- Kyiv School of Economics

- About the School

- News

- 24th issue of the weekly digest on impact of foreign companies’ exit on RF economy

24th issue of the weekly digest on impact of foreign companies’ exit on RF economy

24 October 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 17-23.10.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

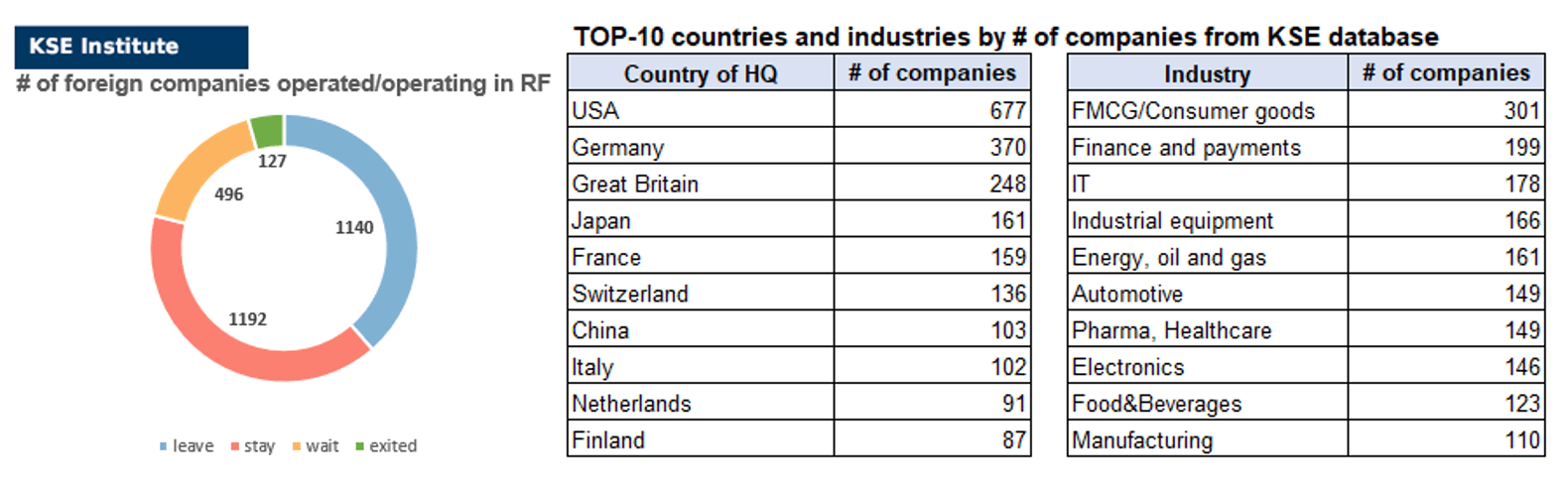

KSE DATABASE SNAPSHOT as of 23.10.2022

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 192 (+1 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 496 +2 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 140 (+9 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 127 (+1 per week)

