- Kyiv School of Economics

- About the School

- News

- Making the GTS Europe’s sole channel of gas sales with Russia

Making the GTS Europe’s sole channel of gas sales with Russia

08 August 2022

Authors: Jacob Nell, Nataliia Shapoval (Kyiv School of Economics) and Borys Dodonov (Kyiv School of Economics)

Executive summary: The EU has now laid out plans to phase out Russian gas sales to the EU completely by 2027, as part of its effort to reduce Europe’s dependence on Russia energy. In this paper, we argue for an additional step to shut Gazprom out of the European gas market from the start of 2023, by banning Russian gas imports to the EU from all routes except the Ukrainian GTS. This would reduce Russia’s influence over European gas markets, while strengthening Ukraine’s energy security and creating an option to raise funding for Ukrainian reconstruction with a special transit levy. Longer-term, ongoing EU imports of Russian gas at a modest level on these terms may be an option.

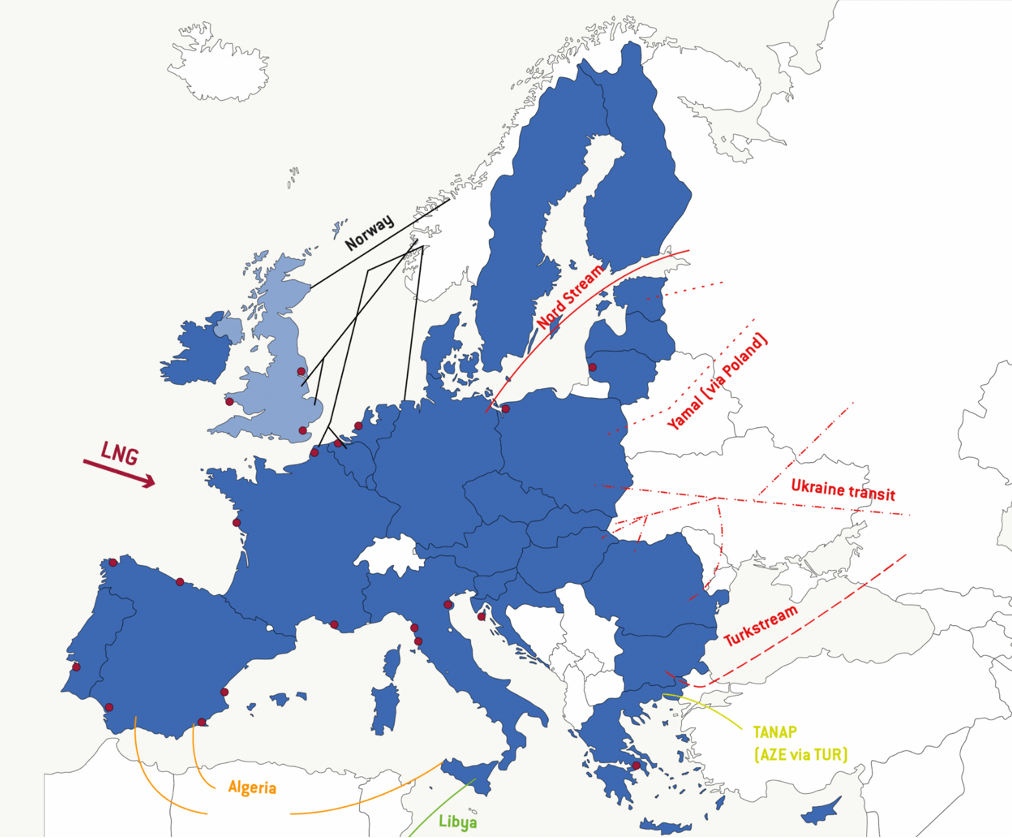

Context: Russia as the largest supplier of gas to Europe. Last year, Russia was a key supplier of gas to Europe, providing 155 bcm, amounting to 41% of the EU’s gas consumption, which it provided through four pipeline export routes (Nord Stream 1, Yamal, the Ukrainian Gas Transmission System (GTS) and Turkstream) as well as some LNG.

