- Kyiv School of Economics

- About the School

- News

- 75th issue of the regular digest on impact of foreign companies’ exit on RF economy

75th issue of the regular digest on impact of foreign companies’ exit on RF economy

3 April 2025

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors; 06.03.2025-03.04.2025

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

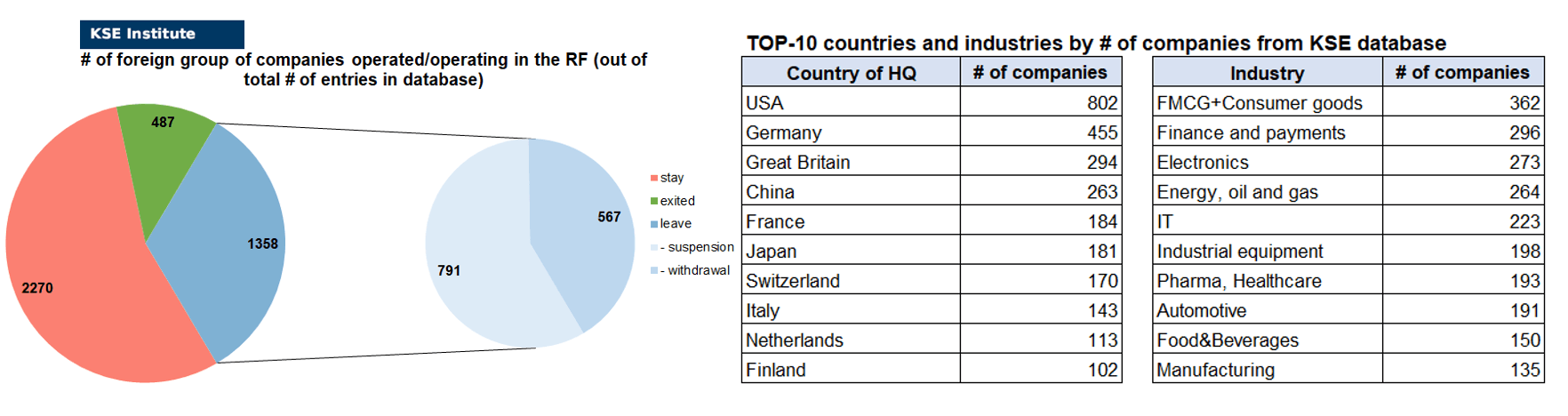

KSE DATABASE SNAPSHOT as of 03.04.2025

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 270² (+7 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 358 (+1 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 487 (+6 per month)