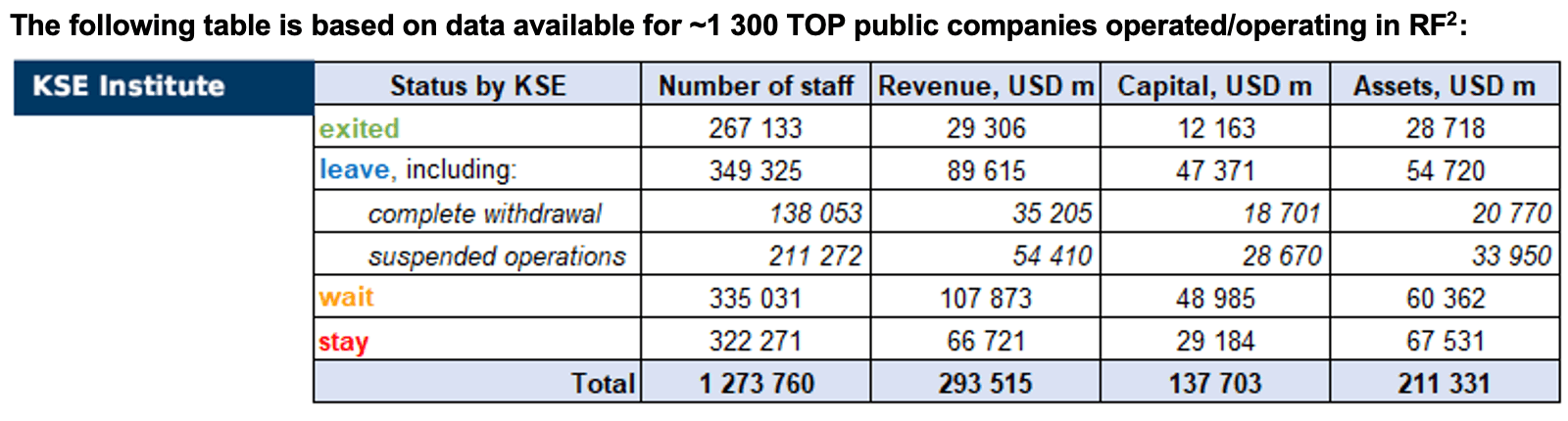

As of October 23, we have identified about 2,955 companies, organisations and their brands from 85 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $137.7 billion), local revenue (about $293.5 billion), local assets (about $211.3 billion) as well as staff (about 1.274 million people). 1,636 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 127 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of October 23, companies which had already completely exited from the Russian Federation, had at least 267,100 personnel, $29.3 bn in annual revenue, $12.2 bn in capital and $28.7 bn in assets; companies, that declared a complete withdrawal from Russia had 138,050 personnel, $35.2bn in revenues, $18.7bn in capital and $20.8 bn in assets; companies that suspended operations on the Russian market had 211,300 personnel, annual revenue of $54.4bn, $28.7bn in capital and $34.0 bn in assets.

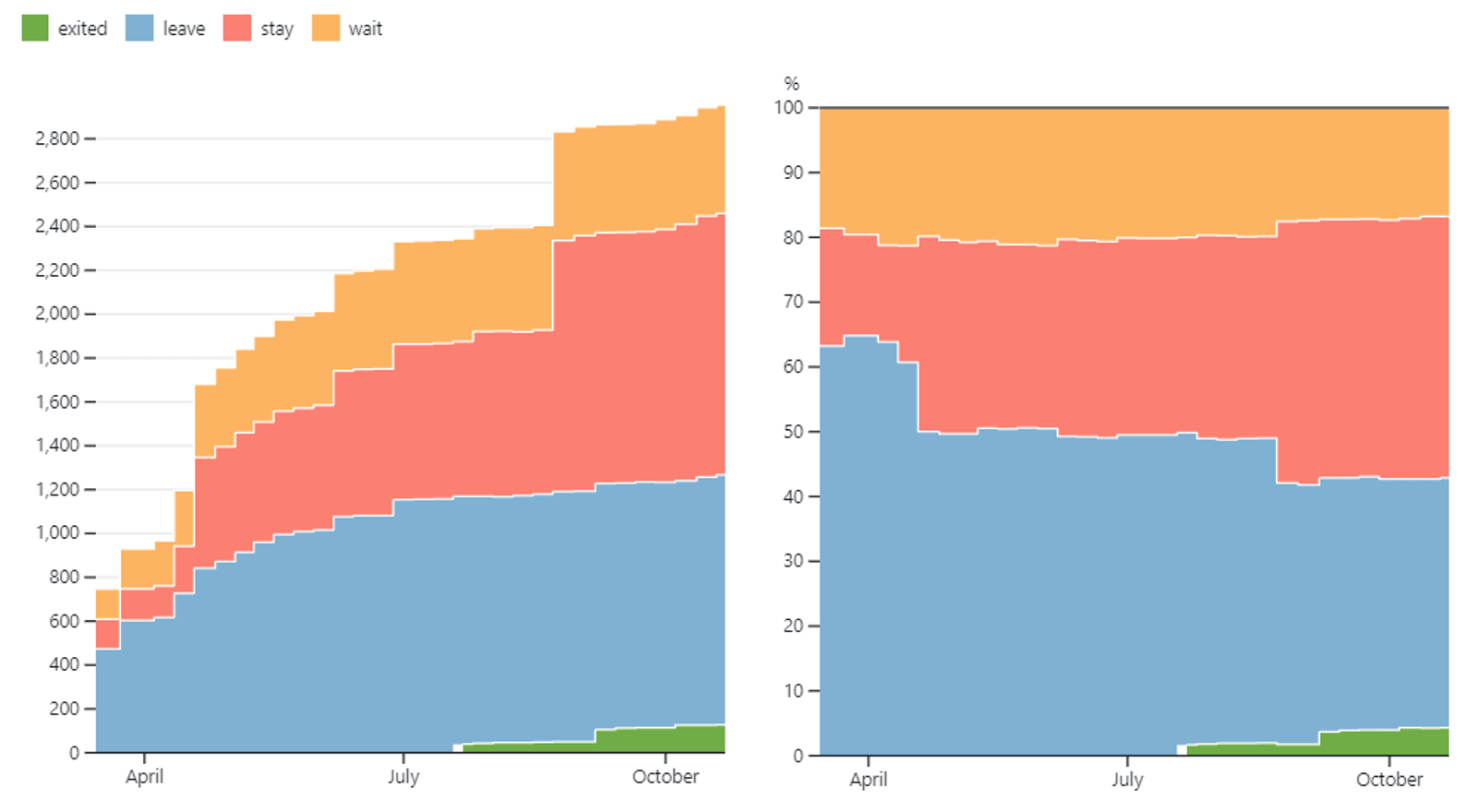

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 38.6% of foreign companies have already announced their withdrawal from the Russian market, but another 40.3% are still remaining in the country, 16.8% are waiting and only 4.3% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 127 companies that completely left the country, since they employed almost 21.0% of the personnel employed in foreign companies, the companies owned about 13.6% of the assets, had 8.8% of capital invested by foreign companies, and only last year they generated revenue of $29.3 billion or 10.0% of total revenue, data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Analysis on Swiss companies and their positions in Russia

Switzerland is not one of Russia’s main economic partners, but it facilitates the entry of Russian goods into the European market and was treated as a kind of “financial haven” for the trade operations of many traders who have legal entities or representative offices in this country.