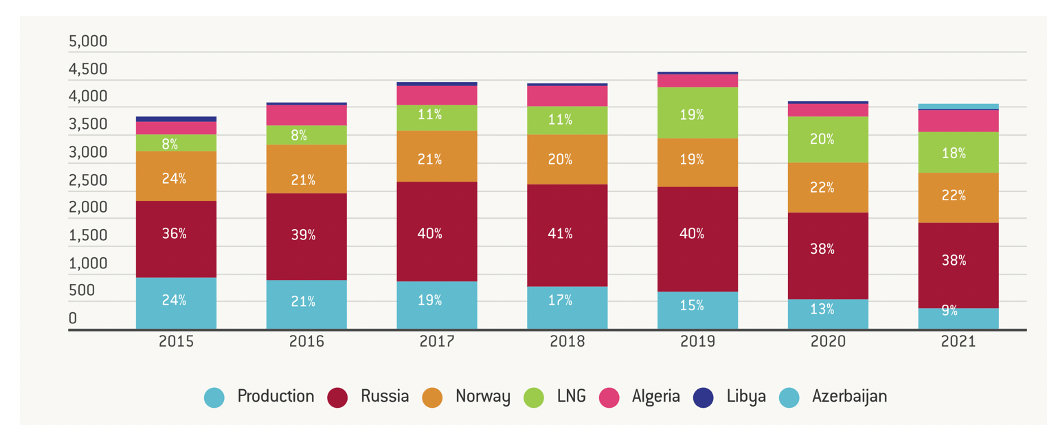

Figure 1. Annual EU27 production and imports, TWh

Source: McWilliams, B., Sgaravatti, G., Tagliapietra, S. and G. Zachmann (2022) ‘Can Europe survive painlessly without Russian gas?’, Bruegel Blog, 27 January, 2022

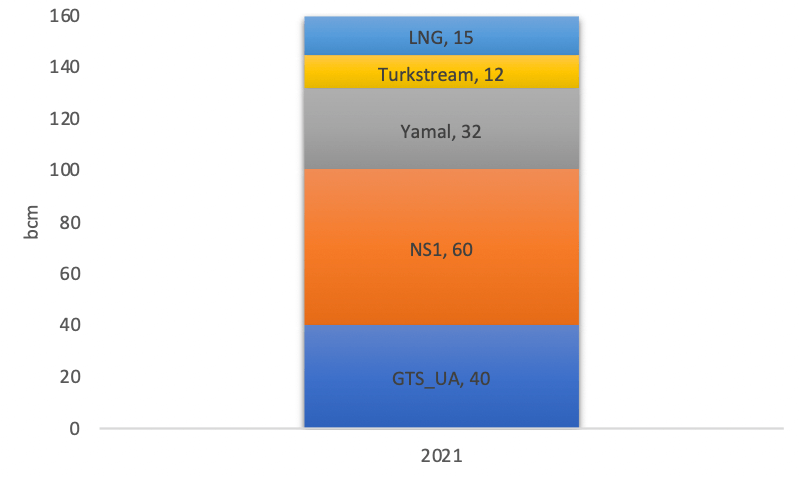

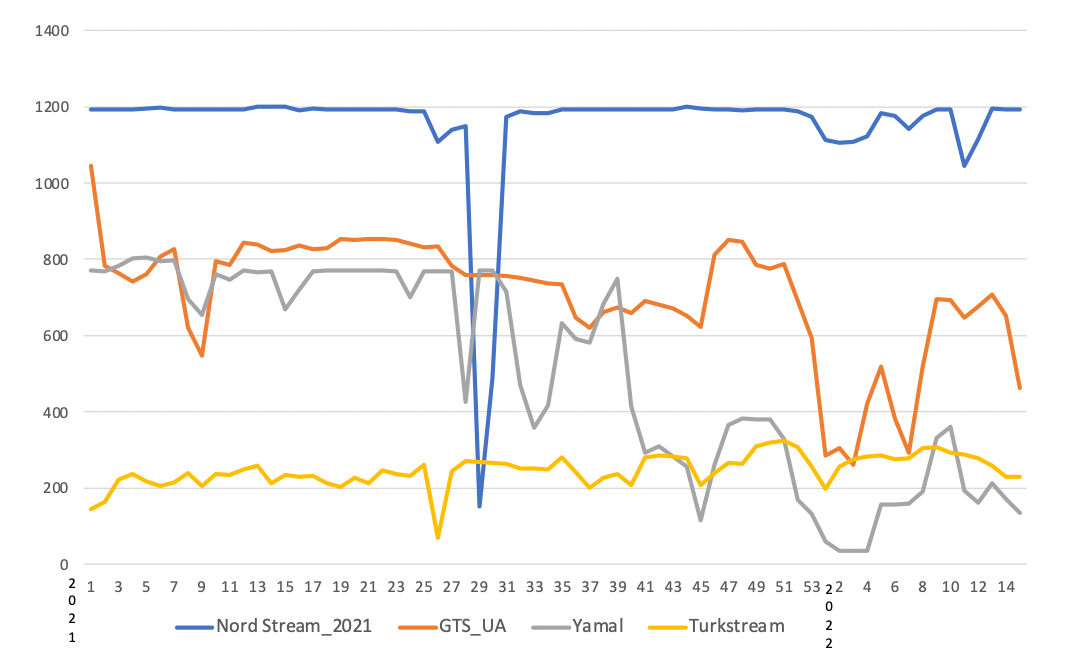

Figure 2. Russian natural gas export to the EU by route, bcm

Source: Georg Zachmann, Giovanni Sgaravatti and Ben McWilliams, (2022), European Natural Gas Imports dataset, IEA, KSE Institute estimates

