- Kyiv School of Economics

- About the School

- News

- The impact of invasion on Russian economy. Oil industry

The impact of invasion on Russian economy. Oil industry

5 August 2022

Main recommendations¹

By Borys Dodonov (Head of KSE Center for Energy and Climate Studies, KSE Institute)

Our recent flagship working group paper on energy sanctions outlines both proactive measures to reduce revenue inflows to Russia and mitigation measures to address the potential impact of Russian retaliatory measures, including an abrupt supply disruption. Thus, in oil sector KSE Institute recommends the following proactive measures to curb Russian oil revenues:

• An adjustable import tax (or tariff) designed to transfer substantial funds away from Russian and/or Belarusian exporters for the purpose of sharply reducing export revenues for the war and providing monies for Ukraine reparations (the “value-transfer mechanism

• Separate value-transfer mechanisms will be maintained for each category of imported crude oil and oil products

• A special escrow account will hold net proceeds due to exporters

• Targeted sanctions against material-service providers enabling seaborne exports aimed at circumventing the Controlled Sales Regime

• Sanctions extension on oil-field services and technologies should be expanded to include all oil-field services and technologies for any oil-exploration and production projects within Russia

The proposed mitigation measures to address possible global supply disruption stemming from a drop in Russian oil supply

• Increase European ownership over critical infrastructure

• Reduce demand for crude oil and oil products by implementing the IEA’s 10 Points Plan to Cut Oil Use

• Further release emergency reserves

• Tap into OPEC+ spare capacity

• Encourage increased non-OPEC production

• Support Kazakh and Libyan production

• Rely on higher European margins to replace Russian oil products

Only implementation of the IEA’s recommendations will enable to lower the oil demand by 2.7 mb/d in OECD countries which is close to 2.9 mb/d of Russian oil supply to the EU in June. Along with supply measures it will enable to gradually phase out Russian oil import by developed countries along with lowering current high prices that have no economic fundamentals.

Impact on production, exports and revenues

Russia is the third largest oil producer behind the United States and Saudi Arabia and the world’s largest exporter of crude and oil products to global markets. Russia was responsible for around 14% of world crude oil supply in 2021. It exports around two-thirds of its oil production. Russia relies heavily on revenues from oil and natural gas, which in 2021 made up 45% of Russia’s federal budget.

