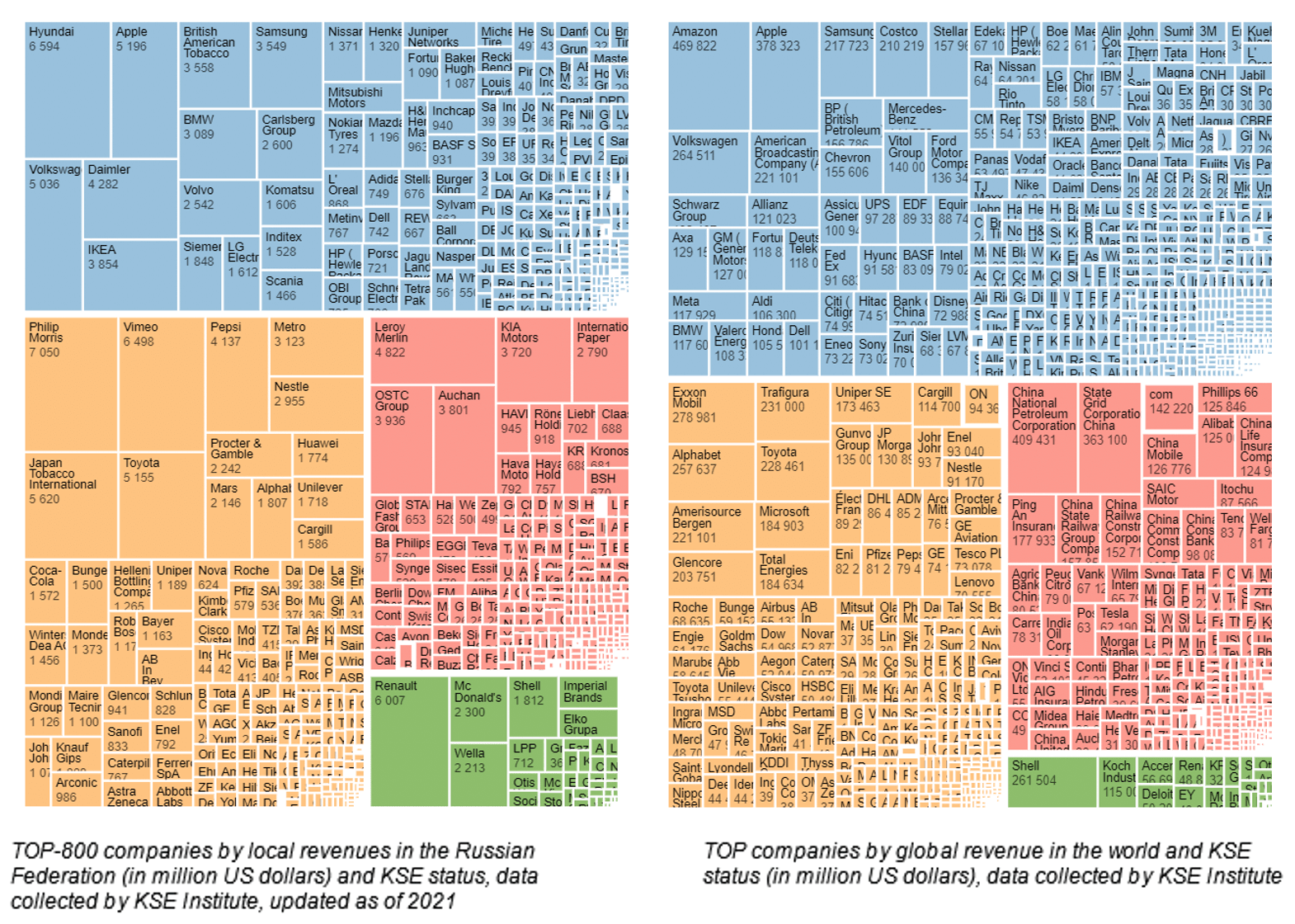

Decisions of TOP foreign companies in terms of local and global revenue⁴:

WEEKLY FOCUS. RUSSIA IS BANNED FROM INTERNATIONAL SPORT

After the International Olympic Committee (IOC) announced its recommendation to International Sports Federations and sports event organizers not to allow participation of Russian and Belorussian teams, almost all banned them. Still, some federations allow participants from Russia and Belarus as individual athletes, not associated with the countries. Ukraine calls for banning athletes from the Russian Federation and Belarus from competing under a neutral flag.

On February 28, ”for the safety of all the participants”, the IOC recommended International Sports Federations and sports event organizers not to allow the participation of Russian and Belarusian athletes and officials in international competitions and not organize events in Russia and Belarus⁵.

Wherever this is impossible, Russian or Belarusian nationals should be accepted only as neutral athletes or teams. Almost all federations banned partici[ants from Russia and Belarus altogether. KSE database and website contains more than fifty such sports federations and event organizers, including football, badminton, boxing, biathlon, ice hockey, curling, rugby, gymnastics, skating, basketball, volleyball, tennis, chess, cycling, golf, handball, judo, motorcycling, skiing, shooting sports, swimming, archery, sailing, taekwondo, triathlon, table tennis, etc

For instance, The national football teams of Russia and Belarus were banned from the 2022 Men’s World Cup and the 2023 Women’s World Cup (FIFA)⁶. UEFA has excluded the national teams and all clubs from European competitions. The International Ice Hockey Federation (IIHF) suspended the participation of all Russian and Belarusian National Teams and Clubs in all IIHF competitions or events.⁷.

Some sports allow participation as individual athletes, not associated with the countries. That includes tennis, cycling, judo⁸ and chess⁹. Some federations attempt to return these athletes by allowing them to compete under a neutral flag, but they have not been successful so far.

