- Kyiv School of Economics

- About the School

- News

- Oil Embargo Roadmap: Four Steps To a Full Embargo

Oil Embargo Roadmap: Four Steps To a Full Embargo

08 August 2022

Prepared by Jacob Nell, KSE Institute, 11.04.2021

Bottom line: Oil is crucial to Russia’s economic resilience, since it underpins its strong balance of payments and budget – so reducing oil revenues is the most effective way of weakening Russia’s economy, and Putin’s financial capacity to wage war. We argue that a European embargo on Russian crude oil and oil products is possible at relatively low economic cost, which will disrupt Russia’s main industry, and materially reduce Russia’s oil revenues by widening the Russian oil discount and reducing demand. If agreement on an immediate full embargo is not yet possible, we propose a four step plan to encourage the ongoing adjustment away from Russian oil: a) banning low volume oil product exports, including jet, gasoline and LPG immediately, b) banning high volume oil product exports, such as fuel oil, naptha and diesel, over the summer, c) banning seaborne crude exports from September, and d) banning pipeline crude exports by the end of the year. A full European embargo could put Russia in a vulnerable position, squeezing current oil revenues. This in turn would put pressure on the RUB, both because of reduced FX inflows and because domestic demand for dollars would likely increase strongly. To keep control, and avoid an inflationary surge, Russia would likely then tighten monetary and fiscal policy, which would further hit the economy, and constrain Russia’s ability to finance the war.

Why is oil so important to the Russian economy?

Oil dominates Russia’s exports and budget revenues. The lifting cost of oil in Russia is low (on one estimate as low as ~US$4-7 per barrel), making sales at global prices highly profitable. Depending on the oil price, crude and product exports account for around 40% of Russian exports, and around a third of budget revenues, while oil accounts for 15-20% of Russia’s GDP. At the same time, oil dependency is also Russia’s greatest vulnerability: whenever the oil price has fallen – after 1986, in 1998, in 2008, in 2014-15, in 2020 – the Russian economy has contracted.

At the moment, high oil prices are a major support for the Russian economy. At the moment, oil provides a daily inflow of ~$500-800 mln daily from exports, including $400 mln of exports to the EU, which is a crucial source of FX and budget revenues, and mitigates the impact of other sanctions. In particular, the full sanctions on the Russian central bank cut off access to just over half of Russia’s FX reserves, and put Russia at risk of a currency crisis, given the illiquidity of gold reserves, and demand for FX inside Russia. But after a sharp initial fall in RUB, the inflow of oil income, with some capital controls to limit convertability, has prevented this, and the RUB has now recovered to its pre-war parity of just under 80 RUBUSD, allowing the CBR to reduce its policy rate from the post-invasion 20% to 17%.

However, Russia’s oil revenues would be massively reduced, if the oil price falls… Lower oil revenues could be due to a lower oil price – but that depends on the global balance of supply and demand, and is hard to influence directly. Measures to increase energy supply from other sources, especially other sources of oil supply – from e.g. oil stocks, Iran, Venezuela, shale oil, OPEC – to reduce tightness in the oil market will help. Helpfully, bullish expectations on oil at the start of the year have moderated, given the risks to demand from Russia’s invasion and Covid restrictions in China, as well as a sharp downward revision to US oil demand, and the release of oil from stocks.

… or an embargo is put in place: Moral pressure and the threat of sanctions has already driven away many buyers, leading to a $30-$35/bbl discount on Russian oil, and reducing oil revenues by around $150-180 mn per day. We think a full embargo by the biggest buyer of Russian oil – Europe, which bought 58% of Russian oil in 2021 – could double this hit, working through three channels:

• Via crude: the current $30-35 discount on Russian crude would increase significantly, and crude export volumes might fall further;

• Via product: oil product exports, which amounts to over a third of total Russian oil exports to Europe, would take a larger hit than crude, since the volumes are smaller and harder to ship to an alternative market;

• Via logistics: Near-term, there would be major disruption as Russian ports, railways and refineries, as they struggled to move or store unwanted liquids.

