- Kyiv School of Economics

- About the School

- News

- One Year of War: Sanctions Impact Assessment and Action Plan For 2023

One Year of War: Sanctions Impact Assessment and Action Plan For 2023

6 березня 2023

Executive Summary

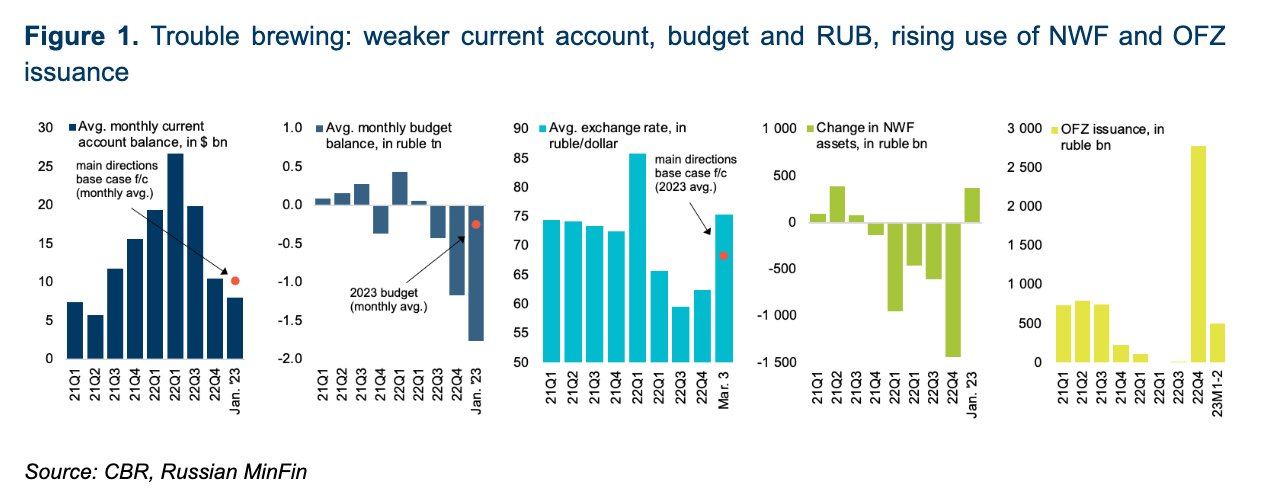

Sanctions clearly had a major impact on Russia: nearly triggering a financial crisis, squeezing oil revenues, and isolating Russia from the advanced economies. So far, they did not have the desired result of stopping the invasion, but their impact is becoming increasingly visible. In particular, the deep discount on Russian oil and the collapse in European purchases of Russian gas have eroded oil and gas revenues, which shielded the country from the effect of sanctions last year. As a result, Russia’s economy has come under increasing pressure: the trade balance has narrowed sharply, the ruble has fallen 20% since November, and the deficit has widened sharply, forcing Russia to step up domestic borrowing and use of the oil fund.

Building on these growing signs of fragility, we propose a comprehensive package to help end the war and secure a just and durable peace. This package has three pillars:

• Constraining Russia: This pillar squeezes Russia’s oil and gas revenues further, in particular by ratcheting down the crude oil price cap to $30/bbl, together with enhanced enforcement and similar reductions to the product price caps. At this oil price, Russia will be constrained by its weak currency and banks, and wide deficit. To reinforce the impact, we propose Europe end direct purchases of Russian gas – and Japan, South Korea and Taiwan ban purchases of Russian oil, LNG and coal, with targeted exemptions if required. We further propose a price cap on nitrogen fertilizer exports, and a ban on additional goods, such as diamonds, uranium, iron ore, timber, steel products, and fish.

• Isolating Russia. This pillar imposes more systematic and comprehensive sanctions, underlying that there will be no normal relations with Russia until it stops trying to redraw borders by force and withdraws from Ukraine. We propose broad sanctions on major companies in the oil and gas sector, now that the West is no longer dependent on Russian supply, and on the main metals and mining companies that supply the Russian military, while tightening financial sanctions, sanctioning Gazprombank, and requiring exit of the Western banks that remain in Russia. It sanctions every legal entity in the Russian military-industrial complex and every senior Russian official, and imposes a licensing regime on all high-technology exports.

