Since the beginning of Russia’s war against Ukraine, KSE Institute (think tank at the Kyiv School of Economics) has been actively cooperating with the Ukrainian government in assessing losses, the effectiveness of sanctions against the aggressor, and developing scenarios for Ukraine’s economic recovery after the war.

KSE Institute is part of an international group of experts in the Office of the President of Ukraine, as well as an intergovernmental group on sanctions against Russia. Our experts provide the main analytical work for these groups and participate in the development of sanctions and position documents of Ukraine. They are also in dialogue with a number of companies, persuading them to leave Russia even without decisions from their country’s government.

In addition, KSE Institute is a co-author of the Recovery Program, which was prepared by the Ministry of Economy of Ukraine, top consulting companies and the best economists at the request of the President of Ukraine. We are preparing for the period of reconstruction of the country.

Action Plan on Strengthening Sanctions against Russia

An international expert group has been working on strengthening sanctions against the Russian Federation.

The group was initiated by the President of Ukraine. It is managed by Andriy Yermak, Head of the Office of the President of Ukraine, and Michael McFaul, Director at the Freeman Spogli Institute for International Studies (FSI). The group consists of international and Ukrainian experts, in particular, representatives of the Kyiv School of Economics.

We have convened a working group of independent, international experts to recommend new economic and other measures to pressure Russian President Vladimir Putin to end his invasion of Ukraine as soon as possible and restore Ukraine’s territorial integrity within its internationally recognized borders. Our working group aims to provide expertise and experience to governments and companies around the world by assisting with the formulation of sanctions proposals that will increase the cost to Russia of invading Ukraine, and support democratic Ukraine in the defense of its territorial integrity and national sovereignty.

Yermak-McFaul Group on Russian Sanctions. Progress Update, July 27 compared to Apr 19, 2022

Yermak-McFaul Group on Russian Sanctions. Progress Update, July 6 compared to Apr 19, 2022

Yermak-McFaul Group on Russian Sanctions. Progress Update, June 24 compared to Apr 19, 2022

Yermak-McFaul Group on Russian Sanctions. Progress Update, June 8 compared to Apr 19, 2022

Yermak-McFaul Group on Russian Sanctions. Update: June 1–8, 2022

Yermak-McFaul Group on Russian Sanctions. Progress Update, May 18 compared to Apr 19, 2022

Yermak-McFaul Group on Russian Sanctions. Update: May 11–18, 2022

During the last 7 days (from May 11 till May 18), a number of sanctions and restrictive measures against the Russian Federation in response to its aggressive war against Ukraine were implemented by the allies of Ukraine. These sanctions cover three main areas: individual sanctions against Russian citizens, new restrictions concerning Russian state-owned enterprises (SOEs), and improving export controls and banning imports.

According to KSE Institute estimations, the total cumulative progress in sanctions’ implementation is 36%, with 15 sanctions-measures from the Yermak-McFaul Group Action Plan out of 42 being implemented successfully.

The total number of new personal sanctions against citizens of the Russian Federation is 50. New sanctions against Russian and Belarusian individuals were imposed among others by Australia (+15, including Illia Kyva, former Ukrainian MP), New Zealand (+23, including Aleksandr Lukashenko), and the United Kingdom (+12, including Alina Kabayeva).

Additional measures against the Russian state-owned companies (SOEs) include new restrictions in the defense sector, infrastructure, media and technology. New sanctions were imposed in Australia (13 Russian SOEs, including PMC Wagner and propaganda media + 2 Belasrusian SOEs), New Zealand (3 Belarusian defence SOEs), and the UK (Russian Railways).

Considering strengthening export control and ban on import of Russian goods and products, the Japan Cabinet introduced a ban on the export of cutting-edge goods, including quantum computers, 3D printers etc.

However, several critical areas of additional sanction control are yet to be imposed. Little or no progress has been made in expanding oil and gas sanctions, with the 6th Sanctions Package of the EU still not being adopted. The experts of the Yermak-McFaul Group also draw upon the importance of additional transportation and insurance-related sanctions, as well as discouraging trade with and investment in Russia.

We also want to focus on the role of new sanctions against the Russian financial sector, namely the Central Bank of Russia, as well as the growing importance of sanction policy coordination among the allies.

Yermak-McFaul Group on Russian Sanctions. Progress Update, May 9 compared to Apr 19, 2022

Yermak-McFaul Group on Russian Sanctions. Progress Update, May 4 compared to Apr 19, 2022

The working group includes independent international experts, such as:

- • Michael Anthony McFaul, an American academic and diplomat, Director at the Freeman Spogli Institute for International Studies, the Ken Olivier and Angela Nomellini Professor of International Studies in the Department of Political Science, and the Peter and Helen Bing Senior Fellow at the Hoover Institution.

- • Anders Åslund, a Swedish economist and diplomat, leading international expert on national economies of Ukraine, Russia and the countries of the former USSR;

- • Francis Fukuyama, an American philosopher, political economist and publicist of Japanese descent;

- • Christopher Miller, an American retired United States Army Special Forces colonel who served as acting United States secretary of defense from November 9, 2020, to January 20, 2021.

