- Kyiv School of Economics

- About the School

- News

- IMPACT OF FOREIGN COMPANIES SELF-SANCTIONING ON RF ECONOMY¹

IMPACT OF FOREIGN COMPANIES SELF-SANCTIONING ON RF ECONOMY¹

16 May 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors; 09-15.05.2022

KSE DATABASE SNAPSHOT

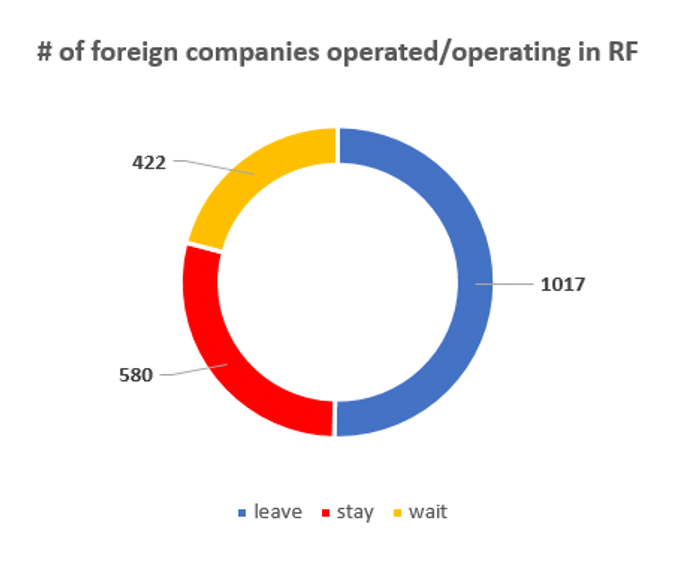

Number of the companies that continue Russian operations (KSE’s status “stay”) – 580

Number of the companies that have reduced current operations and hold off new Investments (status “wait”) – 422

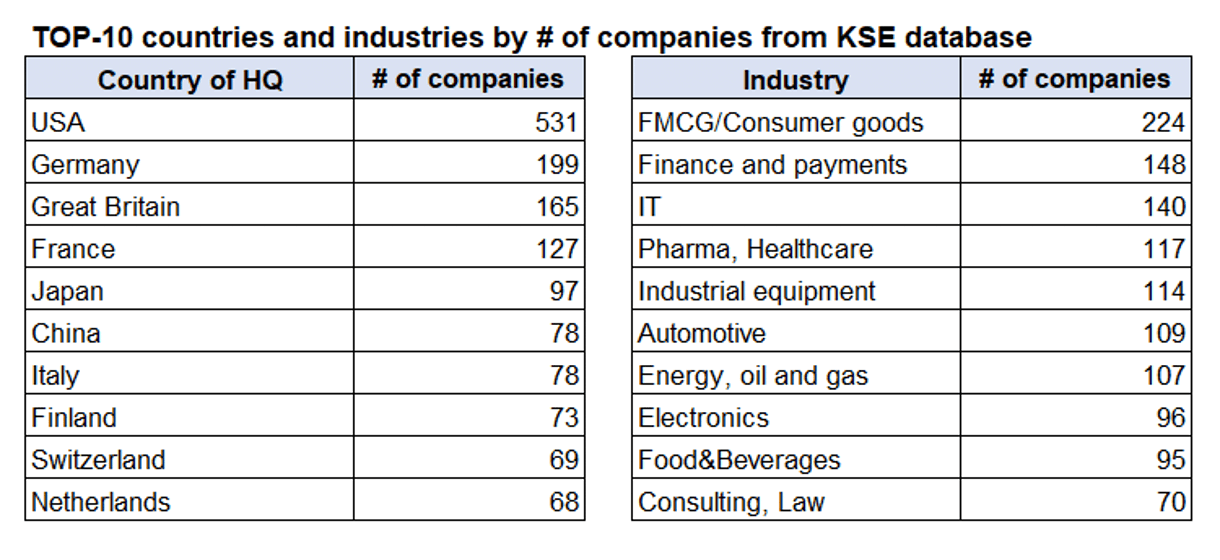

Number of the companies that have curtailed Russian operations (KSE’s status “leave”) – 1 017

