- Kyiv School of Economics

- About the School

- News

- Russia Macro Update: War and Sanctions Deplete the NWF

Russia Macro Update: War and Sanctions Deplete the NWF

23 January 2023

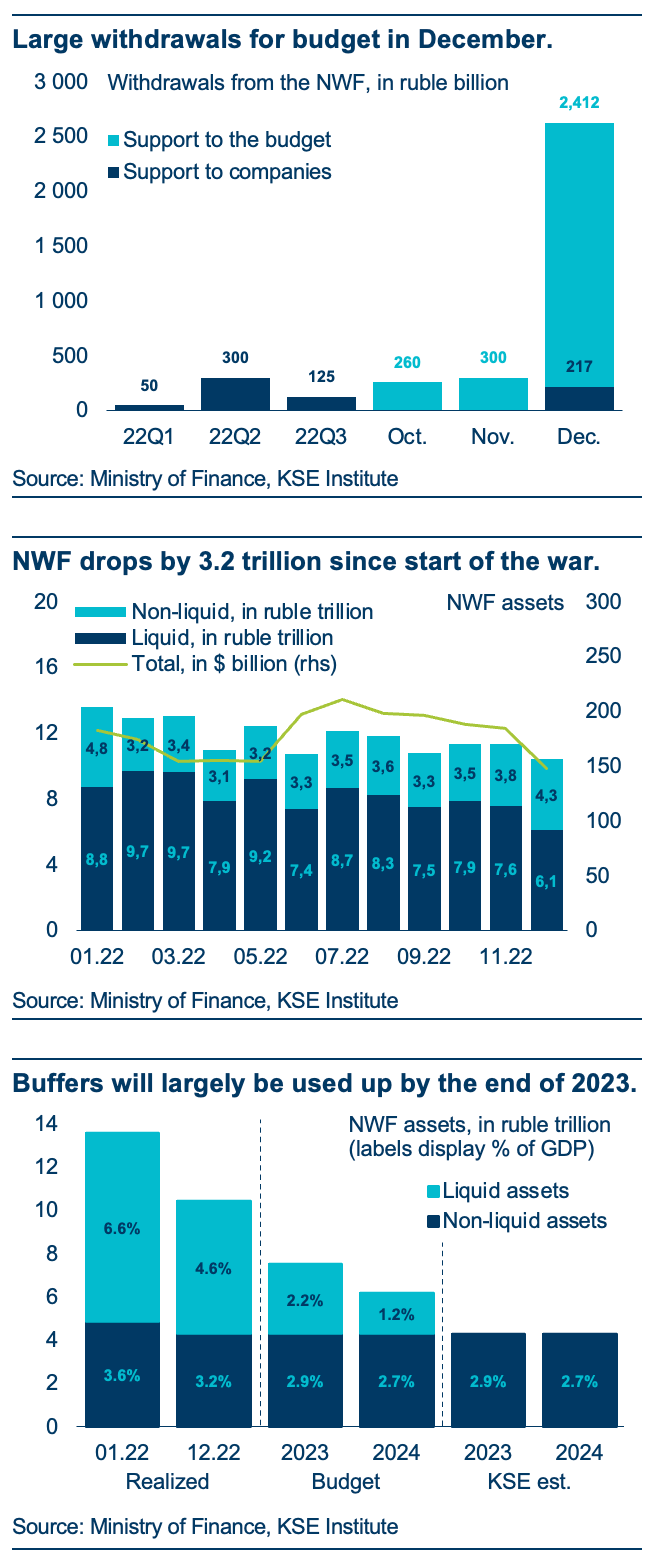

Data released by the Russian Ministry of Finance shows that the war and international sanctions have already had a meaningful impact on the country’s sovereign wealth fund (NWF). In December alone, more than 2.4 trillion rubles were used to finance a record-high budget deficit, bringing full-year support to the budget as well as struggling companies to 3.7 trillion. Since the start of the war, NWF assets have fallen by almost 25% to 10.4 trillion (or $148.4 billion)—with further withdrawals of 4.2 trillion rubles planned in 2023-24. As more than 40% of the fund consist of non-liquid assets, which cannot easily be repurposed for the budget, the fund would largely be used up by 2024 in this scenario. In our view, however, significantly larger fiscal financing needs will lead to the depletion of the NWF before the end of this year. Importantly, the NWF has sold-off 83%, or $55 billion, of high-quality assets—those denominated in G7 currencies—in 2022Q3-Q4, leaving mostly gold and yuan.

Record withdrawal from NWF in December. Russia spent more than 2.4 trillion rubles (or $35.1 billion) of its sovereign wealth fund’s assets to (partially) finance a record-high deficit of 3.9 trillion in the final month of the year according to the Ministry of Finance. This brings total withdrawals from the NWF, for budgetary support and assistance to struggling companies, to 3.7 trillion for 2022 (top chart)—or roughly 2.6% of GDP.

NWF drops by 3.2 trillion rubles. Since the start of the war, Russia has lost around 1/4th of the fund’s total assets in ruble terms, which now stand at 10.4 trillion rubles ($148.4 billion or 7.8% of GDP). Importantly, a significant share of the remaining holdings are not liquid and, thus, cannot easily be used for further fiscal support. At the end of 2022, liquid assets accounted for only 6.1 trillion (4.6% of GDP, middle chart).

Further depletion of buffers going forward. As of now, the budget law allows for an additional 4.2 trillion rubles from the NWF to be used for fiscal financing in 2023-24. But deficits will likely be much larger than authorities assume—possibly around 6% of GDP this year and next—and pressure on the NWF grow.

Liquid NWF assets largely used up this year. The Ministry of Finance expects total assets to decline to around 6.6 trillion rubles (or 3.6% of GDP) by the end of 2024, with the liquid portion of the NWF declining to 2.3 trillion (1.4% of GDP). In our view, however, lower oil prices will significantly weigh on fiscal revenues and, thus, sharply increase fiscal financing needs. As a result, we expect that liquid assets will largely be used up before the end of 2023 (bottom chart).

Asset quality is deteriorating. Over 2022Q3-Q4, the NWF lost a significant share of its high-quality assets—including 80% of euro- (-$42 billion) and the entirety of pound- and yen-denominated ones (-$13 billion). This means that remaining liquid assets overwhelmingly consist of yuan ($45 billion) and gold ($30 billion).

Tough decisions on government spending loom. With costs of the war rising and revenues under pressure, depletion of the NWF will force authorities to cut non-military expenditures. At this critical junction, targeted new or expanded sanctions could have a strong impact on Russia’s ability to continue the war.

Benjamin Hilgenstock, Senior Economist