- Kyiv School of Economics

- About the School

- News

- European Gas and Power: Overreacting to the Threat of a Russian Cutoff (update)

European Gas and Power: Overreacting to the Threat of a Russian Cutoff (update)

7 November 2022

By Jacob Nell, Borys Dodonov and Nataliia Shapoval

Abstract

The paper investigates the current price rally on the European gas market. We argue that there has been a large price overshoot, which is an overreaction to the risk of a complete cut off of gas supply by Russia this winter. We provide three reasons for believing Europe can already manage without Russian gas this winter. First, a major adjustment in sources of supply has already happened. Russia has declined from supplying 36% of Europe’s gas imports in 2021 to supplying 9.9% so far in 2H22 – so Europe is no longer critically dependent on Russian gas. Second, Europe is reducing its gas consumption rapidly – over 11% down on last year in 1H22 – and we argue the Commission’s target 15% reduction in gas demand this winter is fully achievable – which would on its own more than cover a complete Russian gas cut off. Third – reflecting these shifts in supply and demand – European gas storage is on track for a near record build this summer despite declining Russian flows. On current trends, we estimate 2022 will see the second largest European gas storage build ever, and on November 2, 2022 European storages were 95% full – enough to cover the average winter draw nearly 2 times over and even a stress scenario of the largest recent winter draw and a complete Russian gas cutoff from September. Finally, Europe has a trump card in its back pocket, since it could fully or largely replace remaining Russian gas volumes by increasing production at the giant Groningen field. Given these factors, we expect the gas price to fall back to more normal levels, as traders increasingly realize that Europe can avoid a gas crunch this winter without Russian gas.

European gas and power markets are behaving in a paradoxical way. On the one hand, gas and power prices have just set new highs, and are priced to stay extremely high for years, reflecting concerns of a complete Russian gas cut off. This would drive higher inflation and a greater squeeze on real incomes, likely triggering a recession.

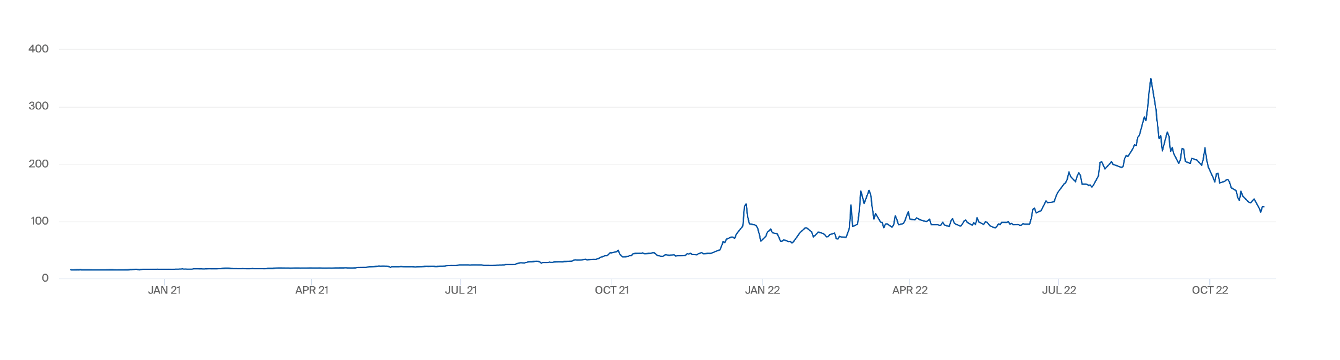

Chart 1: European Gas at record highs, Dutch TTF gas futures, EUR/MWh

Source: ICE

But the data show rapid volume adjustment is underway and by the end of October prices has already declined more than twofold from August peaks. In fact Europe is on track to have the storage – backed up by underlying shifts in supply and demand – to dispense with Russian gas this winter, we estimate. Clearly, there will be an adjustment cost of elevated prices for a period to end Europe’s heavy dependency on Russian energy. But we saw – a more than 10 fold surge in gas prices in the third quarter 2022 and power prices and extreme price volatility – as an overreaction, highlighting deficiencies in energy markets.