The structure of Russian exports to Switzerland mainly consists of raw materials. Energy resources make up 50-70% of supplies, precious metals and stones – about 39.5%. The production of the chemical industry is about 6%, the machine-building industry is slightly more than 1%. The main emphasis is on energy resources. Machines, equipment and vehicles, products of the chemical industry, foodstuffs, metals and their products are imported from Switzerland to Russia. Swiss manufacturers occupy a special place in the market of pharmaceutical products.

ДFor reference: “Lukoil” is considering the split of its Swiss trading company, the creation of its division in Dubai and the sale of the Refinery in Italy, according to Bloomberg⁴. Dubai is becoming the new center for trade in Russian raw materials instead of Switzerland, because it did not introduce any sanctions against Russia.

Switzerland is also one of the largest providers of financial services in demand worldwide. The country made significant investments in the economy of the Russian Federation before the start of sanctions restrictions. Moreover, the structure of investments includes direct and accumulated investments. Currently, there is a difficult geopolitical situation, which has frozen financial transactions between countries⁵.

For many years, Switzerland has maintained a neutral status, so it maintains relations with all countries, regardless of the geopolitical situation. However, from an economic point of view, Switzerland is so dependent on the EU that it is practically part of the Union, and as a result, Russian-Swiss relations are subject to the influence of the international political and economic situation in Europe. Thus, against the background of the Russian-Ukrainian war, Switzerland joined the sanctions imposed by the US and the EU against Russia to prevent the circumvention of sanctions on the territory of Switzerland. The consequences of such a situation are very significant for Russia. The relations between the two countries were really fruitful in the past, but today, in forming its relations with Switzerland, Russia is forced to consider them exclusively within the framework of its dialogue with the European Union.

However, it is worth noting that since Switzerland is not part of the EU, all EU sanctions packages are subject to prior approval and, if they take effect in Switzerland, with a certain delay⁶.

For reference: Russia is currently Switzerland’s 23rd largest trading partner with a mutual trade volume of 4.7 billion Swiss francs (5.1 billion US dollars) per year. Russia accounts for 1% of Swiss exports and 0.4% of Swiss imports. As of June 2020, there were at least 200 Swiss companies in Russia⁷.

After the start of Russia’s war against Ukraine, several Swiss companies immediately suspended their activities on the Russian market due to significant reputational risk, but did not leave the Russian market completely.

For reference: Swiss direct portfolio investments in Russia amount to approximately 28 billion Swiss francs, which is equivalent to 2% of the total investment volume of Swiss companies abroad. According to the Swiss Ministry of Economy (SECO), about two hundred companies employing more than 40 000 people are tied to the Russian market. These are companies in the food, pharmaceutical, logistics, construction and raw materials industries⁸.

Swiss companies began to distance themselves from Russia after its attack on Ukraine. At the same time, sanctions, apparently imposed on Russia by Western countries, have a complex impact on Swiss business, and the main factor is the problems associated with the purchase of Russian energy resources and the resulting upheavals on the world energy markets. In particular, Switzerland prohibits new investments in the Russian energy sector⁹.

For reference: On October 10, 2022, Russian “Gazprombank” ceased operations in Switzerland. This Russian financial institution was one of the last channels of financing trade relations and agreements between Russia and Switzerland¹⁰.

Given the above, it can be argued that despite the fact that the sanctions are a burden for Swiss companies, most of them still support the sanctions. Banks were the most affected by the sanctions. Thus, as of July 7 2022, assets belonging to Russia and Russian citizens worth 6.7 billion Swiss francs were frozen in Switzerland¹¹.

This also concerns the chemical, electric power and metallurgical industries. From 30 to 40 percent of companies in these sectors report being strongly affected by the sanctions. There is also a problematic fact in the transport industry, in particular, many truck drivers in Europe come from Russia. At the same time, the aviation sector is burdened by the closure of airspace both in the West and in Russia.

Although the pharmaceutical industry (represented in Russia by at least 13 companies, the largest of which in terms of revenue are Novartis, Roche, Sandoz and Alcon) is directly excluded from sanctions, there are difficulties in supplying Swiss medications to hospitals in Russia, in particular due to international payment transactions¹².

