- Kyiv School of Economics

- About the School

- News

- IMPACT OF FOREIGN COMPANIES SELF-SANCTIONING ON RF ECONOMY

IMPACT OF FOREIGN COMPANIES SELF-SANCTIONING ON RF ECONOMY

7 June 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors; 30.05.2022-05.06.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua and squeezingputin.com websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains 40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

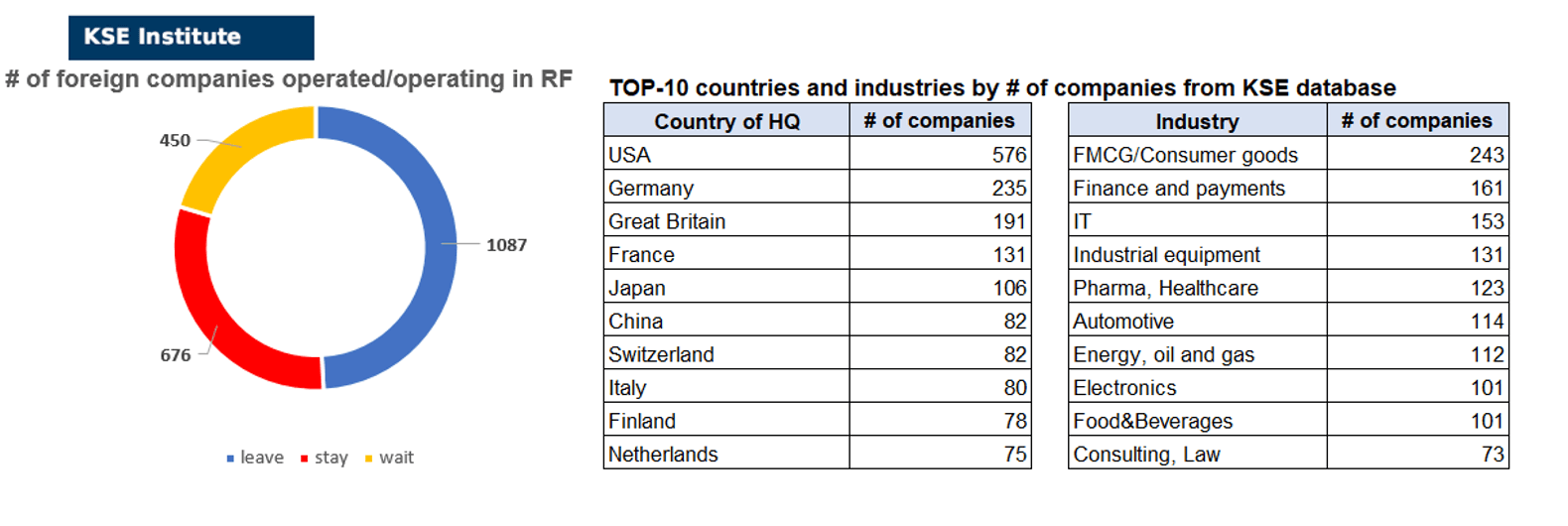

KSE DATABASE SNAPSHOT as of 05.06.2022

Number of the companies that continue Russian operations (KSE’s status “stay”¹ ) – 676 (+86² per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status “wait”) – 450 (+12 per week)

Number of the companies that have curtailed Russian operations (KSE’s status “leave”) – 1 087 (+50 per week)

