- Kyiv School of Economics

- About the School

- News

- KSE Agrocenter Discussion Series Discussion 3: Adaptation, innovative technologies and support instruments

KSE Agrocenter Discussion Series Discussion 3: Adaptation, innovative technologies and support instruments

7 December 2023

On November 29, 2023, the Center for Food and Land Use Research at the Kyiv School of Economics (KSE Agrocenter) organized the seminar «Adaptation, innovative technologies and support instruments».

Dr. Mariia Bogonos, Head of KSE Agrocenter, in the opening notes reminded the audience the setting in front of which the adaptation happens: destroyed agricultural assets; farmland contamination and mining; high transportation and energy costs; labor relocation and mobilization; lack of export capacities Yet there is also a challenge of global warming, the presence of which is unconditional as to when the war ends.

Olena Kryvova, Coordinator of the Ukraine Country Programme at Geneva International Centre for Humanitarian Demining, introduced the aspect of inaccessibility of agricultural land for production due to the risk of explosive ordnance contamination.

Main points:

• There is a risk of fertile land containing anti-personnel mines, anti-vehicle mines, and cluster munitions. The area of land to be demined has not been determined yet, though the survey process is still under way. It is currently certain that up to half the lands mined are proximate to the frontlines.

• The main approach to relieve the risk of contamination is to perform a comprehensive non-technical survey. The land is then immediately released for agricultural use or marked for technical surveys and extraction. The survey projects are conducted predominantly on the scale of amalgamated territorial communities.

• The commercial land monitoring service Feodal has launched a platform for the farmers to apply to for a demining survey.