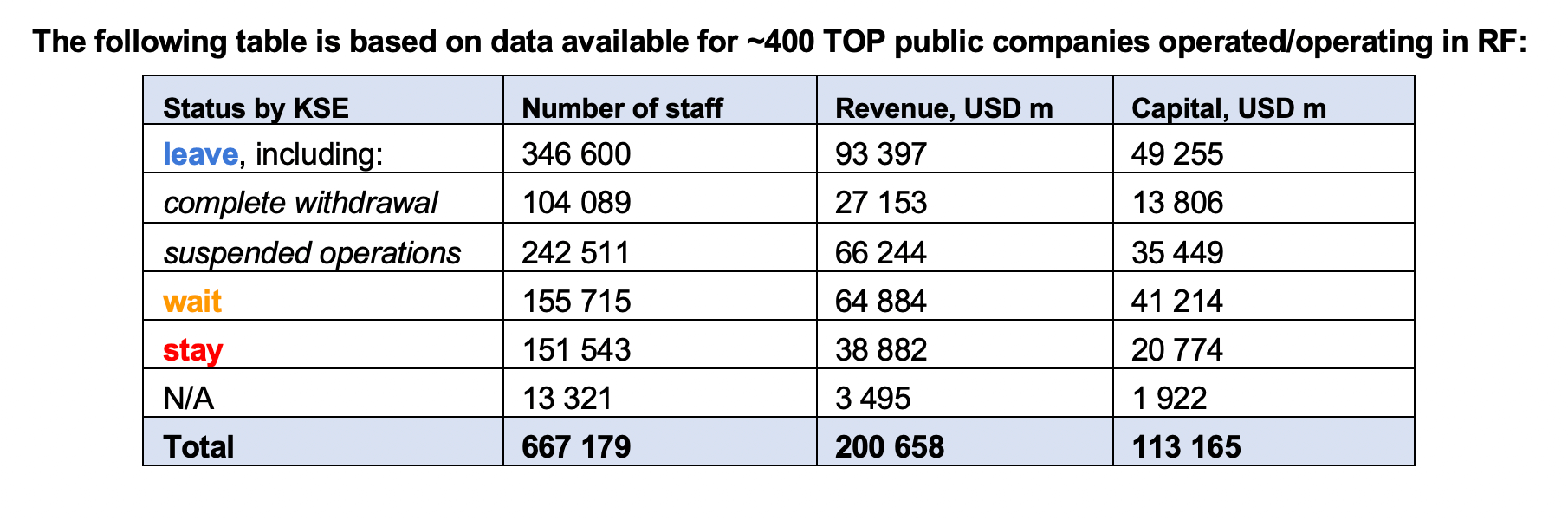

As of May 13, we have identified about 2,000 companies and organizations and analyzed their position on the Russian market. About half of them are public, for ~ 400 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity), which allowed us to calculate the value of capital invested in the country (about $113 billion), local revenue (about $200 billion), as well as staff (almost 0.7 million people). 1,439 foreign companies from 70 countries and 55 industries have reduced, suspended or ceased operations in Russia.

As can be seen from the tables below, As of May 13th, companies that declared a complete withdrawal from Russia had $27.2bn in revenues and $13.8bn in capital; companies that suspended their operations on the Russian market had yearly revenue of $66.2bn and $35.4bn in capital. TOP-10 companies-the largest taxpayers ~ $13,7bn of taxes annually – haven’t completely withdrawn yet, although suspended or scaled back.

