- Kyiv School of Economics

- About the School

- News

- 19th issue of the weekly digest on impact of foreign companies’ exit on RF economy

19th issue of the weekly digest on impact of foreign companies’ exit on RF economy

19 September 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 12-18.09.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 18.09.2022

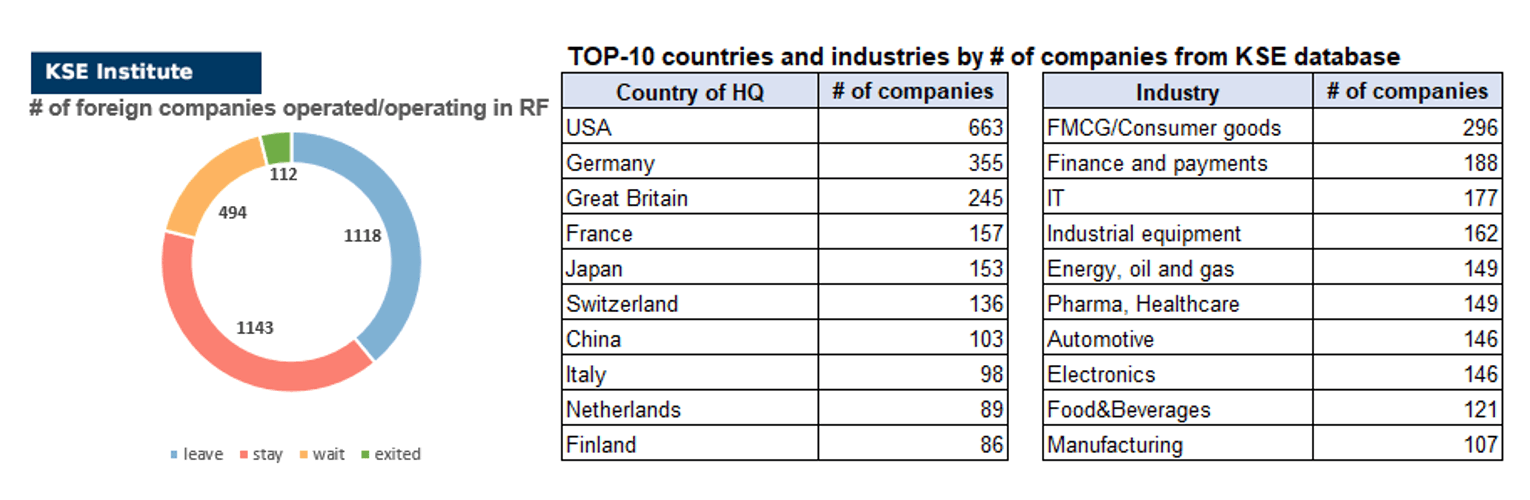

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 143 (-1 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 494 (+1 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 118 (-5 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 112 (+7 per week)