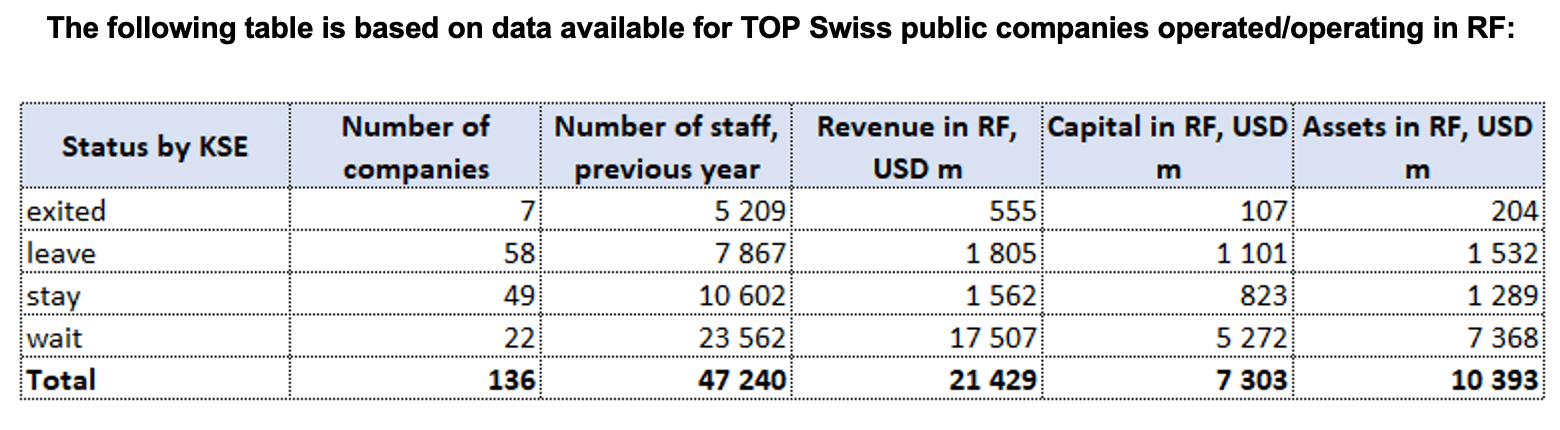

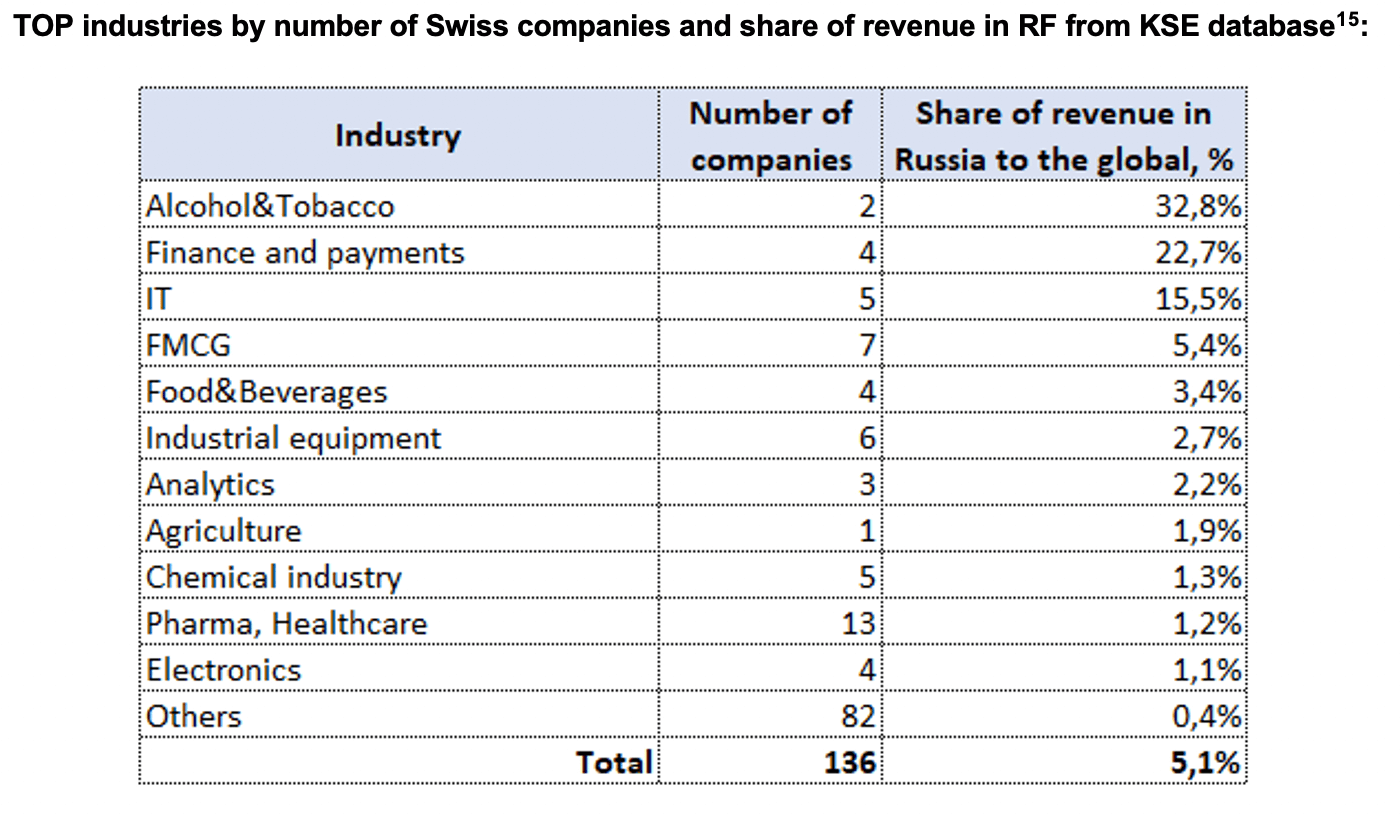

According to data collected by the KSE Institute¹³, in 2021 136 Swiss companies provided jobs for 47,240 people, those companies generated $21.4 bn in annual revenue, had $7.3 bn in capital and $10.4 bn in assets.

7 companies (5% of 136 companies observed) have already completely exited Russia by selling their shares, about 11% of employees have already left or will soon leave their previous jobs due to their exit.

The most “dependent” on Russia in terms of revenue share (more than 10%) in this country are Swiss companies in 3 industries: Alcohol&Tobacco, Finance and payments and IT.

How are Swiss companies reacting?