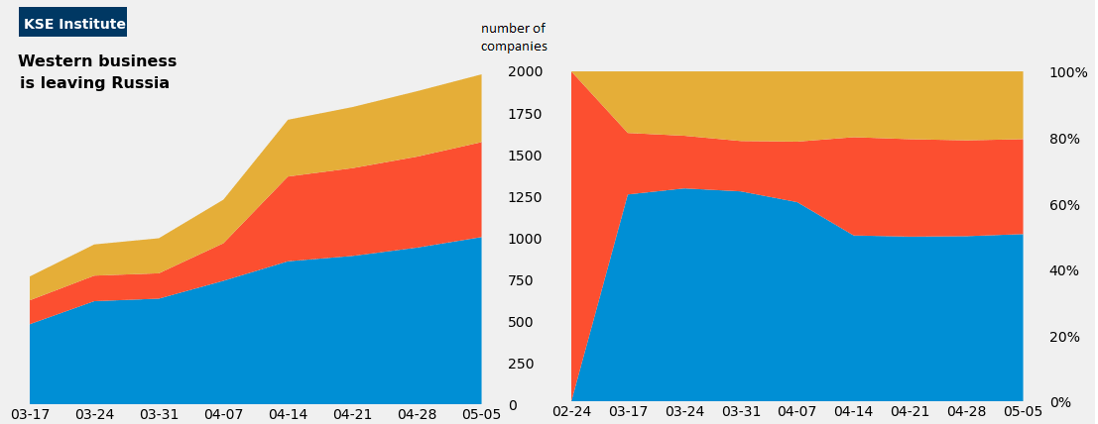

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. But during this time we see an increase in the share of those companies that remain in the Russian market. This is mainly due to the expansion of the KSE database with so-called “secondary” companies.

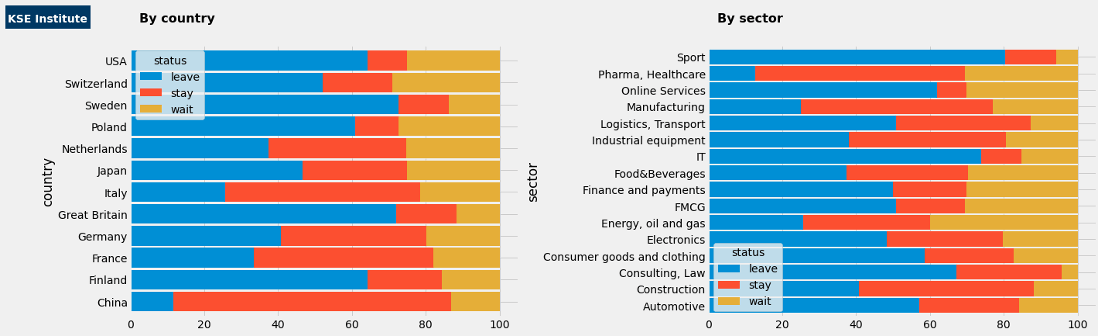

The actions of companies by sector (based on the KSE database, with at least 50 companies representing the industry and with at least 40 companies per country) are shown in the graphs above.

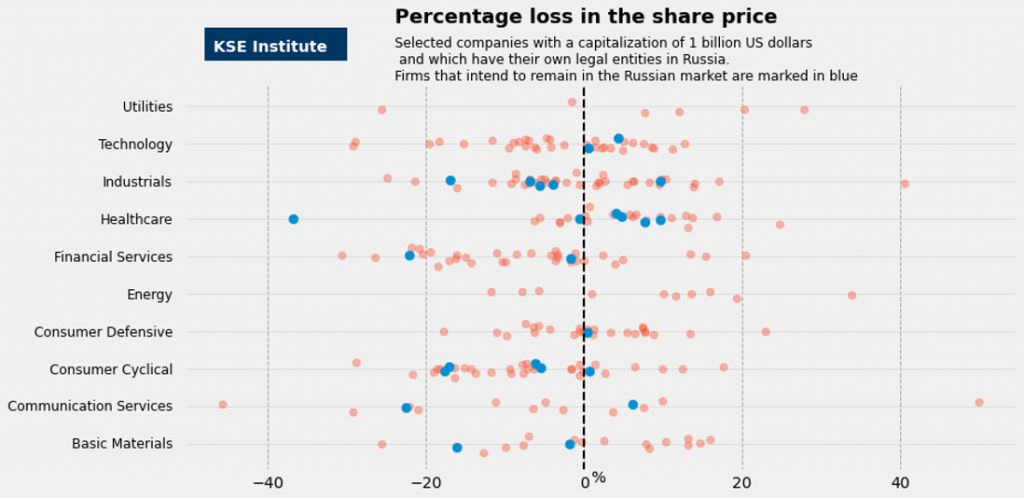

Impact on stock prices/capitalization of companies’ HQ²

WEEKLY FOCUS. BANKING SECTOR

Foreign banks’ opinions are divided on whether to exit business in Russia or not. Out of the three largest foreign banks in Russia, only one has entirely left the Russian market, and two are considering selling the business, but this is just talking so far.