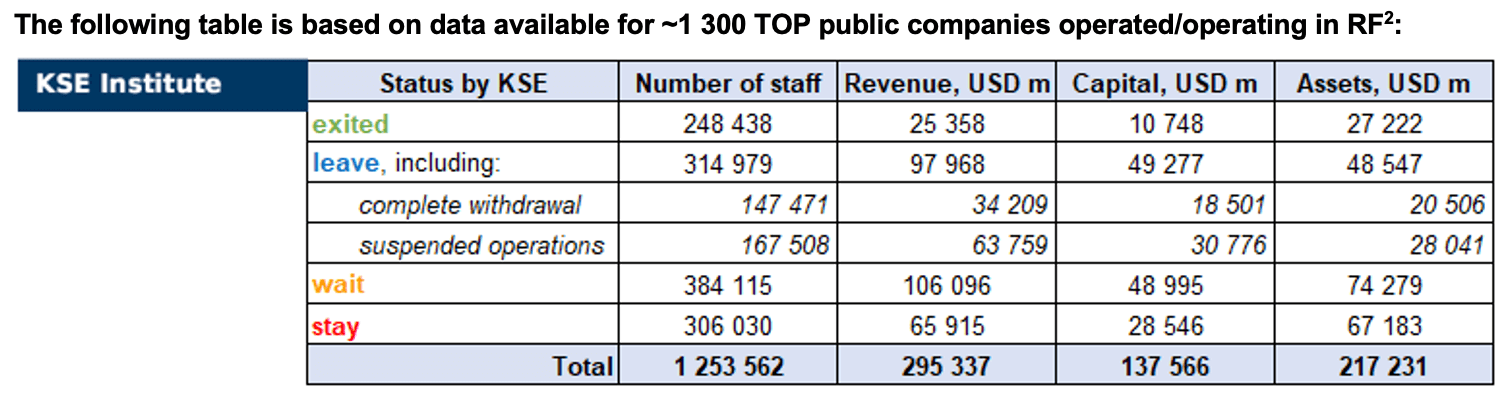

As of September 18, we have identified about 2,867 companies, organisations and their brands from 84 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $137.6 billion), local revenue (about $295.3 billion), local assets (about $217.2 billion) as well as staff (about 1.254 million people). 1,612 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 112 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of September 18, companies which had already completely exited from the Russian Federation, had at least 248,400 personnel, $25.4 bn in annual revenue, $10.7 bn in capital and $27.2 bn in assets; companies, that declared a complete withdrawal from Russia had 147,500 personnel, $34.2bn in revenues, $18.5bn in capital and $20.5 bn in assets; companies that suspended operations on the Russian market had 167,500 personnel, annual revenue of $63.8bn, $30.8bn in capital and $28.0 bn in assets.

