- Kyiv School of Economics

- About the School

- News

- 73rd issue of the regular digest on impact of foreign companies’ exit on RF economy

73rd issue of the regular digest on impact of foreign companies’ exit on RF economy

5 February 2025

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors; 07.01.2025-05.02.2025.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

KSE DATABASE SNAPSHOT as of 05.02.2025

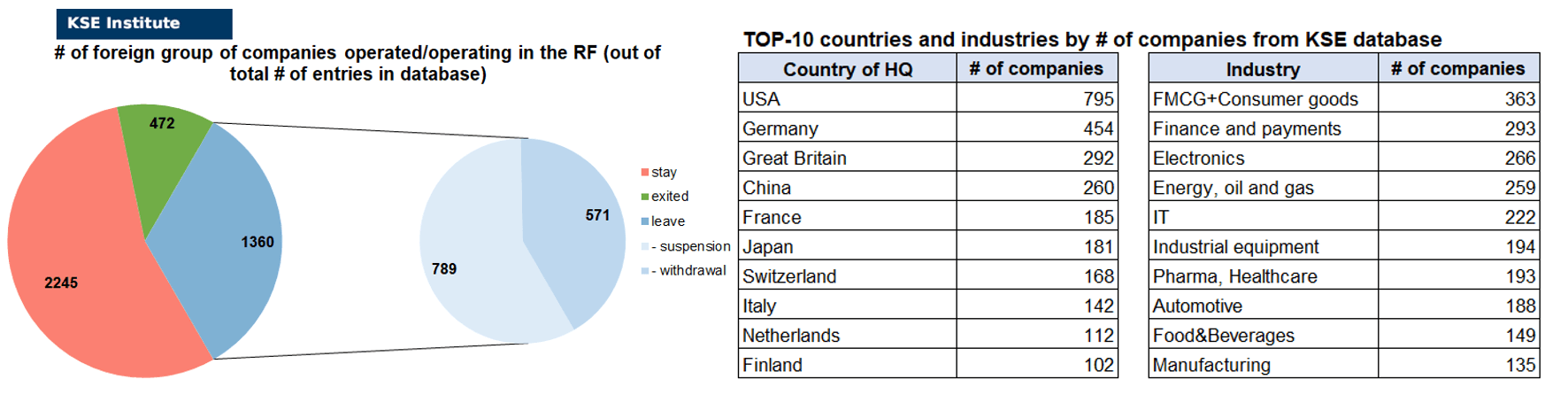

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 245 ²(+17 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 360 (0 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 472 (+5 per month)