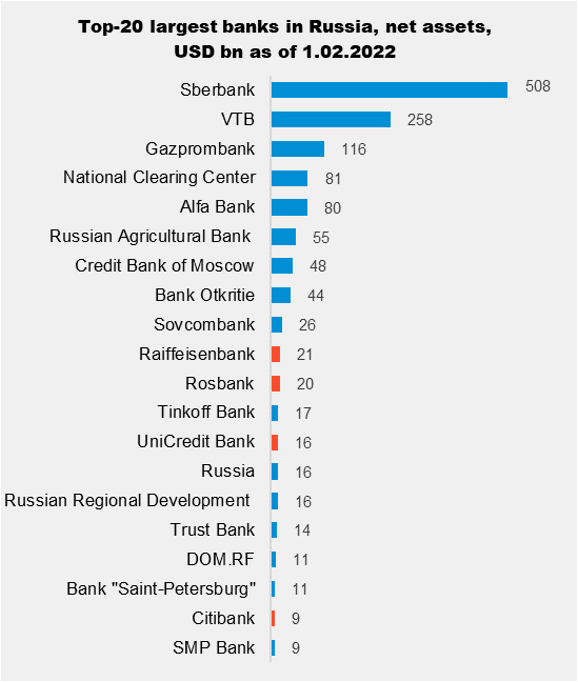

As of April 1st, there were 331 banks in Russia. State-owned banks dominate the banking system. The three largest of them- Sberbank, VTB, and Gazprombank- account for 55% of all assets.

Twenty-six out of one hundred largest banks are foreign, while the share of foreign capital in the banking system is almost 11%. The list of 13 systemically important banks includes three foreign:

- • UniCredit Bank,

- • Rosbank (Societe Generale),

- • Raiffeisenbank (RBI).

In addition, Citibank, Home Credit, OTP Bank and ING Bank are also among the top 50.

Investment banks were the first to announce their withdrawal from the Russian market. From March 10th to 15th , Goldman Sachs, J.P. Morgan, Deutsche Bank, Commerzbank and Citi announced winding down their operations. Moreover, Deutsche bank changed its opinion overnight when the exit of investment banks began. Credit Agricole ceased operations in Russia as well.

However, many subsidiaries of foreign banks serve their international clients and continue to stay in the market despite their small presence and absence of active business with Russian clients. Intesa Sanpaolo, Sumitomo Mitsui Banking Corp., HSBC, ING, and SEB have stopped doing new business with Russian companies but are not leaving the market.

The most pressing question is the exit of the three foreign banks with the largest assets. Societe Generale was the first to announce its withdrawal, signing an agreement to sell Rosbank to Vladimir Potanin’s Interros on April 11th. Meanwhile, Raiffeisenbank and UniCredit Bank remain in the Russian market. In early May, RBI said it was assessing all strategic options for the future of Raiffeisenbank Russia, up to and including a carefully managed exit. On May 11th UniCredit was reported negotiating the sale of Russia’s “daughter”, but no further steps have been taken.

As for the remaining 50 foreign banks, OTP Bank does not provide financing to its bank in Russia and reduces corporate lending. Home Credit reduced assets and tried to sell its Russian subsidiary before the military aggression. Still, after the war had started, the company did not make any statements regarding its business in Russia

What’s new last week – key news from Daily monitoring

11.05.2022

*VNG – Verbundnetz Gas (Germany, Energy, oil and gas). Status by KSE – stay

Germany’s VNG will transfer euro payments for Russian gas to Gazprombank in the future and expects no problems during a conversion to roubles.

https://www.euronews.com/2022/05/10/ukraine-crisis-vng-verbundnetz-gas

*Nurminen Logistics (Finland, Logistics, Transport). Status by KSE – leave

Finnish railway operator Nurminen Logistics has launched a route to China bypassing Russia. The route starts in China and runs through Kazakhstan, Azerbaijan, Georgia and Romania to Central Europe. This was reported by the press service of Nurminen Logistics.