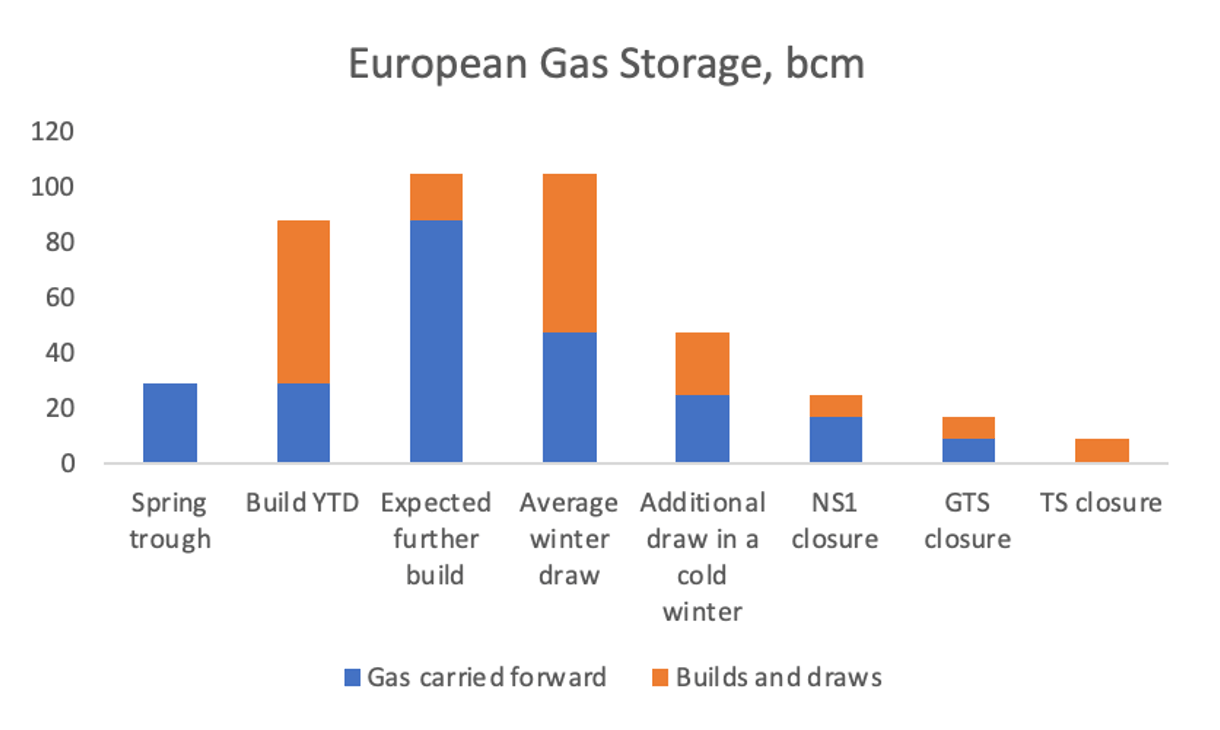

Chart 2. On current trends, European gas storage is on track to just cover a cold winter and a full Russian gas cutoff from September 1, we estimate.

Source: AGSI for data on gas storage and winter draws, KSE Institute for modelling of additional build in 2022. ENTSOG for data on Russian gas flows, provided by Bruguel.

*Note: we assume that a Russian gas cutoff would deprive Europe of the volumes currently flowing through the Nord Stream 1, Ukrainian Gas Transit System and Turkstream pipelines from September 1. See below for further discussion and explanation

We make three main arguments for our view that a “no drama” adjustment is underway.

