- Kyiv School of Economics

- About the School

- News

- Impact of sanctions on Russian economy. Gas sector

Impact of sanctions on Russian economy. Gas sector

5 August 2022

Main recommendations

By Borys Dodonov (Head of KSE Center for Energy and Climate Studies, KSE Institute)

Our recent flagship working group paper on energy sanctions outlines both proactive measures to reduce revenue inflows to Russia and mitigation measures to address the potential impact of Russian retaliatory measures, including an abrupt supply disruption. Thus, in gas sector KSE Institute recommends the following proactive measures to curb Russian gas revenues:

• Channel all sales of Russian gas to the EU through the Ukrainian GTS. This approach would suspend deliveries via Nord Stream 1, Yamal-Europe, and TurkStream Line 2 (for EU exports) that would constrain Russia’s ability to discriminate selectively in its allocations of gas supply.

• Announce the near-term decommissioning date for Gazprom’s Nord Stream 1, TurkStream Line 2 (for EU exports), and Yamal-Europe pipelines.

• Controlled Sales Regime for Russian gas sales. Impose a levy on Gazprom for sales into the EU and retain the balance of payments in escrow accounts. The levy should be high enough to capture all Russia’s excessive profits from limiting gas supply to Europe, e.g., all revenue above the US$ 20-25/MWh, the price at the European hubs in the first quarter of 2021 before Russia started limiting its gas supply to the European market. The balance of revenues would be held in escrow accounts in European banks pending a resolution of the conflict.

• End purchases of Russian gas from the least dependent countries. Some countries have already announced that they will stop purchases Russian gas, including Belgium, Estonia, Finland, France, Latvia, Lithuania, the Netherlands, Poland, Portugal, Romania, Sweden, Spain, and Slovenia.

The proposed short-term mitigation measures to address possible Russian gas supply cuts during this winter:¹

• Reduction gas-to-power demand. This can be done through minimizing gas-fired generation and increasing utilization of coal-fired and nuclear power plants. In particular, the Germany must postpone the retirement of nuclear power units and consider restarting power production at nuclear power units closed last year to until at least mid 2024.

• Demand restraint measures. This should include measures for lower public and residential building energy consumption and incentivizing industrial users to restraint their consumption to avoid gas rationing this winter. For example, turning the thermostats by couple degrees will enable to save natural gas equivalent to the Nord Stream supply in winter. Germany and the Netherlands start testing auctions models where industrial consumers may offer part of their contracted gas supply for compensation.

• Alternative supply sources. The EU and Azerbaijan recently signed an agreement envisioning the increase of gas supply to 20 bcm. The Algeria can still have a possibility to increase its gas supply to Southern Europe to substitute the Russian gas supply. The long-term contract on LNG supply to Europe will send the strong signal that the switch from Russian gas by the EU is permanent and will not be resumed after the end of the war, thus, incentivizing them to boost production to increase their presence at the European market.

• Turn back Groningen production. This can be done through the revision of political decision to accelerate the shutdown of Groningen production to 2022. Technically, Groningen could be turned back on, and if it can then run at the level seen before restrictions were imposed would produce 50 bcm per year, which would alone broadly close the European gas supply gap.

• Unified response of the EU. This can cover the solidarity mechanism within the EU and joint efforts for consumption curtailment

European Union Demand for Russian gas

Russia is the world’s largest gas exporter, it also has the world’s largest gas reserves but is the worlds’ second-largest producer behind the United States. In 2021 Russia produced 762 bcm of natural gas and exported approximately 210 bcm via pipelines.

