- Kyiv School of Economics

- About the School

- News

- 20th issue of the weekly digest on impact of foreign companies’ exit on RF economy

20th issue of the weekly digest on impact of foreign companies’ exit on RF economy

26 September 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 19-25.09.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 25.09.2022

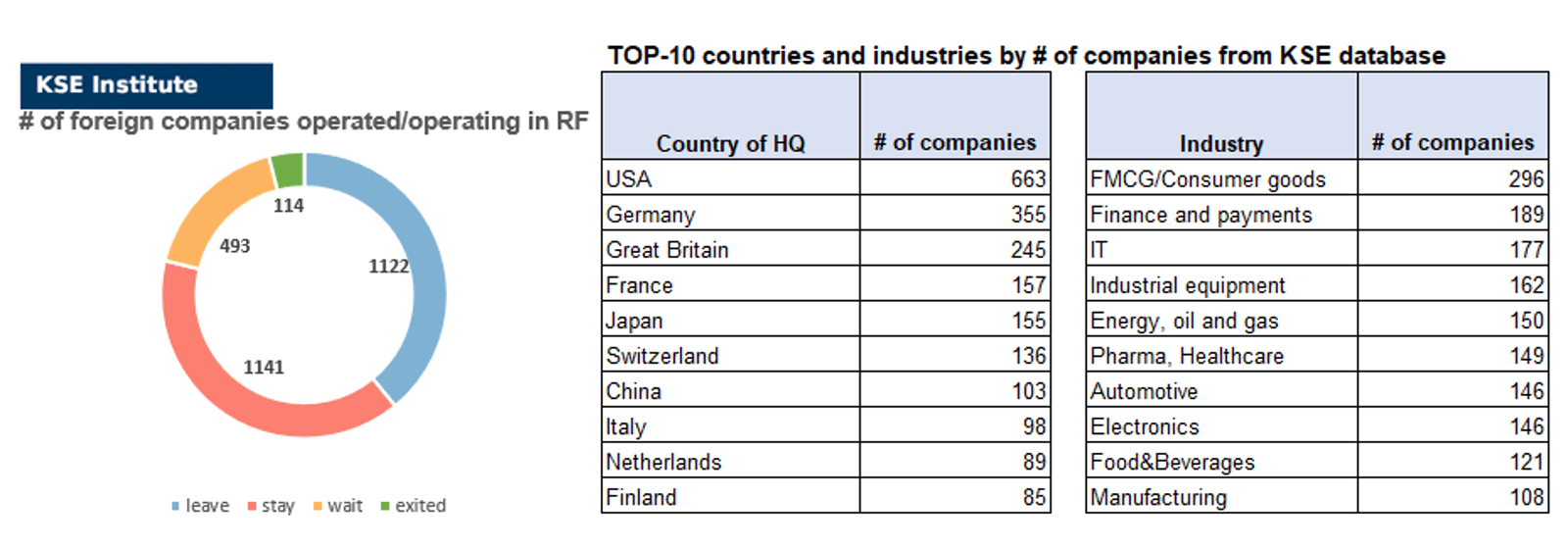

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 141 (-2 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 493 (-1 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 122 (+4 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 114 (+2 per week)

