- Kyiv School of Economics

- About the School

- News

- 48th issue of the regular digest on impact of foreign companies’ exit on RF economy

48th issue of the regular digest on impact of foreign companies’ exit on RF economy

3 July 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 19.06-02.07.2023.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we agreed on partnering with the Push To Leave team. “Push To Leave” allows you to find any brand or company that is operating in Russia just by scanning barcodes.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 02.07.2023

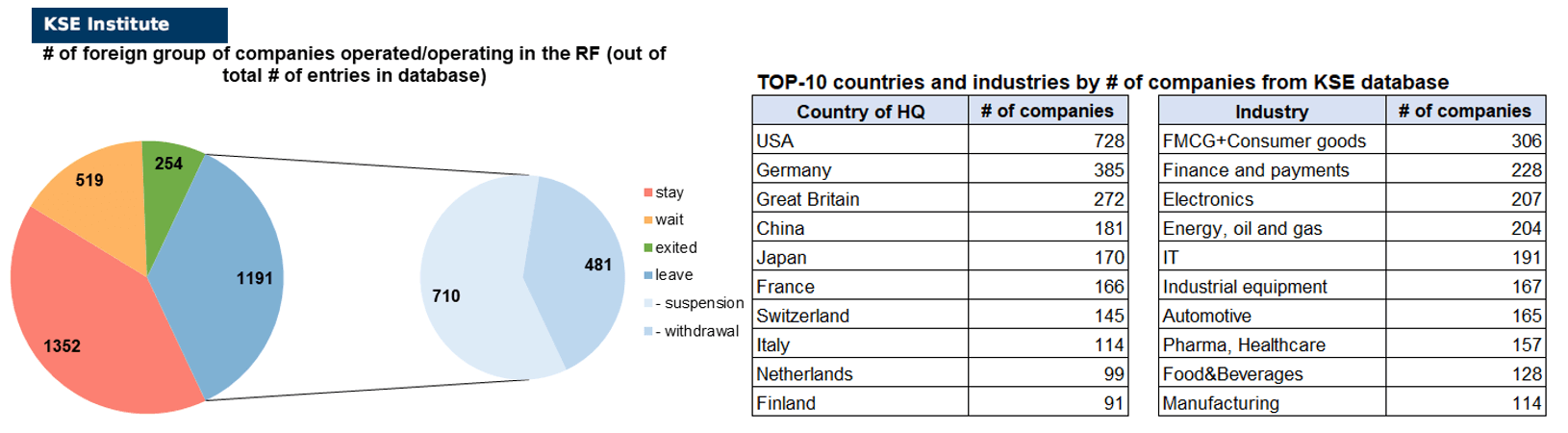

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 352 (+16 per 2 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 519 (+18 per 2 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 191 (-2 per 2 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 254 (+13 per 2 weeks)

