- Kyiv School of Economics

- About the School

- News

- 14th issue of the weekly digest on impact of foreign companies’ exit on RF economy

14th issue of the weekly digest on impact of foreign companies’ exit on RF economy

15 August 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 08-14.08.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

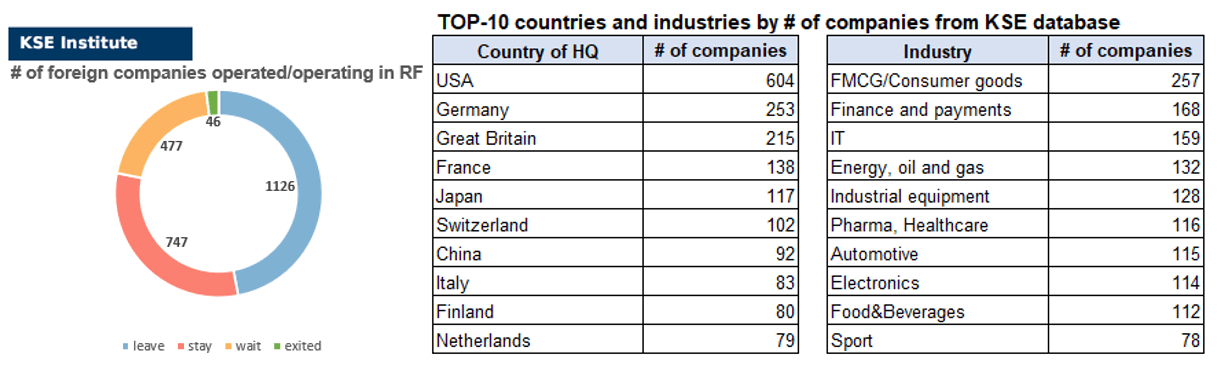

KSE DATABASE SNAPSHOT as of 14.08.2022

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 747 (-7 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 477 (+4 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 126 (+4 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 46 (0 per week)