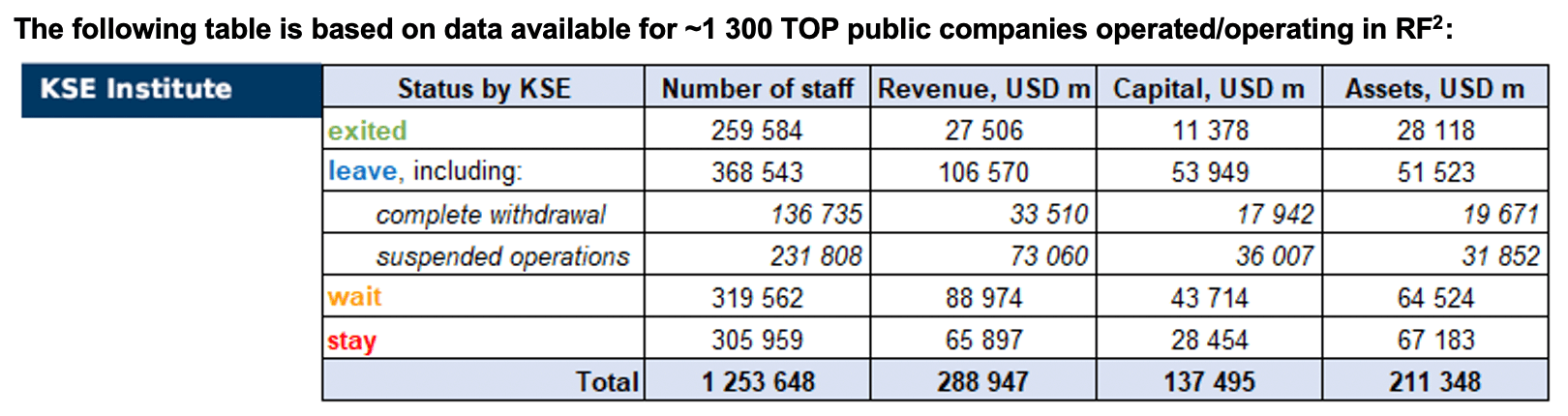

As of September 25, we have identified about 2,870 companies, organisations and their brands from 84 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $137.5 billion), local revenue (about $288.9 billion), local assets (about $211.3 billion) as well as staff (about 1.254 million people). 1,615 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 114 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of September 25, companies which had already completely exited from the Russian Federation, had at least 259,600 personnel, $27.5 bn in annual revenue, $11.4 bn in capital and $28.1 bn in assets; companies, that declared a complete withdrawal from Russia had 136,700 personnel, $33.5bn in revenues, $17.9bn in capital and $19.7 bn in assets; companies that suspended operations on the Russian market had 231,800 personnel, annual revenue of $73.1bn, $36.0bn in capital and $31.9 bn in assets.