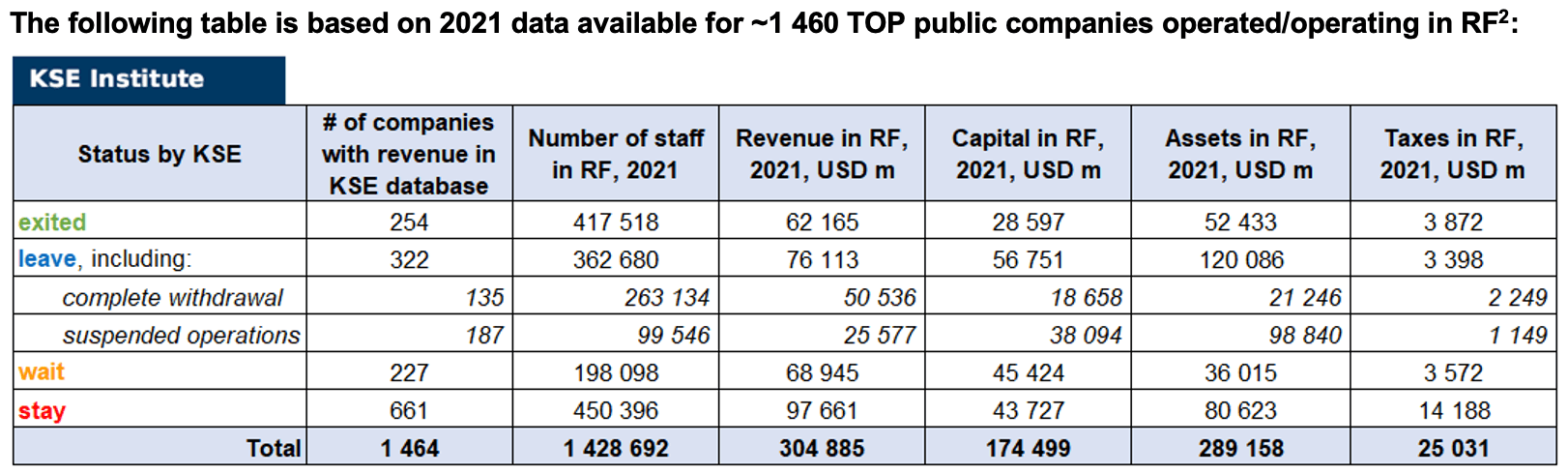

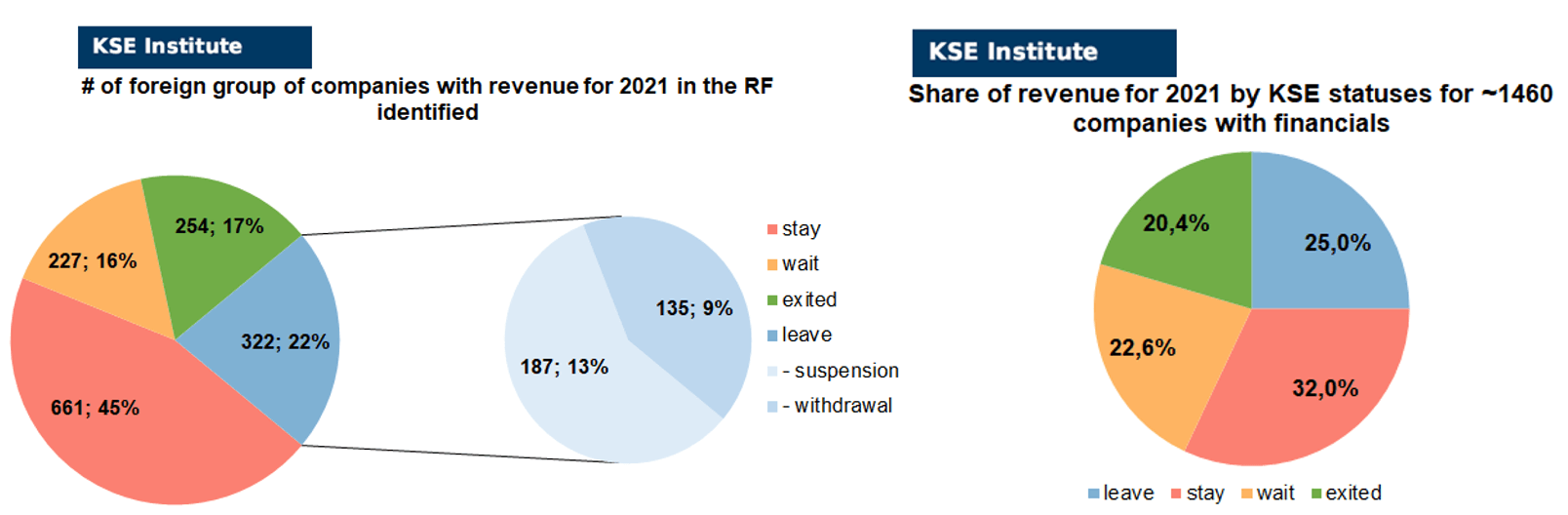

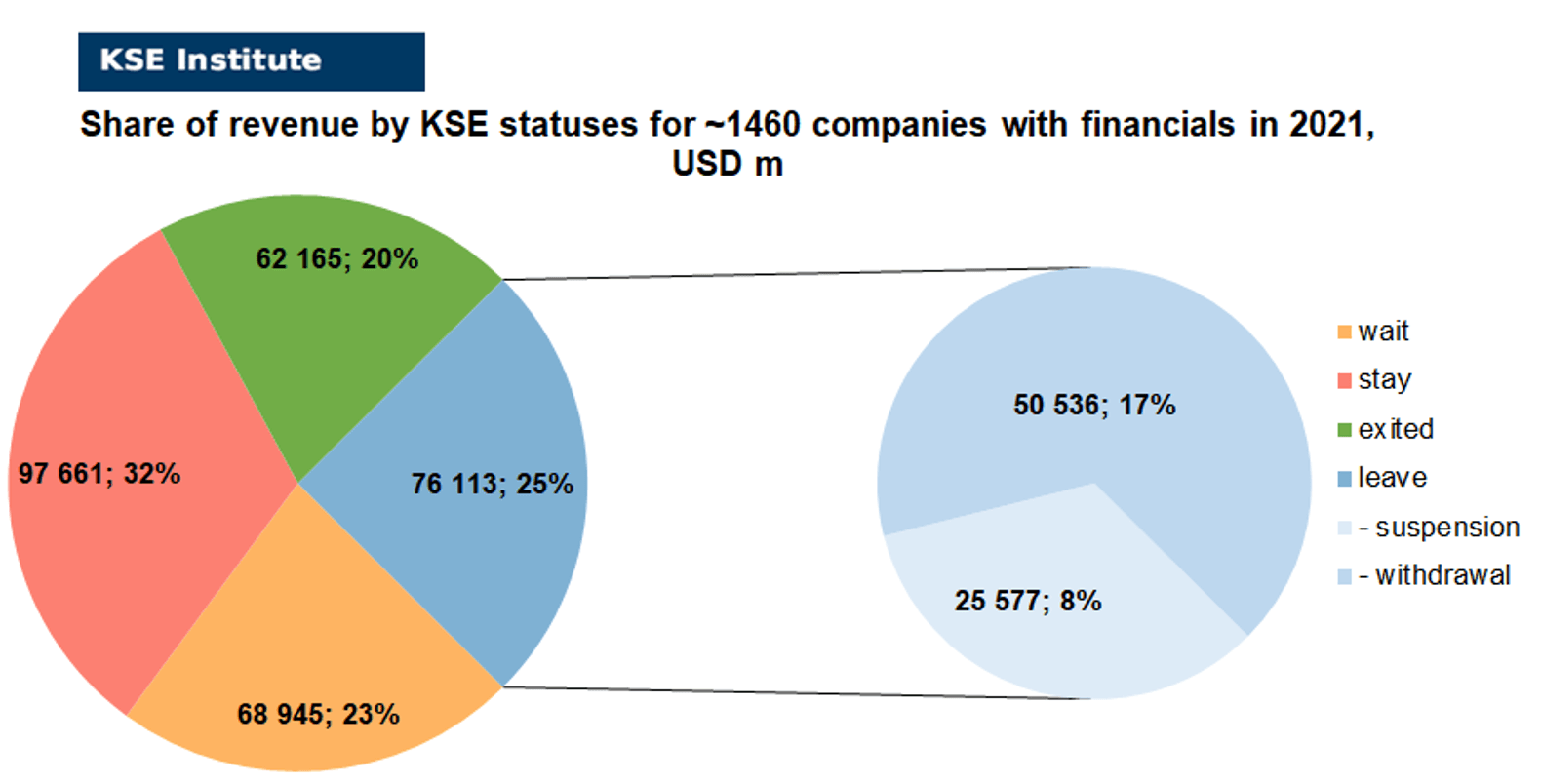

As of July 02, we have identified about 3,316 companies, organizations and their brands from 91 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 460 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021, which allowed us to calculate the value of capital invested in the country (about $174.5 billion), local revenue (about $304.9 billion), local assets (about $289.2 billion) as well as staff (about 1.429 million people) and taxes paid (about $25.0 billion). 1,710 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 254 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of July 02, 254 companies which had already completely exited from the Russian Federation, in 2021 had at least 417,500 personnel, $62.2 bn in annual revenue, $28.6bn in capital and $52.4bn in assets; companies, that declared a complete withdrawal from Russia had 263,100 personnel, $50.5bn in revenues, $18.7bn in capital and $21.2bn in assets; companies that suspended operations on the Russian market had 99,500 personnel, annual revenue of $25.6bn, $38.1bn in capital and $98.8bn in assets.