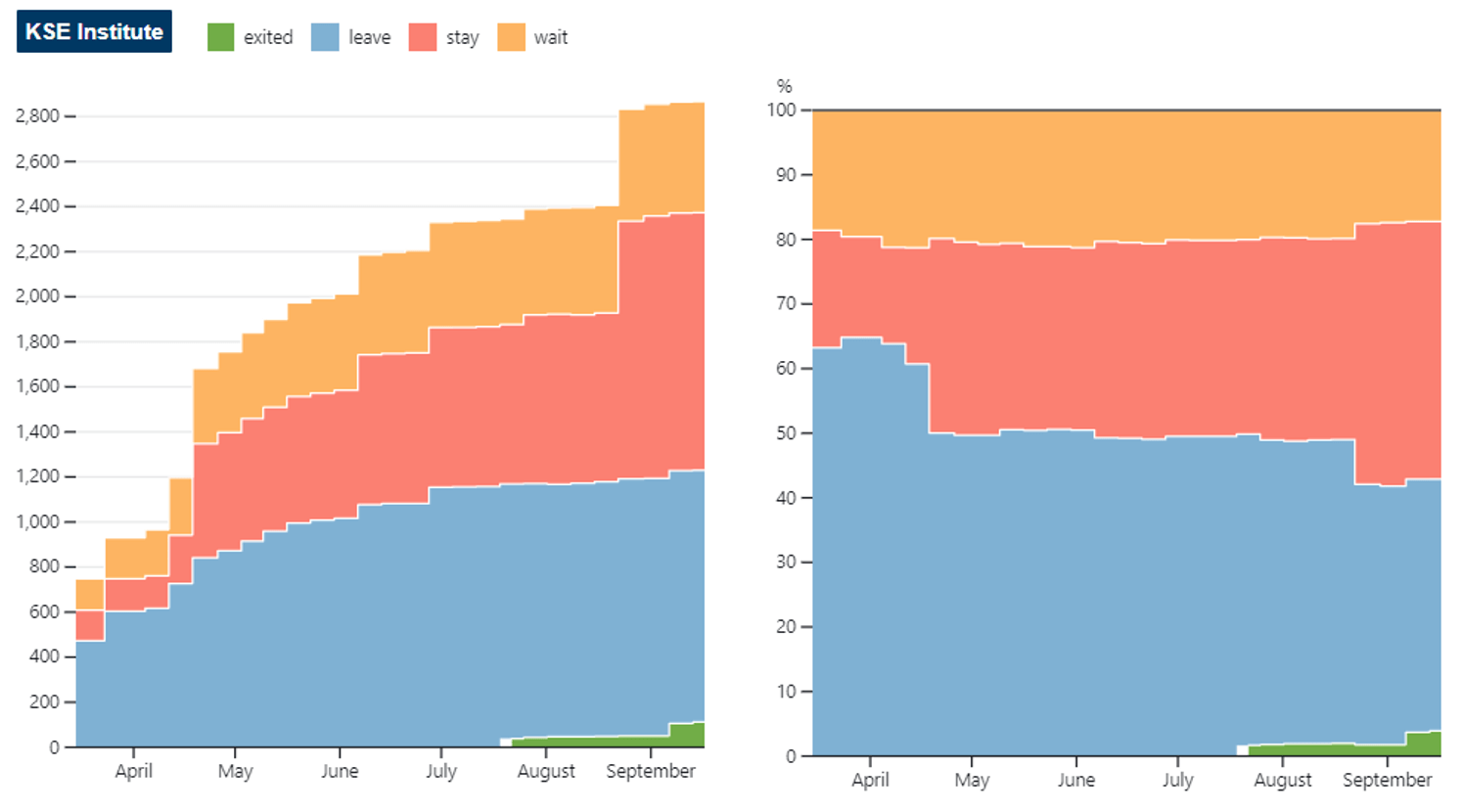

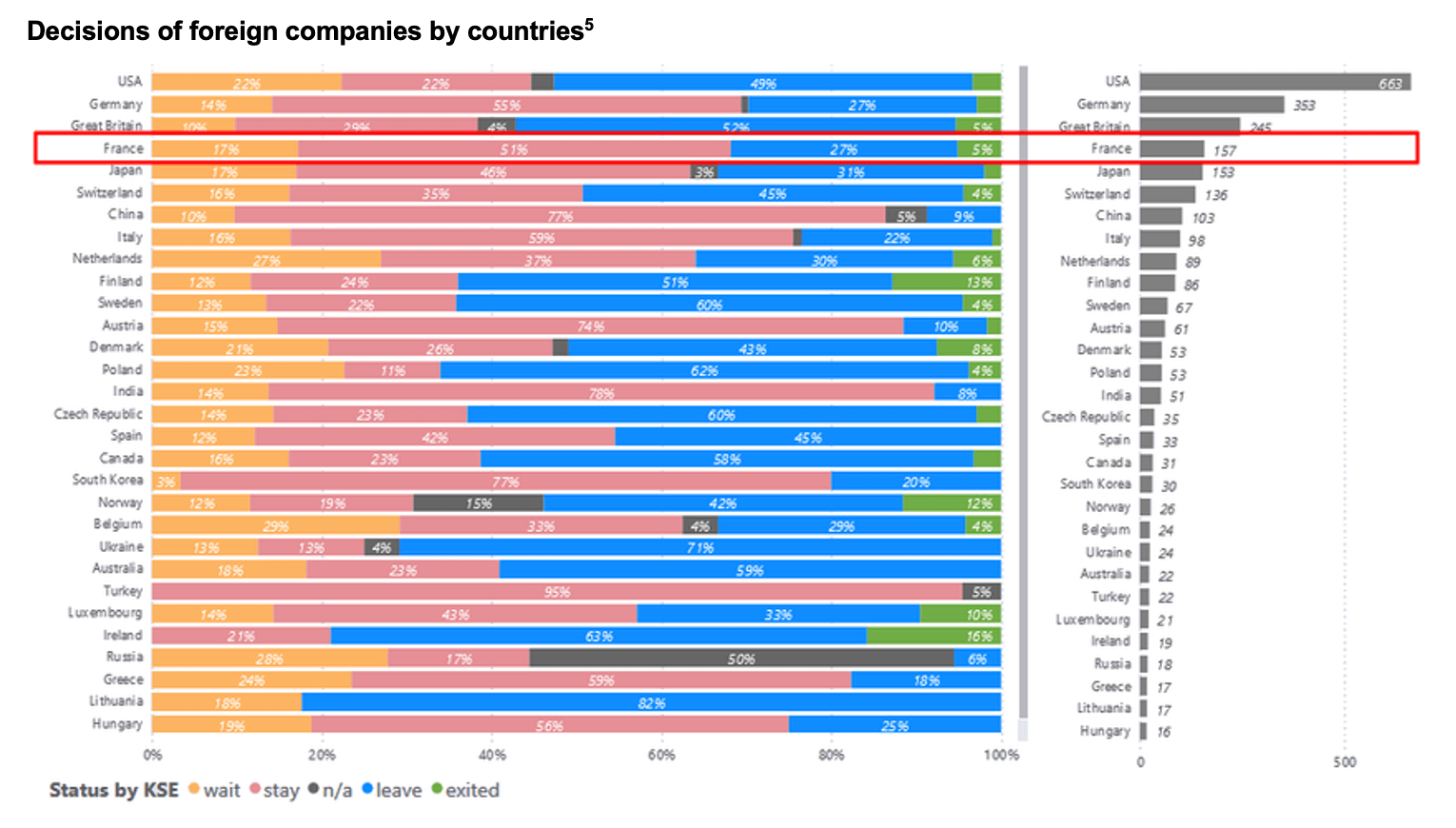

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 39.0% of foreign companies have already announced their withdrawal from the Russian market, but another 39.9% are still remaining in the country, 17.2% are waiting and only 3.9% made a complete exit.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 112 companies that completely left the country, since they employed almost 20% of the personnel employed in foreign companies, and the companies owned about 12.5% of the assets invested by foreign companies in the country, and only last year they generated revenue of $25.4 billion or 8.6% of total revenue, data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Analysis on French companies and their positions in Russia

How many French companies are in Russia?

There were at least 160,000 people employed by 500 French companies (including 35 CAC 40 companies) operating in Russia, a 2021 report into Franco-Russian economic relations published by the French Direction générale du Trésor shows. Based on available data from the KSE Institute, France is one of the leading foreign employers in Russia, second only to the USA (about 400,000 people) and ahead of Germany (about 150,000 people), which is in 3rd place.