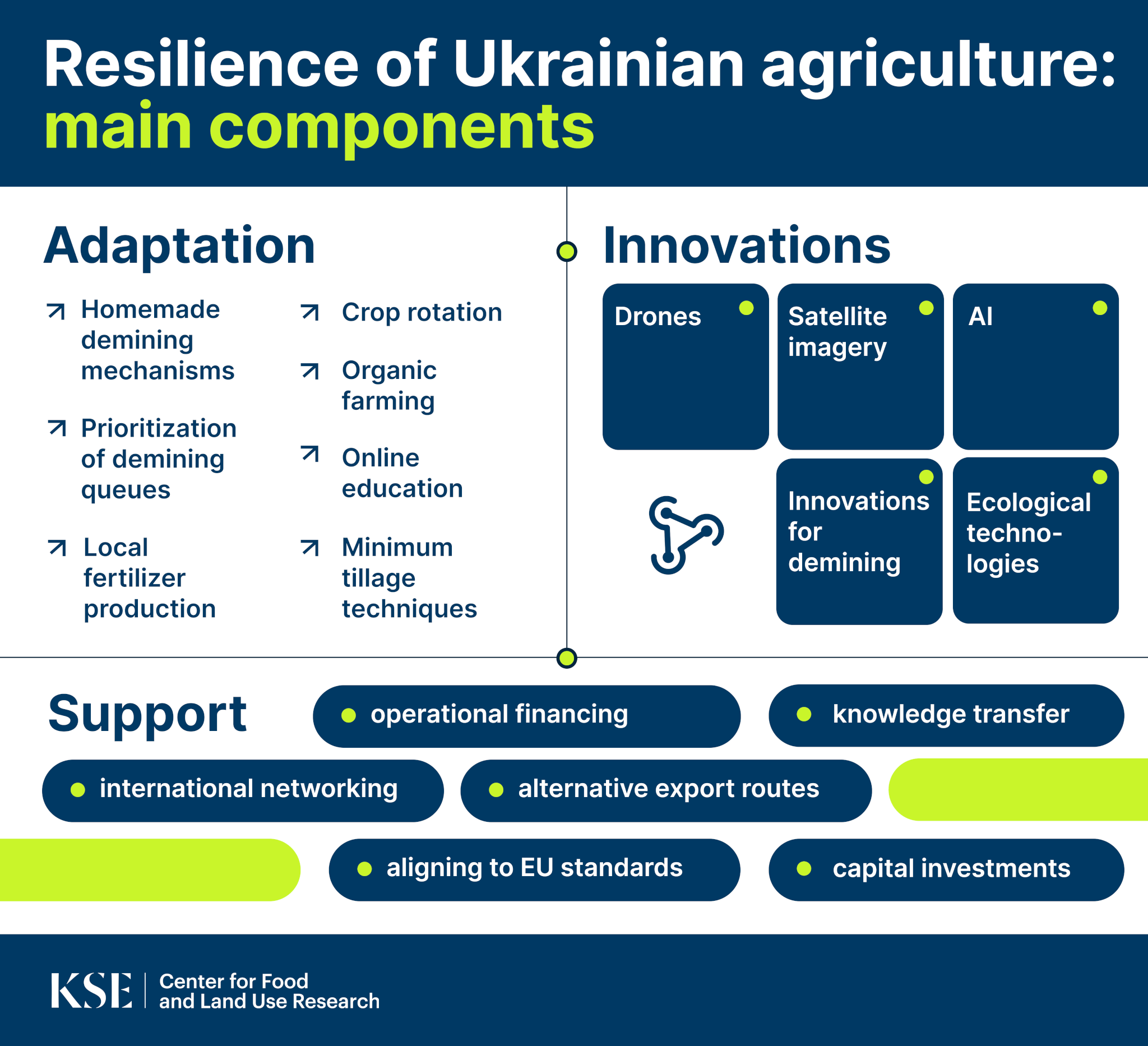

• There are new technologies being introduced: artificial intelligence, use of satellite imagery, domestically produced mine clearing machines, use of drones for data procurement, innovative financing models.

• The Ukrainian government has produced a priority list for lands slated for demining, which is based on the criteria of economic feasibility and explosive ordnance density. Economic feasibility categories are the following: (I) vegetables and melons, (II) other arable land, (III) other non-agricultural land.

• The Ukrainian demining efforts are at the spearhead of innovation. The nuances in the industry speed up the search for the unexploded ordnance, but the demining process is still to be done in a manual and labor-intensive manner.

Hryhorii Stolnikovych, Researcher at KSE Agrocenter, presented the findings of its research into how influential fuel and fertilizers are to the immediate and further crops production and what actions have the farmers sought to alleviate themselves from the inputs price increase.

Main points:

• The fuel prices amount to 35-40% of the total cost of goods produced. Their prices (of natural gas and oil) increased 60%-100% since the start of full-scale invasion. Hryhorii decided to estimate the substitutability of fuel and its price elasticity of production.

• There was an attempt to include the organic producers into the dataset with surveys having minor success, though such producers grow different crops than the ones primarily studied in this project.

• The share of fuel and fertilizers in the costs of wheat, corn and peas have been constantly increasing. The share of fertilizers in the same costs have plateaued. But the share of land in barley costs increased significantly due to the expansion of sowing this crop. The cost of flour does not depend on energy prices to a great extent.

• It turns out that the food producers have greater difficulties in substituting fuel and fertilizers. There is a possibility to domestically produce the fertilizers and this option allows for fuel savings.

Prof. Dr. Rico Ihle, Associate professor at Wageningen University, introduced the way the Ukrainian agricultural sector survives through the difficulties. According to him, the Ukrainian food sector is set to become the innovator in resilience and can rather easily surpass any further hurdles once the country is fended off the RF.

Main points:

• The Ukrainian agricultural sector persevered through the challenges of post-soviet reconstruction, climate change, and war-related supply chain disruptions. The current war-related challenge puts it into a rather unique fate in the world’s history.

• Without any shelter from the EU’s Common Agricultural Policy, the Ukrainian food industry has become the global cornerstone of food supply. In addition, Ukrainian grain exports sustained a 2.5-fold increase in production costs. These statements depict the considerable resilience and adaptability capabilities of the local farmers and processors.

• The challenges to Ukrainian farmers are similar to others in that unforeseen events happen to them. The differences with the other farmers appear in the degree, duration and comprehensiveness of those unforeseen events.

• The Ukrainian agricultural business can convert the war challenge into an opportunity through the resilience innate to them. The food producers have an opportunity to completely decouple the production chains from RF.

• Ukraine can become a global resilience expertise leader through channeling its grief into inventiveness.

Vasyl Hovhera, Economist at European Bank of Reconstruction and Development, and Olena Penenko, Principal Banker at EBRD, have displayed the role this international institution have in assisting the food production industry throughout the past 22 months of the full-scale war and how they still can help any farmer.

Main points:

• The EBRD co-finances projects and assists in institutional change. It supports innovations through technical assistance.

• The EBRD appeared at the forefront of supplying the Ukrainian businesses’ finances during the RF’s invasion. The war had become a liquidity challenge for the Bank’s partners: the energy and railway sector were prominent recipients over this period, while the Bank had to assist the agricultural sector as well since it was left behind by the rest of the banking sector.

• The assistance to the food industry was directed towards improvements in agricultural logistics, the renewal of assets, expansion of production and storage capacities, and to the reintegration of the demobilized personnel into the workforce.

• The EBRD can provide the businesses with the loans in the following manner: direct assistance can be done with the minimal amount of UAH 10 mln., assistance with distributed risks (when the EBRD partners with third party banks) – with at least UAH 2 mln., and a minimal investment of UAH 50 thsd. can be provided as part of the Bank’s portfolio of peer projects.

• EBRD, in coordination with USAID, took part in the Grain Alliance – a logistical assistance project directed to agricultural exports towards Slovakia.

• There are two cases of EBRD assisting the food businesses. The first case related to Astarta company entailed liquidity assistance, capacity modernization, and the implementation of a climate corporate governance programme. The latter became the highlight of the case since the interest rate on the loan is conditional on the greenhouse gas emissions of the company. The second case related to IMK company also entailed logistics financing and the introduction of new digital technologies for production.