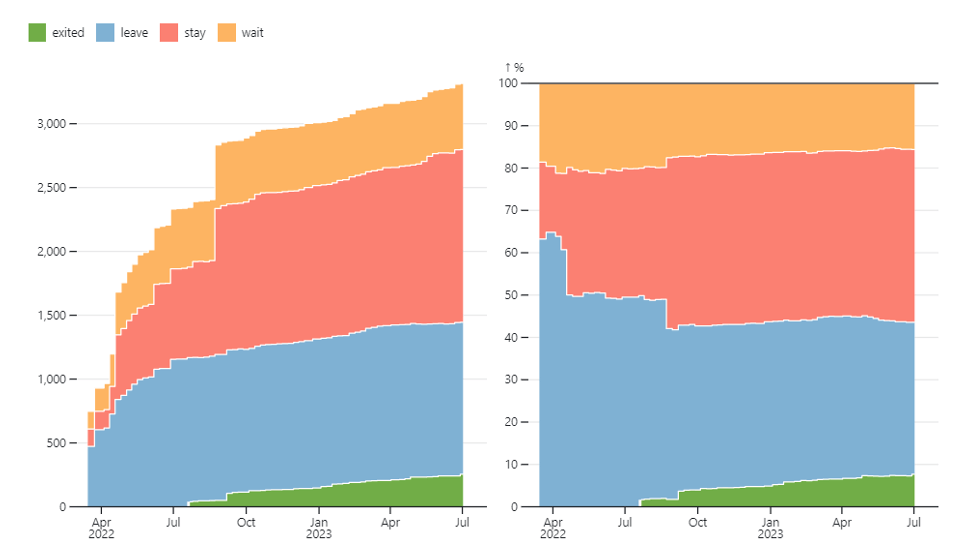

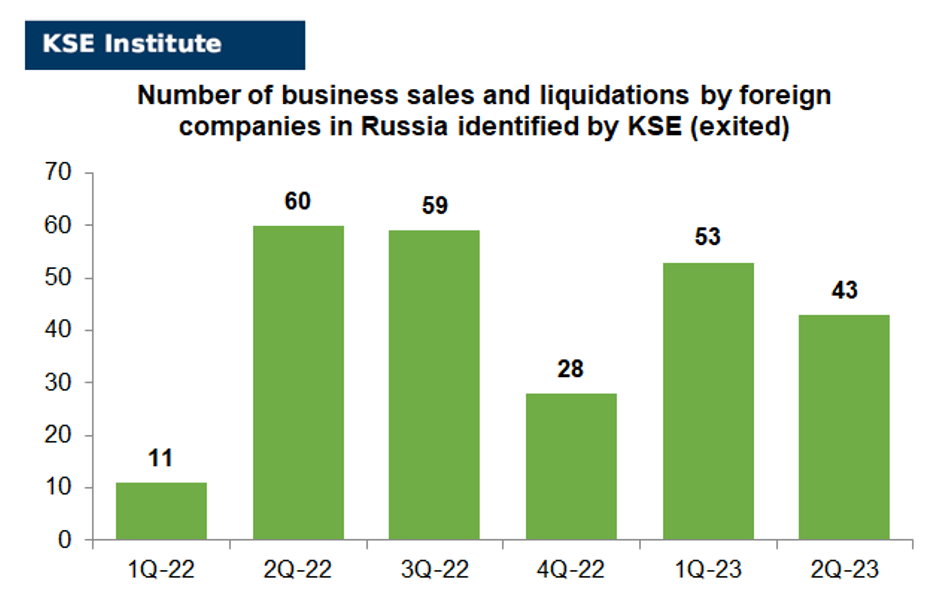

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 10 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 49 were added in June 2023). However, if to operate with the total numbers in KSE database, about 35.9% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 40.8% are still remaining in the country, 15.7% are waiting and only 7.7% made a complete exit.³

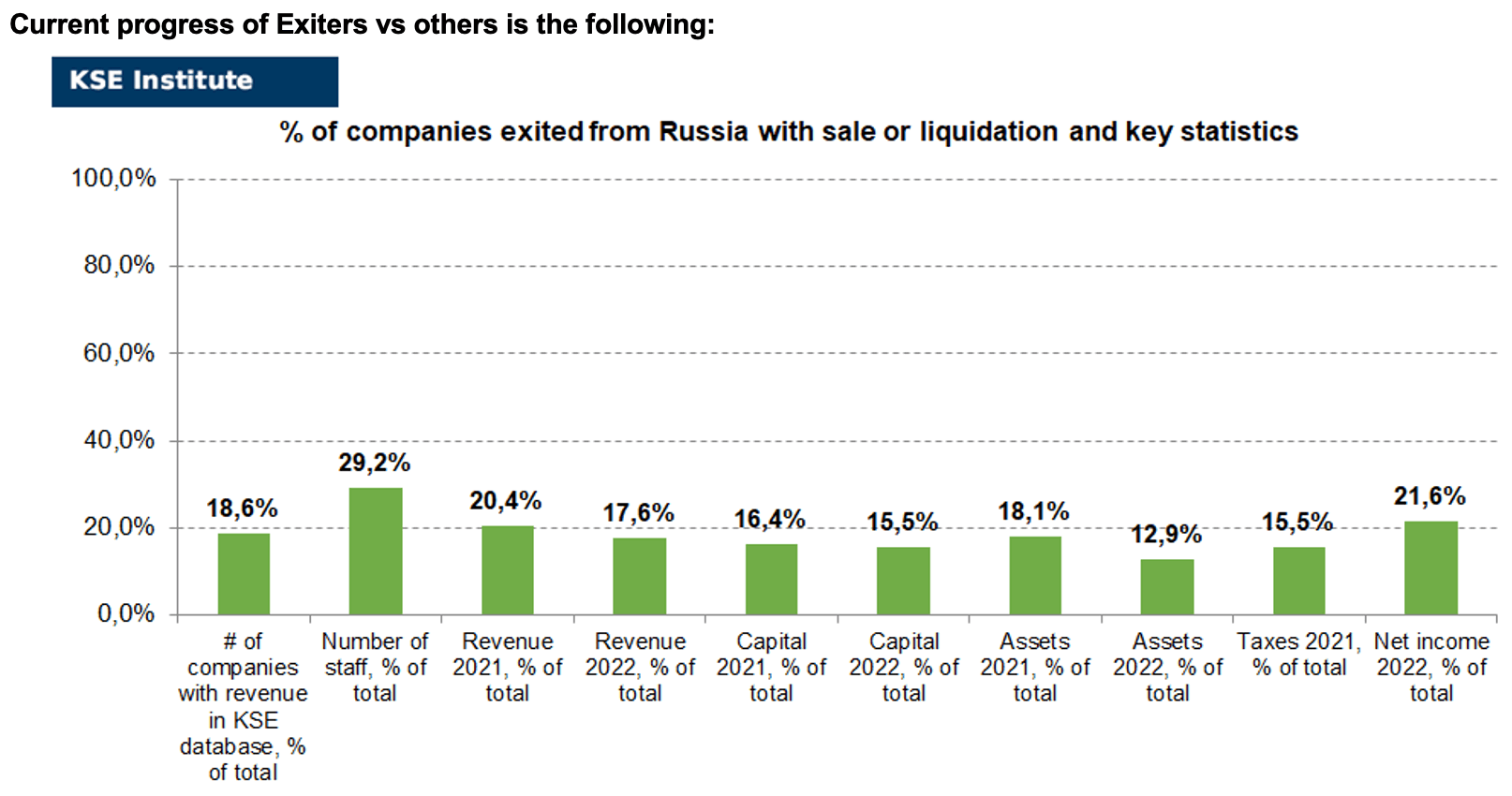

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 254 companies that completely left the country, since in 2021 they employed 29.2% of the personnel employed in foreign companies, the companies owned about 18.1% of the assets, had 16.4% of capital invested by foreign companies, and in 2021 they generated revenue of $62.2 billion or 20.4% of total revenue and paid $3.9 billion of taxes or 15.5% of total taxes paid by the companies observed. Data on 1,460 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, roughly similar % of exited is obtained based on number of companies (17%) and on share of revenue withdrawn (20%). At the same time, a totally different picture is for those who are still staying – 45% of companies represent 32% of revenue and 16% of waiting companies represent 23% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