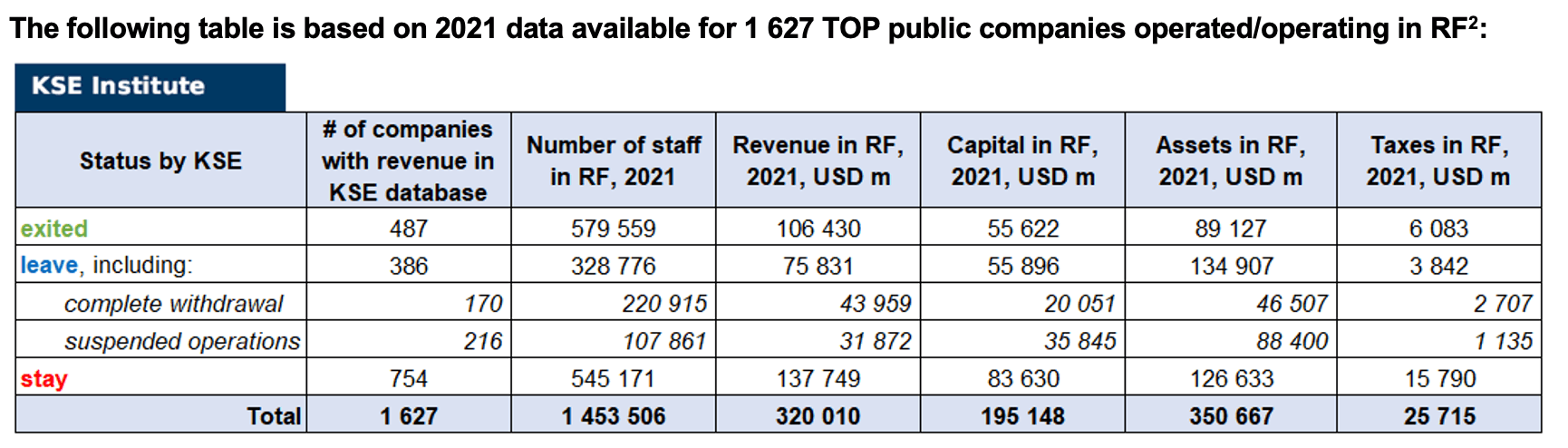

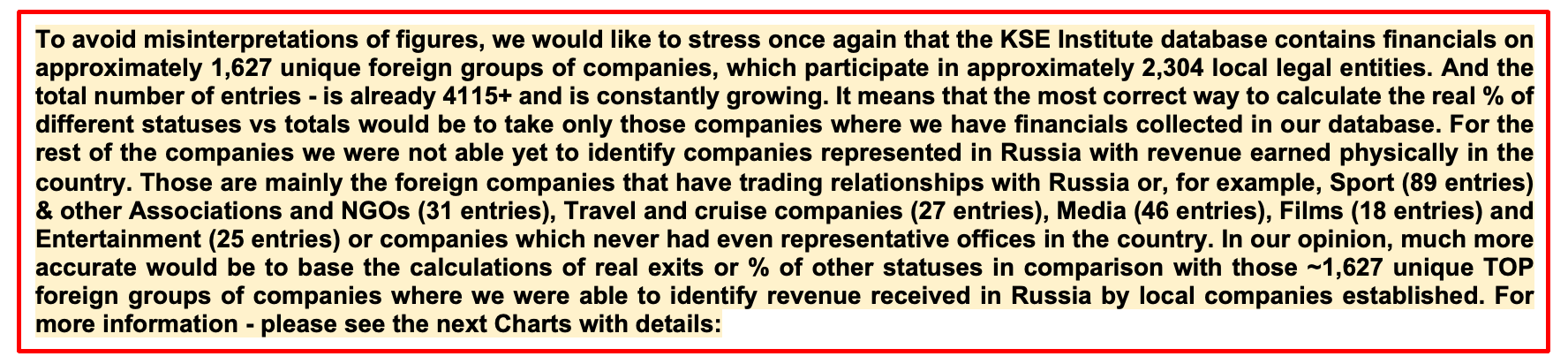

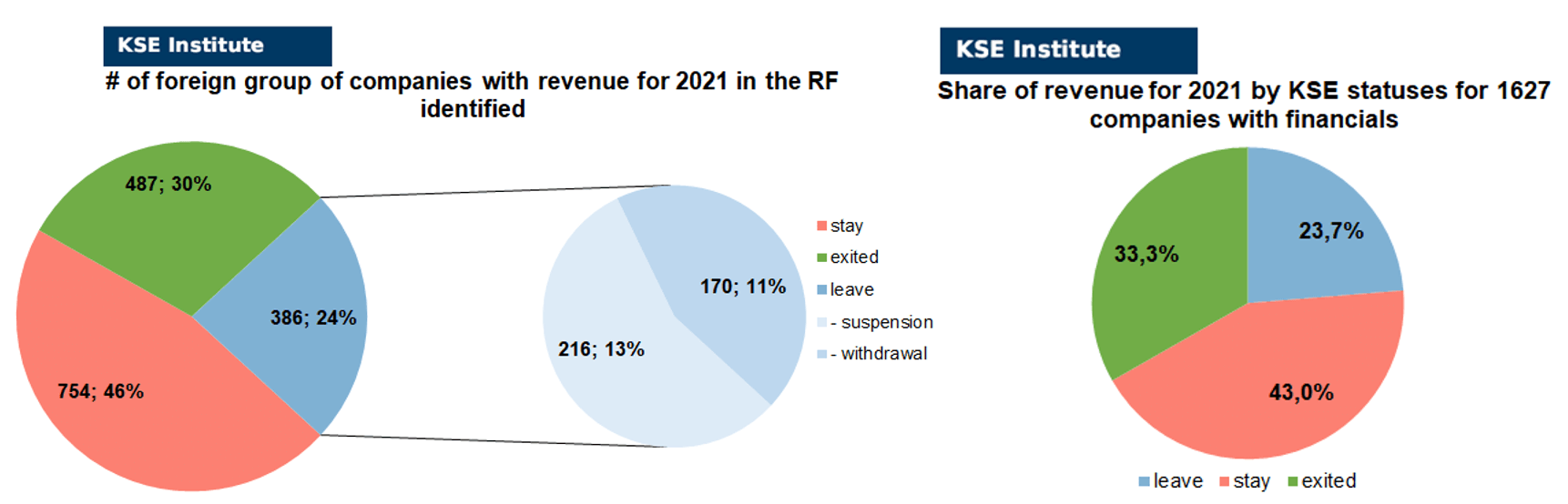

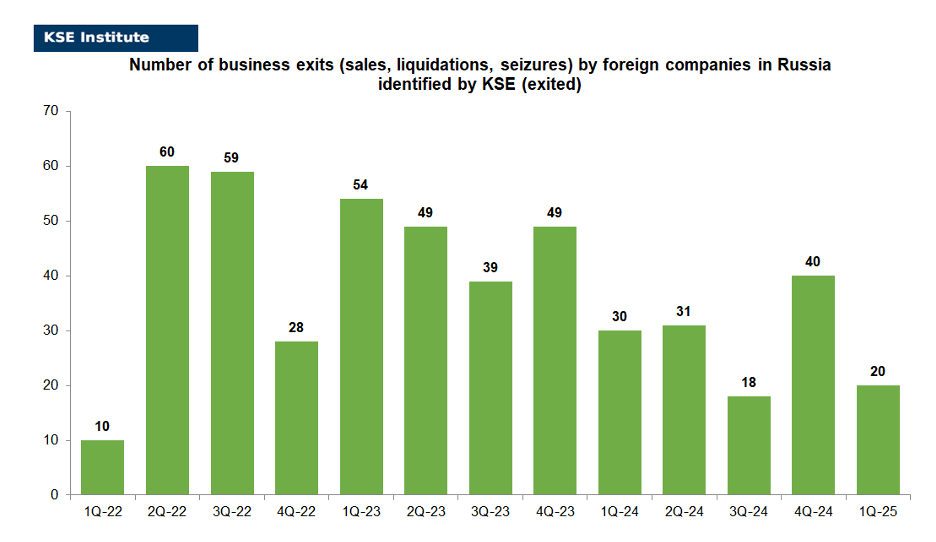

As of April 3, 2025, we have identified about 4,115 companies, organizations and their brands from 108 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1’627 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $195.1 billion), local revenue (about $320.0 billion), local assets (about $350.7 billion) as well as staff (about 1.454 million people) and taxes paid (about $25.7 billion). 1,358 foreign companies have suspended or ceased operations in Russia. Also, we added information about 487 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (2 business sales, and 4 business liquidations took place in March 2025).

