- Kyiv School of Economics

- About the School

- News

- Russia faces major challenges as oil earnings decline and ruble depreciates, states KSE Institute

Russia faces major challenges as oil earnings decline and ruble depreciates, states KSE Institute

18 April 2023

Mounting pressure on the energy sector, a growing budget deficit, shrinking foreign investment, pressure on reserves, and an exodus of skilled workers will worsen Russia’s economic recession in 2023, according to the latest KSE Institute Russia Chartbook.

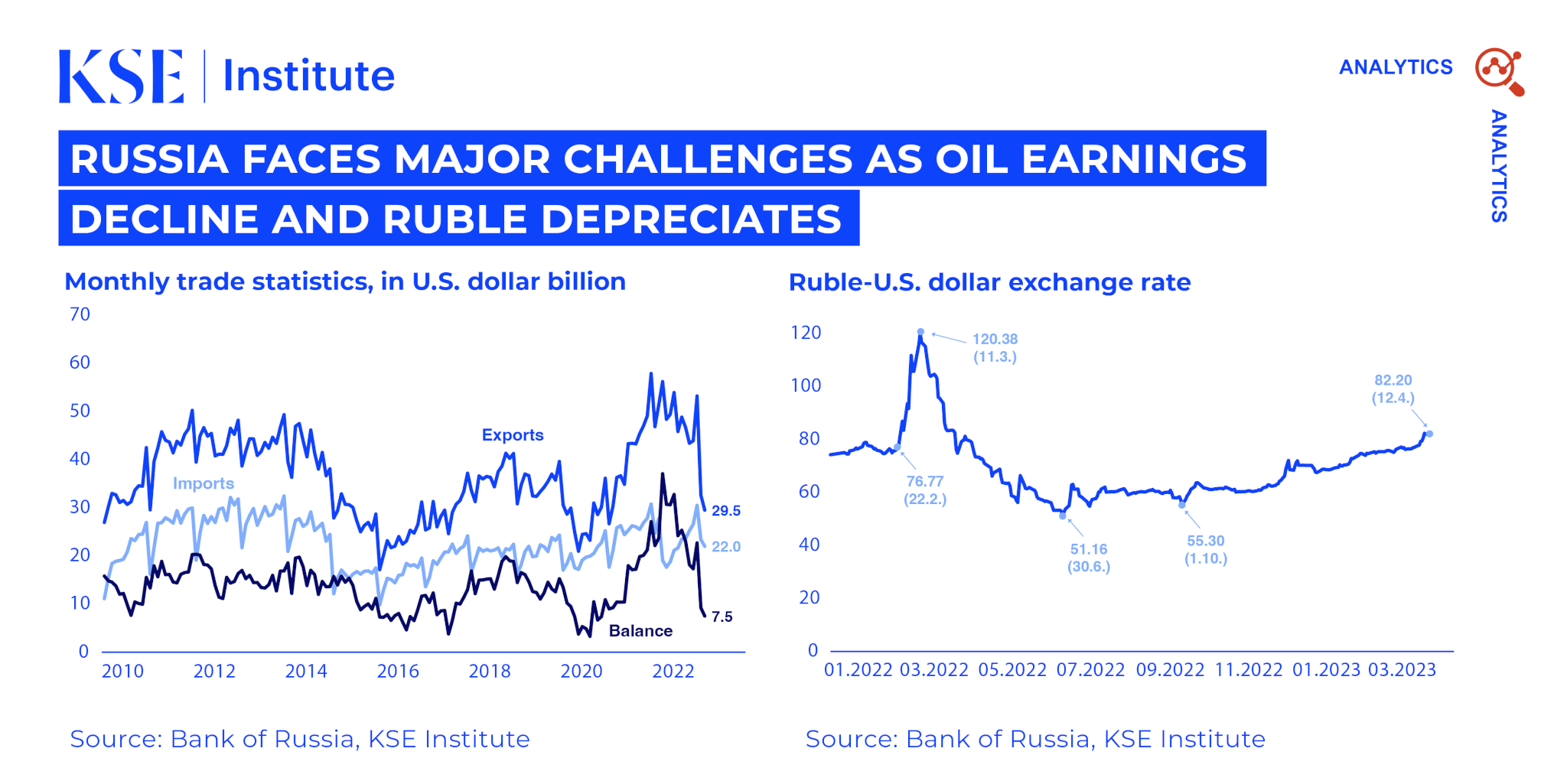

Sanctions on the energy sector have resulted in a significant drop in Russian exports. The main contributors to the decline are the EU embargo on Russian oil (crude and products) and G7 price caps, which have triggered falling prices for Russian oil – plus European countries’ moving away from Russian natural gas. Experts predict that in 2023, Russia’s earnings from oil exports will decrease by 41%, and from gas by 64%.

The decline in exports led to a smaller trade surplus; in 1Q 2023, it shrank to $29 billion, the lowest in two years. In turn, the overall current account surplus also declined, amounting to only $18.6 billion in Q1 2023, 50% less than in 4Q 2022. These dynamics are also reflected in lower fiscal revenues from oil and gas, which fell by 45%. At the same time, spending grew by 35% – primarily driven by the cost of the war.

As of March 31, the federal budget deficit was 2.4 trillion rubles, or 82% of the Russian government’s target for the full year. The budget deficit is anticipated to reach 7-8% of GDP in 2023.

Unfavorable external conditions are weakening the Russian ruble; it has depreciated by 33% against the US dollar since October 2022. With no expected increase in foreign exchange flows to the Russian Federation, the ruble’s depreciation is likely to continue.

To finance the budget deficit, Russian authorities are forced to use the National Welfare Fund. Last year, they did so to the tune of 3 trillion rubles. However, more than 40% of NWF assets are not liquid, and according to KSE Institute experts, liquid assets could be largely depleted by the end of the year.

Another source of budget financing is domestic borrowing. As foreign investors have withdrawn from the market, Russian banks remain the only buyers of these bonds. This will increase pressure on the Russian banking system, whose revenue fell by more than 90% last year, to 200 billion rubles.

The escalation of repression and mobilization has led to a mass exodus of skilled workers from Russia. Last year, over 1.3 million people under the age of 35 left the country.

The decline in oil and gas revenues, the growth of the budget deficit, the worsening banking sector, and emigration from the Russian Federation will result in prolonged economic stagnation. According to experts, the economic recession in the country will only deepen in the medium term.

Given these factors, KSE Institute proposes increasing sanctions pressure on the Russian Federation as soon as possible. In particular, experts call for additional restrictions on the export of Russian raw materials, including oil, gas, uranium, iron ore, diamonds, and nitrogen fertilizers, and further isolating the activities of energy companies. According to KSE Institute experts, such measures could reduce Russia’s export earnings by an additional $49 billion in 2023 and $69 billion in 2024.