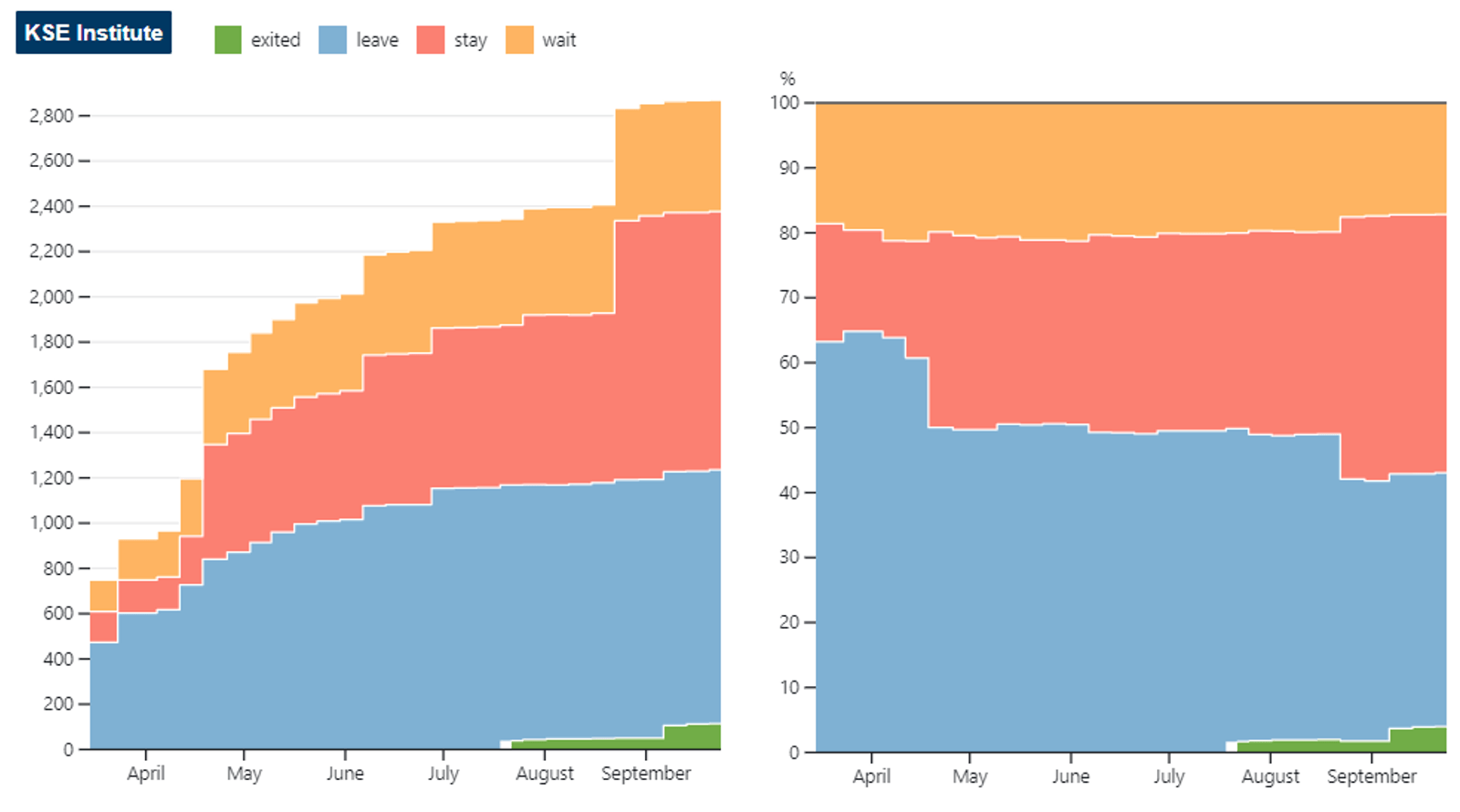

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 39.1% of foreign companies have already announced their withdrawal from the Russian market, but another 39.8% are still remaining in the country, 17.2% are waiting and only 4.0% made a complete exit.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 114 companies that completely left the country, since they employed almost 21% of the personnel employed in foreign companies, the companies owned about 13.3% of the assets, had 8.3% of capital invested by foreign companies, and only last year they generated revenue of $27.5 billion or 9.5% of total revenue, data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Analysis on German companies and their positions in Russia

German companies do far more business in Russia than any other European Union country does, exporting goods worth more than 26 billion euros ($28.4 billion) last year (Poland was second with €8 billion) and investing a further €25 billion in operations there. This commitment to the Russian economy reflects, in part, an ethos embraced by the former West Germany coming out of World War II — that trade could ensure peace and prevent Europe from descending into another war.

