- Kyiv School of Economics

- About the School

- News

- 44th issue of the regular digest on impact of foreign companies’ exit on RF economy

44th issue of the regular digest on impact of foreign companies’ exit on RF economy

1 May 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 17.04-01.05.2023

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we agreed on partnering with the Push To Leave team. “Push To Leave” allows you to find any brand or company that is operating in Russia just by scanning barcodes.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

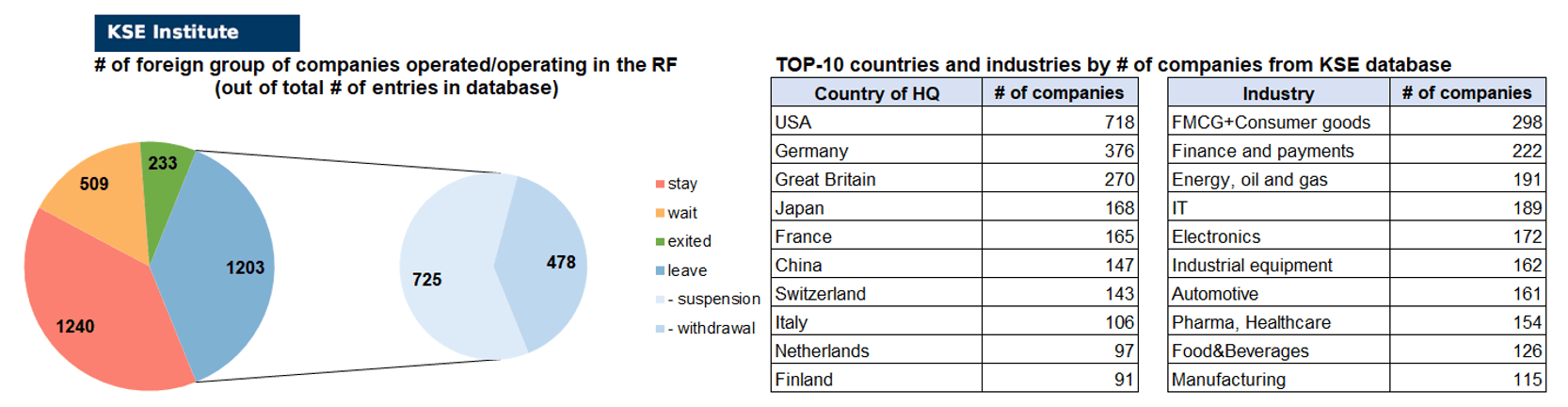

KSE DATABASE SNAPSHOT as of 01.05.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 240 (-2 per 2 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 509 (+1 per 2 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 203 (-9 per 2 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 233 (+20 per 2 weeks)