A full European embargo could put Russia in a vulnerable position, squeezing current oil revenues. This in turn would put pressure on the RUB, both because of reduced FX inflows and because domestic demand for dollars would likely increase strongly. To keep control, and avoid an inflationary surge, Russia would likely then tighten monetary and fiscal policy, which would further hit the economy, and constrain Russia’s ability to finance the war.

Avoiding a major price dislocation: The Asia-Europe shuffle: We think that it is feasible for Europe to replace Russian oil rapidly without driving a further surge in global prices:

• Russian oil banned from the OECD/Europe will be largely bought at a deep discount by Asian buyers who will have strong bargaining power, given sanction risk and a lack of storage, driving Russian prices lower. Some volumes, particularly of product, may not find a market. This process is already underway as the market responds to the risk of sanctions and many Western players stop buying Russian oil, while Chinese, Indian and Indonesian buyers increase their purchases at a deep discount.

• Russian oil supplied to Europe can then be replaced from Middle Eastern and other sources, which will no longer be supplying Asia – alongside some support from the ongoing release from strategic reserves.

• Pipeline oil supplies can also be replaced, as Poland has already committed to doing. When the Druzhba pipeline was closed to decontaminate from chlorine in April-June 2019, pipeline-fed refineries along the Druzhba successfully replaced pipeline supplies with other sources, at a modest additional cost of a couple of dollars per barrel.

• The economic hit is manageable. Current oil prices, while high, are not unprecedented, and in line with oil prices in 2010-2014. Moreover, Europe is less dependent on oil than most economies globally, reflected in an oil burden (spending on oil relative to the size of the economy) of ~2.5% of GDP at $100/bbl, well below China (3.5% of GDP) or the USA (3.3% of GDP). Overall even large oil price increases would be much less costly than the impact of Covid in 2020, when Europe’s economy contracted by nearly 6% and Europe’s fiscal deficit widened by 6.4pp of GDP.

What will happen on the market if Europe stops buying RF oil and oil products?

Russia will lose a further portion – perhaps another third – of oil revenues and shift to new buyers: If Russian oil cannot find buyers in Europe, we expect the Russian oil discount to expand further above the current level (USD 30-35/barrel of crude oil), reducing oil and tax revenues, to attract new buyers, largely in Asia. RF will also likely need to reduce production because of bottlenecks, including limited storage, and a shortage of oil tankers for the longer journeys and increased seaborne trade/reduced pipeline deliveries.

EU/OECD countries will shift to new, mainly Middle Eastern, source of oil: As is already happening, buyers will find new suppliers and transportation routes, mainly from the Middle Eastern sources which are freed up by Asian buyers switching to Russian oil.

Easing the transition: With the oil market tight, the transition will be eased by the ongoing release of oil reserves by the US (1 million barrels of oil a day for six months= 180 mn barrels) and IEA members (a further 500,000 barrels of oil per day for six months = 60 mn barrels).

Reducing Russian volumes: Russia is currently exporting around 5 million barrels a day, so to take Russian oil fully off the market, up to 5 million additional barrels would need to be found. This is not possible immediately, and achieving it over time will require contributions from multiple sources, including stocks, OPEC spare capacity, US shale growth and lifting sanctions on Iran and Venezuela. And additional production would be needed to meet forecast demand growth, which the IEA puts at just over 2 million barrels this year. Here we set out a menu of measures which can help create room to take Russian oil off the market while avoiding a price spike.

- Further release of emergency reserves: The release of 240 mn barrels of emergency reserves by the IEA countries makes a material difference to supply – 1.5 million barrels a day for 6 months. But there is scope to do more – for example, when Allied forces started their air campaign against Iraq, the IEA activated a pre-agreed plan to release 2.5 million barrels a day in 1991. Note IEA Member Countries hold 1.5 billion barrels in public reserves and about 575 million barrels under obligations with industry, so the current release only amounts to 9% of total reserves.

- Tap into OPEC spare capacity: OPEC now has a spare capacity of about 5 mbd, including Iran and Venezuela, and about 3.5 mbd without them. For the moment, OPEC seems to be sticking to the agreed 400k per month pace of quota increases, which it has agreed for May and plans to continue until September 2022, implying a 2 mn barrel per day rise in quotas.