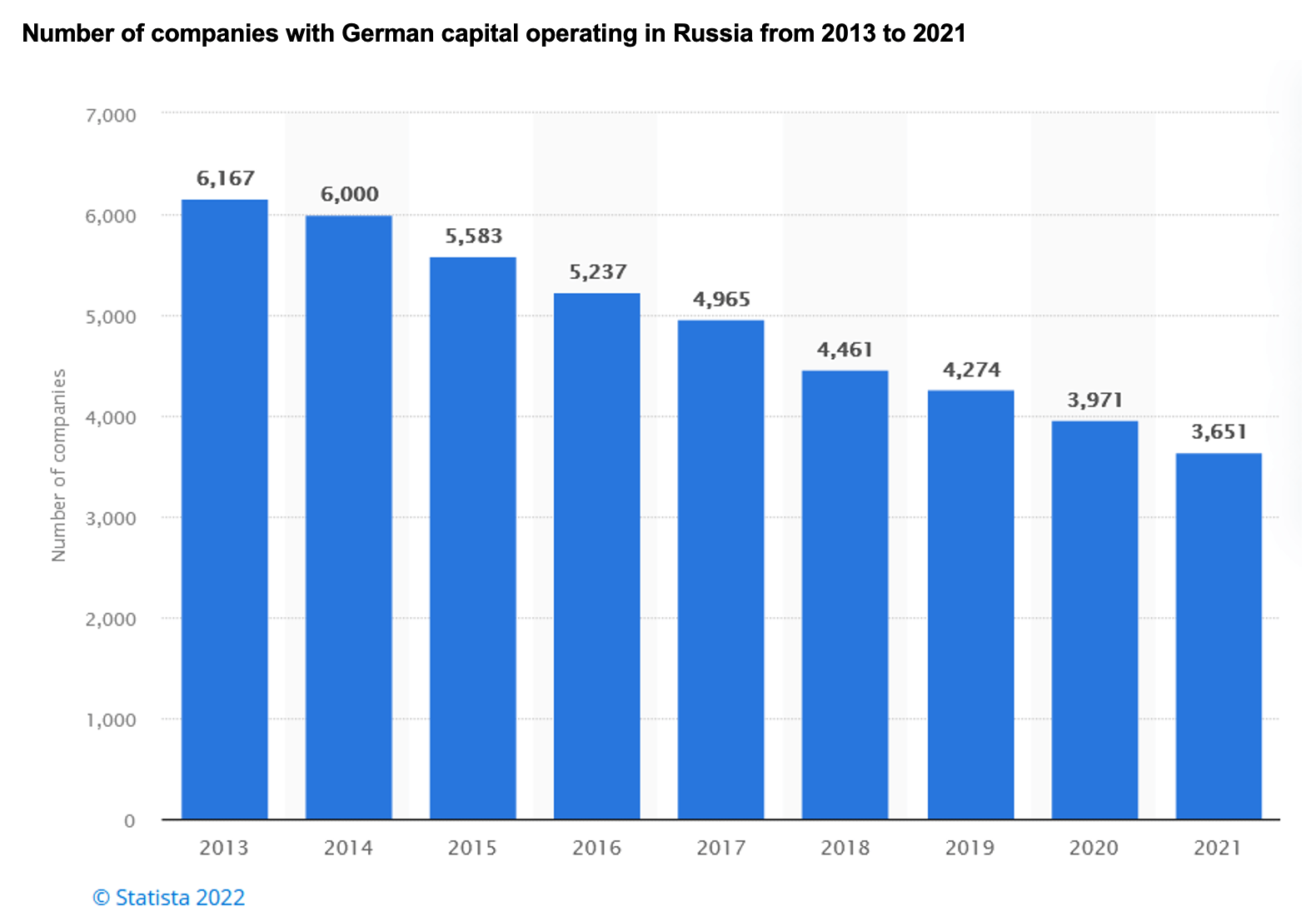

Russia’s annexation of Crimea in 2014, and the sanctions that followed, caused the number of German firms investing in Russia to drop by a third. Still, according to Statista⁴, the figure was just under 4,000 companies by 2021, with many convinced that their presence could help anchor Russia in the democratic sphere⁵.