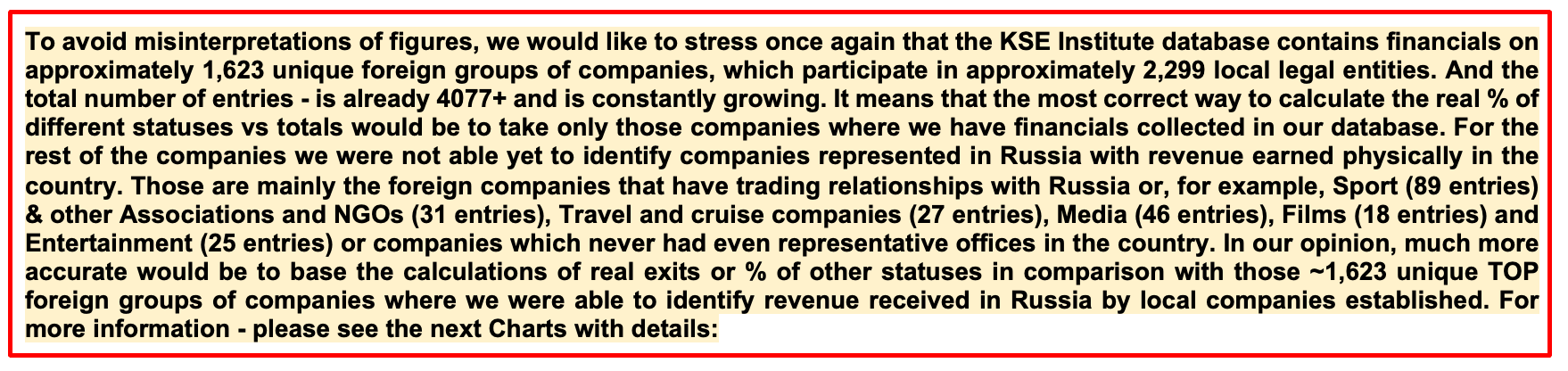

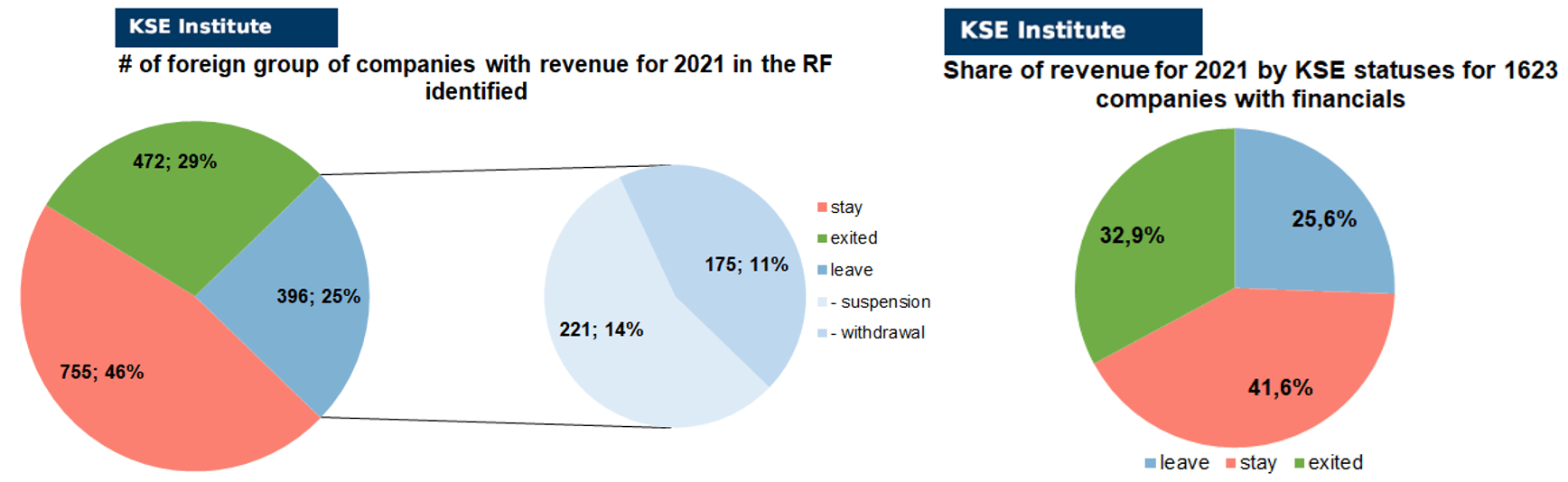

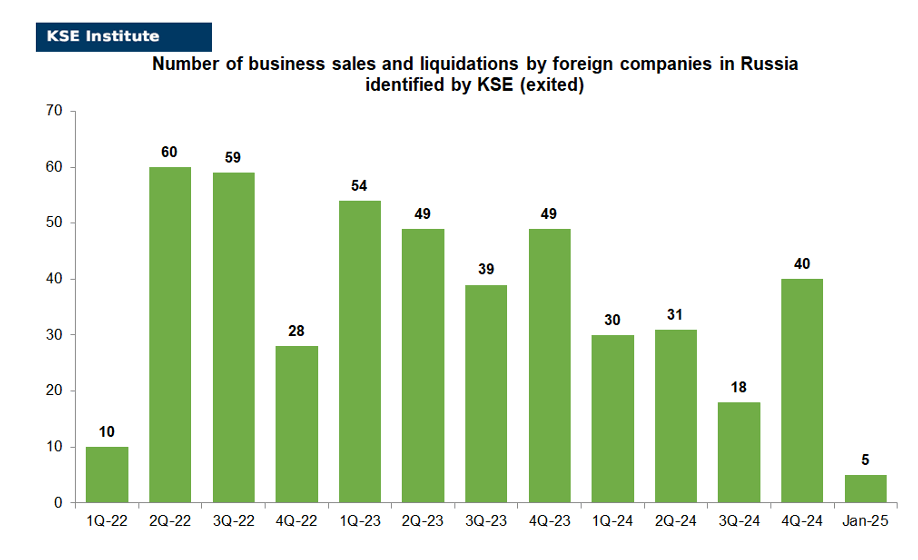

As of February 5, 2025, we have identified about 4,077 companies, organizations and their brands from 108 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1’623 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $194.4 billion), local revenue (about $319.8 billion), local assets (about $343.9 billion) as well as staff (about 1.453 million people) and taxes paid (about $25.7 billion). 1,360 foreign companies have suspended or ceased operations in Russia. Also, we added information about 472 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (4 business sales and 1 business liquidation took place in January 2025).

