- Kyiv School of Economics

- About the School

- News

- 74th issue of the regular digest on impact of foreign companies’ exit on RF economy

74th issue of the regular digest on impact of foreign companies’ exit on RF economy

5 March 2025

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors; 06.02.2025-05.03.2025

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

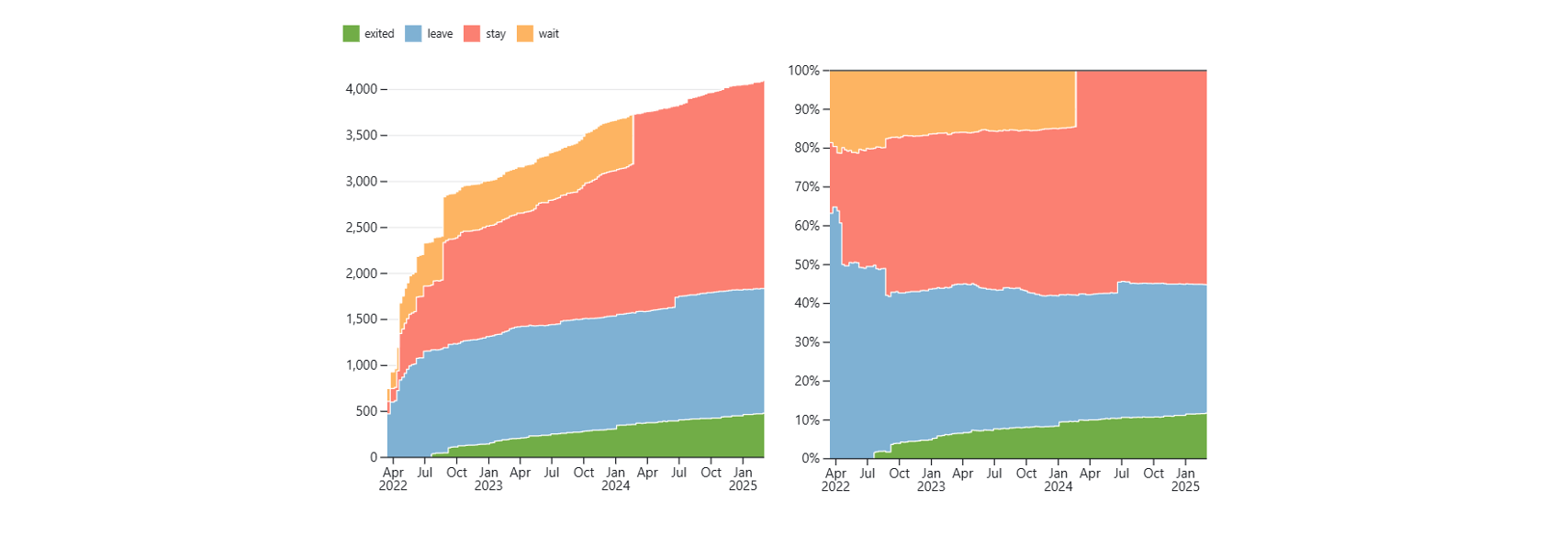

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

KSE DATABASE SNAPSHOT as of 05.03.2025

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 263² (+18 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 357 (-3 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 481 (+9 per month)

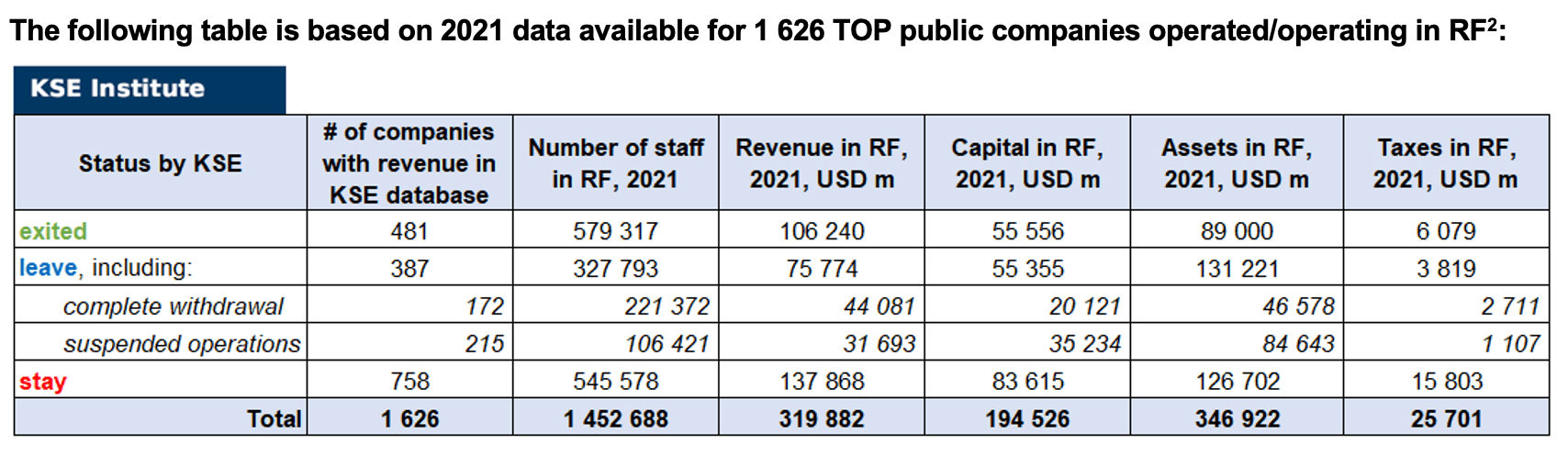

As of March 5, 2025, we have identified about 4,101 companies, organizations and their brands from 108 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1’626 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $194.5 billion), local revenue (about $319.9 billion), local assets (about $346.9 billion) as well as staff (about 1.453 million people) and taxes paid (about $25.7 billion). 1,357 foreign companies have suspended or ceased operations in Russia. Also, we added information about 481 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (5 business sales, 1 seizure and 3 business liquidation took place in February 2025).