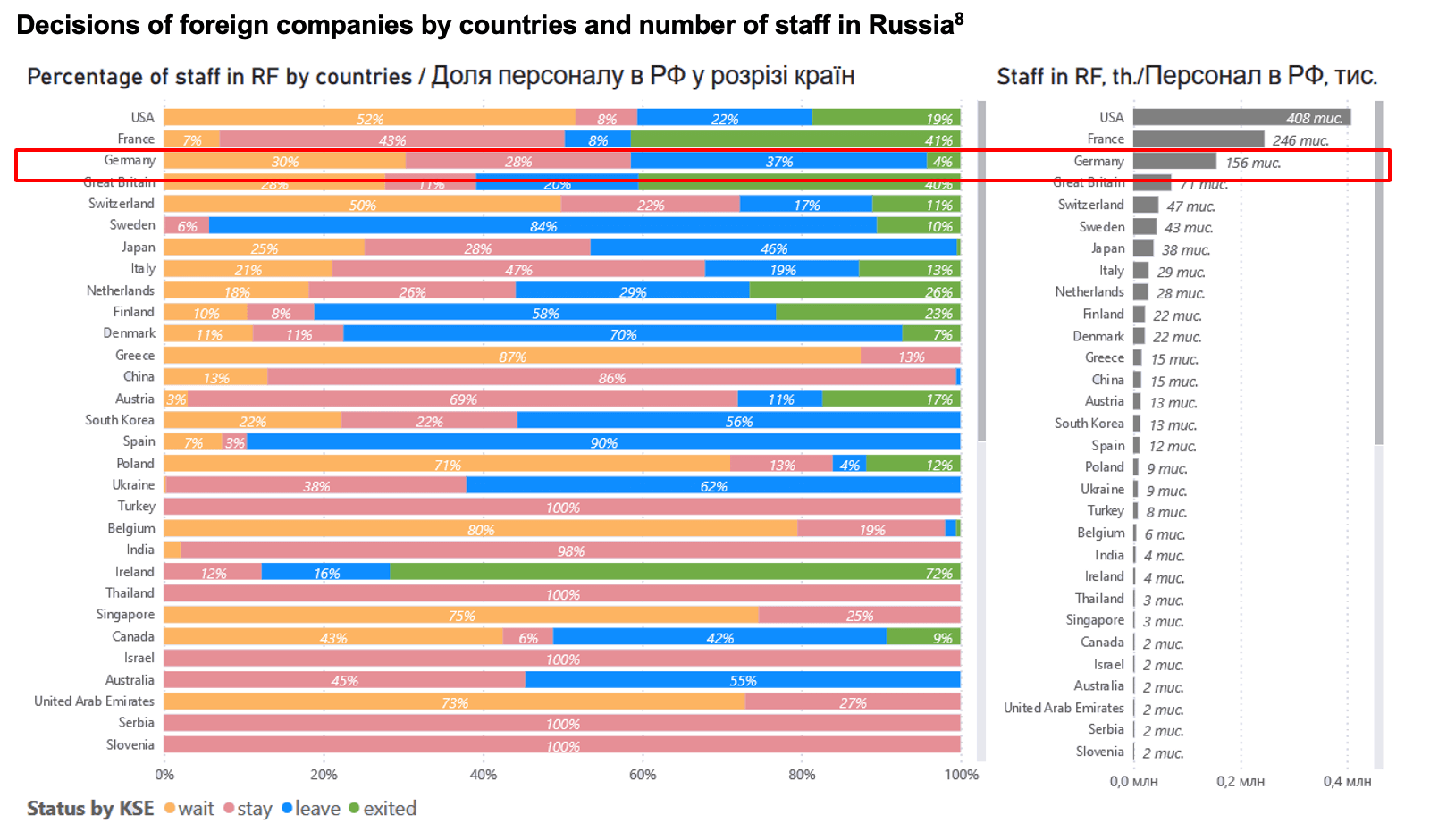

Based on available data from the KSE Institute⁶, Germany is one of the leading foreign employers in Russia, third only to the USA (about 400,000 people) and France (about 245,000 people), which is in 2nd place.

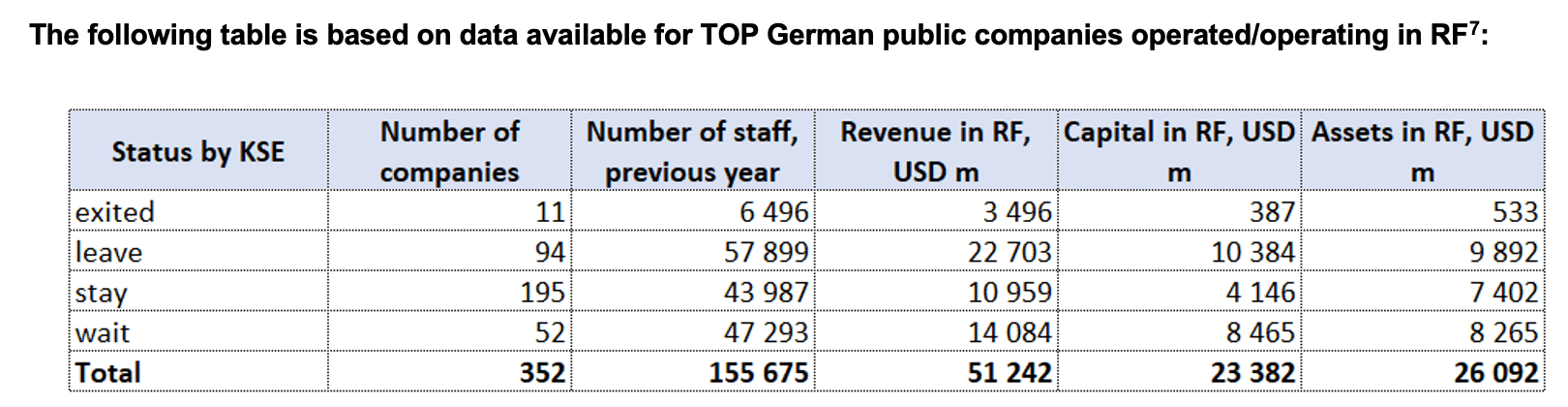

According to data collected by the KSE Institute, in 2021 TOP 352 German companies with a share in the capital of 50+% provided jobs for 155,000 people, those companies generated $51.2 bn in annual revenue, had $23.4 bn in capital and $26.1 bn in assets.