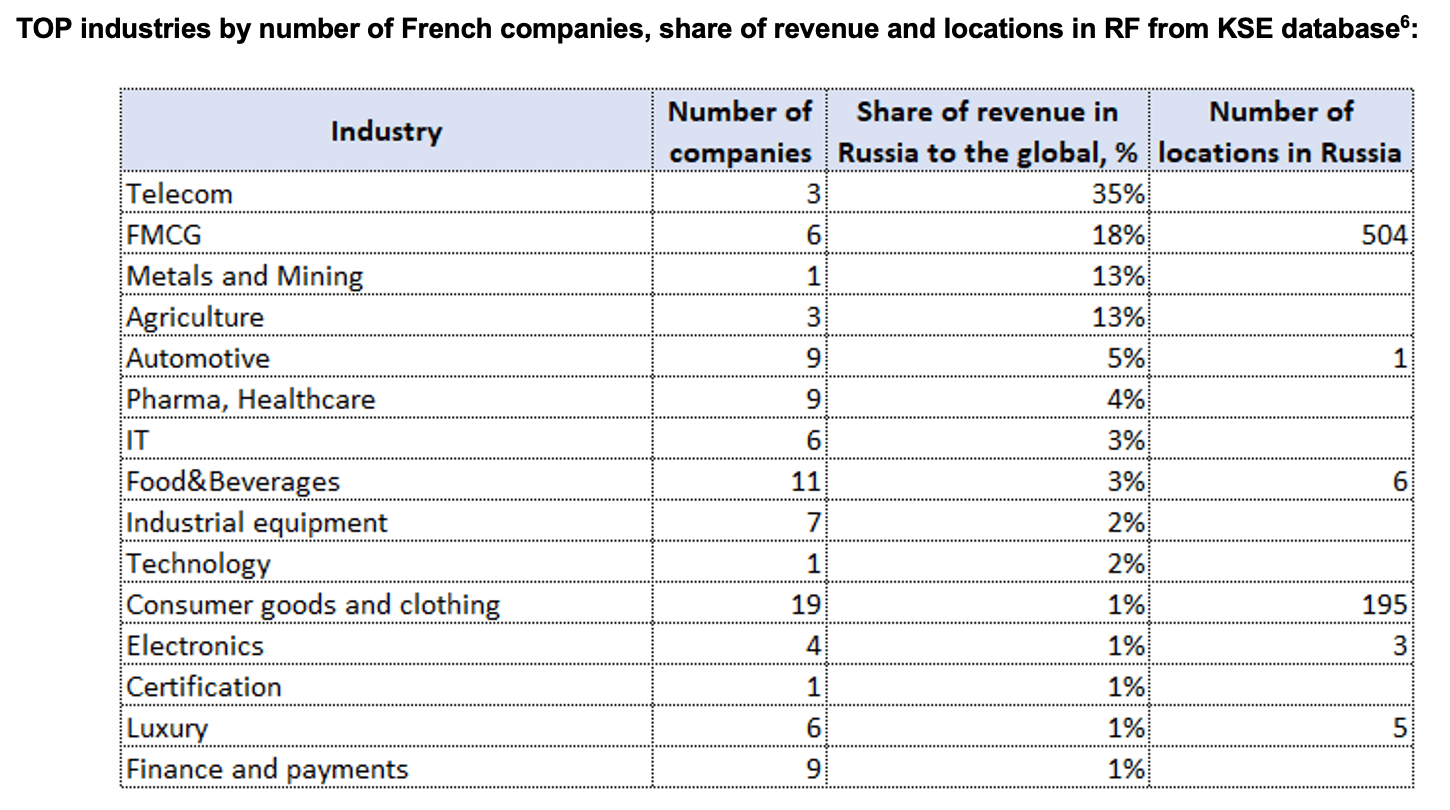

“French companies are particularly well established in the sectors of agri-food, finance, distribution, energy, automotive, construction / urban services, transport, aerospace and pharmaceuticals”, the report states.

Russia was France’s seventh largest market outside the European Union in 2020, with exports to Russia reaching €5.2billion that year, the report also shows.

It should be noted that exact figures on the number of French companies and staff vary depending on the source.

For example, the French Ministère de l’Economie et des Finances reported 700 French subsidiaries in Russia, employing over 200,000 staff.

French companies are Russia’s biggest foreign employer, providing jobs for 160,000 people across a diverse range of sectors, but especially energy, wholesaling and the food industry, according to figures from the French Economy Ministry.

French businesses in Russia tend to be active in more labour-intensive services sectors than their US, German and Italian counterparts.

