- Kyiv School of Economics

- About the School

- News

- Descriptive outlook of trade sanctions

Descriptive outlook of trade sanctions

08 August 2022

Prepared by Oleksii Hamaniuk (PhD student, University of Bonn), Roman Koshovnyk (PhD student, University of Pittsburgh), Dmytro Pokryshka (KSE Institute)

05.08.2022

Executive summary:

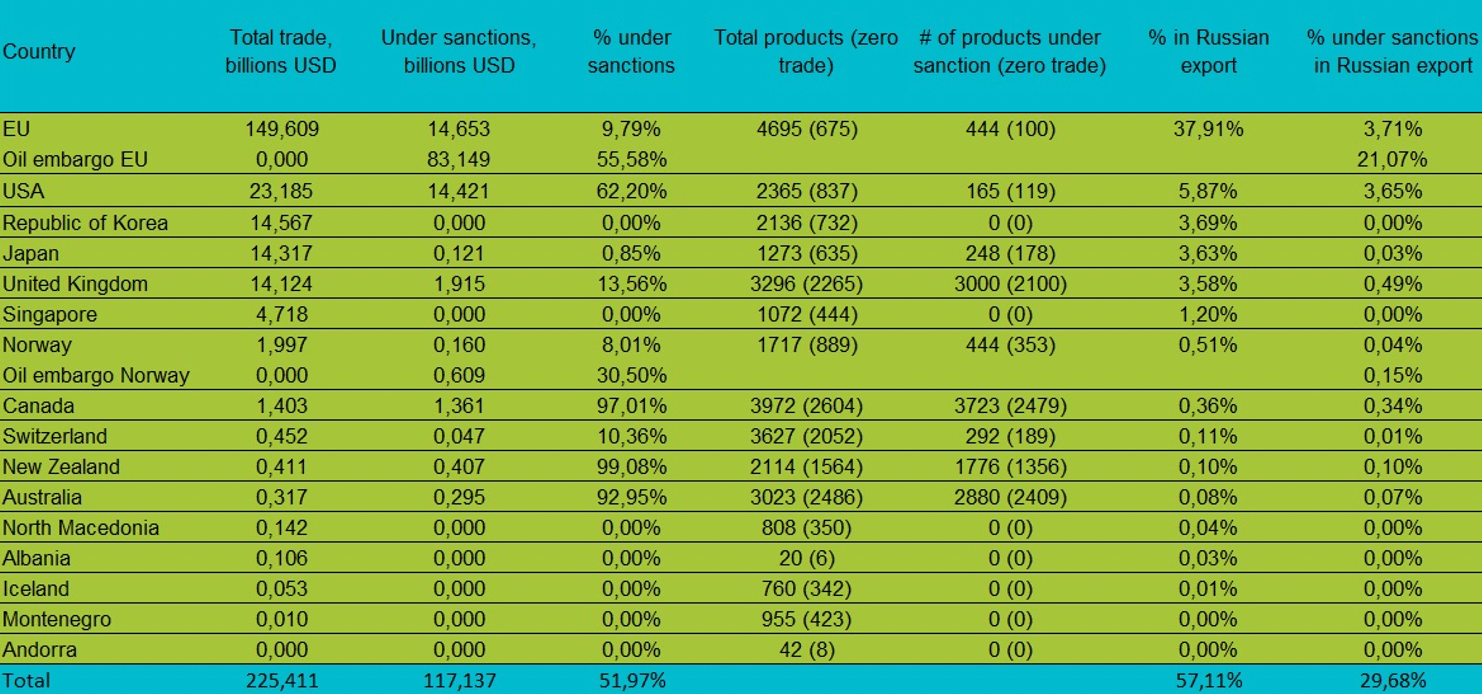

We estimated coverage of sanctioned exports to and imports from Russia. We used the trade data of 2019 for all computations, as some countries have not reported the trade data for 2021 yet, while 2020 was a shock year (pandemic). We use the trade data (imports and exports of Russia) from World Integrated Trade Solutions[1] and the data on the trade restrictions imposed by the partners of Ukraine from the website Global Trade Allerts[2].