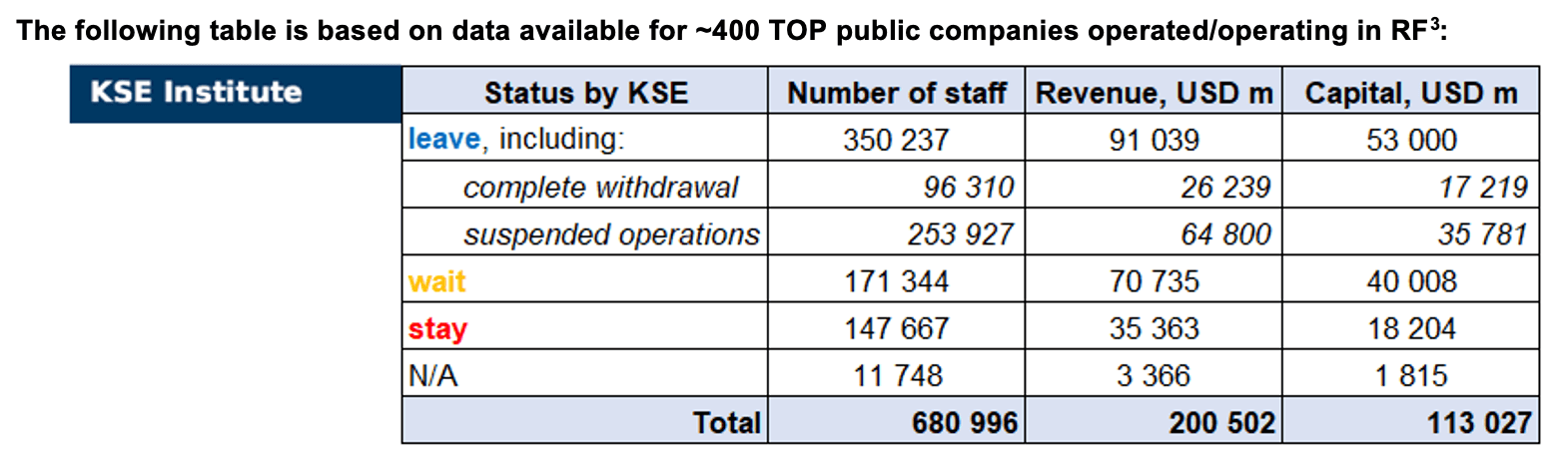

As of June 05, we have identified about 2,213 companies, organizations and their brands from 75 countries and 55 industries and analyzed their position on the Russian market. About half of them are public ones, for ~ 400 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity), which allowed us to calculate the value of capital invested in the country (about $113 billion), local revenue (about $200 billion), as well as staff (almost 0.7 million people). 1,537 foreign companies have reduced, suspended or ceased operations in Russia.

As can be seen from the tables below, As of June 05, companies that declared a complete withdrawal from Russia had $26.2bn in revenues and $17.2bn in capital; companies that suspended their operations on the Russian market had yearly revenue of $64.8bn and $35.8bn in capital. TOP-70 companies-the largest taxpayers paid ~ $20,2bn of taxes annually – haven’t completely withdrawn yet, although suspended or scaled back.