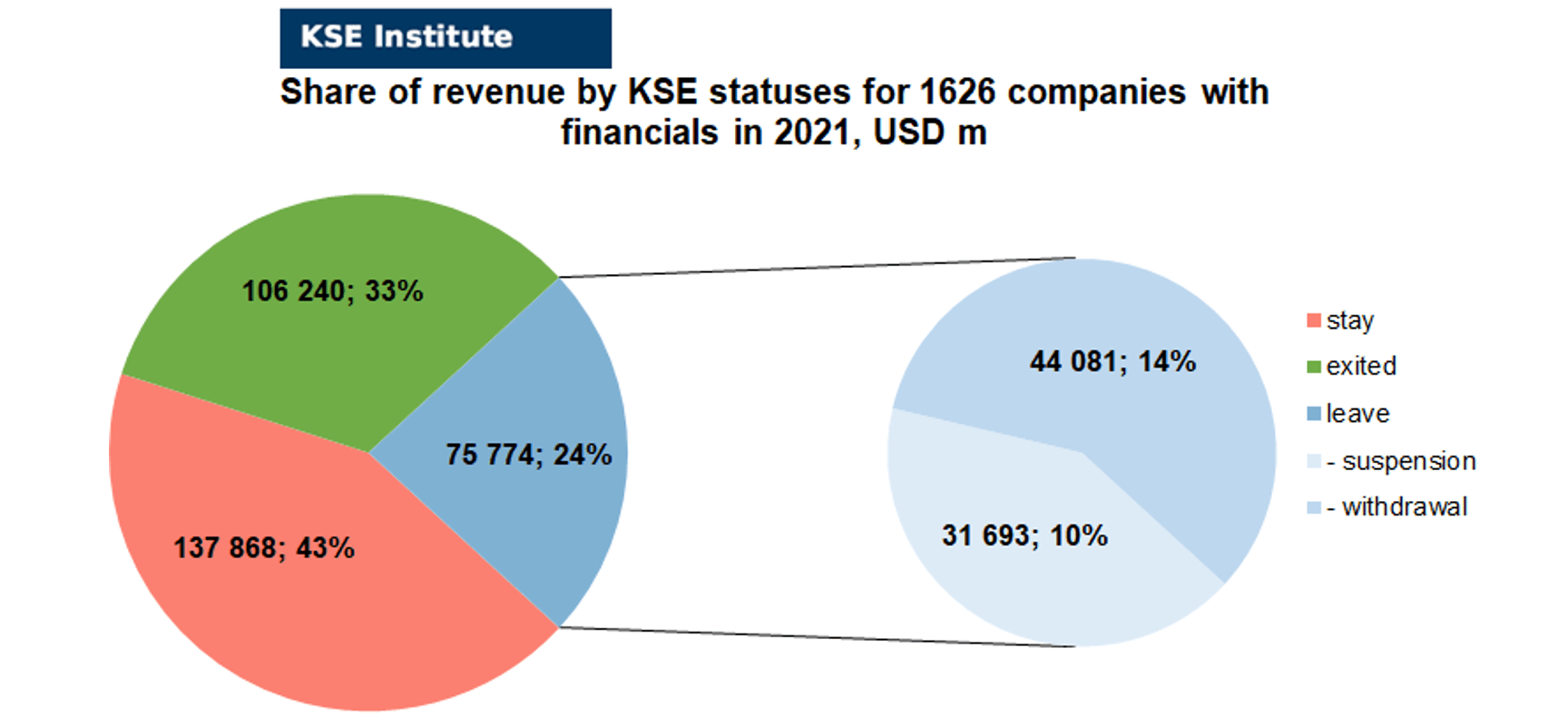

As can be seen from the tables below, as of March 5, 2025, 481 companies which had already completely exited from the Russian Federation, in 2021 had at least 579,300 personnel, $106.2 bn in annual revenue, $55.6bn in capital and $89.0bn in assets; companies, that declared a complete withdrawal from Russia had 221,400 personnel, $44.1bn in revenues, $20.1bn in capital and $46.6bn in assets; companies that suspended operations on the Russian market had 106,400 personnel, annual revenue of $31.7bn, $35.2bn in capital and $84.6bn in assets.

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 30 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 25 were added in February 2025). However, if to operate with the total numbers in KSE database, about 33.1% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 55.2% are still remaining in the country and only 11.7% made a complete exit³