However, Russia is set to lose its role as a supplier of energy to Europe. In response to Russia’s war of aggression against Ukraine and the atrocities committed by its forces, as well as in response to the attempt by Russia to exert influence over Europe by squeezing gas supply from the middle of last year, the EU has announced its intention to stop buying Russian energy. In line with existing policy announcements, the EU is planning to reduce its imports of Russian energy to zero, with a ban on Russian coal from August 2022, a ban on Russian oil from end-2022 is under discussion and may be announced shortly, and the Commission has set an objective of ending the purchase of Russian gas completely by 2027, underpinned by the detailed RepowerEU plans announced on May 18.

We have argued in previous notes – see here for the McFaul working group action plan on energy sanctions, and here for a more detailed note on options to curb oil and gas revenues – that such measures can reduce Russian oil and gas revenues rapidly, putting the Russian economy and currency under pressure and constraining Russia’s ability to wage war. Moreover, if implemented in a smart manner, as part of a comprehensive strategy, we think that a further supply shock in oil and gas can be avoided. In the case of oil, this implies in practice tolerating exports of Russian crude and product to Asian markets for a period until the global market has rebalanced, while maintaining the threat of ancillary sanctions to maintain and deepen the Russian oil discount. In the case of gas, this implies a multiyear effort to cut demand for gas, including by reducing energy demand and by developing substitutes, mainly renewable, for gas. It also requires expanding alternative non-Russian sources of gas supply to Europe by pipeline and ship, and consequently, given the timeframes for infrastructure buildout and increased gas supply, a slower transition to a full European embargo than for oil. Through this interim period, we suggest that the EU get on the front foot and further reduce Russia’s influence over European gas markets by excluding Gazprom from the European gas market, requiring all Russian gas exports to the EU to flow through the Ukrainian GTS, with title to the gas changing hand at the Russian-Ukrainian border. As a consequence, this would shut down Nord Stream 1 and Yamal, both pipeline systems built with the explicit objective of avoiding Ukraine.

In this note, we answer some of the questions we have fielded on this idea, looking at why it might be more preferable to other options, and how it might work. We also sketch a potential role for the Ukrainian Gas Transmission System (GTS) in the longer-term, if Ukraine and Russia reach an agreement, and Russian exports of gas to Europe continue at a modest level, providing say 10% of EU demand (including Ukraine), ie around 50 bcma.

Why not shift to a full EU embargo on Russian gas immediately?

Even with full use of all alternative measures, it will be economically costly for Europe to go “cold turkey” on Russian gas, and may shut down a portion of gas-intensive industry for some time next winter, particularly in Germany, Italy and CEE. Putting the infrastructure and supplies in place to substitute Russian gas out of European gas supply will take time. The main source of marginal supply is likely to be LNG, but there is limited spare LNG capacity at the moment globally, and new LNG projects typically take 3 years or more from approval to first gas. On the other hand, adjustment has already been meaningful: gas imports from Russia are down from 41% of supply in 2021 to 26% in 2022 so far, while Russia gas exports to the EU in recent weeks have been slightly less than the recent strong flows into EU storage, implying Europe could already dispense with Russian gas in the lower-demand summer season.

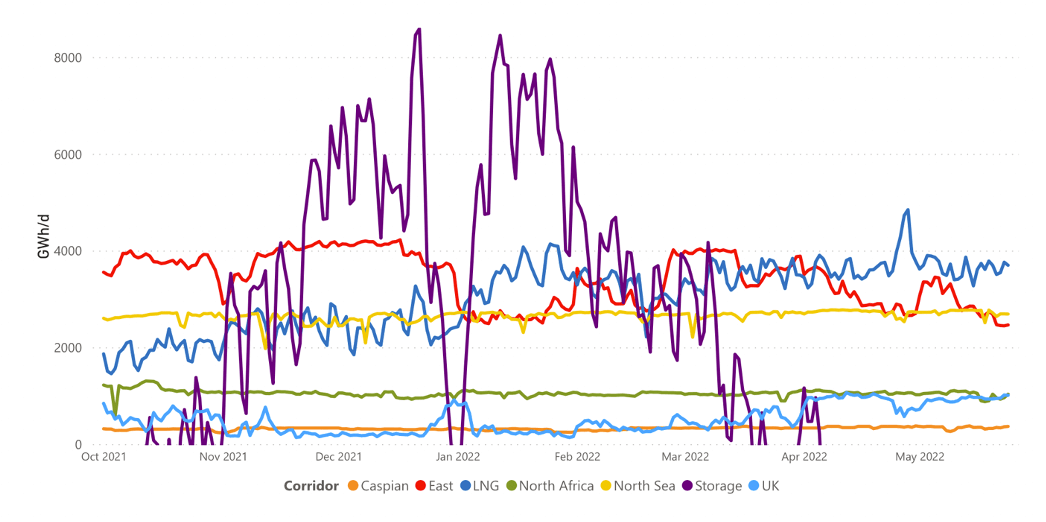

Figure 3. Gas supply corridors and flow to the EU: LNG has displaced Russia as Europe’s largest source of gas supply