- Increase Gulf and US shale oil production: Saudi Arabia and UAE have 3 million barrels a day in spare capacity. Encouragingly, both have made recent statements indicating some willingness to increase output further and faster. Moreover, high prices provide a strong incentive to UAE and Saudis to boost production, and a chance to avoid losing market share to US shale oil. The United States may be able to increase production by 0.7-0.8 mbd in six months.

- Creating alternative routes for Kazakh oil: Currently, significant Kazakh production is locked in by RF as the Caspian Pipeline “suffered storm damage and has to be closed for repairs”. The CPC transports about 1.4 million barrels of oil per day, of which the majority is Kazakh. Here, it would be possible on paper to squeeze nearly a million barrels a day extra through the Caucuses, which is approximately the Kazakh share of CPC throughput. The numbers would have to be agreed with the Kazakhs and Azeris, and with BP, who is the operator of the pipeline, and there may be bottlenecks, e.g. in terms of barge capacity in the Caspian, but in theory the capacity is there:

- the Baku-Tbilisi-Ceyhan pipeline: Spare capacity on BTC is around 700 K barrels a day – capacity is 1.2 million including drag-reducing agents, 1 mln barrels of oil per day without and 2021 throughput was just 25 mln tonnes = 500,000 barrels of oil per day. The Kazakhs and Turkmens already send some oil through BTC so the logistical and contractual arrangements are in place. Redirecting barrels from CPC to BTC would reduce Russian control over oil flows and might make the CPC uneconomic.

- the Baku-Supsa pipeline: the repaired Baku-Supsa line could take about 100,000 bopd and at these high oil prices you could ship some tens of thousands of additional barrels by rail.

- rail through Azerbaijan and Georgia.

In addition, the Kazakhs may be able to transfer some extra barrels by pipeline and rail east to China.

- Reduce demand: IEA 10-Point Plan to Cut Oil Use

The plan proposes 10 demand restraint measures to offset the reduction of Russian oil supply. Full implementation of these measures in OECD countries alone could cut oil demand by 2.7 million barrels a day within the next 4 months, relative to current levels.

- Mandatory reduction of speed limits on highways by at least 10 km/h will result in cumulative reduction of oil demand by 430 thousands barrels a day (kb/d).

- Work from home up to three days a week where possible. One day of working from home can avoid around 170 kb/d of oil use. Three days of working from home avoids around 500 kb/d in the short term.

- Car-free Sundays in cities would avoid around 380 kb/d of oil use.

- The cheaper public transport and incentives for micromobility, walking and cycling can avoid 330 kb/d of oil use.

- Alternate private car access to roads in large cities will reduce the oil demand by 210 kb/d.

- An Increase of car sharing and adoption of practices to reduce fuel use will be able to save about 470 kb/d of oil.

- The promotion of efficient driving for freight trucks and delivery of goods will enable advanced economies to reduce the demand for oil by 320 kb/d.

- Using high-speed and night trains instead of planes where possible avoids about 40 kb/d of oil use.

- The avoidance of business air travel where alternative options exist would lower oil demand by 260 kb/d.

- Accelerated adoption of electric and more efficient vehicles will enable advanced economies to lower oil demand by additional 100 kb/d.

What is the best approach to introducing sanctions, and what is the first step?

The best approach is an immediate comprehensive ban by Europe/OECD on Russian crude oil and oil products, which will maximise the disruption in Russia, reduce oil revenues and shorten the war. Besides, the adjustment is already underway: the market is already partially anticipating this outcome, with Western buyers shunning Russian oil, and Asian buyers buying at a deep discount. Further, the oil reserve release is already underway, supporting supply, while governments have a playbook to reduce oil demand.