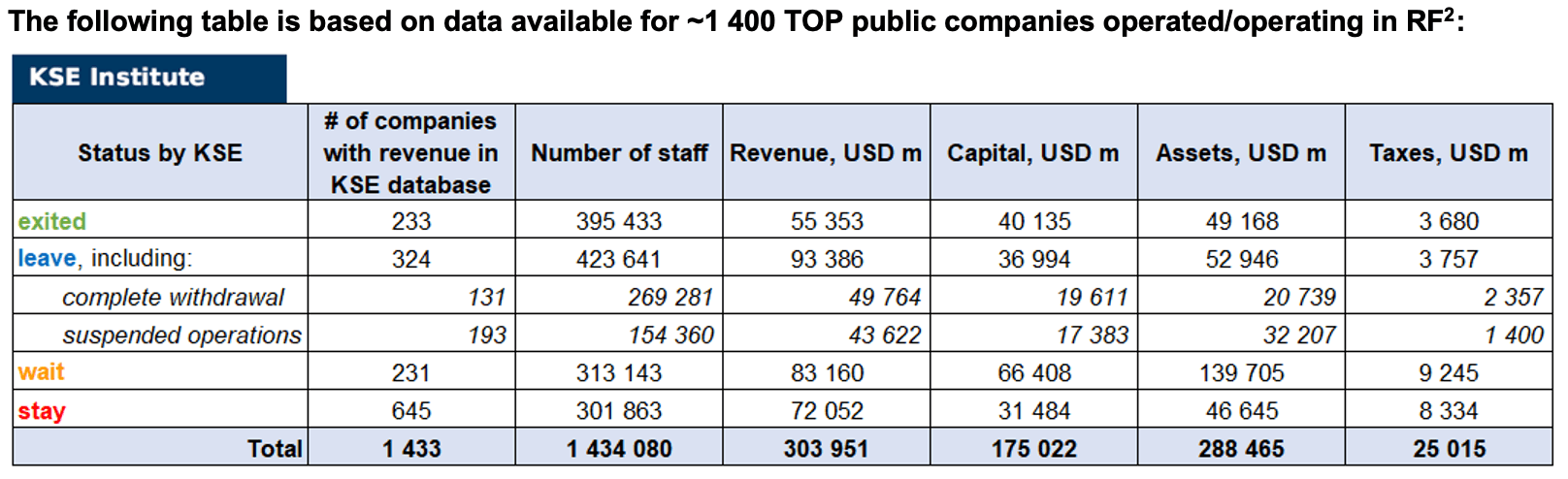

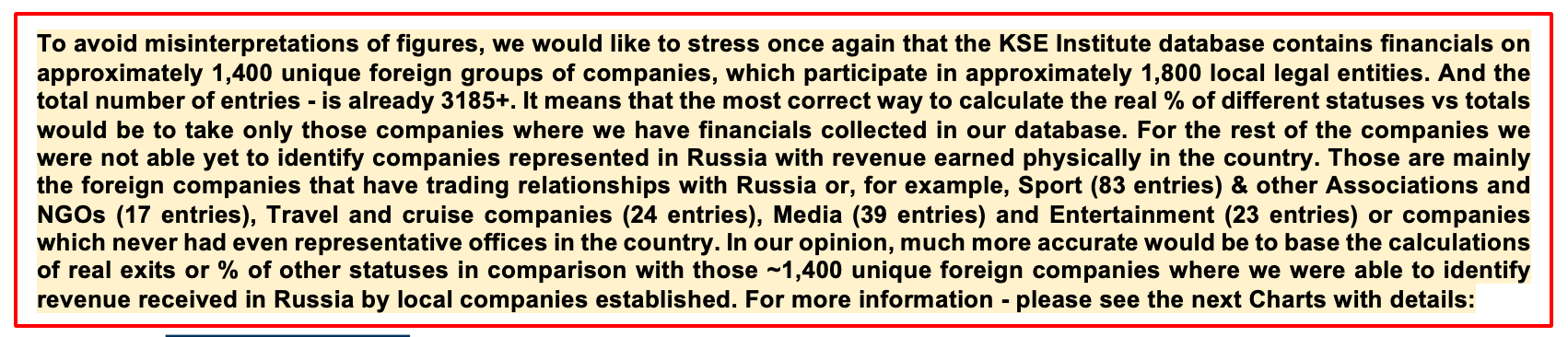

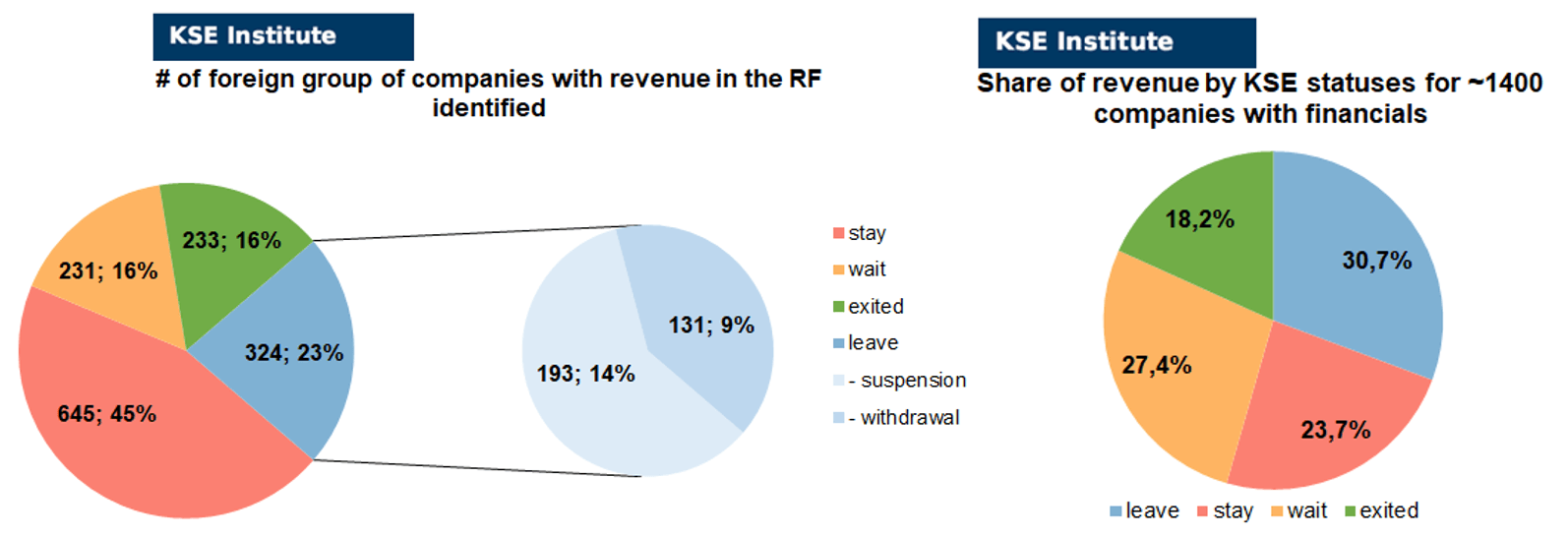

As of May 1, we have identified about 3,185 companies, organizations and their brands from 87 countries and 57 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 400 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $175.0 billion), local revenue (about $304.0 billion), local assets (about $288.5 billion) as well as staff (about 1.434 million people) and taxes paid (about $25.0 billion). 1,712 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 233 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

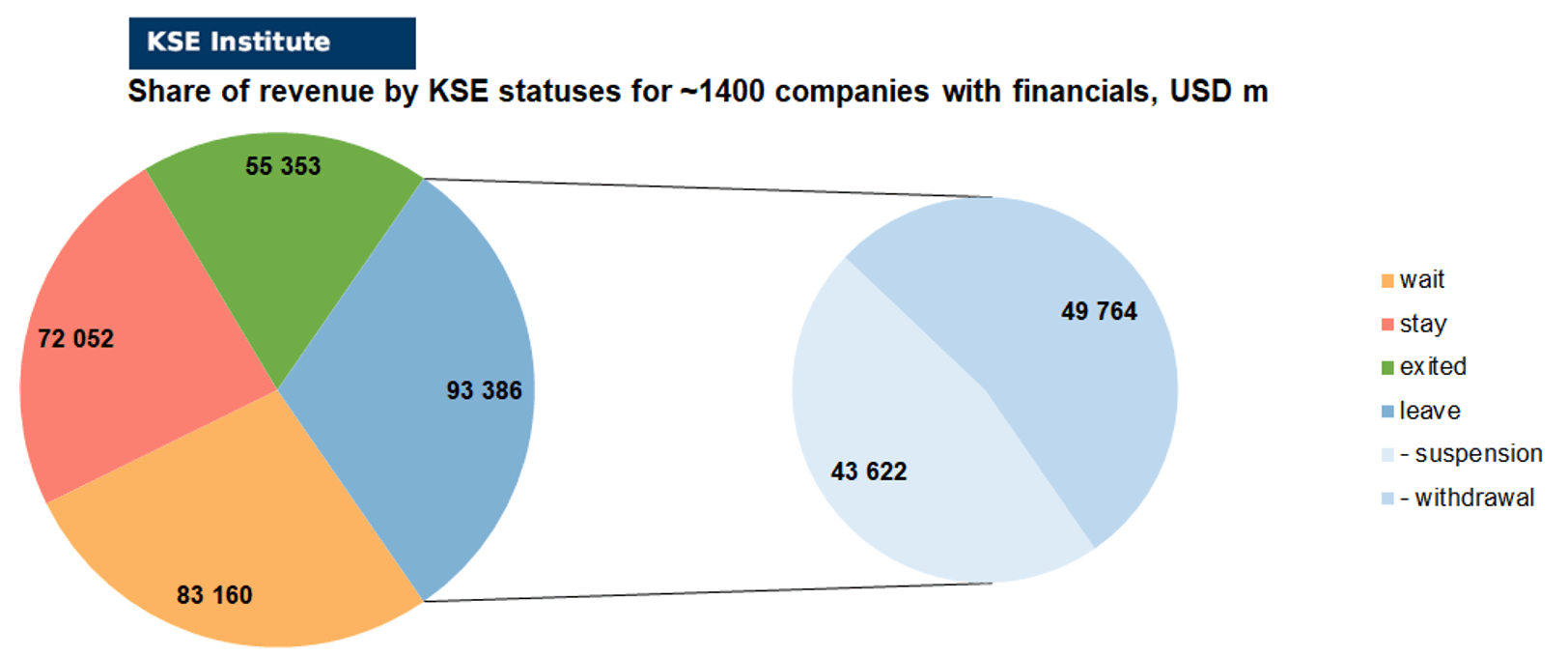

As can be seen from the tables below, as of May 1, 233 companies which had already completely exited from the Russian Federation, had at least 395,400 personnel, $55.4 bn in annual revenue, $40.1bn in capital and $49.2bn in assets; companies, that declared a complete withdrawal from Russia had 269,300 personnel, $49.8bn in revenues, $19.6bn in capital and $20.7bn in assets; companies that suspended operations on the Russian market had 154,400 personnel, annual revenue of $43.6bn, $17.4bn in capital and $32.2bn in assets.