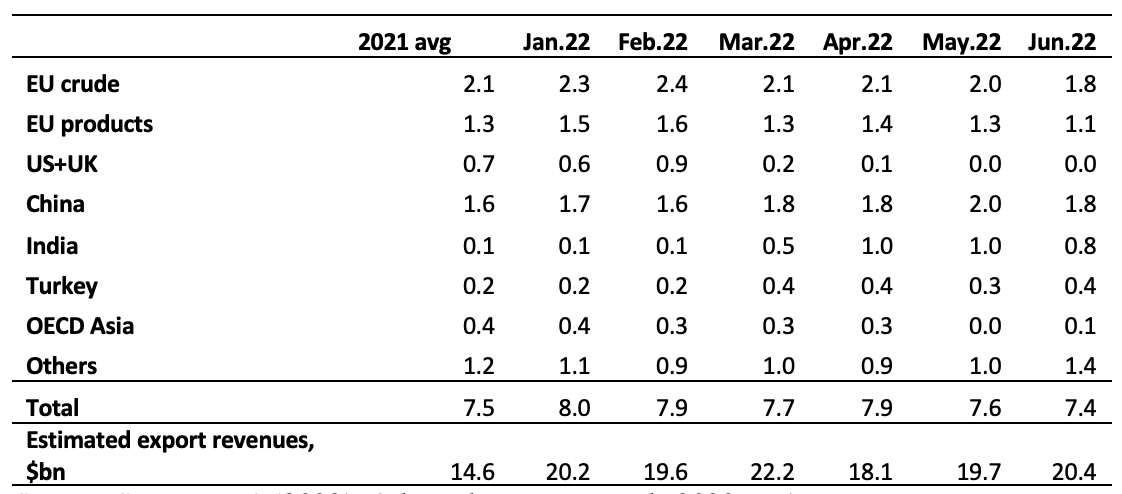

According to the data of the International Energy Agency (IEA), total Russian oil exports was around 7.9 million barrels a day (mb/d) in February 2022, in which OECD countries accounted for 5.4 mb/d or 68% of total crude oil exports (see Table 1). China was Russia’s largest buyer of oil with a share of 20% in total exports while the major destination of Russian oil was the EU countries, which were responsible for a half of Russian oil exports.

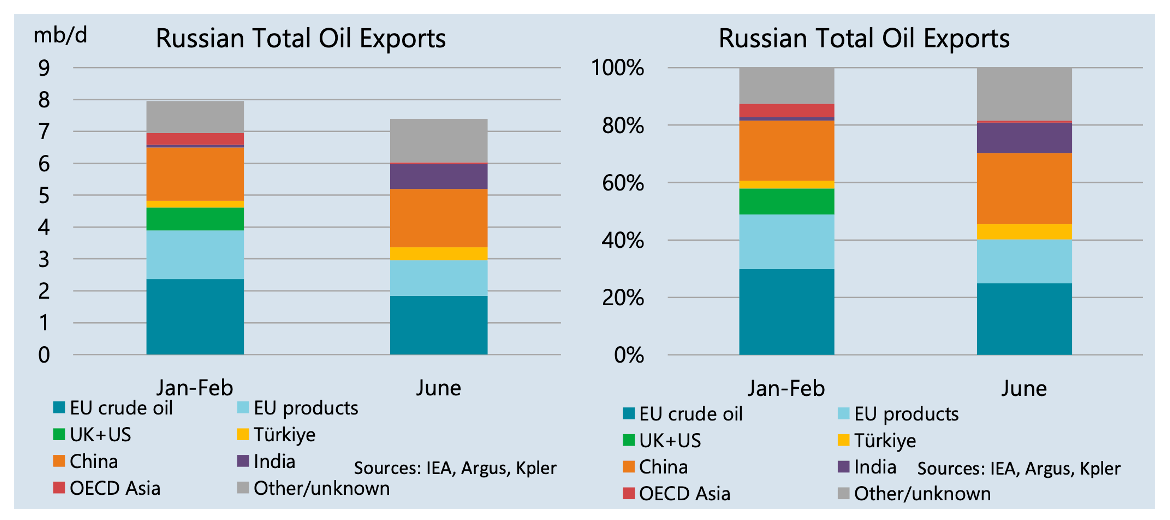

There are some notable changes in Russian export after the invasion. In June 2022, EU countries remained the major destination for Russian crude oil and oil products but their share in Russian oil exports decreased from 50% to 39% (see Figure 1). The share of the United States and the United Kingdom fell to zero from 11% before the invasion. OECD Asia countries also decreased their purchases of Russian oil from 0.3 mb/d to 0.1 mb/d and their share correspondently dropped to 1% in June from 4% in February. The reliance of Russia on China’s market increased further, and the correspondent share has gone up by 4% to 24% in June, while India, which bought less than 1% before the war, increased its share in Russian oil exports to 11% in June (see Figure 1).

Table 1. Russian Oil Exports, mb/d

Source: Source: IEA (2022), Oil Market Report – July 2022, IEA, Paris

Russian oil exports in June fell by 250 kb/d (m-o-m) to 7.4 mb/d, the lowest since August 2021. Meanwhile, export revenues hit back above the $20 billion mark, increasing by US 700 m (m-o-m) on higher oil prices. In May Russia lowered export by about 0.2 mb/d (m-o-m) but earned additional US$ 1.6 bn in revenues due to higher prices. Thus, Russia continues to earn more by exporting less on the market fears of possible oil supply disruption from Russia. However, the oil export revenues are projected to go down to US$ 17.0 bn in August, the lowest level since the invasion, amid further export decline and lower prices.