Source: ENTSOG, gas flows dashboard

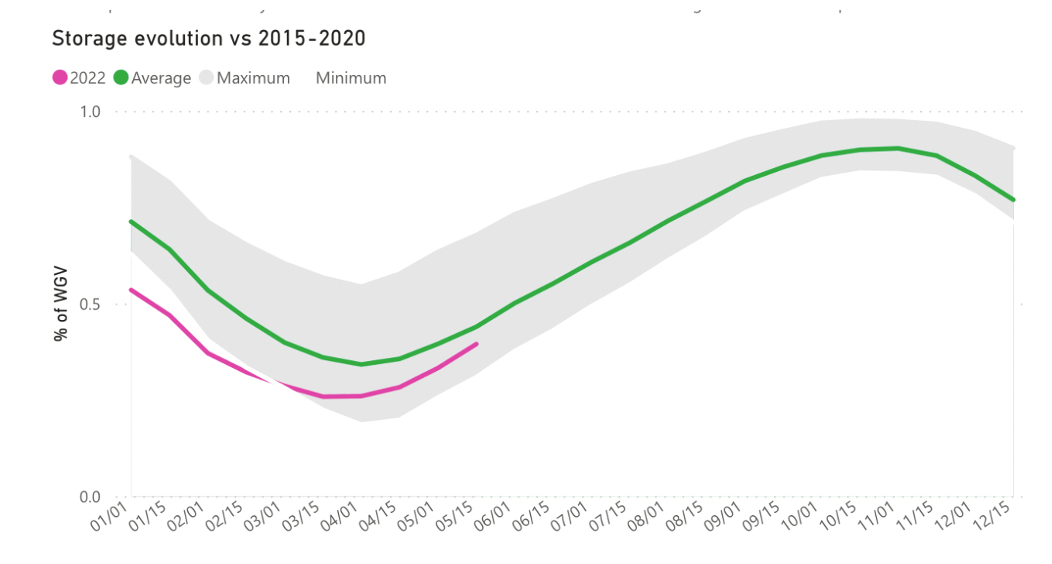

Figure 4. EU gas supply situation now improving rapidly, approaching the 5 year average

Source: ENTSOG, gas dashboard

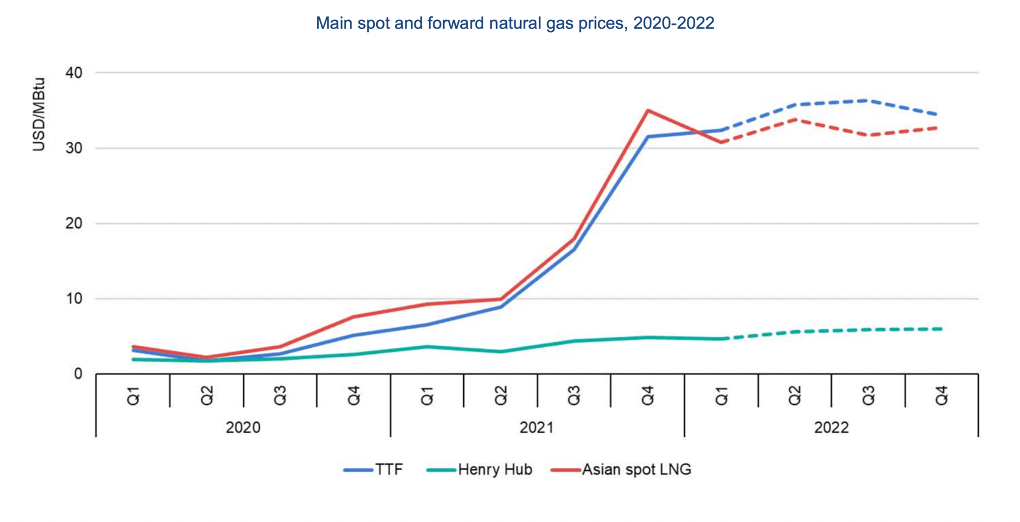

Moreover, Gazprom’s pre-war squeeze on European gas supplies, and the subsequent decision to cut Russia out of EU gas supply does imply higher gas prices, and so power prices, for an extended period. In particular, European gas prices, such as the TTF benchmark, will likely have to trade at a premium to Asian gas prices, eg the JKM benchmark, for the duration of this process, rather than at the discount they previously traded at, to ensure that spot LNG cargoes flow to Europe. Given this tight supply situation and the time required to put alternative infrastructure and source new supply, a transition period looks desirable. This is particularly true for Italy and Germany, the two largest EU consumers of Russian gas.