https://www.unian.ua/economics/transport/viyna-v-ukrajini-finskiy-zaliznichniy-operator-postaviv-hrest-na-rosiji-novini-ukrajina-11821044.html

https://nurminenlogistics.com/newsroom/nurminen-logistics-new-southern-trans-caspian-route-meets-strong-market-demand/

*IKEA (Sweden, Consumer goods and clothing). Status by KSE – leave

Trade giant IKEA has extended the pay of almost 15,000 employees in Russia until August. This was stated in an interview with Reuters by the head of the company Tolga Onju.

https://news.finance.ua/ua/ikea-prodovzhyt-vyplachuvaty-zarplatu-15-tysyacham-pracivnykiv-u-rf-do-serpnya

*Emirates (United Arab Emirates, Air transportation). Status by KSE – stay

The CEO of Emirates protects the airline company’s choice to proceed flying to Russia in the middle of the battle, claims it’s ‘linking individuals’ “It’s a federal government choice. We place’t obtained any kind of guideline truly to quit trips there,” ” Sheikh Ahmed container Saeed Al Maktoum informed CNBC. The Dubai federal government possesses Emirates.Emirates is just one of minority.

https://ajansev.com/2022/05/11/the-ceo-of-emirates-defends-the-airlines-decision-to-continue-flying-to-russia-amid-the-war-says-its-connecting-people/

12.05.2022

*Rapaport Group (Belgium, Luxury). Status by KSE – leave

RapNet,the world’s largest diamond trading network with daily listings of 1.8 million diamonds valued at $8.7 billion, has banned Russian diamonds from its network.

*Siemens (Germany, Industry Conglomerate). Status by KSE – wait

Siemens will leave the Russian market as a result of the war in Ukraine. The company has begun the procedure for terminating its production activities and all production activities.

https://press.siemens.com/global/en/news/statement-war-ukraine-and-situation-russia

*Fortum (Finland, Energy, oil and gas). Status by KSE – wait

In addition to the previously announced investment and financing freeze in our Russian subsidiaries, we have decided to pursue a controlled exit from the Russian market. As the preferred path, this decision includes a potential divestment of Fortum’s Russian operations. The divestment process for Uniper’s Russian subsidiary Unipro is also expected to be resumed as soon as possible.

https://www.fortum.com/media/2022/05/fortums-january-march-2022-interim-report-operating-results-down-fortum-prepares-controlled-exit-russia-and-takes-action-provide-security-supply-europe

*Shell (Great Britain, Energy, oil and gas). Status by KSE – leave

Shell sells business in Russia to Lukoil. These are 411 gas stations and a plant for the production of lubricants

*UniCredit (Italy, Finance and payments). Status by KSE – stay

One of the largest Italian banks, UniCredit, has begun preliminary negotiations to sell its Russian subsidiary after appealing to interested buyers. This was reported by Bloomberg with reference to the interlocutors.

https://news.finance.ua/ua/unicredit-rozpochav-perehovory-pro-prodazh-rosiys-koi-dochky-zmi

*SYLVAMO (USA, FMCG). Status by KSE – leave

We have made the decision to exit Russia. We will do so in an orderly manner and are conducting a process to sell our Russian business. We are working to reach an agreement and plan to complete this process promptly, including obtaining approval from our board, as well as the required government approvals to execute a transaction

https://www.businesswire.com/news/home/20220511005221/en/Sylvamo-Releases-First-Quarter-2022-Results.

*Coca-Cola HBC AG (Switzerland, FMCG). Status by KSE – wait

we are working in close alignment with The Coca-Cola Company on the implementation of the decision to suspend its business in Russia. We can confirm that as of 8th of March we stopped placing orders for concentrate in Russia and ceased investments in the market. As per our announcement on 3rd of March, our guidance for the current financial year remains withdrawn.

13.05.2022

*Arrival (Great Britain, Automotive). Status by KSE – wait

The company had been in the process of shifting its operations out of Russia since Ukraine was invaded at the end of February. Elvidge said the company had “a team” in Russia, which deal with software.

https://www.ft.com/content/b2169723-84ce-48c1-82c8-8a011d08a888

*Eni (Italy, Energy, oil and gas). Status by KSE – leave

Italian energy company Eni intends to pay Gazprom for gas supplies in May, even if the initial payment in euros is converted into rubles. The holding’s lawyers are also conducting legal work in preparation for opening ruble accounts to pay for gas.