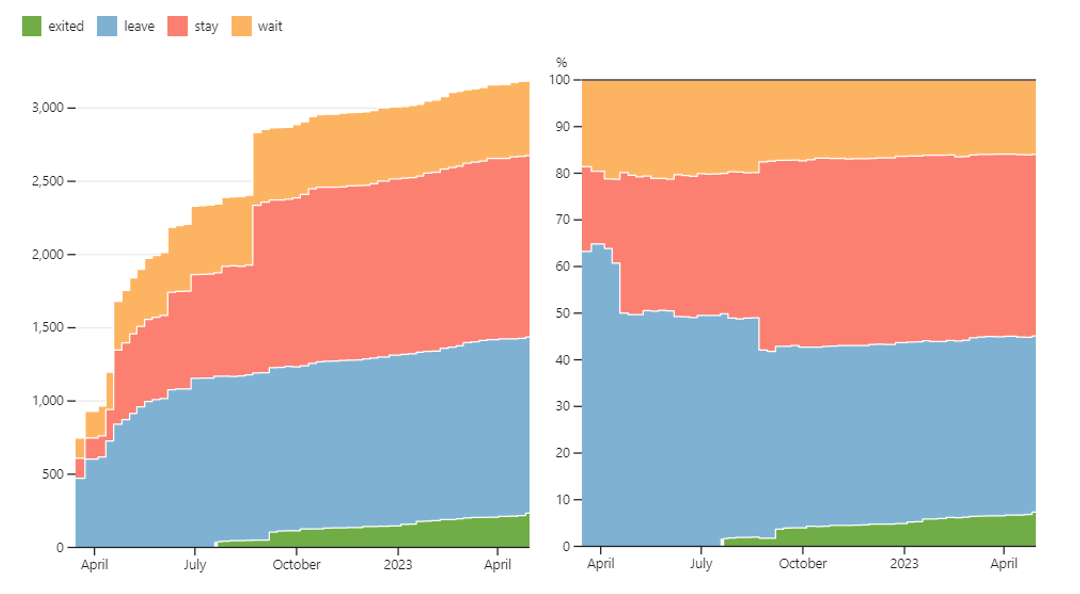

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 8 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database). However, if to operate with the total numbers in KSE database, about 37.8% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 38.9% are still remaining in the country, 16.0% are waiting and only 7.3% made a complete exit³.

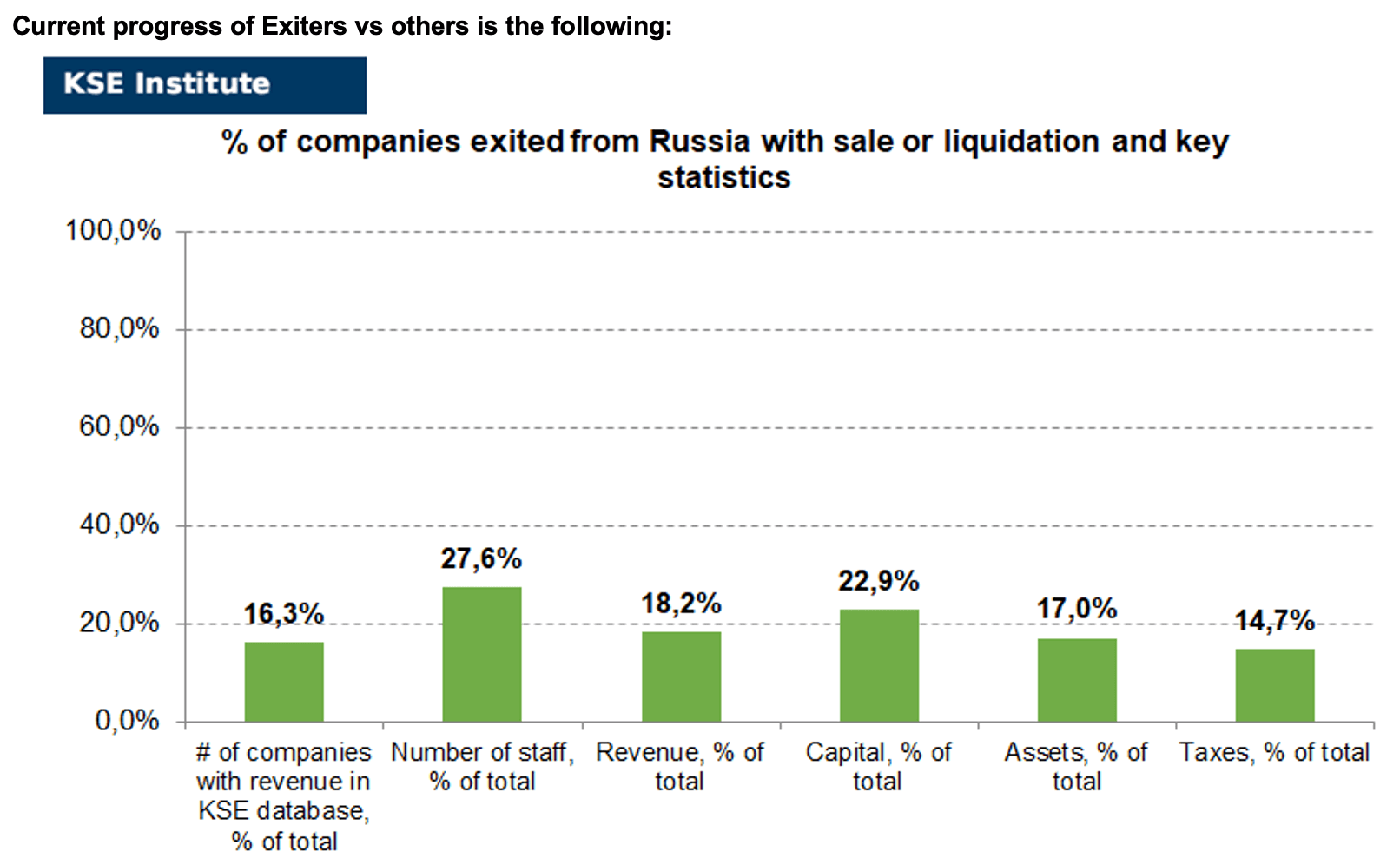

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 233 companies that completely left the country, since they employed 27.6% of the personnel employed in foreign companies, the companies owned about 17.0% of the assets, had 22.9% of capital invested by foreign companies, and in 2021 they generated revenue of $55.4 billion or 18.2% of total revenue and paid $3.7 billion of taxes or 14.7% of total taxes paid by the companies observed. Data on 1,400 TOP companies is presented in the table above.