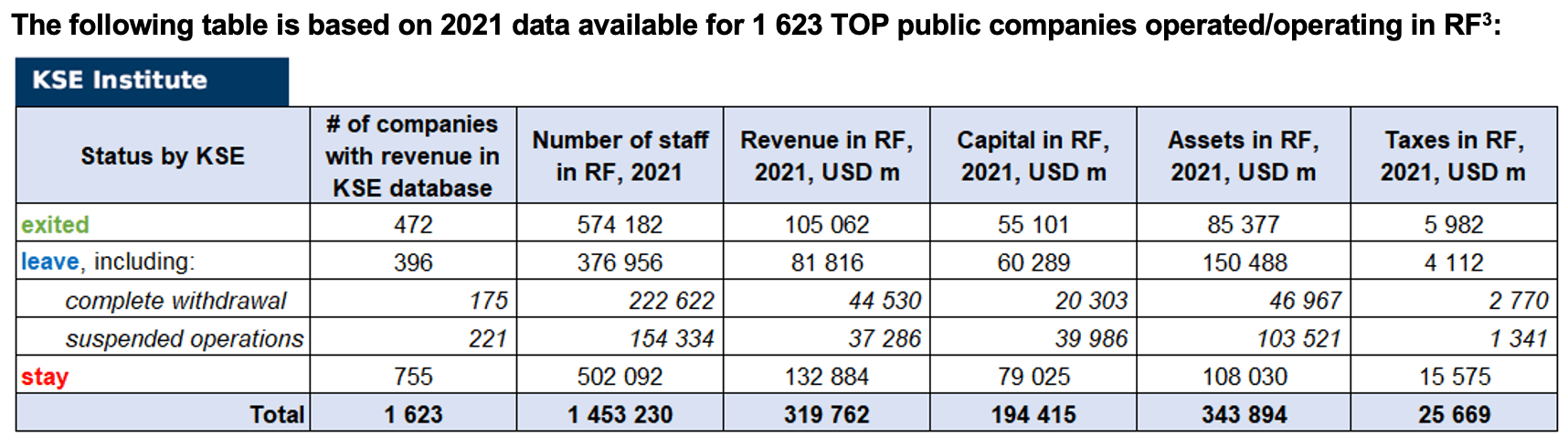

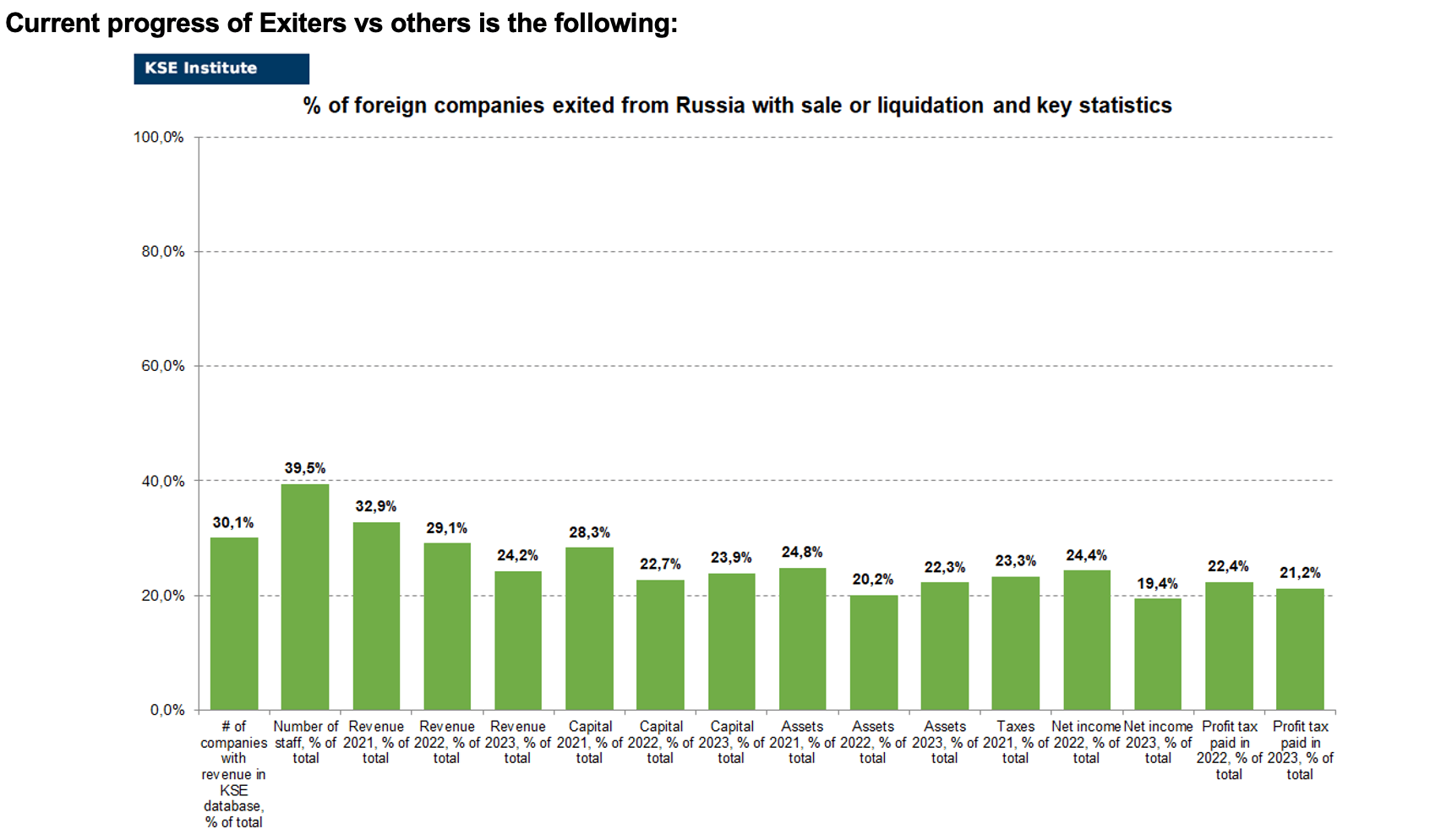

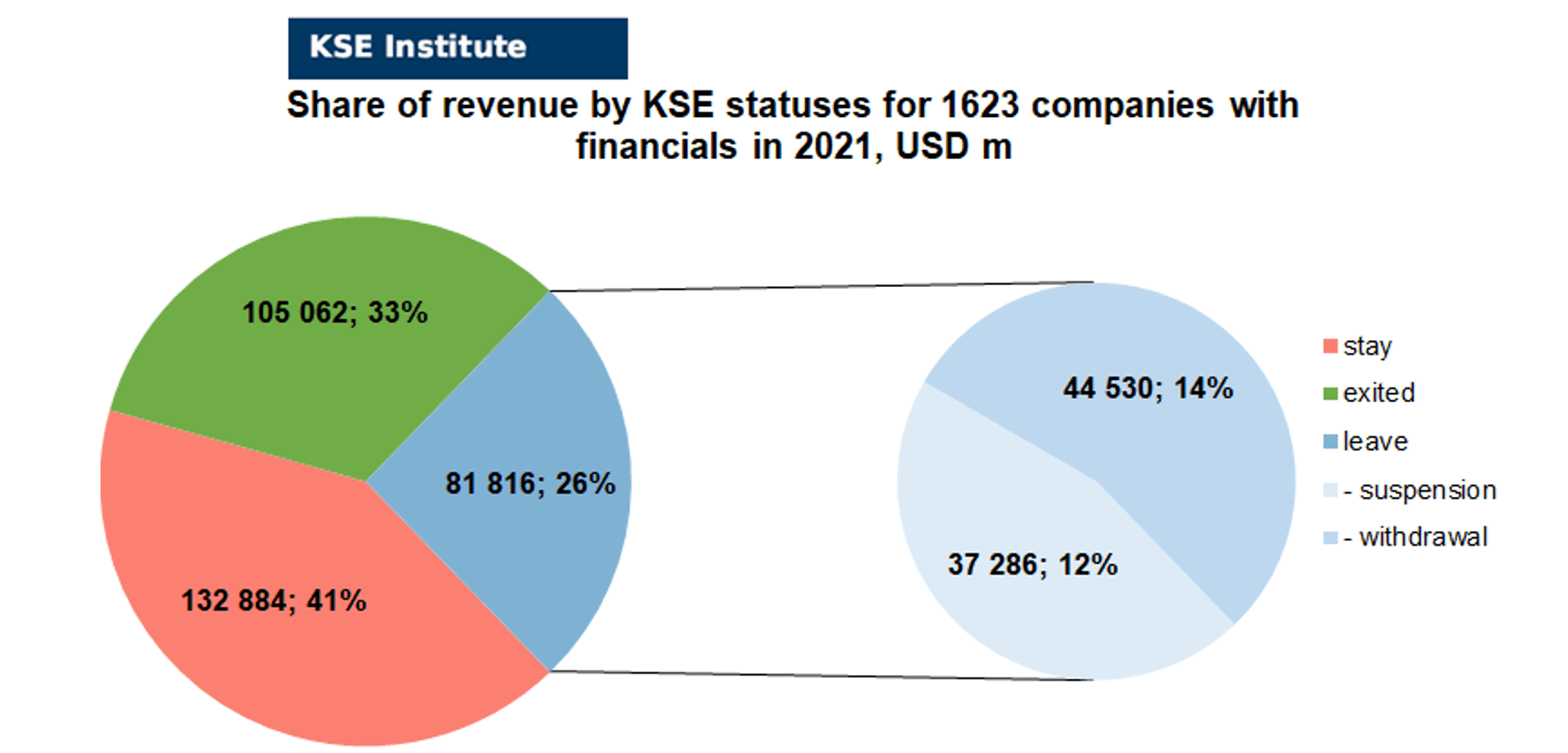

As can be seen from the tables below, as of February 5, 2025, 472 companies which had already completely exited from the Russian Federation, in 2021 had at least 574,200 personnel, $105.1 bn in annual revenue, $55.1bn in capital and $85.4bn in assets; companies, that declared a complete withdrawal from Russia had 222,600 personnel, $44.5bn in revenues, $20.3bn in capital and $47.0bn in assets; companies that suspended operations on the Russian market had 154,300 personnel, annual revenue of $37.3bn, $40.0bn in capital and $103.5bn in assets.

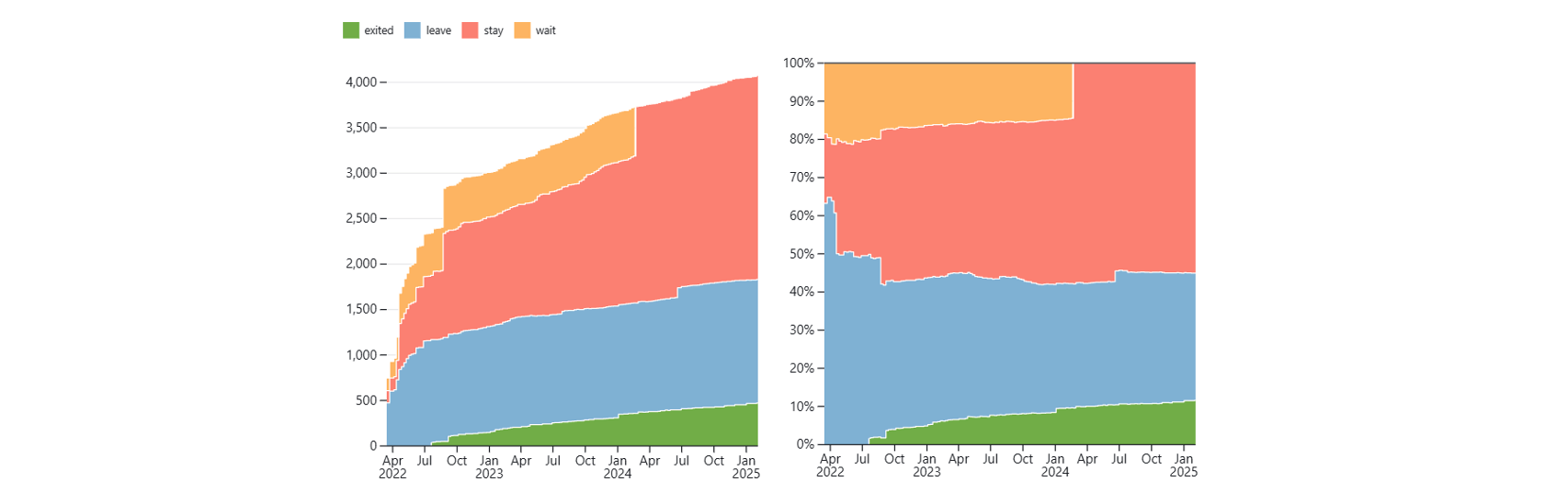

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 29 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 23 were added in January 2025). However, if to operate with the total numbers in KSE database, about 33.4% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 55.0% are still remaining in the country and only 11.6% made a complete exit⁴

At the same time, it is difficult not to overestimate the impact on the Russian economy of 472 companies that completely left the country, since in 2021 they employed 39.5% of the personnel employed in foreign companies, the companies owned about 24.8% of the assets, had 28.3% of capital invested by foreign companies, and in 2021 they generated revenue of $105.1 billion or 32.9% of total revenue and paid ~$6.0 billion of taxes or 23.3% of total taxes paid by the companies observed. Data on 1,623 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (29%) and on share of revenue withdrawn (32.9%). At the same time, a bit different picture is for those who are still staying – 46% of companies represent 41.6% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit). Also, migration of statuses in June 2024 made its effect as well as adding quite a lot of new companies in July 2024 and each month.