*Électricité de France (France, Energy, oil and gas). Status by KSE – wait

War in Ukraine. Due to events, the activities of EDF’s office in Moscow have been suspended

https://www.edf.fr/en/the-edf-group/war-in-ukraine

* LyondellBasell (Netherlands, Chemical industry). Status by KSE – wait

Olefins and polyolefins giant LyondellBasell has become the latest multinational chemical company to announce plans to pull out of Russia partly or altogether.

https://www.linkedin.com/feed/update/urn:li:activity:6930368696326479872

*Eutelsat (France, Telecom). Status by KSE – stay

Eutelsat defends its broadcasting on Russian TV channels. Eutelsat is always neutral and respects the decisions of the regulators on which it depends. At this stage, no regulator or other competent body has asked us to stop broadcasting NTV-Plus and Tricolor in Russia.

*Raisio plc’s (Finland, Food&Beverages). Status by KSE – leave

consumer business in Russia transferred to the new owner https://www.raisio.com/en/newsroom/?article-id=A7EFD6CFD4DC98C3#feed

*Allianz (Germany, Finance and payments). Status by KSE – wait

Allianz which has already stopped accepting new business in Russia, will probably fully exit the country “I would define the likelihood as very high,” Chief Financial Officer Giulio Terzariol told reporters when asked about the chances of closing its operations there. https://www.reuters.com/business/finance/allianz-sticks-full-year-operating-profit-target-2022-05-12/

*Daiichi Sankyo (Japan, Pharma, Healthcare). Status by KSE – wait

Daiichi Sankyo has halted sales of some of its drugs to local distributors in Russia (scaling back)

*Eiken Chemical (Japan, Pharma, Healthcare). Status by KSE – wait

Has tentatively stopped supplying reagents used in blood tests for cancer. https://asia.nikkei.com/Business/Pharmaceuticals/Japanese-drugmakers-reduce-Russia-business-in-wake-of-Ukraine-war

*Kelly (USA, Consulting, Law). Status by KSE – leave

Exploring plans to exit Russia, project-based employees in Russia can continue their employment after the transition

14.05.2022

* NIOC (IRAN, Energy, oil and gas). Status by KSE – stay

National Iranian Oil Company (NIOC) and Russia’s Gazprom Company agreed to strengthen cooperation in relevant fields

https://en.mehrnews.com/news/186748/Iran-s-NIOC-Russia-s-Gazprom-agree-to-enhance-cooperation

*International Paper (USA, Consumer goods and clothing). Status by KSE – leave

The American company Sylvamo Corporation, which produces paper under the SvetoCopy brand, is leaving Russia. The company also intends to sell its main asset in Russia – Svetlogorsk Pulp and Paper Mill, located in the Leningrad region.

https://www.rbc.ua/ukr/news/prodaet-zavod-prekrashchaet-import-rossii-1652497639.htm

*French Open (France, Sport). Status by KSE – wait

Russian and Belarusian players will be allowed to compete at the French Open individually not as country teams, but underlined that any kind of Vladimir Putin will be sanctioned.

https://www.tennisworldusa.org/tennis/news/ATP_Tennis/113894/french-open-warns-russian-players-show-vladimir-putin-support-you-ll-face-sanction/

More details on daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Web site (to be launched soon, stay tuned)

At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities.

Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine.

The database contains a lot of information:

• We collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities.

• We created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring).

• We do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo finance. At the same time, the KSE database is more complete and comprehensive and contains 40 percent more information, as it also includes the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot.

¹ Disclaimer (corrected): At the beginning of the Russian invasion of Ukraine KSE Institute has launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. To prepare the database, we used the ideas and lists of companies of the Ministry of Foreign Affairs, the Ministry of Economic Development and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

²The chart represents only public companies with a capitalization of $1 billion and, according to our data, own assets in Russia and received annual revenue of 5 billion rubles and more.