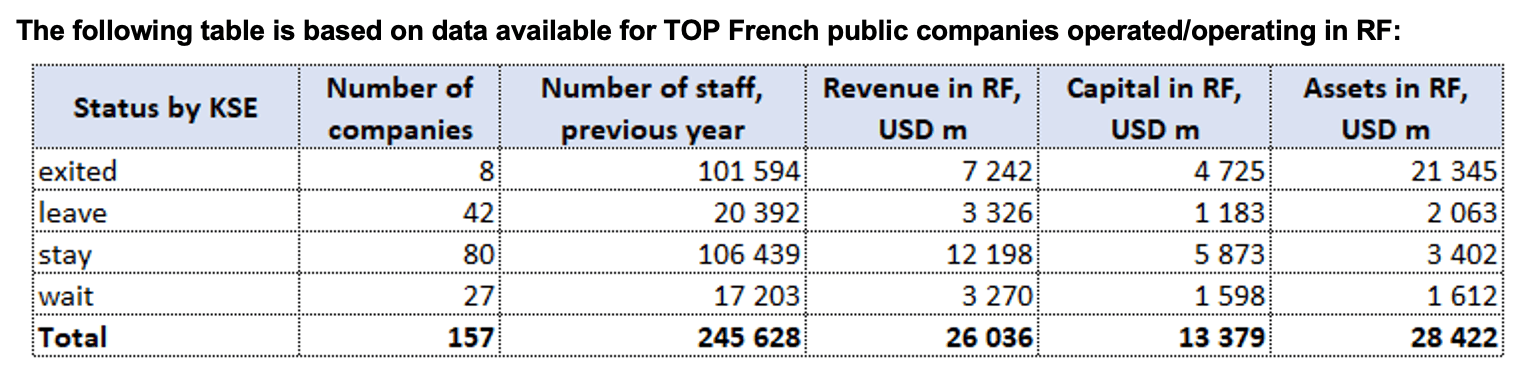

According to data collected by the KSE Institute⁴, in 2021 157 TOP French companies provided jobs for more than 245,000 people, those companies generated $26.0 bn in annual revenue, had $13.4 bn in capital and $28.4 bn in assets.

As of 15/09/2022, about a 40% of employees have already left their previous jobs due to the complete exit of just 8 big companies (namely Renault, Société Générale Publicis Groupe, Schneider Electric, Thales/Gemalto, Delfingen, Rexel and Sodexo).

The most “dependent” on Russia in terms of revenue share in this country are companies in 4 industries: Telecommunications, Fast-Moving Consumer Goods (FMCG), Metals & Mining and Agriculture.

How are French companies reacting?

Out of 157 companies in the database, 51% of companies stay in Russia, 17% are waiting, somewhat limiting their activities, 27% are leaving and only 5% completely exited through sales. Some of the French companies are among the examples of clean breaks from the Russian market, while others defy demands for exit despite pressure.

Clean breaks

• French banking group Société Générale (Status by KSE – exited) announced its complete withdrawal from Russia on April 11. It had been operating in Russia through its subsidiary Rosbank and employed 12,000 staff. Rosbank was one of the thirteen systemically important banks in Russia (together with UniCredit Bank and · Raiffeisenbank). Societe Generale signed an agreement to sell Rosbank to Vladimir Potanin’s Interros, while UniCredit Bank and · Raiffeisenbank remained in RF

• Sanctions significantly impacted the automotive industry – most car factories were forced to stop. However, most manufacturers remain in the Russian Federation and pay their employees. Only Renault (Status by KSE – exited) transferred its share of the carmaker Avtovaz to an auto research institute for 1 ruble.

Defy demands for exit despite pressure

• Auchan (Status by KSE – stay) plans to keep its Russian operations going even though the division is likely to be unprofitable and the country’s invasion of Ukraine continues. It has 41,000 employees and 232 shops in Russia, with 11% of its global sales coming from there. Yves Claude, the CEO of Auchan, has said the company’s choice to stay in Russia is a “human decision”. He told Le Journal du Dimanche: “It is easy to criticise us but we are here, we are standing up and working for the civilian population.”

• Home improvement and gardening retailer Leroy Merlin (Status by KSE – stay) is also in category stay. It has 45,000 employees and 113 shops in Russia, where 18% of its global sales come from (according to KSE Institute data, this share is significantly higher, more than 50%). Major French companies such as Merlin have made the argument that it would be unethical for them to abandon their thousands of employees, or claim that divestment from Russia would only benefit the Russia state, since it would expropriate its assets (as the Kremlin has threatened)⁷.

Retailers Leroy Merlin, Auchan and Decathlon are controlled by the Mulliez family. Decathlon in the end of June closed all of its stores in Russia due to logistics issues (it was announced as temporary closure). But Leroy Merlin and Auchan are keeping their stores in Russia open, even after a Leroy Merlin outlet in Ukraine was reportedly bombed by Russia.

Selected industries analysis

Food producers:

4 out 11 left, including:

• Sodexo (Status by KSE – exited) is a French food services and facilities management company. Sodexo is the only food company that announced its complete exit from Russia. Sodexo transferred ownership of its activities in the country to local management who will continue operations in Russia via an independent structure and brand. The company’s activity in Russia is less than 1% of Grappa’s revenues.

• Pernod Ricard (Status by KSE – leave) – the world’s second-largest wine and spirits seller – pause exports to Russia.