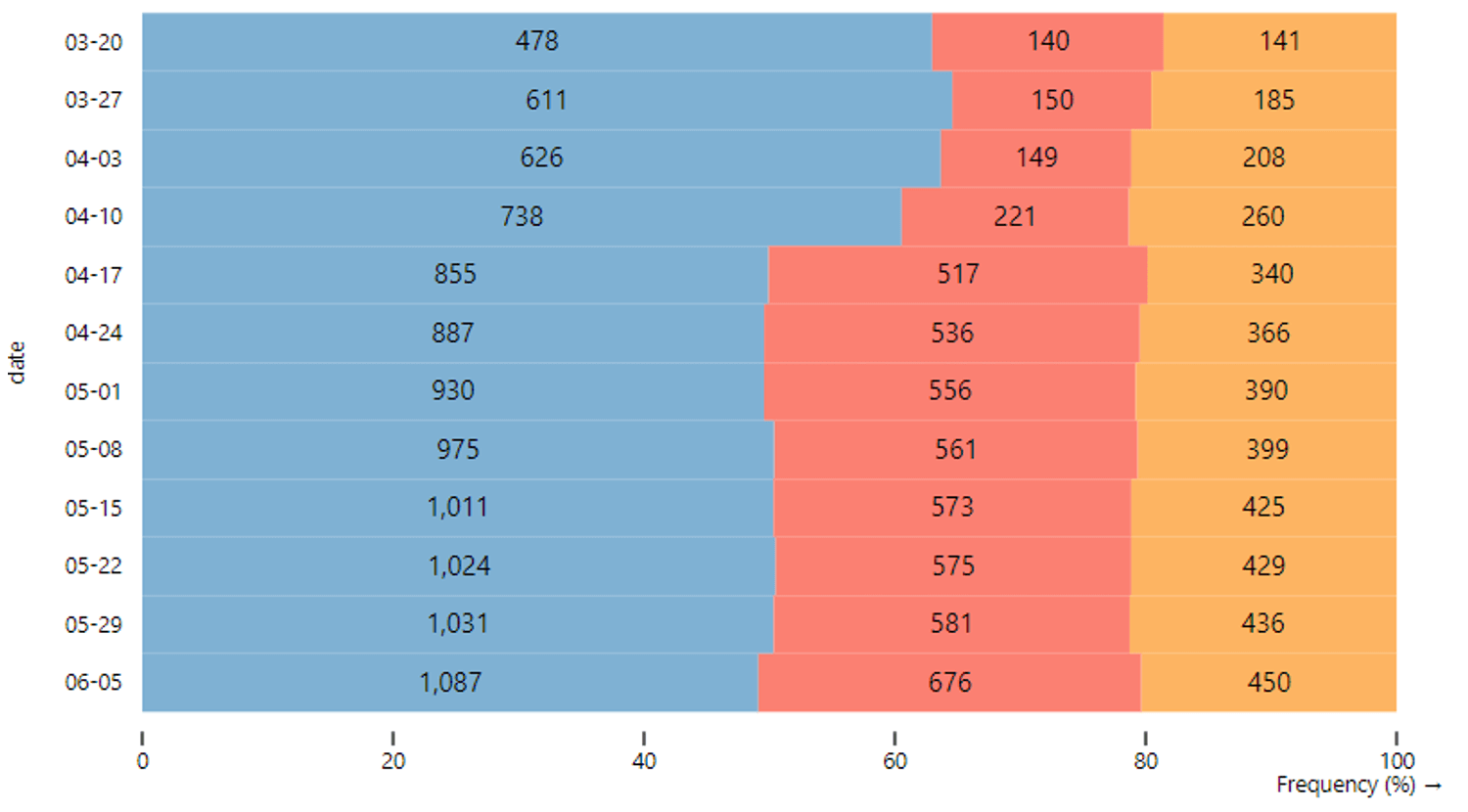

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, more than half (49.1%) of foreign companies have already announced their withdrawal from the Russian market, but another 30.5% are still remaining in the country. The slight change in shares over the last week is due to the addition of +122 companies to the KSE Institute database as a result of synchronization with the project https://squeezingputin.com.

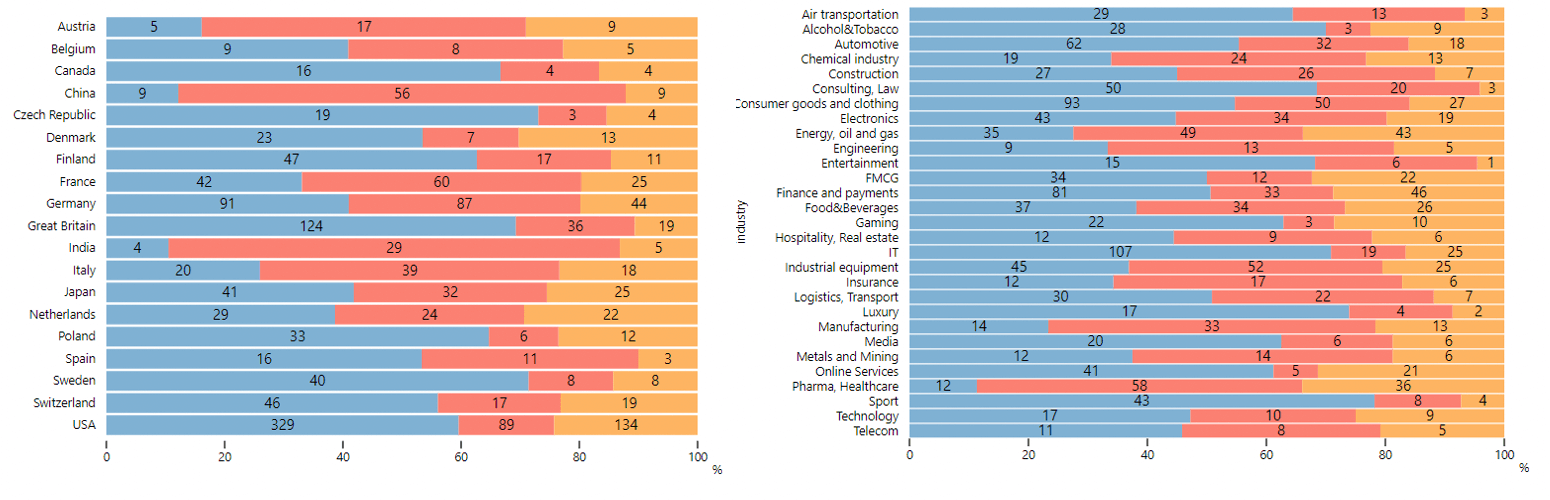

The actions of companies by sector (based on the KSE database, with at least 50 companies representing the industry and with at least 40 companies per country) are shown in the graphs below.