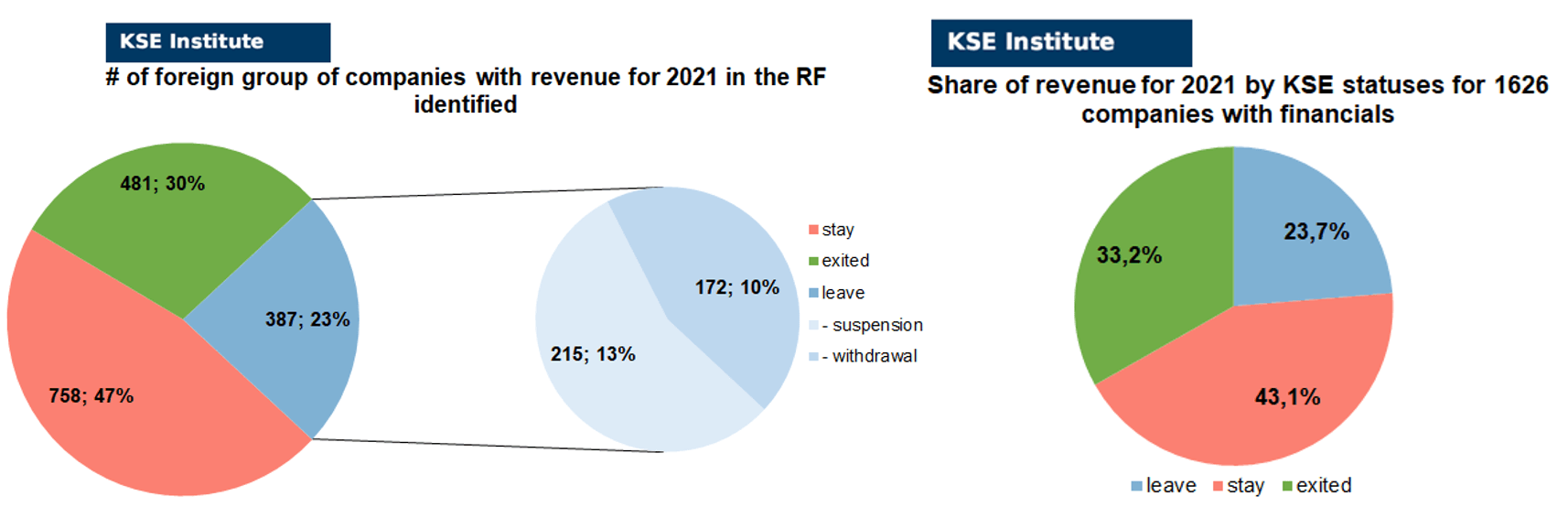

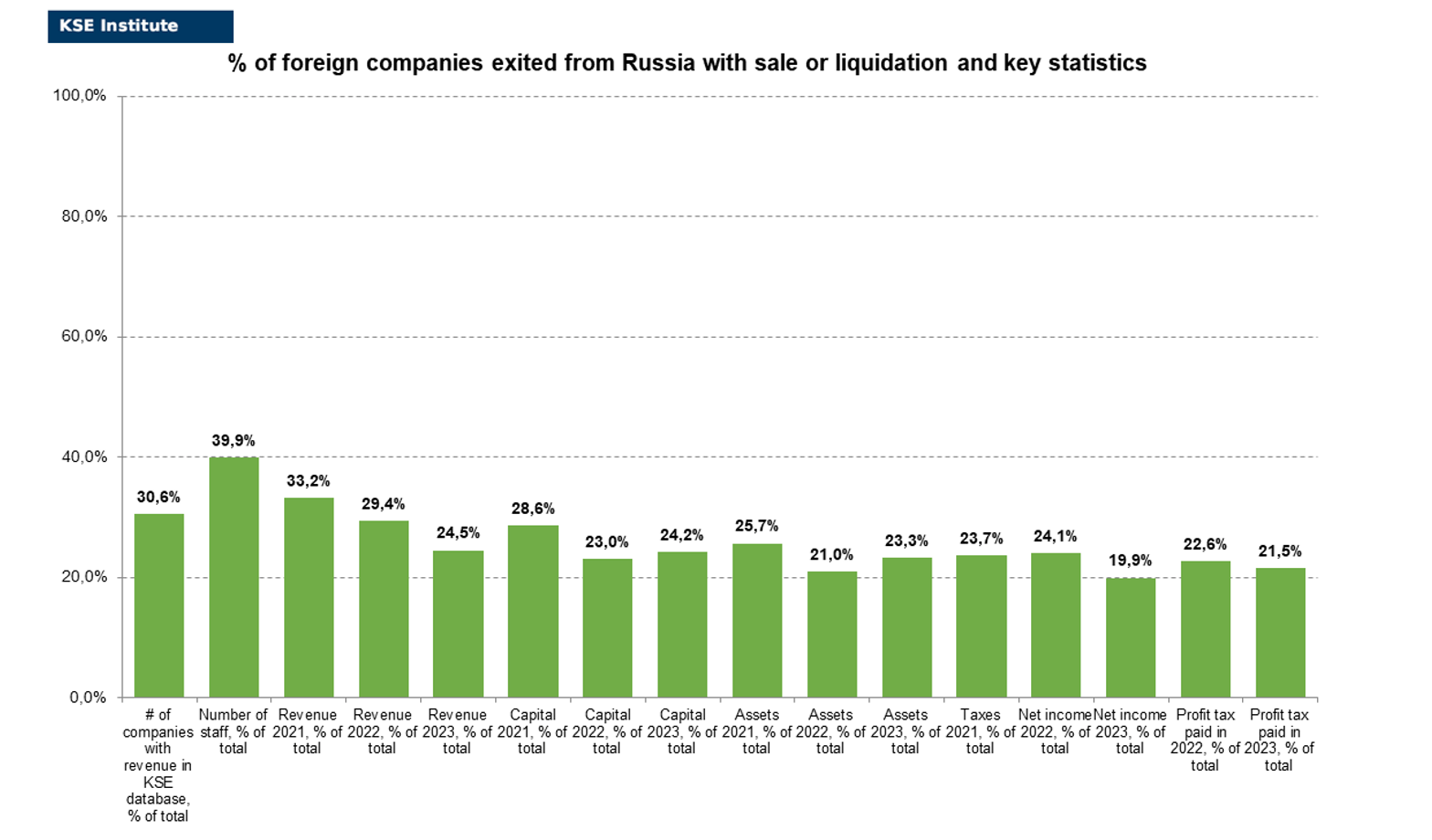

At the same time, it is difficult not to overestimate the impact on the Russian economy of 481 companies that completely left the country, since in 2021 they employed 39.9% of the personnel employed in foreign companies, the companies owned about 25.7% of the assets, had 28.6% of capital invested by foreign companies, and in 2021 they generated revenue of $106.2 billion or 33.2% of total revenue and paid ~$6.1 billion of taxes or 23.7% of total taxes paid by the companies observed. Data on 1,626 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (30%) and on share of revenue withdrawn (33.2%). At the same time, a bit different picture is for those who are still staying – 47% of companies represent 43.1% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit). Also, migration of statuses in June 2024 made its effect as well as adding quite a lot of new companies in July 2024 and each month.