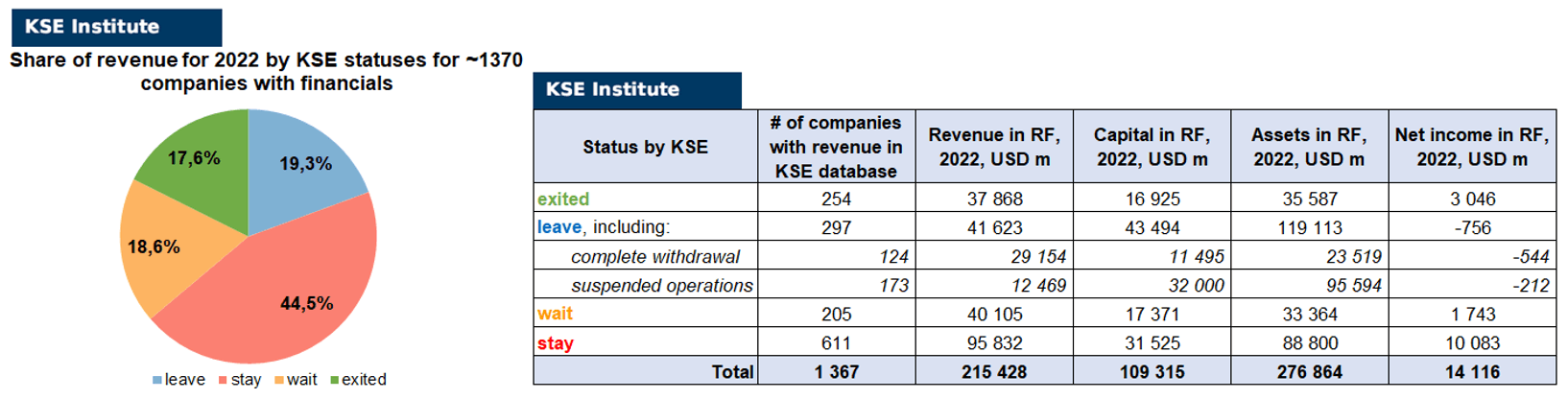

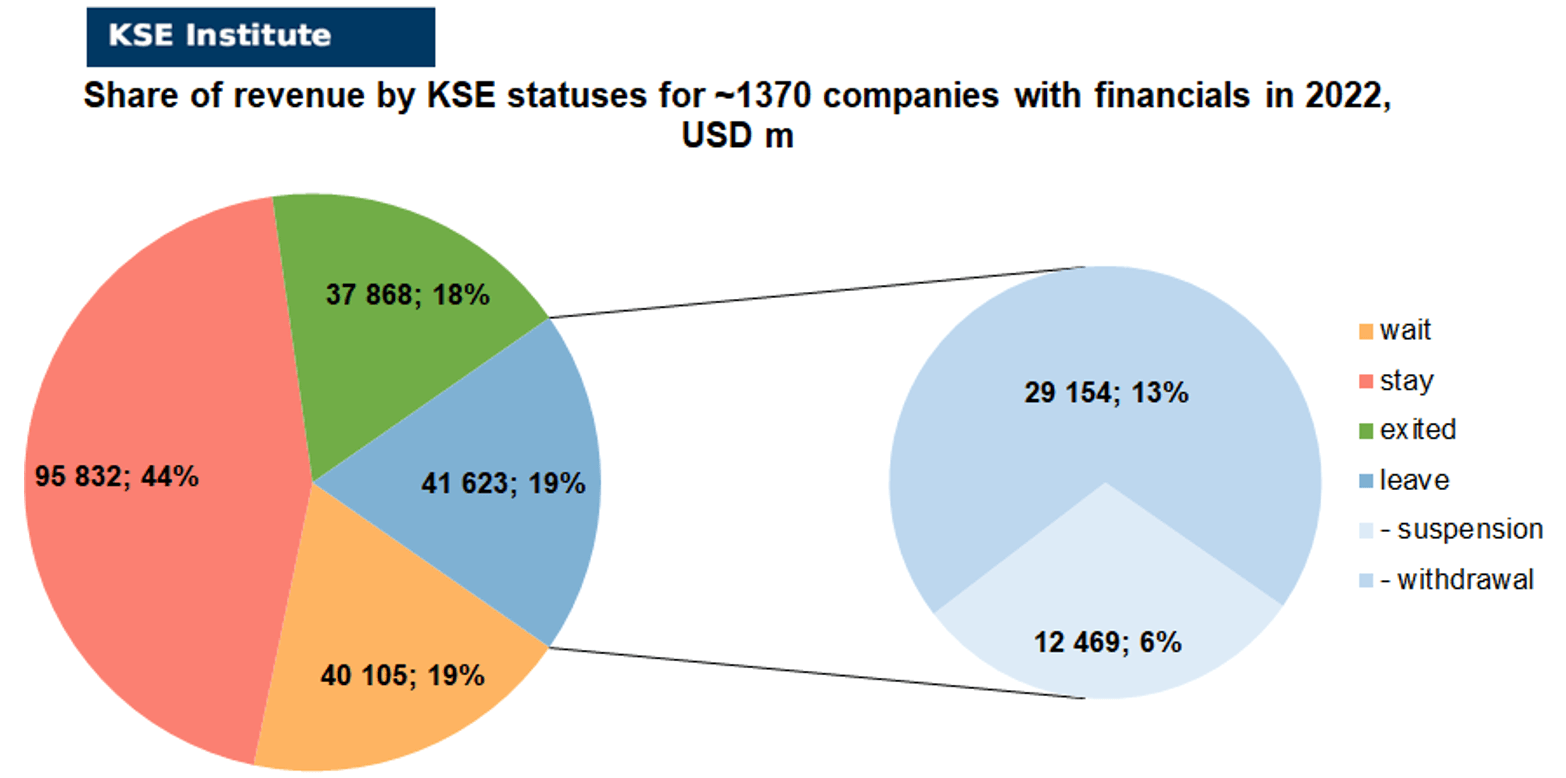

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1370 companies (about 90 companies the data of which we have collected previously have not provided their reporting yet) and provides below the first ever available analysis (as far as we know, this kind of data is being made public for the first time), more details will be provided soon, once we get full information.