Decisions of Western companies by country and sector:

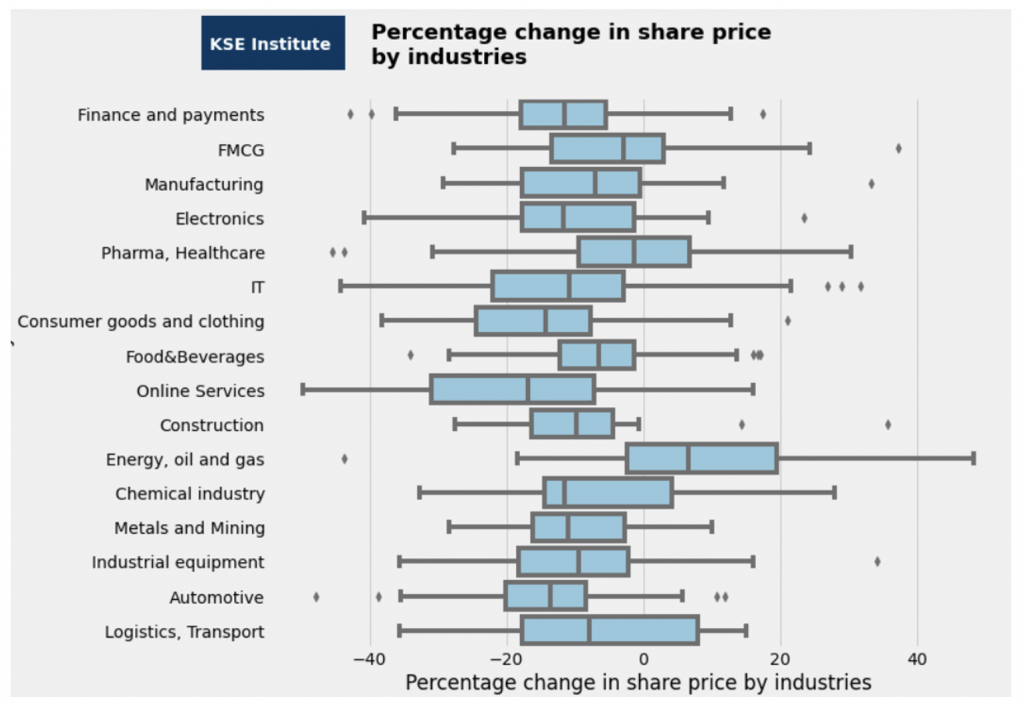

How the capitalization of the largest public companies changed during the war

The only industry that has shown steady growth is Energy, Oil and Gas.

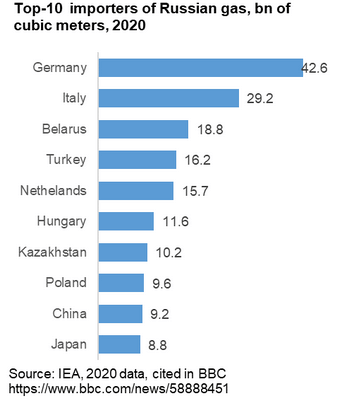

WEEKLY FOCUS. GAS PAYMENTS IN RUBLES

Among European buyers of gas, 9 refused to pay in rubles. Still, the largest buyers started to pay under the new scheme. Payment arrangements are not completely public and it is unclear whether companies are opening ruble accounts and breaking sanctions or not.

On March 31st 2022 Russia issued a new “Executive Order On the Special Procedure to Allow Foreign Buyers to Meet their Commitments to Russian Natural Gas Suppliers”. According to the order, companies have to pay for natural gas supplied in rubles. Russia demanded companies to open accounts in euros or dollars and in rubles in Gazprombank. First, companies pay in euros, then exchange euros for rubles and put it in a ruble account and then pay. European countries split in their decisions. It took more than a month for the EU commission to clarify whether the new scheme complies with the sanctions but it still did not bring 100% clarity. It said that companies can open euro or dollar accounts but accounts in rubles will be breaking sanctions.