• Making Russia Pay. This pillar confiscates frozen Russian assets and starts to disburse them this year, under international governance and with transparent reporting, to pay compensation to Ukrainians killed, injured and displaced by Russia’s invasion, and to finance Ukrainian reconstruction. As well as being just, this funding – including $300 bn in frozen central bank assets – provides funding for Ukraine, which may need exceptional funding of $40-50 bn pa in wartime, sufficient for the duration of any war, and thereby undermines any Russian prospect of being able to “outlast” Ukraine.

Mechanically, we estimate that this package will reduce Russia’s exports by a further $70 bn, largely eliminating Russia’s current account surplus; widen the budget deficit from 6% to 8-9% of GDP, consuming all liquid assets in the oil fund this year, and reduce growth by a further 2-3% of GDP from a 5% contraction to a 7-8% contraction. This economic and fiscal deterioration will put Russia’s economy and budget into a fragile and constrained state, with high risks of a currency collapse and bank runs, unless policy is tightened aggressively. And tighter policy – higher rates and fiscal consolidation – will itself constrain Russian action.

Sanctions have had a major impact

Since Russia’s invasion of Ukraine on February 24th 2022, an unprecedented range of sanctions have been imposed on Russia which have had a major impact. In particular:

• Near financial crisis. In March-April 2022, the freezing of the assets of the central bank and sweeping sanctions on Russian financial institutions, aided by the shock of the invasion, triggered a surge in demand for liquidity in Russia, leading to withdrawals, which threatened financial stability, and a sharp fall in the ruble, which threatened monetary stability. The central bank had to hike rates to 20% and impose capital controls to control the situation – and was only then able to ease rates and controls before the economy was heavily damaged because of Russia’s record oil and gas revenues.

• Squeeze on oil revenues. Sanctions and the threat of sanctions have driven a wide discount on Russian oil, with the main benchmark Urals trading at a discount to Brent of $23/bbl on average, which has reduced Russian oil revenues by $64 bn over the year of Russia’s invasion.

• Loss of the European energy market. Over 2022, in response to the war and Russia’s cutoffs and threats, Europe has effectively ended its dependence on Russian energy. In 2021, Russia supplied Europe with 46% of coal, 27% of oil, and 41% of gas. Now, it is supplying no coal, 5% of oil, and 8% of gas, while gas prices are back to normal ranges, and gas in storage should exit winter at a record high. The IEA estimates Russia’s loss of the European energy market will cost it $1 tn by 2030¹.

• Growing isolation from the advanced economies. Russia is being systematically excluded from the advanced economies, with leading companies pulling out of Russia, skilled experts leaving Russia, and some sectors such as aerospace and automotives, dependent on advanced economy technology, running at a fraction of capacity. Russia is becoming a commodity exporter to emerging markets, and now has little prospect of convergence with the advanced economies.

But sanctions have not achieved their ultimate goal yet.

The invasion continues. Despite defeats in Kyiv, Kharkiv and Kherson, Russia has expanded its war aims, announcing the annexation of four Ukrainian regions – none of which it fully controls –, expanded its military through mobilization, expanded its range of weapons, including through intensive use of Iranian drones, and attacked a wider range of targets, including with targeted attacks on the Ukrainian power network.

Some have called for no more sanctions to be imposed, saying that they are not working.

We disagree. Sanctions have had a significant impact. They contributed to a near financial crisis, squeezed oil revenues, deprived Russia of its largest energy market and the associated leverage, and they are isolating Russia from the advanced economies. Russia contracted last year, when oil exporting peers such as Saudi Arabia grew strongly. Still, Russia’s contraction was less than originally expected by us and many others. We ascribe Russia’s outperformance and initial resilience in the face of sanctions to record oil and gas revenues, which backstopped its economy. Now that this shield has been weakened – partly by a more balanced global energy market but to a larger extent by sanctions on energy and Europe largely ceasing to buy Russian gas – Russia’s vulnerabilities are re-emerging, with a widening deficit and a weakening currency, which are starting to constrain Russia’s ability to fund its war (see Figure 1).