Figure 1. The Structure of Russian Oil Exports in February and June 2022

Source: Source: IEA (2022), Oil Market Report – July 2022, IEA, Paris

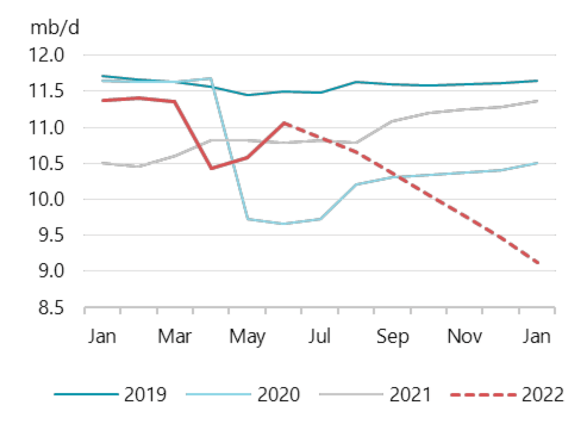

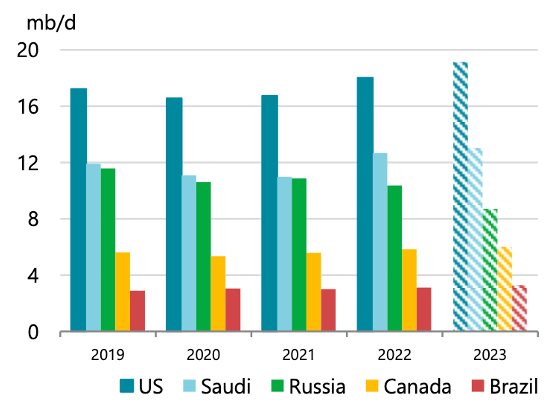

According to the IEA’s estimates, the oil embargo by the EU is expected to eliminate around 3 mb/d of Russian oil from the market. The S&P Global analysts have similar projection of elimination of 1.9 mb/d of crude and 1.2 mb/d of oil products since the embargo on Russian crude and oil products will take into effect in December 2022 and February 2023 respectively. Thus, next year the production in the country is expected to drop to the lowest level in last 20 years. At the same time the US and Saudi Arabia are expected to post annual record-high output both this year and next, widening the gap between them and Russia. Canada and Brazil, the fourth and fifths oil producers are also projected to reach the highest production levels in this and next year. In addition, the high prices are expected to curb the demand growth according to latest IEA and OPEC forecasts for 2022-2023. Thus, the IEA projects no supply deficit amid Russian supply disruption.