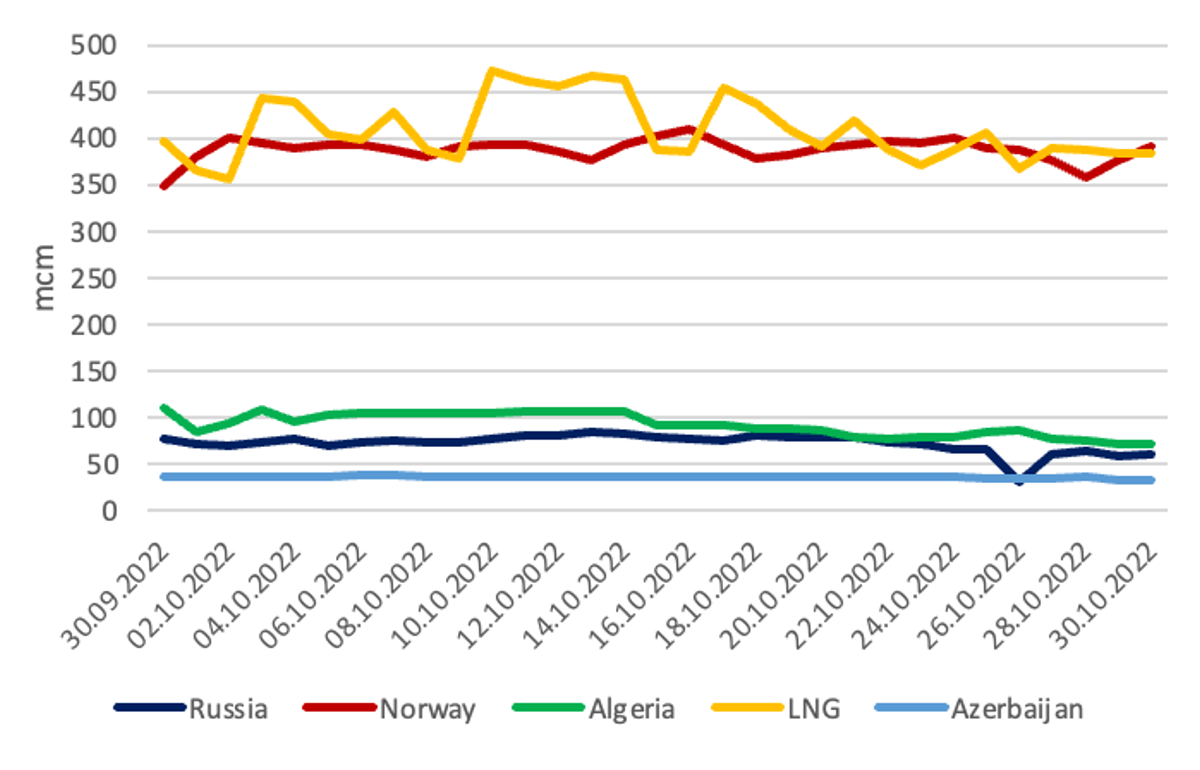

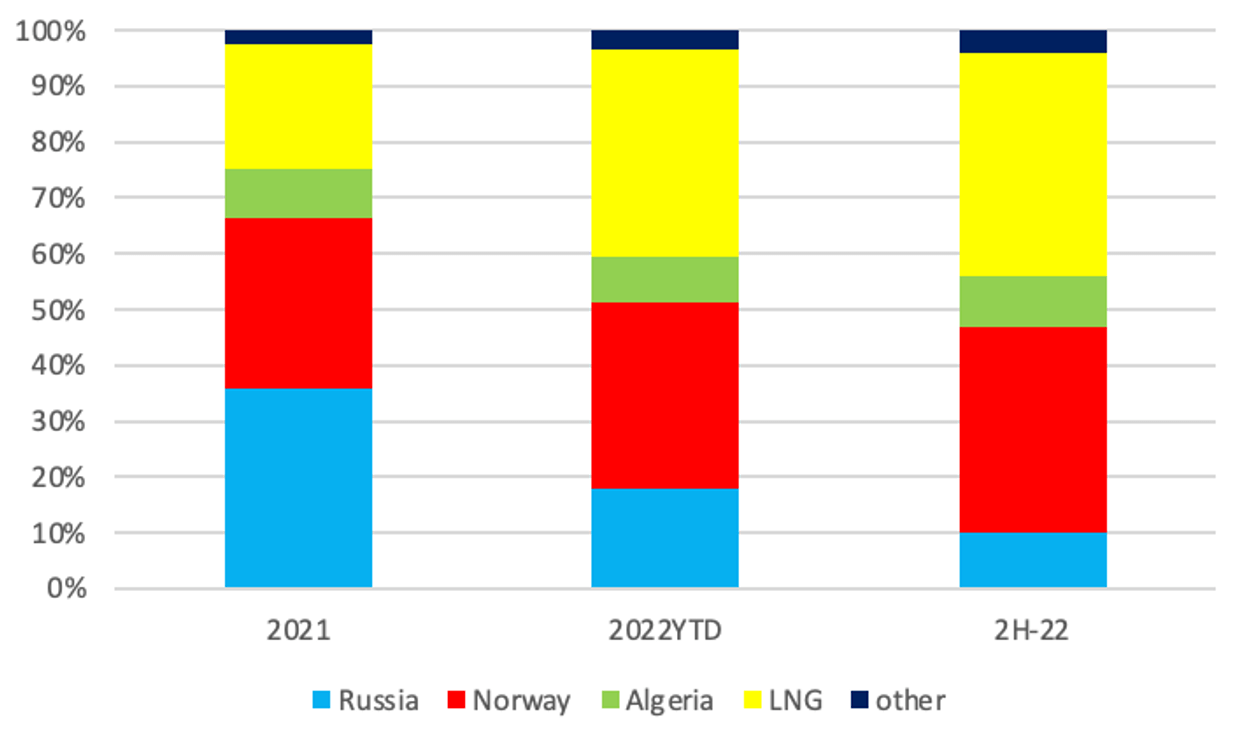

First, the major adjustment in sources of supply has already happened. Russia is no longer the major supplier of gas to Europe. So far in 2H-22, both LNG and Norway have provided about three times as much gas to Europe as Russia. Russia has declined from supplying 36% of Europe’s gas imports in 2021 to supplying 9.9% so far in 2H-22. Russia has already turned from the leading to a second-order source of gas supply for Europe.

Chart 2: European natural gas imports, by source

Source: ENTSOG, Brueghel

Chart 3. Russia gas flows to Europe were currently running below 20% of the level of Norway and LNG in October 2022

