- Kyiv School of Economics

- About the School

- News

- Groningen: Countering Russia’s gas blackmail

Groningen: Countering Russia’s gas blackmail

18 July 2022

By Jacob Nell (Senior Research Fellow at KSE institute, member of Yarmak-McFaul international working group on Russian sanctions), Nataliia Shapoval (Head of KSE Institute, member of Yarmak-McFaul international working group on Russian sanctions), Borys Dodonov (Head of KSE Center for Energy and Climate Studies, KSE Institute). Revised and updated version of original paper published 18/07/22.

Executive summary: The giant Dutch gas field Groningen has reserves estimated at 450 bcm, and before recent production restrictions were imposed was able to produce at a rate of over 50 bcm a year. Increasing Groningen production to replace Russian gas from NordStream 1 this winter would help maintain adequate gas supplies as Europe de-Russifies its gas supply, preventing outages, capping energy and gas prices, reducing Russian gas revenues – and thereby strengthening Europe’s economic stability and weakening Russia’s ability to wage war. Higher production does imply an enhanced risk of subsidence, but the vast additional revenues can finance compensation and regional development: to illustrate, we estimate that selling 25 bcm at current gas prices could buy the entire Groningen region housing stock. The unknown factor is the technical limits on raising production rapidly. But with still high L-gas demand, and an existing pressure maintenance system, we see scope for Groningen to provide a significant boost to European gas supply.