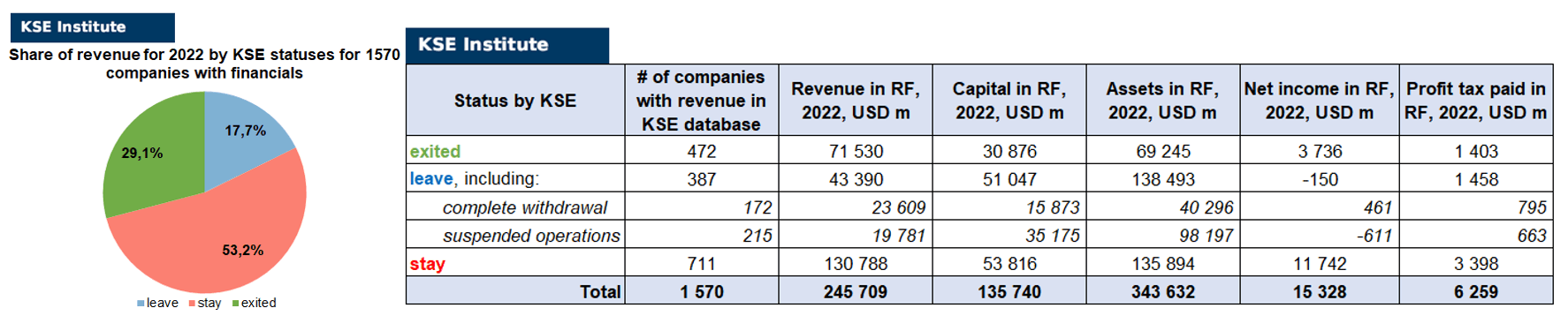

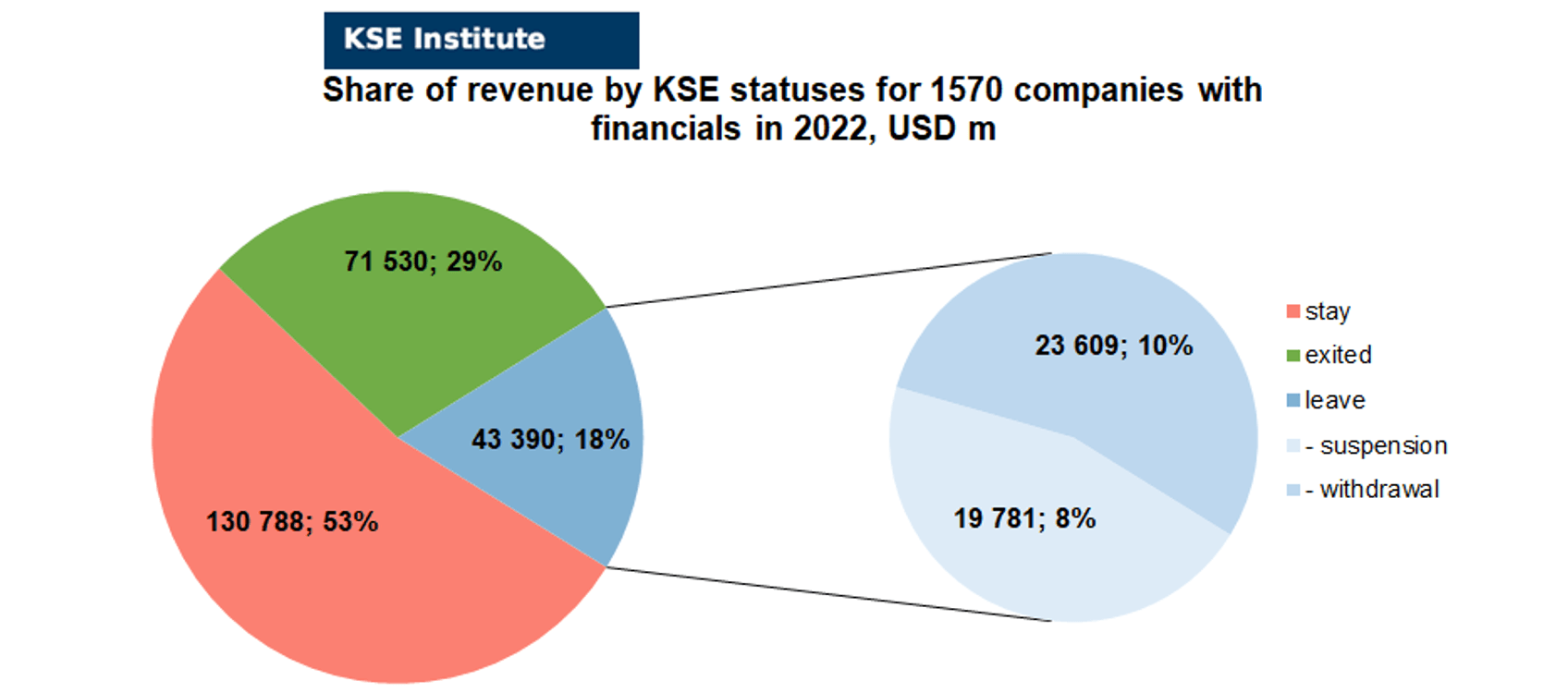

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1570 companies (about 50 companies the data of which we have collected previously have not provided their reporting, we also added revenue data for about 30 banks) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 3.8% less of revenue in 2022 (29.1% from total volume) than in 2021 (32.9% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-7.9%) revenue in 2022 (17.7% from total volume) than in 2021 (25.6% from total volume). At the same time, staying companies were able to generate much (+11.6%) more revenue in 2022 (53.2% from total volume) than in 2021 (41.6% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($343.6bn⁶ in 2022 vs $343.9bn in 2021) and would even probably increase if the remaining reporting for ~70-80 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