As you can see from the charts above, companies which fully exited Russia were able to generate 2.8% less of revenue in 2022 (17.6% from total volume) than in 2021 (20.4% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-5.7%) revenue in 2022 (19.3% from total volume) than in 2021 (25.0% from total volume). Also, the group of the companies with KSE status “leave” is the only one which became loss-making in terms of net income received in 2022. At the same time, staying companies were able to generate much (+12.5%) more revenue in 2022 (44.5% from total volume) than in 2021 (32.0% from total volume). This is partly explained by reclassification of statuses that we did for some companies (e.g. Cargill, Danone, Japan Tobacco International, Mars, Pepsi, Raiffeisen Bank) which significantly increased their revenue in 2022 vs 2021. Companies with status “wait”⁴ gained almost the same share (-4.0%) of revenue in 2022 (18.6% from total volume) vs 22.6% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the first results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($276.9bn in 2022 vs $289.2bn in 2021) and will probably even increase once we receive remaining reporting for ~80-90 companies (until companies decide not to disclose it). KSE Institute has already published a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: On leaving the Russian Federation. Results of June 2023

In this digest, we will summarize the results of June 2023 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1.46 thousand companies identified in the KSE database with revenue data available of more than $300 billion in 2021 and ~$215 billion in 2022. And at least 254 of them have already been sold by local companies or were liquidated and left the Russian market. In June 2023 KSE Institute identified +13 new exits⁵, total number of exits observed since the beginning of Russia’s invasion reached 254.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” also pay attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 20% based on revenue allocation, those who are leaving represent 25% of total revenue (with 34% share of suspensions and 66% of withdrawals sub-statuses), % of staying companies represent 32% of revenue and 23% are waiting companies based on revenue generated in Russia in 2021.

% of exited is 18% based on revenue allocation, those who are leaving represent only 19% of total revenue (with 30% share of suspensions and 70% of withdrawals sub-statuses), % of staying companies represent 44% of revenue and 19% are waiting companies based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

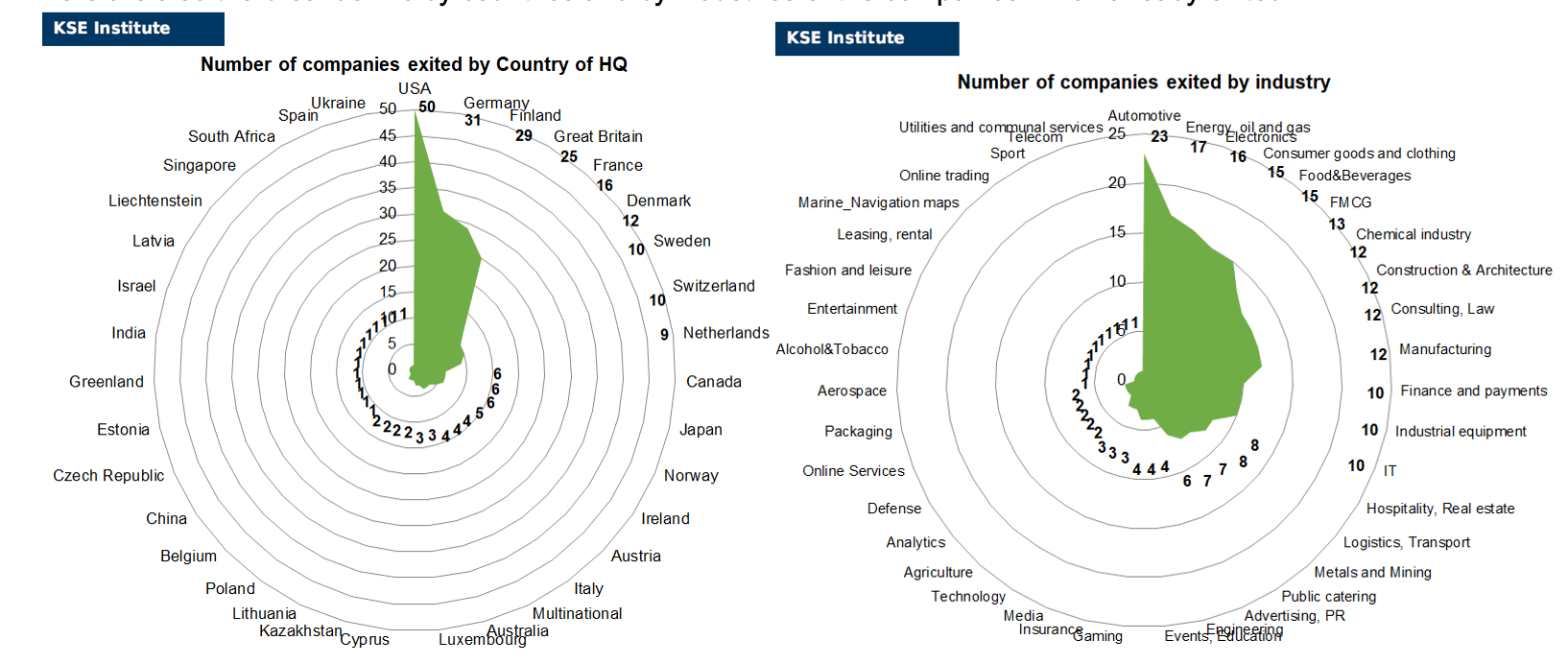

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of June 2023, companies from 35 countries and 39 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain and France and operated in the “Automotive”, “Energy, oil and gas”, “Electronics”, “Consumer goods and closing” and “Food & Beverage” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: 3M, Brenntag, Camso, Hyve Expo International, Johnson Matthey, LANXESS, L’Occitane (was sold a year ago but stores are open and company still continue selling its goods, although L’Occitane Group’s profits in 2023 dragged down by Russian divestiture and lagging brands), Mammoet, Michelin Tyre, Pilkington (NSG Group), Robert Bosch (sold all 6 local companies in Russia), TJX Companies, WABCO Holdings.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process.

Here are just some of them: Bridgestone Corporation (company is making progress on Russian withdrawal), Carlsberg Group (sells its Russian business, subject to regulatory approvals), Essity (divests Russian operations), Polymetal (looks to sell Russian assets due to US sanctions), Swarovski (The CEO of Swarovski announced that the company has completed the exit from Russia but local entity is not sold yet according to KSE), Toyota Motor Corporation (Toyota plant in St. Petersburg sold without buyback option).

Buyers of the business of foreign companies leaving the Russian market will be obliged to place on the stock market 20% of the purchased package, this decision was made by the commission and subcommittee for the control of foreign investment. Finance Minister Anton Siluanov spoke about this in a comment to Izvestia“⁶ at SPIEF 2023.

