- Kyiv School of Economics

- About the School

- News

- Russia Macro Update: Fiscal Picture Continues to Worsen

Russia Macro Update: Fiscal Picture Continues to Worsen

16 January 2023

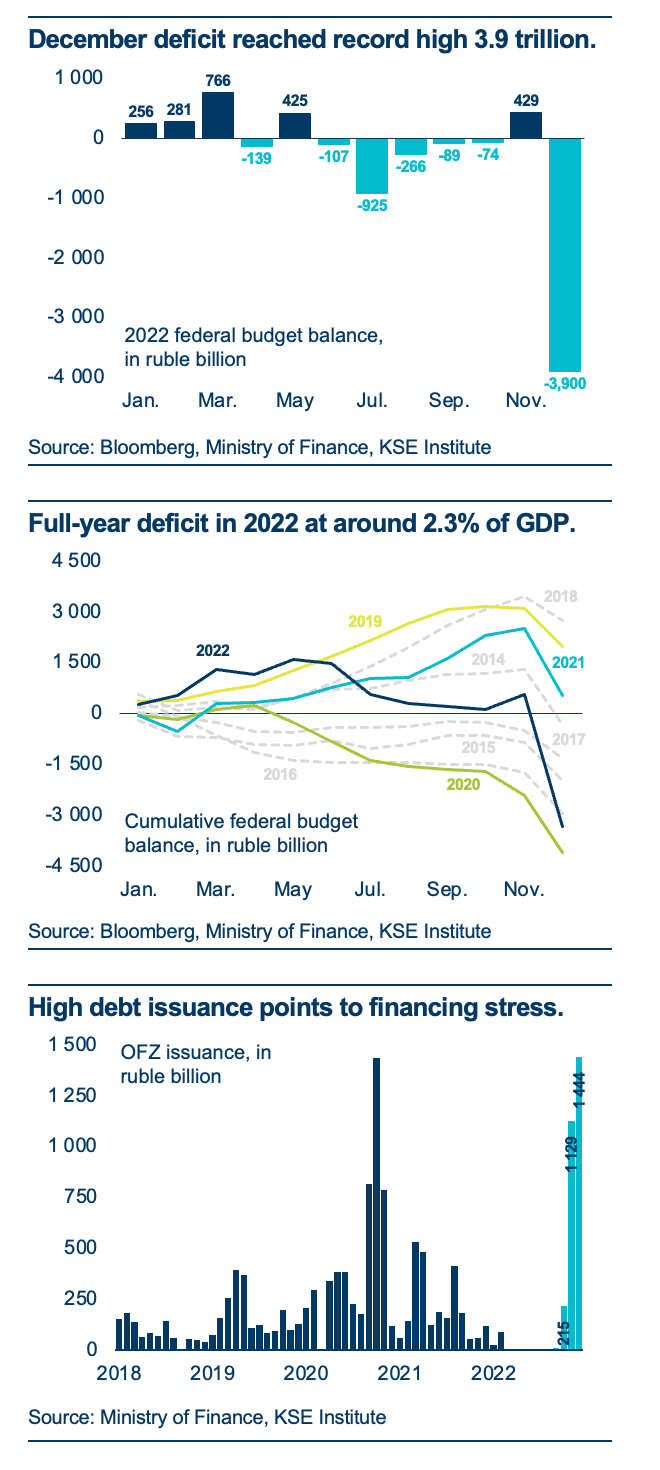

The Russian federal government posted a record deficit of 3.9 trillion rubles in December. As a result, the full-year balance reached -3.3 trillion or around -2.3% of GDP in 2022—a shift of more than 5 trillion compared to pre-war estimates and clear indication that the war and sanctions are having a meaningful effect. There is also evidence for rising financing stress, including elevated issuance of domestic debt in the fourth quarter, reliance on up to 2 trillion rubles from the NWF, and CBR sales of yuan-denominated assets to cover oil and gas revenue shortfalls. We expect the deficit to widen considerably this year, to 6% of GDP, as the economy contracts and the external environment turns less supportive. At this critical junction, additional restrictions on oil and gas exports—notably, a lower price cap—could exacerbate fiscal pressure and constrain Russia’s war effort.

Record-high deficit in December. Russia’s Ministry of Finance announced this week that the federal government deficit came in at 3.3 trillion rubles in 2022—or roughly 2.3% of GDP. As the cumulative balance over Jan.-Nov. stood at 557 billion, this means the Dec. deficit was a record 3.9 trillion (top chart).

Five trillion-ruble shift from pre-war plans. Before the invasion, authorities had projected a surplus of 1.3 trillion; thus, fiscal accounts, in fact, deteriorated by over 5 trillion. Elevated expenditures due to the war, the recession’s effect on tax revenues, and lower oil and gas exports contributed to this, in particular in H2. Large one-time contributions from Gazprom—1.2 trillion in a special tax and over 600 billion in dividends for H1 2022—were not enough to offset these factors.

Exceptionally high December spending. A sizeable deficit in the final month of the year is not unusual but Dec. 2022 represents the largest single-month in the past ten years (middle chart). This was driven by sharply higher spending of close to 7 trillion rubles.

Government funding under pressure. Financing stress is clearly growing. New domestic debt (OFZ) issuance was close to 2.8 trillion rubles in Q4 2022 (bottom chart). Importantly, a large share was issued at floating rates, which will drive up debt service costs in the medium term. These trends continued into 2023, with auctions on January 11 only generating 35 billion in net proceeds (of the 800 billion planned for Q1 2023). Yields also crept higher to 10.3-10.4%—implying upside risk to the current 7% CBR policy rate.

Macro buffers are being used up. To finance the deficit, the government also tapped the National Welfare Fund for 2 trillion—with more to come this year and beyond. In addition, the CBR announced that it would sell 54 billion rubles in yuan-denominated assets to cover oil and gas revenue shortfalls.

Russia facing growing fiscal constraints. Fiscal problems will only grow this year as a deeper contraction and less favorable external environment put pressure on revenues while the war drives up expenditures. The country’s capacity to finance the war will be hindered by the challenge of financing a growing deficit (of ~6% of GDP). Further actions—notably, a lower oil price cap—would exacerbate this and help restrain Russian aggression.

Benjamin Hilgenstock, Senior Economist