Sanction Priorities 2023

Our contention is that tougher sanctions will shorten the war by undermining Russia’s capacity to finance the military effort – and, most importantly, in a way which causes less death and destruction. If you want peace, sanction Russia harder. To this end, we propose a package of sanction measures to constrain Russia, support victory and bring peace, defined as a just and durable end to the war.

The most important measure is to ratchet the oil price caps down. This is the key. Oil and gas is the lifeblood of Russia’s economy – nearly two-thirds of exports and over 40% of federal budget revenues. Moreover, Russian oil is some of the cheapest in the world to produce – the cost of production in Russia is $10-15/bbl² – so the price is mainly rent. In other words, the price cap can be squeezed lower and Russian oil revenues reduced without materially undermining Russia’s incentive to supply. We propose to ratchet the oil price cap down by a total of $30/bbl in steps of $10/bbl every 2 months to $15/bbl on low value products, such as fuel oil, $30/bbl on crude oil, and $70/bbl on high value products, such as diesel. If robustly enforced, this will reduce Russia’s export oil price by at least $20/bbl from the current level (currently ~$50/bbl, according to the Russian MinFin) and oil revenues by at least $50 bn over the next year.

At oil prices below $40/bbl, Russia is financially constrained – facing a very wide budget deficit, a chronically weaker currency, and a live risk of a financial crisis – and will face a dilemma. To stabilize the ruble and prevent a return of high inflation at low oil prices, rates will have to rise strongly and financial conditions tighten. But to head off bank runs and to enable the banks to keep buying bonds and finance the deficit, the CBR will have to give banks additional liquidity and support, and keep financial conditions easy.

Our package has three objectives:

• Constrain Russia: in particular, by further reducing export revenues, so Russia is constrained by a weaker currency and a wider deficit. In addition to the oil price cap ratchet, we propose – now that Russia is a marginal supplier of gas to the European market and European gas storage is at a record high – to end Russian gas pipeline deliveries to Europe except through Ukraine, and end Russian LNG deliveries to Europe. We also call on the East Asian democracies – Japan, South Korea, Taiwan – to follow Europe’s lead and stop buying Russian oil, LNG and coal, with targeted exemptions if needed. In addition, we would extend the price cap to Russian exports of fertilizer, and extend export bans to mined uranium, diamonds, fish, iron ore, timber, and steel products.

• Isolate Russia: Tighten the full range of sanctions – military, corporate, financial, technological, personal, sporting – to reinforce the message to Russia that costs will rise the longer Russia persists with its attempt to redraw borders by force. We propose a more systematic approach to sanctions, including: a) now that Europe is no longer dependent on Russian supply, full sanctions on all Russian oil and gas companies, b) full sanctions on all metal and mining companies who supply the Russian military; c) in finance, tightening the sanctions regime, in particular by sanctioning Gazprombank and giving the remaining western-owned foreign banks – notably Raiffeisen and Unicredit – until year end to wind down their Russian operations; d) full sanctions on every separate legal entity in the Russian military-industrial complex, to frustrate imports of components for Russian weapons; e) a licensing system for all high-technology exports to Russia or to Russian companies; f) personal sanctions on senior Russian officials, including officials at state-owned enterprises, and on Russian officials working in occupied Ukrainian territory, including Rosatom officials, central bank officials and Rostelekom officials; g) a reinforced ban on any participation by citizens of Russia and Belarus in the Olympics or any other international sporting event until the war is over.

Make Russia Pay: to make sure that Russia takes responsibility and pays for the death, suffering and destruction it has caused, we propose to start confiscating seized Russian assets and using them, under enhanced international governance and reporting, to pay compensation to injured and displaced Ukrainians and to fund the reconstruction of Ukraine. This disbursement will also provide a backstop for the Ukrainian economy and currency for the duration of the war.

¹ See WEO 2022, and related 27/10/22 tweet by Christophe McGlade, Head of Energy Supply at IEA.

² The Rosneft 2021 annual report reports unit opex at $2.7/bbl and unit capex at $7.6/bbl. Rosneft accounts for just under 40% of total Russian oil production.