As it is visible on the charts above, roughly similar % of exited is obtained based on number of companies (16%) and on share of revenue withdrawn (18%). At the same time, a totally different picture is for those who are still staying – 45% of companies represent 24% of revenue and 16% of waiting companies represent 27% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: On leaving the Russian Federation. Results of April 2023

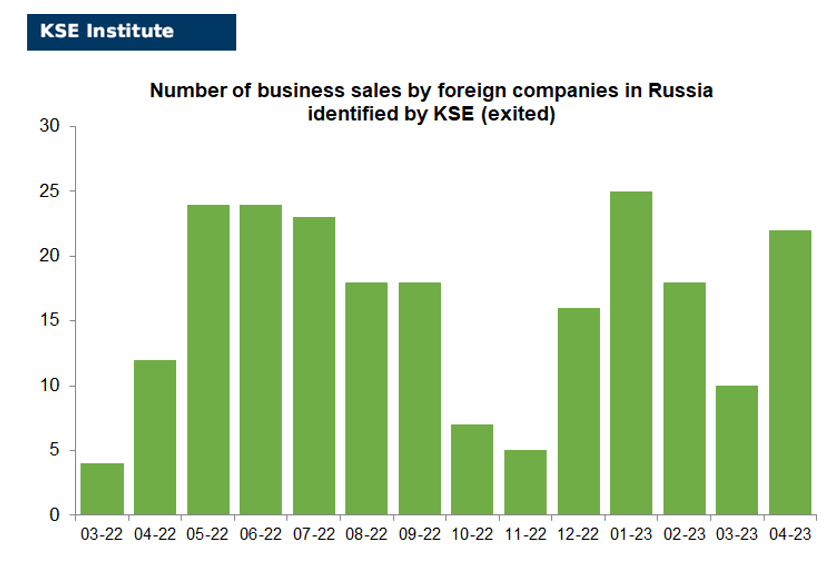

In this digest, we will summarize the results of April 2023 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies).

There are about 1.4 thousand companies identified in the KSE database with revenue data available of more than $300 billion. And at least 233 (about 16%) of them have already been sold by local companies or were liquidated and left the Russian market. In April 2023 KSE Institute identified +22 new exits⁴, total number of exits observed since the beginning of Russia’s invasion reached 233+.

On the chart below, share of exited and other statuses based on revenue allocation is shown. It is worth mentioning when we analyze status “leave” also pay attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 18% based on revenue allocation, those who are leaving represent 31% of total revenue (with 47% share of suspensions and 53% of withdrawals sub-statuses), % of staying companies represent 24% of revenue and 27% are waiting companies based on revenue generated in Russia in 2021.

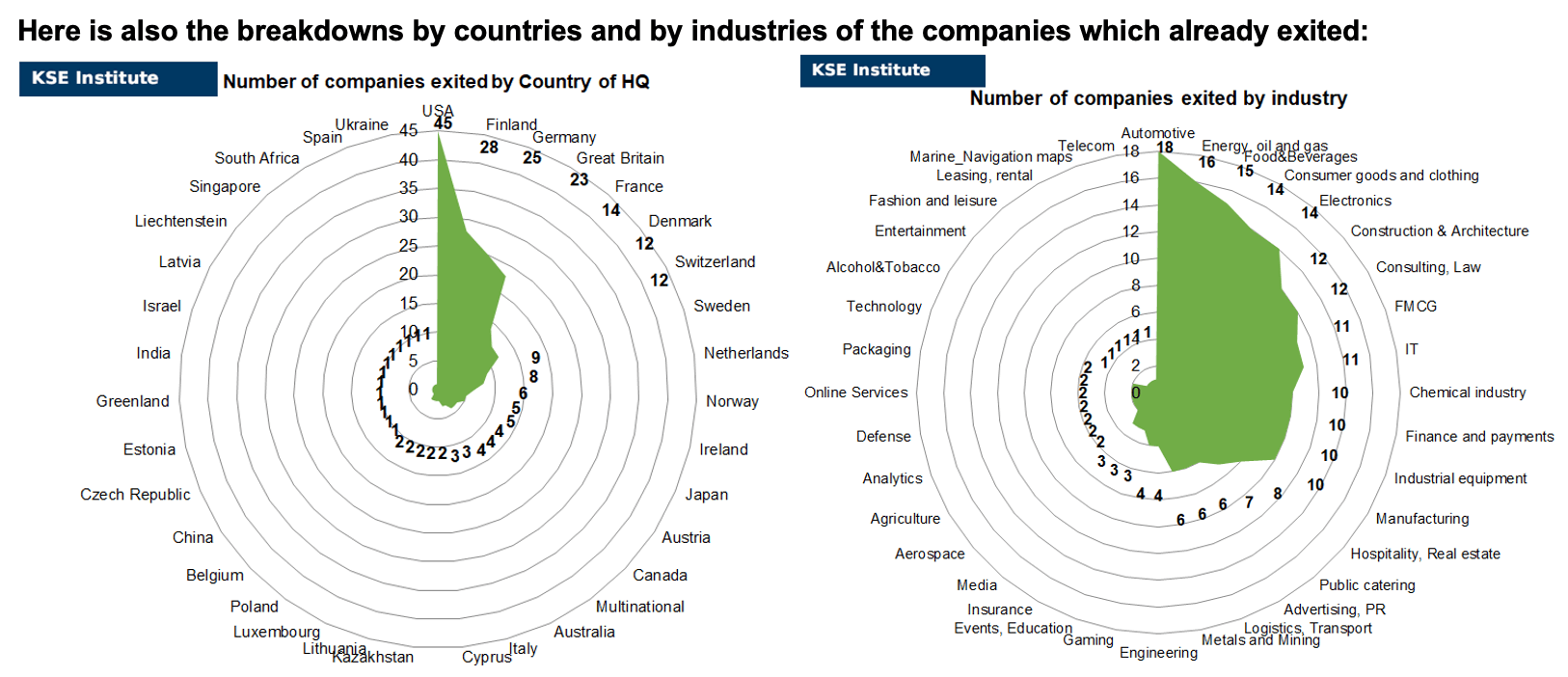

So, as of the end of April 2023, companies from 35 countries and 36 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Finland, Germany, and Great Britain and operated in the “Automotive”, “Energy, oil and gas”, “Food & Beverage”, “Consumer goods and closing” and “Electronics” industries.

Here is the list of “exiters” that we were able to identify recently: AFRY, ALD Automotive, Ansell, CNH Industrial, Daimler (also represented in the country by Mercedes-Benz and Mercedes-Benz Mobility), Electronic Arts, Emerson Electric, European Property Holdings (EPH), HASSLACHER Holding, Henkel, KFC (with parent Yum! Brands), Kone (identified with delay, left in 2022), Metso Outotec, Orica, SATO Corporation, TE Connectivity, TechnipFMC, Telko, Viessmann.

Also, we are not yet in a hurry to assign “exited” status to dozens of companies that are literally on the verge of exit, although have not yet finalized this process.

