- Kyiv School of Economics

- About the School

- News

- 25th issue of the weekly digest on impact of foreign companies’ exit on RF economy

25th issue of the weekly digest on impact of foreign companies’ exit on RF economy

31 October 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 24-31.10.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 31.10.2022

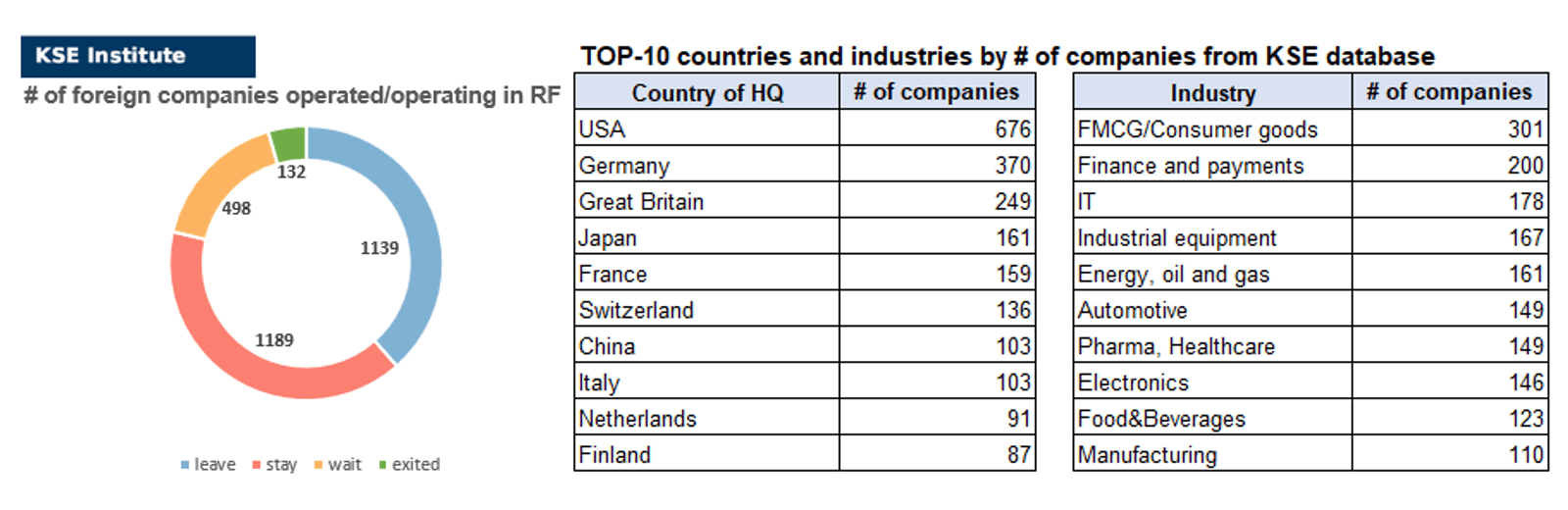

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 189 (-3 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 498 (+2 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 139 (-1 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 132(+5 per week)