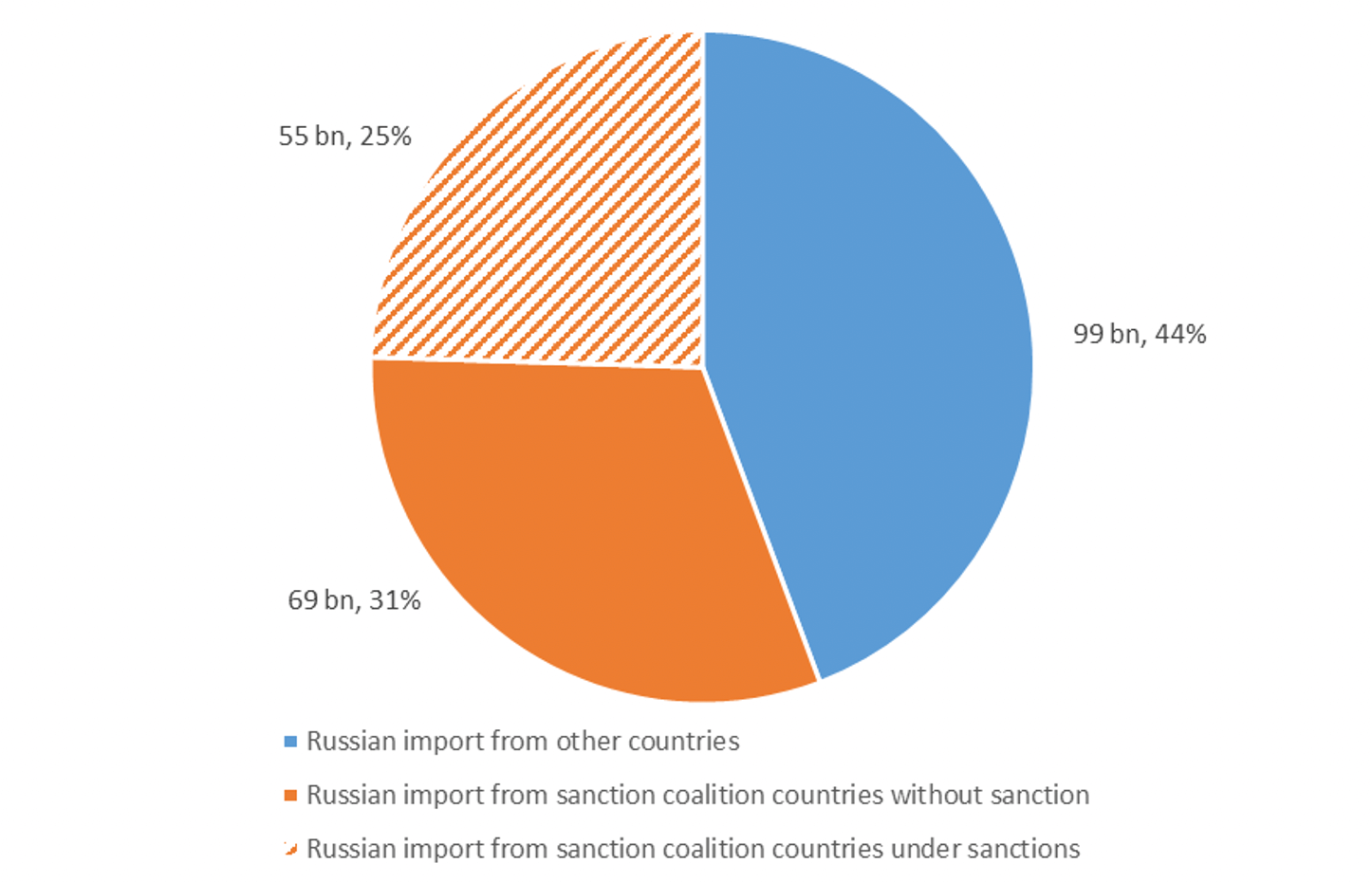

As of 21st of July, countries from the sanction coalition[3] have imposed major export sanctions[4] on 25% of total Russian imports which cover 55 billions USD. Major import sanctions[5] cover 8% of Russian exports or 33 billions USD, while oil embargo from the EU and Norway will add 21 p.p. or 84 billions USD in coverage. The highest nominal sanctioned exports were imposed by the EU (40 billions USD in value, or 42%) and the highest share of sanctioned exports were imposed by Japan (91%), UK (63%), Canada (62%). The highest nominal sanctioned imports were imposed by the EU (15 billions USD, or 10%), while the oil embargo will add 83 billions USD (55 p.p.). The highest share of sanctioned imports were imposed by New Zealand (99%), Canada (97%) and Australia (92%).

While the sanction coalition imposed a significant economic pressure on both Russian exports and imports, there is still room for increasing the cost of unprovoked and unjustified Russian war. EU, as the main trade partner with Russia, can increase the sanction coverage the most. However, other countries from the sanction coalition could also cover a significant share of Russian trade together. For instance, non-sanctioned imports from Russia to the United Kingdom, Republic of Korea, Japan and Singapore together give more than 11% of total Russian exports.

At the same time, sanction coalition countries should stick to their commitments about cutting trade with Russia and should impose supervision on exports to/imports from Russia via other countries and, if necessary, impose secondary sanctions.