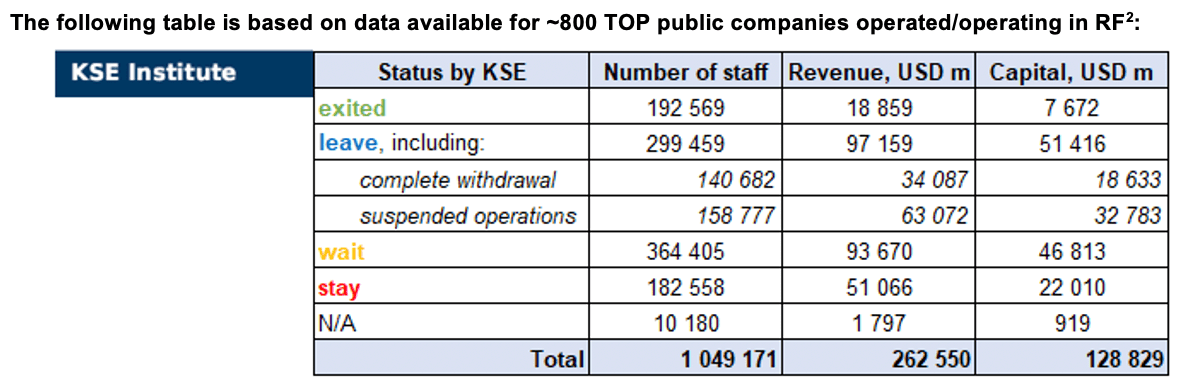

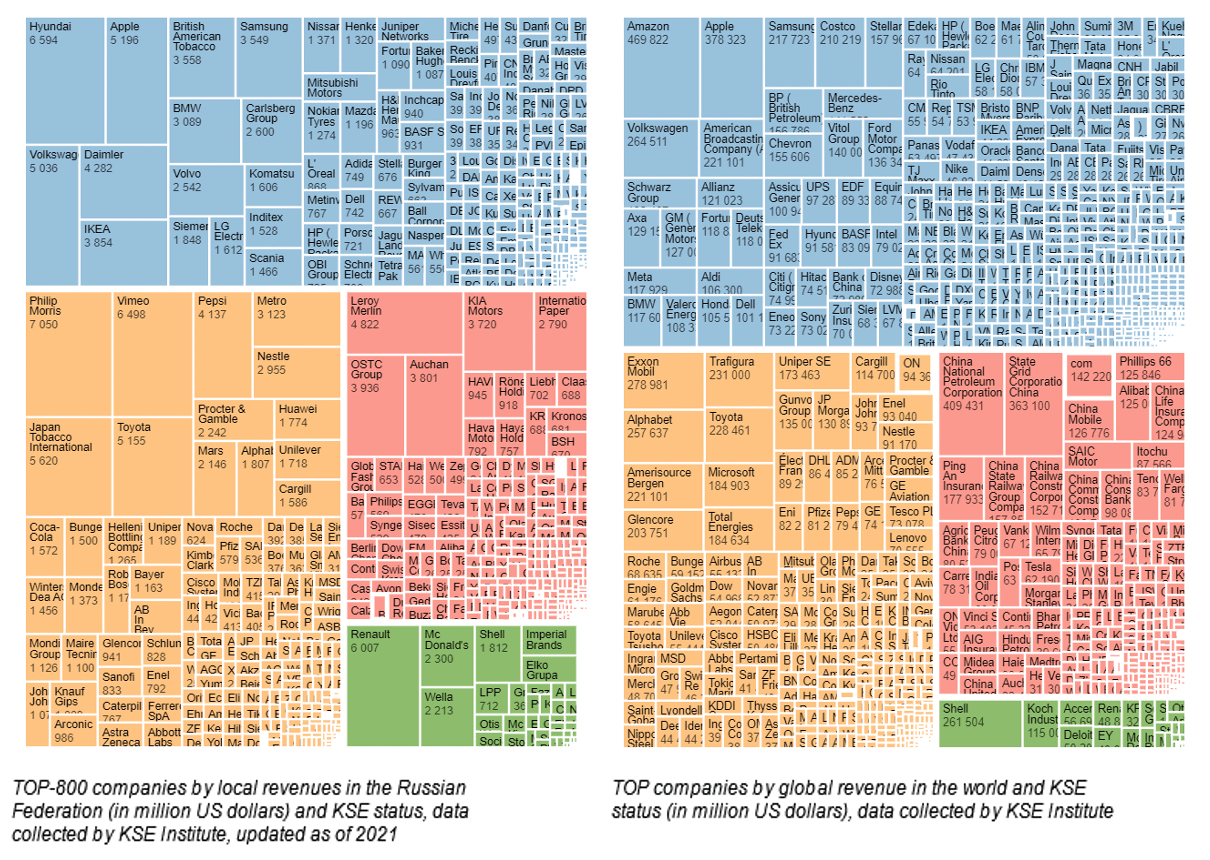

As of August 14, we have identified about 2,396 companies, organizations and their brands from 78 countries and 56 industries and analyzed their position on the Russian market. About half of them are public ones, for ~ 800 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $128.8 billion), local revenue (about $262.6 billion), as well as staff (about 1.049 million people). 1,649 foreign companies have reduced, suspended or ceased operations in Russia. Also, recently we added information about companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, As of August 14, companies which had already completely exited from the Russian Federation, had 192,600 personnel, $18.9 billion in annual revenue and $7.7 billion in capital; companies, that declared a complete withdrawal from Russia had 140,700 personnel, $34.1bn in revenues and $18.6bn in capital; companies that suspended operations on the Russian market had 158,800 personnel, annual revenue of $63.1bn and $32.8bn in capital.