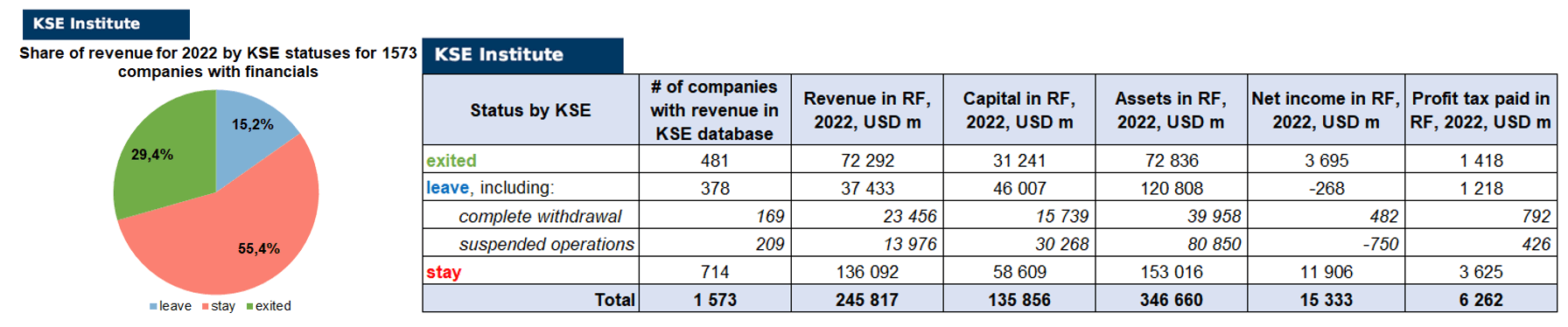

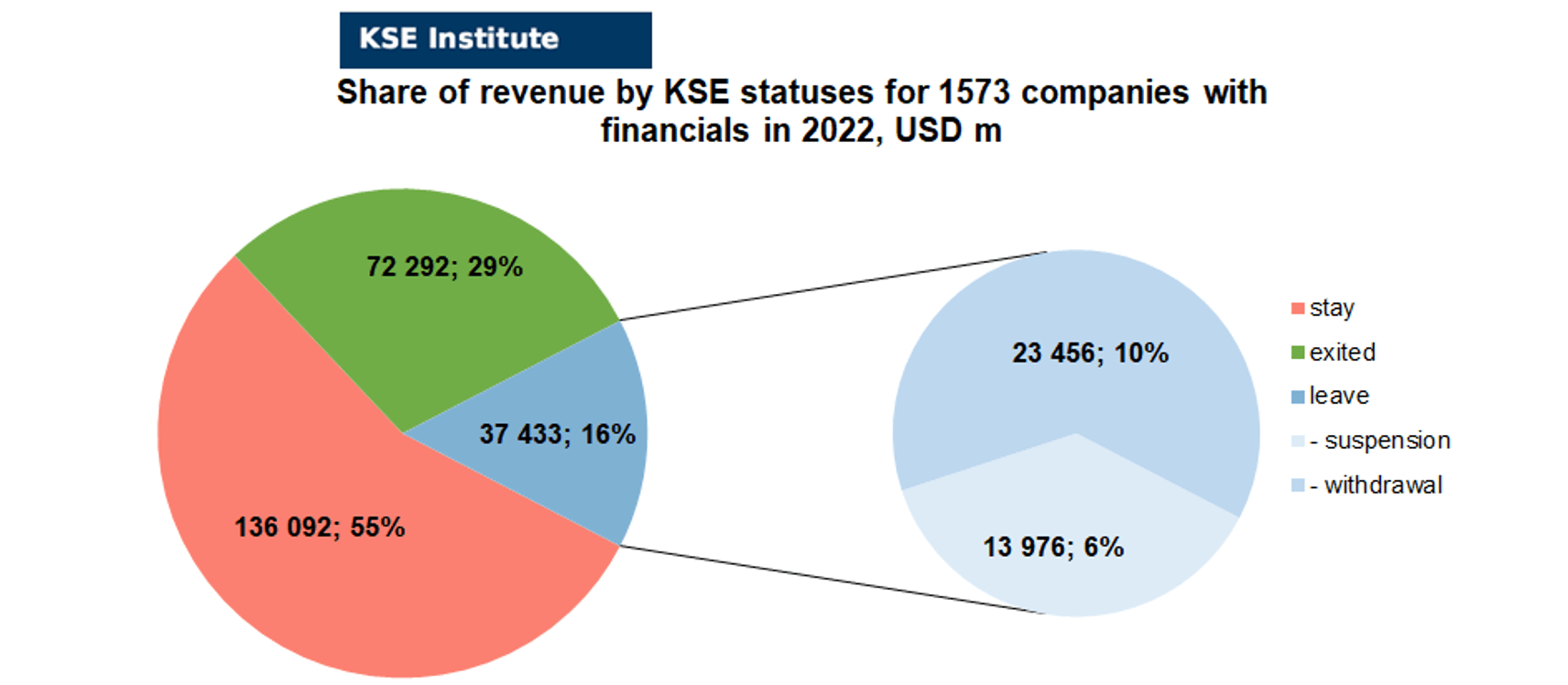

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1573 companies (about 50 companies the data of which we have collected previously have not provided their reporting, we also added revenue data for about 30 banks) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 3.8% less of revenue in 2022 (29.4% from total volume) than in 2021 (33.2% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-8.5%) revenue in 2022 (15.2% from total volume) than in 2021 (23.7% from total volume). At the same time, staying companies were able to generate much (+12.3%) more revenue in 2022 (55.4% from total volume) than in 2021 (43.1% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($346.7bn⁴ in 2022 vs $346.9bn in 2021) and would even probably increase if the remaining reporting for ~70-80 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

Also, in September 2024, the KSE Institute published the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

On January 13, 2025 the new research was published by the B4Ukraine coalition in collaboration with the Kyiv School of Economics and Squeezing Putin which reveals how foreign businesses, including many household names, continue to channel billions in taxes to the Russian state nearly three years into its war on Ukraine. The report named “Corporate Enablers of Russia’s War in Ukraine: A Closer Look at Multinational Taxes and Revenue in Russia in 2023” calls on companies to make a swift responsible exit from the Russian market and urges the G7 and allied countries to establish standards for corporate behavior, promoting immediate exits from the Russian market.

Analysis of data for 2023

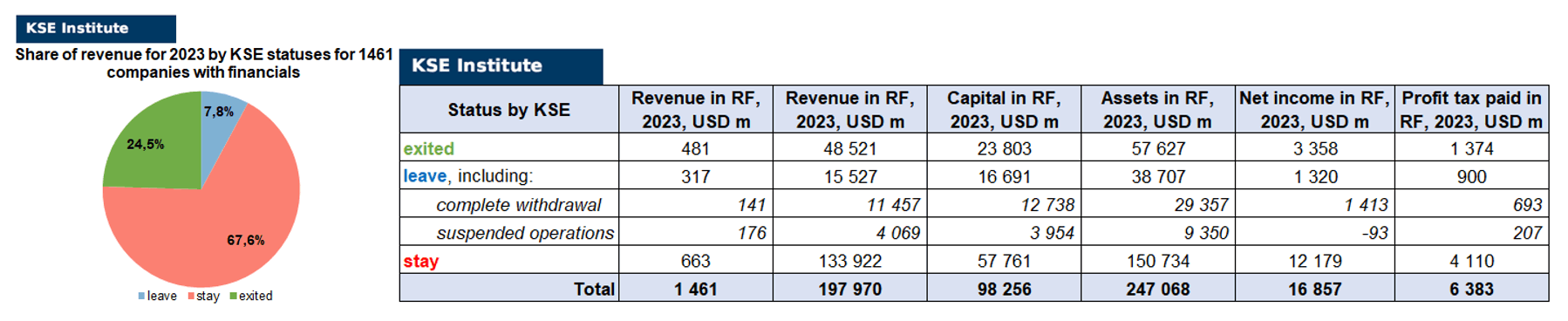

KSE Institute has already collected and preliminarily analyzed data on revenue, capital, assets and net income (profit or loss) in 2023 for ~1461 companies (after it was allowed legally in 2023 about 200 companies the data of which we have collected previously have not provided their reporting and also about 290 companies reported 0 values in revenues). Also, it should be noted that as we convert RUB to USD – the devaluation effect was quite significant, Ruble depreciated in 2023 by more than 24%, from 68.4869 RUB/USD in 2022 to 85.163 RUB/USD in 2023). Please see below charts with the detailed analysis:

As you can see, there is a significant redistribution in revenue allocation based on KSE statuses happened in 2023: share of “exited” has dropped by -8.7% vs 2021 and -4.9% vs 2022 (from 33.2% in 2021 and from 29.4% in 2022 to 24.5% in 2023) which is explained by the fact that more and more companies are being liquidated and those one which were sold are usually not able to generate the previous level of revenue.