The Kyiv School of Economics is presented by:

• Tymofiy Mylovanov, KSE President, Associate Professor of the University of Pittsburgh, Minister of Economic Development, Trade and Agriculture of Ukraine (2019-2020);

• Natalija Shapoval, Head of KSE Institute, Vice President for Economic and Policy Research at KSE;

• Tymofii Brik, Rector at the KSE University, Head of Sociological Research at KSE, Vice President for International Relations;

• Oleksandr Lysenko, corporate governance expert at KSE;

• Andriy Boytsun, corporate governance expert at KSE.

KSE Graduates also took part in the development of the sanctions package: Yurii Gorodnichenko, a member of the KSE International Academic Board, professor at University of California, Berkeley, and Ilona Sologoub, Director of Political and Economic Research at Kyiv School of Economics, Scientific Editor at VoxUkraine.

Our group applauds the actions that have been taken by dozens of governments around the world to sanction Russian companies and individuals, put in place export controls to Russia on critical technologies, and pressure private companies to stop doing business in Russia. We also applaud the steps that have been taken independently by private companies from around the world to stop trading, investing, and doing business in and with Russia. We welcome the actions taken by multilateral financial institutions to suspend their activities with Russian partners. At the same time, we believe that more – much more – can be done to urgently increase pressure on Putin to withdraw his army from Ukraine. We stand with Ukraine in seeking to stop the flow of revenues that underwrite Russia’s brutal war and atrocities against civilians.

While seeking input from and coordination with numerous governmental officials – including especially from the Government of Ukraine – as well as private companies, all members of our working group participate in their individual capacities. We are united in believing that sanctions on Russia should be expanded as quickly as possible until Putin withdraws Russian armed forces from Ukraine. Some now argue that there is nothing left to do regarding economic pressure on Russia; our working group radically disagrees. Finally, we recognize that tightened sanctions, which impede revenue flows and increase the cost of this war, are not a substitute for military and humanitarian assistance, diplomacy, or other foreign policy instruments that should be debated and pursued separately. Our focus here is just on one aspect of the larger, international strategy needed to help end this horrific war.

#RF economy weekly

by Nataliia Shapoval, Chairman of KSE Institute

#RF Economy Weekly: May, 12 – May 20, 2022

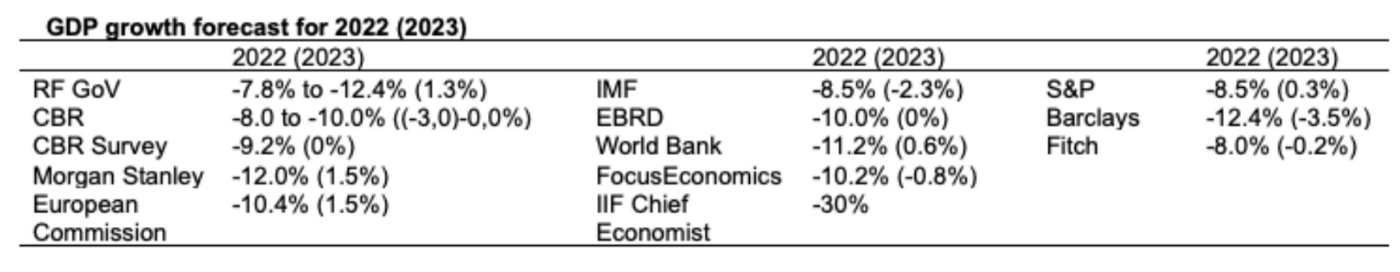

RF economy’s GDP projections converge to -10% in consensus reports, suggesting that the effect of sanctions is smaller than intended. Median estimate of 35 forecasters[1] (compiled by FocusEconomics) is 10.2%. The European Commission also published its forecast, expecting a 10.4% fall of Russia’s GDP in 2022 (range: between -4.5% and -16%). At the beginning of war, when economists considered rapid implementation of tough sanctions feasible — the estimate ranged between 15, 30 or even 50% of economic loss.

RF central bank recognizes that managing economic situation is challenging for them — head of CBR called the crisis of 2022 “one of the most significant challenges facing the RF economy since the 90s”[2]. Along with -10% GDP contraction, CBR baseline scenario suggests that exports of goods and services may fall by 17–21% in 2022 and imports to drop 32.5–36.5% in 2022.

On the backdrop of ruble appreciation, Russian authorities continue to cease currency restrictions. As noted above, imports have been falling faster than exports providing foreign currency for balancing exchange rate and allowing for relief in currency restrictions. Compared to 23 Feb ruble has appreciated by ~21% against dollar and by ~28% against euro, giving it the incongruous title of best performer which has been the highest rate of appreciation globally. On May 20, the dollar XE on the Moscow Exchange fell to 57.4 RUB/USD, record low since April 2018. The euro fell to 59.8 RUB/EUR. On May 16, CBR allowed individuals to transfer abroad up to $50K a month (prior to that, the limit of $10K was imposed). RF GoV allowed exporters not to sell foreign exchange earnings if they have existing import contracts. Previously, CBR allowed banks to sell FX cash to citizens (on Apr 18) and CBR softened currency controls to all exporters — time for mandatory sale of foreign currency was increased from three to 60 working days (on Apr 21). Yet, buying dollars or euro is still very difficult in RF which gave rise to black market. Bloomberg reports that black-market rates ranged from 73 to 76 rubles in Moscow on May 17 (data from currency exchange channels on messenger apps), while official XE equaled 63.35.