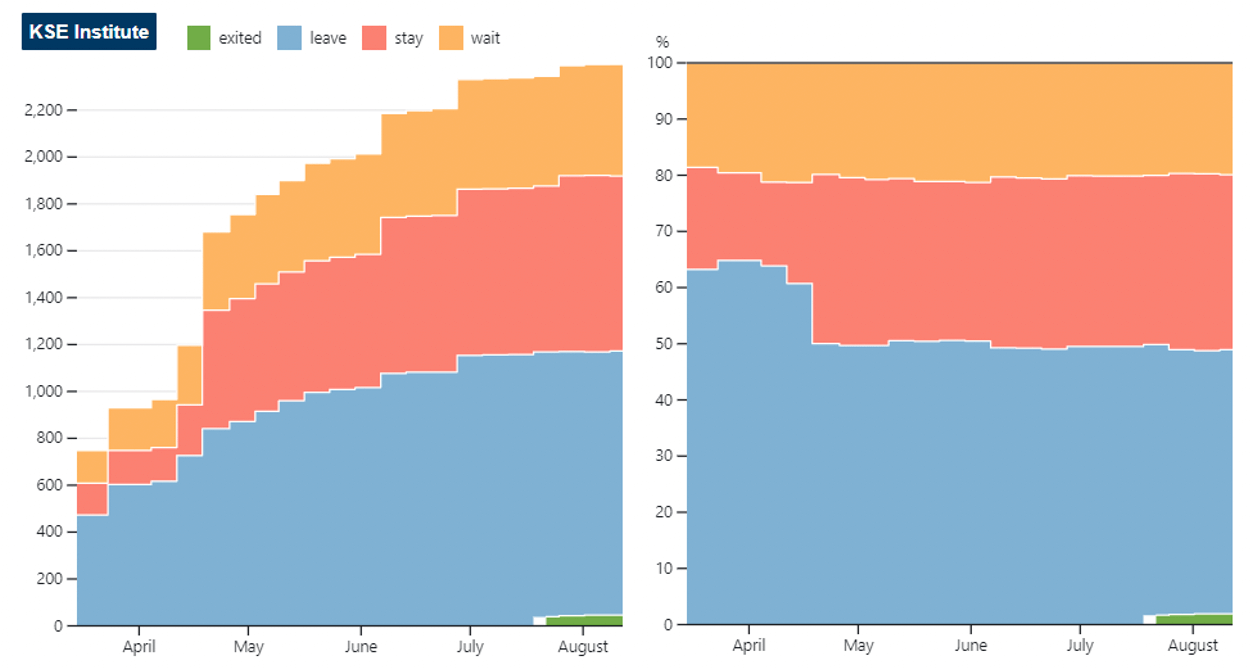

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about a half (47.0%) of foreign companies have already announced their withdrawal from the Russian market, but another 31.2% are still remaining in the country, 19.9% are waiting and only 1.9% made a complete exit³.

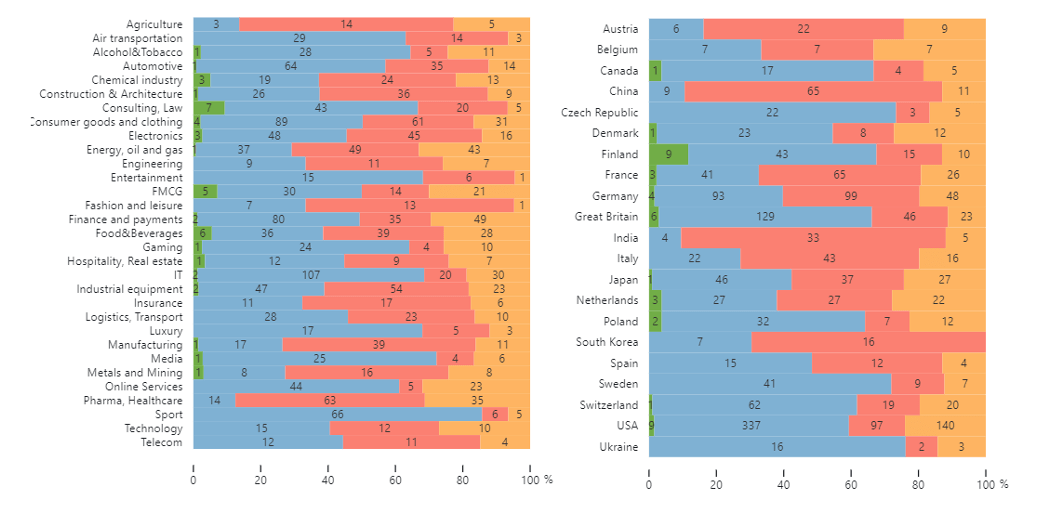

The actions of companies by sector (based on the KSE database, with at least 20 companies representing the industry or country) are shown in the graphs below.