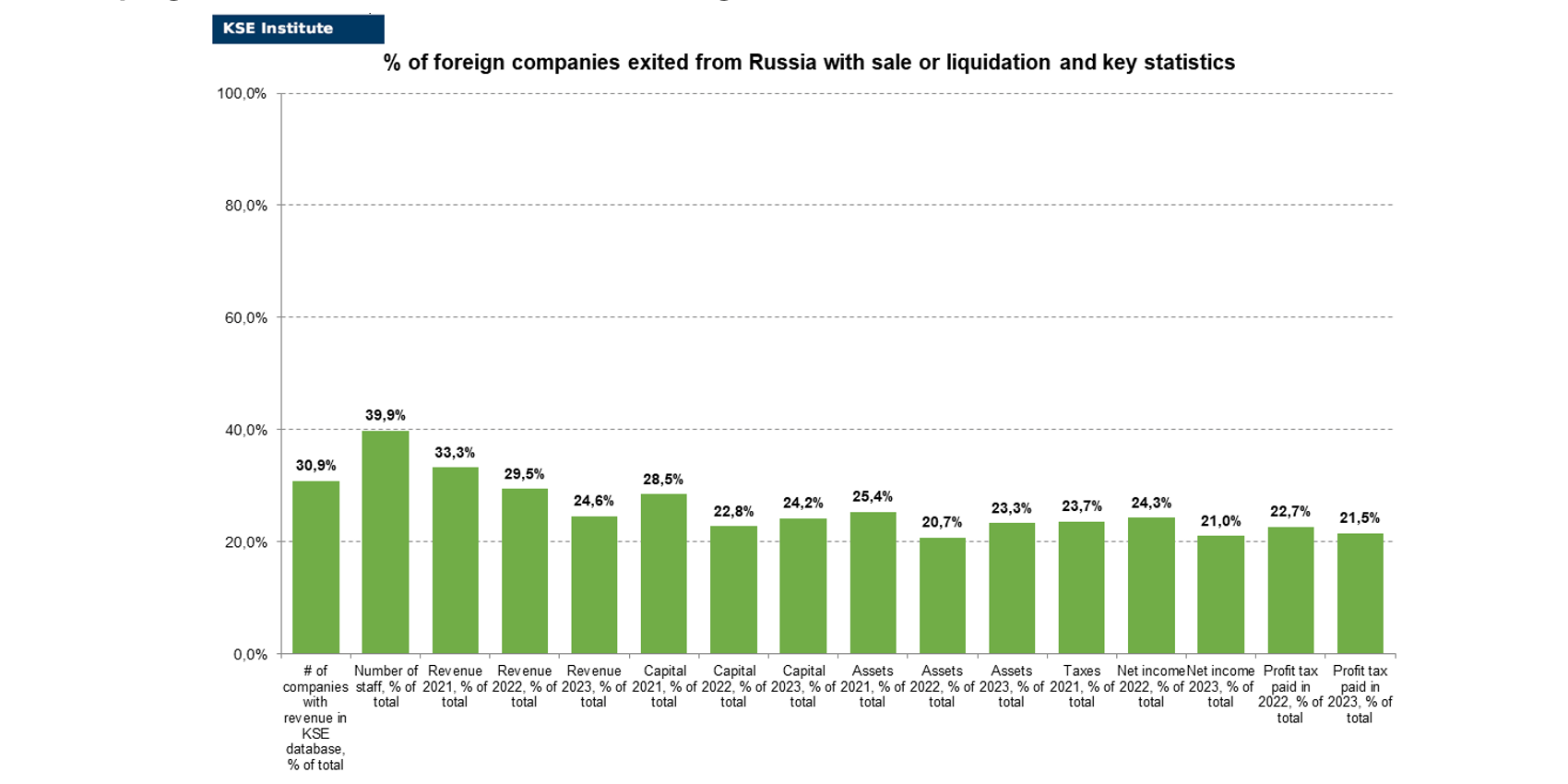

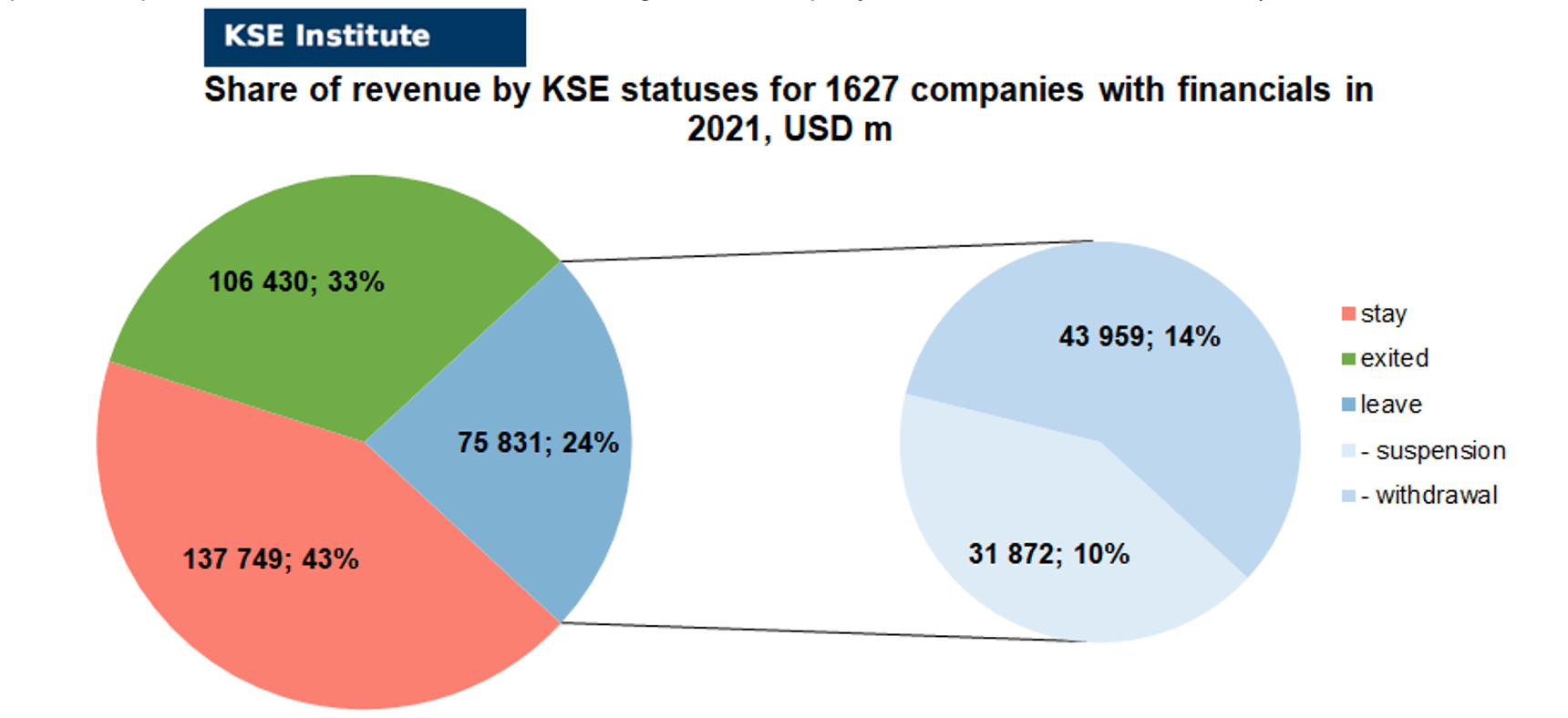

As can be seen from the tables below, as of April 3, 2025, 487 companies which had already completely exited from the Russian Federation, in 2021 had at least 579,600 personnel, $106.4 bn in annual revenue, $55.6bn in capital and $89.1bn in assets; companies, that declared a complete withdrawal from Russia had 220,900 personnel, $44.0bn in revenues, $20.1bn in capital and $46.5bn in assets; companies that suspended operations on the Russian market had 107,900 personnel, annual revenue of $31.9bn, $35.8bn in capital and $88.4bn in assets.

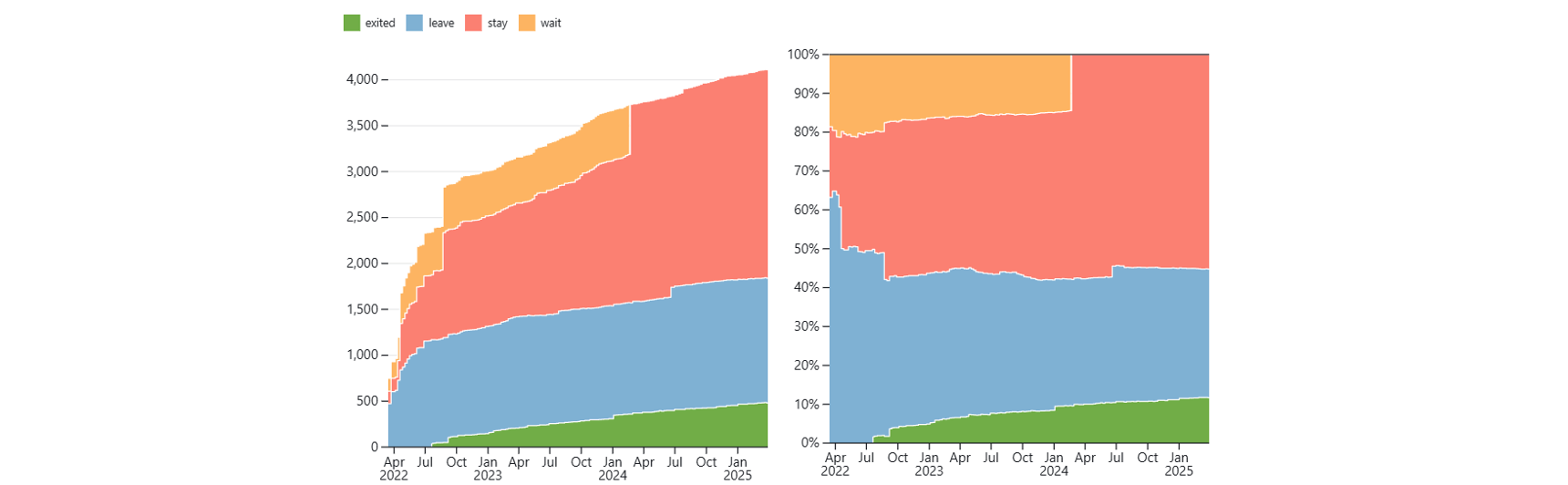

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 31 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 14 were added in March 2025). However, if to operate with the total numbers in KSE database, about 33.0% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 55.2% are still remaining in the country and only 11.8% made a complete exit³

At the same time, it is difficult not to overestimate the impact on the Russian economy of 487 companies that completely left the country, since in 2021 they employed 39.9% of the personnel employed in foreign companies, the companies owned about 25.4% of the assets, had 28.5% of capital invested by foreign companies, and in 2021 they generated revenue of $106.4 billion or 33.3% of total revenue and paid ~$6.1 billion of taxes or 23.7% of total taxes paid by the companies observed. Data on 1,627 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (30%) and on share of revenue withdrawn (33.3%). At the same time, a bit different picture is for those who are still staying – 46% of companies represent 43.0% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit). Also, migration of statuses in June 2024 made its effect as well as adding quite a lot of new companies in July 2024 and each month.