Also, in September 2024, the KSE Institute published the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

On January 13, 2025 the new research was published by the B4Ukraine coalition in collaboration with the Kyiv School of Economics and Squeezing Putin which reveals how foreign businesses, including many household names, continue to channel billions in taxes to the Russian state nearly three years into its war on Ukraine. The report named “Corporate Enablers of Russia’s War in Ukraine: A Closer Look at Multinational Taxes and Revenue in Russia in 2023” calls on companies to make a swift responsible exit from the Russian market and urges the G7 and allied countries to establish standards for corporate behavior, promoting immediate exits from the Russian market.

Analysis of data for 2023

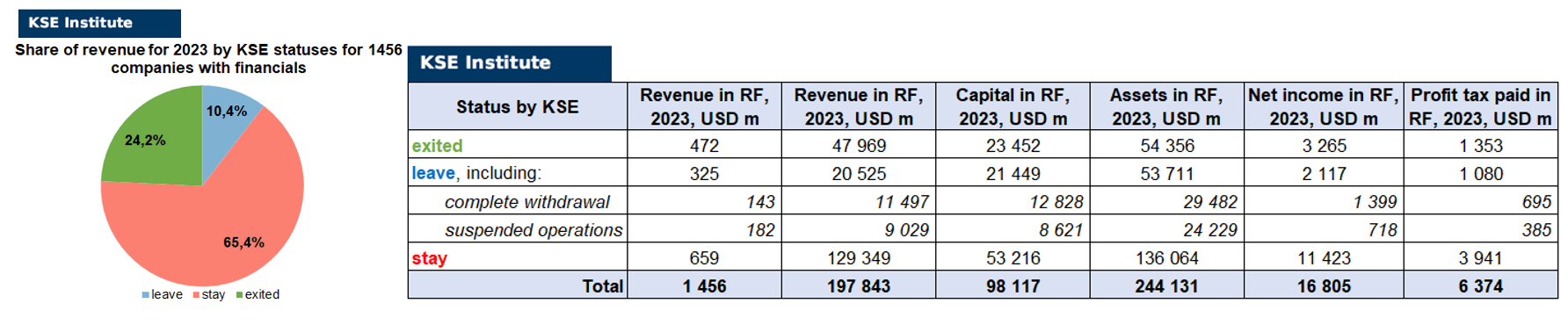

KSE Institute has already collected and preliminarily analyzed data on revenue, capital, assets and net income (profit or loss) in 2023 for ~1456 companies (after it was allowed legally in 2023 about 200 companies the data of which we have collected previously have not provided their reporting and also about 290 companies reported 0 values in revenues). Also, it should be noted that as we convert RUB to USD – the devaluation effect was quite significant, Ruble depreciated in 2023 by more than 24%, from 68.4869 RUB/USD in 2022 to 85.163 RUB/USD in 2023). Please see below charts with the detailed analysis:

As you can see, there is a significant redistribution in revenue allocation based on KSE statuses happened in 2023: share of “exited” has dropped by -8.7% vs 2021 and -4.9% vs 2022 (from 32.9% in 2021 and from 29.1% in 2022 to 24.2% in 2023) which is explained by the fact that more and more companies are being liquidated and those one which were sold are usually not able to generate the previous level of revenue.

Share of companies with status “leave” has dropped even more, by -15.2% vs 2021 and -7.3% vs 2022 (from 25.6% in 2021 and from 17.7% in 2022 to 10.4% in 2023) which is explained by the fact that those companies which are leaving are not concentrated in revenue generation on the Russian market anymore.

As for companies with status “stay” – we see the opposite picture there, they are using momentum to take market share of those who are leaving or left (especially in automotive sector) and are generating comparable with previous years level of revenue: +23.9% vs 2021 and +12.2% vs 2022 (from 41.6% in 2021 and from 53.2% in 2022 to 65.4% in 2023).

MONTHLY FOCUS: On leaving the Russian Federation. Results of January 2025

In this digest, we will summarize the results of January 2025 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’623 companies identified in the KSE database with revenue data available of about $320 billion in 2021 and $245.7 billion in 2022 (which dropped to ~$197.8 billion in 2023). And at least 472 of them have already been sold by local companies or were liquidated and left the Russian market. In January 2025 KSE Institute identified +5 new exits (4 business sales and 1 liquidation, took place in January 2025), total number of exits observed since the beginning of Russia’s invasion reached 472. In addition, company TSYS was counted in the statistics last month, but not listed in the description in December 2024.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 33% based on revenue allocation, those who are leaving represent 26% of total revenue (with 46% share of suspensions and 54% of withdrawals sub-statuses), % of staying companies represent 41% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is less than % of leaving ones (which means that about 59% (!) of pre-invasion revenue generated by foreigners is leaving or already left Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 29% based on revenue allocation, those who are leaving represent only 18% of total revenue (with 46% share of suspensions and 54% of withdrawals sub-statuses), % of staying companies represent 53% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022-2023 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