Source: ENTSOG, Brueghel

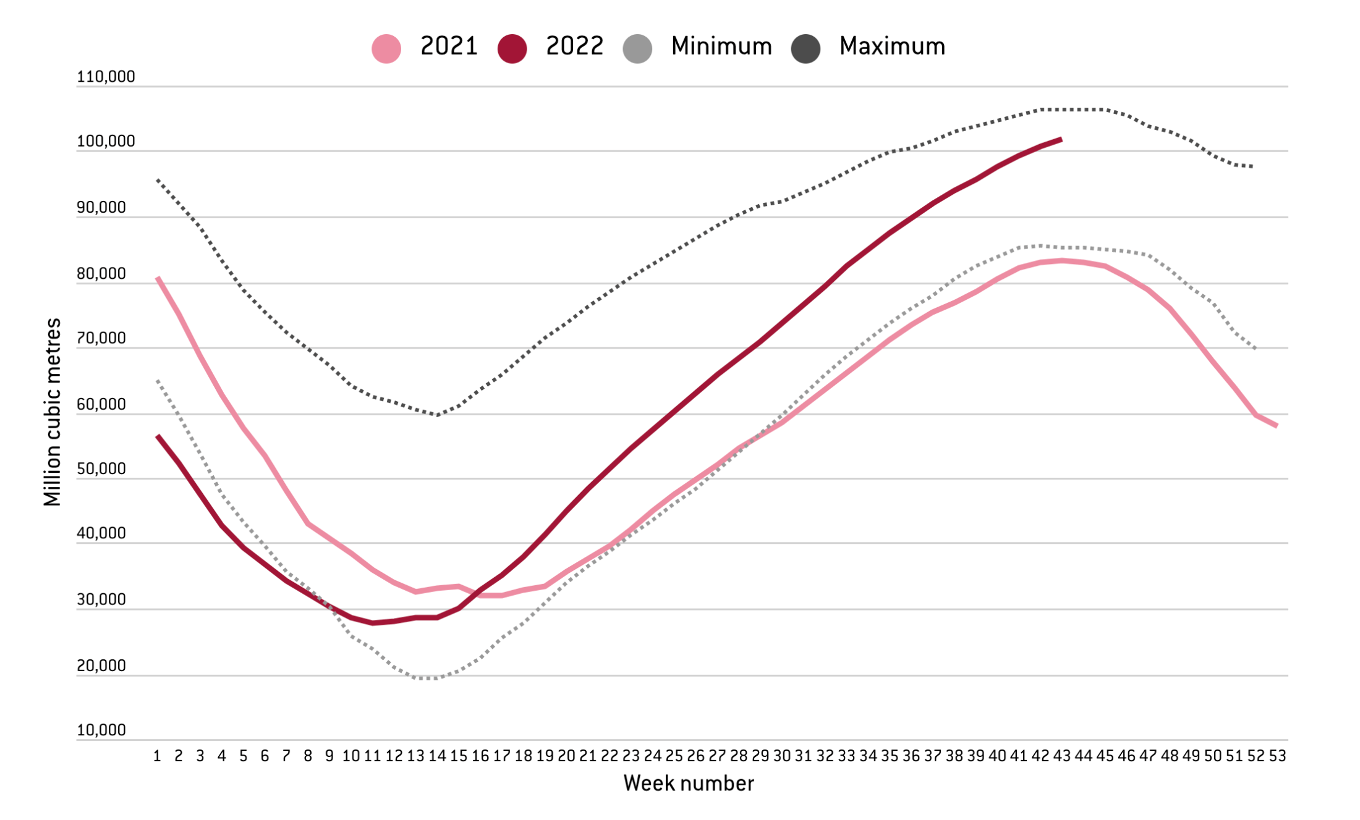

Second, European gas storage is on track for a near record build. Despite starting emptier than in 2021, they were 1 060 TWh or 95% full by November 2, 2022. It is much higher than the approved EU’s best efforts target of 85% full. Moreover, storage build continued to surpass last year’s pace, even after Russia completely cut off Nord Stream flows and reduced gas supply through GTS. Moreover, the favorable forecast for November enables us to project lower than usual gas withdrawal from storage in November.

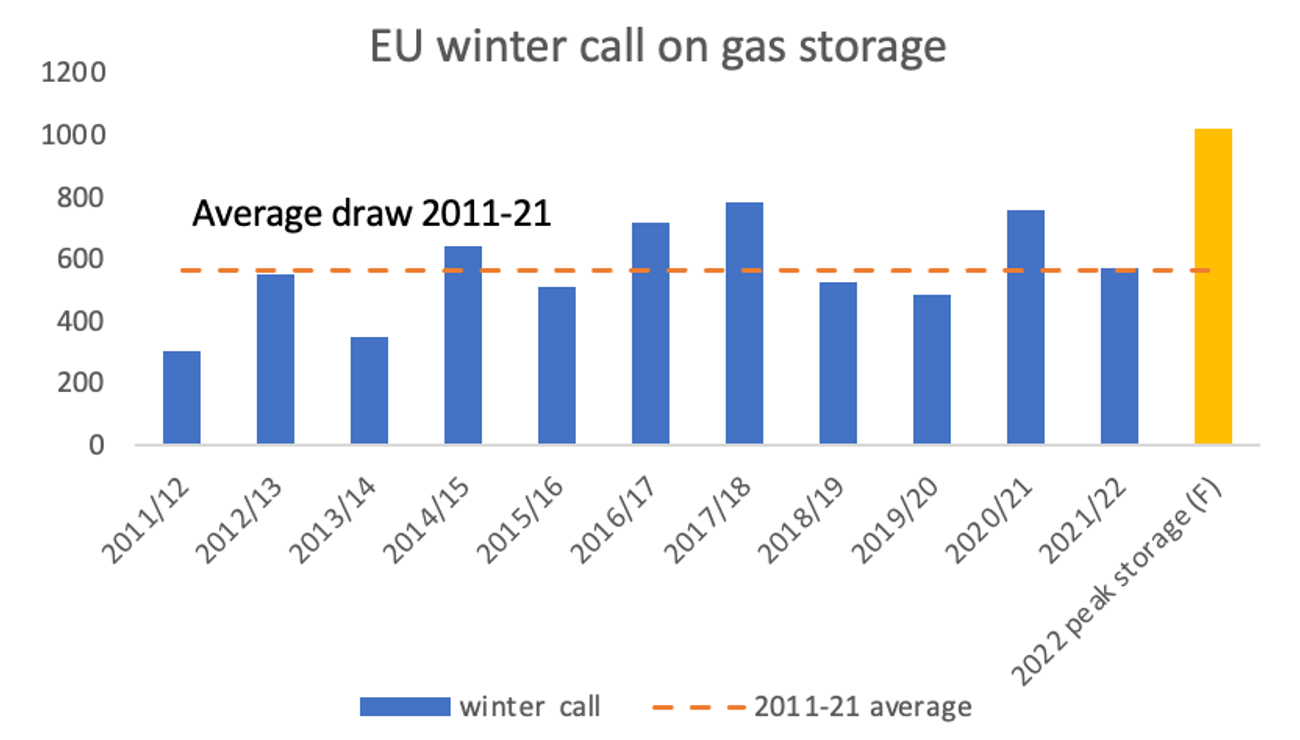

Full storage provides significant protection against a winter shortage. The average winter draw on European gas storage since 2010 has been 561 TwH, while the highest recent winter draw was 785 TwH in 2017-18. Peak 2022 storage will cover the average draw nearly 2 times over (1.82 times coverage) and even the largest recent winter draw with a large buffer ( 1.31 times coverage).

Chart 4: European Gas Storage 2022: Second Highest in Record by November

Source: Bruegel

Chart 5. 2022: Heading for Second Highest Storage Build on Record

Source: AGSI, 2022YTD is data as of August 20, KSE Institute estimate for remainder of 2022