Inflation continues to grow, but on a slower scale. In annual terms, inflation in Apr increased to 17.83% compared to 16.69% in Mar. Annual inflation accelerated in the food sector (from 17.99% YoY in Mar to 20.48% YoY in Apr) and in the services (from 9.94% YoY to 10.87% YoY), in the non-food segment, the annual price growth rate slightly slowed down from 20.34% YoY to 20.19% YoY.

RF reserves continue to decrease, lost $57.4 during the war. Russia’s international reserves fell by additional $7.4bn between May 1 and May 13. For more than two months of the war RF reserves dropped from a historically max level of $643.2bn to $585.7 bln (-$57.4 bn or~9%). In addition, last week the House of Representatives of the US Congress adopted a bill that prohibits the country’s Treasury from providing RF and RB with dollars in exchange for their SDRs.

Bye-bye crypto. Binance has closed Russian transfers and withdrawals to foreign banks, regardless of country of residence. Coinbase cryptocurrency exchange restricted access for Russians to their accounts (with more than €10,000 on their wallets) under EU sanctions. While the US imposed sanctions against the Russian crypto-mining company Bitriver (TOP-3 in RF) on Apr 20.

Industry

RF started seizing assets of foreign companies (Siemens) leaving RF. Last week Siemens terminated service contracts with Russian Railway for maintenance, including maintenance of the Sapsan (high-speed electric trains). However, already on May 16, The St. Petersburg Arbitration Court decided to seize the Siemens equipment needed to repair the Sapsan and Lastochka high-speed trains and hand it over to the Russian Railways. Formally, the court invalidated the termination of the service contract and ordered the transfer to Russian Railways of equipment owned by Siemens, which is necessary for repairing trains. Despite this being the first such precedent, Russia has already denied returning leased aircraft. For example, Avolon (Ireland) lost $304 mln due to Russia’s refusal to return the aircraft. American Air Lease wrote off 27 aircraft left in Russia for ~$800mln. United Arab Emirates (one of the world’s largest lessors) has written off $538mln of losses as a result of Russian airlines refusing to return aircraft in service due to Western sanctions. Also, Russia has hijacked 113 Irish AerCap Holdings aircraft (worth ~2bn$) in response to sanctions.

Sanctioned Sovcomflot is selling its fleet to repay loans: 23 sold of 134 fleet. Such deals should be watched as they can potentially allow RF to channel the fleet to other RF-friendly owners to circumvent sanctions on RF ships. Over the last two weeks media has been widely reporting Sovcomflot` plans to sell up to 1⁄3 (at least 40 of 134). SOE needs foreign currency to pay the loans[3] after sanctions prevent it from paying $8.28m on eurobonds. As of May 17, 23 vessels sold. Only some buyers are known: 5 tankers to Dubai-based Koban Shipping and 4 gas carriers to Singapore’s Eastern Pacific Shipping (~$700mln deal), says WSJ, Evangelos Marinakis-controlled Capital Maritime & Trading affiliates have bought up four LNG dual-fueled aframax tankers[4]. In addition, some previous deals to expand fleet didn’t materialize[5].

Russian authorities try to prevent a shortage of lead on the Russian market. On May 14, RF GoV introduced an export licensing (if exported outside the customs territory of the Eurasian Economic Union) for lead waste and scrap, as well as unprocessed lead, with the exception of semi-products of the production of non-ferrous metals containing precious metals for the period of May 15 — Nov 15. Lead is essential for the production of batteries and is widely used by automotive manufacturers.

RF mobile operators, afraid of equipment breakdown, plan secondhand purchases of network equipment. After Nokia, Ericsson and Huawei left Russia, Russian mobile operators are considering purchasing used network equipment. If equipment is not found, quality of mobile comms in RF and disruptions are expected by the end of the summer.

The secret of Russian soldiers stealing “washing-machines” from Ukrainians has been revealed: chips from dishwashers and refrigerators are now used military equipment — US Secretary of Commerce.

Oil & Gas

Russia plans raising the transport fees on hydrocarbons for EU to compensate for frozen funds. EU and US discussing their tariffs on RF energy too. Similarly to gas-for-rubles scheme, RF will treat failure to comply with cessation of supplies. In its turn, the EU discusses cap natural-gas prices to avoid “unbearably high” costs if RF significantly limits or cuts off the flow, says Bloomberg (European Commission is currently mapping out energy-market intervention measures as part of a package to replace Russian gas)[6]. At the same time US Janet Yellen[7] has been proposing price caps and tariffs for the application in the EU at the G7 meetings.

At a closed meeting the European Commission “approved” the scheme of payment for Russian gas proposed by Putin, says Bloomberg. Companies will be allowed to open Gazprombank accounts in euros or dollars, where the money will then be automatically converted into the ruble accounts. Previously it was reported that 20 EU companies have already opened accounts in Gazprombank to pay for gas from RF, another 14 requested a list of documents for opening such accounts.

West Africa, small OPEC players increase oil sales to EU. Israel, Azerbaijan increases gas sales. Saudi and OAE abstain. Algeria lacks capacity. West African oil companies are increasing sales in the EU, says Bloomberg. Of the OPEC member countries, “minor players” show the largest increase in shipments to EU ports. West African oil shipments to the EU reached an avg of 1.23 mln bar/day in Mar and Apr, up 40% from the same period last year and the highest level since Feb 2020. Israel is increasing natural gas production on the shelf and seeks to reach an agreement on its supply to the EU in the coming months, says Reuters. Bulgaria will be able to receive gas from Azerbaijan in full from July 1 according to Bulgarian Prime Minister. On the contrary, Saudi Arabia and the United Arab Emirates, two largest producers in the OPEC, have refrained from making additional deliveries to Europe despite having the capacity. Algeria doesn’t mind increasing sales but lack investment and capacity.