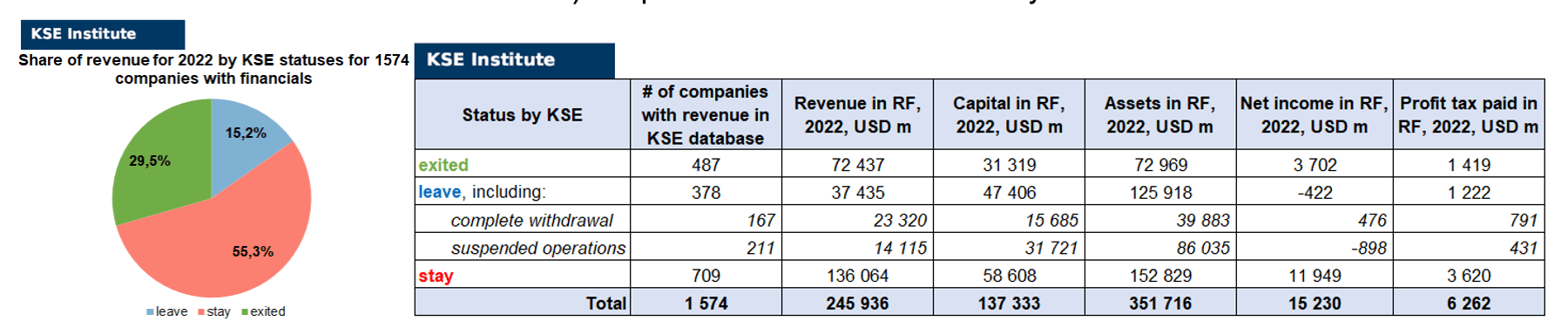

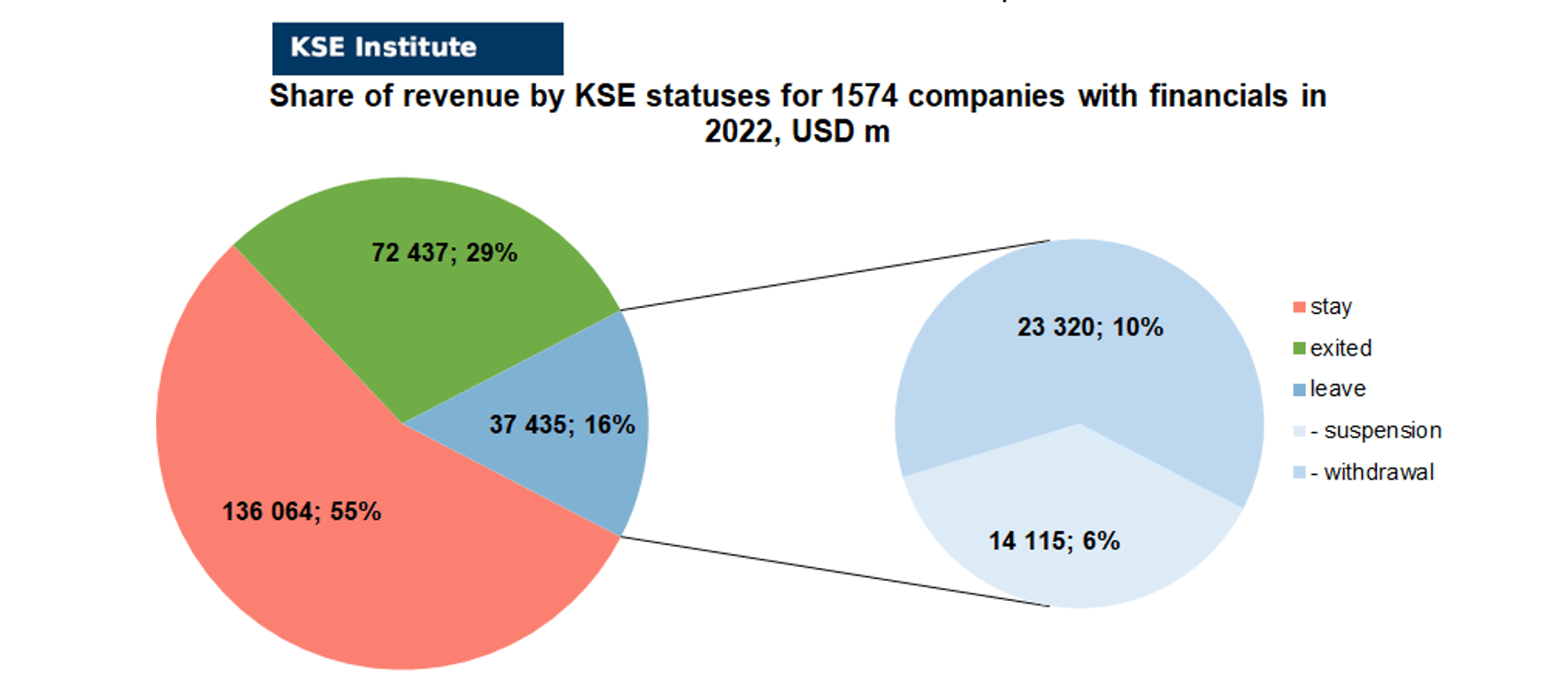

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1574 companies (about 50 companies the data of which we have collected previously have not provided their reporting, we also added revenue data for about 30 banks) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 3.8% less of revenue in 2022 (29.5% from total volume) than in 2021 (33.3% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-8.5%) revenue in 2022 (15.2% from total volume) than in 2021 (23.7% from total volume). At the same time, staying companies were able to generate much (+12.3%) more revenue in 2022 (55.3% from total volume) than in 2021 (43.0% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($351.7bn⁴ in 2022 vs $350.7bn in 2021) and would even probably increase if the remaining reporting for ~70-80 companies could be obtained (until companies decide not to disclose it). KSE Institute in September 2024 has published a study entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551.

On January 13, 2025 the new research was published by the B4Ukraine coalition in collaboration with the Kyiv School of Economics and Squeezing Putin which reveals how foreign businesses, including many household names, continue to channel billions in taxes to the Russian state nearly three years into its war on Ukraine. The report named “Corporate Enablers of Russia’s War in Ukraine: A Closer Look at Multinational Taxes and Revenue in Russia in 2023” calls on companies to make a swift responsible exit from the Russian market and urges the G7 and allied countries to establish standards for corporate behavior, promoting immediate exits from the Russian market.

Also, at the end of February 2025, the KSE Institute published the study “Assessing foreign companies’ direct losses in Russia: financial impact, market consequences, and strategic adjustments” where, among other things, we estimated that Foreign businesses’ direct losses in Russia exceed $170 billion due to write-offs, seizures, unfair court rulings, and exit taxes. You can download its full text in English here: https://kse.ua/wp-content/uploads/2025/03/KSE_Assessing-Foreign-Companies-Losses-in-Russia.pdf

Analysis of data for 2023

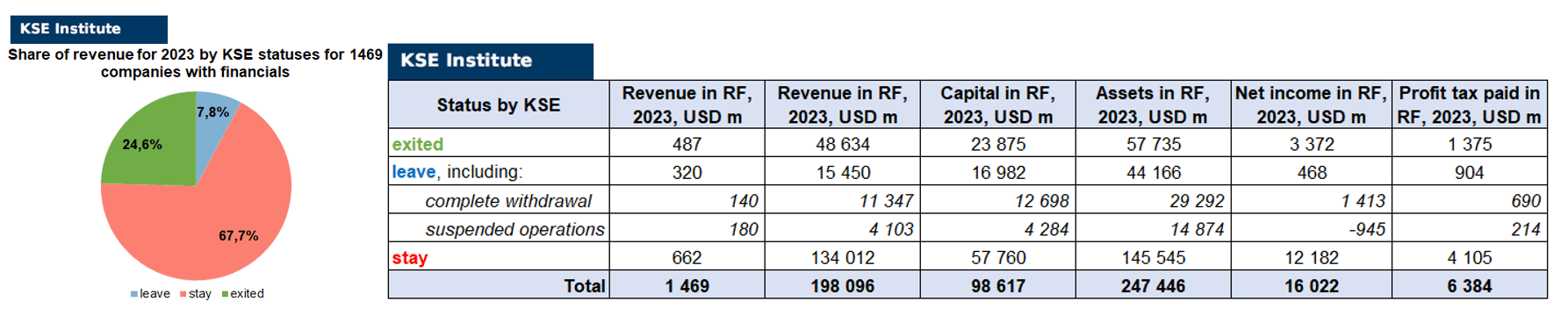

KSE Institute has already collected and preliminarily analyzed data on revenue, capital, assets and net income (profit or loss) in 2023 for ~1469 companies (after it was allowed legally in 2023 about 200 companies the data of which we have collected previously have not provided their reporting and also about 290 companies reported 0 values in revenues). Also, it should be noted that as we convert RUB to USD – the devaluation effect was quite significant, Ruble depreciated in 2023 by more than 24%, from 68.4869 RUB/USD in 2022 to 85.163 RUB/USD in 2023). Please see below charts with the detailed analysis:

As you can see, there is a significant redistribution in revenue allocation based on KSE statuses happened in 2023: share of “exited” has dropped by -8.7% vs 2021 and -4.9% vs 2022 (from 33.3% in 2021 and from 29.5% in 2022 to 24.6% in 2023) which is explained by the fact that more and more companies are being liquidated and those one which were sold are usually not able to generate the previous level of revenue.

Share of companies with status “leave” has dropped even more, by -15.9% vs 2021 and -7.4% vs 2022 (from 23.7% in 2021 and from 15.2% in 2022 to 7.8% in 2023) which is explained by the fact that those companies which are leaving are not concentrated in revenue generation on the Russian market anymore.

As for companies with status “stay” – we see the opposite picture there, they are using momentum to take market share of those who are leaving or left (especially in automotive sector) and are generating comparable with previous years level of revenue: +24.7% vs 2021 and +12.4% vs 2022 (from 43.0% in 2021 and from 55.3% in 2022 to 67.7% in 2023).

MONTHLY FOCUS: On leaving the Russian Federation. Results of March 2025

In this digest, we will summarize the results of March 2025 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’627 companies identified in the KSE database with revenue data available of about $320 billion in 2021 and $245.9 billion in 2022 (which dropped to ~$198.1 billion in 2023). And at least 487 of them have already been sold by local companies or were liquidated and left the Russian market. In March 2025 KSE Institute identified +6 new exits (2 business sales, and 4 liquidations took place in March 2025), total number of exits observed since the beginning of Russia’s invasion reached 487. Also, 7 more liquidations of companies which were marked as exited before happened in March 2025, namely: CNH Industrial, Continental, Inchcape, Kingspan, Lufthansa Technik, Scania and UPS.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 33% based on revenue allocation, those who are leaving represent 24% of total revenue (with 42% share of suspensions and 58% of withdrawals sub-statuses), % of staying companies represent 43% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is less than % of leaving ones (which means that about 57% (!) of pre-invasion revenue generated by foreigners is leaving or already left Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 29% based on revenue allocation, those who are leaving represent only 16% of total revenue (with 38% share of suspensions and 62% of withdrawals sub-statuses), % of staying companies represent 55% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022-2023 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