As of 21/09/2022 only 11 companies have fully exited the country through selling of their business/assets or its part of the business to a local partner and left the market.

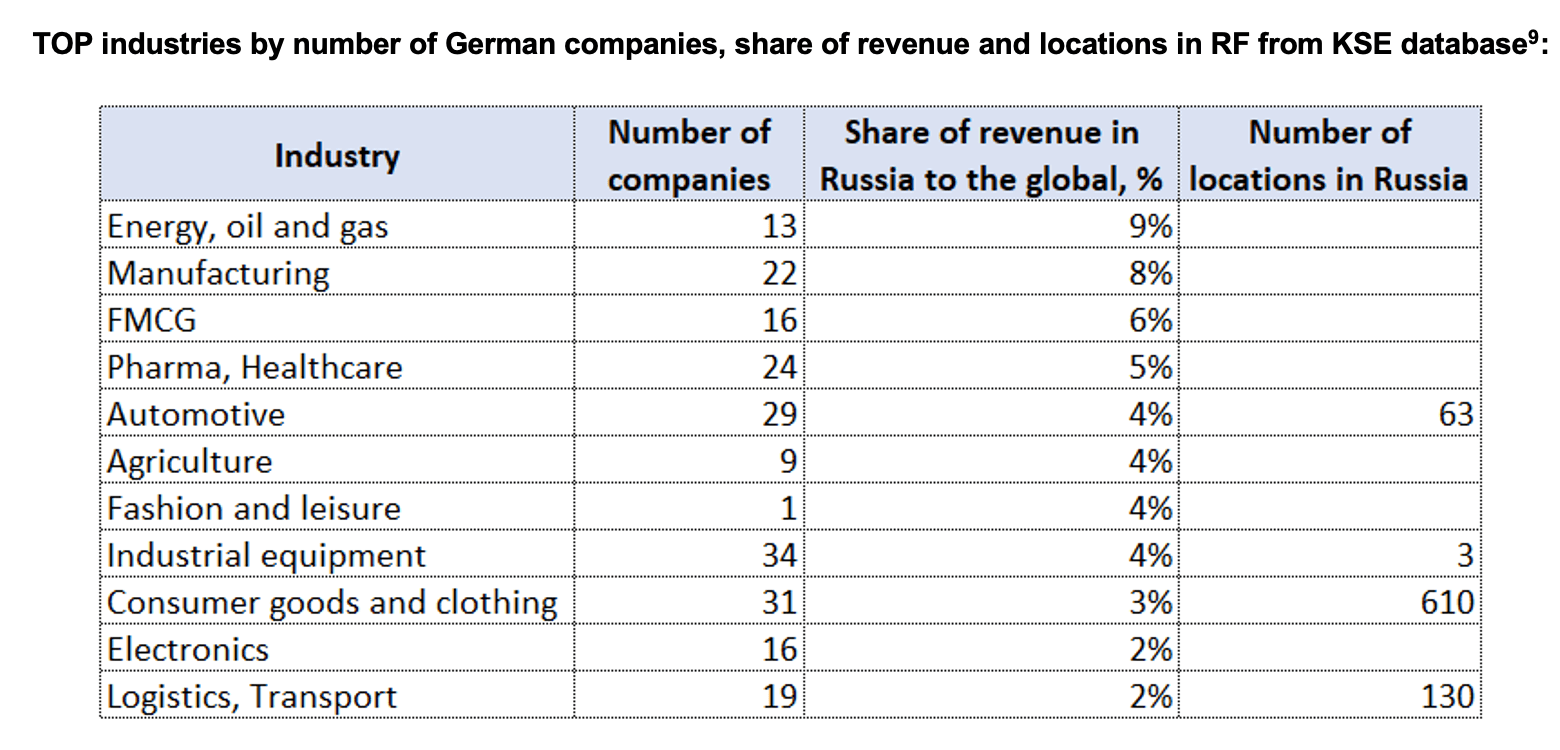

The most “dependent” on Russia in terms of revenue share in this country are German companies in 4 industries: Energy, oil & gas, Manufacturing, FMCG, Pharma & Healthcare.