Poland, Bulgaria and now Finland — cut off from RF gas for refusing rubble payments, but able to replace it. On May 20, Gazprom announced its plan to stop gas supplies to Finland this Saturday. Earlier, same measures were adopted against Poland and Bulgaria. Poland`s reliance on RF gas was 46%(imports to domestic consumption), Bulgaria for 73%, Finland for 68% in 2020. The Russian gas cut-offs did not cause any disruptions of energy supply in these three countries. Although Finland imports most of the gas from Russia, RF gas accounts only about 6% in its total energy consumption. Finland, thus, can substitute gas with other sources of energy and switch to gas supplies from neighboring countries. Bulgaria and Poland are the only two European countries with Gazprom contracts due to expire at the end of this year, and both said they would not hold talks to renew this deal and have an alternative option of supply. In particular, Poland has been boosting the capacity to receive LNG at newly commissioned terminal and has announced it is going to imposed contractual fines to Gazprom.

RF imposed sanctions on 31 UK and EU companies formerly controlled by Gazprom. One of the results — Yamal-Europe pipeline through Poland to lose RF gas transport. On May 3 and May 11 Putin signed decrees which imposed sanctions on a number of foreign companies, including Gazprom Germania and 29 Gazprom Gemania subsidiaries in different countries, and EuRoPol GAZ, which owns the Polish section of the Yamal-Europe gas pipeline. Poland authorities to abandon the use of the Polish section of the Yamal-Europe pipeline owned by EuRoPol GAZ[8].

Lukoil bought 100% LLC «Shell Oil». Contract value not known, but Shell had lost ~$8.1bn while exiting RF. Shell has completely stopped selling fuel in RF, shops and cafes continue to work. Over the past month, the company has gradually left the Russian market: recalled personnel from its joint ventures with Russia’s Gazprom (including the Sakhalin II), then — management and technicians, closed all gas stations. In May, Shell sold Lukoil 100% LLC «Shell Oil» in RF, including 411 petrol stations and the lubricant plant in the Tver region. Shell spent $ 4.24 bln in Jan-Mar 2022 due to refusal to participate in Russian energy projects and wholesale purchases of fuel from RF. Also, due to the withdrawal from Russia, the company was forced to write off $3.9bn. Chinese state companies wanted to buy Shell’s stake (27.5%) in the Russian oil and gas project Sakhalin-2, but now the fate of this deal is unknown. In its turn, Japan is afraid to leave Russian energy projects (in particular, Mitsubishi and Mitsui own 22.5% of the Sakhalin-2 oil and gas project) as other major players from China will take its place — Bloomberg, Nikkei Asia.

Russian imports to Germany in Mar increased by 77.7% YoY, reaching €4.4bn in result of increase of energy prices. Even though, the volume of imports of oil and natural gas from Russia decreased by 27.8% YoY, while its money value increased by 56.5%.

Russia blackmailed Finland with electricity for NATO membership plans — unsuccessful. Russian SOE, Inter RAO, announced that it will stop supplying electricity to Finland from May 14 as they didn’t receive ruble payments. Around 30% of RF`s export came to Finland (8,2 bn kWh, ~$0.4bn) that covers approximately 10% of electricity consumption in Finland[9]. Finnish grid operator (Fingrid) reported that these amounts are substitutable by imports from Sweden and also by domestic production.

Sanction Loophole

Sanctioned Russian “oligarchs” can use Hawala — informal payment system linked to the terrorism financing. It allows the transfer of money abroad, while maintaining anonymity, remaining almost beyond the regulators’ control.

Russian motherboard manufacturer selling products with China’s KaiXian Microprocessor, Zhaoxin[10]. This may indicate that the Chinese company Zhaoxin is selling chips to Russia, which are dual-use goods and are banned by US, EU and allied sanctions. The chips could be used by the Russian military to create advanced weapons.

[1] Including companies

[2] https://www.cbr.ru/Collection/Collection/File/40972/2022_02_ddcp.pdf

[3] There were two main waves of sanctions directly against Sovcomflot: the end of Feb (EU (restrictions on securities and money market instruments; prohibition on new loans); Canada (broad dealing ban)) and Mar (EU (any transaction ban); UK (asset freeze); Switzerland (restrictions on securities and money market instruments; transaction ban); Norway (export ban); Liechtenstein (money and capital markets ban, loan or credit ban, transaction ban). While on Apr 7, Shell suspended operation of two LNG carriers leased from Sovcomflot due to sanctions risks. In addition, the UK (beginning of Mar) and the EU (beginning of Apr) closed access to their ports for Russian vessels. As a result, back on April 26, the company was unable to pay on the Eurobonds.

[5] Daewoo Shipbuilding and Marine Engineering (DSME, South Korea) canceled an order for 1 out of 3 LNG vessels for Sovcomflot, worth $270 million, as they did not receive the 2nd advance payment from Sovcomflot. According to Korean media reports, the DSME and Sovcomflot agreements on 2 other vessels are still in effect, but they will face a similar problem with prepaid payments. The total value of the contract for 3 vessels, signed in 2020, is $800 million.