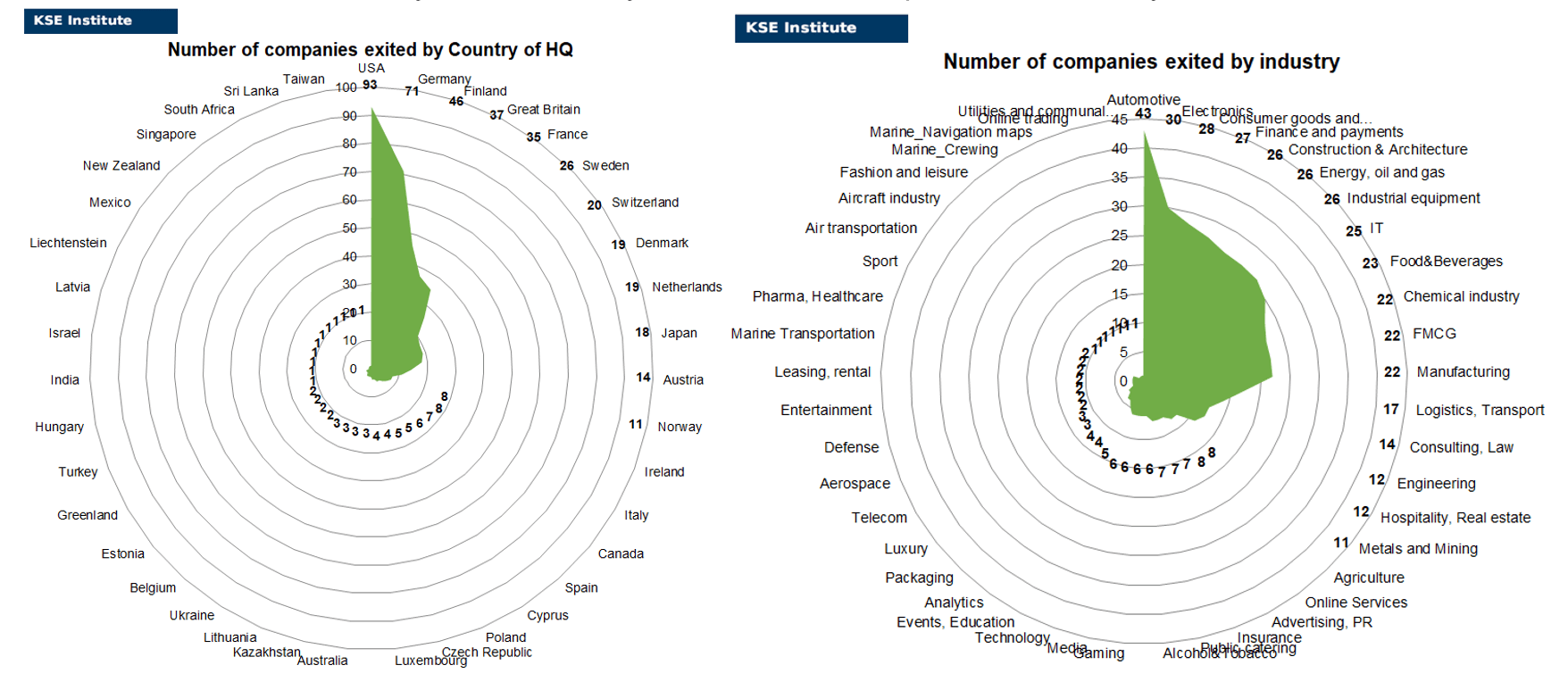

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of March 2025, companies from 39 countries and 45 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain, France and Sweden and operated in the “Automotive”, “Electronics”, “Consumer goods and closing”, “Finance and payments”, “Construction & Architecture”, “Energy, oil and gas”, “Industrial equipment” and “IT” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Biesterfeld (liquidated), GKN (liquidated), Nordson (liquidated) and Roland Berger (liquidated). Also, 2 business sales were accounted for in March 2025: Aliaxis Deutschland (missed earlier) and Sierentz Global Merchants (Steppe Agroholding acquired full control of RZ Agro, which it previously shared with members of the French family of global grain trader Louis Dreyfus). Additionally, 7 more liquidations of companies which were marked as exited before happened in March 2025, namely: CNH Industrial, Continental, Inchcape, Kingspan, Lufthansa Technik, Scania and UPS. Also, in the beginning of April it was announced that Goldman Sachs would sell Russian shares to Balchug Capital.

To read more details on 32 identified cases of full and partial business seizures in Russia – please read our new study named “Assessing foreign companies’ direct losses in Russia: financial impact, market consequences, and strategic adjustments”.

The next review of deals for April 2025 will be available in a month.

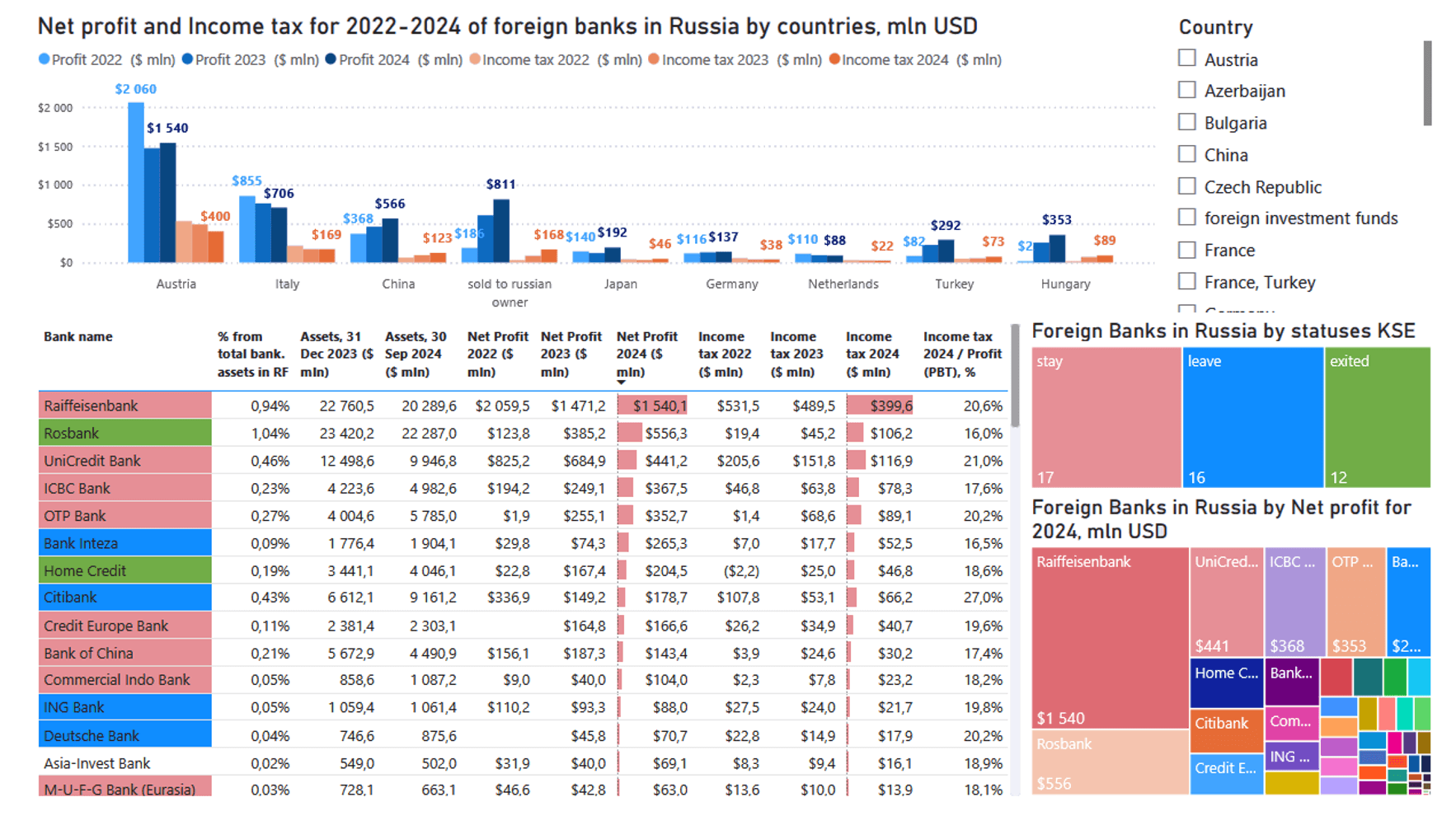

SPECIAL EDITION: Reporting update on the foreign banks in Russia for 12M2024

KSE Institute collected and pre-processed the available reporting data for 12M2024 of foreign banks in Russia.