Decisions of foreign companies by country and sector:

Decisions of TOP foreign companies in terms of local and global revenue⁴:

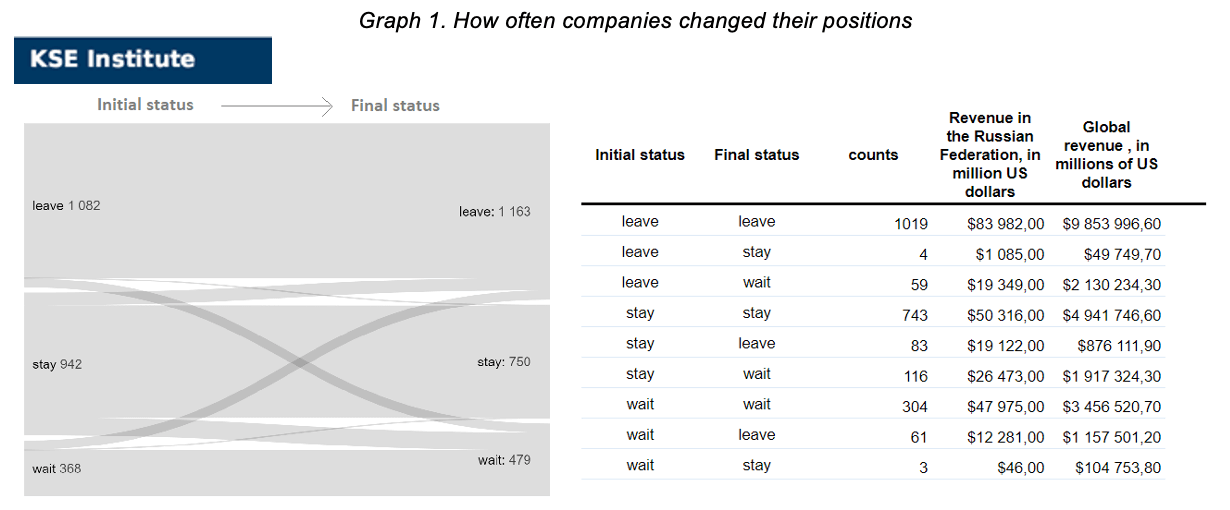

WEEKLY FOCUS: HOW OFTEN DO COMPANIES CHANGE THEIR POSITIONS?

How often does a foreign company change its position about continuing to operate on the Russian market or take certain actions that contradict its previous statements?

To answer this question, we use our own historical dataset, which dates back to March 17 and is updated on a weekly basis. This dataset starts with 748 company statuses, and as of August 13, it already contains 2,400 records. By change of the position, we mean a change in one of the three statuses (stay, wait, leave) and do not take into account our recent status exited, which is essentially a formalized continuation of the leave status (also we will not take into account intermediate statuses, but only initial and current/ terminal).

According to this data, 2066 companies/services did not change their position, 326 – changed (see Graph 1.).

Among the world’s largest companies that have changed their positions are: ExxonMobil, Alphabet, Toyota and Microsoft. All of them have the direction to leave → wait. It can be described as a misunderstanding between society and the actions of the company (which from the beginning declared a decisive break in relations with the Russian Federation, and then it turned out that they continue to support products, maintain partial activity, etc.). There are a total of 59 such cases. And although such a path is characteristic of the largest companies, it is the least popular.

Nevertheless, we observe that in most cases on the paths stay → wait (116), wait → leave (61), stay → leave (83). That is, the absolute majority takes a positive path in the only correct direction – towards the exit.

There is a separate group of companies that, despite their previous statements, turned 180 degrees (leave or wait → stay). These are, for example, Air Serbia (has resumed flights), German agricultural equipment manufacturer Claas (still operating in Russia; not publicly disclosed) and tire manufacturer Continental (on August 1 in Kaluga, the Continental car tire production plant resumed operations), Paribet⁵, Japanese Fujifilm (after a break still works and advertises in Russia) and some others.