Major import sanctions

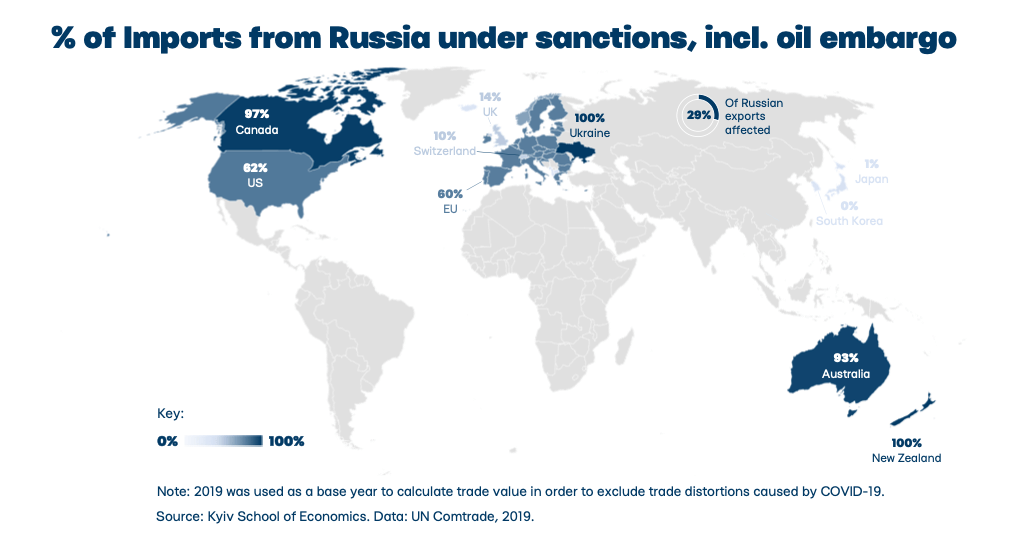

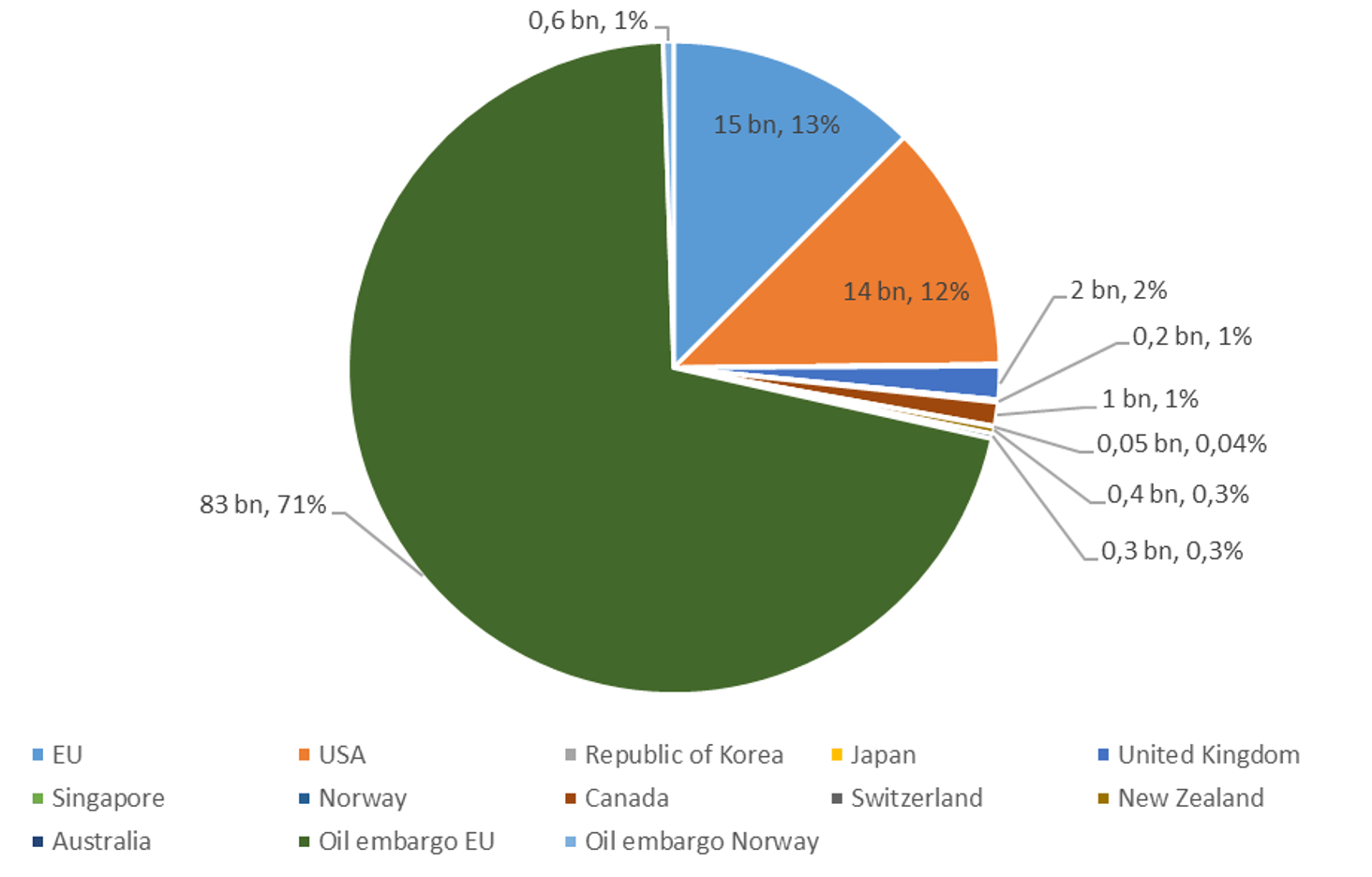

The sanction that gives the highest coverage of the import from Russia is the oil embargo from the EU[6] that will come into force next year. It will compose 71% of Russian exports under major import sanctions. (Figure 6)