Chart 6. High Coverage of the Winter Draw

Source: AGSI, KSE Institute estimate for peak 2022 storage

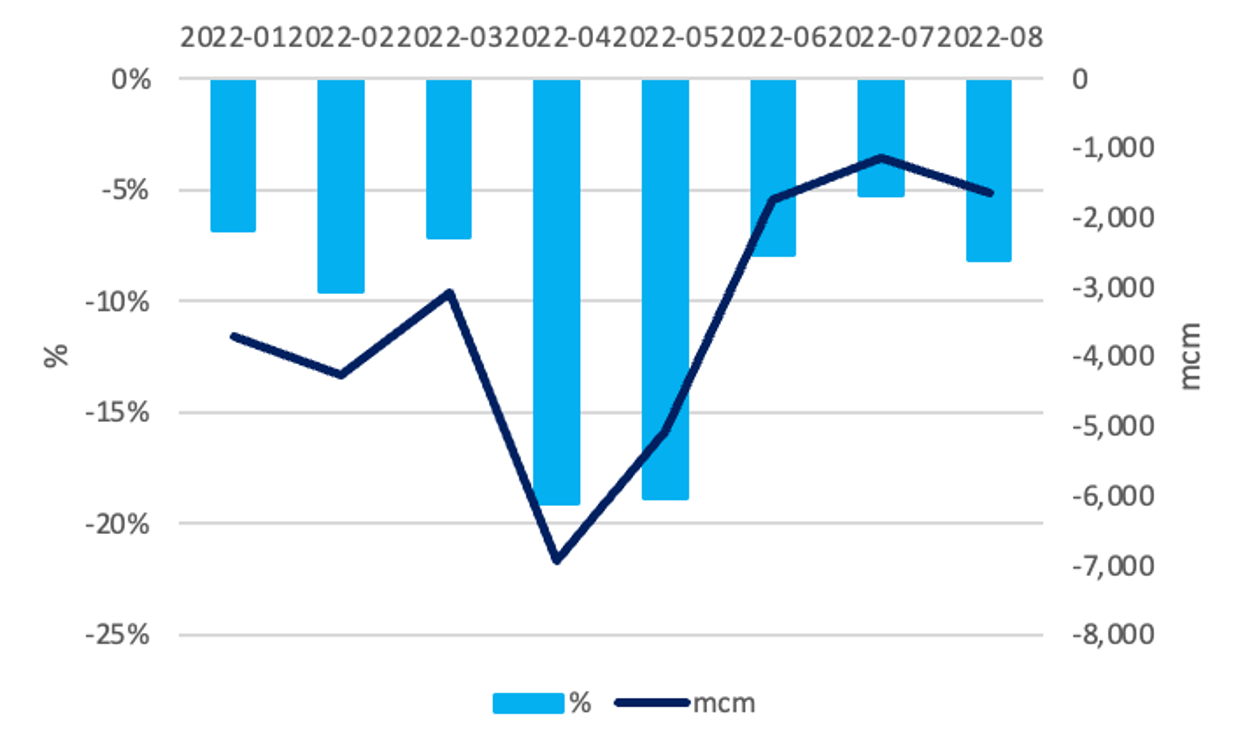

Third, Europe is reducing its gas consumption rapidly. Thus, the EU27 gas demand declined by 27.6 bcm or 10.3% yoy in January-August 2022 driven by milder than usual temperatures in Q1-Q2 and record high gas prices. The average drop in gas demand so far amounted to 3.5 bcm for the first eight months of 2022. Overall, the decline in gas demand is projected to be the highest in history. The IEA estimates the OECD Europe’s gas demand will decline by 54 bcm or around 10% for 2022 and its further decline by 4% in 2023. We expect further progress in reducing gas demand, given additional policy measures, notably associated with the EU agreement in late July on a voluntary 15% reduction in gas demand from August 2022 to May 2023.

Chart 7. Change in the EU27 demand for gas in 8M2022

Source: Eurostat, KSE Institute estimates

Despite these developments, the market continues to price ongoing tightness, driving gas and power prices to unprecedented levels, reflecting fears of a complete Russian gas cutoff.

But a complete Russian gas cutoff is no longer such a potent threat. The supply gap that has to be covered in this event is down by two thirds from 3 bcm a week at the start of the war to under 1 bcm a week after six months – and even at these reduced levels of Russian supply, Europe has been filling its storage more rapidly than last year. Suppose Russia cut off remaining flows – which recently average 505 mcm/week – to Europe. Compared to the current situation. Europe would need to find 30 weeks @ 505 mcm/week. This amounts to an additional 17 bcm of gas by the end of the heating season in April 2023. However, we believe this overstates the potential problem. Given the close political relationship between Russia and Hungary, and the cheap gas and oil which Russia provides to Hungary as part of this relationship, we would expect special arrangements to allow Russian gas to continue to flow to Hungary via Turkstream. If around 160 mcm/week keeps flowing to Hungary, this reduces the potential impact of a Russian supply cut to 345 mcm/week, and the winter shortfall in Russian supply to 11.1 bcm.

How could such a shortfall from a complete Russian gas cutoff be covered?

We see three possible solutions, each capable of covering the problem on its own, and in combination providing some leeway.

First, storage. European gas storage, as of November 2, has 1060 TwH, which comfortably covers a normal winter draw (564 TwH) and the loss of remaining Russian gas supply (215 TwH) out to April. It could even cover – just!- the worst winter draw recorded (785 TwH) and the loss of the remaining Russian gas supply (215 TwH).