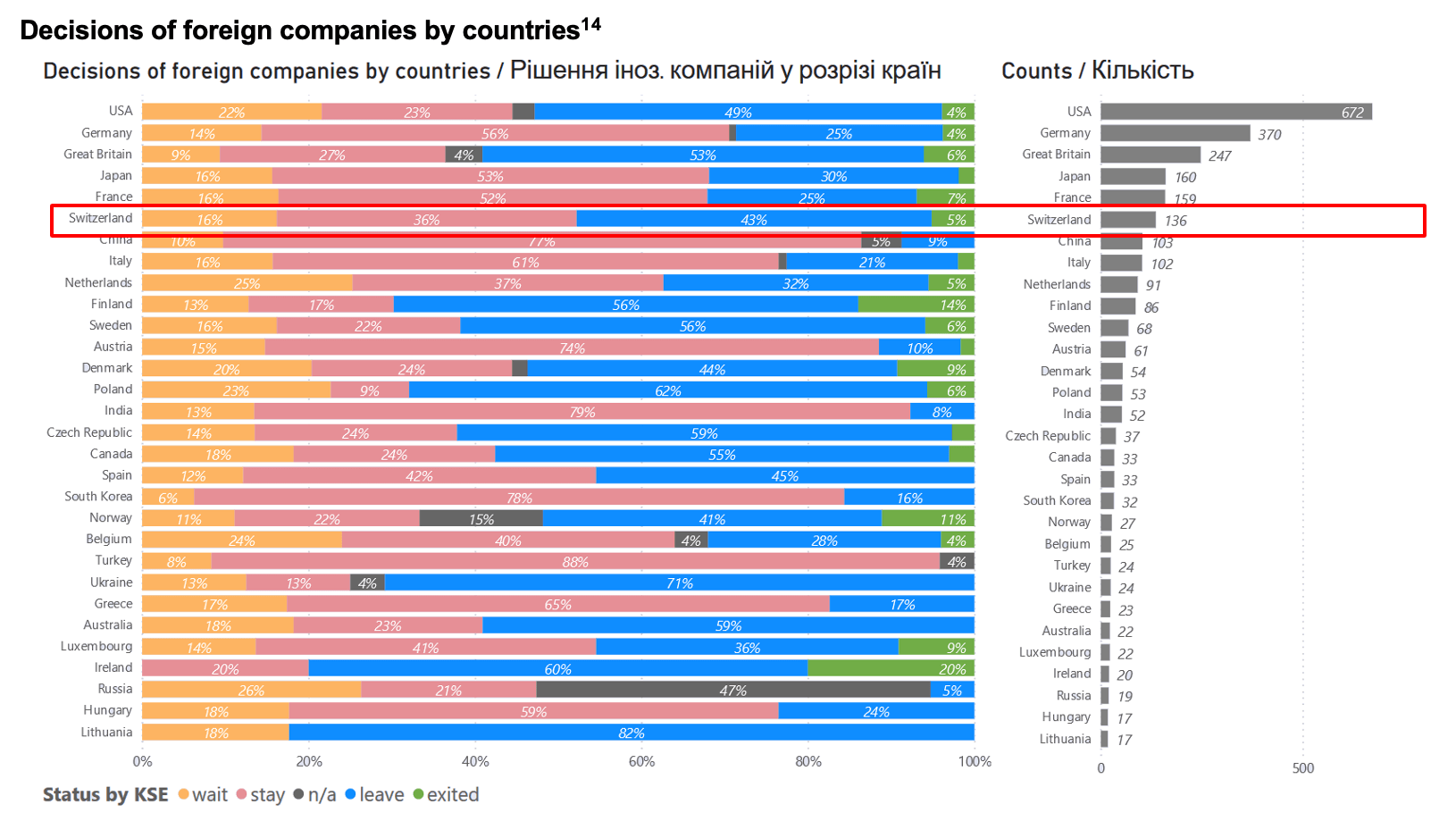

Out of 136 companies in the KSE database, 36% of companies stay in Russia, 16% somewhat limit their activities and 43% are leaving. Some of the Swiss companies are among the examples of clean breaks from the Russian market, while others defy demands for exit despite pressure.

Повний вихід

• Kuehne + Nagel AG (Status by KSE – exited¹⁶) sold its business in the Russian Federation, Azerbaijan, Belarus and Kazakhstan to its Managing Director effective July 20, 2022. The respective country organisations have transferred and are no longer in place. Accordingly, since August 1, 2022, Kuehne+Nagel’s business activities no longer involve the Russian Federation, Belarus, Kazakhstan and Azerbaijan.

• Luxoft (Status by KSE – exited) a DXC Technology Company, fully condemns the war and Russia’s aggression against Ukraine. As a direct result of this tragic war, Luxoft has decided to exit the Russian market. 20.04.2022: IBS IT Service Joint Stock Company becomes a new founder of the organisational liability unit “Information Business”.

Other Swiss companies in which the LLC was sold to an individual/individuals: Zurich Insurance (Status by KSE – exited), Bystronic (Status by KSE – exited), SoftwareONE (Status by KSE – exited), Studio Moderna (Status by KSE – exited), WayRay (Status by KSE – exited).

Companies that ignore exit requirements or partially remain in Russia

• BitRiver (Status by KSE – stay) The third largest oil producer in Russia, Gazpromneft, is partnering with Swiss-based bitcoin mining firm BitRiver to build out mining operations located at oil fields according to a memorandum from the St. Petersburg International Economic Forum. “Over the next two years, BitRiver intends to implement projects to create its own data centers for power-intensive computing with power scaling up to 2 [gigawatts], including [petroleum gas], which will additionally provide high and stable power consumption,” Igor Runets¹⁷, founder and CEO of BitRiver, reportedly stated in the memorandum.

• Coca-Cola HBC AG (Status by KSE – wait) In early August, the company announced that, in close cooperation with The Coca-Cola Company, they have ceased all production and sales of The Coca-Cola Company brands in Russia. There are no plans to revive The Coca-Cola Company brands or products in any format. “In the future, we intend to have a much smaller company in Russia, which has been renamed Multon Partners. This will focus on the production and sale of existing local brands – Dobry, Rich and My Family, and raw materials will be involved from the market. It will be managed and managed locally.“, it says on the company’s website. And already at the end of the month, Reuters¹⁸ announced that Coca Cola HBC AG began producing local cola Dobry Cola in Russia after the cessation of production and sales of Coca-Cola Co products