F&B remained in RF

• The food products company Danone (category two on the Yale list, Status by KSE – wait) is maintaining “for the time being, the production and distribution of fresh dairy products and infant nutrition, in order to meet the basic food needs of civilian populations,” the company has stated. It has 8,000 employees in Russia at 17 production sites and generates 6% of its turnover in Russia.

• Dairy products company Lactalis (Status by KSE – stay) is on category one of the Yale and KSE Institute list, meaning it is essentially ‘continuing business as usual’. The company has said that it is remaining in Russia due to a need to fill the shelves of the shops where civilians buy their supplies.

• Most food companies have not left the Russian market. For example, the French manufacturer of canned vegetables Bonduelle (Status by KSE – stay) published a statement on the company’s website on March 17: “We see it as our responsibility to ensure people have access to basic food and to do everything we can to avoid food shortages. Today, there is no ban on the authorities leaving Russia, and we respect the position of France and the European Union. For all these reasons, we ensure the continuity of our activities in Russia“. It has 1,420 employees and 1 plant in Russia.

Luxury, Clothing, Cosmetis

• Most companies of luxury brands suspended their sales in Russia, including LVMH, Christian Dior, Lacoste, Hermes, Kering (brands Balenciaga, Bottega Veneta, Gucci, Alexander McQueen and Yves Saint Laurent), Vendôme Luxury Group (brands Cartier, Alfred Dunhill, Montblanc, Piaget, Baume & Mercier, Vacheron Constantin, Lancel and Chloé).

• Lacoste (Status by KSE – stay) stores remain open and the company is still operating in Russia.

• L’Oreal (Status by KSE – wait) the largest revenue revenue among cosmetics companies. In Russia, the Group has temporarily closed all its own stores and e-commerce sites and suspended all industrial and media investments. In accordance with European and American sanctions, it has suspended the sales of all products except essential daily products.

• LVMH’s group Sephora (Status by KSE – leave) multinational retailer of personal care and beauty products entered into an agreement for the sale of 100% of the shares of its subsidiary in Russia.

• L’occitane (Status by KSE – stay) announced the closure of stores in April, though it still paid salaries to its employees. In May, the company announced its intention to exit Russia entirely and not to supply its products to Russian retailers. In June, the ownership was transferred to local management and the shop’s name is now transliterated to Cyrillic. Shops resumed operations, and L’occitane products are available in shops according to media reports.

• Such companies as Yves Rocher (Status by KSE – wait) and Clarins (Status by KSE – stay) remain in RF as well.

Pharmaceutical

• French pharmaceutical brands are not leaving Russia, just as other international companies, the largest French pharma companies in Russia are Sanofi and Servier Laboratories. Sanofi (Status by KSE – wait) halted advertising and promotional spending and new recruitment of patients clinical trials, continued medical supply and treating current patients. Servier Laboratories (Status by KSE – wait) suspending new investments but still operating in Russia.

• Ipsen (Status by KSE – stay) is the third largest French pharmaceutical company remaining in Russia. The company suspended several promotional activities in Russia, including advertising and participation in non-scientific congresses. In addition, they will not initiate any new clinical trials. But the company does not plan to completely withdraw from the Russian market. The company argued that as a pharmaceutical company, they have a responsibility to ensure that patients have access to their treatments. Consistent with their unwavering commitment to patient service, they will continue to meet patient healthcare needs. The company suspended several promotional activities in Russia, including advertising and participation in non-scientific congresses. In addition, they will not initiate any new clinical trials. But the company does not plan to completely withdraw from the Russian market.

Other companies in RF

Tyre manufacturing company Michelin (Status by KSE – wait) announced the closure of its factory in Davydovo, near Moscow, on March 15. It falls into the Yale study’s⁸ fourth category, meaning it is suspended operations but keeping open an option to return to Russia. Its investment into Russia is minimal, with the market only representing 2% of total sales and 1% of its global production.

Oil and gas company TotalEnergies (Status by KSE – wait) has begun to scale back operations in Russia. It announced on April 27 an asset write-down of around €3.9billion in investment, principally from the Arctic LNG 2 mega project. TotalEnergies is selling its 49 per cent stake in a Siberian gasfield to Russian energy producer Novatek, days after accusations that the asset supplied feedstock for jet fuel suspected to have been used by the Russian military.