You can also contribute by spreading the status of the company with a call to leave Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)⁶

08.08.2022

*Siemens Energy AG (Independent) (Germany, Energy, oil and gas) Status by KSE – wait

Siemens Energy loss widens amid Russia withdrawal

https://www.marketwatch.com/story/siemens-energy-3q-rev-eur7-28b-271659936745

German energy holding Siemens Energy has started restructuring its business activities in Russia and intends to complete the exit from assets in Russia at the end of the current fiscal year. But it is possible to continue servicing the equipment for “Nordic Stream-1”

https://www.epravda.com.ua/news/2022/08/8/690135/

*Ball Corporation (USA, Aerospace) Status by KSE – leave

The manufacturer of aluminum cans Ball estimated losses due to the exit from the Russian Federation at 435 million dollars

09.08.2022

*Saipem (Italy, Industrial equipment) Status by KSE – wait

Saipem in Talks to End Its Arctic LNG 2 Projects in Russia

https://www.linkedin.com/feed/update/urn:li:activity:6962678697682202626

https://www.oedigital.com/news/498579-saipem-in-talks-to-end-its-arctic-lng-2-projects-in-russia

*Maire Tecnimont (Italy, Engineering) Status by KSE – wait

Italian Conglomerate Maire Looks to Gas From Waste to Cut Reliance on Russia

*Wizz Air (Hungary, Air transportation) Status by KSE – wait

WizzAir will resume flights to Moscow from October

https://news.finance.ua/ua/wizzair-vidnovyt-reysy-do-moskvy-z-zhovtnya

10.08.2022

*Kährs (Sweden, Manufacturing) Status by KSE – wait

Kährs started a process to evaluate the possibilities and conditions for divesting its operations in Russia.

*Mazars (France, Consulting, Law) Status by KSE – leave

stop all Mazars activities in Russia, explore exit options, do not take new clients from Russia

11.08.2022

*Boreo (Finland, Electronics) Status by KSE – leave

Boreo has today sold its 90% shareholding in the electronic component distribution business in Russia (“YE Russia”) to companies controlled by Mr. Yrjö Pönni, current General Director and 10% shareholder of YE Russia (“Buyer”)

https://www.boreo.com/publication/gnw-boreo-2495825-en

*Tik Tok (China, Online Services) Status by KSE – leave

Tiktok is ‘shadow promoting’ banned Russian content to users

12.08.2022

*Tchibo (Germany, FMCG) Status by KSE – exited

Tchibo exited the Russian business

https://www.epravda.com.ua/news/2022/08/12/690323/

https://www.kommersant.ru/doc/5504485

*Canadian Tire (Canada, Automotive) Status by KSE – leave

Helly Hansen (Norway, Consumer goods and clothing) Status by KSE – leave

Canadian Tire claims exit in the official announcement (Helly Hansen exited Russia)

13.08.2022

*EnBW (Germany, Energy, oil and gas) Status by KSE – wait

no new energy deals with Putin’s Russia, has two long-term Russian gas contracts, takes $561 million hit due to Russian gas supply cuts

*Mondi Group (Great Britain, FMCG) Status by KSE – wait

Mondi agreed on Friday 13.08.2022 to sell its largest plant in Russia to an investment vehicle owned by Russian billionaire Viktor Kharitonin for $1.6 billion. Mondi also has three much smaller plants in Russia that are not part of the deal

https://www.reuters.com/markets/deals/packaging-firm-mondi-sell-russia-business-156-bln-2022-08-12/

*Coca-Cola HBC AG (Switzerland, FMCG) Status by KSE – wait

Stopped all production and sales of brands of The Coca-Cola Company in Russia, renamed company to Multon Partners, will focus on the production and sale of existing local brands; intend to have a much smaller operation in Russia

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 07/08/2022, we have updated data for some companies on personnel, revenue, and capital for 2021 (and will continue to do so as new data is processed). Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The first collected information is already available and systematized in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/.

⁴ KSE Institute started to develop new BI analytics module with a lot of dashboards, the first one is already available at the https://leave-russia.org/ website soon, stay tuned for further updates

⁵ Corrected information regarding the Ukrainian bookmaker Parimatch, which was believed to have continued its activities in Russia under a different name. According to the information provided by the company on 16/08/2022, the franchise and software were used illegally. Accordingly, the status of the company was changed from “Stay” to “Leave”.

⁶ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site