• EBRD also launched a training platform AgriAcademy for the farmers to obtain new skills.

• EBRD continues the development of the irrigation infrastructure and the institutional adaptation for the needs thereof.

• The Bank also consults small and medium enterprises on more innovative and sustainable production technologies.

The seminar evolved from presentation of the developments and findings into a panel discussion, in which the following people took part:

• Rodion Rybchynskyi, Head of Union of Millers of Ukraine.

• Stefan Dreesmann, Leader of the German-Ukrainian Cooperation in Organic Agriculture (COA) project.

• Oleh Khomenko, Director General of Ukrainian Club of Agricultural Business.

The discussion involved the following topics:

- 1. How did the RF’s invasion affect flour production? How did it adapt? And what effective support means it wants?

• The domestic demand for flour decreased by 5%. The dynamic is understandable since a considerable share of the Ukrainian population has sought refuge abroad.

• The flour industry has faced a substantial change in export logistics. It entailed a switch of the routes from the sea to overland.

• The conflict taking place on the EU border is only the beginning of the tumultuous relationships of the food producers on both sides of the demarcation line. It will be flaring up every half a year until Ukraine finally enters the European Union.

• The Ukrainian milling companies are in competition with Dutch and Spanish producers. For the time being, Ukrainian products win the competition, primarily through lower prices. There is still a need to increase flour quality, especially because of the poor grain quality.

• The flour milling industry faces considerable human capital losses and loses liquidity since the food processors above in the production chains become more indebted. To counter the adverse dynamics grain clusters could be developed to vertically cooperate with farmers.

• The Union of Millers of Ukraine expresses gratitude to EBRD and USAID for their assistance to the industry.

- 2. How did the RF’s invasion influence organic farming? How did it adapt?

• 22% of the Ukrainian organic farms have lost the respective EU certification for exports thereto. The total loss of land under organic farm operation amounts to 38%.

• The Ukrainian government has recently adopted a domestic organic product certification framework. 100 companies have already received the respective certificates. The logo for Ukrainian organic products is rather appealing to the experts.

• The Ukrainian food industry supplies 200 thsd. tons of organic products to the EU. It has managed to retain the past volume of product sales. No wonder this is the case since the prices for the organic products are not so much different from the ones for the conventional produce.

• The Europeans still hold a stereotype that Ukraine consists only of large farms. Evidence shows that this is not the case.

• Organic farming is the adaptation strategy to the war-related challenges.

Supplementary presentation by Dr. Dreesmann

- 3. How did the RF’s invasion affected agricultural production? How did it adapt?

• The farming industry prominently faces the human capital problems: the newest machines, technologies and processes are useless when there are no people operating them. The agricultural businesses are liable to reporting new employees and firings to the conscription offices and are allowed to retain only 50% of workers.

• The farmers decreased their use of fertilizers through new tillage techniques.

• Soybeans have become a more profitable option for sowing, whilst corn, wheat, and sunflower have lost some of the popularity in this regard.

• There persists an issue with value-added tax refunds for exporters from before the war. The legislation that caused it is about undocumented grain, the elimination of which is a noble cause, but its implementation has unforeseen consequences.

• The agricultural businesses can be assisted to overcome the current war-related challenges through offering them new tillage techniques and new export possibilities.

- 4. Why did organic farming decrease in size and scope?

• One portion of farms have appeared to be under RF’s occupation, or at least a share of land in the unoccupied farms.

• No organic farmer expected the EU border conflict to occur.

• Nonetheless, the small organic farms are very enthusiastic about their purpose of existence, about being environmentally friendly and cooperating between each other. They have an optimistic outlook on the future.

- 5. Does the food production industry need support? How can it be done?

• If the purpose of the assistance is to maintain a large-scale food industry, the producers will gladly accept it. They do not need subsidies; they rather need state organizational support with promoting their produce. The Ministry of Economy has still not approved the allowance list for foreign exhibitions the companies can participate in, even if the companies could pay for that on their own. The food producers also need organizational support for experience exchange trips and education programs to Europe.

• A number of policies could strengthen the resilience of food industry: support of leasing programs for equipment, state compensation of insurance for container transportation, control over payment periods from food retail to processors, financing the adaptation of Ukrainian food companies to the EU Green Deal requirements.

- 6. What are the capacities for milling expansion?

• More than 10 enterprises in milling and pasta production have been launched during the full-scale invasion.

• Export companies are sure to operate throughout the war. The companies with domestic orientation are less resilient. All the companies entered the war with considerable reserves of cash and capacity. They have been eating into them throughout the war. The limits for robustness can be seen within 2-3 years.

At the end of the seminar Dr. Mariia Bogonos expressed the hope that the industry comes out with least losses and ready tools of support from Ukrainian society and European community.