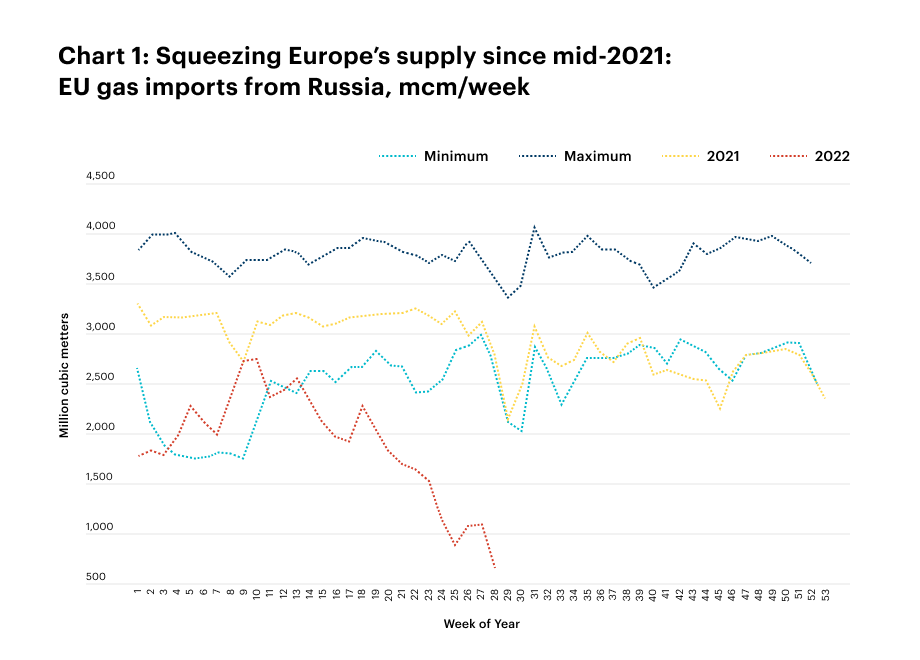

The Russian gas squeeze

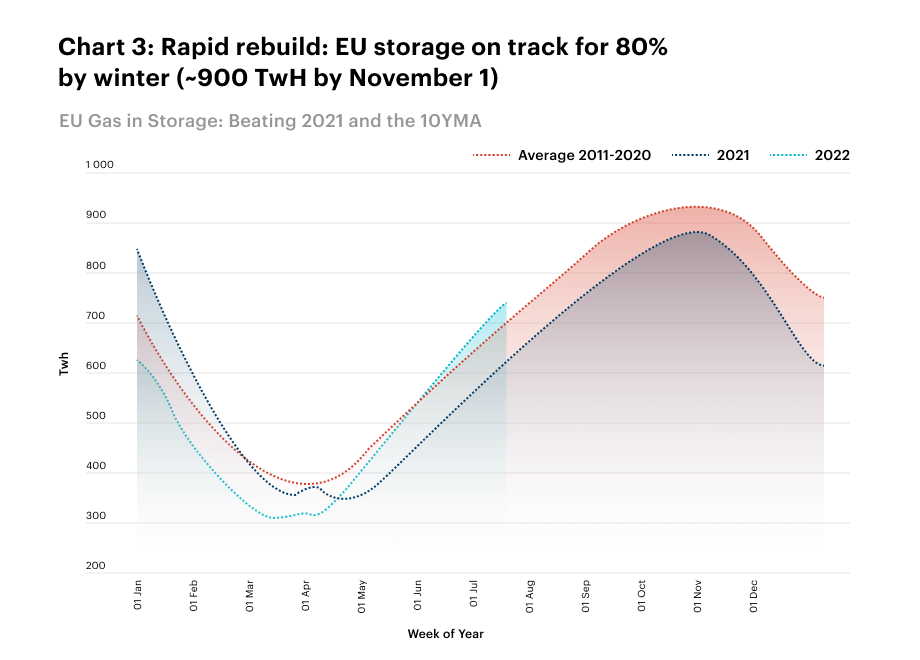

The Russians have squeezed gas supply to Europe since mid-2021, successfully driving gas prices to historic highs – but they may have overplayed their hand. Russian gas supply at the end of June was running at around 1 bcm per week, or 50 bcm per annum, around one-third of the approximately 150 bcm Russia has supplied to Europe in recent years. While this squeeze has been effective in driving prices higher, the higher prices are doing their work of stimulating alternative supply and reducing demand. Even at this reduced flow, Europe is putting enough into storage – a record 37 bcm in the second quarter – to be clearly on track in aggregate to exceed the targeted 80% storage level – about 90 bcm – by the start of winter.

Groningen: probably able to close the Russian supply gap

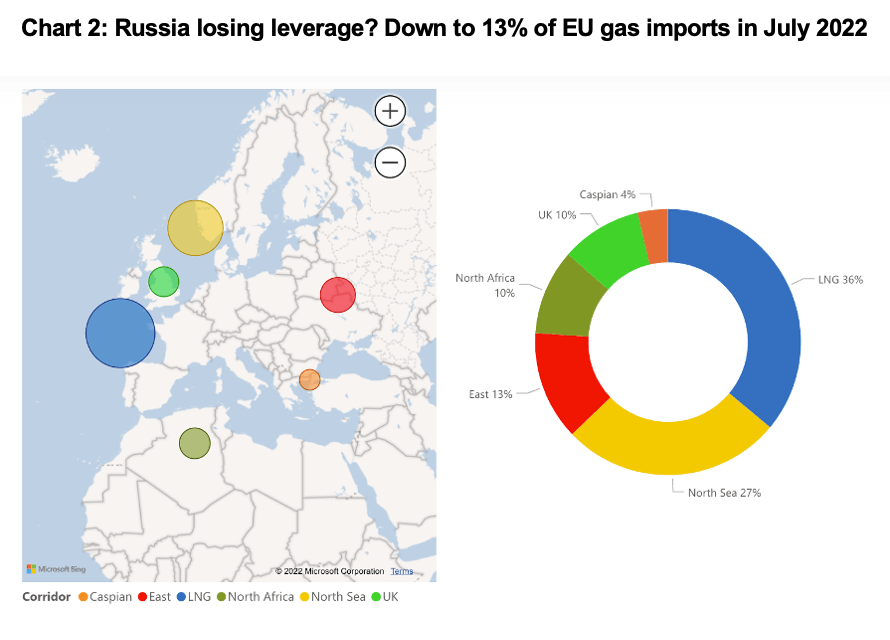

Current high prices for European gas reflect pervasive uncertainty about whether Russian gas can be replaced and an expectation among some, eg French finance minister Le Maire, that Russia will cut off flows to Europe. Russia is squeezing European gas supply, as it has since mid-2021, with further steps this year as it turned off gas flows to Poland, Bulgaria, Finland and the Netherlands for not paying in rubles. Given Gazprom’s track record of using maintenance and accidents as a justification for cutting flows, many wonder if flows on Nordstream1 will restart on July 22 after the planned maintenance.

If these Russian volumes cannot be replaced, especially in a cold winter, then Europe risks forced shutdowns of industry, especially in gas-dependent Germany and Italy. This can probably be avoided – LNG and Norway are providing record volumes, and may provide more, and gas storage levels are much higher than at this time last year. Substitution away from gas to coal, oil, nuclear and renewables can be substantial, especially in power, and is only just starting. Demand management measures – particularly reduced cooling and heating – can be effective, and drove a 15% fall in power consumption for instance in Tokyo after the Fukushima earthquake. They now look likely to be energetically implemented, after the IEA called for action, the Commission has now proposed a 15% reduction in gas demand, initially voluntarily and then on a mandatory basis.