Figure 5. Natural gas spot prices at the main EU, US and Asian hubs, showing European gas trading at a premium to Asia

Source: IEA (2022), Gas Market Report, Q2-2022, IEA, Paris

Why prefer the GTS to other Russian export routes?

Figure 6. Map of Natural Gas Import Routes to the EU

Source: Bruegel

We favour reducing the number of routes to one to avoid Russia playing one supplier off against another, given Russia’s unreliable behaviour as an energy supplier, and to impose a cost now on Russia, by reducing the value of its gas export infrastructure. Across the four routes, we have four reasons for favouring the GTS over the alternatives.

- 1. Response to Russian aggression. First, we see the other pipeline routes – and particularly Nord Stream 1 – as being motivated to a large extent by Russia’s desire to send gas supplies around Ukraine, and therefore as part of the aggressive Russian strategy to undermine Ukraine’s independence. We therefore see action which reduces the value of those assets to zero, at least as far as their value derives from facilitating gas exports to Europe, as an appropriate and proportionate response.

- 2. Logistical advantages. Second, the GTS has a number of natural advantages over the alternatives, including i) greater capacity to supply to Europe (up to 146 bcma compared to a capacity of 55 bcma on Nord Stream 1 and 33 bcma on Yamal), ii) large associated storage (31 bcm), iii) multiple connections, including multiple supply routes from Russia and export routes into EU markets and iv) greater distance from the sea and therefore from potential LNG supply, which is the main alternative source of gas supply for most EU countries. This makes the GTS better positioned than the other export routes for EU member states such as Austria, southern Germany, Hungary, Slovakia, Czech Republic who have less advantaged access to LNG supply.

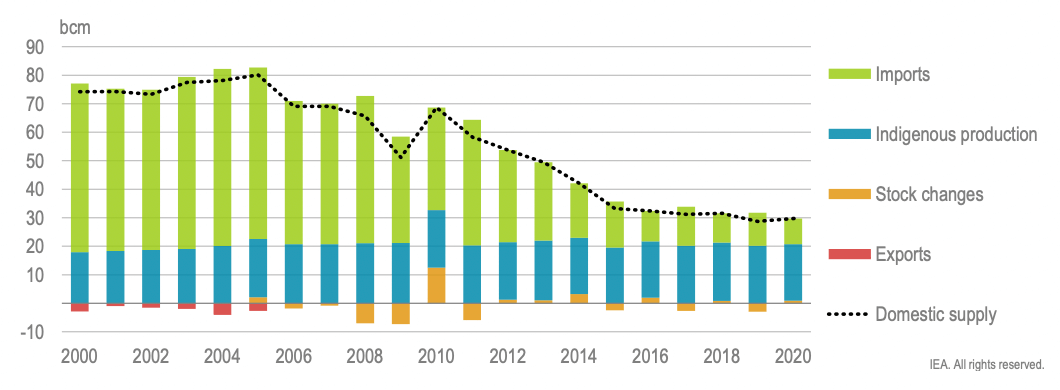

- 3. Protecting Ukrainian energy supply. Third, we see maintaining the GTS as the residual supply route for Russian gas to the EU as helping to protect Ukraine’s energy supply, which otherwise might be vulnerable to a Russian energy embargo, given Russian gas provides nearly a third of Ukraine’s gas consumption. Ukraine stopped direct purchases from Gazprom in 2016 and has imported gas at the entry points with the EU since 2016 and its interconnection points with Hungary and Poland were virtualised in 2020, allowing for backhaul (virtual reverse flows). Still Ukraine has physically consumed around 10 bcm of Russian gas per year since 2016, even if has been accounted as an import from the EU. Ending Russian gas transit through GTS would make both the indirect import of Russian gas and the virtual reverse flows impossible for Ukraine.

Figure 7. Natural gas supply in Ukraine by source in 2000-2020

Source: IEA, (2022), Ukraine In-depth Energy Policy Review, unpublished draft

- 4. Keeping Gazprom out of Europe. Gazprom has used its market power to undermine the European gas market, squeezing supplies last year and driving a tight market and record high prices, partly in an effort to increase Russian influence over Europe. The simplest way to keep Gazprom out of the internal European gas market is to require it to sell its gas at the border into a pipeline in which it has no equity. Since Gazprom has equity in Nord Stream 1, Yamal Europe and Turkstream, that leaves the GTS as the only Gazprom-free pipeline to Europe.