International Governing Bodies of Tennis issued a Joint Statement in early March¹⁰ that players from Russia and Belarus will continue to be allowed to compete in international tennis events. However, they will not compete under the name or flag of Russia or Belarus until further notice. However, some of the tennis events’ organizers went further. All England Lawn Tennis Club (AELTC) and the Lawn Tennis Association (LTA) banned athletes from competing in the upcoming UK grass-court events. The Women Tennis Association’s reaction was that individual athletes should not be penalized or prevented from competing due to where they are from or the decisions made by the governments of their countries. As a result, WTA punished and fined Wimbledon and LTA¹¹. Wimbledon appealed the decision.

Ukraine calls for banning athletes from Russian Federation and Belarus from competing under a neutral flag¹². Russian attacks have claimed the lives of more than 80 Ukrainian athletes and coaches and destroyed more than 100 sporting facilities, while Russian and Belarusian athletes are supporting the war with their silence. The Sports Committee of Ukraine launched a website Sport Angels with information about Ukrainian athletes who died due to the invasion of Russia¹³.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)¹⁴

01.08.2022

*LHV Pank (Estonia, Finance and payments) Status by KSE – wait

New restrictions on payments received from banks in Russia and Belarus.

Due to the complicated international situation caused by the Russo-Ukrainian War, LHV Pank will no longer be able to accept payments from Russian and Belarusian banks from 9 August 2022.

https://www.lhv.ee/en/news/2022/25

*Continental (Germany, Automotive) Status by KSE – wait

On August 1, the Continental plant producing automobile tires will start working again in Kaluga.

https://aif.ru/money/company/zavod_shin_continental_v_kaluge_vozobnovit_rabotu_s_1_avgusta

*OBI Group (Germany, Consumer goods and clothing) Status by KSE – leave

OBI closes deal to sell Russian business for one euro

02.08.2022

*Ekaterra (Netherlands, Food & Beverages) Status by KSE – wait

The discontinuation of Ekaterra means that tea brands Lipton, Saito and Brooke Bond will cease to be produced in Russia by the end of 2022. After that, the Ekaterra company will completely stop their sales and distribution on the Russian market.

*Baker Hughes (USA, Energy, oil and gas) Status by KSE – leave

Baker Hughes Announces Local Management Buyout of its Oilfield Services Business in Russia

*Heineken (Netherlands, Alcohol&Tobacco) Status by KSE – leave

The Dutch brewing corporation Heineken N.V. said it plans to reach an agreement on the sale of Russian assets, valued at a total of 475 million euros, in the second half of 2022.

https://www.epravda.com.ua/news/2022/08/1/689868/

https://www.theheinekencompany.com/newsroom/heineken-nv-reports-2022-half-year-results/

03.08.2022

*Jotun (Norway, Chemical industry) Status by KSE – leave

The Norwegian paint manufacturer Jotun has announced the sale of its business in the Russian Federation and exit from the country.

https://www.epravda.com.ua/news/2022/08/2/689921/

https://www.jotun.com/ww-en/about-jotun/media/news/jotun-has-decided-to-exit-russia/

*Maersk (Denmark, Logistics, Transport) Status by KSE – leave

Maersk expects a quick conclusion of negotiations on the sale of business in the Russian Federation

https://www.epravda.com.ua/news/2022/08/3/689955/

*Nokian Tyres (Finland, Automotive) Status by KSE – leave

Nokian Tyres aims for Q3 decision on new plant to replace Russia production

*Metso Outotec (Finland, Industrial equipment) Status by KSE – wait

CEO tells YLE Metso Outotec has adhered fully to sanctions against Russia

04.08.2022

*ExxonMobil (USA, Energy, oil and gas) Status by KSE – wait

Exxon Mobil is negotiating to transfer its stake in the Sakhalin-1 project to another company

https://www.epravda.com.ua/news/2022/08/4/689996/

*Societe Generale (France, Finance and payments) Status by KSE – exited

The French Societe Generale estimated the loss from the sale of its bank in the Russian Federation at 3.3 billion euros

https://www.epravda.com.ua/news/2022/08/3/689963/

*PHX Energy Services (Canada, Energy, oil and gas) Status by KSE – leave

PHX Energy Services Pulls Out of Russia

https://www.marketwatch.com/story/phx-energy-services-pulls-out-of-russia-271659442238

05.08.2022

*AB InBev Efes (Russia, Alcohol & Tobacco) Status by KSE – wait

AB InBev Efes has localized production of some popular beer brands in Russia.

https://www.interfax.ru/business/855277

*BlackRock (USA, Finance and payments) Status by KSE – leave

BlackRock to Shutter Russia ETF That Once Held $800 Million

*Paramount (USA, Films) Status by KSE – leave

Paramount+ subscribers grew to over 43 million thanks to the addition of 4.9 million subscribers and the removal of 1.2 million users from Russia, the company revealed in its report for the second quarter of the year.

https://senalnews.com/en/digital/paramount-reached-over-43-million-subscribers-during-q2

*Glencore (Switzerland, FMCG) Status by KSE – wait

Glencore’s profits more than doubled to a record in the first half of the year, cementing the group’s status as one of the biggest winners from the turmoil in commodity markets unleashed by the war in Ukraine.

https://www.ft.com/content/5ce49d4e-be60-4675-ae7e-8fe70b9b1bac

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 07/08/2022, we have updated data for some companies on personnel, revenue, and capital for 2021 (and will continue to do so as new data is processed). Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The first collected information is already available and systematized in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/.

⁴ KSE Institute started to develop new BI analytics module with a lot of dashboards, the first one is already available at the https://leave-russia.org/ website soon, stay tuned for further updates

¹⁴ Last week, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site