For the convenience of users, aggregated data are presented in new dashboard on the site https://leave-russia.org/banks:

Data on Net profit as of 31.12.2024 and Assets as of 30.09.2024:

|

Bank name |

Assets as of 30.09.24, RUB billion |

% in total assets |

Profit for 12M2023, RUB billion |

% in total profit for 12M2023 |

Profit for 12M2024, RUB billion |

% in total profit for 12M2024 |

|

|---|---|---|---|---|---|---|---|

| Raiffeisenbank | 1 881.1 | 1.01% | 125.3 | 3.72% | 142.5 | 3.53% | |

| UniCredit Bank | 922.2 | 0.49% | 58.3 | 1.73% | 40.8 | 1.01% | |

| OTP Bank | 536.3 | 0.29% | 21.7 | 0.64% | 32.6 | 0.81% | |

| ICBC Bank | 462.0 | 0.25% | 21.2 | 0.63% | 34.0 | 0.84% | |

| Bank of China | 416.4 | 0.22% | 16.0 | 0.47% | 13.3 | 0.33% | |

| Credit Europe Bank | 213.5 | 0.11% | 14.0 | 0.42% | 15.4 | 0.38% | |

| China Construction Bank | 114.7 | 0.06% | 1.0 | 0.03% | 3.7 | 0.09% | |

| Commercial Indo Bank | 100.8 | 0.05% | 3.4 | 0.10% | 9.6 | 0.24% | |

| Sumitomo Mitsui | 96.0 | 0.05% | 3.3 | 0.10% | 4.6 | 0.12% | |

| KEB HNB Bank | 75.1 | 0.04% | 1.0 | 0.03% | 1.1 | 0.03% | |

| Denizbank Moscow | 71.8 | 0.04% | 2.7 | 0.08% | 4.7 | 0.12% | |

| M-U-F-G Bank (Eurasia) | 61.5 | 0.03% | 3.6 | 0.11% | 5.8 | 0.14% | |

| Credit Suisse | 34.9 | 0.02% | 0.5 | 0.01% | 1.5 | 0.04% | |

| Woori Bank | 33.2 | 0.02% | 0.4 | 0.01% | 3.0 | 0.07% | |

| Mizuho Bank | 32.5 | 0.02% | 1.2 | 0.04% | 3.3 | 0.08% | |

| Agricultural Bank of China | 25.5 | 0.01% | 1.0 | 0.03% | 1.4 | 0.04% | |

| UBS Bank | 3.7 | 0.00% | -0.5 | -0.01% | 0.0 | 0.00% | |

| Foreign banks with Stay | 5 081.2 | 2.72% | 274.2 | 8.14% | 317.4 | 7.86% | |

| Total, banking system | 187 121.0 | 100% | 3 368.5 | 100% | 4 039.0 | 100% | |

As you can see from the above information:

• Banks with status Stay as of 30.09.2024 occupy about 2.72% (vs 3.03% as of 31.03.2024 and 2.41% as of 31.03.2024) of all assets of the banking system (Raiffeisenbank – 1.01%, UniCredit – 0.49%, OTP Bank – 0.29%, ICBC – 0.25%, Bank of China – 0.22%);

• Banks with status Stay earned 15.73% more net profit in 12 months of 2024 than in 12 months of 2023. At the same time, the share of profit compared to all banks fell slightly from 8.14% in 2023 to 7.86% in 2024 with a share of 2.72% in all assets.

Comparison of the growth of assets of banks with status Stay with the entire banking system:

| Indicator | 30.09.2023 | 31.03.2024 | 30.06.2024 | 30.09.2024 |

| Assets of the banking system of Russia, billion rubles | 158 994 | 172 141 | 176 676 | 187 121 |

| Assets of foreign banks with status Stay, billion rubles | 4 579 | 5 220 | 4 264 | 5 081 |

| Number of foreign banks with status Stay | 21 | 19 | 18 | 17 |

| Share of banks with status Stay, % | 2.88% | 3.03% | 2.41% | 2.72% |

• Порівняння чистого прибутку банків зі статусом Stay з всією банківською системою:

| Indicator | 1 half of 2023 | 9 months 2023 | 1 half of 2024 | 9 months 2024 | 12 months 2024 |

| Profit of the banking system of Russia, billion rubles | 1 692 | 2 667 | 1 829 | 2 632 | 4 039 |

| Profit of foreign banks with status Stay, billion rubles | 105 | 162 | 134 | 211 | 317 |

| Share of banks with status Stay, % | 6.20% | 6.06% | 7.32% | 8.01% | 7.86% |

• As we can see, the share of net profit of foreign banks with status Stay decreased slightly in 12 months of 2024 to 7.86% compared to 9 months of 2024 (from 8.01%), but increased significantly compared to previous periods – even with the exit of Citigroup from this group.

• At the same time, overall, the profit of the Russian banking system increased significantly in 2024 (to 4’039 billion rubles) compared to 2023 (3’368.5 billion rubles), and foreign banks are still quite profitable and paid a total of about $1.3 billion in income tax in 2024.

• It can be separately noted that the average ruble exchange rate depreciated by 8.6% in 2024, from 85.163 Russian rubles/US dollar in 2023 to 92.5212 Russian rubles/US dollar in 2024.

You will find more details in the dashboards from KSE Institute: https://leave-russia.org/banks

What’s new last month – key news from Daily monitoring

(updated on a monthly basis) ⁶

03.03.2025

*Check Point Software (Israel, IT) Status by KSE – stay

*Fortinet (USA, IT) Status by KSE – stay

In 2024, devices from Check Point Software Technologies worth more than $3 million were imported into Russia, along with approximately $1 million worth of products from this company’s competitor, Fortinet.

*Knauf Gips (Germany, Construction & Architecture) Status by KSE – leave

The Rotenberg brothers wanted to buy the assets of the largest manufacturer of building materials that left Russia

*AliExpress (China, Consumer goods and clothing) Status by KSE – stay

The Chinese marketplace AliExpress has banned Russians from ordering a number of computer components, including DDR4 and DDR5 RAM and M.2 solid-state drives (SSDs).

*Toyota (Japan, Automotive) Status by KSE – leave

The media of the aggressor country wrote about some kind of meeting, where they discussed the company’s prospects for operating in the Russian market and possible ways to resume cooperation.

https://nv.ua/ukr/auto/news/toyota-rozglyadaye-povernennya-na-rosiyskiy-rinok-roszmi-50494585.html

*The World Bank (USA, Finance and payments) Status by KSE – leave

Washington Conference on Public Sector Digitalization to Consider Applications from Russian Participants

https://www.kommersant.ru/doc/7550348

*Visa (USA, Finance and payments) Status by KSE – leave

The Visa payment system, which withdrew from the Russian market in March 2022, has not yet made any decisions on resuming operations in Russia.

https://epravda.com.ua/finances/koli-visa-vidnovit-robotu-v-rosiji-803893/

05.03.2025

*Goldman Sachs (USA, Finance and payments) Status by KSE – leave

*JPMorgan (USA, Finance and payments) Status by KSE – leave

Goldman Sachs and JPMorgan offer investors ruble-linked derivatives

06.03.2025

*Aliaxis Deutschland (USA, Food & Beverages) Status by KSE – leave

The Prosecutor General’s Office filed a lawsuit against the American Universal Beverage Company, which owns the canned food manufacturer Glavprodukt.

https://www.rbc.ru/business/06/03/2025/67c9510d9a794728caaa2687

*Airbus (Netherlands, Aircraft industry) Status by KSE – stay

*Boeing (USA, Aircraft industry) Status by KSE – leave

Foreign planes have one year left to fly in Russia

https://www.moscowtimes.ru/2025/03/05/inostrannim-samoletam-vrossii-ostalos-letat-odin-god-a157140

*SOCAR (Azerbaijan, Energy, oil and gas) Status by KSE – stay

SOCAR, the State Oil Company of Azerbaijan, Kazakhstan’s “KazMunayGas, Russia’s “Tatneft,” and Uzbekistan’s “Uzbekneftegaz” have signed quadrilateral and bilateral documents on the sidelines of the international conference on “Digitalization, Industrial Safety, and Procurement in the Energy Sector”

07.03.2025

*International Council for the Exploration of the Sea (ICES) (Denmark, Association, NGO) Status by KSE – leave

The Russian Federation has officially notified the International Council for the Exploration of the Sea (ICES) of its decision to withdraw following a temporary suspension imposed in 2022 due to Russia’s invasion of Ukraine.