Here are just some of them: Aspo (Aspo’s subsidiary Telko has already completed the sale of its Russian operations), CMA CGM (French-based shipping group CMA CGM has completed its withdrawal from the Russian market by divesting stakes in terminals through an asset swap, the company said. One of the world’s largest transport companies CMA CGM sold its asset in Russia for €1 but no changes in the register were introduced yet), Continental (Continental AG plans to close the Russian business, said the company’s CEO Nikolai Setzer. Continental signed a Russia divestment deal in February 2023), Eli Lilly (The American pharmaceutical company Eli Lilly has decided to leave Russia and transfer its business to its partner in Central and Eastern Europe — the Swiss-registered distributor Swixx Biopharma. The company will hand over business in the country to Swixx BioPharma. Through it, Eli Lilly will continue to supply drugs to Russia), Foraco (Foraco International announced its exit from Russia), Heineken (Heineken found a buyer for the Russian branch), IBM (The Russian subsidiary of IBM completed all its commercial activities at the end of 2022), Inditex (Zara-owner Inditex obtains approval to sell business in Russia), Latvijas Gaze (Latvijas Gaze announced late in the evening on the 14th of April that it found a buyer for the company’s 100% of shares in Gaso. This buyer is Estonian Eesti Gaas), Raven Property Group Limited (Partial exit done, 2 out of 4 local entities changed owners), Softline International (Softline went through a closed line: the Russian part of the group was sold to the ZPIF of Tethys Capital Management Company), Takeda (Takeda considering selling its Russian manufacturing plant), UPM (UPM sold its assets in Russia to JSC Astranaut Rus Holding Oyj, a structure that is part of the holding), Windar Renovables (Spanish firm Windar Renovables is exploring selling its 51% stake in its Russian joint venture to partner and steelmaker Severstal).

RBC, informed by government sources⁵, provided some details on the amounts which the state budget collected from the foreign business “free of charge”. ₽20 billion – that’s the amount of “commission” which russian authorities forced foreign companies to pay for leaving Russia.The funds were transferred from December 2022 to April 17, 2023, according to the data of the “Electronic Budget”. The transfers were made under the item “Grant-free receipts”.

According to government requirements, foreign companies must pay to the budget at least 10% of the transaction amount for the sale of a business in Russia. In this case, the assets must be sold at a discount of at least 50% of the value, which will be determined during an independent assessment.

In March 2023, the authorities adjusted the requirements: now companies must send to the budget at least 5% of the market value of the business if the discount on the sale is less than 90%, and at least 10% of the market value if the discount exceeds 90%.

Russian President Vladimir Putin instructed to direct the funds collected from foreign companies to the development of tourism infrastructure in Russia.

The legal nature of the “voluntary contributions” is unclear, says Roman Rechkin, senior partner at law firm Intellect. According to him, the funds are transferred voluntarily, but at the same time as part of a certain obligation. If these are donations, then the company can take into account the contributions in expenses and reduce income tax. If this is a mandatory payment for the provision of “public services”, that is, the issuance of a permit for a transaction, then, according to the Tax Code, it becomes a “fee”. But the Tax Code prohibits the establishment of taxes and fees that are not provided for by it, the lawyer explains.

It is also not completely clear who should pay this fee – a foreign seller or a Russian buyer, says Zhanna Supryaga, executive director of the Dvitex law firm. According to her, the parties to the transaction can provide in the contract that this obligation is fulfilled by the buyer. The fee is paid by the applicant, who can be both the seller and the buyer, confirmed to RBC media by the managing partner of the Moscow Bar Association “Nikolaev and Partners” Yuri Nikolaev.

The next review of deals for May 2023 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)⁶

29.04.2023

*Chennai Petroleum Corp Ltd (India, Energy, oil and gas) Status by KSE – stay

India’s Chennai Petro aims to lift Russian oil intake in 2023/24

*Oriflame Cosmetics (Switzerland, Consumer goods and clothing) Status by KSE – leave

Oriflame Sells Russian Manufacturing Unit

https://www.directsellingnews.com/oriflame-sells-russian-manufacturing-unit/

*International Judo Federation (Hungary, Sport) Status by KSE – stay

The IJF Executive Committee has decided to allow athletes from Russia and Belarus to participate in IJF events as individual neutral athletes.

*Robert Bosch (Germany, Electronics) Status by KSE – wait

Germany’s Bosch sells some Russian assets to holding company S8 Capital

28.04.2023

*Mondelez (USA, Food & Beverages) Status by KSE – stay

During the first quarter of 2022, Ukraine generated 0.3% and Russia generated 2.4% of consolidated net revenue and during the first quarter of 2023, Ukraine generated 0.4% and Russia generated 2.8% of consolidated net revenue

https://ir.mondelezinternational.com/static-files/bab233b3-2b13-4680-bda7-add99c014c62

*APS Energia (Poland, Energy, oil and gas) Status by KSE – leave

Official Statement Yearly Report for 2022 Year: On Page 35 Is presented The company’s official strategy on operations on the Russian market is presented, which clearly shows the suspension of any investments on the Russian market.

On page 8 of the report there is also information about the suspension of operations of subsidiaries in Russia APS Traction and APS Invest

*Continental (Germany, Automotive) Status by KSE – leave

Continental decided to leave Russia in March and has already received permission from Moscow, but asked the American Ministry of Trade to check the deal before closing, the answer is delayed.

https://www.rbc.ru/business/28/04/2023/644b38a29a794751bb57a0fa

*International Boxing Association (Switzerland, Sport) Status by KSE – stay

USA Boxing, the national governing body for the sport in the country, terminated its membership of the Russian-led International Boxing Association (IBA)

https://edition.cnn.com/2023/04/28/sport/usa-boxing-iba-withdrawal-spt-intl/index.html

*Petro Welt Technologies (Austria, Energy, oil and gas) Status by KSE – exited

Petro Welt Technologies AG: Group results 2022: Divestment of Russian operating companies, focus on business in Kazakhstan

https://uk.finance.yahoo.com/news/petro-welt-technologies-ag-group-203531782.html?guccounter=1

*Microsoft (USA, IT) Status by KSE – wait

Russian representative offices of international companies and legal entities that have not been sanctioned receive offers from the American Microsoft to extend the license for its software.

https://www.kommersant.ru/doc/5955078

*Tik Tok (China, Online Services) Status by KSE – wait

Despite the restrictions, the profit of the Russian TikTok grew 10 times per hour

https://www.rbc.ru/technology_and_media/27/04/2023/6448eecc9a7947655231e6a6

https://www.kommersant.ru/doc/5954545?tg

*Wikimedia Foundation Inc. (USA, Online Services) Status by KSE – leave

The Wikimedia Foundation was fined 2 million rubles. for not removing prohibited information from “Wikipedia”.