[8] https://www.hydrocarbons-technology.com/projects/yamal-europegaspipel/

[9] In 2021 Russia produced 1131 bn kWh of electricity and consumed domestically 1106 kWh. In 2021 Russia exported 21,77 bn kWh of electricity for $1,33bn value.

[10] https://wccftech.com/intel-amd-ban-sees-russia-turn-to-chinese-chips/

Prepared by KSE Institute, NBU communication department with Jacob Nell, ICU, Dragon Capital

#RF Economy Weekly: May, 3 – May 11, 2022

A new study by European University Institute suggests that full withdrowal of the FDI from RF by 40 countries-allies of Ukraine would lead to -28.2% loss of GDP. FDI withdrowal, as compared to other sanctions, has rather limited effect on countrie-allies, while very strong effect on RF economy. By now, sanctions on investment are very fragmented. The US prohibited new investments into RF. G7, banned new investments in the energy sector and a few other specific sectors (present in G7 statement, but we didn’t identify respective legal document). Similar EU sanction extends only to the energy sector, and excludes peaceful atom and transportation of energy resources to the EU. Some international companies sized investment to RF voluntarily. Liechtenstein introduced ban on investment in Russia and in projects co-invested by Russian Direct Investment Fund. Last week the UK tax regulator withdrew the status of a recognized stock exchange from Moscow Stock Exchange. The U.S. registered a bill obliging public companies to disclose their ties to RF and other aggressor countries. Germany plans sanctioned Russians to report property in Germany.

Experts from SOFREP military outlet estimate the cost of war for RF at $900 mln per day, which gives ~68.4 bln over 76 days of war. This figure includes payments to servicemen, provision of ammunition, as well as the cost of repair of lost or damaged military equipment. For comparison, EU spends $ 800 mln a day for RF gas and oil during the war, according to KSE.

RF economy is able to withstand the blow of the 6th EU package, if it manages to reorient oil exports to Asia, even at prices not lower than $44 per bar — FT. The main potential buyers are in Asian countries. In particular, China’s independent refineries have already increased purchases, but major Chinese state traders are still avoiding oil imports from RF, fearing Western sanctions. However, for RF it is not easy to deploy oil flows to Asia, since the share of EU countries in RF oil exports was 60%, while China — 3 times less.

Preliminary estimate Q1 2022 growth by RF MinEcon: GDP + 3.7% YoY after a +5.0% in Q4 21. In Mar GDP growth slowed to 1.6% YoY in Mar, from 4.3% in Feb and 5.8% in Jan.

Russia continues to burn reserves. As of Apr 29, RF burned additional $14bn of international reserves over the week. In total, for the two month of the war RF reserves dropped from a historically max level of $643.2bn to $593 bn (-$50bn or ~8%).

Ruble continues to appreciate, but this doesnt reflect actual economic situation. From 7 Apr to 7 May, ruble strengthened against dollar by 19%, the RUB/USD XE fell from 82.6 to 67.4. On Mar 5, ruble for the 1st time since Mar 2020 fell below 68 RUB. Yet, RUB is not a freely converteable currency and both dollars and euro are largerly beyound acess for the RF due to sanctions. Therefore, such change in the exchange rate doesnt reflect actual situation.

RF budget is loosing oil&gas revenues. Oil and gas revenues of the RF budget in Apr turned out to be lower than expected by $1.9 bln (133.1 bln RUB). RF`s MinFin received $9.6 bln (665 bln RUB) vs planed $11.5 bln (798.4 bln RUB) in Apr. Forecast for May is almost 2x lower — $5.9 bln (414 bln RUB). As of the end of Apr, the price of Urals was at avg of $70.52/bar — RF MinFin. While the avr price of Brent was $105. The discount for Russian oil buyers was $34.48 or 33%. Compared to Mar the discount increased by 8 p.p

NWF won’t be replenished in 2022. Seizure of RF reserves, coupled with economic difficulties, led to the suspension of the budget rule. Starting from 2018 NWF was receiving oil&gas revenues generated from prices above $42/bar Urals. NWF ~$38 bln in foregin currency fell under sanctions and was frozen. Since 2023 NWF is planned to be replenished in rubles.

Industry. In Apr, the PMI index in the service sector of RF rose to 44.5 points from 38.1 points in Mar. Despite the growth, the indicator remained below the threshold of 50 points, which indicates a deterioration in the business environment. S&P Global Russia Manufacturing Purchasing Managers’ Index (PMI) posted 48.2 in Apr, up from 44.1 in Mar to signal the 3rd successive deterioration in the health of the Russian manufacturing sector. Although the rate of decline eased from March’s recent low, it was the 2nd-sharpest since Aug 2021. Output expectations were historically subdued amid concerns regarding the impact of sanctions on future demand and new orders.

RF MinTrade now allows counterfeit products of Apple, Microsoft, Playstation, Renault, Nissan, General Motors and others, which decided to stop deliveries to RF. RF Mintrade has released an updated list of companies, whose products (> 50 groups of goods) are allowed to be imported into RF without the trademark owner’s permission. On the other side, such legalization may lead to the rise of cost of electronics for the end consumer by up to 50% compared to the cost of goods before the start of the war — say analysts polled by Russian Forbes.

Oil & gas.