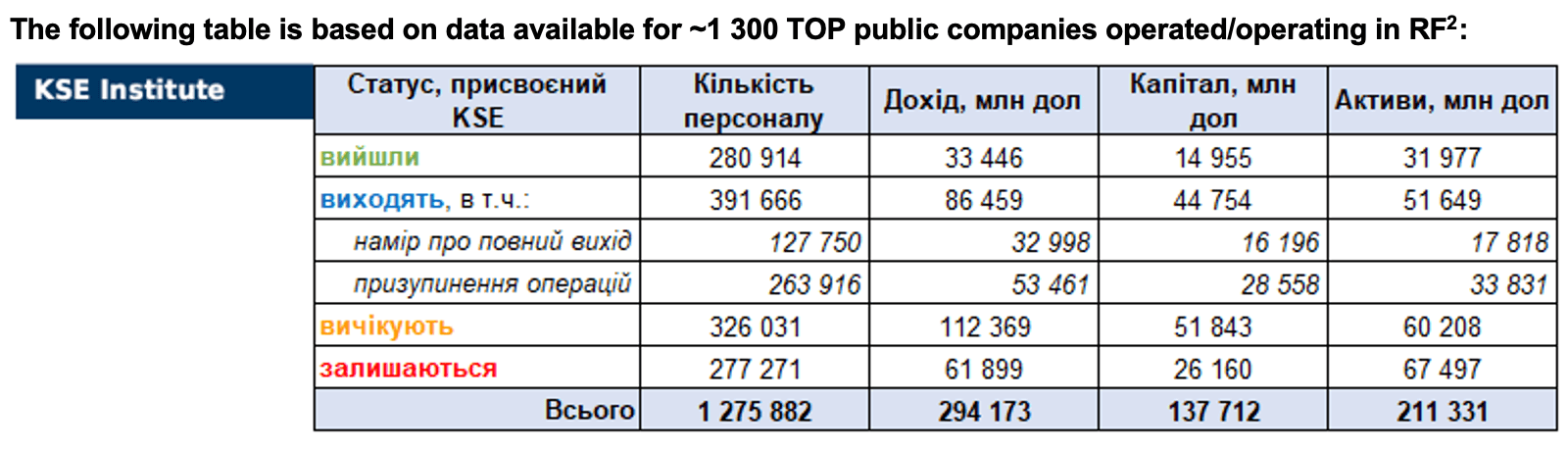

As of October 31, we have identified about 2,958 companies, organisations and their brands from 85 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $137.7 billion), local revenue (about $294.2 billion), local assets (about $211.3 billion) as well as staff (about 1.276 million people). 1,637 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 132 companies that have completed the sale of their business in Russia based on the information collected from the official registers (October update this week allowed us to identify another 5 exited companies).

As can be seen from the tables below, as of October 31, companies which had already completely exited from the Russian Federation, had at least 280,900 personnel, $33.4 bn in annual revenue, $15.0 bn in capital and $32.0 bn in assets; companies, that declared a complete withdrawal from Russia had 127,800 personnel, $33.0bn in revenues, $16.2bn in capital and $17.8 bn in assets; companies that suspended operations on the Russian market had 263,900 personnel, annual revenue of $53.5bn, $28.6bn in capital and $33.8 bn in assets.

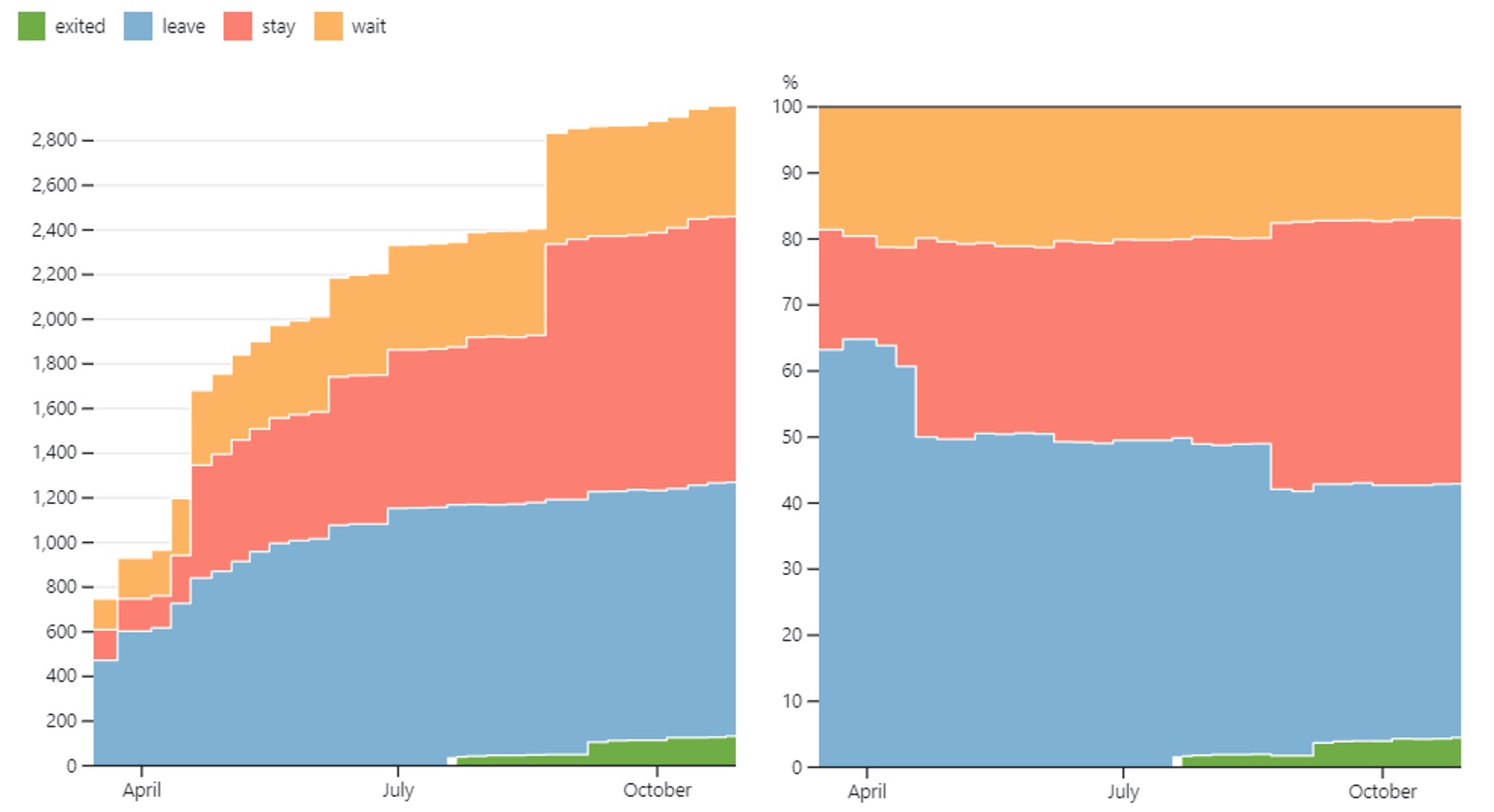

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 38.5% of foreign companies have already announced their withdrawal from the Russian market, but another 40.2% are still remaining in the country, 16.8% are waiting and only 4.5% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 132 companies that completely left the country, since they employed almost 22.0% of the personnel employed in foreign companies, the companies owned about 15.1% of the assets, had 10.9% of capital invested by foreign companies, and only last year they generated revenue of $33.4 billion or 11.4% of total revenue, data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Analysis on British companies and their positions in Russia

Great Britain has long been the country most involved in international investment processes in the world.

For at least the last twenty years, Great Britain has maintained its most stable investment positions in the USA, the Netherlands, Luxembourg, France, Ireland, Belgium, Spain, Australia and China. At the same time, Russia is not included in the list of top countries in terms of investment attractiveness for Great Britain, however, over the past ten years, accumulated British investments in Russia ranked fifth in Russia itself, after Cyprus, the Netherlands, Germany and the Virgin Islands⁴.

For reference: in 2021, the share of foreign direct investment (FDI) of Great Britain in the Russian market was 1.7%. In 2020, the volume of FDI from Great Britain to Russia was 11.2 billion GBP and the volume of foreign direct investment from Russia in Great Britain was 681 million GBP⁵.

Many influential British companies from the FTSE-100 index list have conducted operations in Russia for many years. Before the Russian-Ukrainian war, in particular until 2022, about 600 companies were registered in the Russian-British Chamber of Commerce⁶.

According to the recent research of YouControl company⁷, the total number of Russian commercial companies, the founders of which are residents of Great Britain, reaches 2,370 legal entities (it is worth noting that most of them are relatively small or do not have a controlling share of ownership). It is also noted that British subsidiaries in Russia often serve as fronts for international financial flows leading to Russian owners. For example, HSBC Holdings, Unilever, GlaxoSmithKline, AstraZeneca, Linde, Legal & General Group and LyondellBasell Industries are companies that have their headquarters in Great Britain and support cooperation with the Russian Federation. At the same time, as the study showed, the largest share of British capital in the Russian Federation is represented in construction, wholesale trade, real estate operations, transport and logistics, as well as IT⁸.

For reference: prior to 2022, approximately three-quarters of the capital of British companies in Russia was concentrated in the extraction of mineral and energy raw materials⁹.

Russia’s actions in Ukraine have become one of the most pressing foreign policy issues for relations between Great Britain and Russia. In 2014, Great Britain, together with the USA and EU countries, supported the introduction of sanctions against Russia because of the war it started in Ukraine. At the same time, the activity of bilateral economic cooperation between Great Britain and Russia began to decline.

In 2022, with the beginning of Russia’s large-scale military aggression against Ukraine, Great Britain instantly reacted to this event and supported Ukraine. London, together with other Western allies, imposed financial restrictions on Russia in order to punish the latter for its military escalation against Ukraine, while such restrictions also apply to third countries that help Moscow.

In early March 2022, the ex-Finance Minister and the current Prime Minister of the United Kingdom Rishi Sunak declared the inadmissibility of new British investments in Russia and announced the support by the British Government to British companies in stopping the latter’s business in Russia. At the same time, it was noted that it would be difficult to wind up existing investments, since British companies own assets in Russia, in which tens of billions of GBP were invested¹⁰.

In this context, Great Britain introduced new financial sanctions against Russian financial institutions, contributing to their removal from the SWIFT international payment system. It also introduces an export ban on IT consultancy, a ban on the import of British pounds sterling cash into Russia, a ban on the export of almost 700 British goods to Russia and, most importantly, a phase-out of Russian oil imports by the end of the year – depriving Putin’s government of access to its lucrative revenues from oil¹¹.

For instance, after Great Britain introduced financial sanctions against Russia¹², the latter turned out to be significantly cut off from the British financial system, which is very sensitive for Russia. At the same time, Russia is losing British technologies and preferences in trade on the territory of Great Britain.

For reference: Russia’s economy is already feeling the impact of British sanctions. UK merchandise exports to Russia fell by 28.0% in the last 12 months to August 2022 compared to the same period the previous year. Imports of British goods from Russia during the same period decreased by 22.4%, respectively¹³.

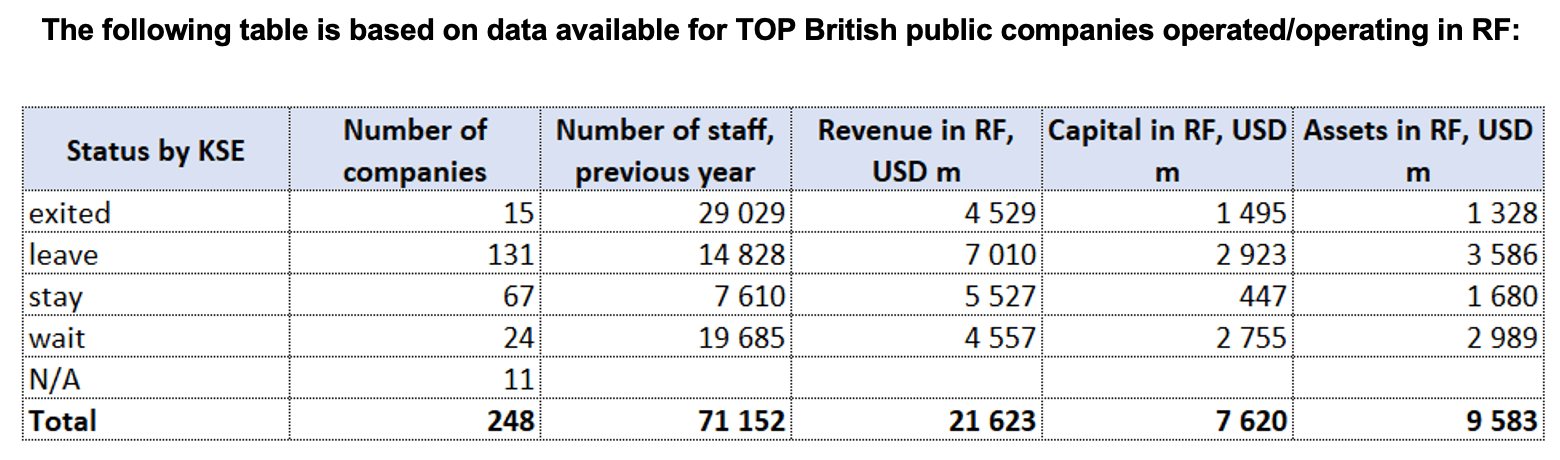

According to data collected by the KSE Institute¹⁴,

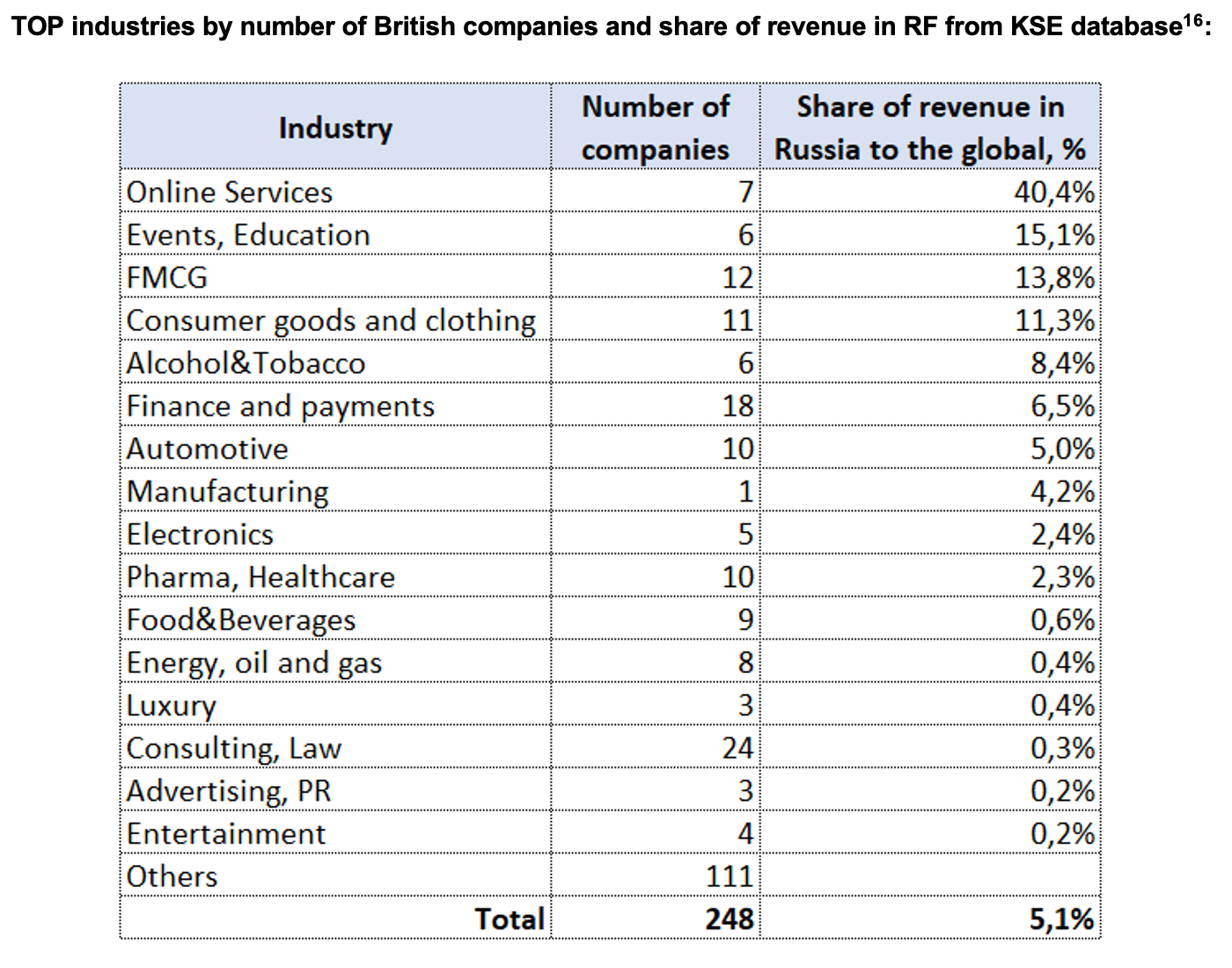

in 2021 248 British companies provided jobs for 71,150 people, those companies generated $21.6 bn in annual revenue, had $7.6 bn in capital and $9.6 bn in assets.

15 companies (6% of 248 companies observed) have already completely exited Russia by selling their shares, about 41% of employees have already left or will soon leave their previous jobs due to their exit.

The most “dependent” on Russia in terms of revenue share (more than 10%) in this country are British companies in 4 industries: Online Services, Events and Education, FMCG, Consumer goods and clothing.

How are British companies reacting?

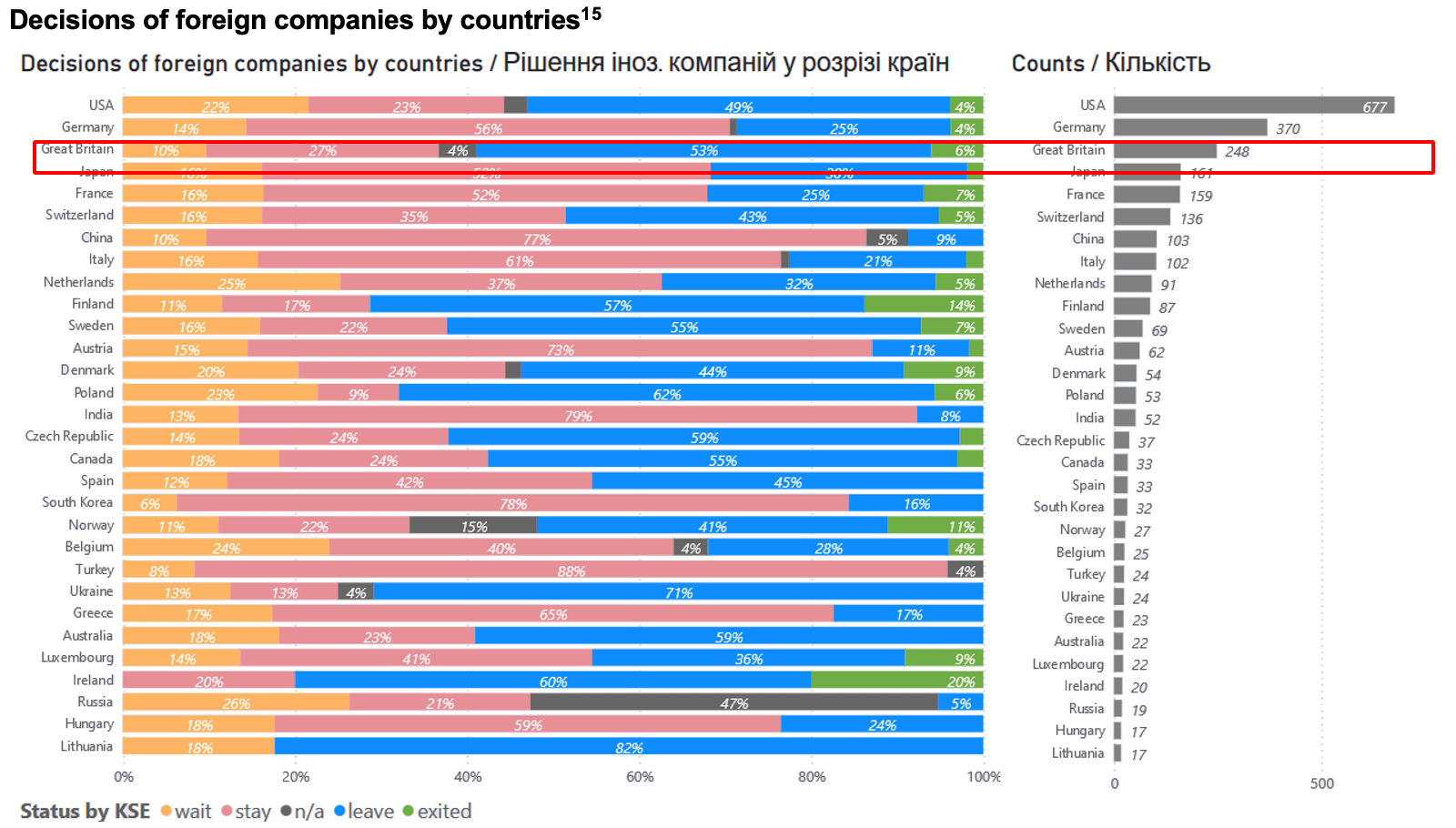

Out of 248 companies in the KSE database, only 27% of British companies stay in Russia, 10% waiting and somewhat limiting their activities and 53% are leaving. Some of the British companies are among the examples of clean breaks from the Russian market, while others defy demands for exit despite pressure.

Clean breaks

15 British companies (or 6%) included in the KSE database have completely left the Russian market and sold their shares (all of them have “exited”¹⁷,

status by KSE, legally there are British beneficiaries anymore):

Compass Group (Public catering), Deloitte (Consulting & Law), Eversheds Sutherland (Consulting & Law), EY (Consulting & Law), Hyve Group plc (Events, Education), PwC (Consulting & Law), Hays plc (Consulting & Law), Arrival (Automotive), Kantar TNS (Analytics), Nisa (FMCG).

WPP PLC (Media, Status by KSE – exited) “WPP stands with Ukraine and the international community in condemning the Russian invasion, which has created a humanitarian crisis in the heart of Europe. The Board of WPP has concluded that WPP’s ongoing presence in Russia would be inconsistent with our values as a company, and we are therefore discontinuing our operations in the country.”- according to the company’s statement. WPP sold its business to the existing local management.

Shell (Energy, oil and gas, Status by KSE – exited) Shell plc is a British multinational oil and gas company headquartered in London, England. Shell Overseas Investments B.V. and B.V. Dordtsche Petroleum Maatschappij, subsidiaries of Shell plc, have completed the sale of Shell Neft LLC, Shell’s retail stations and lubricants business in Russia, to PJSC LUKOIL. This followed the receipt of all necessary regulatory approvals.The sale agreement was announced on May 12, 2022. All people currently working for Shell Neft, more than 350 in total, will remain employed by Shell Neft, which is now owned by LUKOIL.

Imperial Brands (Alcohol & Tobacco, Status by KSE – exited) Imperial Brands announces the transfer of its Russian business to investors based in Russia. In FY21, Russia and Ukraine represented in total around 2 per cent of net revenues and 0.5 per cent of adjusted operating profit. The company had 1,000 employees in Russia.

Inchcape (Automotive, Status by KSE – exited) Inchcape’s business in Russia is a retail-only operation, and during 2021 it disposed of its St. Petersburg operations. The remaining business contributed £750m of revenue in 2021 or around 10% of group sales. Over the last five years, it generated circa 5% of the group’s operating profit or pre-pandemic: less than 3%. “In light of the current circumstances, we have come to the conclusion that the group’s ownership of its business interests in Russia is no longer acceptable,” the company said in a statement.

Marks & Spencer (Consumer goods and clothing, Status by KSE – exited) In March, British food and clothing retailer Marks & Spencer suspended supplies to its Turkish franchisee’s Russian business following Russia’s invasion of Ukraine. “Taking into account the unfolding humanitarian crisis after Russia’s invasion of Ukraine, M&S has suspended deliveries to the Russian business of our Turkish franchise” the company said.

Online Services

Gett (Status by KSE – leave) According to the decision of the Gett global office, on May 31, 2022, technical support, development and maintenance of the Gett mobile application in Russia will be discontinued.

TransferGo Ltd (Status by KSE – leave) and Zepz (Status by KSE – leave) have joined the list of fintech companies that have suspended payment services in Russia in response to the country’s invasion of Ukraine. TransferGo, which took to LinkedIn to announce its solidarity with Ukraine, said in March that it would immediately stop payments to Russia.

OnlyFans (Status by KSE – wait) has “temporarily paused” Russian accounts and says it can no longer serve Russian creators.

Events, Education

ACCA (Status by KSE – leave) In March, a statement appeared on the company’s website: “As the war continues in Ukraine, ACCA has taken a number of steps including increasing support for our Ukrainian members and students, and suspending operations in Russia.The suspension in Russia also covers Belarus, and includes in-market activities, including exams.”

Universities UK (Status by KSE – leave) “We have engaged with the UK Government on how to develop the most effective and targeted actions against the Putin regime, and recognise and support the decision to cease funding new collaborative projects with Russia. “ – according to the company’s statement.

Quacquarelli Symonds (QS) (Status by KSE – wait) Nunzio Quacquarelli, founder and CEO of QS, said in March: “For now, we will remove Russian and Belarusian entries in the new QS university rankings and stop advertising Russian universities or Russia as a study destination. We are ceasing all cooperation with new clients in Russia and suspending active interaction with current Russian clients.”

But on April 4, QS posted a new version of the statement, which still had much of the same language but no longer included the statement on redacting Russian universities.

FMCG

J Sainsbury (Status by KSE – leave) is the largest chain of supermarkets. In response to Russia’s invasion of Ukraine, the British supermarket group Sainsbury’s has withdrawn from sale all products that are 100% supplied from Russia.

Asda (Status by KSE – leave) The supermarket has confirmed that it is removing products that originate from Russia from its stores and online.

Alexander McQueen (Kering) (Status by KSE – leave) Due to growing concerns regarding the current situation in Europe, Kering is temporarily closing its stores in Russia for its Houses that the Group operates directly in the country.

Lush (Status by KSE – leave) The company suspended supplies to their Russian licensee and stopped online sales in Russia. “We are communicating daily with our Russian and Ukrainian colleagues as events unfold. Our Russian and Ukrainian businesses are Associate companies, both 65% owned by a Russian citizen who had built the business over 20 years to 48 shops in Russia and 15 in Ukraine, employing over 600 staff who share the Lush values of environmental protection, animal rights, social justice and peace.”

Mondi Group (Status by KSE – wait) In May, the company announced that they would stop working, but in July, in the media appeared information¹⁸ that the plants would continue to work. The world leader in the production of packaging and paper Mondi (UK) continues its work in Russia. There, the company owns a complex plant for the production of pulp, packaging paper and high-quality paper JSC “Mondi SLPK” and three processing enterprises “Mondi Aramil” LLC, “Mondi Pereyaslavl” LLC, and “Mondi Lebedyan” LLC. In addition to its facilities, the company has more than 5,300 employees in Russia.

Consumer goods and clothing

Mothercare (Status by KSE – leave) The company suspended cooperation with Russia, including the suspension of the shipment of all products. The local partner network has also suspended operations in around 120 stores and online. Russia accounts for around 20-25% of Mothercare’s global retail sales and was previously expected to contribute around £0.5m a month to the Group’s profits.

Reckitt Benckiser Group (Status by KSE – leave) Begins a process aimed at transferring ownership of its Russia business. The company decided to freeze capital investment, advertising, sponsorship and promotion in Russia.

Unilever (Status by KSE – wait) Unilever owns 8 large Russian enterprises, including a margarine factory in Moscow, a sauce factory, a tea-packing factory and a perfume and cosmetics factory in St. Petersburg, a food factory and an ice cream factory in Tula, as well as ice cream factories in Novosibirsk and Omsk.The company suspended all imports and exports of its products into and out of Russia, and will stop all media and advertising spend. Unilever will not invest any further capital into the country nor will get profit from its presence in Russia. Unilever will continue to supply essential food and hygiene products made in Russia to people in the country.

Agent Provocateur (Status by KSE – stay) The British lingerie brand Agent Provocateur is leaving all boutiques and online stores open in Russia, and these are 13 boutiques in Moscow, St. Petersburg, Rostov-on-Don and Sochi.

Summary

Following Russia’s annexation of four regions of Ukraine, Great Britain introduced new sanctions against Russia, banning its citizens and businesses from buying a range of services from British firms. The new sanctions aim to further damage Russia’s economy by blocking the country’s access to IT consultancy, accounting and commercial legal services from British firms. At the same time, it is worth noting that Russia especially values Great Britain in terms of audit and commercial legal services due to London’s position as one of the world’s leading centers for the provision of professional services¹⁹.

Considering the above, it is worth noting that despite the geopolitical crisis in Europe, according to the OECD²⁰, Great Britain’s GDP will grow by 3.6% in 2022 and public investment will weaken. At the same time, there is also a certain vulnerability of the British economy from Russia’s invasion of Ukraine due to the rise in prices for Russian energy carriers and disruptions in its supply chains.

British sanctions are considered a useful foreign policy tool for punishing an aggressor and can be used to force a change in the Kremlin’s behaviour towards Ukraine. The intense search for means that can save Ukraine from Russian aggression shows that Great Britain is a true patron of the Ukrainian people, their statehood and sovereignty, and British companies show one of the best indicators of exit from Russia compared to other countries.

You can also contribute by spreading the status of the company calling for the exit from Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)²¹

24.10.2022

*Gas Engineering and Development Company (IGEDC) (Iran, Energy, oil and gas) Status by KSE – stay

Moscow and Tehran have struck a deal that would see the Islamic Republic selling 40 domestically produced gas turbines to Russia, Reza Noushadi, the CEO of Iranian Gas Engineering and Development Company

https://english.alahednews.com.lb/68161/391

*International Ski Federation (Switzerland, Sport) Status by KSE – leave

In March, the FIS had banned athletes from Russia and Belarus until the end of the 2021-22 season but that suspension has now been extended into next campaign.

*Huhtamaki (Finland, FMCG) Status by KSE – leave

Finland’s Huhtamaki books bigger than expected gain from Russia divestment

25.10.2022

*KFC (USA, Public catering) Status by KSE – leave

The owner of KFC is selling his chain in the Russian Federation – it can be called “Rostic’s”

https://www.epravda.com.ua/news/2022/10/25/693013/

*Texas Instruments (USA, Electronics) Status by KSE – stay

US-Based Texas Instruments Whose Electronics is Found in Russian Weaponry Has Not Withdrawn from the Russian Market

https://news.yahoo.com/us-based-texas-instruments-whose-112212033.html

*SAP (Germany, IT) Status by KSE – wait

SAP delays Russia exit as deal talks fail and workers at risk

*KIA Motors (South Korea, Automotive) Status by KSE – stay

Kia sees volatility rising in Russia with the prolonged war in Ukraine, and in a worst-case scenario, may shutter its business entirely

https://europe.autonews.com/automakers/kia-latest-automaker-mull-exiting-russia

26.10.2022

*Halliburton (USA, Energy, oil and gas) Status by KSE – exited

Houston-based oilfield services giant Halliburton posted a net profit of $544 million for the third quarter of 2022 — up from $109 million one year earlier — boosted by rising sector-wide activity, higher oil prices and stronger margin performances.

*Mercedes-Benz (Germany, Automotive) Status by KSE – leave

Mercedes-Benz to quit Russian market, sell shares to local investor

*Inditex (Spain,Consumer goods and clothing) Status by KSE – leave

Zara Parent Sells Russian Real Estate

27.10.2022

*Ford Motor Company (USA, Automotive) Status by KSE – exited

Ford Officially Exits Russia. Sale of Van Plant Comes 8 Months After Ukraine Attack.

https://www.barrons.com/articles/ford-exits-russia-joint-venture-ukraine-51666797835

28.10.2022

*Nokian (Finland,Automotive) Status by KSE – leave

Nokian strikes deal to sell Russia tire operations

https://www.tirebusiness.com/news/nokian-strikes-deal-sell-russia-tire-operations

*JPMorgan Russian (Great Britain, Finance and payments) Status by KSE – stay

In a London Stock Exchange notice made today (27 October), the board said that because of “the inability to dispose of these under the current sanctions and restrictions, the company also needs the flexibility within its new investment objective and policy to continue to hold Russian securities”.

https://quoteddata.com/2022/10/jpmorgan-russian-expand-remit/

*Total Energies (France, Energy, oil and gas) Status by KSE – stay

TotalEnergies lands $9.9 bln profit as it books new Russia charge

29.10.2022

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

Citigroup Inc said on Friday its Russian unit had agreed to sell a portfolio of personal installment loans to commercial bank Uralsib, as the major U.S. lender seeks to retreat from the country and reduce its exposure to Russia.

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

¹⁷ The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities.

²¹ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site