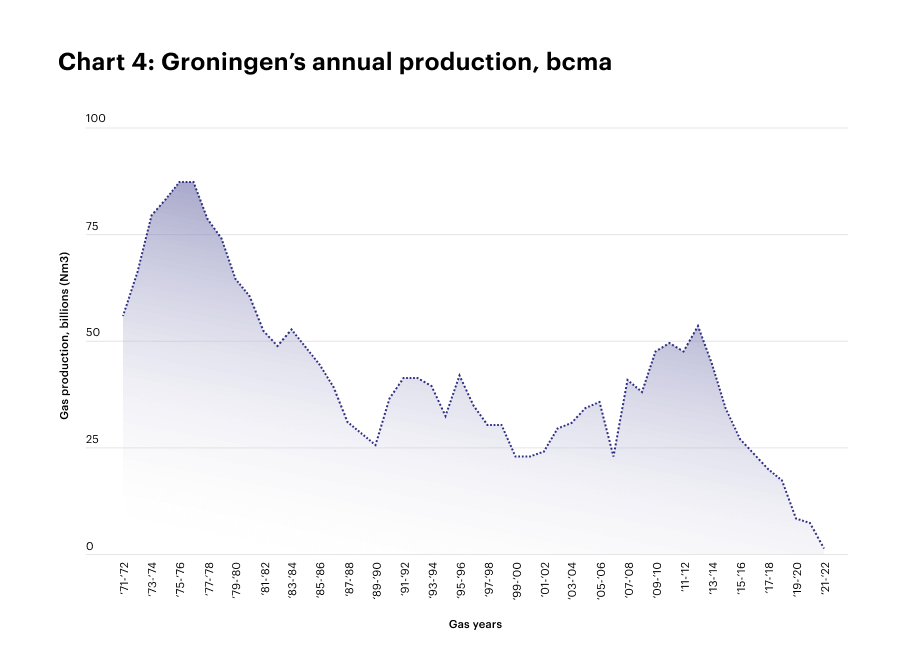

But there is also a potential domestic supply solution, which would immediately calm fears of outage: Groningen, as pointed out in this recent Bloomberg article and flagged in our working group paper on oil and gas sanctions. This giant Dutch gas field still has 450 bcm of reserves, and ran at 53 bcm in the 2012-13 gas season, the last before restrictions were imposed, and still at 27 bcm in the 2015-16 gas season. Recently, the reserves have been written off – Groningen reserves were officially reported by the Dutch regulator at a mere 6.6 bcm for instance this year – and production curbed to low single digits. But this was a political decision – in particular a March 2018 political decision to close the field by 2030 to reduce the risk of subsidence and seismic tremors, followed by a September 2019 political decision to accelerate shutdown to mid-2022. Technically, Groningen could be turned back on, and if it can then run at the level seen before restrictions were imposed would produce 50 bcma, which would broadly close the European gas supply gap, given Europe has been rebuilding gas storage at an adequate pace, even as Russian gas flows have been running at a ~50 bcma rate.

Source: ENTSOG, Bruegel

Source: ENTSOG. Note “East” refers to gas from Russia, by whichever route it arrives eg including gas via Belarus and Ukraine