Share of companies with status “leave” has dropped even more, by -15.9% vs 2021 and -7.4% vs 2022 (from 23.7% in 2021 and from 15.2% in 2022 to 7.8% in 2023) which is explained by the fact that those companies which are leaving are not concentrated in revenue generation on the Russian market anymore.

As for companies with status “stay” – we see the opposite picture there, they are using momentum to take market share of those who are leaving or left (especially in automotive sector) and are generating comparable with previous years level of revenue: +24.5% vs 2021 and +12.2% vs 2022 (from 43.1% in 2021 and from 55.4% in 2022 to 67.6% in 2023).

MONTHLY FOCUS: On leaving the Russian Federation. Results of February 2025

In this digest, we will summarize the results of February 2025 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’626 companies identified in the KSE database with revenue data available of about $320 billion in 2021 and $245.8 billion in 2022 (which dropped to ~$198.0 billion in 2023). And at least 481 of them have already been sold by local companies or were liquidated and left the Russian market. In February 2025 KSE Institute identified +9 new exits (5 business sales, 1 seizure and 3 liquidations took place in February 2025)⁵, total number of exits observed since the beginning of Russia’s invasion reached 481. In February, assets of the company Raven Russia (~$2 billions of warehouses and transport terminals) were transferred to the Federal Property Management Agency. Companies which moved in February 2025 to status “exited” generated about $1.2 billion of revenues in 2021.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 33% based on revenue allocation, those who are leaving represent 24% of total revenue (with 42% share of suspensions and 58% of withdrawals sub-statuses), % of staying companies represent 43% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is less than % of leaving ones (which means that about 57% (!) of pre-invasion revenue generated by foreigners is leaving or already left Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 29% based on revenue allocation, those who are leaving represent only 16% of total revenue (with 37% share of suspensions and 63% of withdrawals sub-statuses), % of staying companies represent 55% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022-2023 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

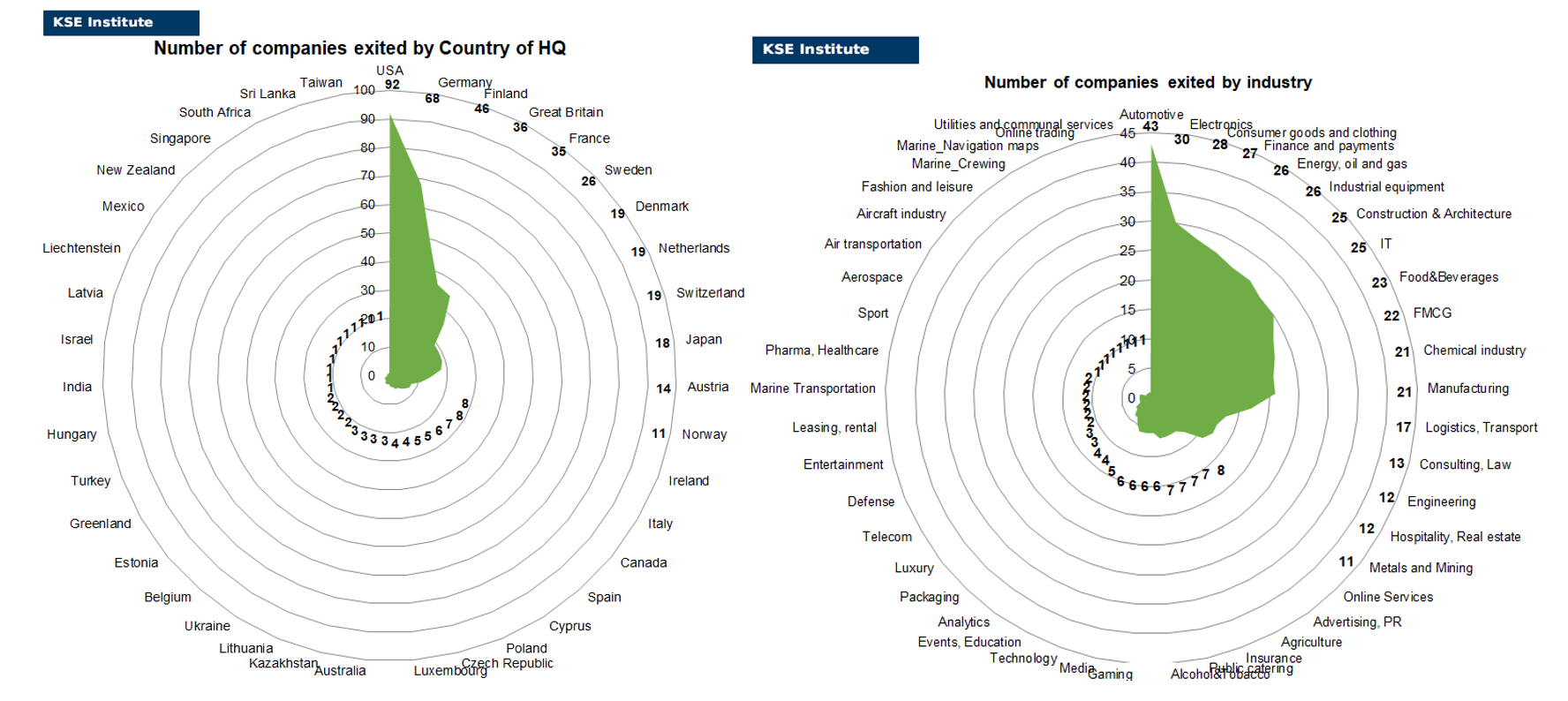

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of February 2025, companies from 39 countries and 45 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain, France and Sweden and operated in the “Automotive”, “Electronics”, “Consumer goods and closing”, “Finance and payments”, “Energy, oil and gas”, “Industrial equipment”, “Construction & Architecture” and “IT” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Celanese (liquidated), Konecranes (liquidated) and Trelleborg Group (liquidated). Also, 5 business sales were accounted for in February 2025: Autoliv (Sweden’s Autoliv sold Russian business to buyer of former Mercedes-Benz plant), Rehau, Tikkurila Oyj, UPM and Vinci SA (French construction giant Vinci SA exits Russian toll road business. French company Vinci S.A., one of the largest infrastructure companies in Europe, has finally left Russia. Its share in LLC “North-West Concession Company” (SZKK) was acquired by the group “Natsproektstroy”. SZKK is reportedly a joint venture created in 2007 by the companies “Mostotrest” and Vinci S.A. It was responsible for the construction and operation of a key section of the Moscow-St. Petersburg expressway). Additionally, in February, assets of the company Raven Russia owned by Raven Property Group Limited (valued for ~$2 billions of warehouses and transport terminals) were seized and transferred to the Federal Property Management Agency.