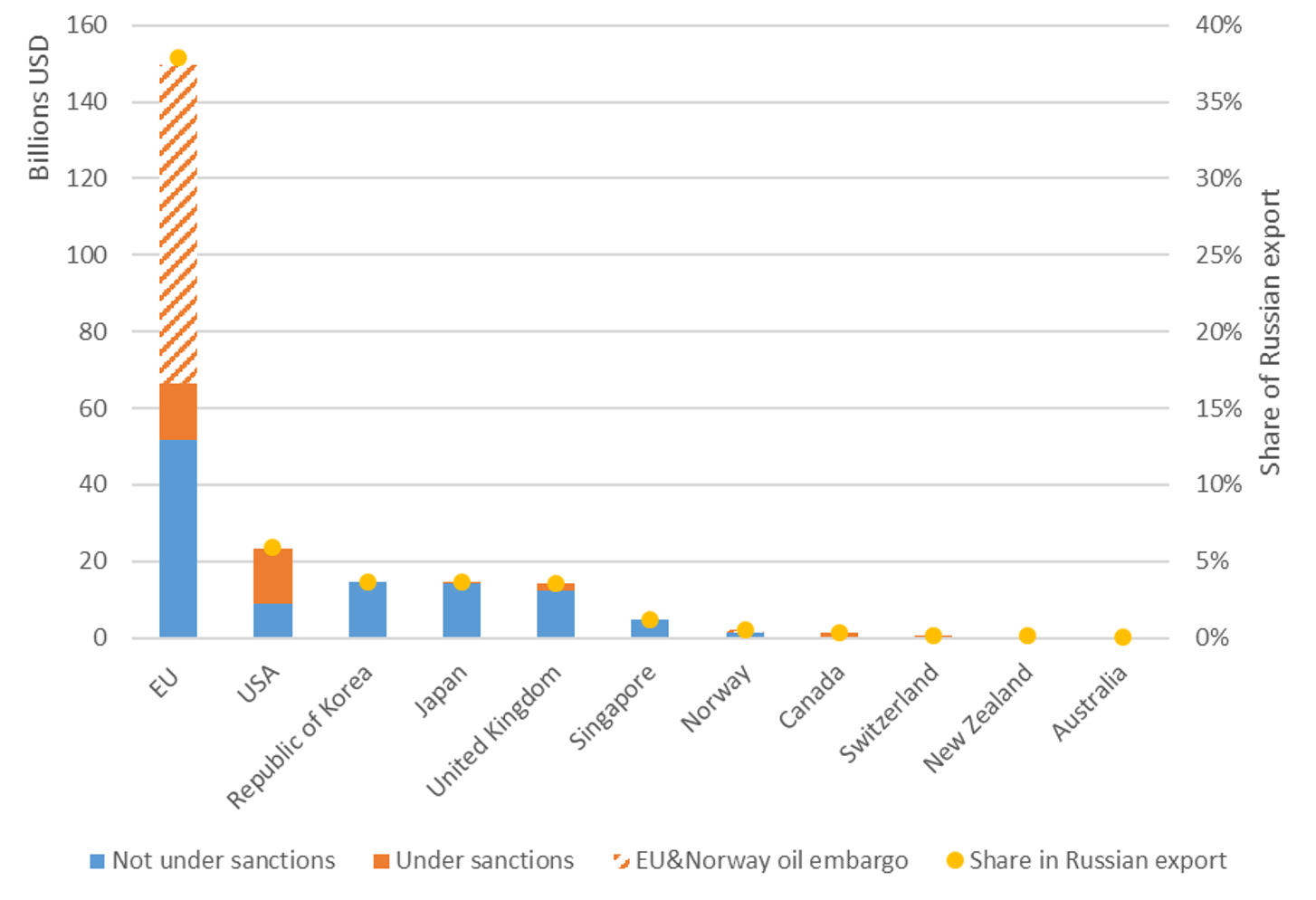

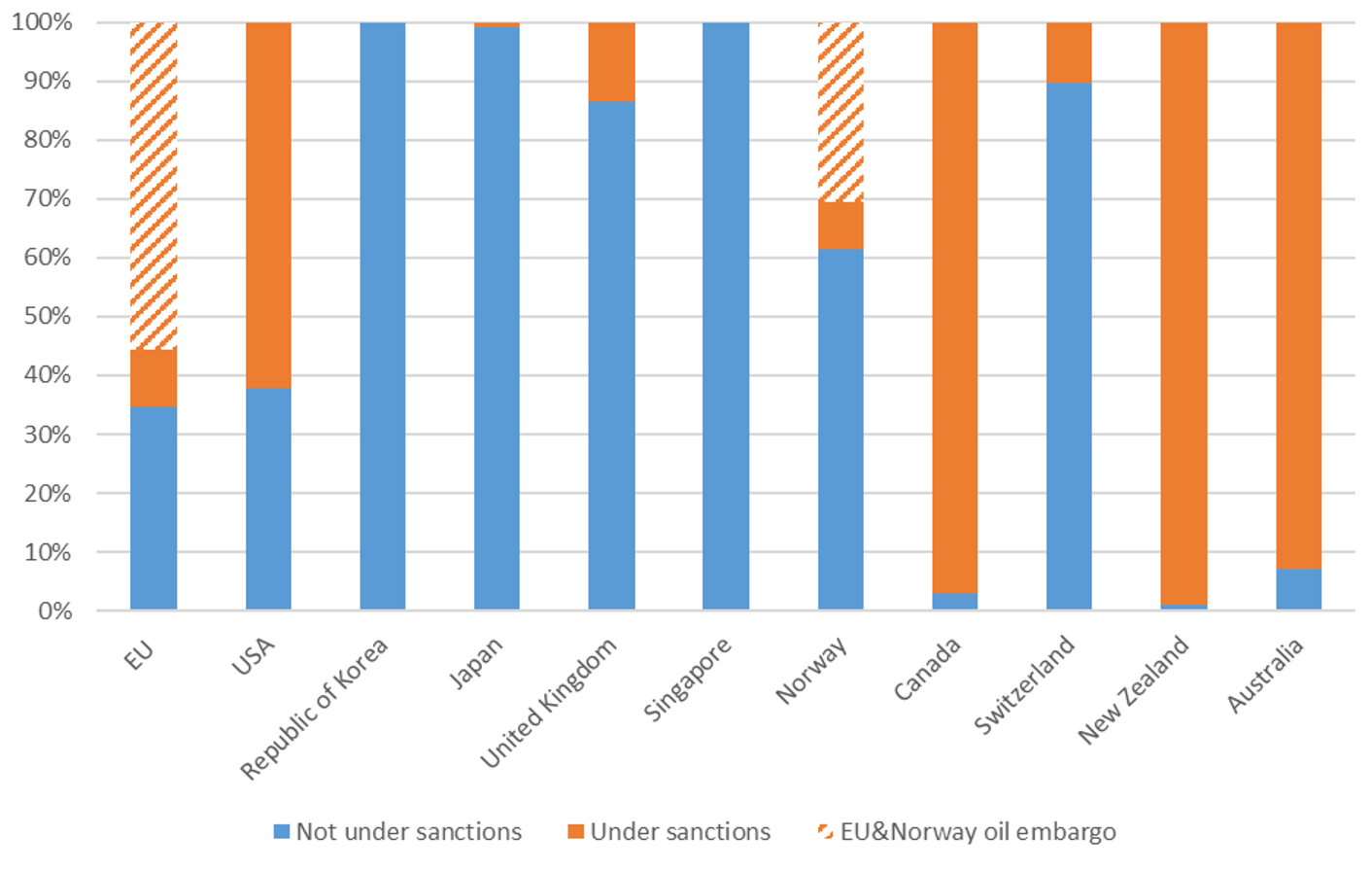

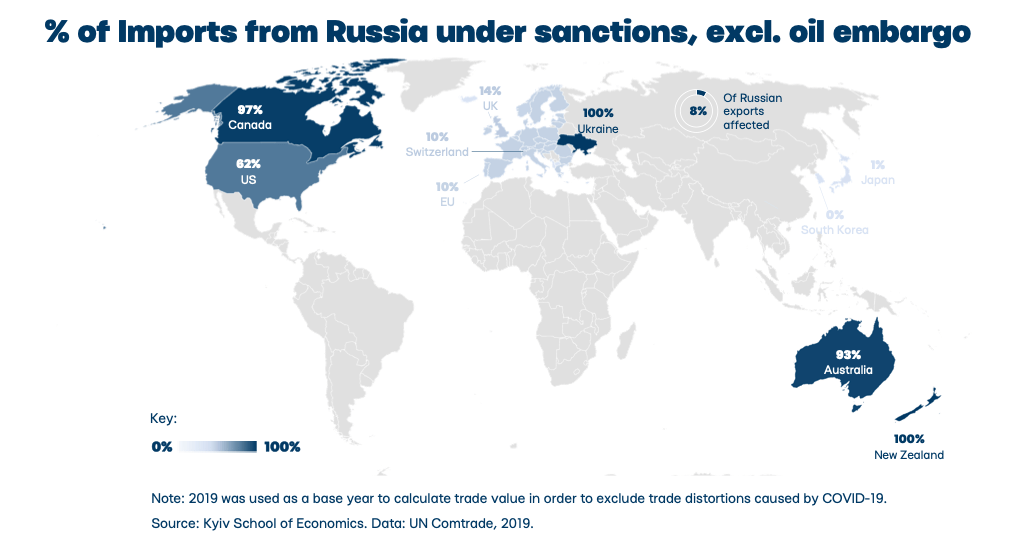

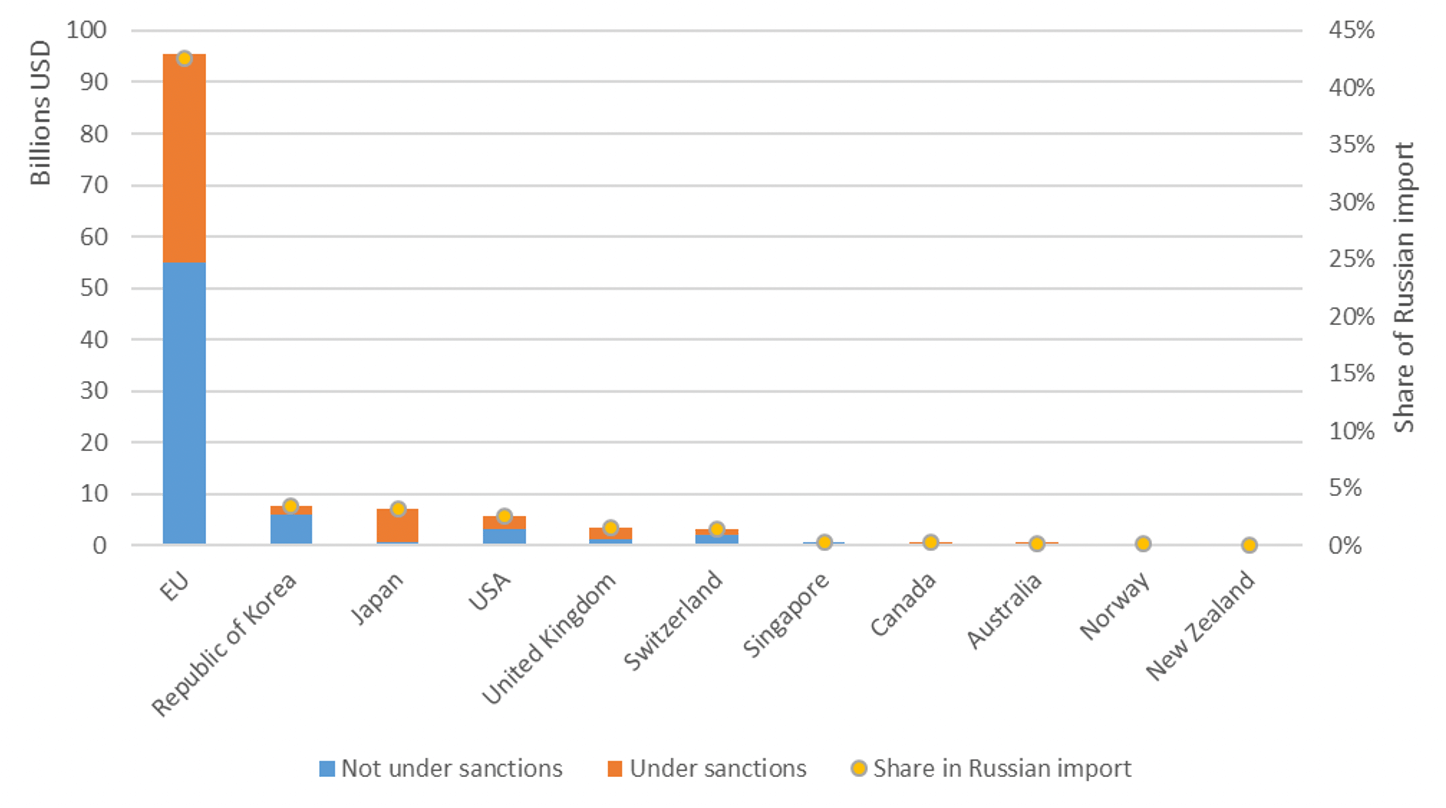

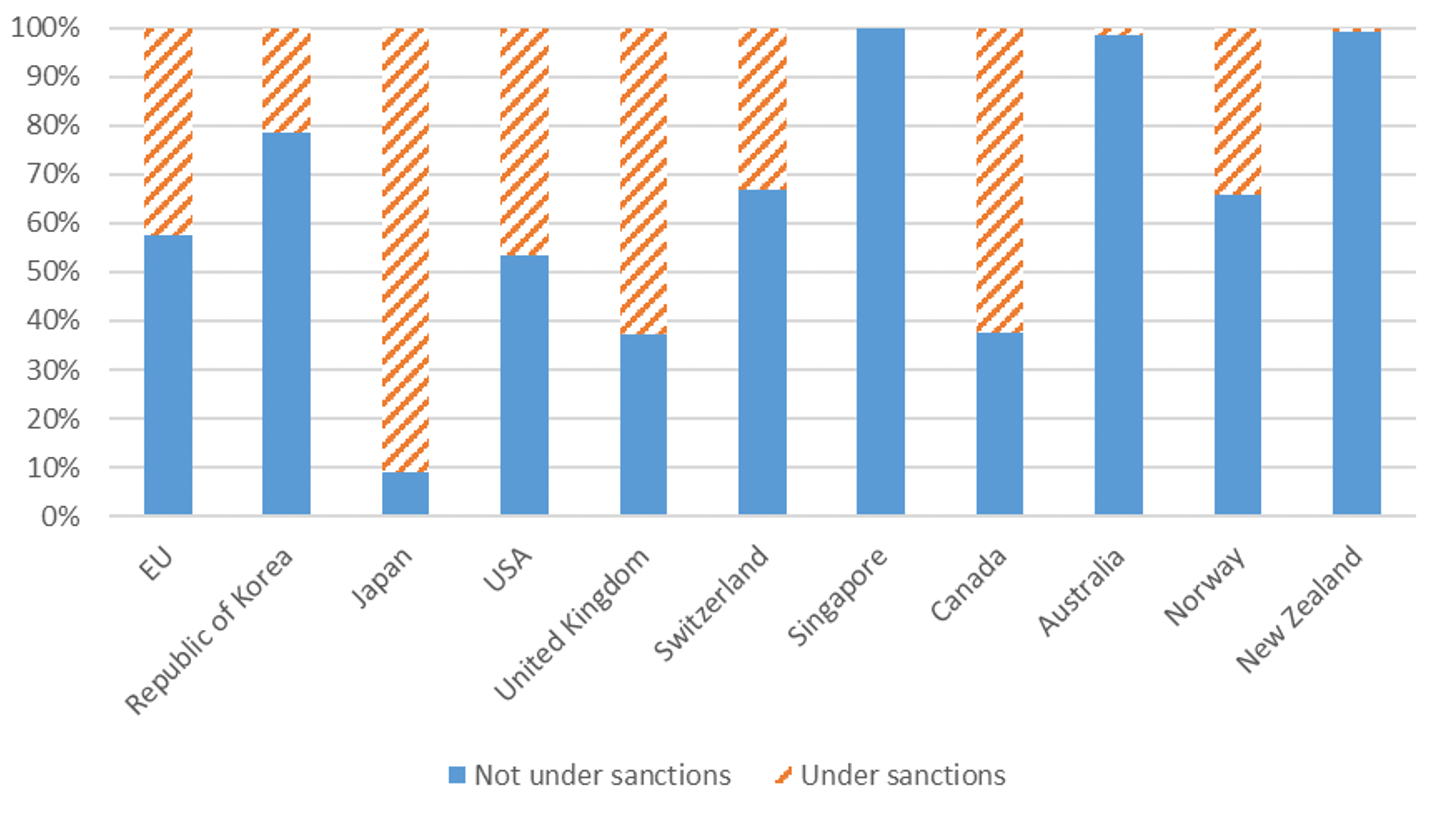

Major import sanctions with the highest coverage in absolute terms were introduced by the EU and USA. (Figure 