- Kyiv School of Economics

- About the School

- News

- The Russian Economy At The End Of 2023: Stumbling, But Not Falling (Yet) — KSE Institute’s Russia Chartbook

The Russian Economy At The End Of 2023: Stumbling, But Not Falling (Yet) — KSE Institute’s Russia Chartbook

19 December 2023

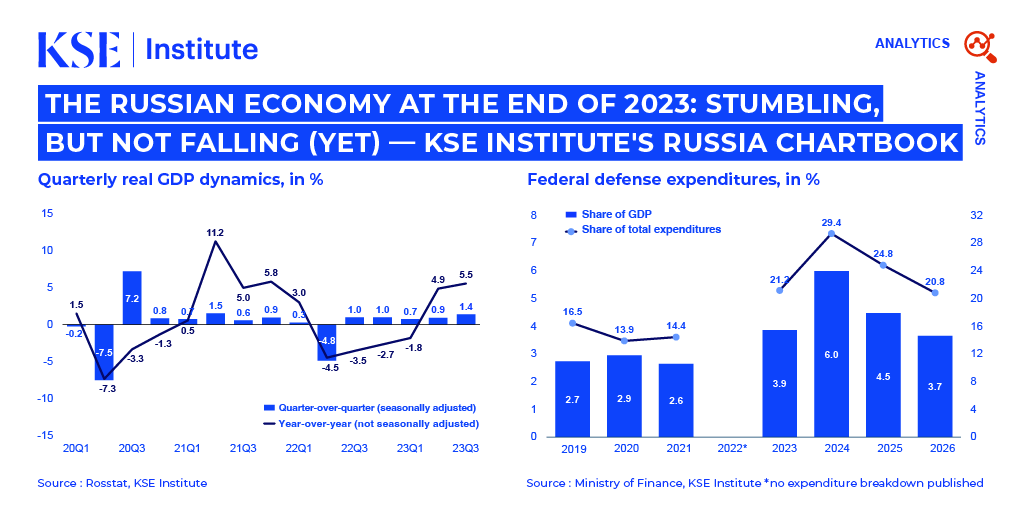

KSE Institute released its December Russia Chartbook, “The Russian Economy At The End Of 2023: Stumbling, But Not Falling (Yet)“, providing an overview of Russia’s economy, foreign trade, as well as fiscal and monetary policies. It highlights continued challenges of energy sanctions, including widespread price cap violations and overall reduced leverage of restrictions on Russian exports. As a result, Russia’s external environment has improved substantially in the second half of the year. But the future course is not yet clear – and very much depends on the next steps taken by Ukraine’s allies.

KSE Institute’s analysis of data for October-November reveals that compliance with the $60/barrel price cap has been nearly nonexistent, with over 99% of crude oil exports sold above the threshold, possibly through attestation fraud. Second, Russia’s reliance on its ‘shadow fleet’ continues, diminishing the cap’s effectiveness. Only 33.8% of seaborne crude oil involved G7/EU service providers in July-November 2023, marking a significant decline from 51% in H1 2023 and 58% in H2 2022.

While there are some encouraging signs as well – Russian oil export volumes declined by 2.7% in November vs. the previous month and export earnings fell to $15.2 billion – pressure on Russia will decrease if sanctions enforcement is not improved. The price cap coalition cannot bet on moderation of global oil prices to continue, especially in light of OPEC+’s determination to cut production. Altogether, higher oil exports, coupled with the central bank’s cumulative 850 basis points interest rate hike and reintroduction of capital controls reintroduction, have contributed to a more stable ruble.

At the same time, decreasing macroeconomic pressure creates more policy space. Non-oil and gas receipts have increased, highlighting the resilience of Russia’s economy as it rebounds from the initial impacts of the war and sanctions. Moreover, Russian authorities are expected to meet this year’s deficit target, leaving macro buffers intact and allowing it to spend 10.7 trillion rubles (~$100 billion) on the war in 2024 (+68% vs. this year).

In our updated forecast, we expect oil and gas exports to reach $225 billion in 2023, $186 billion in 2024, and $176 billion in 2025. Notably, oil export earnings are projected to exceed previous estimates by $27 billion this year. Based on January-November data for Russia’s current account, we project an overall surplus of $55 billion for this year. This should not conceal, however, that Russia is in a very different position compared to 2022: Over the first eleven months of the year, the country’s external surplus (of $50.5 billion) is 77% smaller.

KSE Institute underscores the urgency of bold action to maintain the effectiveness of oil sanctions and proposes three key measures: ensuring G7/EU authorities have proof of price cap compliance, leveraging ‘choke points’ by EU coastal states to restrict Russia’s ‘shadow fleet,’ and strengthening penalties on entities for price cap violations.