Assets of 2 more companies were partly seized with unfair courts decisions in February 2025: Bayadera Group (The vodka assets of the largest Ukrainian alcohol company “Bayadera Group” belonging to them in the Russian Federation (Bayadera Group produces, among other things, vodkas “Vozduh” and “Perepelka”) worth more than 9 billion rubles. according to the court’s decision, they are transferred to the state’s income. The reason for this was the participation of entrepreneurs in the financing of the Armed Forces) and Pratt & Whitney (A Moscow court has ordered the former Russian subsidiary of American aircraft engine manufacturer Pratt & Whitney to pay more than 2 million rubles ($22,000) in compensation to the leasing company after it exits the Russian market in 2022). So in fact, 3 business seizures took place in February, which show the real attitude of Russian authorities to the return of western business to the country.

To read more details on 32 identified cases of full and partial business seizures in Russia – please read our new study named “Assessing foreign companies’ direct losses in Russia: financial impact, market consequences, and strategic adjustments”, summary of which you can find in the next section below.

The next review of deals for March 2025 will be available in a month.

SPECIAL EDITION: Foreign businesses’ losses in Russia exceed $170 billion due to write-offs, seizures, unfair court rulings, and exit taxes – KSE Institute study

Since the beginning of the full-scale invasion, over 1,300 international companies have scaled down or ceased their operations in Russia. According to the study “Assessing foreign companies’ direct losses in Russia: financial impact, market consequences, and strategic adjustments”, conducted by KSE Institute, the total confirmed financial losses of foreign businesses have exceeded $170 billion.

The majority of these losses stem from asset write-offs, totaling over $167 billion. Of this amount, more than $57 billion comes from companies whose assets were seized by Russian authorities and transferred to local businesses or state institutions, despite their estimated market value being around $74 billion before expropriation. Additionally, companies were forced to pay at least $3 billion in “exit taxes,” which became a mandatory condition for asset sales and saw a significant increase starting in 2023.

The most affected companies are based in the United States ($46 billion), Germany ($44.5 billion), the United Kingdom ($35.1 billion), France ($12.1 billion), Austria ($6.7 billion), and Finland ($5.1 billion).

Some of the largest financial losses include British Petroleum (BP) writing off $25.5 billion following its exit from Rosneft, the nationalization of Uniper ($22 billion) and Fortum ($4.07 billion), ExxonMobil’s $4 billion write-off, Renault’s forced sale of its Russian business ($2.4 billion), and Société Générale’s exit from Rosbank ($3.3 billion loss).

The sale of foreign companies’ assets in Russia frequently occurred at severe discounts of up to 90–100% below their market value. The Kremlin and affiliated business groups took advantage of this situation, acquiring international corporations’ assets at nominal prices.

Russia has systematically used economic pressure mechanisms. At least 30 companies have fallen victim to forced asset seizures, including Carlsberg, Danone, Fortum, Wintershall Dea, Uniper, and ExxonMobil.

In 2023, companies paid $1.2 billion in exit taxes, while by July 2024, they had paid an additional $1.5 billion (equivalent in dollars based on the exchange rate at the time). Total tax burdens from forced exits have exceeded $3 billion. In many cases, leaving the Russian market was accompanied by frozen profits and asset transfers to Russian-controlled entities.

The largest financial losses were in the Energy sector, where the total write-offs of BP, ExxonMobil, Fortum, TotalEnergies, and Uniper exceeded $60 billion.

In the Automotive industry, Renault lost $2.4 billion, with Volkswagen and Nissan also suffering significant losses. In finance, Société Générale incurred $3.3 billion in losses, while UniCredit and Raiffeisen Bank faced large-scale lawsuits and asset devaluations.

In the Consumer goods sector, McDonald’s, Nestlé, Unilever, Danone, and Carlsberg either exited the market or sold their assets at minimal prices.

According to the KSE Institute, the departure of international companies further isolates Russia economically. The country has lost a significant share of foreign investment, while its economy is becoming increasingly dependent on state control and Chinese businesses.

You can download the full report here: https://kse.ua/wp-content/uploads/2025/03/KSE_Assessing-Foreign-Companies-Losses-in-Russia.pdf

What’s new last month – key news from Daily monitoring

(updated on a monthly basis) ⁶

03.02.2025

*Raven Property Group Limited (Great Britain, Hospitality, Real estate) Status by KSE – exited

The Moscow Arbitration Court has fully satisfied the claim of the Prosecutor General’s Office to recover shares and stocks of the Raven Russia group of strategic companies into the state treasury.

https://www.kommersant.ru/doc/7477647?ysclid=m6nw9h0rd3779517580

Company comments regarding the court hearing on 31.01.2025

https://rrpa.ru/news/kommentriy-v-otnoshenii-rezultatov-sudebnogo-zasedaniya-31-01-2025/

04.02.2025

*International Ice Hockey Federation (Switzerland, Sport) Status by KSE – leave

The International Ice Hockey Federation (IIHF) Council has extended the suspension of the Russian national team from participating in the World Championships and has decided not to allow Russian hockey players to participate in the program of tournaments that will be held under the auspices of the organization in 2026.

https://www.iihf.com/en/news/65675/russia_and_belarus_not_reincorporated_into_2025_20

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen Bank earns millions from companies supplying the Russian army

05.02.2025

*Deribit (Netherlands, Finance and payments) Status by KSE – leave

Deribit, a crypto exchange that provides options and futures trading services, has announced the termination of its operations in the Russian Federation.

https://www.deribit.com/kb/restrictions-for-russians

https://incrypted.com/ua/birzha-deribit-ogolosila-pro-pripinennya-diyalnosti-u-rf/

07.02.2025

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Carlsberg’s exit from Russia: for what price was the Russian company Baltika sold?