Some of the companies refused to pay under the new scheme and they faced harsh consequences. Among them are⁶:

- • PGNiG (Poland): supplies cut April 27

- • Bulgargaz (Bulgaria): supplies cut April 27

- • Gasum (Finland): supplies cut May 21

- • GasTerra (Netherlands): supplies cut May 31⁷

- • Shell Energy (Germany): supplies cut May 31⁸

- • Lithuania (Amber Grid), Estonia (Eesti gas), Lanvia (JSC Conexus Baltic Grid ) stopped buying gas from Russia and prepared two months of storage.⁹

Still, many companies continued to pay to Gazprom, opening euro or dollar accounts in Gazprombank. It is not clear whether they used rubble accounts for payment. Companies that pay under the new scheme include:

- • MVM (Hungary)

- • VNG, RWE, Uniper (Germany)

- • Engie (France)

- • Eni (Italy)

- • OMV (Austria)

- • CEZ (Czech republic)

- • SPP (Slovakia)

- • Geoplin (Slovakia)

- • DEPA Commerce, Mytilineos and Prometheus Gas¹⁰ (Greece)

- • UK allowed deals with Gasprombank till May 31st¹¹

Overally, 9 EU companies refused to pay in rubles, including ones from Netherlands, Poland, Bulgaria, Danmark, Finland, Baltic states. Still, the largest buyers (specifically in Italy and Germany – only one company from Germany refused to pay in rubles, see the chart on the right) started to pay under the new scheme. Payment arrangements are not completely known to the public and it is unclear whether companies are opening ruble accounts, which the EU Commission commented would mean breaking of sanction.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)

30.05.2022

*Unipec (China, Logistics, Transport) Status by KSE – stay

Unipec adds 10 vessels to transport crude from Russia

https://www.arabnews.com/node/2091946/business-economy

*Minor, International Ice Hockey Federation (Switzerland, Sport) Status by KSE – leave

Russia and Belarus barred from 2023 IIHF World Championship

https://www.insidethegames.biz/articles/1123737/russia-belarus-freeze-participation

*Netflix (USA, online services) Status by KSE – leave

Netflix closes up in Russiа

https://www.broadbandtvnews.com/2022/05/30/netflix-closes-up-in-russia/

31.05.2022

*GasTerra (Netherlands, Energy, oil and gas) Status by KSE – wait

Dutch gas trader GasTerra has decided not to comply with Gazprom’s one-sided payment requirements. These payment requirements are set out in a decree passed by Russian President Vladimir Putin regarding payment for the supply of Russian gas. In response to GasTerra’s decision, Gazprom declared to discontinue supply with effect from 31 May 2022.

https://www.gasterra.nl/en/news/gasterra-will-not-go-along-with-gazproms-payment-demands

Gazprom says it fully cuts off gas supplies to Dutch gas trader GasTerra

*Ørsted (Denmark, Energy, oil and gas) Status by KSE – wait

Ørsted continues to reject demand for payment in roubles – risk of Gazprom Export’s gas supplies to Ørsted being halted.

https://orsted.com/en/media/newsroom/news/2022/05/20220530528511

01.06.2022

*Canva (Australia, IT) Status by KSE – leave

As we shared in early March, we stand vehemently opposed to the Russian government’s continued acts of aggression, and we’re committed to standing for peace and safety everywhere – which is why we’re blocking access to Canva in Russia for the foreseeable future.

https://www.canva.com/newsroom/news/exiting-russia/

*Gett (Great Britain, Online Services) Status by KSE – leave

In accordance with the decision of the Gett global office, on May 31, 2022, technical support, improvement and operation of the Gett mobile application in Russia will be terminated. This means that the last day of the Application is May 31, 2022.