1) However, in relative terms the highest share of import from Russia was covered by major import sanctions from New Zealand, Canada and Australia (all imposed sanctions with >90% coverage). (Figure 2,3,4)

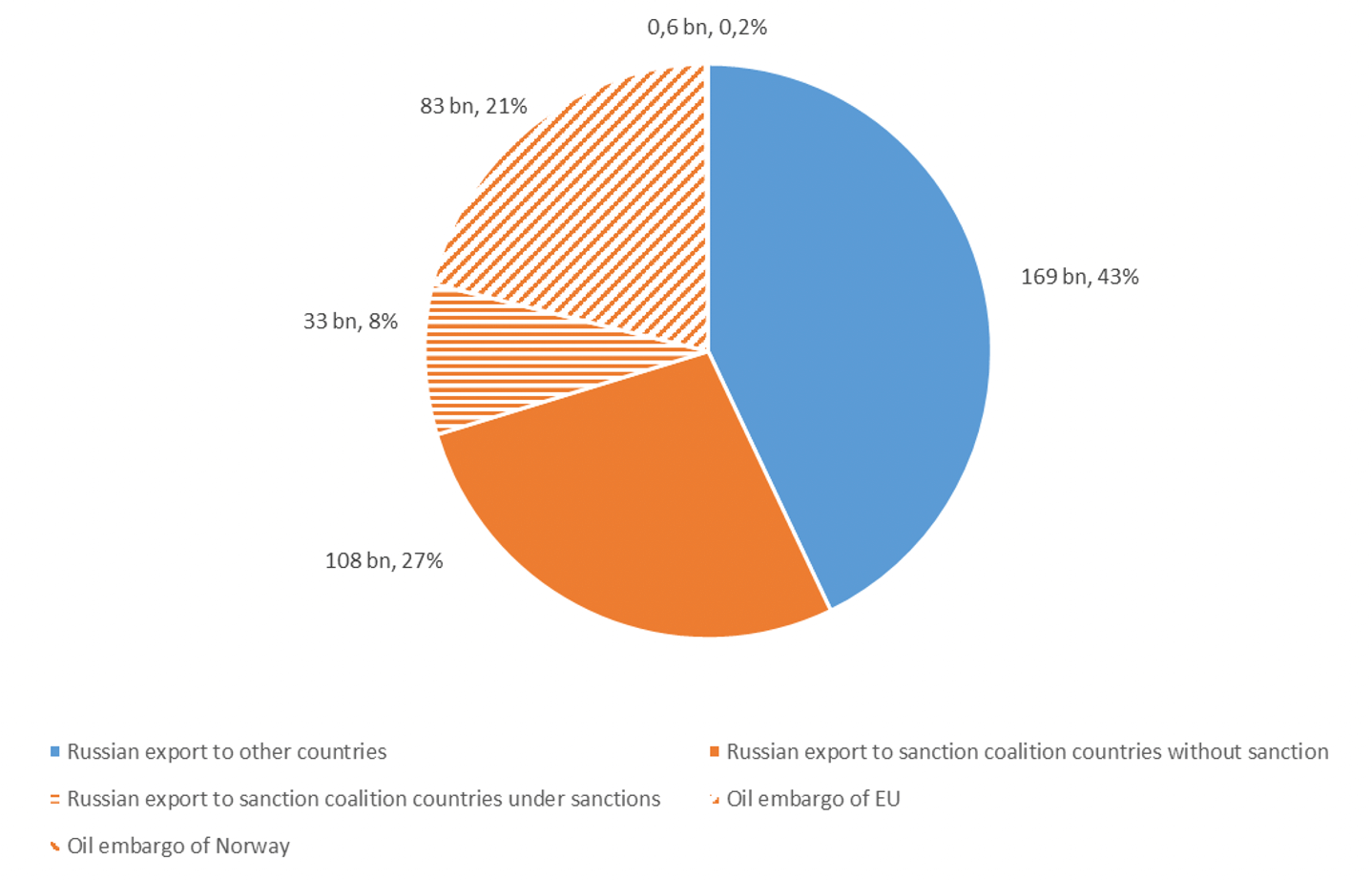

In total Russian exports, 8% (or 33 billions USD) are currently under major import sanctions. Oil embargo from EU and Norway will add 21 p.p in coverage (or 84 billions USD). 27% of total Russian exports will remain non-sanctioned imports of the sanction coalition even after the oil embargo comes into force. In addition, 43% of Russian exports are exports to other countries. (Figure 5)

