- Kyiv School of Economics

- About the School

- News

- Russia Macro Update: The Price Cap Fundamentally Works

Russia Macro Update: The Price Cap Fundamentally Works

24 October 2023

Reported prices for Russian crude oil have risen in recent months along with global prices—but realized export prices are lower than what the International Energy Agency and others suggest. The reason for this—based on analysis of the price distribution for exports from Baltic Sea ports—is that the G7/EU price cap is now partially being complied with. Separate segments of the market now essentially operate under different rules—one segment that reflects reported spot market prices and another where Russia is forced to sell under the $60/barrel threshold in order to secure transport capacity from G7/EU service providers. Thus, the price cap regime appears to be fundamentally working as intended thanks to improved compliance. And if certain improvements are made to the existing system, it could further step up pressure on Russia and bring the war in Ukraine to an end.

Russia may be earning less from oil than we think. The International Energy Agency’s recent estimate of a surge in Russia’s oil export revenues in September has raised concerns over the effectiveness of the energy sanctions regime. And, indeed, with global oil prices rising, the country is likely earning more from its exports than in H1 2023. However, the situation may be somewhat less dire than it looks at first glance.

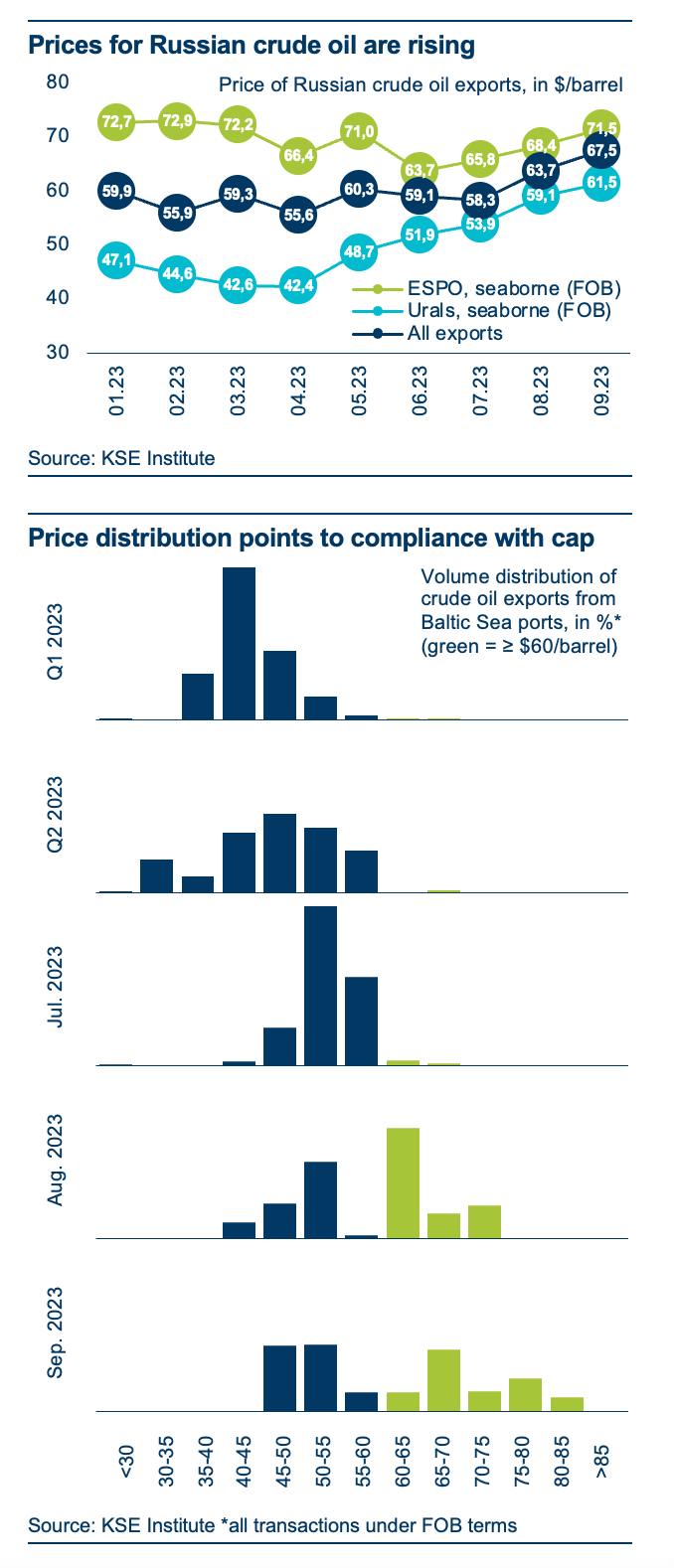

Average export price of $67.50/barrel in September. Russian trade data shows that the average realized price of crude oil exports has risen in recent months—with seaborne Urals at $61.50/barrel and seaborne ESPO at $71.50/barrel (top chart). While this is higher than the price cap’s threshold, it is much lower than the IEA’s latest oil prices—of ~$71/barrel for Urals and $79/barrel for ESPO, respectively, in August.

Price distribution shows the price cap is working. What is more, a closer look at the distribution of export prices in the Baltic Sea provides evidence for partial compliance with the price cap. In August-September, a bifurcation in the market’s price structure appears to have emerged—with one segment (48% of volume) priced below $60/barrel (cargoes shipped using G7/EU services) and another one (52%) at negotiated market prices (shipped with the shadow fleet; bottom chart).

Oil market fragmentation drives price differences. This development may also be behind the recent divergence between realized export prices reflected in Russian trade data and IEA estimates, which had historically been aligned closely. The prices that the IEA and other agencies are providing most likely only reflect negotiated spot prices as reported by market participants, but not cargoes sold at the capped price. Importantly, this effect only materialized after Urals prices rose above $60/barrel in recent months.

The price cap appears to work, but improvements are needed. With evidence for partial compliance emerging, it is now clear that the sanctions regime can work. But changes are needed: (1) By requiring adequate insurance for passage through EU territorial waters, Russia’s ability to circumvent the price cap by using a sanctions-proof fleet can be significantly curtailed—and environmental risks addressed. (2) By strengthening the attestations system (e.g., via a whitelist of traders permitted to provide pricing information) and regular audits, including of inflated costs, compliance can be improved markedly.

Benjamin Hilgenstock, Senior Economist