Figure 2. Russia Total Crude Oil Supply

Source: IEA

Figure 3. Total Oil Supply Selected Producers

Source: IEA

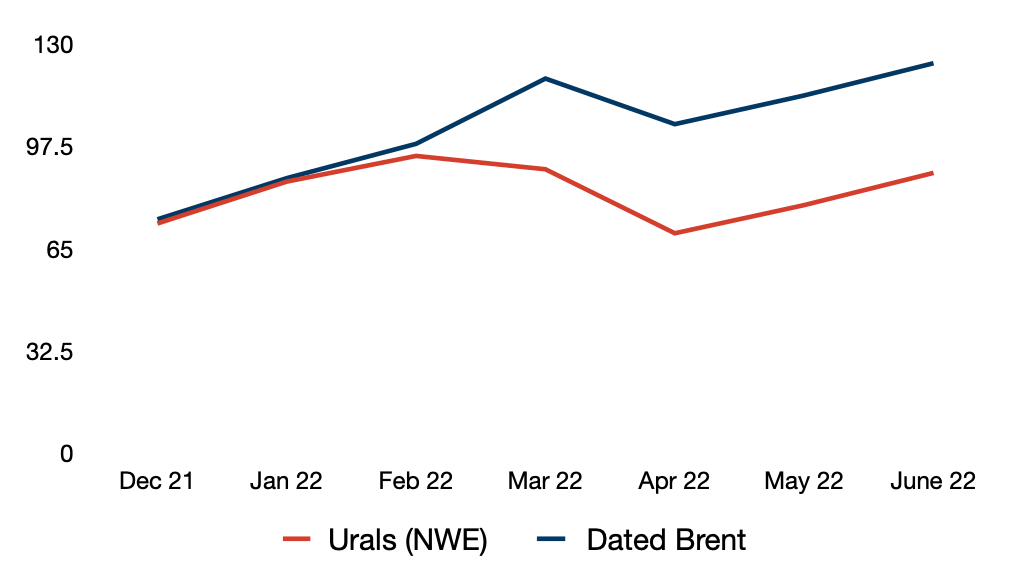

Russian oil has become a toxic product – from now on, Russia is forced to sell oil at a significant discount, which reached 35 US dollars per barrel over Brent in the second quarter of 2022. It may increase even further as ban on Russian oil will come into effect.

Figure 4. Spot market price of Russian Urals and Dated North Sea crude in December 2021-June 2022

Source: IEA, KSE Institute estimates

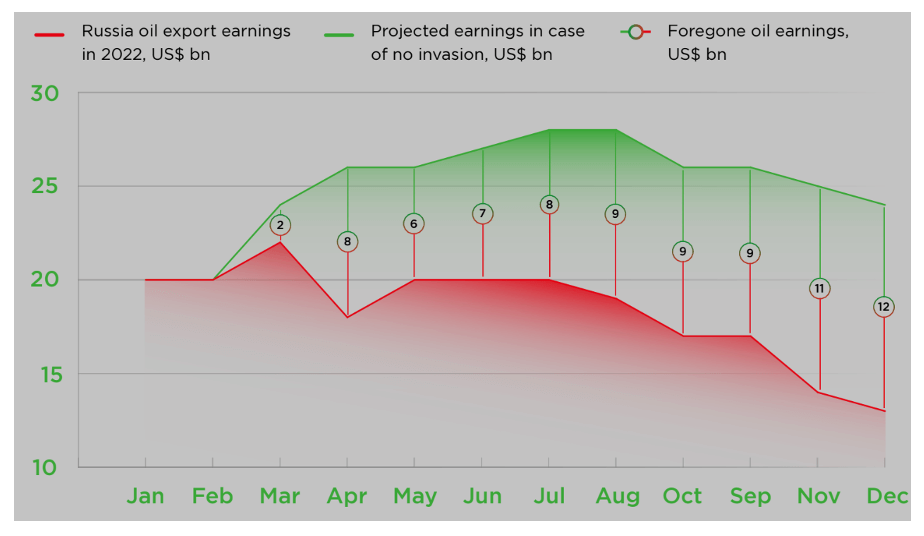

The Russian oil industry is not only forced to sell its oil at a record discount, but is also forced to reduce production and refining, as Ukraine’s Western allies refuse to buy these volumes even at a record discount. Thus, the opportunity costs are calculated as the difference between sold and hypothetical price for oil times the hypothetical production in line with OPEC+ quota, if there was no invasion. Total lost exports of oil industry are estimated at US$ 79 bn in 2022. Russian oil export earnings are projected to fall drastically from US$ 222.0 bn to US$ 79.2 bn in 2022 and 2023, respectively.