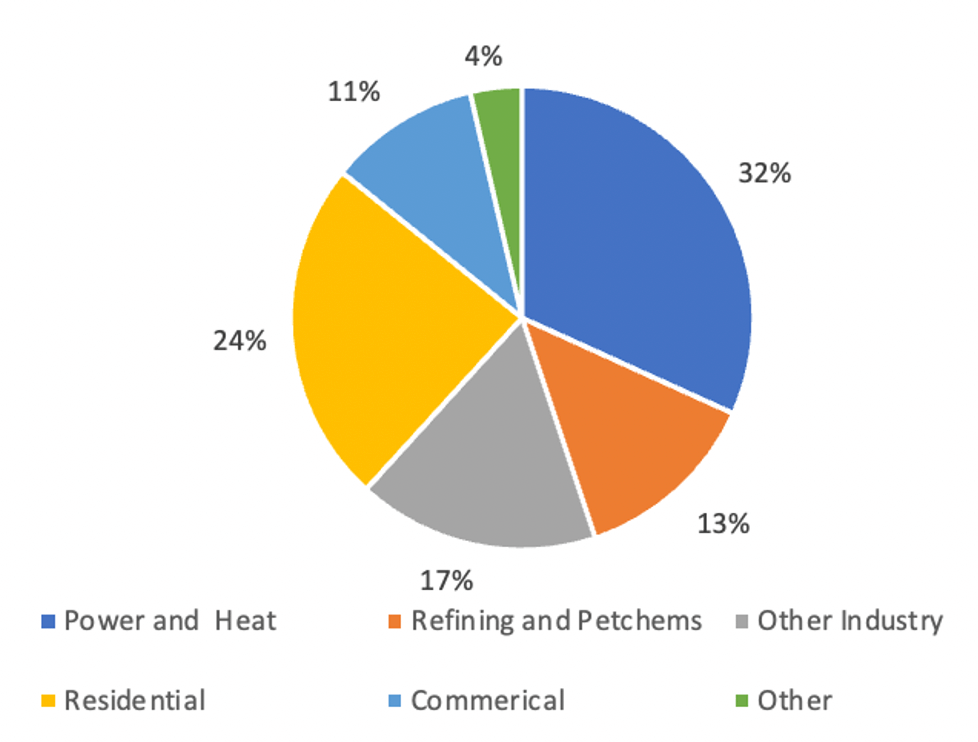

Second, reduced demand. The use of gas in its main markets – for power, for heating, and in industry – can vary significantly in the short run. In power, there is significant existing power capacity – e.g. coal, oil, lignite, biomass, nuclear – which can be used more intensively to replace gas. In residential and commercial usage, demand management measures – notably, setting maximum temperatures for heating, minimum temperatures for cooling, and more efficient settings for boilers – can cut demand dramatically, as seen in the 12% reduction in electricity demand in Japan after Fukushima. And industrial demand – often initially shielded by long term contracts from higher prices – has significant elasticity – albeit in some cases through shutdowns in response to higher prices. In May, demand reduction and gas substitution measures were only starting to come online, but EU7 gas consumption was already down by 12% vs the long term May average. The Commission’s targeted 15% reduction in gas demand should reduce gas demand by 5 bcm a month – more than enough, given only 2.4 bcm per month is needed to cover a complete Russian gas cutoff.

Chart 8. European gas demand evenly split between Power&Heat, Industry and Residential&Commerical

Source: European gas balance 2020, IEA. In this presentation we have added refining usage, and petrochemical energy and non-energy usage together to provide a combined figure for the “downstream” segment of the energy industry (‘Refining and Petchems’).

We think this planned 15% reduction is fully achievable. For instance, the Energy Information Administration estimated –0.15 and –0.18 price elasticities for residential and commercial consumers in the second year after natural gas prices double.[1] Since the natural gas price more than doubled in 2021 and is more than five times higher now than it was in 1H2021 we would expect even higher price elasticities – although this will also depend on the extent to which wholesale price increases have been passed on to households, which varies substantially.

The consumer response to large gas price increases during Ukraine’s phasing out of natural gas price subsidies for residential consumers in 2015-2016 provides a relevant comparison. The prices increased more than four times in real terms over two years and in response, households decreased their natural gas consumption by 25% and continued decreasing it thereafter. In 2020 residential natural gas consumption was only 54% of the 2014 level.

Third, we see near-term scope for additional gas supplies, notably from LNG and the giant Dutch Groningen field.