https://www.interfax.ru/russia/898000

*Pernod Ricard (France, Alcohol & Tobacco) Status by KSE – wait

Update on Russia

27.04.2023

*CNH Industrial (Great Britain, Automotive) Status by KSE – exited

CNH Industrial Sells Russian Interests

*John Deere (USA, Automotive) Status by KSE – wait

Deere sold its Russian leasing arm to the Moscow-based Insight Investment Group, but that didn’t entirely sever ties with the country. Deere did not initially close its Russian factory in Orenburg, which builds seeding and tillage equipment in the country’s south, or its parts depot and combine and tractor manufacturing facility in Domodedovo, outside Moscow. Both locations are still listed as a part of the company’s worldwide network.

https://www.reuters.com/markets/deals/cnh-industrial-sells-russia-business-2023-04-19/

*Claas (Germany, Automotive) Status by KSE – stay

CLAAS, based in Germany, has not curtailed its work in Russia.

https://northernag.net/cnh-industrial-sells-russian-interests/

*Morgan Stanley (USA, Finance and payments) Status by KSE – wait

Morgan Stanley Real Estate Fund VII, which is managed by the American company Morgan Stanley, intends to sell 50% of the shopping and entertainment center “Gallery”. “Gallery” is Morgan Stanley’s latest asset in the real estate sector in Russia.

*Aytemiz Akaryakit (Turkey, Energy, oil and gas) Status by KSE – leave

PJSC “Tatneft” acquired 100% of the shares of Aytemiz Akaryakit fuel company (Turkey)

https://www.interfax.ru/business/897908

*Banco Santander SA (Spain, Finance and payments) Status by KSE – leave

The Polish Prosecutor’s Office seized all funds from the accounts of the Russian Embassy

https://www.tvc.ru/news/show/id/264737

*State Bank of India (SBI) (India, Finance and payments) Status by KSE – stay

SBI seeks oil data to avoid sanction risk

https://www.livemint.com/economy/sbi-seeks-oil-data-to-avoid-sanction-risk-11682531985598.html

*Hyundai (South Korea, Automotive) Status by KSE – leave

South Korea’s Hyundai Motor Co plans to exit Russia and sell its manufacturing plants there to a Kazakh company

*JPMorgan (USA, Finance and payments) Status by KSE – wait

The United States gave JPMorgan permission to process payments for agricultural exports via the Russian Agricultural Bank, but the arrangement was no substitute for reconnecting the bank to the SWIFT system

*Intesa Sanpaolo (Italy, Finance and payments) Status by KSE – wait

Intesa details reduced Russia exposure in message to shareholders

26.04.2023

*Roodell (Uzbekistan, Automotive) Status by KSE – stay

Russian AvtoVAZ will transfer the production of new cars to Uzbekistan

https://ukrrudprom.com/news/Rossiyskiy_AvtoVAZ_pereneset_proizvodstvo_novih_mashin_v_Uzbekistan.html

*Wintershall Dea AG (Germany, Energy, oil and gas) Status by KSE – leave

The German oil and gas company Wintershall Dea is studying available options for exiting Russian assets and taking personnel out of the country.

https://www.rbc.ru/business/26/04/2023/6448e8239a7947608d63d0e8?utm_source=yxnews&utm_medium=desktop

*Yum Brands (USA, Public catering) Status by KSE – exited

*KFC (USA, Public catering) Status by KSE – exited

A few months after it became known that the American corporation Yum! Brands, which owns the chain of fast food restaurants KFC, is leaving Russia, new establishments have begun to open in the country in the same premises.

*Fortum (Finland, Energy, oil and gas) Status by KSE – wait

*Uniper SE (Germany, Energy, oil and gas) Status by KSE – leave

The Federal Property Management Agency (Rosymuschestvo) received temporary management of shares in PJSC “Unipro” and PJSC “Fortum” belonging to foreign shareholders, according to the decree of the President of the Russian Federation published on Tuesday evening.

https://www.interfax.ru/business/897730

*NASA (USA, Aerospace) Status by KSE – stay

The joint operation of the International Space Station with Russia will last until 2031, – NASA

*Tendam (Spain, Consumer goods and clothing) Status by KSE – leave

Spain’s Tendam hands Russian shops to Belarusian company

*Lloyd’s Register (Great Britain, Industrial equipment) Status by KSE – leave

Lloyd’s expects insurer settlements on planes stuck in Russia

https://finance.yahoo.com/news/lloyds-expects-insurer-settlements-planes-082730152.html

*Nokian Tyres (Finland, Automotive) Status by KSE – exited

Nokian Tyres targets return to growth after Russia exit

25.04.2023

*Metso Outotec (Finland, Industrial equipment) Status by KSE – exited

Metso Outotec ends wind-down in Russia

https://www.construction-europe.com/news/metso-outotec-ends-wind-down-in-russia/8028498.article

*Mercedes-Benz (Germany, Automotive) Status by KSE – leave

Group of companies “Avtodom” announced the closing of the transaction on the acquisition of the Russian assets of Mercedes-Benz. At the same time, it was previously reported that Mercedes agreed with the new owner of assets in Russia on a repurchase option, which can be implemented, but on the condition that sanctions are lifted.

Mercedes-Benz has disabled the Mercedes me ID electronic service for Russian car owners

https://habr.com/ru/news/731400/

*Robert Bosch (Germany, Electronics) Status by KSE – wait

Bosch initiated mass lawsuits in Russian courts for the protection of trademarks

24.04.2023

*Gatik Ship Management (India, Energy, oil and gas) Status by KSE – stay

An oil tanker company heavily involved in moving Russian oil lost industry standard insurance for its fleet after falling foul of a Group of Seven price cap relating to the transportation of the nation’s barrels.

*ORICA (Australia, Metals and Mining) Status by KSE – exited

ORICA COMPLETES EXIT PROCESS FROM RUSSIA

https://www.orica.com/news-media/2022/orica-completes-exit-process-from-russia#.ZEZLrOxBz_R

*Heineken ( Netherlands, Alcohol&Tobacco) Status by KSE – leave

Dutch brewer Heineken has asked regulators in the Russian Federation to approve the sale of its business in Russia.