Source: AGSI

Source: NLOG

The earthquake problem…

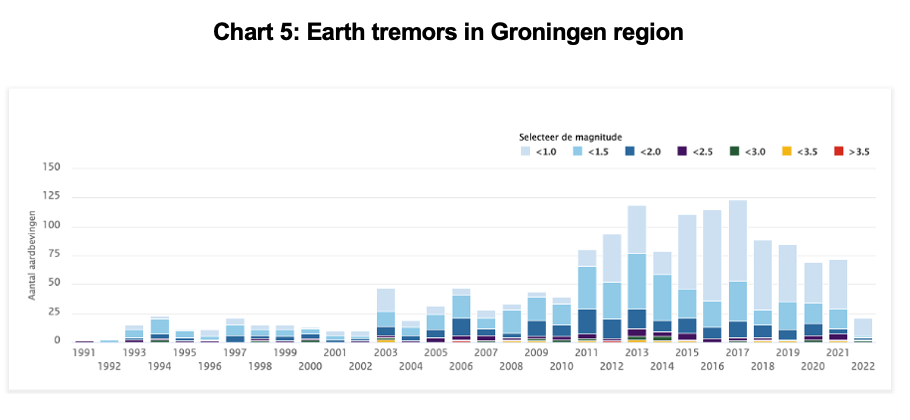

The main hurdle to increased production at Groningen is the series of seismic tremors – such as the Huizinge 2013 earthquake – in recent years, which is now linked to subsidence due to reduced pressure as the field has been depleted (see this Columbia University study on the termination of Groningen gas production for a useful overview). That experience, which has caused some property damage, although no injuries so far, combined with fears of greater impact from potential future seismic activity, has led to a political consensus that extraction should be wound down, with the date for ending extraction brought forward suddenly from a decision in 2018 to phase out production gradually by 2030 to a decision in 2019 to end production in 2022. Plus, once a consensus has formed, it can be hard to dislodge, despite the current power and gas crisis. For instance in Germany the government has ruled out an extension to the life of the remaining three nuclear reactors at the end of this year, including a proposal from the operators of the nuclear plants to extend their lifetime by a modest three months, i.e. through next winter to spring 2023.

Source: KNMI

…can be compensated by the extra revenues, we think.

However, we think the current high gas price should alter the situation. At current gas prices of 160€/MwH or around 1600€/mcm, producing enough gas to replace Russian supply at the current flow rate of around 1 bcm per week (50 bcm a year) would generate at least 75 billion euros in the course of a year, equivalent to over 9% of Dutch GDP. This sum is so large relative to the Groningen economy – three times the statistical office estimate of regional GDP – that it should be enough to compensate any losses from enhanced seismic activity, and endow a large fund to support the future development of the region. For instance, it could finance an annual dividend payment of €150,000 for each of the half million adults living in Groningen province. Even more strikingly, it could buy the entire residential housing stock of Groningen twice over – a purchase costing €37 bn at current market prices, assuming 120,000 dwellings in Groningen, and an average cost of a single family home of €310,000. These are examples not proposals. The general point is that the revenues are so large, that the Dutch government would have ample resources – the extra revenues from additional volumes – to compensate any subsidence-related damage.

In fact, we see several reasons for favouring hypothecation of the revenues to a Groningen development fund. First, tying the additional funds to the region which is at risk of damage from the additional production is just and should help to secure local political buy-in. Second, a fund which will be spent over time is likely to have a more sustained positive economic impact than one-off payments, which could also prove inflationary. Third, the evidence suggests that saving additional oil and gas revenues in a fund, as Norway has done, has significant advantages over immediate consumption of oil and gas revenues through the budget, as was done in the Netherlands and the UK. Both the Netherlands (1960s) and the UK (1980s) suffered “Dutch disease” from an overvalued exchange rate, and have no permanent fund to show for the depletion of their resource wealth.

Technical complexities: L-gas and pressure

We see two technical challenges to simply opening the valves and returning to a pre-restrictions production rate of 50 bcma.