— Exports of crude oil from the US to the EU in Apr peaked in 6 years. The US oil miners sent EU buyers ~50 mb from major terminals in Texas and Louisiana. This is almost ½ of the total amount of oil sent abroad from the Gulf of Mexico.

— Greece might be helping RF to circumvent sanctions — in Apr, its share in the transportation of Russian oil tripled compared to 2021.

— Gazprom has sent a letter to EU customers that they can continue to pay for Russian gas without violating sanctions. A new document “clarifies the procedure” for payments for gas in RUB: foreign currency received from buyers is to be exchanged for rubles through accounts at the Russian National Settlement Center and excludes the possibility of any “third party” participating in the settlements (CBR), says Bloomberg.

— Coal. In Mar, the export of Russian coal to non-CIS countries decreased by 5% YoY, to 15.7 mln t. Russian coal exports to the UK (-50%) and Germany (-70%) dropped significantly. Meanwhile, deliveries to Poland decreased by only 6.3%. The EU as a whole in Mar purchased coal ~2 times less than a year ago (volumes decreased to 3 mln t). Along with this, deliveries to Asia also slightly decreased in Mar, to 7.3 mln t. China reduced purchases of Russian coal by 12% to 1.6 mln t. While exports to India increased 2.2 times, to 848.8K t, to Turkey — by 37%, to 1.5 mln t.

The US exports to RF in Mar 2022 fell by almost five times to only $101 mln since Feb. American car exports fell from $83 mln to $20mln in Mar, pharma products — from $60mln to $14mln, aircraft engines and luxury goods fell to almost zero. On the other hand, the sanctions temporarily spurred exports from Russia to the US (especially due to the growth in crude oil supplies — up to $363 mln), as the US authorities provided for a transitional period before their full entry into force.

Under the pressure of US sanctions, Chinese technology companies are closing down business in RF without making official statements. According to the Chinese GoV, China’s exports to Russia in Mar fell by a total of 27% compared to Feb. Exports of technological products fell particularly sharply — supply of laptops decreased by >40%, smartphones by ⅔, base stations — by 98%. Chinese tech giants such as Lenovo and Xiaomi are publicly refusing to do business with Russia, says WSJ.

Russians continue to steal wheat and agro production from temporary occupied territories. Russians have already “exported” ~500K tons of grain from the south and east Ukraine (a third of the reserves in these areas). Also, they have stolen ~100K tons of grain from the Luhansk region (equivalent to the volume of grain needs of the region’s residents for almost 3 years). They already tried to send 27k t of grain stolen in Ukraine to Egypt, but failed.

No more consulting in RF. The UK has imposed a ban on companies from the RF using the services of British firms in the areas of PR, accounting and consulting management. The US also joined such a sanction by banning U.S. citizens and companies from providing audit, consulting, and marketing services to Russian firms.

Russia’s ranking in the World Press Freedom Index has fallen again due to Kremlin censorship during the war in Ukraine. RF dropped from 150th place (out of 180) by five positions to 155, behind Zimbabwe, Sudan and Libya.3.8 mln people left RF in Q1 22 — FSB. For comparison: from 2000 to 2021, 5 mnl people left RF.

War in Ukraine made Russians even more conformist, but approval of Putin and Mishustin started to fall. 61% russian citizens noted that war RF against Ukraine rather rallied Russian society. 20% adheres to the opposite position — VTsIOM. Also they notice that for 67% Russia’s Victory Day is the most important holiday in the year. Approval of Putin’s activities decreased by 3pp to 79% (May 1 to Apr 24), approval of Mishustin is falling for two weeks in a row: -6 pp to 54% (May 1 to Apr 17) — FOM.

A rise in migration from RF is detected. 3.8 mln people left RF in Q1 22 according to FSB. For comparison: from 2000 to 2021, total 5 mnl people left RF. One bright examples, IT sector that is now experiencing “brain-drain”: in Mar, 50–70K IT-specialists left RF, 2nd wave of emigration in Apr could reach 100K. In its turn, RF MinTrans sees the risks of an outflow of Russian pilots abroad, 13% of which are currently idle. Interestingly, analysts claim that the Russian black market of bureaucratic services has shifted from migration patents to the issuance of international passports “on an urgent basis.”

SANCTION LOOPWHOLE. The US authorities are exploring ways to increase Russians’ access to the US refugee program — Politico. Such action sends a powerful signal of US generosity to ordinary Russians — some of whom could be threatened with treason for opposing the war — and undermine Putin’s oppressive regime by accelerating brain drain from his country.

Prepared by KSE Institute with Jacob Nell, ICU, Dragon Capital; With materials of NBU communication department media reports

#RF Economy Weekly. April 26, 2022 – May 2, 2022

– Russia’s economic recovery will take 10 years, Ukraine will need 5 years to do the same — S&P Global Market Intelligence. S&P forecast of the RF GDP dynamics suggests a fall of 11.1% in 2022; they expect the growth to be restored only in 2024 at the level of 1.6%. Experts` GDP forecasts for RF vary between 8.5% by IMF to 30%+ by IIF Chief Economist and KSE. RF MinEcon expects GDP to fall by 8.8%-12.4% in 2022 and grow 1.3% in 2023. CBR expects GDP fall of 8.0–10.0% in 2022 (12.5–16.5% fall in Q4 22). Inflation is expected above 18–23% in 2022 and 6.2% in 2023 (CBR, MinEcon)

– Default is not on the agenda — for now. RF made the latest payment of $636 mln almost reaching the end of the 30-day grace period using domestic reserves. RF schedule of payment on external debt assumed ~$4.7 bln payment in 2022 since RF foreign reserves had been largely “frozen”. ~ $731 mln was paid since then from “frozen reserves” based on the waiver to the US respective sanction. $1.58 bln was bought from (RF) investors in rubles. $636 mln were to be paid on April 4. The last transaction was rejected by the bank (supposedly, JPMorgan Chase) following the US Treasury decision.