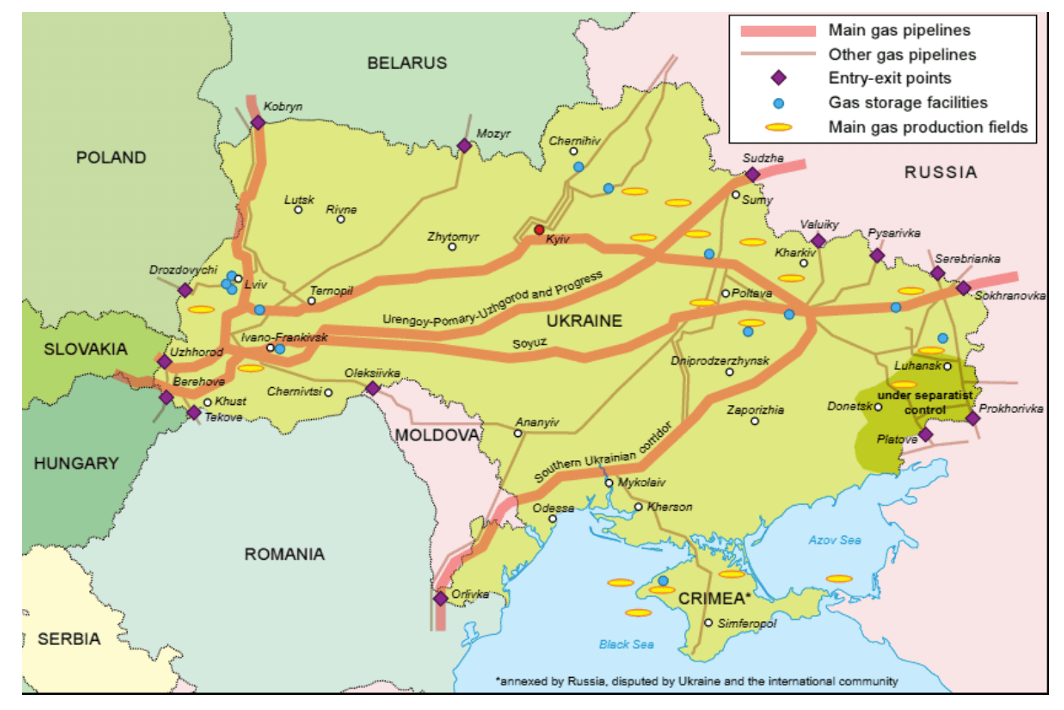

Can the GTS cope with all Russian gas exports to the EU?

We see two issues here.

The first is the obvious risk that the operation of the GTS may be impacted by the war – a risk highlighted recently by the decision of the GTS to cut flows through two sections of the pipeline controlled by Russian troops. At the moment, one of the two main entry points from Russia – at Sokhranovka in the east – is under Russian control, although the other more important entry point at Sudzha near Sumy is now back under Ukrainian control.

Figure 8. The Ukrainian Gas Transmission System (GTS)

Source: Oxford Institute of Energy Studies, November 2018

The second issue is whether the GTS has the technical capacity to substitute for the Russian gas supplied by other routes, which on current flows would amount to around 230 mcm/day, or 83 bcma. The short answer here is in aggregate the GTS has the capacity, and to spare – it can provide 146 bcma on exit, and is currently only transiting around 30 bcma.

If anywhere, the likely squeeze on the infrastructure would be on the route to Germany through Slovakia since shutting other pipelines to move to a single channel of sales via the GTS would have most impact on German users with their current advantaged access to Nord Stream 1 flows, which are in excess of 1 bcm per week. Even here, in aggregate there is almost enough spare capacity in the Ukraine-Slovak pipeline to accommodate the current NS1 flows. According to ENTSOG, there is currently spare capacity of 1.356 Twh per day on this route, which when annualised is equivalent to 50 bcma, broadly comparable to NS1’s firm technical capacity of 50-55 bcma. Besides, a) in the past the capacity of the Ukraine-Slovak pipeline was higher, so there may be scope for rapid debottlenecking, and b) with European gas storage now over 44% full and approaching 5Y average levels, the pace of Russian gas imports can slacken, without jeopardising the new target of filling European gas storage to 80% full by the start of the heating season in November, c) Germany plans to have substantial LNG infrastructure in place in North Germany from the end of 2022, reducing its demand for Russian gas.

Figure 9. Weekly natural gas export from Russia by pipelines in 2021-2022, mcm/week

Source: ENTSOG

Why insist on title to the gas changing hand at the border?

Last year, Gazprom squeezed gas imports to Europe and failed to refill its storage facilities in Europe, while repeatedly suggesting that it was about to increase supplies, helping to create a tight market in Europe, pushing gas and power prices to record highs and European gas prices to trade at a premium to Asian prices for the first time. While at the time it seemed this was being done to pressure the German government to approve Nord Stream 2, in retrospect it looks likelythat this was also intended to increase Russia’s leverage over Europe as it prepared to invade Ukraine.