The commission and the subcommittee are sanctioning transactions with residents from unfriendly countries, for which a ban was introduced in the spring of 2022, recalls the publication.

On June 16, Russian President Vladimir Putin, during his speech at the plenary session of the SPIEF-2023⁷ announced the adoption of a “special decision” to support and saturate the stock market. “It concerns the situation when foreign owners sell Russian assets. In this case, part of the shares of companies that change ownership should go to the Russian stock exchange,” he said, without specifying what share of securities he was talking about.

The Central Bank was the first to speak about the mandatory placement on the stock exchange of a part of the shares of departing companies when they are bought from non-residents⁸.

On May 16, the head of the regulator, Elvira Nabiullina, announced that this issue was being discussed with the government. On the same day, the first deputy chairman of the Central Bank, Vladimir Chistyukhin, explained that the regulator plans to offer new owners to place on the stock market from 10 to 20% of the purchased package.

Later that month, Russian Deputy Finance Minister Alexei Moiseev said⁹, that the Finance Ministry supported the Central Bank’s initiative. “It is assumed that each decision of the subcommittee, when considering a detailed type of issues, will be accompanied by such a condition,” he said. The official also clarified that the measure would not affect shares in which deals had already been made.

The next review of deals for July 2023 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)¹⁰

18.06.2023

*Conviasa (Venezuela, Air transportation) Status by KSE – stay

“Aeroflot” and the airline Conviasa (Venezuela) signed a memorandum on the expansion of air communication with the countries of the Caribbean basin at PMEF-2023

https://tourism.interfax.ru/ru/news/articles/99046/

*Peninsula Petroleum Ltd (Ireland, Energy, oil and gas) Status by KSE – leave

NACP excluded from the list of international sponsors of the war the world’s leading ship fuel supply company, the Irish Peninsula Petroleum Limited.

*Mondelez (USA, Food & Beverages) Status by KSE – stay

STATEMENT ON OUR OPERATIONS IN RUSSIA

https://www.mondelezinternational.com/News/Statement-on-our-Operations-in-Russia

In Sweden, supermarkets warn buyers that the Mondelez International corporation has not closed its branches in Russia, and large consumers are refusing its products

Mondelez ‘singled out’ in boycott over Russia business: executive

*AliExpress (China, Consumer goods and clothing) Status by KSE – wait

The Ministry of Defense of the Russian Federation buys patriotic drones from China’s AliExpress

https://tlgrm.ru/channels/@moscowtimes_ru/13482

*PPG (USA, Chemical industry) Status by KSE – wait

*Tikkurila Oyj (Finland, FMCG) Status by KSE – wait

Paints and Varnishes Exports into Russia

https://squeezingputin.com/support.html#Paints13Jun23

*Hugo Boss (Germany, Luxury) Status by KSE – stay

The Hugo Boss company, which announced its exit from Russia, is the leader in revenues among brands in the Russian Federation

https://www.zeit.de/2023/26/hugo-boss-russland-ladenschliessungen-umsatz

19.06.2023

*STMicroelectronics (Switzerland, IT) Status by KSE – stay

*Vicor (USA, Energy, oil and gas) Status by KSE – stay

*Xilinx (USA, IT) Status by KSE – stay

*Intel (USA, IT) Status by KSE – stay

*Texas Instruments (USA, Electronics) Status by KSE – wait

*Maxim Integrated (USA, Electronics) Status by KSE – stay

*ZILOG (USA, Electronics) Status by KSE – stay

Yermak-McFaul Group: 81% of foreign components of Russian missiles are produced in the USA

*Kerui Group (China, Energy, oil and gas) Status by KSE – stay

NACP included the company in the International War Sponsors

https://sanctions.nazk.gov.ua/en/boycott/32/

*Fimi (China, Electronics) Status by KSE – stay

*AEE (China, Electronics) Status by KSE – stay

Small Chinese drone manufacturers are interested in localizing assembly in the Russian Federation and are negotiating the organization of joint ventures with local developers. Among potential investors, they name Fimi, AEE and ZeroZero.

https://www.kommersant.ru/doc/6053996?tg

*Bank of China (China, Finance and payments) Status by KSE – wait

Bank of China (BoC) — China’s third-largest bank by assets — introduced restrictions on payments in yuan for Russian clients.

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – leave

Ikea is gradually excluding Mondelez products from department stores

https://www.gp.se/ekonomi/ikea-fasar-ut-mondelez-produkter-fr%C3%A5n-varuhusen-1.102579174

*Samsung (South Korea, Electronics) Status by KSE – wait

*LG Electronics (South Korea, Electronics) Status by KSE – wait

The Ministry of Statistics and the Ministry of Industry and Trade are discussing the ban on the parallel import of Samsung and LG smartphones

https://www.interfax.ru/russia/906901

*China National Petroleum Corporation (China, Energy, oil and gas) Status by KSE – stay

Rosneft and China’s CNPC switched to paying for raw materials in national currencies

https://www.kommersant.ru/doc/6053323

*Tetra Pak (Sweden, FMCG) Status by KSE – exited

*Mars (USA, Food & Beverages) Status by KSE – stay

Mars, Bounty and Twix ice cream in bars will disappear from Russian shelves

https://business-magazine.online/fn_1341607.html

*Aker Solutions (Norway, Energy, oil and gas) Status by KSE – leave

Compliance With Applicable Sanctions and Export Controls

https://www.akersolutions.com/compliance-with-applicable-sanctions-and-export-controls/

20.06.2023

*OKX (Seychelles, Finance and payments) Status by KSE – wait

Crypto exchange OKX closes access to some of its products to Russian users. Selected Earn offers, Shark Fin and Double Investment products will not be available to OKX users in Russia.

https://ru.beincrypto.com/okx-zakryla-dostup/

*Hornady (USA, Defense) Status by KSE – stay

The facts of supplies of cartridges from the American company Hornady to the Russian Federation have been revealed

https://www.epravda.com.ua/news/2023/06/19/701321/

*General Electric (GE) (USA, Industrial equipment) Status by KSE – wait

The American General Electric (GE) will not be able to continue servicing gas turbines for the heat of power plants with a total capacity of 5 GW in Russia due to sanctions.

https://www.epravda.com.ua/news/2023/06/19/701337/

*Starbucks (USA, Public catering) Status by KSE – exited

Timati argued with Sber analysts about the dynamics of coffee sales at Stars

https://www.rbc.ru/business/17/06/2023/648cd2739a7947204358b1c3

*Robert Bosch (Germany, Electronics) Status by KSE – leave

*Hisense (China, Electronics) Status by KSE – stay

*Midea Group (China, Electronics) Status by KSE – stay

Chinese investors, including Midea and Hisense, are interested in the acquisition of Russian Bosch plants.

https://www.kommersant.ru/doc/6054654

*Kazakhstan Temir Zholy (Kazakhstan, Logistics, Transport ) Status by KSE – leave

Kazakhstan Temir Zholy (KTZ) temporarily bans jet fuel imports by rail from Russia

https://www.railfreight.com/railfreight/2023/06/20/ktz-bans-jet-fuel-rail-imports-from-russia/

*Qazaq Gaz (Kazakhstan, Energy, oil and gas) Status by KSE – stay

*Uzgastrade (Uzbekistan, Energy, oil and gas) Status by KSE – stay

After months of Kremlin political pressure, Russian giant Gazprom finally signs first Central Asia deal. The Uzbek ministry said the deal is between Gazprom’s export arm, Gazprom Export, and Uzbekistan state gas distributor Uzgastrade.