– CBR decreased its key policy rate to 14.0% — this policy attempts to prevent an economic recession. At the beginning of the war, CBR acted in an orthodox way: the policy rate was increased from 9.5% to 20% to support the financial system and prevent uncontrolled price increases, as well as liquidity support to the banking system, was provided. On Apr 7 the rate was decreased to 17 %.

– Deficit budget. The deficit could reach 1.2% of GDP (expected previously for 2022) or ~6.4% of budget revenues (planned previously for 2022) — a shortfall in revenues is to be from NWF. Original budget 2022 assumed a surplus of 1% of GDP. At the same time, RF MinFin is afraid of the complete depletion of NWF and started preparing new budget rules to prevent this.

– RF Reserves. The international reserves decreased by $4bn over the week — to $607.1bn. Before that, reserves had already lost $38.8 bn.

– The trend for refraining from dividends` payment. RF GoV authorized Russian Railways and VTB Bank (through controlled votes in the supervisory board) to refrain from payments of dividends. Prior to that, CBR issued similar recommendations for all non-credit financial institutions and banks. With such measures Russia is trying to prevent outflows of capital to foreign stock-holders, substitute for investments withdrawn, and compensate for other gaps in the budgets of those companies.

– Labor market. RF MinEconomy estimated 250K workers to be idle, whereas Federation Council estimates are at the level of ~600K people that have “gone idle” or are at risk of being fired. Demand for labor in Mar decreased by 0.5% compared to Feb. Since the end of Feb, a sharp reduction in the volume of hiring began — Gaidar Institute for Economic Policy. Real wage is forecasted to fall by -18% in 2022 and -25.7% by 2024 (CEBR), -28.4% in 2022 (Sberbank Rossii). Unemployment is forecasted to grow up to 10% in 2022 (up to 4.3 mln of additional unemployed). Unemployment in RF in Mar 2022 remained at 4.1% (Rosstat).

– Self-sanctioning. Societe Generale’s stock price jumped 5% after it announced its exit from RF and incurring a $3.4bn write-down. This case is supported by the broader trend. During the war, companies staying in RF lost -5.5% in their share prices and international capitalization, as compared to those who suspended (+3%) or terminated (+4%) activity (KSE analysis of 600 public companies present in RF).

– Investments. Investment demand inside of Russia is declining due to high economic uncertainty — as can be incurred from the Nabibulina reports. Large projects. TotalEnergies, a major French energy company, began to exit RF. The company has written off $4.1bn invested in the joint project with NOVATEK «Arctic LNG-2». The French energy giant initially refused to cut ties with Moscow, despite other oil majors including BP Plc and Exxon Mobil Corp. and Shell Plc announcing their exit.

– Industry. The industrial production index in Mar grew by 3.0% YoY (+9.9% compared to Feb 22). Production of some industrial goods has decreased sufficiently: television receivers (-27%), lead accumulators for starting piston engines (-23%), fiber optic cables (-56%), refrigerators (-40%), washing machines (-44%), internal combustion engines (-54%), cars (-62%), passenger railway cars (-29%). However, increased production of other products (semiconductors (+49%), metal constructions (+17–23%), electric engines and generator sets (+12%), agro vehicles (+15–22%) signals the need to increase pressure on the RF.

– Oil & Gas. Rosneft didn’t manage to sell 6.5 mln t of oil during the tender, since demanded full advance payment in RUB. Gazprom halted gas supplies to Bulgaria (Bulgargaz) and Poland (PGNiG), since both companies refused to pay for gas in RUB. Against this background, gas prices in the EU rose by 21%, to $1350 per 1,000 m3. Since Feb 24, RF has earned €62bn on energy exports due to rising prices. RF sold €44 bln in energy to the EU, which is twice the total of the same period in 2021 (reflects the price increase and attempts to fill in the reserves in the EU). According to KSE estimates, during the war period, gas revenues exceeded oil revenues for Russia: this is triggered by RF oil-price discounts and very high gas prices.

– Gazprom. Over the last 4 months “Gazprom” gas production decreased by 2.5%, to 175.4 bln cubic meters, while gas exports fell by 27%, to 50.1 bln cubic meters. The average daily export of “Gazprom” in April decreased by 22% compared to March (5% decrease if compared to April 2021), which is a 3-month lowest value.

– Trade. Russian gas deliveries to China through the “Sila Sibiri” pipeline in the first four months of 2022 increased by 60% YoY. Overall Russian gas export to China is expected at the level of 48 bln cubic meters this year. According to the data of the GTS Operator of Ukraine, the nomination for pumping Russian gas to the region as of May 2 is 98.9 mln cubic meters, while the application for May 1 was 92.9 mln cubic meters (6.5% increase). After Poland rejected making payments in rubles, the reverse flow through the Yamal-Europe gas pipeline from Germany to Poland was at a maximum level of 31 mln cubic meters per day, which is exactly the volume that Poland previously received in Russia.