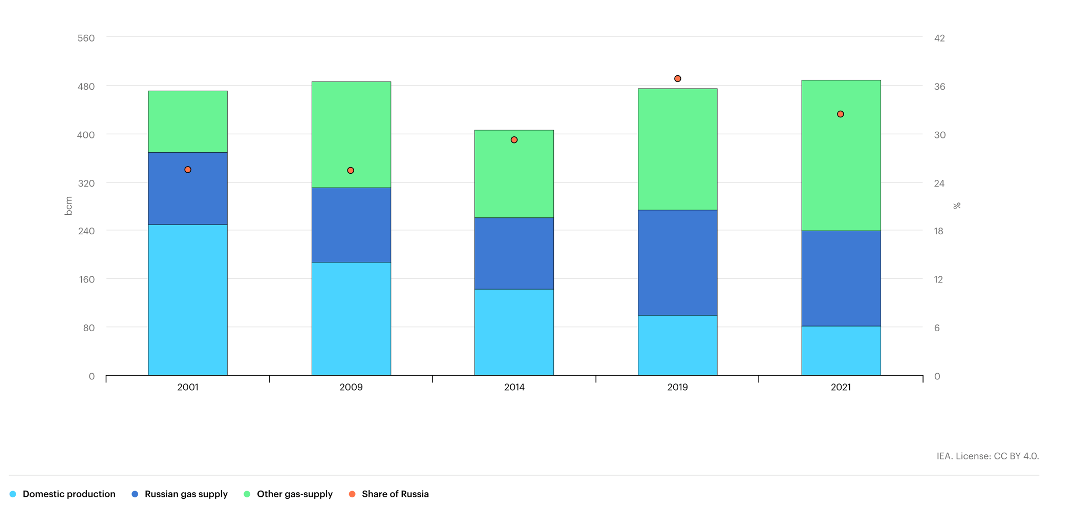

Europe is the main destination of Russian gas export. In 2021 it imported the 140 bcm of Russian gas via pipeline and 15 bcm of LNG. The reliance of the European Union and the UK on Russian gas supplies has increased over the last decade. Natural gas demand in the EU and UK remained rather flat in aggregate over this period, but production declined considerably, and the gap has been filled by increased imports. The share of Russian pipeline gas supplies increased from 25% of the region’s total gas demand in 2009 to 37% in 2019 but dropped to 32% in 2021 driven by Gazprom’s own strategy of reducing short-term sales to the EU.²

Figure 1. Share of Russian pipeline gas in European Union and United Kingdom gas demand, 2001-2021

Source: IEA

In response to Russian invasion, the European Commission approved the REPowerEU Plan detailing the measures and investments required to reduce fossil fuel dependence on Russia to zero by 2027. As the first step, the European Union pledged to cut its Russian gas supply to one third by the end of the year. Several EU member countries already refused from Russian gas. Lithuania, Estonia and Latvia ceased Russian gas imports at the beginning of April. Bulgaria, the Netherlands and Poland all announced that they do not intend to renew long-term contracts with Gazprom, which are expiring at the end of 2022.