8AstraZeneca (Great Britain, Pharma, Healthcare) Status by KSE – stay

AstraZeneca to continue to pay Russian doctors despite Ukraine war

*ASML Holding (Netherlands, IT) Status by KSE – stay

Ex-ASML employee in Dutch custody had contact with Russian intelligence, prosecutors say

10.02.2025

*De Beers (Great Britain, Luxury) Status by KSE – stay

De Beers CEO Says US Diamond Demand Shows Signs of Recovery

*Tikkurila Oyj (Finland, FMCG) Status by KSE – exited

The owner of St. Petersburg-based Tikkurila LLC since February 5 has become Moscow-based SmartBusinessGroup JSC, according to the Unified State Register of Legal Entities.

https://www.kommersant.ru/doc/7480858

*NIS Serbia (Serbia, Energy, oil and gas) Status by KSE – stay

Vucic: US Embassy Declares Refusal to Postpone Sanctions Against Serbian NIS

https://www.kommersant.ru/doc/7480897

*Uniper SE (Germany, Energy, oil and gas) Status by KSE – leave

Russian Gazprom loses multi-billion arbitration to German company Uniper

11.02.2025

*Rohde & Schwarz (Germany, Technology) Status by KSE – stay

*Keysight Technologies (USA, IT) Status by KSE – stay

The Kaluga Research Radio Engineering Institute (KNIRTI), which produces systems for Sukhoi Design Bureau aircraft, in December signed contracts for 720 million rubles for the purchase of equipment from the German company Rohde & Schwarz and the American company Keysight.

*International Monetary Fund (IMF) (USA, Finance and payments) Status by KSE – stay

The US, despite sanctions, allowed Nabiullin’s ex-deputy to work full-time at the IMF

12.02.2025

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Sanctioned nuclear icebreakers helped export gas from the Russian Arctic bought by Shell

*Hindustan Aeronautics Ltd (India, Aerospace) Status by KSE – stay

Algeria has confirmed the purchase of Russian Su-57 Felon stealth fighters, making it the first foreign customer for the fifth-generation aircraft.

https://defence-blog.com/algeria-confirms-purchase-of-russian-su-57-fighter/

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

Italy’s UniCredit reported a rise in revenue last year from its Russian business, but said it had cut loans and deposits in the country and complied with the European Central Bank’s demands for reductions.

13.02.2025

*Coca-Cola (USA, Food & Beverages) Status by KSE – stay

Coca-Cola from the Taliban. Russia buys a well-known drink in Afghanistan after the company’s exit from the Russian Federation

https://biz.nv.ua/economics/rossiya-naladila-postavki-coca-cola-iz-afganistana-50489359.html

*DB Ventures (Great Britain, Finance and payments) Status by KSE – stay

The British company DB Ventures has registered the David Beckham trademark with the Russian Rospatent.

https://www.pravda.com.ua/eng/news/2025/02/11/7497669/

14.02.2025

*Hyundai (South Korea, Automotive) Status by KSE – leave

Hyundai is exploring a return to the Russian market amid expectations of a quick ceasefire in Ukraine after Trump-Putin talks

https://www.rbc.ru/business/14/02/2025/67af79239a7947fe4020aeb4

*MET Gas and Energy Marketing AG (MET GEM) (Hungary, Energy, oil and gas) Status by KSE – stay

Transnistria began to receive Russian gas through Hungary and “Moldovagaz”

https://www.pravda.com.ua/rus/news/2025/02/14/7498276/

*Pratt & Whitney (USA, Aerospace) Status by KSE – leave

A Moscow court has ordered the former Russian subsidiary of American aircraft engine manufacturer Pratt & Whitney to pay more than 2 million rubles ($22,000) in compensation to the leasing company after it exits the Russian market in 2022.

*Tüpraş (Turkey, Energy, oil and gas) Status by KSE – leave

Turkey’s largest refiner is limiting purchases of Russian oil and fuel to avoid being hit by U.S. sanctions

*NIOC (Iran, Energy, oil and gas) Status by KSE – stay

Iran and Tatneft sign $700 million oil contract

*Amma Сonstruction Machinery Co. Ltd (China, Industrial equipment) Status by KSE – stay

*Zhongxin Heavy Industry Machinery Co., Ltd (China, Electronics) Status by KSE – stay

China is investing in the occupation of Ukraine.

15.02.2025

*Google (USA, Online Services) Status by KSE – exited

Google facilitated Russia and China’s censorship requests

17.02.2025

*OMV (Austria, Energy, oil and gas) Status by KSE – exited

Austrian company OMV won arbitration against Gazprom

https://news.finance.ua/ua/avstriys-ka-kompaniya-omv-vyhrala-arbitrazh-proty-hazpromu

*Mastercard (USA, Finance and payments) Status by KSE – leave

*Visa (USA, Finance and payments) Status by KSE – leave

Payment systems Visa and Mastercard, which left Russia after the invasion of Ukraine began, will soon reopen their business in the country, said Anatoly Aksakov, head of the State Duma Committee on Financial Markets.

*JKX Oil & Gas (Great Britain, Chemical industry) Status by KSE – leave

British oil and gas company JKX Oil & Gas Group (JKX) announced that it has filed claims against the Russian Federation regarding the initiation of a lawsuit due to the loss of assets and investments.

https://epravda.com.ua/energetika/naftogazova-kompaniya-jkx-suditsya-z-rosiyeyu-803332/

18.02.2025

*Coca-Cola HBC AG (Switzerland, Food & Beverages) Status by KSE – stay

Coca-Cola Prepares for Return to Russia

19.02.2025

*Bayadera Group (Ukraine, Alcohol&Tobacco) Status by KSE – leave

The Velikoustyug District Court of the Vologda Region has recognized Ukrainian oligarchs Natalia Bondareva and Svyatoslav Nechitailo, as well as Yuriy Moklyak, who manages their assets in Russia, as extremists.

https://www.kommersant.ru/doc/7515630

*Gucci (Italy, Luxury) Status by KSE – stay

Italian brand Gucci has registered a trademark in Russia until 2033. This will allow it to sell clothes, accessories, jewelry and open restaurants

https://biz.liga.net/ua/all/fmcg/novosti/italiyskyy-brend-gucci-zareiestruvav-torhovu-marku-v-rosii

*Bharat Petroleum (BPCL) (India, Energy, oil and gas) Status by KSE – stay

Why India’s BPCL expects lower processing of Russian crude in March?

