- Kyiv School of Economics

- About the School

- News

- Russia Macro Update: Deficit Target Already Obsolete

Russia Macro Update: Deficit Target Already Obsolete

7 March 2023

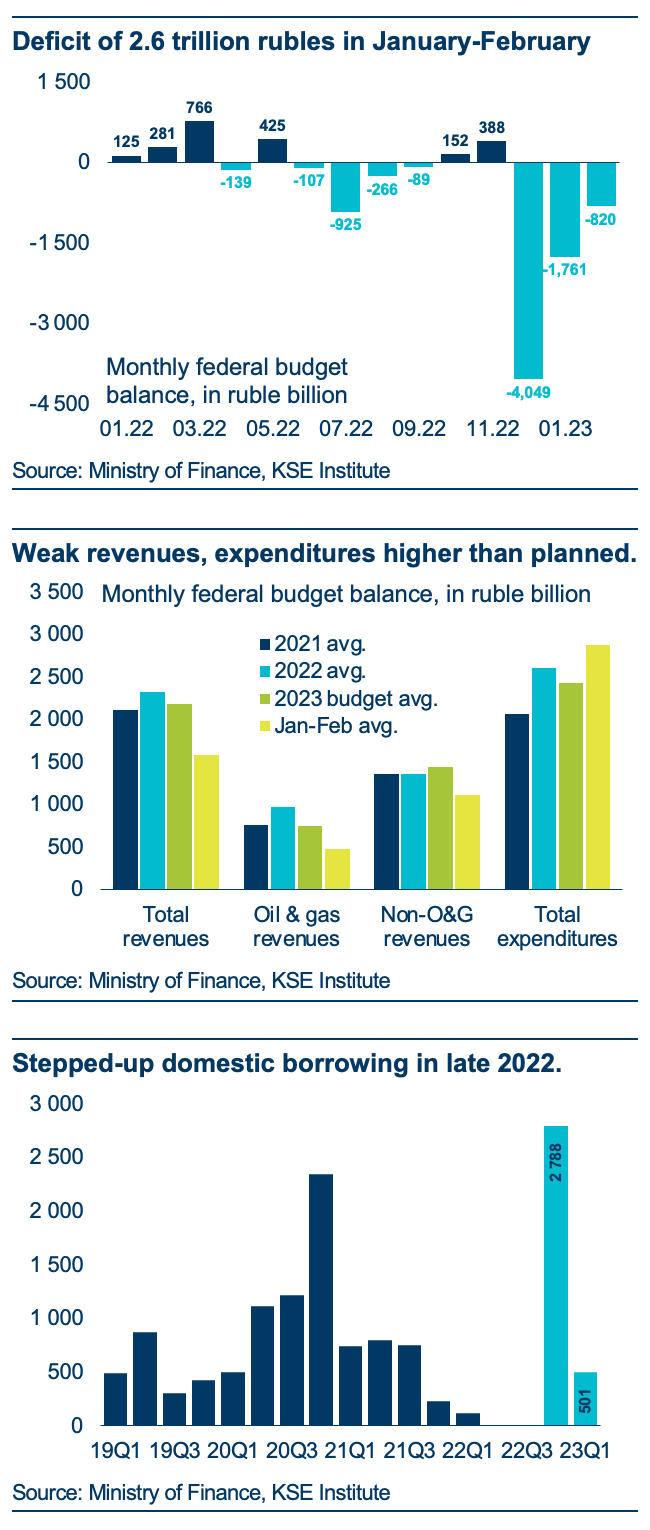

Russia’s Ministry of Finance reported a federal budget deficit of 820 billion rubles for February on Monday. This brings the total for the first two months of the year to 2.6 trillion rubles—or roughly $32 billion—and represents 88% of the planned deficit for the full year. Revenues, while noticeably higher than in the previous month, are lagging behind both 2021-22 averages as well as budgetary plans. At the same time, expenditures remain elevated due to the war. In our view, Russia will see a full-year deficit 3-4 times as large as in 2022—and face significant financing challenges. At 2022Q4 pace, liquid NWF assets will be used up before the end of the year, leaving authorities with little options other than stepped-up domestic borrowing—resulting in rising interest rates. Changes to the benchmark oil price, and further squeezing of companies, will not make a material difference.

January-February budget deficit of 2.6 trillion. The Ministry of Finance reported a deficit of 820 billion rubles (or ~$11 billion) for February this week (top chart)—a smaller gap than reported in January but still indicative of growing budgetary trouble. As a result, Russia is facing serious financing challenges.

Oil & gas revenues underperform. While revenues improved compared to January (by 33% to 1.8 trillion) and expenditures fell (by 16% to 2.6 trillion), both sides of the budget show clear signs of trouble. For instance, oil and gas revenues in Jan.-Feb. came in 46% below their level in the corresponding period in 2022. Non-O&G receipts, despite a recovery in Feb., are 10% below. At the same time, expenditures remain 51% above their level in Jan.-Feb. 2022.

Budget target already unrealistic. Fiscal dynamics in the first two months of the year mean that the deficit target for 2023 will be missed by a large margin. The cumulative Jan.-Feb. deficit of 2.6 trillion represents close to 90% of what had been planned for the full year (2.9 trillion). Importantly, oil and gas revenues underperformed (middle chart) despite a weaker ruble (68.3 RUB/$ assumed in the budget), which increases the local currency-value of oil and gas revenues.

Tax maneuvers not sufficient. In response to weak oil and gas revenues, authorities announced that they will change the benchmark tax oil price (from Urals to Brent plus a discount). But we believe that this will only result in additional revenues of around 600 billion rubles in 2023—not enough to make a fundamental difference even when taking into account another 500 billion potentially squeezed out of large enterprises.

NWF will be used up, issuance rising. Due to its use for budgetary support, Russia’s oil fund shrunk by 1.4 trillion rubles in 2022Q4 alone. At this pace, the NWF’s liquid portion will essentially be depleted by the end of this year. Authorities will also have to rely on stepped-up domestic borrowing, something they already did towards the end of last year (bottom chart). Issuance slowed in 2023Q1 (to just 500 billion to date) due to reliance on pension fund prepayments. But, with this buffer likely used up by now, more OFZ will need be sold—at a time when the Ministry of Finance already struggled to receive satisfactory bids in some of the auctions. As a result, yields will rise.

Benjamin Hilgenstock, Senior Economist