– War sociology. Share of Russians who had negative attitudes to EU rose from 27% to 64% during the year — VTsIOM.

– Demography. Birth rates in RF in Mar decreased by 9.9% YoY. Whereas, mortality increased by 5.1% from 191.3 to 201K people (doesn’t take into account war-related deaths).

– SANCTION LOOPHOLES. RF plans to organize the production of components for its military and dual-use products in CSTO countries, especially those that require foreign components.It is also planned to re-export Russian products to international markets under the guise of Georgian, Armenian and Azerbaijani products.

Prepared by KSE Institute with Jacob Nell, ICU, Dragon Capital; With materials of NBU communication department media reports

#RF economy weekly. April 19, 2022 – April 25, 2022

– Macro: RF estimates of GDP decline -9.2%, inflation – 22% (20% in Mar). Estimates of international organization range between 8.5% by IMF to 30%+ by IIF Chief Economist and KSE. April inflation is 17.62% (22% forecast for the year).

– As of April 21, 9,741 sanctions and restrictions imposed on RF. Iran, Syria, North Korea, Myanmar, Venezuela and Cuba in total – 9,670 restrictions over decades of isolation. Yet, RF restrictions are of smaller scope.

– Banks: In March, the outflow of retail deposits in foreign currency equaled $9.8bn. For Q1 22 – $20bn (or -22% from $93bn as of Dec 2021). The number of consumer loans issued in Mar has sharply dropped by -61.6% (compared to Feb). Most Russians are not planning to take a loan in the next 2–3 months, only 8% are considering such a possibility – NAFI poll.

– Since April 8 central bank of RF has been softening currency controls imposed on February 28 suggesting that there is no deficit of dollars and euros.

– RF statistics conceal: exports and imports, cargo turnover of Russian seaports, oil production and exports. Previously, RF central bank allowed banks not to publish financial reports from 31 Dec 2021 to 30 Sep 2022. In its turn, the CBR won’t publish on its website the reporting forms of banks until Oct 1, 2022. Also, CBR hid the list of participants in the financial messaging system (SPFS).

– Investments. The British Tax Service is revoking the status of the Moscow Exchange as a recognized stock exchange.

– Energy: In the 1st half of Apr, the average daily refining fell by 6%. Shipments of Russian oil by sea for the week fell by 25% – Bloomberg. India’s state-owned oil refining companies plan to buy as much oil as possible from Russia. Export of Russian coal in April collapsed by more than 20%, and since the beginning of the year, the decline was 9%.

– Divestment of Japanese, US and British companies from RF LNG projects poses a risk of China taking over more control of RF offshore oil and gas development, thus making Japan hesitate over withdrawal. Japanese trading company Marubeni Group (owns 30% of the Sakhalin-1; ExxonMobil owns 30% withdrawing from RF; the rest is owned by India and Russia) decided to withdraw from Russia. Yet, Japanese companies Mitsubishi and Mitsui decided to continue Sakhalin-2 LNG project (they own 22.5%; Shell owns 27.5% withdrawing from RF; Gazprom holds 50%). Chinese state companies have already announced plans to buy Shell’s stake.

– Italian energy company Enel and Danish Vestas have frozen wind farm project in Tatarstan due to sanctions.

– Aerospace: Rosatom and the Moscow Aviation Institute to produce new electric air transport, incl. unmanned aerial vehicles (potential military). The Novosibirsk Aircraft Plant employs 1.6 K people and invests $33.6 mln in construction of heavy stealth drones Okhotnik.

– Self-sanctioning: At least 206K employees of international companies continue to be on payroll (FT).

– RF allows parallel import for 200+ brands, including Tesla and Jaguar, technology brands Apple and Samsung, XBox and PlayStation consoles, etc.

– Industry. The production index in RF in Mar increased by +5.7% (against Mar 2021), while the demand index decreased by -2.2%. The greatest decline in demand is observed in high-tech industries (-16.7%). On Apr 20, RF PM stated that total cost of introduced support “packages” ~$31.6bn.

– Cars. Sales of new cars in Russia may be reduced by 50%. Russia is to allow production of cars with engines of “Euro-0”. German tire manufacturer Continental has resumed production at the Kaluga factory (due to the risk of criminal prosecution by management in the RF).

– Metallurgy: Iron and Steel: Russian metallurgists estimate a decrease in sales in 2022 at 17 mln tons or 23% decline or more (metallurgy is 3.7% of Russia’s GDP, $50 bln; ~72 mln tons sales).

– Titanium: Crimean Titan resumed work after a 4-month break. They want to create a chemical cluster with Kazakhstan.

– Gold: The London Bullion Market Association has suspended the Good Delivery status of Russian suppliers – six Russian refineries (Mar 2022), as well as 3 banks. LBMA accounted for up to 88% of Russian exports or $15.4 bln in 2021. To circumvent LBMA self-sanctions, Russian gold producers can use the refining scheme in other countries (Kazakhstan, India, China).

– Wood: The export of unprocessed wood from RF in Q1 22 dropped by 54% to 1.4 mln m3 – RF Federal Customs Service. Decrease in exports of sawn timber in Q1 22 is also observed. Finland has closed the border crossing with RF and froze all plans for its development, through which timber was transported.