- Kyiv School of Economics

- About the School

- News

- Russian oil export revenues in October marked the second highest level since July 2022 – Russian Oil Tracker by KSE Institute

Russian oil export revenues in October marked the second highest level since July 2022 – Russian Oil Tracker by KSE Institute

30 November 2023

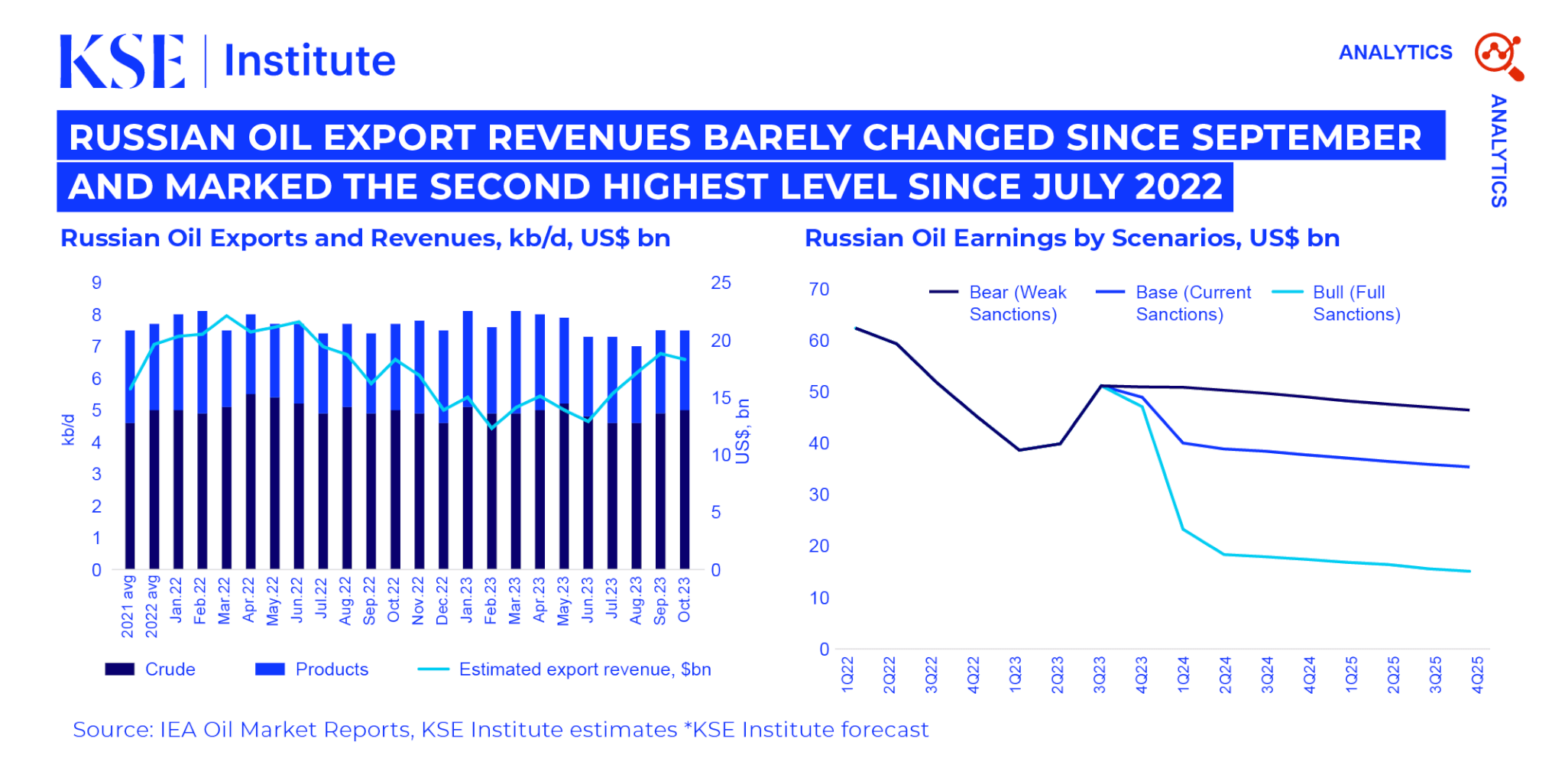

In October, Russian oil export earnings reached $18.3 bn. This marked the second highest level since July 2022, according to the November issue of ‘Russian Oil Tracker’ by KSE Institute. While the positive aspect includes improvement of price cap enforcement for Russian crude and oil products, concerns arise over reduced reliance on Western maritime services and increased use of the shadow fleet.