Selected industries analysis

Sport

Of the 28 international sports organisations that are in the KSE database, 26 have banned or restricted the participation of Russian athletes in competitions due to Russia’s invasion of Ukraine.

• FIFA (Status by KSE – wait) FIFA accused of ‘ignoring’ Ukraine and urged to scrap Russian TV deals. As part of a response aimed at limiting Russia’s participation in world sport, FIFA has banned Russia from any qualifying matches for the 2022 World Cup. However, this came after furious opposition from a number of European football associations, including Poland, which was due to play Russia in a World Cup qualifier. FIFA stepped up its response by banning Russia from the World Cup in Qatar.

• International Boxing Association (Status by KSE – stay) The International Boxing Association (IBA) lifted its ban on amateur boxers from Russia and Belarus over the war in Ukraine that had been in place since early March. Most international sports federations banned athletes from Russia and Belarus indefinitely seven months ago, acting after an IOC recommendation. It is believed that the IBA is the first international federation in an Olympic sport to lift its ban but later the International Boxing Association lifted the ban on Russia, Belarus and Russian “Gazprom” became its General Partner.

• FIDE (International Chess Federation) (Status by KSE – leave) the FIDE Council decides that no Russian and Belarusian national flag be displayed or anthem be played in all FIDE-rated international chess events. FIDE terminates all existing sponsorship agreements with any Belarusian and Russian sanctioned and/or state-controlled companies and will not enter into new sponsorship agreements with any such companies. Taking into account the current recommendations of the IOC, to suspend the national teams of Russia and Belarus from participation in official FIDE tournaments until further notice.

• UEFA (Status by KSE – leave) Suspended Russian teams from international competition, including the Champions League and second-tier Europa League. Banned Russians from using the UEFA flag, anthem and name at matches. Moved the Champions League final from St. Petersburg to suburban Paris in May 2022.