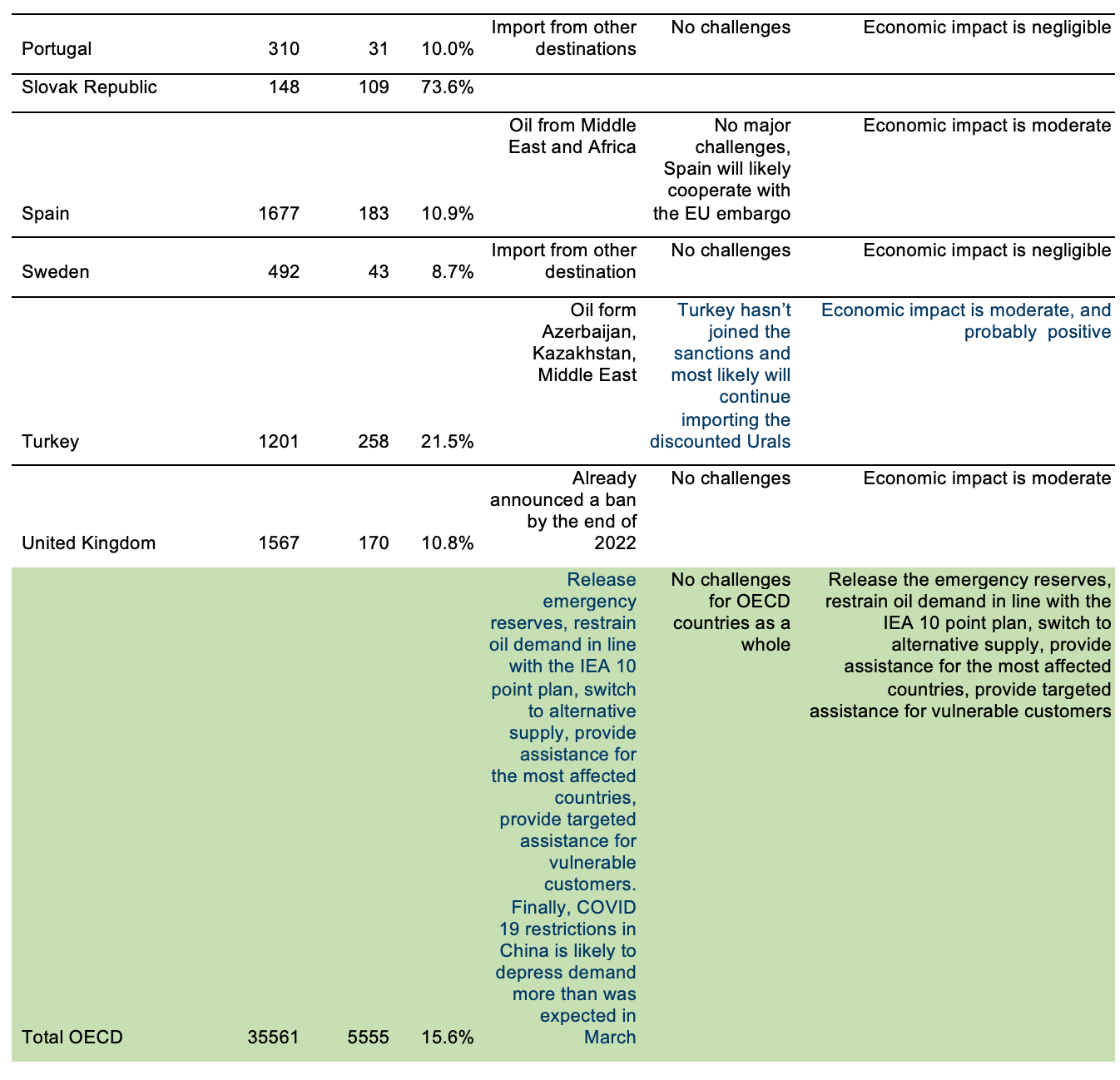

If our allies cannot yet agree on a full ban, we call for further steps to continue tightening sanctions, to ensure the market continues its rapid adjustment away from Russian oil. The recent European moves to ban Russian ships from European ports and to ban coal – although only from the summer – are welcome. However, they do not directly address Russian oil exports, which is the most important source of financing for Putin’s war. We propose a four step process to move to a full embargo: a) immediate ban on lower volume oil product exports, including jet, LPG and gasoline, to be enacted in the sixth round of sanctions; b) ban over the summer higher volume oil products, including naptha, fuel oil and diesel; c) ban on seaborne crude exports from September; d) ban on pipeline exports by the end of the year, following the example of the US, UK, Poland and the Baltics.