Russian oil export revenues barely changed since previous month and stayed at $18.3 bn. Russian seaborne oil export volumes decreased by 3%, primarily driven by a 13% decline in oil products exports (MoM). Nevertheless, the overall impact on earnings is relatively modest, with the $690 million drop in oil products exports being largely offset by a $660 million increase from crude export revenues.

The discount on weighted average Russian crude narrowed by around $1.7 per barrel in October. Average prices for Urals FOB Baltic, Black Sea, and ESPO FOB dropped to $77/bbl, $79/bbl, and $84/bbl respectively. Diesel, fuel oil, and naphtha exceeded price caps, indicating weak policy enforcement by EU/G7 governments.

However, Urals discount widened by $3/bbl by the end of October after US OFAC blocked two vessels for using US-based services while carrying Russian crude sold above the price cap. The US Treasury letters to shipping companies for potentially breaching the G7/EU price cap sent in early November also indicates a switch to a tough-touch approach of price cap enforcement.

During the previous month, Russia continued to decrease its dependence on Western maritime services, particularly for crude shipments. Only 26% of crude oil was shipped by tankers with P&I Club insurance, down from 32% in September. The level of P&I Club coverage for crude oil exports also varied by port in October 2023. Specifically, 38% of crude exports from Black Sea ports, 33% from the Baltic Sea, 23% from the Arctic Ocean, and 12% of shipments from Pacific Ocean ports utilized P&I Club insurance.

At the same time, Russia is increasingly utilizing the shadow fleet. In October 2023, 185 loaded Russian shadow fleet tankers left Russian ports, with 72% of them over 15 years old. This poses significant environmental risks to the EU, particularly the coastlines of European countries, including the Danish Straits. In fact, during October 2023, the shadow fleet accounted for exports of approximately 2.6 million barrels per day (mb/d) of crude oil and 0.8 mb/d of oil products.

More fundamentally, Russia conceals ties to the shadow fleet by dispersing ship managers and concealing tanker ownership. In October, KSE Institute discovered that Sun Ship Management and Scf Mgmt Fzco, top leaders in seaborne oil exports via shadow fleet, operate the fleet of tankers that has the same features as owner possesses only one tanker, but all these owners have the same registration address.

Interestingly, the top five flags of Russian shadow fleet vessels are Panama, Liberia, Gabon, Cook and Marshall Islands. Aframax and Seuzmax are the core of the Russian shadow fleet carrying crude while Seawaymax and Handysize form the Russian shadow fleet carrying oil products. Meanwhile, India remains the biggest importer of Russian seaborne crude oil, with Turkey standing as the primary buyer of Russian oil products.

KSE Institute now projects Russian oil revenues of $178 billion in 2023, up from the July estimate of $153 billion. In the base case with current oil price caps and status quo of sanctions but their stronger enforcement, revenues will decline to $155bn and $152bn in 2024 and 2025. If the price cap is lowered to US$ 50/bbl discount to forecast Brent prices, revenues would drop to $77bn and $70bn in 2024 and 2025. Weak sanctions enforcement might lead to increased Russian oil revenues, reaching $200bn and $197bn in 2024 and 2025.

We recommend policy strategies such as performing attestations, bolstering certification processes, creating a list of authorized brokers/traders, imposing fines for price cap breaches, and sanctioning third-party entities aiding in violations. Importantly, there’s an emphasis on mandating insurance for tankers navigating G7/EU territorial waters and prohibiting G7/EU entities from participating in the sale or financing of vessels.

Full Russian Oil Tracker for November 2023 by KSE Institute is available here.