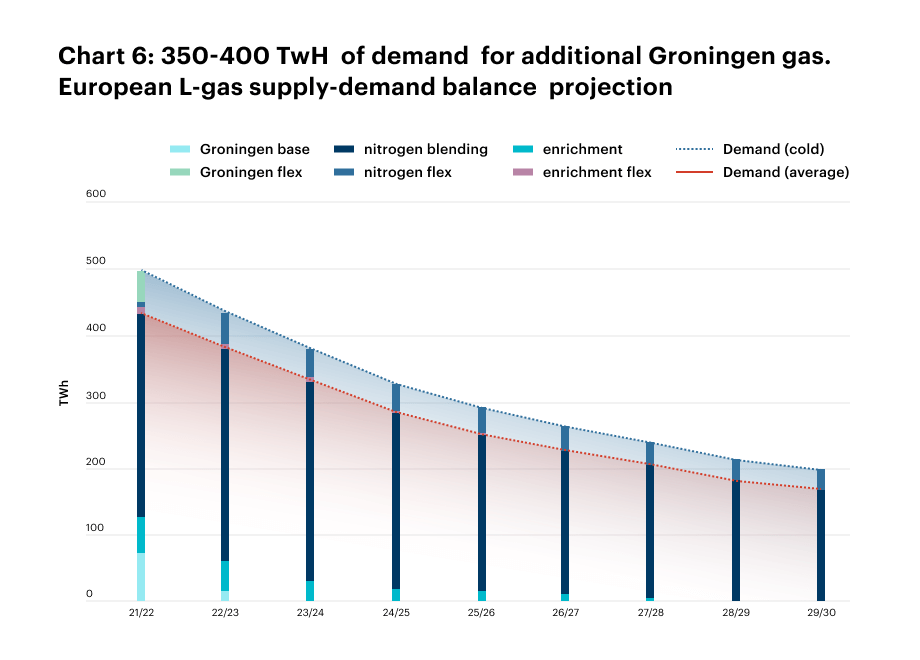

First, Groningen gas is low calorific gas (L gas), with a high nitrogen content, which can pose a problem if homes and factories are equipped to run on “standard” high calorific gas, with a low nitrogen content. But Groningen gas was the standard for NW Europe, so the infrastructure and default for much consumption is still L gas. For instance, the Dutch gas company Gasunie is currently investing over €500 mn in constructing a plant at Zuidbruik, scheduled to open in October 2022, to add nitrogen to transform up to 10 bcma of high cal gas into L gas which can be injected into the Dutch gas system. If more L gas is available for a period than this nitrogen blending capacity will not be needed yet. In short, there may be a technical limit on consumption of low cal gas – but we expect it to be high, given a wide network of established L gas consumers and storage facilities in Netherlands, Germany, Belgium and France. The most recent March 2022 report on the conversion of the L-gas market implies that there are between 350-400 TwH (36-41 bcm) of pseudo L-gas demand which could be displaced by additional Groningen production, which would increase supply of high calorific gas by a similar amount. This is equivalent to 8-9% of European gas demand, or 60%-70% of 2020-21 Nord Stream 1 gas flows from Russia.

Source: IEA, L-gas Market Conversion – Winter Report 2022

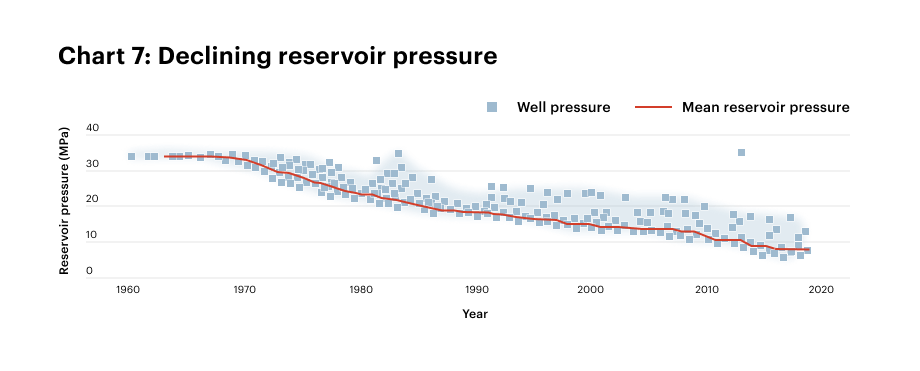

Second, reservoir pressure may be too low to support an immediate increase in production. Groningen has a pressure maintenance system, but it may need to be boosted to increase reservoir pressure and support higher flow rates. This in turn may require drilling of further injector wells and sustained injection of additional fluids – which could take some time – to increase reservoir pressure. There are multiple options here, such as the Groningen Group 2.0’s recent proposal to increase nitrogen injection in the north of the field, and carbon capture and storage (CCS) may also be an option.

Source: Reservoir pressure from www.nam.nl/feiten-en-cijfers, quoted in “Numerical and experimental simulation of fault reactivation and earthquake rupture applied to induced seismicity in the Groningen gas field: (Buizje 2020)