How are German companies reacting?

Out of 352 companies in the database, 55% of companies are still staying in Russia, 15% are waiting, somewhat limiting their activities, 27% are leaving and only 3% completely exited through sales. Some of the German companies are among the examples of clean breaks from the Russian market, while others defy demands for exit despite pressure.

Clean breaks

Obi Group (Status by KSE – exited) a German chain of hardware stores in Wermelskirchen, which operates throughout Europe.

On July 27, German OBI GmH signed an agreement with a group of Russian investors on the sale of six legal entities of the Russian chain of OBI DIY stores. The amount of the transaction is symbolic 1 euro. At the beginning of 2022, it included 27 hypermarkets, which employed about 4,900 employees.

The Polish manufacturer of sanitary ware and ceramics Cersanit (KSE status – exited) also left the Russian market. The headquarters of the company is located in Germany. On February 24, 2022, the company decided to suspend all planned and already implemented investments in our Russian plants. The total value of these investments amounted to 83 million euros.

The assets planned for sale mainly consist of three large production enterprises in Fryanov, Kuchyno and Syzran, as well as a trading company.

Defy demands for exit despite pressure

Riol Chemie GmbH (Status by KSE – stay) is a German distributor of chemicals, reagents, deactivation agents and others. The chemical company is at the center of an investigation by public prosecutors, who suspect that executives at the firm exported toxic substances and special laboratory material to Russia in more than 30 instances over the past three and a half years without obtaining the necessary permits.

Continental (Status by KSE – stay) is a German multinational automotive parts manufacturing company specializing in brake systems. As you know, the company has not produced car tires since March 1, 2022. The company’s employees have been idle since March and received 2/3 of their salary. The capacity of the enterprise is 4 million tires per year, and tires under the brands Continental, Gislaved and Matador were made in Kaluga. In April, the company claimed that it would be forced to resume tire production in Kaluga due to the risks of criminal liability for employees. On August 1, the company resumed work at the plant in Kaluga. The company has 2,230 employees.

Selected industries analysis

Food producers:

Dr. Oetker (Status by KSE – leave) Food manufacturer Dr. Oetker completely withdraws from Russia. The company has already stopped all exports to Russia, all investments in the Russian subsidiary and all domestic marketing activities immediately after Russia’s attack on the sovereign democratic state of Ukraine. Dr. Oetker sells all shares of the Russian Dr. Oetker Organization to its previous Russian managing directors, thereby ceasing all of its operations in Russia. The company has 144 employees.

HARIBO (Status by KSE – leave) The manufacturer of golden bears Haribo is trying to support refugees from Ukraine with transport and accommodation. “Until further notice, we will not produce any goods for the Russian market,” the press secretary of the company told the publication.

Energy, oil and gas

Uniper SE (Status by KSE – wait) In March, the company said that the existing long-term gas import contracts with Russia remain part of secure European gas supply – Uniper will not enter into new long-term supply contracts for natural gas with Russia. In April, the company stated that it can continue to buy Russian gas, making payments in euros, which, in its opinion, will not violate European sanctions. And in may Uniper have paid for Russian gas under a new scheme proposed by Moscow, in a bid to ensure continued supply of the fuel that is critical to Europe’s top economy. With the main pipeline from Russia to Germany blocked, Uniper is forced to seek alternative supplies from the spot market to serve its customers, which include manufacturers and local utilities. The German government is planning to inject about 8 billion euros into Uniper SE as part of a historic agreement to nationalize the gas giant and stave off a collapse of the country’s energy sector.

Siemens Energy AG (Independent) (Status by KSE – wait) announced that it was ceasing all new business in Russia. The company said it started the restructuring of its activities in Russia in the third quarter, which led to a loss of EUR200 million in gas and power. The activities are expected to be concluded by the end of the fiscal year without a further significant financial impact. For the whole of fiscal 2022, Siemens Energy said it expects net loss to exceed the prior year’s loss due to the impact of the restructuring in Russia.

Companies that remained in the Russian Federation

However, fellow Siemens spin-off Siemens Healthineers, (Status by KSE – stay) which makes medical equipment, insisted its “priority remains to support medical professionals and patients in every circumstance and in every country.” It pledged to comply with any levied sanctions but said such measures “should not have adverse humanitarian consequences for the civilian population.” It has 335 employees in Russia.