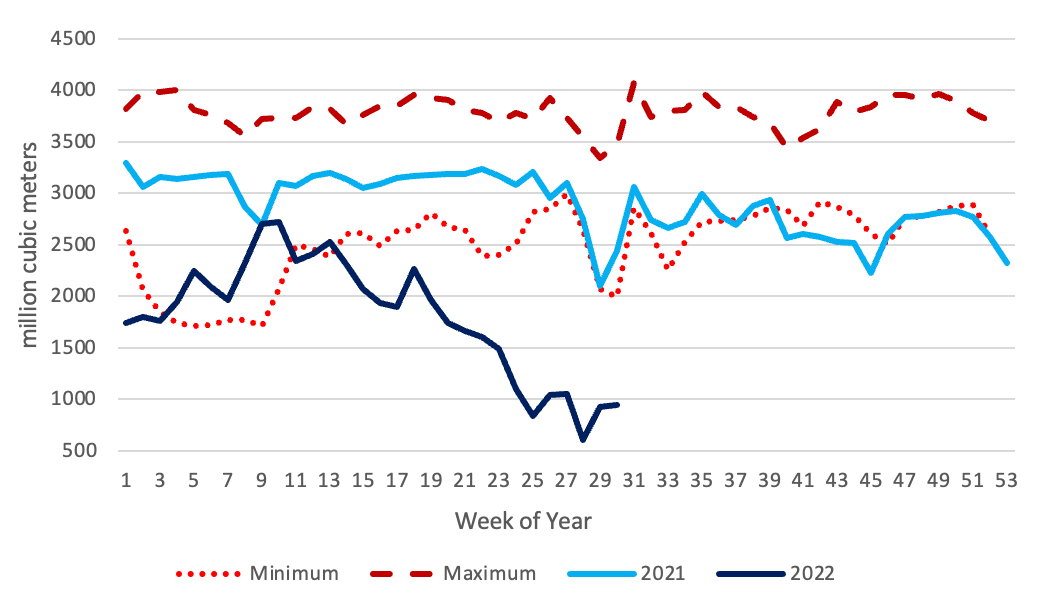

Russian retaliation strategy for sanctions

Russia continues weaponizing gas supply since the invasion to create pressure on the EU members states and punish for imposed sanctions on Russian. Russian gas supply to the EU is constantly declining in 2022 (see Figure 2). Last month and a half weekly imports fell to below 1 bcm compared to the 3 bcm average in 2021. Russia completely halted the gas supply via the Yamal-Europe pipeline, uses only around 40% of booked and paid transit capacities of Ukrainian Gas Transit System, and a week ago decreased the utilization of Nord Stream capacities by 20%. It already cut off gas supply to Bulgaria, Poland, Finland, Denmark and the Netherlands and there is very high probability of cutting gas supply to all other EU countries before the winter.

Figure 2. EU natural gas import from Russia

Source: McWilliams, B., G. Sgaravatti, G. Zachmann (2021) ‘European natural gas imports’, Bruegel Datasets

Russia successfully blackmailed Germany by limiting Nord Stream supply to return to Russia repaired by Siemens Canada Nord Stream turbine. Gazprom did not need the turbine to continue gas supply via Nord Stream at full capacity. The compressor stations are equipped with backup turbines and there was no technical need to reduce the gas supply from 167 to 67 mcm per day. In addition, Gazprom could ensure the contracted gas supply through either Ukrainian Gas Transport System (GTS) or by resuming gas supply through Yamal-Europe pipeline. German-Canadian decision incentivizes Kremlin to increase pressure on Western Allies and mounting its appetite for further phasing out sanctions that already start biting. Thus, Gazprom further reduced gas supply through Nord Stream pipeline to 33 mcm per day after the turbine was delivered to Germany and shipped to Russia.

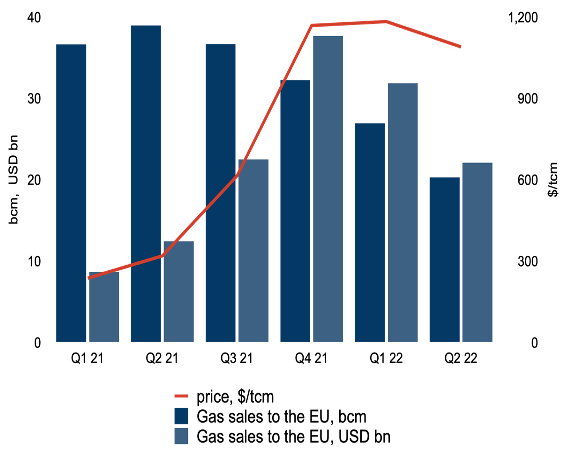

Russian gas revenues

Despite a very significant drop in volumes, Russia is receiving record revenues from gas exports due to record gas prices in Europe. For example, in the first and second quarter of 2022, gas prices 5.0 and 3.4 times exceeded the corresponding prices last year (quarter-to-quarter). So high prices in Europe is a sole responsibility of Russia which created an artificial tightness at the European market last heating season and continues supporting it by lowering gas supply to the EU in 2022.

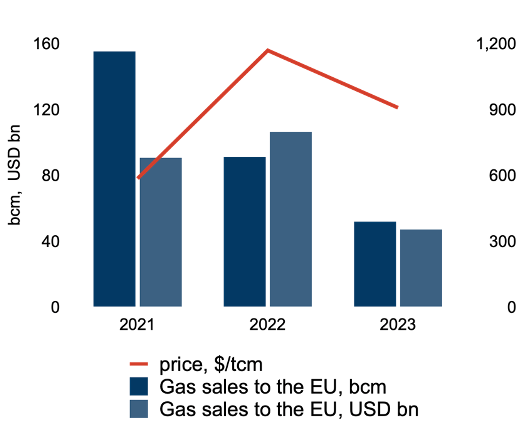

In 2023, a Russian gas exports to Europe is projected to decline further, although the price in Europe will remain very high in face of a deficit. Export revenues from gas sales are projected to fall more than twice from US$ 106 bn to US$ 47 bn. Thus, Russia continues to earn more and more by exporting less natural gas. In order to curb Russian gas revenue used for military expenditures, the EU should impose a levy on Gazprom for sales into the EU and retain the balance of payments in escrow accounts. The levy should be high enough to capture all Russia’s excessive profits from limiting gas supply to Europe. Russia is heavily reliant on its gas revenues and does not have an infrastructure to redirect gas exports to Asia. The price cap for Gazprom may be introduced at US$ 20-25/MWh, the price at the European hubs in the first quarter of 2021 before Russia started limiting its gas supply to the European market, while the residual revenue will be transferred to escrow accounts. It is still much higher than Russian marginal costs of supply that are around US$ 12-14/MWh.