Alcohol & Tobacco

• Oettinger Davidoff AG (Status by KSE – leave) is the first major player in the cigar industry to announce the suspension of its activities in Russia. “We condemn the invasion and the use of violence in Ukraine and we support the sanctions adopted by the US, the European Union as well as Switzerland. This is why, after careful consideration, we have to temporarily suspend our business with the Russian Federation until further notice.”

• Japan Tobacco International (Status by KSE – wait) On March 10, the company suspended new investments and marketing activities in Russia. Given the challenging and unpredictable conditions, JT Group continued to evaluate various options for its business in Russia, including a potential transfer of ownership. “The group remains committed to its 4,000 employees in Russia, including to ensure their work,” they wrote on the company’s website.

Finance and payments

Of the 4 companies that are in the KSE database, only one has suspended its cooperation with Russia. The rest are waiting and are in no hurry to leave the aggressor’s market.

• Pictet (Status by KSE – leave) said in a notice to shareholders dated Feb. 28 that it had suspended its Russian equities fund “in light of the current and ever-evolving circumstances associated with Ukraine/Russia situation, the current political situation and liquidity constraints“.

• Credit Suisse (Status by KSE – wait) has stopped pursuing new business in Russia and is cutting its exposure to the country, following global peers in pulling back after the invasion of Ukraine. The Swiss bank is helping its clients unwind their Russia exposure. The bank added that it has moved roles out of the country and is assisting employees to relocate elsewhere. The Zurich-based bank said it had an exposure of 848 million francs ($906 million) to Russia at the end of last year and about 125 employees there.

• Julius Baer (Status by KSE – wait) The company has suspended new business in Russia, reduced current risk exposure, but retains current Russian clients. The net asset value of the advisory subsidiary Julius Baer CIS Ltd Moscow was 0.4 million Swiss francs as of December 31, 2021. In the spring, the Swiss private bank Julius Baer said that it has contacts with a number of people who were under sanctions after the invasion of Ukraine, and is not taking new clients who live in Russia.

• UBS (Status by KSE – wait) As a result of sanctions imposed against Russia by various jurisdictions including the US, EU, UK, and Switzerland, among others, UBS said it is not conducting any new business with Russia or clients domiciled there. Furthermore, Switzerland’s largest bank continued to reduce its exposure to Russia by a further $100 million in the second quarter. While the sum is negligible in relation to its overall assets and business, it is nevertheless something that UBS and other banks point out in the reporting of their results.

Summary

Considering the above, it can be argued that Switzerland currently has limited direct economic ties with Russia, which is connected with the war in Ukraine and this, in turn, has a negative effect on the domestic economic situation in Switzerland itself. Thus, according to the OECD¹⁹, the prospects for real GDP growth in Switzerland will slow to 2.5% in 2022 and 1.3% in 2023.

It is also worth noting that the Government of Switzerland will continue to monitor the impact of the war against Ukraine on international relations and will present a comprehensive assessment of the situation regarding Switzerland’s neutrality policy in particular and its foreign policy strategy in general in 2023²⁰.

You can also contribute by spreading the status of the company calling for the exit from Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)²¹

17.10.2022

*Schlumberger (USA, Energy, oil and gas) Status by KSE – wait

Some of oilfield service firm Schlumberger’s more than 9,000 Russian employees have begun receiving military draft notices through work, and the company is not authorising remote employment to escape mobilisation, according to people familiar with the matter and internal documents.

*HSBC (Great Britain, Finance and payments) Status by KSE – wait

The South China Morning Post reported on Monday that Hongkong and Shanghai Banking Corporation (HSBC) had sent a letter to most of its Russian clients in the city over the suspension of retail investment services because of sanctions enacted by the European Union.

However, the suspension would not affect clients’ personal savings accounts or other personal banking needs, the report noted.

18.10.2022

*ExxonMobil (USA, Energy, oil and gas) Status by KSE – leave

Exxon Mobil on Monday said it has fully exited Russia, with the energy giant saying that President Vladimir Putin had expropriated its assets in the country and “unilaterally terminated” the company’s Sakhalin-1 oil project.

https://www.cbsnews.com/amp/news/exxon-exits-russia-after-putin-expropriates-sakhalin-1-project/#app

*Pertamina (Indonesia, Energy, oil and gas) Status by KSE – wait

Pertamina moves forward on $24bn Rosneft project

https://asia.nikkei.com/Business/Energy/Pertamina-moves-forward-on-24bn-Rosneft-project

*Hyundai (South Korea, Automotive) Status by KSE – wait

South Korea’s Hyundai Motor is considering options for its suspended Russia operations that could include selling its manufacturing plant there, South Korean media reported

*ONGC Videsh Ltd (India, Energy, oil and gas) Status by KSE – stay

India’s Oil and Natural Gas Corp plans to take a stake in the new Russian entity that will manage the Sakhalin 1 project in the far east as it seeks to retain a 20% share in the asset

*Cisco Systems Inc (USA, IT) Status by KSE – wait

A purportedly leaked Russian customs database shows around 500 shipments of Cisco gear arriving in Russia in August, months after the networking giant halted its business operations in that country.