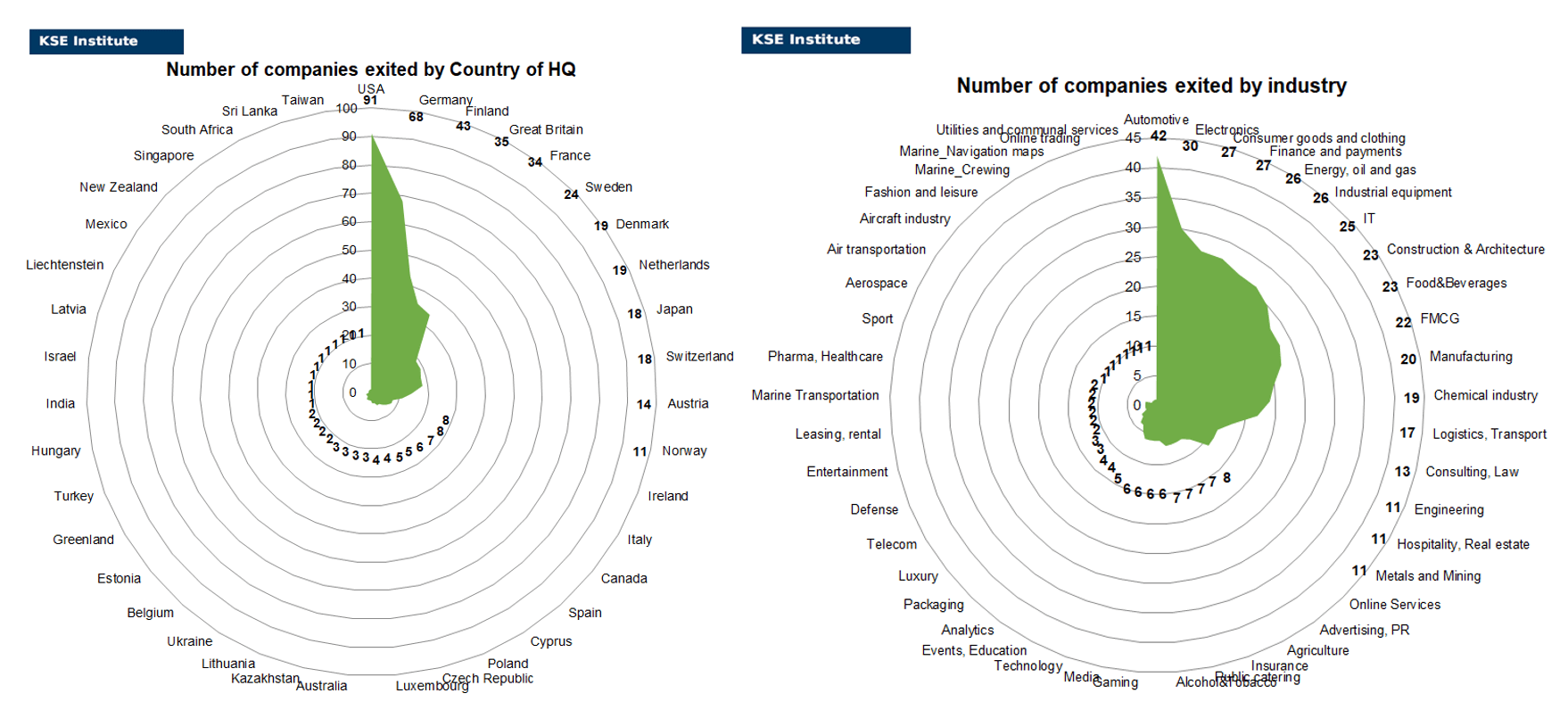

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of January 2025, companies from 39 countries and 45 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain, France and Sweden and operated in the “Automotive”, “Electronics”, “Consumer goods and closing”, “Finance and payments”, “Energy, oil and gas”, “Industrial equipment” and “IT” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Yang Ming (liquidated). Also, 4 business sales were accounted for in January 2025: Eleiko (Exit was missed earlier – company closed its business in Russia and sold its local company to management in May 2024), Edscha, Groupe BPCE and Smit International. In addition, company TSYS was counted in the statistics last month, but not listed in the description in December 2024.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: Bergkamp Investments (Kama Capital, which buys assets of Western companies leaving Russia, may acquire the Kutuzov Tower business center and the Q-Park logistics complex in Kazan. This property belongs to the Irish Bergkamp Investments, which was forced to sell it not only because of the political situation, but also because of the bankruptcy of the beneficiary. Under better conditions, the company could have earned up to 18 billion rubles from the sale of its real estate. But now it can count on 5% of this amount in the worst case), Goldman Sachs (Vladimir Putin has given permission to Balchug Capital CJSC to buy the Russian division of the American banking group Goldman Sachs), ING Bank (The Dutch ING Group has agreed to sell its banking business in Russia to a Russian investor. The buyer is a little-known company, Global Development, a “Moscow financial investor with experience in factoring services.” After the deal, the group will effectively wind down its presence on the Russian market. Under the terms of the agreement, Global Development will acquire shares in ING Bank. The bank’s new owner intends to continue servicing clients in Russia under a different brand. As a result – ING Group will have write offs for about 700 mil EUR), J&T Finance Group (Slovakia’s J&T Real Estate has found a buyer for its only asset in Russia, the five-star Baltschug Kempinski Hotel opposite the Kremlin in central Moscow) and Trelleborg Group (1 of 3 entities was liquidated in January 2025).

The next review of deals for February 2025 will be available in a month.