Figure 3. Total Russian gas sales to the EU in 1Q2021-2Q2022

Source: WB commodity prices, Bruegel datasets, KSE Institute estimates

Figure 4. Total Russian gas sales to the EU in 2021-2023

Source: WB commodity prices, Bruegel database, KSE Institute estimates

It should be no illusion on Russian intension to completely cut its gas supply this winter to punish European for an ongoing support of Ukraine and create a wedge in the European alliance. Thus, the European Union should accelerate its efforts to tackle an imminent and permanent cut of Russian gas supply this winter. The short-term measures include rapid reduction of gas-to-power demand, restraining natural gas demand, turning back Groningen production, increase the supply from alternative sources, and unified response of the EU for Russian gas supply cut. The adopted plan to cut by all member states the demand by 15% demonstrate such unified response and should prevent the severe gas crunch in case of complete gas cutoff by Gazprom

Impact of sanctions on production and project development

Gazprom and Novatek are Russia’s main gas producers, but many Russian oil companies, including Rosneft, also operate gas production facilities. Gazprom is the largest gas producer, but its share of production has declined over the past decade, as Novatek and Rosneft have expanded their production capacity. However, Gazprom still accounted for 68% of Russian gas production in 2021. Most of production is concentrated in West Siberia, but investment plans envision the shift to Yamal and Eastern Siberia and the Far East, as well as the offshore Arctic.

The IEA projects the Russian production will go down from 762 to 668 bcm or by 12% (y-o-y) in 2022 but admits the forecast is mired in large uncertainty due to Russia’s unpredictable behavior. The Russian demand will go down from 501 to 484 due to slowdown of the economy stemmed from Western sanctions. EU imports of Russian pipeline gas are projected to decline by over 45% in 2022 to below 80 bcm, while Russian LNG inflows are expected to be sustained at above last year’s level of 15 bcm. Thus, the share of Russian gas in EU gas demand is projected to drop to 25% in 2022 – its lowest level in more than two decades.³ The export may even further go down if Russia continues supplying gas at current level or decide to cut it further.

Sanctions limiting access to major capital markets and key energy technologies, together with the European Union’s decision to phase out Russian gas as soon as possible will very negatively affect Russia’s upstream development. The IEA projects the cumulative production loss will go up to 550 bcm for the 2022-2025 period. Upstream developments in western Siberia and the Yamal Peninsula are expected to be the most affected, while the production in east Siberian fields aimed at supplying gas to China market is set to be more resilient.⁴

The Arctic LNG 2 project (with a capacity of 27 bcm/year) is experiencing delays and will not be completed in projected timelines. Novatek, the project’s developer, noted that the company is not in a position to confirm the previously adopted project timelines. Though the almost completed Train 1 may be commissioned in 2023, Trains 2 and 3 will not be commissioned in the mid-term. Thus, the production of Utrenneye field will amount no more than 10 bcm/year by 2025, twice as low as was initially projected.⁵

The abandonment of Nord Stream 2 leave the Kharasavey field and the Bovanenkovo expansion project without offtake export markets. The Kharasavey field (32 bcm/year nameplate capacity) was due to start production in 2023. The 18 bcm/yr Baltic LNG project was planned for commissioning for 2023-2024. However, current sanctions on western technologies export to Russia will delay the start of the project, which, in turn, delay the start of the supergiant Tambey field, previously planned by 2026.⁶

¹Please see the full list of mitigation measure in the working paper on Russian energy sanctions at KSE’s webpage https://kse.ua/about-the-school/news/energy-sanctions-roadmap-recommendations-for-sanctions-against-the-russian-federation/

²IEA, 2022, Gas Market and Russian Supply, https://www.iea.org/reports/russian-supplies-to-global-energy-markets/gas-market-and-russian-supply-2

³IEA (2022), Gas Market Report, Q3-2022, IEA, Paris

⁴Ibid.

⁵Ibid.

⁶Ibid.