- Kyiv School of Economics

- About the School

- News

- KSE Institute’s Russia Chartbook – Addressing The Shadow Fleet Challenge: Stepped-Up Enforcement Weighs On Russia’s Ability To Evade The Price Cap

KSE Institute’s Russia Chartbook – Addressing The Shadow Fleet Challenge: Stepped-Up Enforcement Weighs On Russia’s Ability To Evade The Price Cap

23 February 2024

KSE Institute has published its February Russia Chartbook “Addressing The Shadow Fleet Challenge: Stepped-Up Enforcement Weighs On Russia’s Ability To Evade The Price Cap.” Recent enforcement actions in the form of designating individual Russian shadow-fleet vessels show signs of being an effective strategy. Despite external pressures and challenges to macro buffers, the Russian economy, fueled by war expenditures, managed to grow by 3.6% in 2023. This clearly shows that the sanctions regime can and should be improved. Among other streams, Ukraine and its allies should continue strengthening the enforcement of the oil price cap and focus on reducing the shadow fleet.

In 2023, Russia’s external environment sharply worsened, particularly for goods exports, which fell by 28% to $424 billion. This led to significant declines in the trade ($120bn, -62%) and current account ($51bn, -79%) surpluses, undermining macroeconomic stability. Meanwhile, the ruble depreciated by more than 40% against the euro and the US dollar since late 2022, intensifying inflationary pressures. To counter this, the CBR raised interest rates by a cumulative 850 bps and reintroduced capital controls.

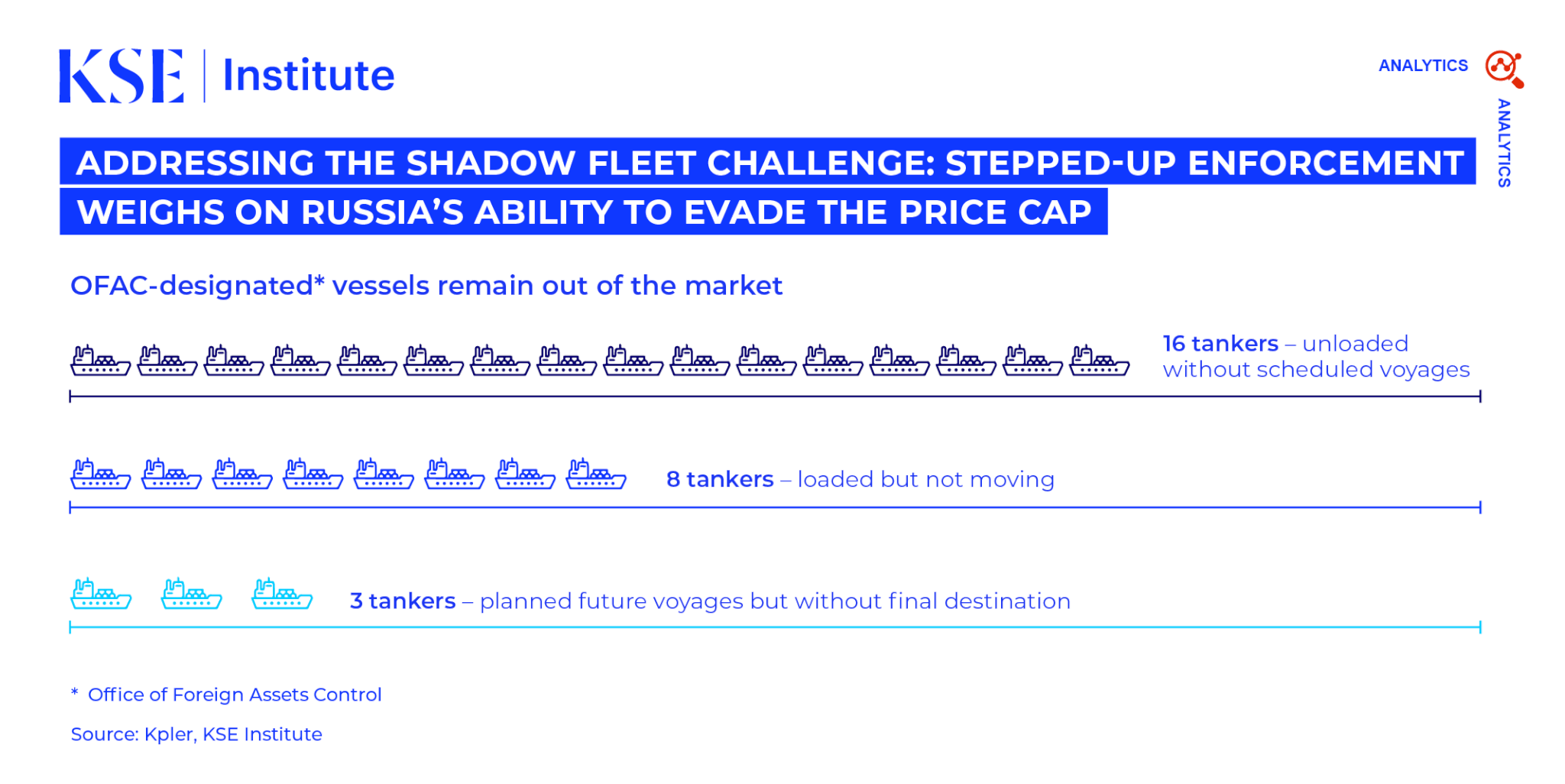

Increased enforcement of energy sanctions is also having an impact. Specifically, the coalition authorities are now targeting individual shadow tankers, sidelining them and causing caution among trading participants. To date, OFAC has listed 27 vessels as assets of sanctioned entities, which are currently inactive or struggling to find buyers. A further ~125 vessels may be targeted due to their (past) links to US service providers. Importantly, targeting of vessels has led to a widening discount of Russian oil to Brent from ~$11-12/bbl in November to ~$15/bbl in January.

KSE Institute forecasts a decline in oil and gas exports from $230bn in 2023 to $197bn in 2024 and $177bn in 2025. As a result, the overall current account is expected to show surpluses of only $49 billion and $32 billion in 2024-25. Maintaining pressure through sanctions is crucial, as a $10/barrel change in oil prices can affect export earnings by ~$25-30 bn/year.

As expected, the war and sanctions are straining macroeconomic buffers. Despite a budget deficit of 1.9% of GDP in 2023 and increased non-oil and gas revenues allowing for additional spending (3 trillion rubles), financing is becoming a challenge as external sources are cut off. Russia has relied heavily on the NWF, which has depleted almost half of its liquid assets since February 2022. Going forward, the burden may shift to the Russian banking system as sanctions limit access to reserves.

The robust economic recovery observed in Russia is driven by war-related fiscal stimulus–and this effect is set to strengthen in 2024, potentially adding 2.5 pp to GDP growth. While the economy has fully recovered from the initial shock of the war and sanctions, underlying vulnerabilities remain and problems could resurface in the future.

In order to expose these economic vulnerabilities and contain Russia in 2024 and beyond, KSE Institute proposes to: strengthen price cap enforcement by stepping-up investigations and penalties; continue targeting the shadow fleet, including by imposing insurance requirements; lower the price caps on crude oil and oil products; complete the ban on Russian hydrocarbons; and target oil and gas-related services that Russia relies on.