This is the latest and most striking in a long list of examples of Gazprom abusing its market power and undermining the European gas market, by taking advantage of the leverage in its partnerships, of its ownership of critical infrastructure in Europe and its ability to favour one client over another, including by directing flows from one pipeline to another.

Given this unreliable behaviour, and that Gazprom takes orders from the Russian government, Europe and member states have already taken some steps against Gazprom operations in Europe. For instance the German authorities have refused to approve Nord Stream 2 and have taken control over a Gazprom subsiduary (Gazprom Germania) which controls keystorage infrastructure. However, we propose to go further, and exclude all Russian state-owned and state-controlled enterprises such as Gazprom from participating in the European gas market, which implies no transit of gas within EU territory in a Gazprom-owned pipeline and no storage of gas within EU territory in a Gazprom-owned facility. More generally, we propose that title to Russian gas should be exchanged at the border, so no Russian entity owns gas in the EU.

Why not impose a tariff-and-escrow account arrangement on Russian gas sales to the EU, rather than seeking to close off some export routes, as an alternative mechanism to impact Russian gas revenues?

In the McFaul group action plan on energy sanctions we highlighted the scope in principle to force Russia to pay a tariff and deposit the proceeds in an escrow account, with withdrawal limited to approved purposes, e.g. to finance the import of foods and medicines. We believe, this is a good option from the economic perspective, which could complement a policy of switching to a single channel of sale. However, we argue here that switching to a single channel of sales should be implemented first. From our perspective, rerouting gas to a single channel of sale would be the preferred strategy to application of the tariffs and escrow policies. We see two reasons for this preference.

Firstly, application of a single channel of sale is easier and faster to implement. It would likely require a single EU-level normative act, reinforced by a change of conditions at the level of individual contracts. By contrast we think a tariff-and-escrow policy would require more granular decisions to be made and so, would take more time to implement. For instance the EU would have to decide upfront what level to set the tariff at, how to adjust it, how to enforce it, and how to approve disbursements from the escrow account. Secondly, we think the tariff and escrow approach may be seen as more contentious in terms of EU competence, and the legal basis for the decision as therefore less insecure, and more open to challenge at the ECJ.

Secondly, we see a greater risk of a Russian cutoff in reaction to a move to a tariff-and-escrow policy. Of course, Russia may cut off all supplies to Europe anyway, building on the recent decisions to cut off Bulgaria, Poland and Finland for refusing to pay for gas in roubles. But in principle, we see a decision not to buy any more Russian gas through Nord Stream 1, Yamal or Turkstream as less likely to trigger a strong Russian reaction, such as a full gas embargo, than a decision to impose a tariff and escrow account system, since it does not have any necessary immediate implications for Russian revenues and control over those revenues. A shift to a single channel of sales is therefore likely more compatible with an orderly winddown of Russian gas supply, as opposed to an immediate and complete Russian cutoff. At the same time, it does impose major costs on Russia immediately, since it would make the Nord Stream 1 link – built across the Baltic at a reported cost of $8.8 bn – worthless.

What about future Russian gas supply to Europe?

Looking ahead, there is one scenario where Russia continues to be aggressive to its neighbours, and the EU completes the intended transition to complete deRussification of its energy supply, as well as imposing further sanctions on all who continue to use Russian energy. In this case, Ukraine will meet its gas needs from domestic production and from imports from Europe, sourced from LNG, and eventually likely by pipeline from Caspian or Black Sea sources.

There is another scenario where there is at least some agreement with Russia, and an end to active hostilities. In this scenario, Ukraine and the EU may agree that a modest level of gas supply from Russia continues to be acceptable, provided that Europe has the capacity to substitute the Russian gas with alternative sources of supply, and thereby avoids the damaging dependence which had developed prior to the invasion of Ukraine. In this case, ensuing that the Russian gas supply to Europe goes through Ukraine will help protect Ukraine energy security and will also give it some additional leverage with Russia.

What about making Russia pay?

We see another advantage to insisting on a single channel for Russian gas sales to the EU via the GTS, since it provides another opportunity to make Russia pay for its war of aggression and the destruction it has caused in Ukraine.

In particular, we see challenges in making Russia pay, given the likely size of the bill (potentially hundreds of billions of USD), the likely reluctance of the Russians to admit their guilt and therefore responsibility, and the likely difficulty of enforcing a judgement against a state with nuclear weapons and a seat on the Security Council. There is scope to use the Russian assets which have been frozen or seized under sanctions, perhaps under a donor guarantee and using the interest payments from the frozen principal to fund borrowing while the lawyers wrangle. There is also scope to impose levies on Russian goods – including energy products – supplied to EU markets to fund reconstruction. However, both of these will likely be long and complex legal situations, and it is possible that Ukraine’s ability to make Russia pay will depend on securing Russian agreement or at least unanimity in the EU, including for instance Hungarian agreement, which could make it harder to achieve.