An immediate ban on at least some products is important since the oil processing and transport chain is short of spare capacity, so there is not storage even for products where the export flows are modest, such as gasoline and LPG. The lack of storage facilities at refineries and ports means that export bans are highly disruptive, and cause shutdowns – for instance Kommersant has reported that Lukoil is on the verge of shutting refineries because it has run out of fuel oil storage and has had similar problems with LPG, as a result of the collapse in LPG export sales.

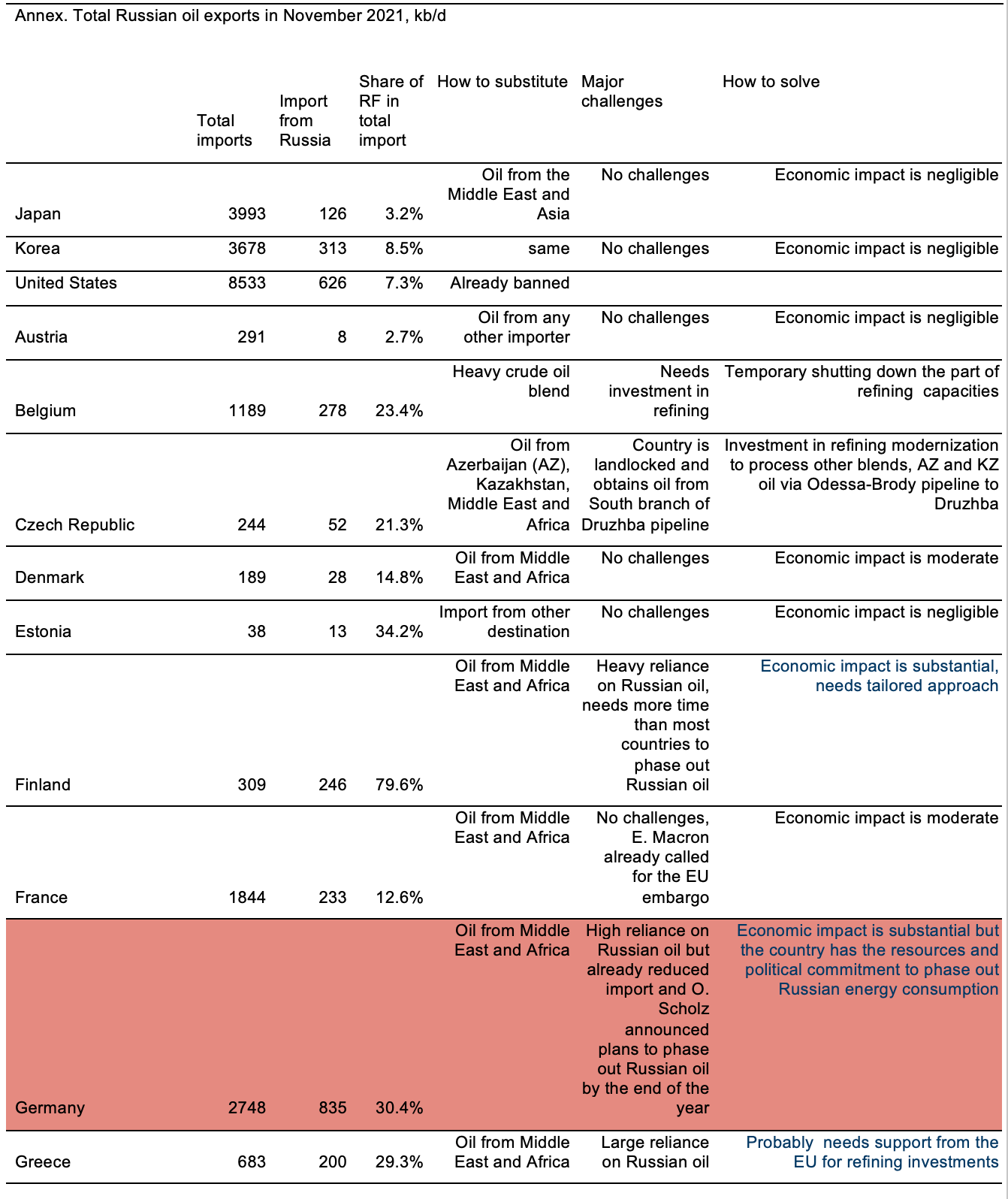

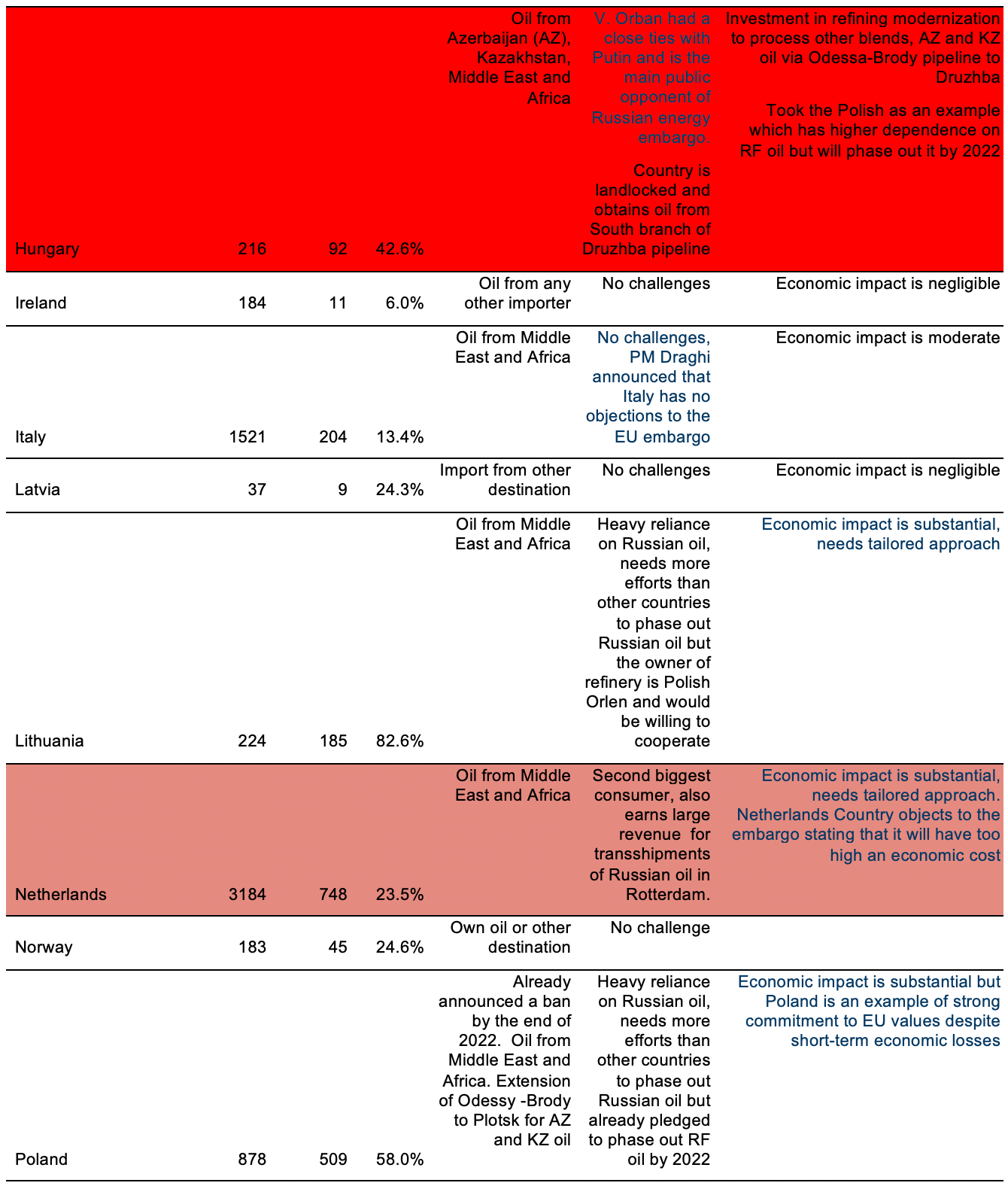

Despite the calls for a full oil embargo by many EU members in response to Russian atrocities in Bucha, Irpin and Gostomel, the European Commission could not reach an agreement on such an embargo in the fifth package of sanctions. Those countries who publicly called for the embargo, e.g. France, and those who publicly supported it, e.g. Italy, should not wait for the EC decision and should follow the Polish pledge to fully phase out Russian energy consumption by the end of 2022. Poland was the third biggest Russian oil importer in the EU and its reliance on Russian oil import was 58% compared to just 30% and 24% for two of the other biggest importers in the EU – Germany and the Netherlands respectively (see Annex with Russian oil imports and reliance on Russian oil by OECD countries). Most countries will face much lower costs stemming from a Russian oil import ban than Poland. Further, any incremental decline in Russian oil exports will be hard to handle for a Russian oil industry with limited storage capacity.