*Tether (China, Finance and payments) Status by KSE – stay

Russian cryptocurrency exchange Garantex said on Thursday that stablecoin Tether had blocked digital wallets on its platform holding more than 2.5 billion rubles ($28 million), forcing it to suspend operations days after it was hit with EU sanctions.

https://finance.yahoo.com/news/sanctioned-russian-crypto-exchange-suspends-130334622.html

*Euroclear (Belgium, Finance and payments) Status by KSE – stay

European Company That Seized $200 Billion of Russia’s Money Hired Bodyguards to Protect It from Kremlin Agents

*Maxar Technologies (USA, Aerospace) Status by KSE – stay

US revokes Ukraine’s access to some types of satellite surveillance

*Aliaxis Deutschland (Germany, Construction & Architecture) Status by KSE – exited

Poliplastic Group acquired 65% of the supplier of plastic pipes and fittings AMS Pro

08.03.2025

*Mondelez (USA, Food & Beverages) Status by KSE – stay

Oreo-Maker Mondelez Turns to New SEC Guidance to Quiet Call for Russia Transparency

*Lufthansa (Germany, Air transportation) Status by KSE – leave

Lufthansa ‘Hopes’ for Russia Airspace Reopening

https://airlinegeeks.com/2025/03/07/lufthansa-hopes-for-russia-airspace-reopening/

*OTP Bank (Hungary, Finance and payments) Status by KSE – stay

Hungary’s biggest bank, OTP Bank boosted its business with Russia last year, helping to bolster its profits, as rival European lenders came under increasing pressure to pare back their ties with Moscow due to its war in Ukraine.

10.03.2025

*Eutelsat (France, Telecom) Status by KSE – stay

French satellite operator Eutelsat still broadcasts EU-sanctioned Russian TV, radio

*University of South Africa (Unisa) (South Africa, Events, Education) Status by KSE – stay

The University of South Africa has signed a memorandum of understanding with its two Russian counterparts to enhance student mobility programmes, joint research and shared teaching methodologies.

https://www.enca.com/videos/discussion-unisa-signs-language-pact-russian-universities

11.03.2025

*Siemens (Germany, Electronics) Status by KSE – exited

*Adidas (Germany, Consumer goods and clothing) Status by KSE – leave

*Volkswagen (Germany, Automotive) Status by KSE – exited

*Robert Bosch (Germany, Electronics) Status by KSE – exited

*Trumpf (Germany, Industrial equipment) Status by KSE – stay

“Under no circumstances”: the largest German companies are not going to return to Russia

https://epravda.com.ua/svit/naybilshi-nimecki-kompaniji-ne-zbirayutsya-povertatisya-v-rf-804239/

*Analog Devices (USA, Electronics) Status by KSE – stay

*Texas Instruments (USA, Electronics) Status by KSE – exited

*Maxim Integrated (USA, Electronics) Status by KSE – stay

*Microchip Technology (USA, IT) Status by KSE – leave

*Micron (USA, IT) Status by KSE – leave

*NXP USA, Inc. (USA, Electronics) Status by KSE – stay

*Xilinx (USA, IT) Status by KSE – stay

*Qorvo (USA, Telecom) Status by KSE – stay

*ON Semiconductor (USA, Electronics) Status by KSE – exited

*Infineon (Germany, Electronics) Status by KSE – exited

Investigation: We tried to buy American chips as a Russian defense manufacturer — and it worked

12.03.2025

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Russian court to hear Raiffeisen appeal over 2 billion euro penalty on April 24

*Kazzinc (Kazakhstan, Metals and Mining) Status by KSE – stay

*Kazchrome (Kazakhstan, Metals and Mining) Status by KSE – stay

Russian manufacturer of control and technical diagnostics devices INTRON PLUS plans to conclude agreements with two large companies in Kazakhstan this year.

https://en.trend.az/business/4016407.html

*Engie (France, Energy, oil and gas) Status by KSE – stay

*Europol Gaz (Poland, Energy, oil and gas) Status by KSE – stay

*OMV (Austria, Energy, oil and gas) Status by KSE – exited

*CEZ (Czech Republic, Energy, oil and gas) Status by KSE – stay

European energy companies have filed lawsuits against Gazprom, demanding a total of 18 billion euros in compensation for the suspension of gas supplies.

https://www.pravda.com.ua/eng/news/2025/03/11/7502290/

*Indústrias Nucleares do Brasil (Brazil, Energy, oil and gas) Status by KSE – stay

INB signs contract with Russian company for conversion and enrichment of uranium produced in Caetité

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

A new investigation by BankTrack and B4Ukraine reveals that a subsidiary of Austria’s Raiffeisen Bank International remains invested in numerous sanctioned Russian entities—including Gazprom, Sberbank, and Russia’s Ministry of Finance.

14.03.2025

*Sinopec Limited (China Petroleum & Chemical Corporation) (China, Chemical industry) Status by KSE – leave

*PetroChina (China, Energy, oil and gas) Status by KSE – stay

*China National Offshore Oil Corporation (CNOOC Group) (China, Energy, oil and gas) Status by KSE – stay

China state firms curb Russian oil imports on sanctions risks, sources say

*airBaltic (Latvia, Air transportation) Status by KSE – leave

AirBaltic denies accusations of purchasing Russian fuel

15.03.2025

*Siemens (Germany, Electronics) Status by KSE – exited

A German court has decided to launch a criminal trial against two former executives of German engineering giant Siemens who are accused of violating sanctions by helping export Siemens gas turbines to Russian-occupied Crimea

16.03.2025

*PokerStars (Ireland, Gaming) Status by KSE – leave

PokerStars has announced that it will be transferring its Russian online poker players to an independent, third-party site in early April, effectively declaring its withdrawal from the Russian poker market.

17.03.2025

*683 Capital Partner (USA, Finance and payments) Status by KSE – stay

Vladimir Putin issued an order allowing the American hedge fund 683 Capital Partners LP to acquire securities of Russian joint-stock companies owned by a number of foreign funds; the corresponding order was published on the portal of regulatory legal acts.

*Sierentz Global Merchants (Switzerland, Agriculture) Status by KSE – exited

The head of the company RZ Agro, controlled by the Steppe agroholding, has been replaced

18.03.2025

*Etihad Airways (United Arab Emirates, Air transportation) Status by KSE – stay

Etihad Airways is strengthening its connections to the Middle East and Russia with a third daily flight to Moscow and a new flight to Sochi, offering more travel options for travelers around the world.

*Reliance (India, Energy, oil and gas) Status by KSE – stay

Reliance exported Rs 6,850 cr worth of fuel from Russian oil to US

*SMBC Aviation Capital (Ireland, Air transportation) Status by KSE – leave

SMBC Aviation Capital receives $445m settlement for terminated Russian contracts

*JPMorgan (USA, Finance and payments) Status by KSE – leave

*683 Capital Partner (USA, Finance and payments) Status by KSE – stay

Putin permits sale of some Russian stocks, but not for JEMA

https://quoteddata.com/2025/03/putin-permits-sale-of-some-russian-stocks-but-not-for-jema/

*OTP Bank (Hungary, Finance and payments) Status by KSE – stay

OTP is expanding in Russia as rivals scale back amid sanctions

https://www.thebanker.com/content/e33a634a-1ac2-4589-8683-777b5d6d7dfd

19.03.2025

*Nissan (Japan, Automotive) Status by KSE – exited

*Decathlon (France, Consumer goods and clothing) Status by KSE – exited

*Robert Bosch (Germany, Electronics) Status by KSE – exited

*Otis Worldwide (USA, Industrial equipment) Status by KSE – exited

*Baker Hughes (USA, Energy, oil and gas) Status by KSE – exited

*Nokian Tyres (Finland, Automotive) Status by KSE – exited

*Elko Grupa (Latvia, Electronics) Status by KSE – exited

*VEON (Netherlands, Telecom) Status by KSE – exited

*Ingka (Netherlands, Consumer goods and clothing) Status by KSE – exited

*Henkel (Germany, Chemical industry) Status by KSE – exited

The Bell surveyed major Western companies about returning to Russia

*1xBet (Cyprus, Entertainment) Status by KSE – stay

*Royal Pay Europe (Latvia, Finance and payments) Status by KSE – stay

The Cabinet of Ministers has approved a proposal by the National Agency for Identification, Tracing and Management of Assets (ARMA) to sell 1.75 million war bonds confiscated in 2024 from the Latvian company Royal Pay Europe, which is linked to the Russian bookmaker 1xBet.