Bayer (Status by KSE – wait) German chemical-pharmaceutical company. In March, Bayer AG announced that it was cutting its presence in Russia and Belarus. The company suspended advertising activities, terminated all investment projects, and stopped considering any business proposals. But in August, the company decided to continue supplying agricultural products to Russian farmers. Bayer added that it expects Russian authorities to help protect the free flow of agricultural products. It has 700 employees in Russia and generates 2,26% of its turnover in Russia.

Other companies in RF

• HeidelbergCement (Status by KSE – wait) The company is freezing all new investments in Russia. HeidelbergCement is present with three cement plants all for domestic operations. At the P&L level in 2021, the company revenue accounted in Russia was around 1%.

• Robert Bosch (Bosch) (Status by KSE – wait) The German manufacturer of household appliances Bosch is looking for a buyer for its Russian factories and has not yet fully exited the Russian market. Bosch does not understand what to do with Russian capacities that do not bring profit. It has 2000 employees in Russia.

• Most companies of luxury brands suspended their sales in Russia, including Adidas, Hugo Boss, Karl Lagerfeld, Mytheresa, Puma, Schwarz Group, Edeka.

You can also contribute by spreading the status of the company calling for the exit from Russia on social networks directly from the company cards on the website https://leave-russia.org/ .

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)¹⁰

19.09.2022

*Nike (USA, Consumer goods and clothing) Status by KSE – leave

Zelensky thanked Nike for their decision to leave the Russian market

20.09.2022

*Isbank (Turkey, Finance and payments) Status by KSE – wait

*Denizbank (Turkey, Finance and payments) Status by KSE – wait

Turkish lenders Isbank and Denizbank have suspended use of Russian payment system Mir, the banks said on Monday, following a U.S. crackdown on those accused of helping Moscow skirt sanctions over the war in Ukraine.

*Bunge (USA, Food & Beverages) Status by KSE – leave

Bunge to sell oilseed processing business in Russia

https://www.reuters.com/markets/deals/bunge-sell-oilseed-processing-business-russia-2022-09-19/

*PepsiCo Inc. (USA, FMCG) Status by KSE – leave

PepsiCo Inc has stopped making Pepsi, 7UP and Mountain Dew in Russia nearly six months after the U.S. company said it would suspend sales and production after Moscow sent tens of thousands of troops into Ukraine.

*Warner Music Group (USA, Entertainment) Status by KSE – wait

Warner Music arm seeks Russian deals despite business suspension

21.09.2022

*Toho Gas (Japan, Energy, oil and gas) Status by KSE – stay

Toho Gas has renewed its contract to purchase liquefied natural gas from the Sakhalin 2 oil and gas project in Russia

https://www.japantimes.co.jp/news/2022/09/20/business/toho-gas-russia-energy-sakhalin/

*London Metal Exchange (Great Britain, Finance and payments) Status by KSE – wait

Russian aluminum giant Rusal mulls selling directly on LME

*UEFA (Switzerland, Sport) Status by KSE – leave

Euro 2024: UEFA confirms Russia ban for tournament; Belarus enter draw despite German plea

*Uniper SE (Germany ,Energy, oil and gas) Status by KSE – wait

Germany to Nationalize Gas Giant Uniper in Historic Bailout

22.09.2022

*Ball Corporation (USA, Aerospace/Packaging) Status by KSE – exited

Ball Corporation Completes Sale of Russian Beverage Packaging Business to Arnest Group for $530 Million

*JPMorgan (USA, Finance and payments) Status by KSE – wait

JPMorgan Chase CEO Jamie Dimon clashes with Dem rep over Russia investments

23.09.2022

*Toyota (Japan, Automotive) Status by KSE – leave

Toyota closes a plant in Russia and lays off employees. Toyota stops production in Russia

https://www.epravda.com.ua/news/2022/09/23/691792/

https://motor.ru/news/toyota-russian-plant-23-09-2022.htm?utm_source=motortw&utm_medium=social

*Ericsson (Sweden, IT) Status by KSE – wait

Ericsson says no hardware exported to Russia, only software support

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematized in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/.

⁷ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing, while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and left the market

¹⁰ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site