A timetable for steps to a full embargo – e.g. as we propose, low volume oil products with immediate effect, high volume oil products (eg diesel, fuel oil, naptha) over the summer, seaborne crude oil from September, pipeline crude oil by year end – is important since it will validate market and Russian expectations of a comprehensive ban and accelerate adjustment.

The dependence on Russian oil varies substantially by the EU countries. Thus, for France and Italy the import dependence[1] is only around 13% while for Finland or Lithuania it exceeds 80%. In addition, part of Russian oil is imported to the EU by pipelines while another part is seaborne imports. Landlocked countries such as Hungary, Slovakia and the Czech Republic import Russian oil via the Southern branch of the Druzhba pipeline through Ukraine. These countries would face a larger logistical challenge in implementing an EU immediate ban, which might argue in favour of a phased approach to a full embargo. The first stage might include an immediate ban on some oil products and voluntary commitments to stop buying Russian seaborne crude oil by individual countries. The second stage might involve banning higher volume oil products over the summer. The third stage might start in September and consist of a ban on all seaborne Russian crude and product imports. The final stage of phasing out Russian imports would be a full embargo on Russian oil, including pipeline imports, effective from January 1, 2023.

Two best practice examples: a) Poland, the third biggest consumer of Russian oil with import dependency at around 60%, and which also imports oil via the Druzhba pipeline, has already pledged to phase out all oil and gas purchases from Russia by the end of 2022; b) Croatia decreased its reliance on Russian oil from 63% in 2010 to 12% in 2019, respectively and its reliance on Russian natural gas from a third to zero in 2011.

Oil: Russian exports and European imports

OECD Europe imports a total of 4.5 million barrels per day (mb/d) of oil from Russia, of which 3.6 mb/d was crude oil and feedstocks and 1.9 mb/d oil products. In total, the EU accounts for around 4.0 mb/d of Russian oil exports.[2] OECD Asia and the OECD America imported 440 kb/d and 625 kb/d respectively in November 2021. In total, OECD countries were responsible for 5.6 mb/d or 70% of Russian oil exports – implying that a full embargo imposed by democratic countries would have a dramatic impact on the Russian economy.[3]

Europe is dependent on Russian oil for over ¼ of its crude oil. Germany is the largest importer of crude oil with ~35% crude oil coming from Russia[4] [5], and Slovakia the most dependent, getting over 90% of its oil from Russia. Most oil imports into the bloc are sea-borne which makes it easier to diversify. Up to 8% of Europe’s oil supplies, or 30% of total Russian oil exports to Europe , are by pipeline.

Source: IEA data and KSE Institute assessment

Source: Eurostat

[1] Import dependence (ID) for Russian oil is defined as ID=(Russian oil import)/(total import)

[2] IEA (2022), Russian supplies to global energy markets, IEA, Paris https://www.iea.org/reports/russian-supplies-to-global-energy-markets

[3] IEA (2022), Russian supplies to global energy markets, IEA, Paris https://www.iea.org/reports/russian-supplies-to-global-energy-markets

[4] https://www.transportenvironment.org/discover/europes-dependence-on-russian-oil-puts-285m-a-day-in-putins-pocket/

[5] Germany`s consumption of Russian oil (~0.5 mmbd) comes ~0.4 mmbd via Russian Druzhba pipeline. Key refineries relying on Druzhba oil: Schwedt Refinery (~0.2 mmbd, PCK, Rossneft minority stake 37.5%) and Leuna Refinery (~0.2, Total). Replacing Russian oil might require reducing utilization of Druzhba refineries as seaborne options can be limited due to alternative logistics bottle-necks (mainly increasing utilization of Rostock-Schwedt-Leuna pipeline and railway).