*Rakuten Group. Inc (Japan, Online Services) Status by KSE – wait

For the first time, Viber was fined one million rubles for not removing fakes

https://lenta.ru/news/2023/06/20/viber/

*Decathlon (France, Consumer goods and clothing) Status by KSE – leave

Decathlon stores plan to return to Russia in October this year. They will start with approximately 30 points, new names and assortment.

21.06.2023

*Yukon Advanced Optics Worldwide (Lithuania, Electronics) Status by KSE – stay

Yukon Advanced Optics Worldwide, a Belarusian-based optical device manufacturing company operating in Vilnius, Lithuania, continues to supply Russians with military equipment, despite announcing its withdrawal from the Russian market

*Rheinmetall (Germany, Defense) Status by KSE – stay

Rheinmetall subsidiary still selling components to Russia long after 2022

*Lantmännen Unibake (Sweden, Agriculture) Status by KSE – leave

Lantmännen has signed agreements to divest the Russian operations

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

*Renault (France, Automotive) Status by KSE – exited

*Nissan (Japan, Automotive) Status by KSE – exited

*Mitsubishi Corporation (Japan, Conglomerate) Status by KSE – stay

Russian carmaker Avtovaz has completed the acquisition of RN Bank, a joint venture between Italian lender UniCredit and the Renault-Nissan-Mitsubishi Alliance

*DP World (United Arab Emirates, Logistics, Transport) Status by KSE – stay

DP World, one of the world’s largest operators in the field of container transportation, signed an agreement with Rosatom on the development of the Northern Sea Route

*Mitsui & Co.(Japan, Conglomerate) Status by KSE – stay

Japan’s Mitsui says no plans to exit Russia’s Sakhalin-2 LNG project

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

Citibank Fights Russian Exec’s Suit Over Blocked Transfer

*Swedbank (Sweden, Finance and payments) Status by KSE – wait

Latvian Swedbank to pay 3.4 million dollars over Crimean sanction violation

*UnionPay (China, Finance and payments) Status by KSE – wait

Chinese cards of Russian banks refused to be accepted in China

https://tlgrm.ru/channels/@moscowtimes_ru/13575

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Due to restrictions introduced on the side of correspondent banks from July 3, 2023, it will not be possible to make an outgoing payment in euros to another bank if the recipient’s bank is located in one of the following countries: Russia, Azerbaijan, Armenia, Belarus, Georgia, Jordan, Kazakhstan, Kyrgyzstan , Moldova, United Arab Emirates, Tajikistan, Turkmenistan, Uzbekistan.

22.06.2023

*Commercial Aircraft Corporation of China СOMAC (Китай, Авіабудування) Статус за KSE – виходять

Commercial Aircraft Corporation of China продовжить програму створення широкофюзеляжних літаків без Росії

.https://theaircurrent.com/aircraft-development/comac-appears-to-drop-russia-from-cr929-branding/

https://www.moscowtimes.ru/2023/06/22/kitai-vikinul-rossiyu-iz-proekta-sovmestnogo-samoleta-a46792

*World Wide Fund for Nature (WWF) (Швейцарія, Асоціація, НУО) Статус за KSE – виходять

21 червня 2023 року Мін’юст визнав Всесвітній фонд дикої природи (WWF; визнано іноземним агентом) небажаною організацією на території РФ.

https://www.kommersant.ru/doc/6055938

*J&T Banka (Чехія, Фінанси та платежі) Статус за KSE – виходять

Президент Росії Володимир Путін санкціонував купівлю активів чеського J&T Bank в РФ холдингу Бюрократ, якому належить Реаліст Банк

https://www.kommersant.ru/doc/6056025

http://publication.pravo.gov.ru/document/0001202306210004

*Capcom (Японія, Ігри) Статус за KSE – вичікують

Минулого року Capcom продала понад 100 тисяч копій своїх ігор у Росії, незважаючи на призупинення діяльності

https://gameworldobserver.com/2023/06/21/capcom-russia-sales-over-100k-copies

*Apple (США, Електроніка) Статус за KSE – вичікують

Apple виправляє недоліки програмного забезпечення iPhone, використовувані в масових зломах росіян

https://www.washingtonpost.com/technology/2023/06/21/apple-hacks-russia-kaspersky-nsa/

*International Olympic Committee (IOC) (Швейцарія, Спорт) Статус за KSE – залишаються

Рекомендації Міжнародного олімпійського комітету (МОК) щодо допуску російських спортсменів до змагань поширюються і на російських членів МОК. У зв’язку з цим комісія з етики МОК має намір перевірити їх на причетність до збройних сил Росії та підтримку бойових дій в Україні.

https://www.kommersant.ru/doc/6055944

*Google (США, Онлайн сервіси) Статус за KSE – вичікують

Федеральна служба судових приставів РФ зняла всі гроші з рахунків російської “дочки” Google

23.06.2023

*Vakif Bank (Turkey, Finance and payments) Status by KSE – stay

The Russian tour operator Pegas Touristik offers its customers to issue a MasterCard Momentum card of the Turkish Vakif Bank upon arrival in the country

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – leave

Carlsberg sells its Russian business, subject to regulatory approvals

https://www.ft.com/content/85be4c75-996a-46ef-833a-67ef18fbbda6

*Amazon (USA, Online Services) Status by KSE – wait

Russia’s state communications regulator Roskomnadzor has added Amazon Web Services and 11 other foreign technology companies to a widened list of firms it wants to open local offices or face penalties and possible bans.