Figure 5. Foregone Russian Monthly Oil Export Revenues, US$ bn

Source: KSE Institute estimates

Circumvention of sanctions

Reorientation of export routes

Russia was able to divert the large part of sanctioned oil from Europe and North America to India and China. However, it had to shun part of its production since China and India could not absorb the total amount that was either sanctioned or self-sanctioned by Western Allies. Russian oil supply was 920 kb/d below its OPEC+ supply quota in June. As the EU embargo on Russian oil is phased in, the diversion of additional export from European to these markets faces significant logistical challenges. First, China has well diversified its oil imports structure and most likely will not be willing to hurt its energy security by being heavily reliant on Russia. Second, the shipping of these huge quantities will be very problematic due to restrictions on oil transport services that come into effect along with the EU ban on Russian oil purchases.

Both China and Brazil are net oil products exporters and Russia will have to find other markets or shun some of its refineries after the EU ban of Russian oil products in February 2023. Brazil’s president announced in early July a deal to directly import Russian diesel to lower prices in the country. Direct flows of all Russian oil products to Brazil are just 25 kb/d, or 5% of Brazil’s imports. Brazil imports 250 kb/d of diesel, mostly from the US and India. This is equivalent to 30% of current Russian diesel exports, and could be a significant development in the reorientation of trade flows. However, as in the crude oil the EU’s insurance ban may pose significant logistical challenges to facilitate these trade flows . The other potential destination for diversion of trade flows from Europe is African countries, which have not supported Russian sanctions.

Fujairah oil products re-exports

Russian oil export to Fujairah hit a record high of 116 thousand barrels a day (kb/d) in June, according to Kpler estimates. This is six times higher than Russian fuel flowed to this UEA hub in February. The increase of Russian fuel oil flows to Fujairah coincided with an increase in fuel oil exports from Fujairah to the US as the US refineries look to replace Russian fuel oil feedstocks. Fujairah has historically not been a significant exporter to the US, according to Kpler and US customs data before February 2022.

STS tracking activity

Ship-to-Ship (STS) transfer operations provide additional challenges to the enforcement of already imposed and planned sanctions on Russian bloody oil. Following the invasion, it was recorded a noted increase of Russian oil to Greek port Kalamata. According to S&P Global, the three-months average fuel oil shipments from Russian Black Sea ports to Kalamata soared from 218,000 mt in February to an all-time high of 481,000 mt at the end of May. STS transfers was recorded in other regions as well. For example, there were three STS cases in June, with vessels loading in the Russian Baltic ports and then performing STS transfers, while their transponders were turned off.

Once the EU embargo will take effect it would be harder to send Russian oil in larger quantities to some destinations, even with the help of STS activity, mask the origin as in Fujairah case or re-exports from blending hubs. KSE projects Russia will be able to redirect only 0.7–1.0 mb/d of its oil exports when the adopted sanction package will come into effect, shifting crude oil to Asia and oil products mostly to Africa or Brazil and overall decline in Russian oil exports will amount 3.1 mb/d.

Frozen project

Major oil producing companies like BP, Equinor, Shell, ExxonMobil, Total Energies as well all ‘big four’ oilfields service majors – Halliburton, Schlumberger, Weatherford and Baker Hughes either decided to exit or suspended new investments into the country. The developed countries also banned export of technology and equipment for oil industry in Russia. Lost access to western financing and technologies already resulted in a disruptions of oil production at joint projects and halted the development of Russian ambitious oil projects. The ExxonMobil-operated Sakhalin-1 Project recorded output of just 10 kb/d versus 220 kb/d before Russia invaded Ukraine. The most ambitious Russian US$ 180 bn oil project Vostok Oil is now delayed till 2029 instead of planned 2024 after sanctions delayed or restricted everything from drilling equipment and software to ice-class tankers. Located at Russian far north the project was supposed to produce 2 mb/d a premium, easy-to-refine type of crude and would account for 2% of daily global output by the end of this decade.

¹Please see Energy Sanctions Roadmap: Recommendations for Sanctions against the Russian Federation, https://kse.ua/about-the-school/news/energy-sanctions-roadmap-recommendations-for-sanctions-against-the-russian-federation/ for detailed sanctions recommendations