Figure 1. Import of goods from Russia by being under major trade sanctions (based on 2019 trade data)

Figure 2. Share of imports from Russia by being under major trade sanctions (based on 2019 trade data)

Figure 3. Map of import flows from Russia coverage by trade sanctions without oil embargo from EU and Norway (based on 2019 trade data)

Figure 4. Map of import flows from Russia coverage by trade sanctions including oil embargo from EU and Norway (based on 2019 trade data)

Figure 5. Russian exports by being under major trade sanctions, billions USD (based on 2019 trade data)

Figure 6. Russian exports under trade sanctions, billions USD (based on 2019 trade data)

Major export sanctions

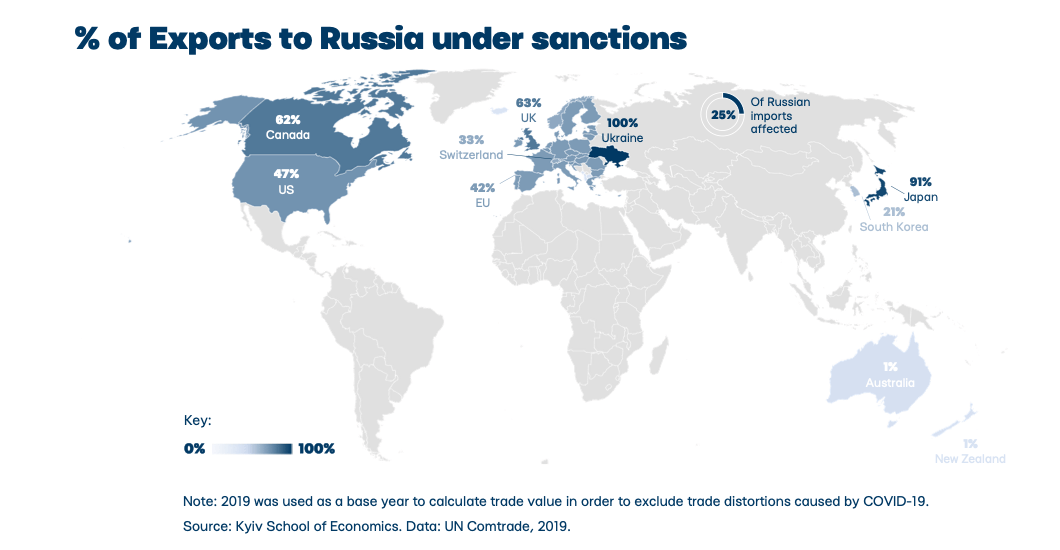

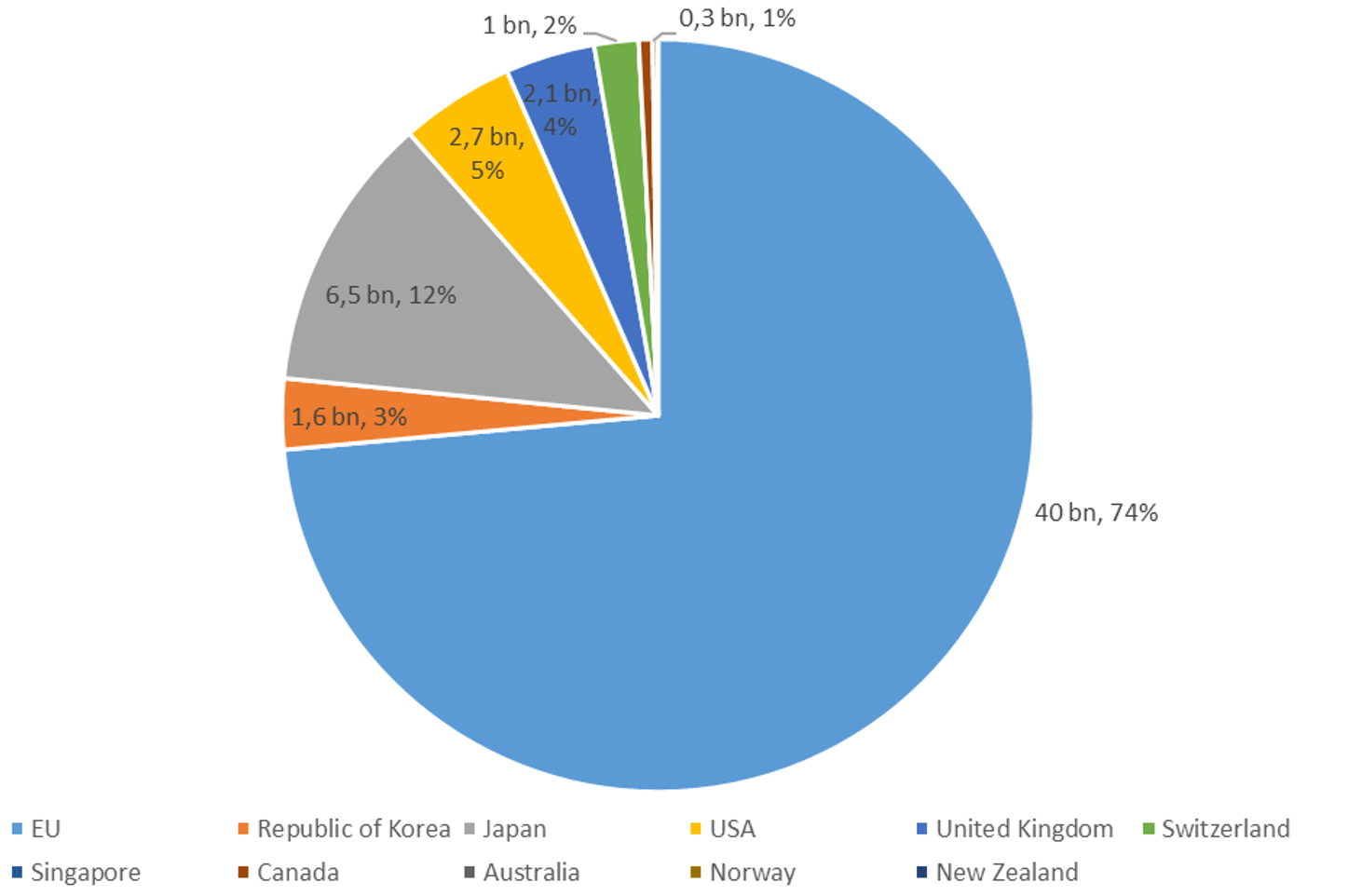

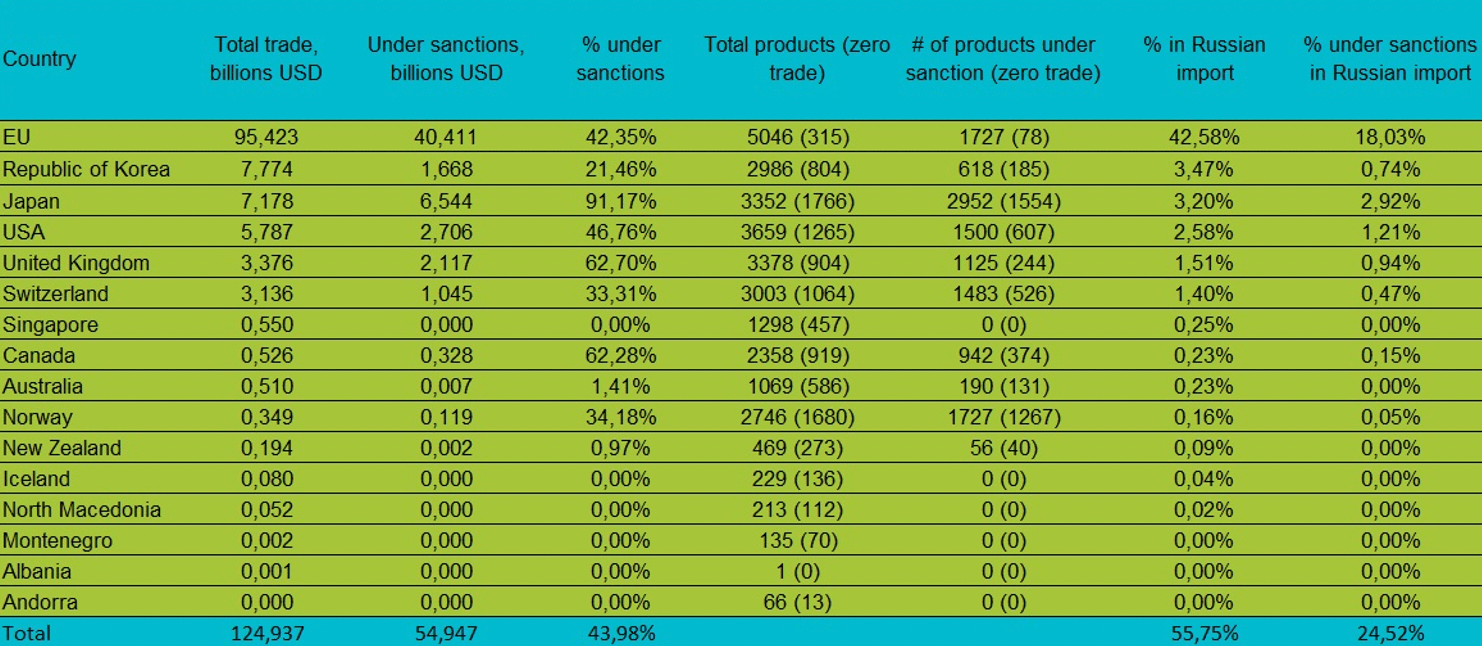

We can see that the EU is the major trading partner with Russia. Its exports cover 43% of Russian imports. Total share of exports from the sanction coalition covers 56% (Figure 7). So far, 24% (or 55 billions USD) of total Russian imports are under major export sanctions (Figure 10). In relative terms Japan, UK and Canada imposed major export restrictions on more than 60% of their exports to Russia (Figure 8,9). The EU and USA imposed such measures on more than 40 % of their exports to Russia, while their total coverage of exports in monetary terms is more than 75% of all sanctioned Russian imports. Figure 11 shows us the distribution of sanctioned 55 billions USD of Russian imports between sanction coalition countries.

Figure 7. Exports to Russia by status of being under major trade sanctions (based on 2019 trade data)

Figure 8. Share of exports to Russia by being under major trade sanctions (based on 2019 trade data)

Figure 9. Map of export flows to Russia coverage by trade sanctions (based on 2019 trade data)