19.10.2022

*Eastnine AB (Sweden,Hospitality, Real estate), Status by KSE – leave

Eastnine to Sell its Stake in Russian Fashion Retailer to Sistema for EUR193 Mln

*Apple (USA, Electronics) Status by KSE – wait

Apple has reinstated the apps made by the Russian technology group VK on the App Store after the company provided proof that it’s not “majority owned or controlled by a sanctioned entity”

*Volvo Group (Sweden, Industrial equipment) Status by KSE leave

Volvo may sell its Russian business

https://www.epravda.com.ua/news/2022/10/19/692791/

*Glencore (Switzerland, FMCG) Status by KSE – wait

Glencore delivers Russian-origin aluminium into LME system -sources

*Google (USA, Online Services) Status by KSE – leave

Google Suspends YouTube Accounts Of Russian Federation Council Permanently

*Royal Caribbean Cruises (USA, Tourism, Travel) Status by KSE – leave

Royal Caribbean Cruises stopped taking orders from Russian travel agencies

*Dapper Labs (Canada, Gaming) Status by KSE – wait

The NFT company Dapper Labs allowed users affected by EU sanctions to withdraw their non-reciprocal tokens to a non-custodial Blocto wallet.

https://forklog.com/news/dapper-labs-pozvolit-polzovatelyam-iz-rossii-vyvesti-nft

20.10.2022

*Freedom Holding (Kazakhstan, Finance and payments) Status by KSE – leave

Freedom Holding Corp. (the “Company”) today announced that it has entered into an agreement to sell its Russian subsidiary, Investment Company Freedom Finance LLC (“Freedom RU”), together with Freedom RU’s subsidiary FFIN Bank LLC (such companies together the “Russian Subsidiaries”). The transaction is subject to the approval of the Central Bank of the Russian Federation and is expected to close in the coming months.

*Orion (Finland,Pharma, Healthcare) Status by KSE – leave

Finnish Orion Pharma has started the liquidation of its Russian office – it is planned to be closed by the end of 2022.

https://www.epravda.com.ua/news/2022/10/20/692839/

*Schlumberger ( USA, Energy, oil and gas) Status by KSE – wait

Schlumberger evaluates options for Russia staff as Ukraine war escalates

*Volkswagen (Germany, Automotive) Status by KSE – leave

Volkswagen Seeks Buyer For Its Russian Plant In Kaluga

https://www.carscoops.com/2022/10/volkswagen-seeks-buyer-for-its-russian-plant-in-kaluga/

21.10.2022

*Uniqa (Australia, Insurance) Status by KSE – leave

Austrian insurance company Uniqa UNIQ.VI is looking into the possibility of a complete exit from Russia

https://www.nasdaq.com/articles/austrias-uniqa-looking-into-complete-russia-exit-ceo

*Truphone (Great Britain, Telecom) Status by KSE – wait

Truphone to Pay $600,000 U.S. Fine, Ensure Russian Ownership Divested

*Uniqlo (Japan, Consumer goods and clothing) Status by KSE – wait

The Japanese clothing retailer Uniqlo has informed the company’s staff that some stores in Russia, which suspended operations in March 2022, will be completely closed

https://meduza.io/news/2022/10/21/uniqlo-nachala-sokraschat-set-svoih-magazinov-v-rossii

*Kraken (USA, Finance and payments) Status by KSE – wait

Kraken is the latest cryptocurrency exchange to restrict accounts of Russian users on its platform in compliance with sanctions from the European Union.Russian users would be able to withdraw their funds by request.

https://cointelegraph.com/news/kraken-crypto-exchange-is-next-to-close-doors-to-russian-users

*Baker McKenzie (USA, Consulting, Law) Status by KSE – stay

Chicago’s Baker McKenzie announces independent firm in Russia

https://www.chicagobusiness.com/law/baker-mckenzie-independent-law-firm-russia

*LG Electronics (South Korea, Electronics) Status by KSE – leave

The management of the South Korean LG is discussing the possibility of closing the plant in Russia (it produces refrigerators, washing machines and televisions) and transferring production to Uzbekistan at the Artel facility.

https://www.kommersant.ru/doc/5621910

*Renault (France, Automotive) Status by KSE – exited

Russia to launch Moskvich car production at former Renault plant in December

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² Including 25 new companies with status “stay” added from https://bloody.energy/ website, without them the number of companies in this category would decrease by 3

³ As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

¹⁶ The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities.

¹⁷ https://bitcoinmagazine.com/business/gazpromneft-partners-with-bitriver-to-mine-bitcoin

²¹ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site