*Binance (China, Finance and payments) Status by KSE – stay

Binance Ends Russian Account Limits as Country Uses Tech to Bypass Sanctions

https://beincrypto.com/binance-ends-russia-account-limits/

*Fortum (Finland, Energy, oil and gas) Status by KSE – wait

Chairman of the board of VTB Andrey Kostin proposed to take ownership of foreign companies

*HSBC (Great Britain, Finance and payments) Status by KSE – leave

The Hong Kong bank HSBC refused the company to make payment under the contract with the foreign partner, referring specifically to the decision of the National Security and Defense Council (NSDC) of Ukraine

https://www.vedomosti.ru/finance/articles/2023/04/24/972176-hsbc-zametil-ukrainskie-sanktsii

*Leroy Merlin (France, FMCG) Status by KSE – leave

Leroy Merlin has excluded the sale of its warehouses

https://www.rbc.ru/business/24/04/2023/64462f089a7947c74e9a4842

*CMA CGM (France, Logistics, Transport) Status by KSE – leave

CMA CGM divests Russian asset

https://www.worldcargonews.com/news/cma-cgm-divests-russian-asset-71397

*Uber (USA, Online Services) Status by KSE – exited

“Yandex” bought the share of Uber in the group of companies “Yandex Taxi”

https://www.kommersant.ru/doc/5951573?from=top_main_1

*Raiffeisen (Austria, Finance and payments) Status by KSE – wait

Gref refuses negotiations between Sberbank and Raiffeisen about the exchange of assets

https://www.kommersant.ru/doc/5951365?tg

*Chery Automobile (China, Automotive) Status by KSE – stay

The Chinese car manufacturer Chery is studying the possibility of localization of production in Russia. The company can launch its own car production in the Russian Federation or open a factory under the terms of partnership, said the president of Chery International, Zhang Guibin

https://www.kommersant.ru/doc/5942140?tg

*Peninsula Petroleum (Ireland, Energy, oil and gas) Status by KSE – stay

NACP has included Peninsula Petroleum to international war sponsors list

*Henkel (Germany, Chemical industry) Status by KSE – leave

Henkel expects net financial loss from sale of Russia business

22.04.2023

*Badminton World Federation (Malaysia, Sport) Status by KSE – leave

BWF Extends Ban on Russian, Belarusian Athletes and Officials From International Events

*Marcegaglia (Italy, Metals and Mining) Status by KSE – stay

Marcegaglia has acquired Russian steelmaker Severstal’s unit in Latvia

*Takeda (Japan, Pharma, Healthcare) Status by KSE – wait

Takeda considering selling its Russian manufacturing plant

https://www.thepharmaletter.com/article/takeda-considering-selling-its-russian-manufacturing-plant

21.04.2023

*TBC Bank (Georgia, Finance and payments) Status by KSE – leave

*Bank of Georgia (Georgia, Finance and payments) Status by KSE – leave

One of the largest Georgian banks, TBC Bank, has begun to warn clients that it may close their accounts if transactions related to the circumvention of Western sanctions against the Russian Federation are detected.

https://tass.ru/ekonomika/17573977

*Duracell (USA, Consumer goods and clothing) Status by KSE – leave

The shareholders of the Duracell battery manufacturer have decided to withdraw from the Russian market. Before exiting the Russian market, the company will sell off the remaining stock of goods and settle with employees, writes Mash.

https://biz.censor.net/news/3413545/vyrobnyk_batareyiok_duracell_yide_z_rosiyi_zmi

*International Investment Bank (IIB) (Hungary, Finance and payments) Status by KSE – stay

The International Investment Bank (IIB) in Budapest, which has come under US sanctions, is closing its Hungarian headquarters and leaving the EU. “The bank has started the relocation of its headquarters from Hungary to Russia,” the statement said.

20.04.2023

*European Property Holdings (EPH) (Switzerland, Hospitality, Real estate) Status by KSE – exited

Real Estate Investor EPH Completes Exit from Russian Portfolio

*Group-IB (Singapore, IT) Status by KSE – exited

Group-IB exits Russia to focus exclusively on expanding global Digital Crime Resistance network

https://www.group-ib.com/media-center/press-releases/group-ib-exits-russia/

https://www.techinasia.com/sg-cybersecurity-firm-exits-russian-market

*Telko (Finland, Chemical industry) Status by KSE – exited

Aspo’s subsidiary Telko completes the sale of its Russian operations

*Continental (Germany, Automotive) Status by KSE – leave

Germany’s Continental aims to sell its tyre plant in the Russian city of Kaluga to S8 Capital

*CNH Industrial( Great Britain, Automotive) Status by KSE – leave

Agricultural and construction machine maker CNH Industrial ceased its operations in Russia and said it sold its business in the region for about $60 million.

https://www.reuters.com/markets/deals/cnh-industrial-sells-russia-business-2023-04-19/

*IBM (USA, IT) Status by KSE – leave

IBM’s Russian “subsidiary” ended its commercial activities at the end of 2022

*Xiaomi (China, Electronics) Status by KSE – stay

*Vivo (China, Electronics) Status by KSE – stay

Foreign phone manufacturers have started pre-installing RuStore when delivering to the Russian Federation

https://www.kommersant.ru/doc/5941250?tg

*Bank of Cyprus (Cyprus, Finance and payments) Status by KSE – wait

Bank of Cyprus notified 4,000 clients who have Russian passports and are not residents of EU countries that their accounts will be closed in accordance with the policy of accepting clients and the corresponding risk appetite

https://www.rbc.ru/finances/20/04/2023/644132bb9a7947c1b20c34f8?from=from_main_7

*Henkel (Germany, Chemical industry) Status by KSE – leave

Henkel divests its business activities in Russia

*Volkswagen (Germany, Automotive) Status by KSE – leave

Russia’s government has approved the sale of Volkswagen’s factory in the city of Kaluga

19.04.2023

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

UniCredit Bank will increase the minimum fee for currency transfers

UniCredit Bank will close three more branches in the regions in June

https://frankmedia.ru/120627?utm_source=tf

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Shell claimed it had left Russia for good, and wrote off its Russian assets as losses

*UEFA (Switzerland, Sport) Status by KSE – leave

Russia says talks with UEFA about reinstatement are tough

*JSW Steel (India, Metals and Mining) Status by KSE – stay

India’s JSW Steel plans to sell specialty steel to Russia

*Airbus (Brazil, Aircraft industry) Status by KSE – wait

On December 1 of 2022, Airbus made an announcement about its intention to decouple its supply chain from Russian Titanium in a “matter of months”. It is not clear how many months Airbus has in mind, but as of the end of February (the last available data points), exports continued as can be seen from the next chart.

https://squeezingputin.com/support.html

*Mercedes-Benz (Germany, Automotive) Status by KSE – leave

Dealer group “Avtodom” closed the deal on the acquisition of Russian assets of the German car concern Mercedes-Benz, including a Moscow-based car plant

https://www.interfax.ru/business/896618

Mercedes includes buyback option as Russian assets sale given official approval

*Candy (Italy, Electronics) Status by KSE – stay

*Haier (China, Electronics) Status by KSE – stay

*Arçelik (Turkey, Electronics) Status by KSE – stay

The Italian brand Candy, owned by China’s Haier, has suspended the work of the factory in Kirov against the background of declining demand and increased competition from cheaper Chinese and Russian brands.

https://www.kommersant.ru/doc/5940511?tg

*Tendam (Spain, Consumer goods and clothing) Status by KSE – leave

The company, which announced its departure from Russia, will transfer some of its points of sale in the country to the Belarusian franchisee Fashion House.

https://www.kommersant.ru/doc/5940484?tg

*Goldman Sachs (USA, Finance and payments) Status by KSE – leave

*Bank of America (USA, Finance and payments) Status by KSE – leave

Russian structures Goldman Sachs and Bank of America recorded losses at the end of 2022 for the first time in at least five years.

https://www.rbc.ru/finances/19/04/2023/643ea6549a79474545a9e757

*Dell (USA, Electronics) Status by KSE – leave

Dell’s Russian office estimated its costs for termination of contracts in Russia at 3.4 billion rubles

https://www.tadviser.ru/a/261366

*Intesa Sanpaolo (Italy, Finance and payments) Status by KSE – stay

Bank “Inteza” stopped opening foreign currency accounts to new private clients in Russia.