Carpooling company BlaBlaCar (Status by KSE – wait) has announced an end to investment in Russia but is remaining present in the country. It has around 25 million Russian users.

FM Logistic (Status by KSE – stay) the largest French logistics company in Russia. It operates more than 890,000 m2 of warehousing space in Russia and employs 8,000 people in the country. The warehouse market leader in Russia was growing its transport business.

France’s Schneider Electric SE (Status by KSE – leave) has agreed to sell its Russian unit to the local leadership team⁹. The share of sales of Schneider Electric from the Russian division is about 2%. Schneider Electric said it expected to write off up to 300 million euros ($313 million) in net book value as a result of the divestment. The company has 3,500 employees in Russia and Belarus.

You can also contribute by spreading the status of the company calling for the exit from Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)¹⁰

12.09.2022

*Air Moldova (Moldova, Air transportation) Status by KSE – stay

Moldovan national airlines blocked from resuming flights to Moscow

Air Moldova is ready to seek the resumption of flights to Moscow through the court

https://www.pravda.com.ua/news/2022/09/11/7366996/

*Nissan (Japan, Automotive) Status by KSE – leave

Nissan extends suspension of Russia factory for three months until late December

*Oldendorff Carriers (Germany, Marine Transportation) Status by KSE – wait

In the days leading up to the sanctions deadline, the giant German shipping company Oldendorff Carriers moved multiple shipments of coal from the Russian ports of Taman and Ust-Luga. Oldendorff ships delivered coal after the sanctions deadline

13.09.2022

*Polar Seafood Group (Greenland, Food & Beverages) Status by KSE – exited

Polar Seafood sells off stake in Russian subsidiary

https://www.intrafish.com/markets/polar-seafood-sells-off-stake-in-russian-subsidiary/2-1-1297569

*Google (USA, Online Services) Status by KSE – leave

A Moscow court accepted a bankruptcy application by Google’s Russian subsidiary

14.09.2022

*Inditex (Spain, Consumer goods and clothing) Status by KSE – leave

Inditex sees sales benefit from increase in dollar vs euro

Gross margin reached seven-year high in the first half

*Traton Group (Germany, Automotive) Status by KSE – leave

Traton sells some assets in Russia, incurs 550 million euro loss

*Equinor (Norway, Energy, oil and gas) Status by KSE – exited

How Norway’s Equinor exited Russia: Move fast, sell cheap

Equinor has transferred $1bn in commitments to oil company Rosneft for just €1

15.09.2022

*Deugro (Germany, Logistics, Transport) Status by KSE – exited

deugro signed an agreement on September 5, 2022 to sell its business in the Russian Federation as part of a management buyout to its former local management.

https://deugro.com/2022/09/deugro-performs-management-buyout-in-russia/

*Samsung (South Korea, Electronics) Status by KSE – wait

Samsung Electronics Co Ltdsaid on Thursday nothing had been decided after a newspaper reported the company was expected to return to the Russian market this year, six months after suspending shipments following the invasion of Ukraine.

16.09.2022

*Sandvik (Sweden, Engineering) Status by KSE – leave

*FERRONORDIC (Sweden, Construction & Architecture) Status by KSE – wait

Ferronordic and Sandvik terminated their dealer agreements for Russia

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – leave

IOC considering lifting ban on Russian athletes

https://pakobserver.net/ioc-considering-lifting-suspension-on-russian-athletes/

*PIMCO (USA, Finance and payments) Status by KSE – wait

*Goldman Sachs (USA, Finance and payments) Status by KSE – wait

PIMCO bought Russia government international bonds and hedged its position through credit default swaps (CDS). Goldman Sachs placed about US$1.3bn of orders to buy Russian bonds on behalf of sellers of Russia CDS protection and two sources confirmed PIMCO was heavily involved.

https://www.ifre.com/story/3516497/pimco-bets-on-russian-debt-recovery-in-cds-auction-hcnvwhhg0p

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematized in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/.

¹⁰ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site