Figure 10. Russian imports by being under major trade sanctions, billions USD (based on 2019 trade data)

Figure 11. Russian imports under trade sanctions, billions USD (based on 2019 trade data)

Table 1. Major import sanctions analysis

Table 2. Major export sanctions analysis

[1] https://wits.worldbank.org/

[2] https://www.globaltradealert.org/ – website that aggregates trade restrictions, created by University of St.Gallen (Switzerland). Some sanctions on this website are being presumed from public statements, while the official documents are unpublished or unavailable.

[3] Sanction coalition — a diplomatic informal alliance of major democratic states-partners of Ukraine, which imposed financial, personal or trade restrictions on Russia for its invasion of Ukraine. Currently, the sanction coalition consists of 20 countries. For this work we consider countries that have more than 150 millions USD trade with Russia.

[4] Major export sanctions — export ban and/or export licensing requirements for the entire product code (not firm-specific) based on the 6-digit HS 2017 classification. Export licensing requirements were imposed by the USA and considered harmful enough to reduce export to Russia of these products almost to zero.

[5] Major import sanctions — import ban and/or import blocking tariff of additional 35 % for the entire product code (not firm-specific) based on the 6-digit HS 2017 classification. Some countries also imposed withdrawal of Most-favoured nation status from Russia. However, we cannot measure how harmful such a sanction is for Russian exports to different countries, while we consider an additional 35% of tariff harmful enough to reduce Russian export of these products almost to zero.

[6] To compute oil embargo coverage we subtracted import of Russian oil to Hungary, Bulgaria and Croatia from the total EU oil import from Russia, as these countries are exceptions from the oil embargo policy.