*Heineken (Netherlands, Alcohol&Tobacco) Status by KSE – leave

Heineken found a buyer for the Russian division

https://www.reuters.com/markets/deals/heineken-seeks-approval-sale-russian-business-2023-04-19/

18.04.2023

*Indian Railways (India, Logistics, Transport) Status by KSE – stay

India to Sign $6.5 Billion Deal with Russian Firm for 120 Vande Bharat Express Trains

*SATO Corporation (Finland, Hospitality, Real estate) Status by KSE – exited

SATO Corporation has completed its Russian business divestment

*Open Mineral Ltd (United Arab Emirates, Metals and Mining) Status by KSE – stay

Open Mineral Ltd, registered in Abu Dhabi a year ago and fully owned by Open Mineral AG with headquarters in Zug (Switzerland). According to documents cited by the Financial Times, between August 2022 and January 2023, this company imported $44 million worth of Russian gold to the United Arab Emirates (UAE) in six batches.

https://www.ft.com/content/6d51fd1e-07b4-4aa6-95b0-e1634816bf3d

*Pernod Ricard (France, Alcohol&Tobacco) Status by KSE – wait

ABSOLUT CEASES EXPORTS TO RUSSIA, EFFECTIVE IMMEDIATELY

https://www.theabsolutcompany.com/absolut-ceases-exports-to-russia-effective-immediately/

*Latvijas Gaze (Latvia, Energy, oil and gas) Status by KSE – wait

*Eesti Gaas (Estonia, Energy, oil and gas) Status by KSE – wait

LG announced late in the evening on the 14th of April that it found a buyer for the company’s 100% of shares in Gaso. This buyer is Estonian Eesti Gaas.

https://bnn-news.com/russias-gazprom-receives-part-of-the-money-from-gasos-sale-244907

*Aurubis AG (Germany, Metals and Mining) Status by KSE – leave

Aurubis AG Europe’s largest copper smelter and producer, no longer buys the red metal from Russia after it let supply contracts lapse

*KFC (USA, Public catering) Status by KSE – exited

*Yum Brands (USA, Public catering) Status by KSE – exited

Yum! Brands has completed its exit from the Russian market by selling its KFC business in Russia to Smart Service Ltd., a local operator led by Konstantin Yurievich Kotov and Audrey Eduardovich Oskolkov.

*EVN AG (Austria, Energy, oil and gas) Status by KSE – wait

EVN is currently in advanced negotiations with a potential buyer for the two combined heat and power plants in Moscow, which represent the last remaining activities of the EVN Group in Russia

https://www.evn.at/getattachment/8929f36a-1cc0-4ecd-be5c-f1403ef7b1f1/EVN-Full-Report-2021-22.pdf

*Bank of China (China, Finance and payments) Status by KSE – stay

*ICBC (China, Finance and payments) Status by KSE – stay

*China Construction Bank (China, Finance and payments) Status by KSE – stay

*Agricultural Bank of China (China, Finance and payments) Status by KSE – stay

There are four banks with Chinese capital operating in Russia.

*Bank of Cyprus (Cyprus, Finance and payments) Status by KSE – wait

Clients of the Bank of Cyprus with Russian citizenship began to receive notifications about the closure of their accounts.

https://www.bfm.ru/amp/news/523348

*Stockmann (Finland, Manufacturing) Status by KSE – exited

In 2015, Stockmann agreed to sell its Russian operations to Reviva Holdings, which still owns the company. Now the company has 12 representative offices, mainly in Moscow and St. Petersburg. The CEO of Stockmann Russia is opening 16 new stores across the country in 2023

*Binance (China, Finance and payments) Status by KSE – wait

Crypto exchange Binance removed the limit of 10,000 euros for the accounts of Russians.

https://finclub.net/ua/news/binance-skasuvala-sanktsiini-limity-dlia-rosiian.html

*International Basketball Federation (FIBA) (Switzerland, Sport) Status by KSE – leave

Following the IOC recommendations on the participation of athletes with a Russian or Belarusian passport in international competitions published on 28 March, the FIBA Executive Committee has decided to not allow the registration of the Russian men’s national team in the FIBA Olympic Pre-Qualifying Tournaments 2023

17.04.2023

*Microsoft (USA, IT) Status by KSE – wait

Microsoft has stopped warranty service for Xbox consoles in Russia

*Toyota (Japan, Automotive) Status by KSE – leave

At the former Toyota plant in St. Petersburg, production of the new Almaz-Antey truck may begin as early as 2024.

https://www.kommersant.ru/doc/5939117

*Baileys (Diageo) (Ireland, Alcohol&Tobacco) Status by KSE – leave

Pour Cosmopolitan into cans

https://www.kommersant.ru/doc/5939163?tg

*MyGames (Netherlands, Gaming) Status by KSE – leave

Astrum and My.Games agreed on the division of the game

https://www.kommersant.ru/doc/5939161?tg

*State Bank of India (SBI) (India, Finance and payments) Status by KSE – stay

State Bank of India and Bank of Baroda informed refiners they will not handle payments for oil bought above the limit

*Volkswagen (Germany, Automotive) Status by KSE – leave

*Skoda (Czech Republic, Automotive) Status by KSE – wait

The Arbitration Court of the Nizhny Novgorod Region canceled the seizure of the shares of Volkswagen and Skoda in LLC “Volkswagen Group Rus”.

15.04.2023

*Norwegian Fencing Federation (NFF) (Norway,Sport) Status by KSE – leave

The Norwegian Fencing Federation (NFF) has ruled that it will not send its athletes to events that feature Russian or Belarussian competitors and withdrawn Oslo Cup from the international programme.

https://www.insidethegames.biz/articles/1135949/norwegian-fencing-federation-rus-blr

*H&M (Hennes and Mauritz) (Sweden, Consumer goods and clothing) Status by KSE – leave

*Inditex (Spain, Consumer goods and clothing) Status by KSE – leave

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – leave

Brands that left Russia lost a couple of billions

https://www.kommersant.ru/doc/5915073

*Quzhou Nova (China, Metals and Mining) Status by KSE – stay

Chinese firm imported copper from Russian-controlled part of Ukraine

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

In early April, the KSE Institute also published its methodology entitled “How to Identify Foreign Business in Russia and What are the Key Issues of Creating and Keeping a Full List of the Largest Foreign Companies in Russia”, you can download its full text using the following links:

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ It needs to be mentioned that open access to Russia’s EGRUL register was classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁶ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website