20.02.2025

*Kongsberg Automotive (Norway, Automotive) Status by KSE – stay

How a Norwegian company fueled Russia’s war machine despite EU sanctions

*Boeing (USA, Aircraft industry) Status by KSE – leave

*Airbus (Netherlands, Aircraft industry) Status by KSE – stay

Boeing and Airbus shipments passed on to Russia via India, despite sanctions

*Renault (France, Automotive) Status by KSE – exited

Renault does not rule out a return to Russia after the end of Russian military aggression in Ukraine

21.02.2025

*H&M (Hennes and Mauritz) (Sweden, Consumer goods and clothing) Status by KSE – leave

Swedish clothing chain H&M has announced that it has no plans to return to Russia. The company left the country’s market in 2022 amid a “special operation”

https://liferbc.ru/news/67b5914b9a79475b365eb5c9?from=short_news

*UniCredit (Italy, Finance and payments) Status by KSE – stay

UniCredit could accelerate its exit from Russia if there is a breakthrough on the Ukraine war, its chief executive Andrea Orcel has said, with the Italian bank one of the few large western lenders to have remained in the country.

https://www.ft.com/content/15e9e87e-e290-40f1-8539-5f5b06da905b

22.02.2025

*Dabaa Nuclear Power Plant (Egypt, Energy, oil and gas) Status by KSE – stay

The Director General of the Russian company Rosatom, Alexey Likhachev, said that sanctions are an obstacle to the construction of the first nuclear power plant in Egypt, “but they will not stop us.”

23.02.2025

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

Citibank, the Russian subsidiary of the American financial giant Citigroup, is taking the unprecedented step of forgiving outstanding loans for around 1,000 clients as it prepares to exit the Russian market.

https://evrimagaci.org/tpg/citibank-writes-off-russian-client-loan-debts-215377

24.02.2025

*Apple (USA, Electronics) Status by KSE – leave

Apple no longer provides Russian developers with access to the Apple Developer Enterprise Program, a platform for creating corporate applications

*Hyundai (South Korea, Automotive) Status by KSE – leave

The South Korean automaker Hyundai Motor does not consider the possibility of resuming work in Russia. “There is currently no discussion on this,” said a company representative.

*Gagawa (Turkey, Public catering) Status by KSE – stay

Turkish JSC TD Uluslyarası Restaurant Yatyrymlary Ticaret Anonymous Şirketi reduced its stake in Gagawa Restaurants LLC (which manages the Turkish Gagawa chain in Russia) from 100% to 84.2%

https://www.kommersant.ru/doc/7532300

*Samsung (South Korea, Electronics) Status by KSE – stay

Samsung is increasing its marketing activity in the Russian Federation

25.02.2025

*Renault (France, Automotive) Status by KSE – exited

The head of AvtoVAZ named the conditions for the return of Renault

https://www.rbc.ru/business/25/02/2025/67bdd2c39a79471d8a4773cb

*Vinci SA (France, Construction & Architecture) Status by KSE – exited

The French company Vinci S.A., one of the largest infrastructure companies in Europe, has finally left Russia.

https://epravda.com.ua/svit/odna-iz-naybilshih-infrastrukturnih-kompaniy-yevropi-viyshla-z-rosiyskogo-rinku-803681/

https://www.rbc.ru/business/25/02/2025/67bc9e919a794727eff808d2

*UEFA (Switzerland, Sport) Status by KSE – stay

Russian federation to surrender seat on UEFA executive committee as war in Ukraine rages on

26.02.2025

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

The International Olympic Committee (IOC) has called on international federations to allow Russian and Belarusian athletes to participate in competitions so that they have the opportunity to qualify for the 2026 Winter Olympics.

https://www.kommersant.ru/doc/7534539

*World Athletics Council (Sweden, Sport) Status by KSE – leave

The head of the International Athletics Federation (World Athletics), Sebastian Coe, became the first of seven candidates for the post of President of the International Olympic Committee (IOC) to openly support the idea of Russia’s prompt return to world sport, although he linked it to the end of the Russian-Ukrainian conflict.

https://www.kommersant.ru/doc/7534057

*Samsung (South Korea, Electronics) Status by KSE – stay

Samsung marketing in Russia rises, but business resumption uncertain

27.02.2025

*Volkswagen (Germany, Automotive) Status by KSE – exited

Russian banker Kim boosts car leasing, financial portfolio with VW bank purchase

28.02.2025

*Hexagon (Sweden, Technology) Status by KSE – stay

*WENZEL Group (Germany, Industrial equipment) Status by KSE – stay

*Automated Precision (USA, Industrial equipment) Status by KSE – stay

*Renishaw (Great Britain, Engineering) Status by KSE – stay

According to customs data for 2024, coordinate measuring machines and parts for them manufactured by more than 70 companies were imported to Russia.

*Tigers Realm Coal (Australia, Metals and Mining) Status by KSE – leave

Tigers Realm Coal Limited has been navigating the sale of its Russian operations to Limited Liability Company APM-Invest, with the process being delayed due to new Russian legislation affecting company exits.

*Barilla Group (Italy, Food & Beverages) Status by KSE – stay

Italian pasta producer Barilla has notified retailers of a 15-30% price increase on imported products.

01.03.2025

*YouTube (USA, Online Services) Status by KSE – leave

The popular video hosting YouTube is completely unavailable in Russia. This was reported by the Center for Monitoring and Control of the Public Communications Network (CMCN) of the Russian Federal Service for Supervision of Communications, Information Technology and Mass Media (Roskomnadzor) on Saturday, March 1.

https://korrespondent.net/world/russia/4760041-v-rossyy-zaiavyly-o-nedostupnosty-YouTube

*Autoliv (Sweden, Automotive) Status by KSE – exited

Sweden’s Autoliv sells Russian business to buyer of former Mercedes-Benz plant

02.03.2025

*BGM Production LLC (Kazakhstan, Industrial equipment) Status by KSE – stay

*Hyundai Wia (South Korea, Automotive) Status by KSE – stay

A company from Kazakhstan, bypassing sanctions, supplied high-precision machine tools for the military-industrial complex to Russia

*Sony Pictures Entertainment (USA, Films) Status by KSE – leave

Former Sony vendor demands $11 million from Russian cinemas

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

In September 2024, the KSE Institute published the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP“. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁵ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁶ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website