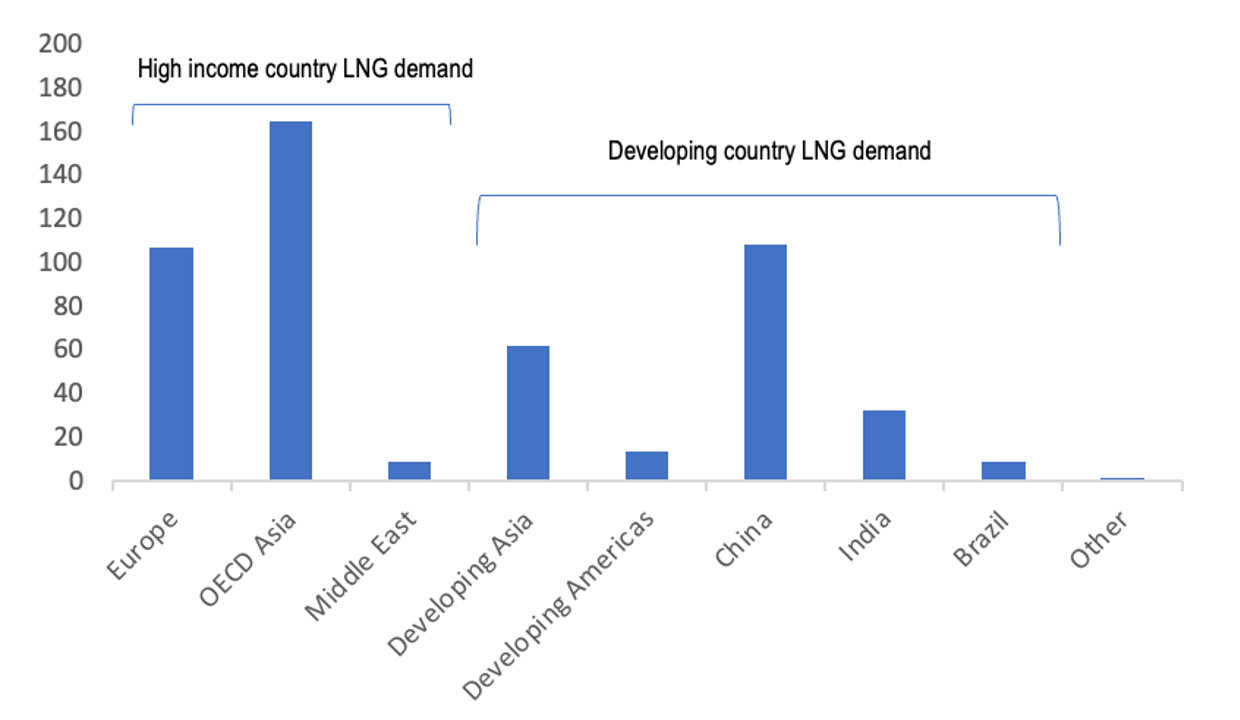

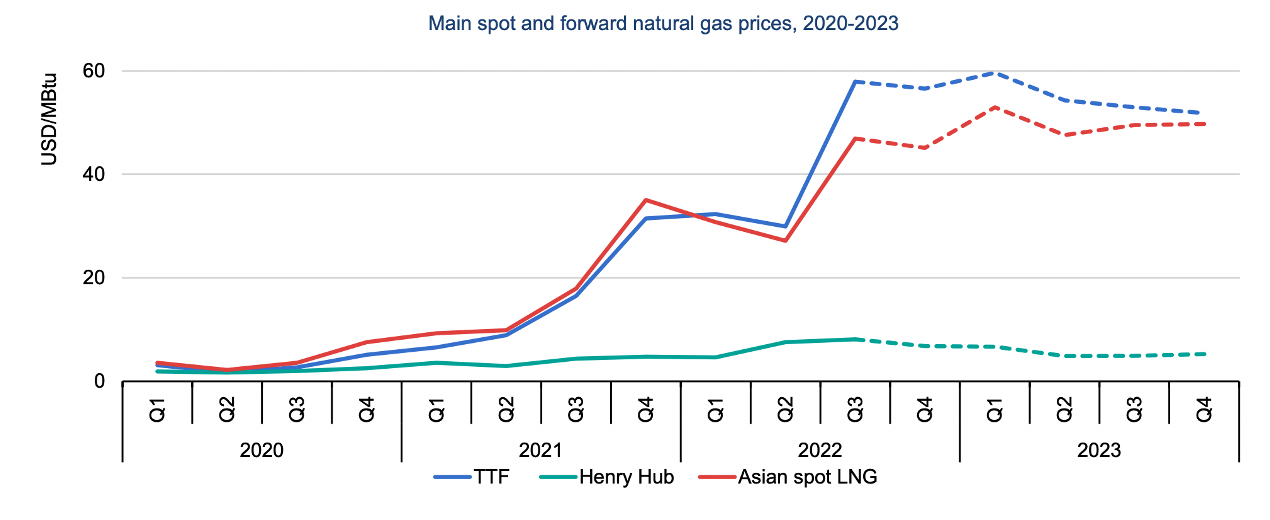

The gas bulls argue that there was a dearth of investment decisions on new LNG projects in recent years, and the world will be short LNG at least until 2024 or perhaps 2025, when the giant new Qatar LNG expansion and the recent set of US LNG projects are scheduled to come online. We see three problems with this argument. First, it overstates the dearth of new capacity, with substantial expansions coming online in 2022 in the US at the Calcasieu Pass and Sabine Pass LNG facilities, which increase peak liquefaction capacity by about 24 bcm per year. Second, higher prices incentivise additional production, with producers seeking to maximise output, implying some increase in supply at existing facilities. Third, and most importantly, the Europeans, including the UK, are relatively small in the global LNG market, accounting last year for 21% of LNG demand, and they are paying more – so the cargoes are flowing to Europe, with lower income gas consumers such as Pakistan losing out in particular. According to forward curves, TTF is expected to trade at a premium of USD 13/MBtu above Asian spot LNG during the 2022/23 gas winter (see figure below), enabling strong LNG inflow into Europe. In fact, the LNG response has already beaten expectations. For instance, in the early days of the war, the US and Europeans announced a deal to supply 15 bcm more LNG to Europe over the course of 2022. Although touted as ambitious, this proved a huge underestimate of the LNG response – since the invasion, European LNG supply is already up 24 bcm over last year. If LNG supplies continues at the current rate, additional LNG supply in 2022 will amount to 61 bcm, a 64% increase. And given the flexibility shown by the LNG market so far, we see potential for further supply at high prices, since lower income developing countries, who are likely to be more price-sensitive than European buyers and often with access to cheaper coal as a substitute, accounted for 231 bcm of LNG demand in 2021.

[1] https://www.eia.gov/analysis/studies/buildings/energyuse/pdf/price_elasticities.pdf (IEA Gas Market Report Q4 2022)

Chart 9: 2021 LNG demand, bcm

Source:

Chart 10. TTF, Henry Hub and Asian spot prices in 2020-2022

Source: IEA

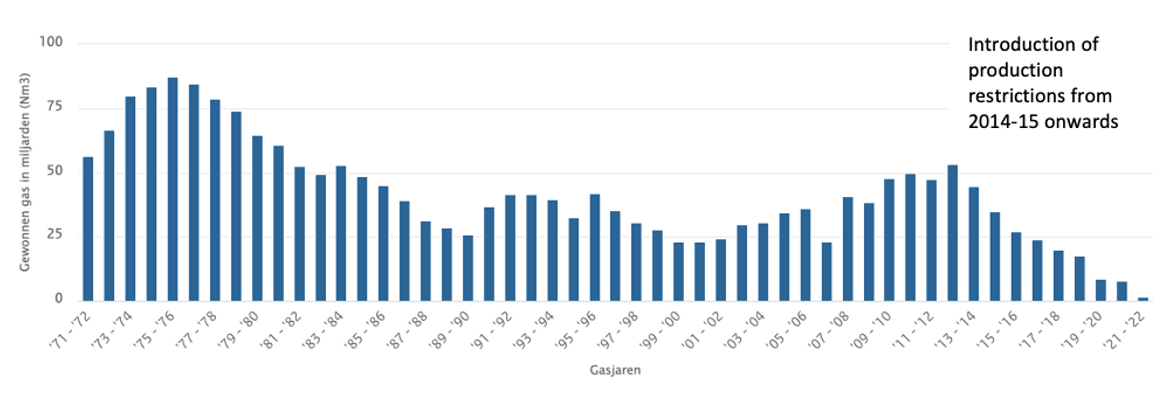

Groningen. Finally, as we have discussed in more detail in a separate note, Europe could fully or largely replace remaining Russian gas volumes by increasing production at the Groningen field, which has reserves of 450 bcm and ran at 50 bcma in the last year before production was restricted. Production has been restricted as a result of social discontent with property damage from subsidence, exacerbated by company obstruction in paying compensation. But, as we point out, at current gas prices, the additional revenues, which can be paid to the local region, are sufficient to compensate and reward Groningen for taking additional seismic risk. For instance, the additional revenues from 6 months of production at a historically modest 2 bcma per month would be sufficient to buy the entire residential housing stock of Groningen at market prices.

Chart 11: Groningen’s annual production, bcma

Source: NLOG

Downside Risk to Gas Prices

Our view is that the market has got its pricing of European gas and power wrong: the market is pricing a crisis, but there is no crisis. Europe has multiple options to close any supply gap this winter from Russia cutting off its remaining gas supply, including high storage, reduced gas demand and gas supply from other sources.

Here we highlight three downside risks.

Warm winter. Gas demand is closely correlated with temperature. Consequently the tightness in the European gas market is heavily dependent on the risk of a cold winter which drives a strong 22/23 winter draw. But if Europe has a warm winter, with a winter draw in the 300-350 TwH range, as in 2014-15 and 2011-12, it would exit the heating season with around 700 TwH, ie storage over 2/3rds full. Admittedly these weak winter draws reflected a time when Dutch production was higher, before the winding down of Groningen. But even an average winter draw, similar to 2019/20, of 550-600 TwH would leave storage levels in spring 2023 nearly twice the 2022 spring trough.

Substitution of gas in power. Europe has had bad luck this summer in the power sector. Low rainfall has hindered hydro power generation, river transport – often used to transport fuel – and power plant cooling, and a large portion of the French nuclear fleet has been down for repairs, so the call on gas in power has remained robust despite the record prices, and this has amplified the impact of high gas prices by driving electricity prices up to record levels too. However, the risks are biased against this situation persisting, with stronger autumn winds and heavier rainfall, a return of some of the offline French nuclear fleet, and the firing up of idle coal and lignite plants likely to reduce the use of gas in power.

Double impossibility. At the moment, market pricing for gas and power – staying at record levels for years – does not looks coherent. In fact we think it looks incoherent in both economic and energy terms. In macro terms, if current energy forwards are realised, inflation will surge further, squeezing disposable income and driving a recession, even as the higher implied inflation likely drives further tightening from the ECB. Such a recession would then reduce energy demand and lower prices for energy. And in energy terms, at these extraordinary prices – with gas 4-5 times more expensive than oil – we would expect to see broad substitution of gas with other fuels, resulting in deep destruction of gas demand.

In our view, the main risk in this situation is complacency. European governments have policy room to dispense with Russian gas immediately, provided they are prepared to be bold and respond adequately to the changed circumstances. However, this implies a willingness to adjust, which has not yet always been evident – for instance, we think the Dutch should keep the Groningen field pumping and the Germans should keep their nuclear plants on until the energy crisis is past, but so far both governments have stuck to their existing policy of phasing them both out at the end of this year.

Why is the market pricing a crisis?

If gas and power are overpriced, and the balance of risks is to the downside, since Russia’s threat to drive disruption by cutting off gas supplies is increasingly a hollow threat, and Europe can now manage without Russian gas, why is the market pricing a crisis, at over 10 times normal prices for gas and electricity in Q3 2022, extreme volatility, and prices staying at current elevated levels for years?

Probably the main reason is the grip of an established narrative. Analysts and traders are used to seeing Russian gas as indispensable to the European gas market, and may continue to believe this until Europe has survived the real world test of a winter. However, this belief ignores how the underlying shifts in supply and demand have already supported a strong storage build, which should allow Europe to cover a cold winter and a Russian gas cutoff.

In our view, the extreme recent movements in markets – with daily price swings of over 10%, and prices which are over 10x average levels, and far in excess of prices required to incentivise additional supply – are suggestive of market manipulation, and warrant further investigation by regulators. We see two potential sources of risks. First, fixed income and commodities markets are often dominated by a small group of well-informed leveraged speculators. Since the rest of the market often takes its lead from this group, it can be a profitable strategy for this group to exaggerate a trend, before exiting at a profit. As a result, market pricing can often be more extreme than a neutral best estimate, since unjustified pricing – and a profitable trade – can continue for some time until a theory is corrected by hard facts. The second is the risk that Russian-controlled funds are taking a position in European energy markets for political reasons, to drive higher energy prices and put more pressure on European governments to withdraw their support for Ukraine. And relatively small trades can have a disproportionate impact in thin markets.

Recap: Europe on track for a rapid and smooth adjustment, yet markets pricing a crisis

Markets are pricing a long and hard energy crisis in Europe, which would drive inflation higher and likely lead to a recession. But this is at odds with the facts: the volume adjustment in European gas markets is going well, with other sources of supply up strongly, especially LNG, demand down markedly, and the EU on track for a strong storage build, adequate to cover the winter draw and a Russian gas cutoff. As a result, Europe is now close to being able to dispense with Russian gas, depriving Russia of its ability to blackmail Europe using the gas weapon and of its gas export earnings, which could be worth over $40 bn over the winter at current prices – particularly if the Dutch decide to tap Groningen until the energy crisis is over.