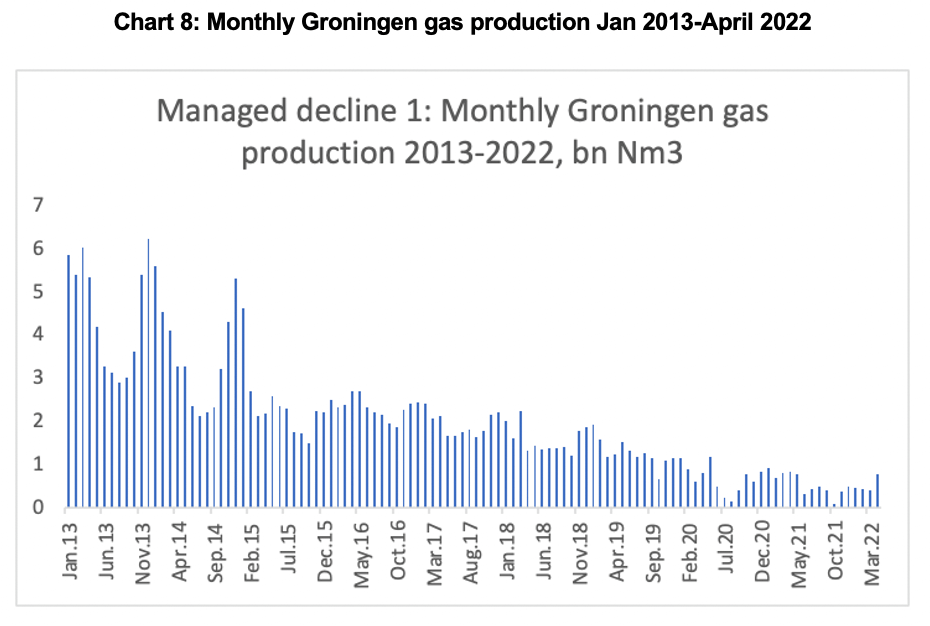

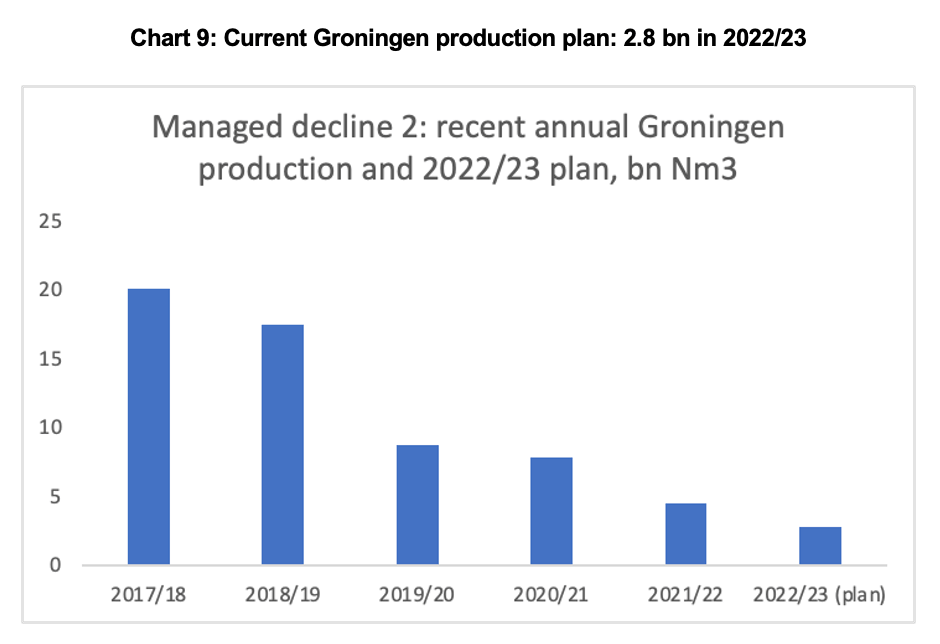

At the same time, Groningen’s production profile suggests substantial scope to increase production, with monthly extraction rates of 5-6 bcm before restrictions were imposed in 2014 and over 2 bcm per month as recently as March 2018, and only a modest further decline in reported reservoir pressure since then. Moreover, extraction rates often double or halve month-to-month, which suggests that production is controlled mechnically rather than constrained by the reservoir or a slower-moving pressure management system. In addition, we note that in early 2022, the Dutch government sanctioned 2.8 bcm of production in the 2022/23 gas season, going back on an earlier decision to close the field, except for back up purposes, in October 2022, and indicated scope for further production thereafter, “depending on the geopolitical situation” – suggesting additional production is a matter of choice not physics.

Source: NLOG field datacentre

To dispel concerns that the Dutch government is hiding behind technical reasons to justify a political decision to stick with the existing consensus around ending Groningen production, and to pave the way for additional Groningen production, we propose three steps:

a) A commitment from the Dutch government to hypothecate all additional Groningen revenues from production above the current profile, after any additional costs, to spending on Groningen infrastructure and compensation for subsidence, perhaps reinforced by a guarantee of compensation;

b) Publication of independent reports setting out the potential L-gas demand in NW Europe, and the options on reservoir pressure management, and the associated gas production profiles;

c) Immediate preparation of pads and mobilisation of rigs to drill additional injector wells – if necessary ahead of a final decision to proceed – to ensure enhanced reservoir pressure and production can be achieved as rapidly as possible.