SPECIAL EDITION: Global Civil Society Groups Demand Companies Exit Russia, Name Kremlin’s Top Tax Contributors

On January 13, 2025 the new research was published by the B4Ukraine coalition in collaboration with the Kyiv School of Economics and Squeezing Putin which reveals how foreign businesses, including many household names, continue to channel billions in taxes to the Russian state nearly three years into its war on Ukraine. The report named “Corporate Enablers of Russia’s War in Ukraine: A Closer Look at Multinational Taxes and Revenue in Russia in 2023” calls on companies to make a swift responsible exit from the Russian market and urges the G7 and allied countries to establish standards for corporate behavior, promoting immediate exits from the Russian market.

In 2023, 1,600 multinational corporations—almost three-quarters of those with local Russian subsidiaries at the start of 2022—continued to do business in Russia, contributing to its illegal war of aggression in Ukraine. These companies, including some that have since exited, made over $196.9 billion in revenues through their Russian subsidiaries, with $16.8 billion recorded as profit.

In 2023, foreign multinationals paid an estimated $21.6 billion in total tax, bringing the total estimated taxes paid to $41.6 billion since the start of the full-scale invasion in 2022. $41.6 billion is equivalent to just under one-third of Russia’s estimated 2025 military budget, highlighting the major financial contribution these foreign firms still have on the Russian economy.

Companies based in nations committed to supporting Ukraine’s defence effort remain among the largest contributors to Russia’s tax base. These 930 G7 and EU firms were the top profit taxpayers in Russia, with 16 of the top 20 contributors coming from these nations. In 2023, 827 firms headquartered in EU member states generated $81.4 billion in revenues and paid $3 billion in profit tax.

Compared to the G7’s aid contributions, for every $10 their governments provide in bilateral aid to Ukraine, their companies may still be contributing $1 in taxes to the Russian state.

On a country basis, American firms generated the largest total revenues in Russia and emerged as the Kremlin’s most substantial contributors through profit taxes, paying $1.2 billion in 2023. Germany follows, with its companies paying $692.5 million in profit taxes to the Kremlin in the same year. This is particularly striking given that the United States and Germany, two major donors, have collectively committed over $125 billion in bilateral aid to Ukraine since the invasion.

The Fast Moving Consumer Goods (FMCG) sector plays a pivotal role in sustaining corporate contributions to the Russian budget. In 2023, this sector—which includes household names such as Mars, Nestle and Procter and Gamble—led the way as Russia’s top earners, followed by alcohol and tobacco (Philip Morris, Japan Tobacco International) and food and beverages (PepsiCo, Mondelez, Coca-Cola HBC). Combined, these consumer sectors brought in a huge $587.52 billion in revenue and paid $1.5 billion just in profit tax, therefore outearning their nearest competitors in finance and automotive sectors.

Companies remaining in Russia will pay even more in corporate taxes to the Kremlin in 2025 and beyond. Changes to the Russian Tax Code will see the corporate profit tax rate rise from 20% to 25%, beginning in 2025, marking a key step in Moscow’s strategy to instrumentalise Western business presence to secure additional revenues. Meanwhile, domestic firms in Russia’s military-industrial sector are being subsidized by the Kremlin, enjoying new tax breaks, subsidies, and preferential leasing programs.

We call on companies operating in any capacity in Russia to exit in order to minimize contributions to the war economy, avoid complicity in human rights abuses, and align with international human rights obligations. B4Ukraine and KSE also urges G7/EU governments to use all available means to urge companies to cut ties with Russia, including establishing clear standards for corporate conduct and introducing deterrent measures such as financial penalties, restriction to access to contracts and exclusion from public procurement opportunities for companies which continue doing business with Russia.

You can find more research papers here: https://kse.ua/selfsanctions-kse-institute/

What’s new last month – key news from Daily monitoring

(updated on a monthly basis) ⁷

03.01.2025

*Fanuc (Japan, Technology) Status by KSE – stay

*Siemens (Germany, Electronics) Status by KSE – exited

*HEIDENHAIN (Germany, Industrial equipment) Status by KSE – stay

Russian producers of Oreshnik super missile used western tools

https://www.ft.com/content/990bbc2f-6b6f-4990-b022-3bf4cd090686

04.01.2025

*Air Serbia (Serbia, Air transportation) Status by KSE – stay

Air Serbia Cuts Flights to Russia

05.01.2025

*Uniper SE (Germany, Energy, oil and gas) Status by KSE – leave

Uniper strives to protect LNG fleet from risk of Russian seizure

https://www.ft.com/content/30b32880-f1a0-4198-b277-244fb22b7397

*Disney (USA, Entertainment) Status by KSE – stay

*Sony (Japan, Electronics) Status by KSE – leave

Disney and Sony bank £13.5m from Russian business

https://www.telegraph.co.uk/business/2025/01/05/disney-and-sony-bank-135m-from-russian-business/

*NIS Serbia (Serbia, Energy, oil and gas) Status by KSE – stay

Vucic to Request Talk with Putin Over Possible Sanctions Against NIS https://www.kommersant.ru/doc/7421425

06.01.2025

*Revolut (Great Britain, Finance and payments) Status by KSE – leave

Ukrainians can register for Revolut through “Diya”, but the company has a Russian footprint

https://mezha.media/2025/01/07/ukraintsi-mozhut-zareiestruvatys-v-revolut/

*McDonald’s (USA, Public catering) Status by KSE – exited

Is there talk of a return? Why is McDonald’s resuming trademark registration in the Russian Federation

07.01.2025

*Siemens Energy AG (Independent) (Germany, Energy, oil and gas) