- Kyiv School of Economics

- About the School

- News

- 22nd issue of the weekly digest on impact of foreign companies’ exit on RF economy

22nd issue of the weekly digest on impact of foreign companies’ exit on RF economy

9 October 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 03-09.10.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 09.10.2022

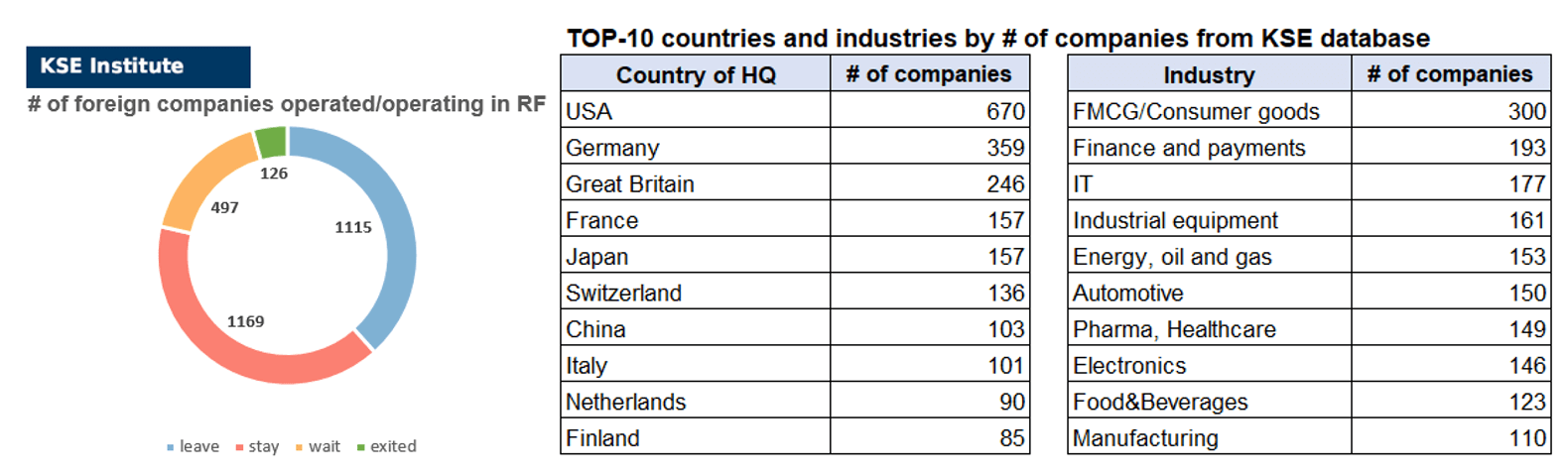

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 169 (+15 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 497 (-4 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 115 (-4 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 126 (+12 per week)

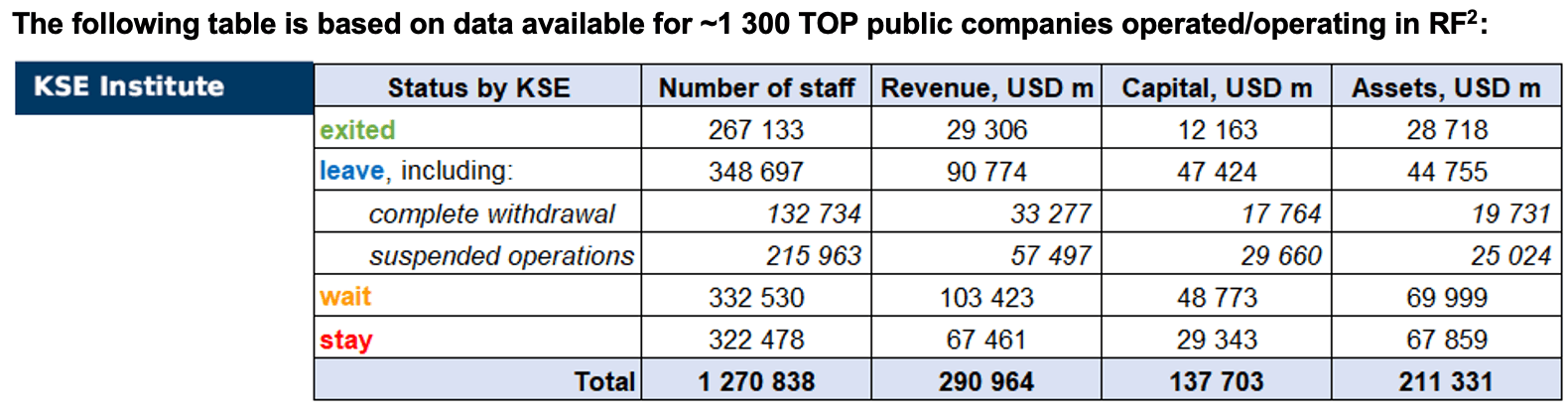

As of October 09, we have identified about 2,907 companies, organisations and their brands from 85 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $137.7 billion), local revenue (about $291.0 billion), local assets (about $211.3 billion) as well as staff (about 1.271 million people). 1,612 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 126 companies that have completed the sale of their business in Russia based on the information collected from the official registers (September update this week allowed us to identify another 12 exited companies).

As can be seen from the tables below, as of October 09, companies which had already completely exited from the Russian Federation, had at least 267,100 personnel, $29.3 bn in annual revenue, $12.2 bn in capital and $28.7 bn in assets; companies, that declared a complete withdrawal from Russia had 132,700 personnel, $33.3bn in revenues, $17.8bn in capital and $19.7 bn in assets; companies that suspended operations on the Russian market had 216,000 personnel, annual revenue of $57.5bn, $30.0bn in capital and $25.0 bn in assets.

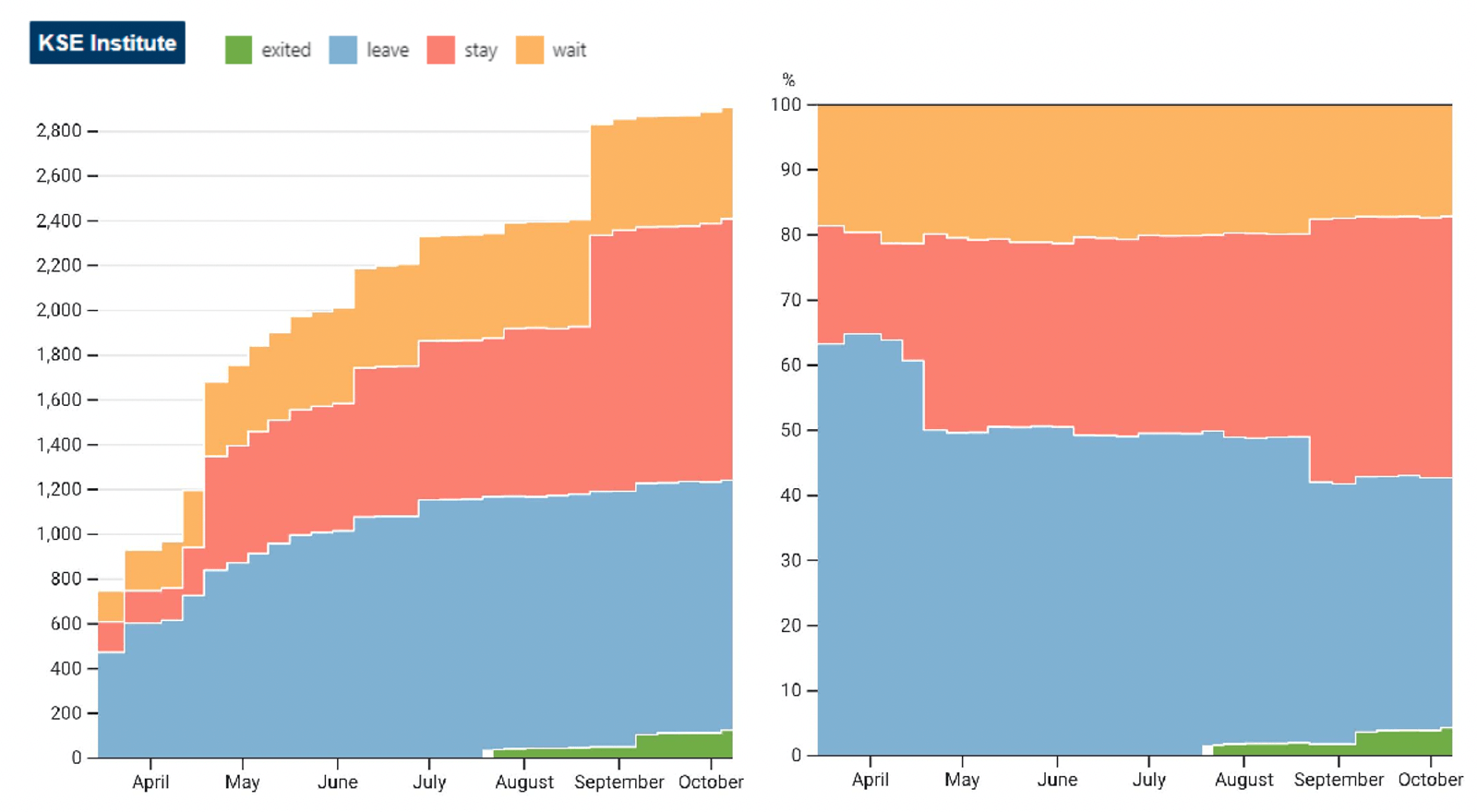

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 38.4% of foreign companies have already announced their withdrawal from the Russian market, but another 40.2% are still remaining in the country, 17.1% are waiting and only 4.3% made a complete exit³.

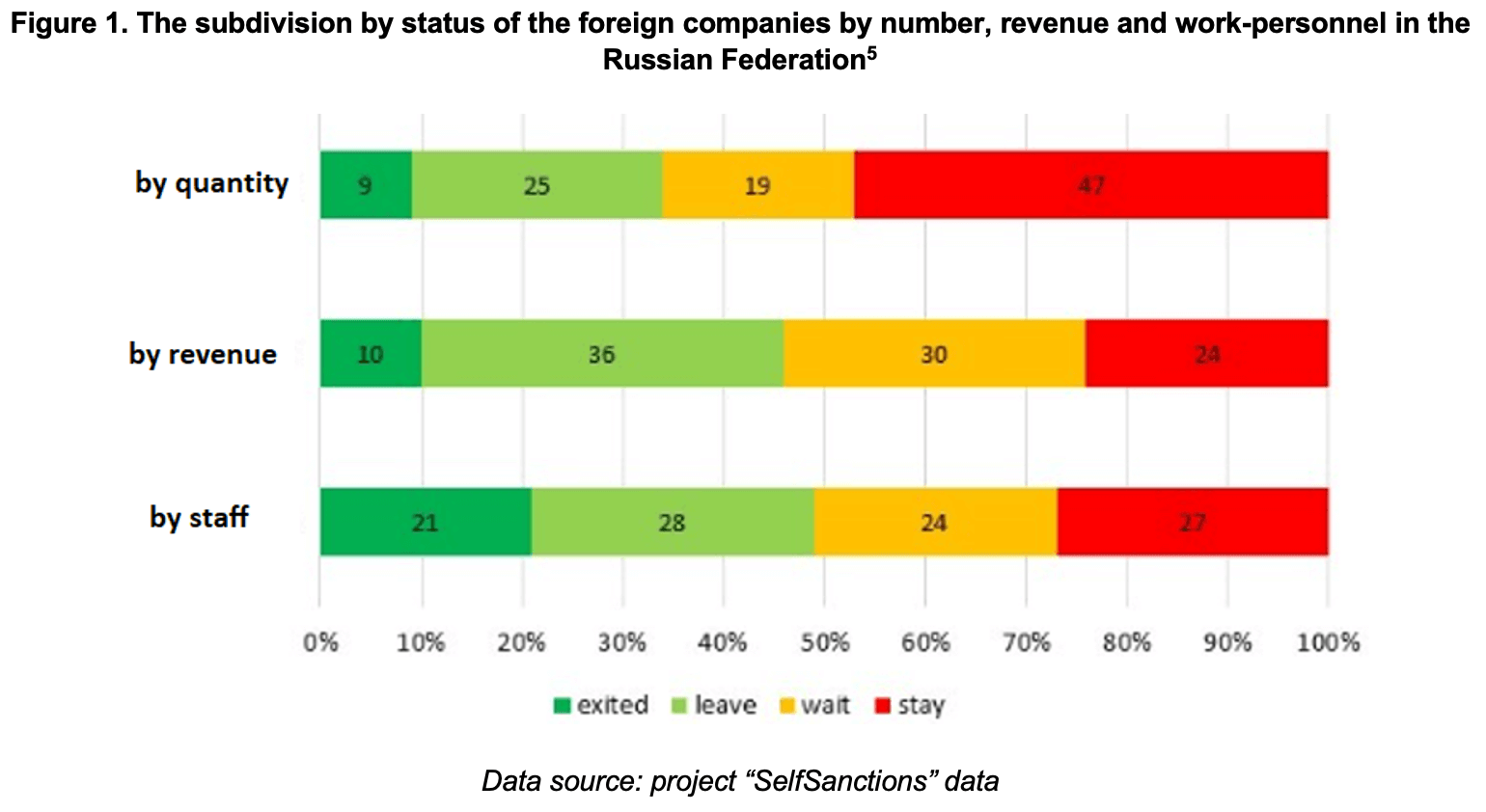

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 126 companies that completely left the country, since they employed almost 21.0% of the personnel employed in foreign companies, the companies owned about 13.6% of the assets, had 8.8% of capital invested by foreign companies, and only last year they generated revenue of $29.3 billion or 10.1% of total revenue, data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Why do some foreign companies remain in Russia?

On February 24 in 2022 the “great war” began, and many foreign companies have begun to make statements about their work in the aggressor-country. For someone, the very fact of the invasion has become a red line that has crossed out the possibility of doing business “as usual”. Someone was forced to stop or cease the operations, faced with new logistical and economic realities. And some, on the contrary, decided to take advantage of the opportunity to capture the market share, which has been cleared by competitors.

To track these changes, KSE Institute launched the analytical project “SelfSanctions” in March 2022. Currently, this project has collected information on almost three thousand companies. For each one has been given the one of four statuses: stay – remains in the Russian Federation, wait – temporarily suspended or reduced activity, leave – intends to leave the market, exited – sold assets/terminated relations/left the market. Each company has been given the accompanying information – the sector of the economy in which it operates, the country in which the headquarters are located, the number of employees in Russia, annual revenue, etc.

The special attention is paid to companies that are physically present in the Russian Federation: they are owned by a local legal entity and accordingly pay taxes to the budget of the aggressor-country. These are almost all of the largest corporations in the world – about 1.2 thousand⁴. In 2021, the total revenue of these companies in Russia was 290 billion US dollars, Russian personnel – about 1.3 million people.

As at September, almost half of them remain deeply involved in the economy of the Russian Federation and ignore any demands to leave. It can be seen from the graphs in Fig. 1, that there are remaining mostly companies, which have small revenues (the share in terms of quantity is greater than in terms of revenues).

To make the report more substantive, consider the situation in the automobile industry. Among its four dozen representatives are, for example, Haval Motor, Geely and Chery Automobile. They have intended to work further and continue to capture the market share, which freed the competitors. Hyundai, Daimler Truck, BMW, Nissan, AB Volvo, Mitsubishi and others have halted the production activities, usually due to “temporary logistical difficulties.” Volkswagen, Scania and MAN – put their assets up for sale. However, the French Renault even managed to sell them and its Central Office, the car factory in Moscow and the share in AvtoVAZ were purchased by state corporation “Rostec” for symbolic 1 Russian ruble (but with buyback option in 6 years). Toyota Motor Corporation also finally decided to close its factory in Russia a few days ago. Mazda in talks to end Russia production, following Toyota exit.

All three companies that remain are definitely from China. Therefore, not only economic indicators, but also the country of origin – in particular, whether it has imposed sanctions against Russia – can influence a company’s decision to leave or stay. Indeed, if a country has imposed sanctions against Russia, its companies leave Russia 3.8 times more often than if the country has refrained from sanctions⁶.

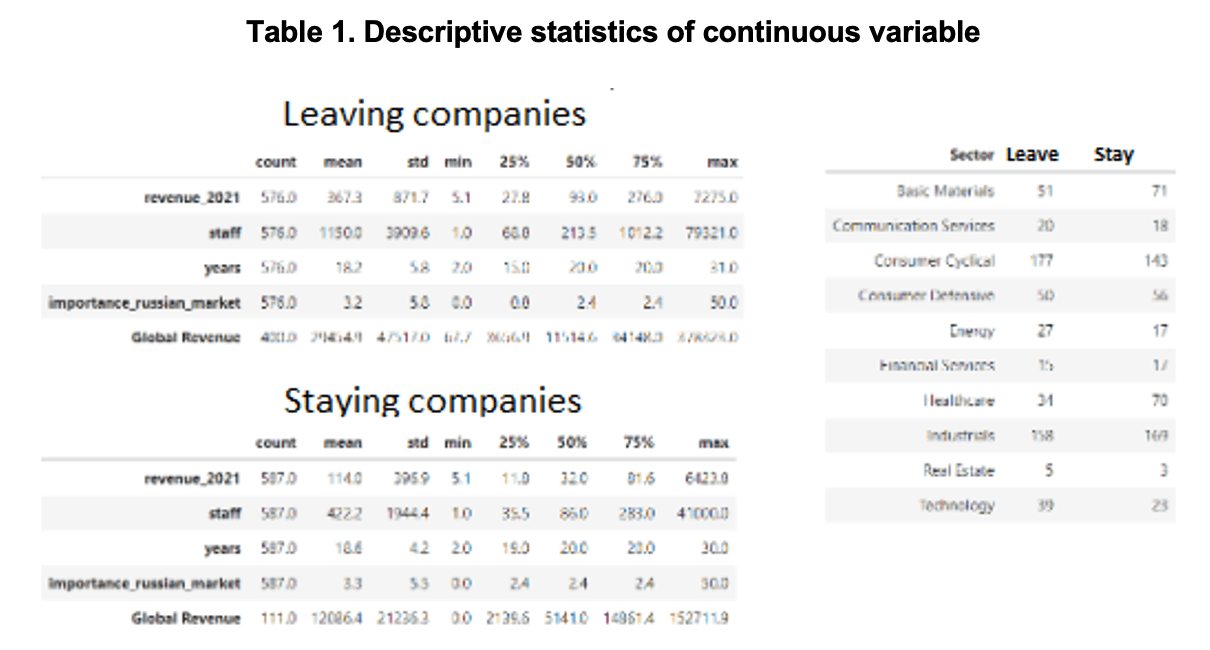

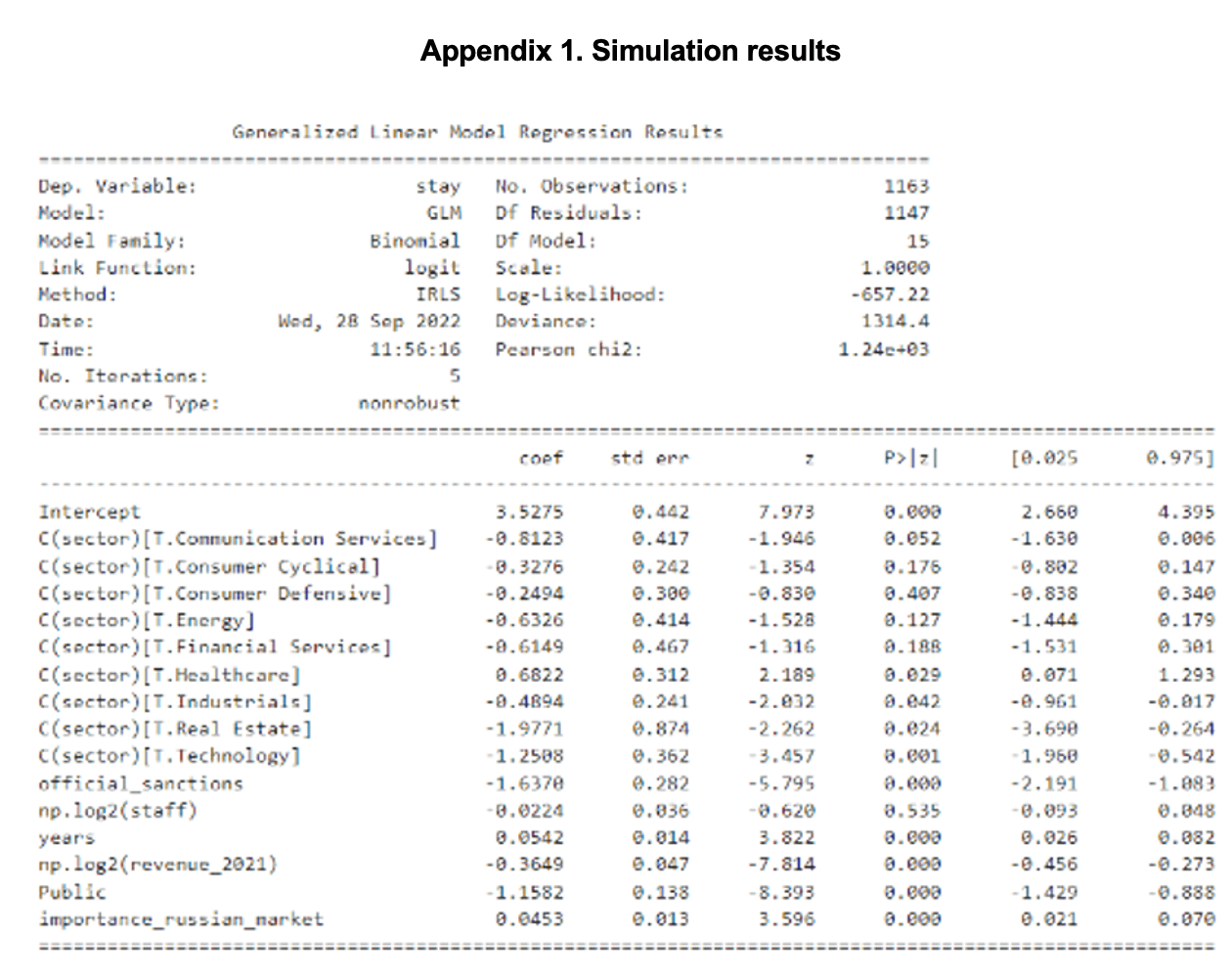

For a more accurate forecast of the activity of companies, it is necessary to take into account several factors at the same time. For this, we will use the logistic regression model, where the position of the company depends on the dependent variable (our status “stay”).

Independent variables:

• The sector to which the company belongs (sector)⁷;

• Whether the company comes from a country that has imposed sanctions against the Russian Federation (official_sanctions);

• The amount of revenue in the Russian Federation in 2021 (revenue_2021);

• Number of personnel in the Russian Federation (staff),

• Importance of Russian business (importance_russian_market). To measure this indicator, we used the share of local revenue in global (Global revenue). If the last indicator is unknown, we took the median value of the share – 2.4%;

• Whether parent company was publicly traded (public);

• How many years the company has been working in the Russian Federation (years).

Descriptive statistics are shown in Table 1.

Accordingly, the model has the following form:

log(p/(1−p))=β0+β1(sector)+β2(official_sanctions)+β3(log2(stаff))+β5(log2(revenue_2021))+β4(years)+β6(Public)+β8(importance_russian_market)

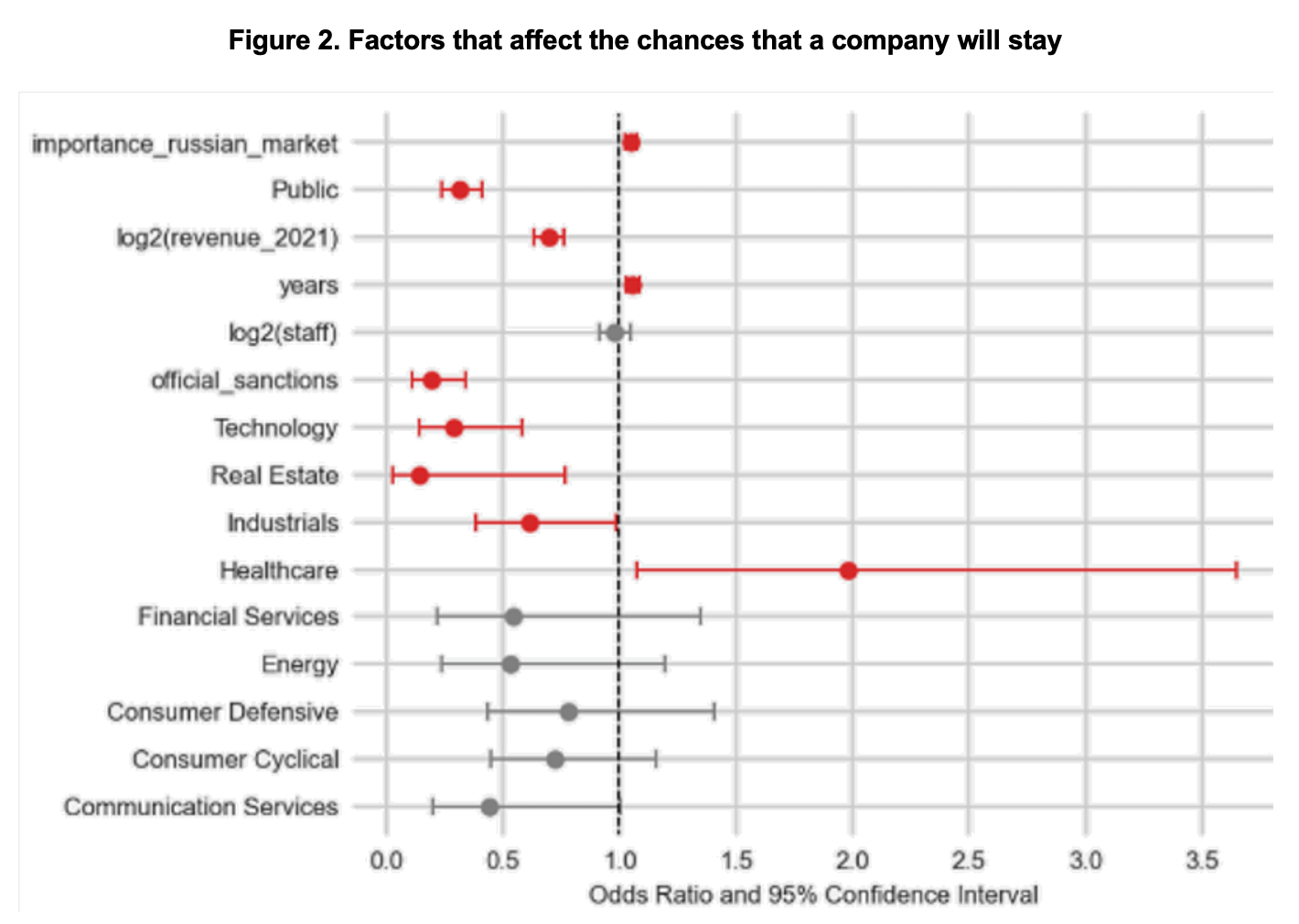

The simulation results are shown in Fig. 2 and in Appendix 1.

Statistically significant factors are marked in red. If they are less than one (located to the left of the vertical dotted line) – they increase the chances of leaving, if they are more than one, the company will remain.

The model shows that, taking into account other factors, if a company originates from a country that has introduced sanctions (USA, Europe), it increases the chances that it will exit the market by 5.1 times⁸

compared to companies whose countries of origin are not imposed sanctions (China, India, Turkey, etc.). Probably, both government decisions and the decisions of companies are influenced by the mood of the population of the respective countries.

Companies from the fields of industry, Real estate and Technology are more inclined to leave Russia, while those from Healthcare industry – to stay (the companies themselves – mainly well-known pharmaceutical brands – explain this decision by a concern for the health of Russians).

Companies with larger local revenues and public companies are also inclined to leave the market: perhaps, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that leaving the Russian Federation is not as painful for them as it is for smaller companies.

The more comprehensive example of the forecast may have this form: companies that come from countries that have not introduced state sanctions, have been working on the Russian market for 10 years, and the share of revenue in global business is at least 10%, all other equal conditions being, have a chance to stay almost 14 times⁹ higher.

So the increased sanctions pressure on Russia, as well as, increased public dissatisfaction with companies that still remain (now they need directly to support the forced mobilisation), has an impact on companies and increases the chances that they will finally leave the Russian market.

You can also contribute by spreading the status of the company calling for the exit from Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)¹⁰

03.10.2022

*Eni (Italy, Energy, oil and gas), status by KSE – exited

Eni CEO hopes halt to Russian gas flows will be resolved this week

04.10.2022

*H&M (Hennes and Mauritz) (Sweden, Consumer goods and clothing) Status by KSE – leave

Swedish fashion giant H&M witnesses fall in profits owing to Russia exit

*Amazon (USA, Online Services), Status by KSE – leave

Amazon faces fines of up to $200,000 in Russia over banned content -agencies

*ExxonMobil (USA, Energy, oil and gas) status by KSE – wait

Exxon Mobil is working with its partners on the U.S. company’s exit from the Sakhalin-1 oilfield in eastern Russia

https://financialpost.com/pmn/business-pmn/exxon-working-with-russia-and-partners-on-sakhalin-1-exit

05.10.2022

*Mitsui OSK Lines (Japan, Energy, oil and gas), status by KSE – stay

Japan’s Mitsui OSK Lines said it had signed a long-term charter contract with the new Russian operator of the Sakahlin-2 liquefied natural gas (LNG) project for LNG carrier Grand Mereya to continue its shipping service.

*International Boxing Association (Switzerland, Sport), Status by KSE – stay

International Boxing Association lifts ban on Russia, Belaru

https://olympics.nbcsports.com/2022/10/05/international-boxing-association-russia-belarus/

06.10.2022

*London Metal Exchange ( Great Britain, Finance and payments) Status by KSE – wait

The London Metal Exchange will restrict new deliveries of copper and zinc from Russia’s Ural Mining & Metallurgical Co. and one of its subsidiaries, after the UK sanctioned co-founder Iskandar Makhmudov.

*Total Energies (France, Energy, oil and gas) Status by KSE – stay

TotalEnergies to continue shipping Russian LNG as long as no EU sanctions -CEO

07.10.2022

*Eutelsat (France, Telecom) Status by KSE – stay

Eutelsat has released its Consolidated Financial Statement saying that, as at June 30th (the end of its financial year), some 6.7 per cent of its revenues were “exposed” to Russian customers.

https://advanced-television.com/2022/10/06/eutelsat-confirms-russian-satellite-status/

*Google (USA, Online Services ) Status by KSE – leave

Google Sues Russia Over $127 Million Seized by Government

https://www.pcmag.com/news/google-sues-russia-over-127-million-seized-by-government

*Space Exploration Technologies Corp. (USA, Aerospace)Status by KSE – stay

SpaceX delivers Russian, Native American women to the station.

It was the first time in 20 years that a Russian hitched a ride from NASA’s Kennedy Space Center, the result of a new agreement reached despite friction over the war in Ukraine.

https://yourvalley.net/stories/spacex-delivers-russian-native-american-women-to-station,332721

*Fidelity (Great Britain, Finance and payments) Status by KSE – leave

Fidelity Emerging Markets suffered double-whammy from Russian invasion

https://quoteddata.com/2022/10/fidelity-emerging-markets-suffered-doublewhammy-russian-invasion/

08.10.2022

*Dapper Labs (Canada, Gaming) Status by KSE – wait

NFT powerhouse Dapper Labs has cut off payment services for non-fungible token owners with links to Russia

*Softline International (Great Britain, IT) Status by KSE – leave

IT firm Softline to sell Russia business

https://www.reuters.com/markets/deals/it-firm-softline-sell-russia-business-2022-10-07/

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematized in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/.

⁴ These are companies that have at least 50% ownership of a local legal entity and an annual revenue of at least 5 million US dollars. There are about 1.3 thousand of them in total, but we were not able to determine the status/position for all of them, so for this analysis only those where we clearly know it were used – 1163 of them

⁵ More infographics and an analytical dashboards are available on the project website at https://leave-russia.org/bi-analytics

⁶ We analysed a total of 1163 companies. Of the countries that introduced sanctions – 554 leave, 510 remain, from countries that did not introduce sanctions – 22 and 77, respectively. (554/510)/(22/77) = 3.8

⁷ The “SelfSanctions” project collects data across industries (more than 50). For this analysis, they were grouped into 10 sectors: Industrials, Consumer Cyclical (Non-essential consumer goods), Communication Services, Technology (IT + Online services), Financial Services, Basic Materials, Consumer Defensive (Essential items), Energy, Healthcare, Real Estate.

⁸ 5.1 = 1/exp(-1.6370). With the 95% confidence interval will be between 3 and 9

⁹ 13,9 = exp(0.0542*10 years)*exp(0.0453*10 importance_russian_market)*1/exp(-1.6370*official_sanctions)

¹⁰ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site