How much is needed? Perhaps 2 bcm a month to backstop European supply

Assuming other sources of additional supply and reduced demand come through in response to high prices, we think that the Dutch government would backstop European gas supply if it announced:

a) an increase in Groningen extraction rates sufficient to compensate for the loss of the June Nord Stream flows of 70 mcm a day, 500 mcm a week;

b) a general commitment that Groningen stands ready to continue providing increased supplies to the European market, until the EU gas supply has been deRussified.

In practice, this general commitment likely implies flowing Groningen gas at the enhanced rate of an additional 2 bcm a month through next winter, assuming that Europe will be able to source additional gas and substitutes for gas by winter 23/24. Groningen sales of an additional 2 bcm a month for eight months (August 2022 to March 2023) at current prices would generate €24 bn in revenues for Groningen – and thereby deprive Russia of €24 bn billion in gas revenues, reducing its ability to wage war. It would also be particularly effective at alleviating gas shortages in Germany, the area likely worst effected by the sudden loss of NordStream 1 flows, which saw a sharp deceleration in inflows into storage while Nord Stream 1 was down for maintenance.

Macroeconomic impact: lower inflation, fewer hikes, stronger EUR

June euro area inflation of 8.6%Y was heavily driven by high energy prices, which is running at over 40%Y, and directly accounts for 3.6pp, or 42%, of headline inflation. This is largely due to record high gas prices, and the knock on effect to record power prices, which are driven by gas prices. Using Groningen as Europe’s gas backstop and constraining the threat of Russian gas blackmail should reduce macro volatility in three respects:

First, it should reduce the outage risk in gas and power prices, lowering their level and their volatility. If Groningen substitutes current Nord Stream gas supply, the market should price a normalisation or decline in energy prices, and hence a drag on headline inflation, from 1Q23. Reducing inflation and inflation volatility has important further consequences: lower supply side inflation will support growth by reducing the squeeze on real incomes and consumption, and lower and less volatile inflation reduces the risk of a policy error from excessive tightening in response to a temporary supply shock. This may allow the ECB to pause tightening once rates have been returned to their estimate of neutral, around 0.5% – a cumulative hike of around 100 bps rather than the more dramatic 180 bps of tightening currently priced in.

Second, the shift away from Russia imports to domestic consumption will be meaningful enough to impact the euro area trade balance, amounting to a monthly decline in imports of around €3 bn, or 0.2-0.3% of EA monthly GDP. Combined with increased confidence from the reduced impact of a Russian gas supply cutoff, this could outweigh lower expectations of tightening, and support a modest rebound in the euro back above parity to the dollar.

Geopolitical impact: reduced Russian earnings and leverage

Using Groningen as Europe’s gas supply backstop could reduce Europe’s dependence on Russian gas to a residual level, significantly weakening Russia, who constitutes the principal threat to European security and prosperity.

In particular, this is a hit to Russia’s export earnings, which underpin its balance of payments and budget. Although historically gas has only provided around 10% of Russian oil and gas export earnings, recent record high gas prices means that gas was generating over 30% of oil and gas export earnings. Moreover, while embargoed oil can flow east by ship and still generate some export earnings, even if discounted, embargoed pipeline gas has no alternative export market, and likely stays in the ground. Compared to the status quo, additional Groningen earnings – amounting to €24 bn if it were to replace recent Nord Stream 1 flows for eight months at current market prices – would be a straight transfer from Russia to the Netherlands, significantly weakening Russia’s ability to finance war.

More generally, using the Groningen gas backstop reduces the threat of Russian gas blackmail, and counters Russian attempts to deter European support for Ukraine. It also opens the door for the EU to turn the tables and exert leverage on Russia over gas sales. For instance, as we suggested in another paper (see Making the GTS Russia’s Sole Channel of Gas Sales to Europe), the EU could require all Russian gas flows to the EU to take place through the Ukrainian GTS, with title transfer to take place at the Ukrainian border. This would reduce Russian leverage over the European gas market, and also open the door for the Ukrainians to impose a reconstruction levy on flows of Russian gas, which can help finance Ukrainian reconstruction.