20.03.2025

*Eutelsat (France, Telecom) Status by KSE – stay

French TV regulator orders Eutelsat to stop broadcasting two Russian channels

*LG Electronics (South Korea, Electronics) Status by KSE – stay

LG Electronics restarts home appliance plant in Russia

https://www.kedglobal.com/electronics/newsView/ked202503210001

*Hyundai (South Korea, Automotive) Status by KSE – leave

Hyundai Motor Group is gearing up for a potential re-entry into the Russian market, following its withdrawal in 2023 due to geopolitical tensions arising from the Russia-Ukraine war.

https://www.businesskorea.co.kr/news/articleView.html?idxno=238016

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen’s Russian subsidiary lent to the Putin regime – was it allowed to do so?

*Oracle (USA, IT) Status by KSE – exited

OTP Bank is the first in Russia to switch to domestic card processing without Oracle

https://www.kommersant.ru/doc/7588017?erid=F7NfYUJCUneRHUdfqhBs

*International Basketball Federation (FIBA) (Switzerland, Sport) Status by KSE – leave

The International Basketball Federation (FIBA) extended the penalty of Russian and Belarusian national teams and clubs from all its sanctioned competitions until May 2025

https://www.insidethegames.biz/articles/1152411/fiba-extends-ban-on-russian-teams-may

*Ericsson (Sweden, Telecom) Status by KSE – leave

The Ericsson brand, which left Russia, was given into Russian hands

21.03.2025

*Herbert Smith Freehills (Great Britain, Consulting, Law) Status by KSE – stay

Herbert Smith Freehills, an elite global law firm based in London, has been fined by the British government after its former Moscow office made millions of pounds to sanctioned Russian banks.

22.03.2025

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

Newly elected International Olympic Committee President Kirsty Coventry has spoken out against the Olympic ban over war and wants to open talks on Russia’s potential return to the Games

23.03.2025

*Nayara (India, Energy, oil and gas) Status by KSE – leave

Rosneft, Russia’s largest oil company, is in talks to sell a stake in India’s Nayara Energy. Rosneft has already valued Nayara Energy at more than $20 billion and has held talks with Reliance Industries, Adani, JSW Group and Saudi Aramco

24.03.2025

*Jodas Expoim (India, Pharma, Healthcare) Status by KSE – stay

Director of major Indian pharmaceutical company arrested for supplying counterfeit drugs to Russia

*Telegram (United Arab Emirates, Online Services) Status by KSE – stay

Russian company working with the state promises $4 million for hacking Telegram

*Sinopec Limited (China Petroleum & Chemical Corporation) (China, Chemical industry) Status by KSE – leave

One of China’s largest crude oil buyers, Sinopec Shanghai Petrochemical, cut purchases from Russia in the first quarter after more than doubling in 2024.

25.03.2025

*NIS Serbia (Serbia, Energy, oil and gas) Status by KSE – stay

Croatian Economy Minister Ante Susnjar said state-owned oil pipeline operator Jadranski Naftovod (Janaf) could acquire Russia’s stake in Serbian oil company Naftna Industrija Srbije (NIS), calling the potential deal a “natural business symbiosis”

https://centraleuropeantimes.com/2025/03/croatia-eyes-russias-share-in-serbian-oil-firm-nis/

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

The Russian Prosecutor General’s Office is demanding that Shell pay 1.5 billion euros in compensation for unpaid gas supplies in 2022 to Gazprom Export, which could be partially offset by the payment to the British company for its stake in Sakhalin-2, which is reserved in a special account.

*Herbert Smith Freehills (Great Britain, Consulting, Law) Status by KSE – stay

UK fines law firm for breach of Russia sanctions for first time

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen International shipped billions in foreign currency to Russia in the lead up to the invasion, with a three-fold increase in the average value of deliveries compared to previous years.

26.03.2025

*Total Energies (France, Energy, oil and gas) Status by KSE – exited

TotalEnergies sues Yannick Jadot for defamation over accusations linked to Russian operations

*Vitol Group (Switzerland, Energy, oil and gas) Status by KSE – stay

*Trafigura (Singapore, Metals and Mining) Status by KSE – stay

*Gunvor Group (Switzerland, Energy, oil and gas) Status by KSE – stay

The heads of some of the world’s leading energy traders have said they are ready to return to Russia for business if sanctions are fully lifted, although some have expressed concerns about the prospect in the near future.

27.03.2025

*Bank of America (USA, Finance and payments) Status by KSE – stay

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

*Brinks (USA, Security & Protection) Status by KSE – leave

Western Banks Sent Billions in Cash to Russia on Eve of Ukraine Invasion, Data Shows

*Ariston (Italy, Electronics) Status by KSE – stay

“On March 26, 2025, by Presidential Decree No. 176 of the Russian Federation, Ariston Holding NV regained ownership and full control of the shares of its Russian subsidiary,” the Italian company said in a statement.

28.03.2025

*World Athletics Council (Sweden, Sport) Status by KSE – leave

World Athletics extends Russia and Belarus ban.

https://www.insidethegames.biz/articles/1152540/iaaf-extends-ban-on-russia-and-belarus

*Bridgestone Corporation (Japan, Automotive) Status by KSE – exited

Cordiant restarts former Bridgestone plant in Russia

https://www.tirebusiness.com/news/cordiant-restarts-ex-bridgestone-plant-russia

*HR Smith Group / Techtest (Great Britain, Aerospace) Status by KSE – stay

*Hindustan Aeronautics Ltd (India, Aerospace) Status by KSE – stay

Major Donor to Reform U.K. Party Sold Parts Used In Weapons to Russian Supplier

*Swift (Belgium, Finance and payments) Status by KSE – stay

Russia has called on the West to ease sanctions as a precondition for a Black Sea security deal, including restoring links between its Agricultural Export Bank and the SWIFT system.

https://www.rbc.ua/ukr/news/uryadi-nimechchini-zrobili-zayavu-shchodo-1742993750.html

*Samsung Electronic (South Korea, Electronics) Status by KSE – stay

*Hyundai (South Korea, Automotive) Status by KSE – leave

*LG Electronics (South Korea, Electronics) Status by KSE – stay

South Korean companies consider returning to Russia

https://www.moscowtimes.ru/2025/03/28/koreiskie-kompanii-zadumalis-o-vozvraschenii-v-rossiyu-a159462

29.03.2025

*Space Exploration Technologies Corp. (SpaceX) (USA, Aerospace) Status by KSE – stay

Russian Presidential Envoy for International Cooperation Kirill Dmitriev has said that Russia is ready to supply a small nuclear power plant for the SpaceX mission to Mars.

31.03.2025

*Renault (France, Automotive) Status by KSE – exited

*Ariston (Italy, Electronics) Status by KSE – stay

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

*Wintershall Dea AG (Germany, Energy, oil and gas) Status by KSE – exited

*Fortum (Finland, Energy, oil and gas) Status by KSE – exited

Putin stole their businesses, but now they want them back

*Samsung (South Korea, Electronics) Status by KSE – stay

Samsung has launched a massive recruitment drive in two Russian regions

*Ro Marine (Norway, Insurance) Status by KSE – stay

Russia’s ‘shadow fleet’ tankers used fake insurance certificates to pass through NATO waters in the Baltic Sea

https://www.currenttime.tv/a/rossiya-tankery/33360826.html

https://www.blackseanews.net/read/229145

*LG Electronics (South Korea, Electronics) Status by KSE – stay

South Korean LG Increases Revenue in Its Business in Russia

https://www.forbes.ru/biznes/533919-uznokorejskaa-lg-narastila-vyrucku-svoego-biznesa-v-rossii

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

In September 2024, the KSE Institute published the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP“. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

In January 2025 the new research was published by the B4Ukraine coalition in collaboration with the Kyiv School of Economics and Squeezing Putin which reveals how foreign businesses, including many household names, continue to channel billions in taxes to the Russian state nearly three years into its war on Ukraine. The report named “Corporate Enablers of Russia’s War in Ukraine: A Closer Look at Multinational Taxes and Revenue in Russia in 2023” calls on companies to make a swift responsible exit from the Russian market and urges the G7 and allied countries to establish standards for corporate behavior, promoting immediate exits from the Russian market.

Also, at the end of February 2025, the KSE Institute published the study “Assessing foreign companies’ direct losses in Russia: financial impact, market consequences, and strategic adjustments” where, among other things, we estimated that Foreign businesses’ direct losses in Russia exceed $170 billion due to write-offs, seizures, unfair court rulings, and exit taxes. You can download its full text in English here: https://kse.ua/wp-content/uploads/2025/03/KSE_Assessing-Foreign-Companies-Losses-in-Russia.pdf

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁵ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁶ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website