- Kyiv School of Economics

- About the School

- News

- Russia Macro Update: “The price cap fundamentally works”

Russia Macro Update: “The price cap fundamentally works”

26 October 2023

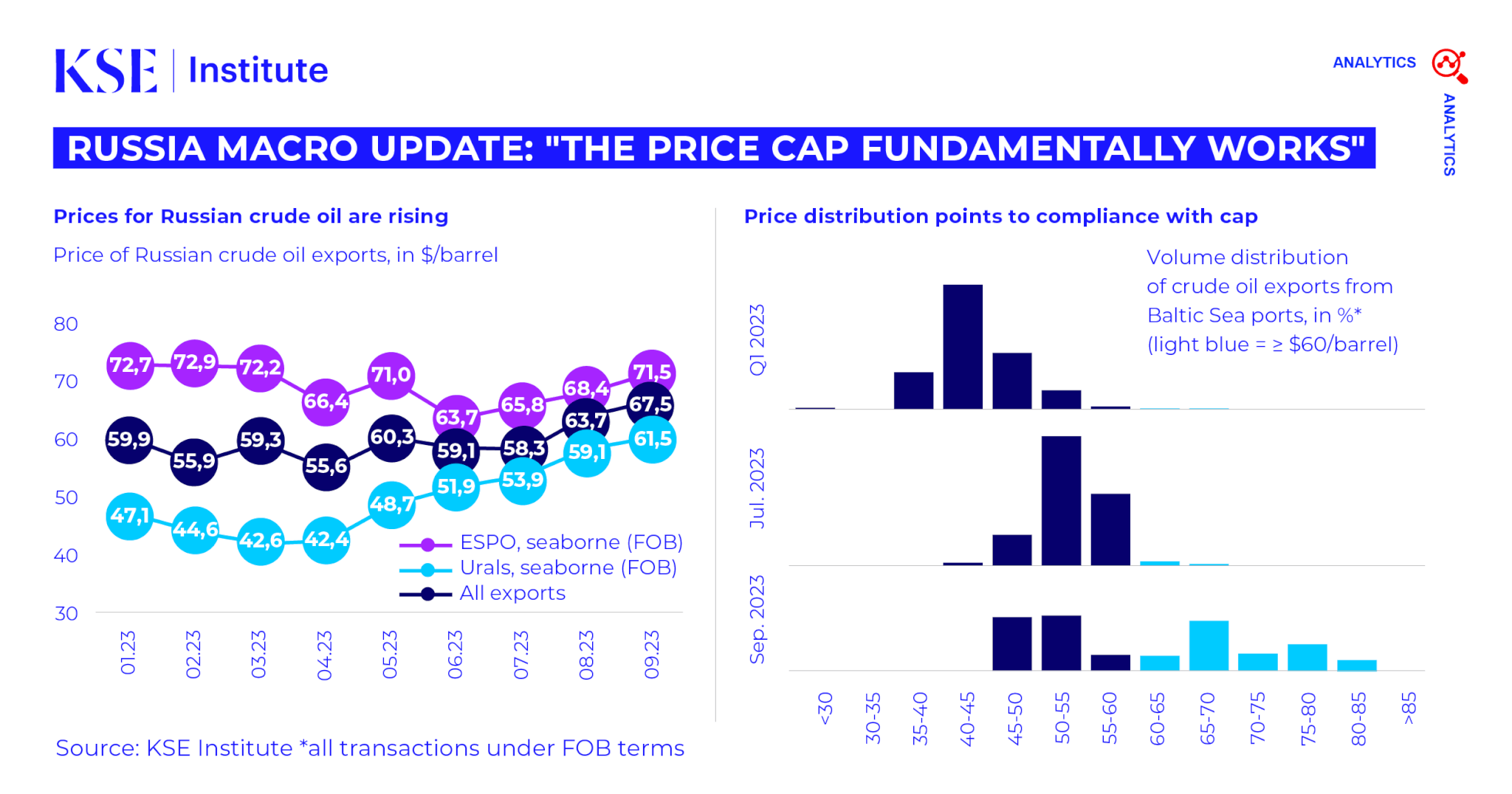

KSE Institute has released an analytical note on the G7/EU’s flagship energy sanctions policy, titled “The price cap fundamentally works.” Benjamin Hilgenstock, senior economist at KSE Institute, examines data on Russian oil exports and finds evidence for (partial) compliance with the price cap regime in recent months.

Specifically, in August and September, the distribution of prices at Baltic Sea ports points to a bifurcation of the market – with one segment (48%) where prices are below the $60 per barrel threshold and cargoes are shipped with the involvement of G7/EU services, and another (52%) where negotiated market prices materialize as Russia utilizes a sanctions-proof fleet.

This market fragmentation has resulted in a gap between realized export prices in Russian trade data and the International Energy Agency’s estimates. The IEA’s prices are more likely to reflect negotiated spot prices rather than cargoes sold at the capped price. As a result, Russia’s income from oil exports may be lower than previously anticipated, even if global oil prices rise.

Russian trade data for September indicates that the average realized price for seaborn Urals was $61.5 per barrel, while for seaborn ESPO it was $71.5 per barrel. Although these prices surpassed the cap, they remain significantly lower than the prices recorded by the IEA in August — approximately $71 per barrel for Urals and $79 per barrel for ESPO.

The analysis suggests that, fundamentally, the price cap can be effective, but it requires improvements – to preserve the policy’s leverage in the medium run, bolster compliance, and address environmental risks. Proposed steps include mandating proper insurance for ships traversing EU territorial waters and strengthening the attestation system.