*YIT (Finland, Construction) Status by KSE – leave

YIT withdraws from all operations in Russia by completing the sale of the businesses

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

Citigroup may retain a banking license and some operations in Russia, chief executive Jane Fraser said, even as it tries to sell its consumer and commercial arms in the country following the war with Ukraine.

https://www.ft.com/content/c2d9c16c-5e3d-41d3-aea1-002e06f8cfe1

*Puma (Germany, Consumer goods and clothing) Status by KSE – leave

Puma taking orders from wholesalers with Russian presence, prior itold it suspended all shipments to Russia

*Uniper (Germany, Energy, oil and gas) Status by KSE – wait

*RWE (Germany Energy, oil and gas) Status by KSE – wait

German companies Uniper and RWEhave paid for Russian gas under a new scheme proposed by Moscow, in a bid to ensure continued supply of the fuel that is critical to Europe’s top economy

02.06.2022

*Pixabay (Germany, Online Services) Status by KSE – leave

Free photo bank Pixabay blocked access for users from Russia.

https://www.epravda.com.ua/news/2022/06/2/687729/

*VA Tech Wabag (India, Industrial equipment) Status by KSE – stay

VA Tech Wabag NSE -1.44 % said it secured an Engineering and Procurement order worth about €18 million (about Rs 149 crore) from DL E&C CO LTD, Korea, for a water treatment package for the EuroChem Methanol Production facility in Kingisepp, Russia

*Viciunai group (Lithuania, Food & Beverages) Status by KSE – leave

Business is being sold, leaving Russia.

https://www.viciunaigroup.eu/novosti/viciunai-group-30

*Oerlikon (Switzerland, Engineering) Status by KSE – leave

The Oerlikon Group said it had entered into an agreement with the local management team to sell all its operations in Russia

https://www.swissinfo.ch/eng/oerlikon-to-sell-russia-business-to-local-owners/47642402

*Upwork (USA,Online Services) Status by KSE – leave

The largest freelance exchange Upwork has blocked the accounts of users from Russia and Belarus

https://www.epravda.com.ua/news/2022/06/2/687731/

*Hewlett-Packard (USA, IT) Status by KSE – leave

HP turns back on $1b in annual sales by quitting Russia and Belarus

03.06.2022

*Formosa Petrochemical Corp (Taiwan, Energy, oil and gas) Status by KSE – stay

A tanker recently seen at a refinery plant in Mailiao harbor, Yunlin County, belonging to Formosa Petrochemical Corp. (FPCC) was delivering oil products bought from Russia, the company confirmed Thursday.

https://focustaiwan.tw/business/202206020021

*Bristol Myers Squibb (USA, Pharma, Healthcare)Status by KSE – wait

BMS is handing over its Russian commercial operations to its distribution partner Swixx Healthcare, previously known as Amicus, a Bristol spokesperson said over email Wednesday.

*HP Enterprise (USA, IT) Status by KSE – leave

HPE announces orderly exit of Russia, Belarus

*McDonald’s (USA,Public catering) Status by KSE – leave

Russia McDonald’s new owner set to reopen, expand.According to Russia’s anti-monopoly service, which approved the takeover, McDonald’s retains the right to buy its Russia restaurants back within 15 years.

*Allianz (Germany,Finance and payments) Status by KSE – wait

Allianz to sell majority stake in Russian operations to Interholding

04.06.2022

*G-Core Labs (Luxembourg, IT) Status by KSE – leave

G-Core Labs has decided to suspend the provision of services in the Russian Federation.

https://gcorelabs.com/russian/

*Marriott (USA, Hospitality, Real estate) Status by KSE – leave

We have come to the conclusion that the recently announced US, UK and EU restrictions will make it impossible for Marriott or hotel franchising to operate in the Russian market. Therefore, we decided to suspend all Marriott International operations in Russia. The process of suspending operations in the market, where Marriott has been operating for 25 years, is complex.

https://news.marriott.com/news/2022/06/03/marriott-international-statement

*UniCredit ( Italy,Finance and payments) Status by KSE – leave

UniCredit widens search for buyers to sell out of Russia

*Lego (Denmark, Consumer goods and clothing) Status by KSE – leave

Lego stores in Russia shut down after supplies dry up

*British American Tobacco (Great Britain,Alcohol&Tobacco) Status by KSE – leave

What next for BAT shares? Investors eye update on Pall Mall maker’s Russian exit and sales of vaping products

More details on daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹- KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

² +122 companies have been added to the KSE Institute database in the last week as a result of synchronization with the project https://squeezingputin.com, incl. 81 companies with “stay” status, 7 companies with “wait” status and 34 companies with “leave” status.

³ We started to collect information for more companies and will update the database with extended information soon. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. More details will be available soon once we analyze more data/information and find the reputable sources for verification.