However, in the case of a transit levy on Russian gas going through the GTS to Europe, we see a way of making Russia pay which would be to a greater extent under Ukraine’s control. As the only route by which Russia would be permitted to sell gas to Europe, Russia would continue to have some interest in continuing supply even with higher charges; and as an object in Ukrainian territory, even if under some shared governance to recognise the EU interest and ensure effective and transparent management, Ukraine would have a greater level of control.

Moreover, the sums from an enhanced transit levy to fund reconstruction could be meaningful. If Russian transit volumes run at 50 bcma, with a gas price of $500 per 1000 cubic metres and Ukraine levies a 20% reconstruction levy, over and above the transit charges, then that amounts to annual revenue of $5 bn USD, or around 3% of 2021 Ukrainian GDP. Moreover, such a levy may last for decades – as a point of comparison the 5% levy on Iraqi oil to finance compensation to Kuwait paid out $52.4 bn between 1991 and 2022.

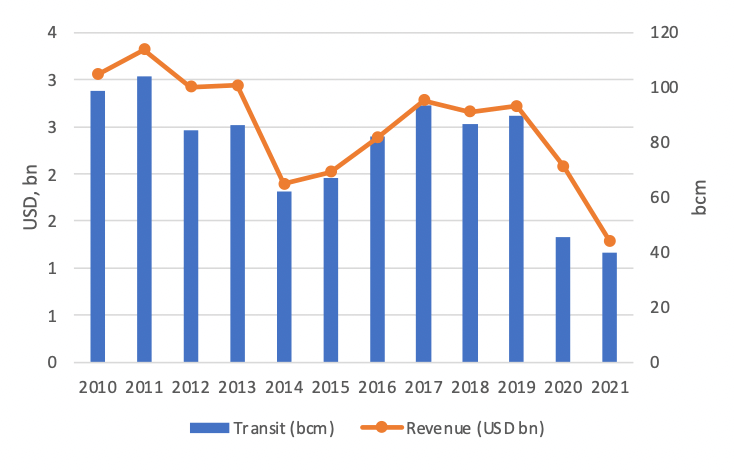

Figure 10. Ukraine GTS revenues from Russian gas transit and volume of transit in 2010-2021, USD bn*

Source: Naftogaz of Ukraine, Bruegel natural gas imports dataset, and KSE Institute estimates

* Note: Since 2020 the transit contact signed between Naftogaz and Gazprom envisions transit payments based on booked capacities instead on payment for actually transited gas as in 2010-2019. The minimum transit volumes were agreed as 65 bcm in 2020 and 40 bcm/year between 2021 and 2024.

What about governance of the GTS?

There are two related concerns. First, there have been persistent concerns about a lack of transparency in the trade in gas through Ukraine, allied to allegations of corruption, for instance in the Rosukrenergo scheme. However, many of these concerns have been addressed by the current unbundling process. Second, if the GTS is the single channel of sales for Russia to sell gas to EU consumers, then those EU consumers will want to be assured that they are being treated fairly and reasonably. To address these concerns, we would at a minimum propose a number of additional transparency and governance measures, such as: i) governance arrangements involving a GTS board with representatives from major gas consumers, and an executive team with a mixed Ukrainian and international/European background; ii) a dashboard, such as ENTSOG has set up, showing weekly flows of gas at the entry and exit points and the stocks in storage.

However, we also see potential merit in a more radical and structural solution. This could consist of two steps:

- 1. The Commission, or a coalition of gas-importing member states, buy a share in the GTS, so that the GTS becomes a jointly owned and managed asset. Depending on the details of the transaction, this might involve a cash payment of several billion euros, which could then be used to finance the reconstruction of Ukraine’s energy infrastructure, as well as an ambitious programme for the renewal and modernisation of the GTS itself to cut methane leaks.

- 2. The Commission, or some common body, acting on behalf of the importing member states and Ukraine, could buy the gas at the Russian border, so that Gazprom, or any other Russian state entity, had no further role in the supply of gas in Europe. For transparency, all payments could be executed through a single account, perhaps held at the ECB, with details of all payments regularly published. At the same time, the Commission, or other paying entity, could withhold the transit fee, which would be transferred to GTS to fund its operations, and the reconstruction levy – perhaps imposed as 20% of the value of gas sales – which could then be transferred to either the Ukraine reconstruction fund or to the Ukrainian Treasury or to a compensation fund, depending on the governance arrangements for the reconstruction/compensation funds.