*JCB (Great Britain, Manufacturing) Status by KSE – wait

*ISUZU (Japan, Automotive) Status by KSE – wait

No official position, they were present on recent Moscow Truck Expo.

https://www.youtube.com/watch?v=vj6nI21kQBE&t=1609s

*FATF (France, Аssociation, NGO) Status by KSE – wait

The International Anti-Money Laundering Group (FATF) did not include Russia in the “black list”.

https://www.epravda.com.ua/news/2023/06/23/701527/

Ministry of Finance of Ukraine disagrees with the decision of FATF not to blacklist russia

*Poly Technologies (China, Defense) Status by KSE – stay

Chinese Firm Sent Large Shipments of Gunpowder to Russian Munitions Factory

https://www.nytimes.com/2023/06/23/business/economy/china-russia-ammunition.html

*Geely (China, Automotive) Status by KSE – stay

The Chinese car manufacturer Geely was included in the list of international sponsors of the war.

*Wintershall Dea AG (Germany, Energy, oil and gas) Status by KSE – leave

*Rockwool (Denmark, Construction & Architecture) Status by KSE – stay

How Western companies clinging to Russia are losing markets, business and reputation

https://www.epravda.com.ua/publications/2023/06/23/701487/

*International Boxing Association (Switzerland, Sport) Status by KSE – stay

On June 22, members of the Executive Committee of the International Olympic Committee (IOC) voted against the recognition of the International Boxing Association (IBA).

https://www.kommersant.ru/doc/6056587?tg

*Reima (Finland, Consumer goods and clothing) Status by KSE – exited

“Detsky Mir”, which bought the Russian business of the Finnish children’s clothing brand Reima (exited), will develop stores under the Lassie banner on this base

24.06.2023

*Samsung (South Korea, Electronics) Status by KSE – wait

*LG Electronics (South Korea, Electronics) Status by KSE – wait

The Russian authorities are “losing patience” with electronics manufacturers Samsung and LG and are preparing to ban their equipment in the country because they refuse to sell their plants in the Kaluga and Moscow regions.

26.06.2023

*Puma (Germany, Consumer goods and clothing) Status by KSE – leave

In the Russian branch of the brand, the general director has changed

https://www.kommersant.ru/doc/6068099

*Total Energies (France, Energy, oil and gas) Status by KSE – exited

“Arctic LNG-2” is becoming more expensive

https://www.kommersant.ru/doc/6068141?tg

*Deutsche Bank (Germany, Finance and payments) Status by KSE – leave

Deutsche Bank informed clients that it could no longer guarantee full access to Russian shares owned by them, reminded them of the problems faced by investors trying to return funds stuck in Russian companies.

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – leave

Former IKEA manufacturers announced the opening of their stores in Russia

27.06.2023

*OBI Group (Germany, Consumer goods and clothing) Status by KSE – exited

The first hypermarket of the German DIY chain OBI will open in Myakinino near Moscow on the site of the burnt-out Sindika market.

https://www.kommersant.ru/doc/6068803?tg

*Geely (China, Automotive) Status by KSE – stay

Several Swedish players are investigating a boycott of Volvo Cars

https://www.di.se/nyheter/flera-svenska-aktorer-utreder-bojkott-av-volvo-cars/

*Vitol Group (Switzerland, Energy, oil and gas) Status by KSE – wait

*Gunvor Group (Switzerland, Energy, oil and gas) Status by KSE – wait

Vitol and Gunvor help keep Russian refined oil flowing, data shows

https://www.ft.com/content/ba9754e3-6f4e-4455-b6be-c6c6edf6b853

28.06.2023

*L’Occitane (France, FMCG) Status by KSE – exited

L’Occitane 2023 profits dragged down by Russian divestiture and lagging brands

*Bacardi (Great Britain, Alcohol&Tobacco) Status by KSE – stay

Bacardi continues deliveries to Russia, and the profit of the Russian branch of the company – “Bacardi Rus” – in 2022 increased three times – from 1.5 billion to almost 4.7 billion rubles.

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

*OTP Bank (Hungary, Finance and payments) Status by KSE – stay

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

*Credit Agricole (France, Finance and payments) Status by KSE – wait

*Societe Generale (France, Finance and payments) Status by KSE – exited

*Intesa Sanpaolo (Italy, Finance and payments) Status by KSE – stay

*ING Bank (Netherlands, Finance and payments) Status by KSE – wait

ECB Urges Banks to Speed Up Plans to Exit or Shrink Russia Units

*Google (USA, Online Services) Status by KSE – wait

Russian court fines Google an additional $47 million

*Telegram (United Arab Emirates, Online Services) Status by KSE – stay

The Russian authorities will spend 1 billion rubles to replace Telegram for officials

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

On June 27, clients received permission to unblock assets in Euroclear from the Belgian regulator.

https://www.kommersant.ru/doc/6069509

*Extreme Networks (USA, IT) Status by KSE – stay

Top manager at U.S. firm Extreme Networks privately sold high-tech in Russia.

https://www.reuters.com/business/top-manager-us-firm-privately-sold-high-tech-russia-2023-06-28/

29.06.2023

* HEAT Motors (Kazakhstan, Automotive) Status by KSE – stay

According to Spark-Interfax, as of March 2023, Hans Peter was the CEO of the automobile company Hit Motors Rus LLC, owned by the Kazakh HEAT Motors LLP. By decision of the Board of Directors of JSC MAZ Moskvich, Hans Peter Moser was appointed CEO of the company from June 29, 2023.

https://www.kommersant.ru/doc/6070554?tg

*Clearstream (Luxembourg, Finance and payments) Status by KSE – leave

Clearstream Banking informs clients holding positions in ADR and GDR programmes with Russian underlying equities that the processing of new instructions to convert voluntarily or to cancel holdings has been suspended until further notice

https://www.clearstream.com/clearstream-en/securities-services/settlement/a23056-3604478

30.06.2023

*BNP Paribas (France, Finance and payments) Status by KSE – leave

BNP Paribas Asset Management is set to liquidate the firm’s Europe Emerging Equity fund on 3 July, following more than a year of suspension.

https://www.investmentweek.co.uk/news/4119190/bnp-paribas-liquidate-suspended-russia-fund

*Harting (Germany, Manufacturing) Status by KSE – stay

HARTING Technology Group comments on media reports

*Extreme Networks (USA, IT) Status by KSE – stay

Unveiling Extreme Networks’ Controversial Russia Operations and the Challenges of Enforcing Trade Restrictions in the Tech Industry

https://gritdaily.com/extreme-networks-controversial-russia-operations/

*Pilkington (Japan, Manufacturing) Status by KSE – exited

In depth: Stirling insulation firm Superglass exits Russian ownership to embark on new chapter

https://www.usglassmag.com/2023/06/nsg-group-exits-russia/

*VEON (Netherlands, Telecom) Status by KSE – leave

Veon Russia exit prompts board downsizing

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

In May 2023, the KSE Institute published a new research entitled “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave”, you can download its full text in English using the following links: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963 and https://www.researchgate.net/publication/370902501

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After almost 16 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no differences.

⁵ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

¹⁰ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website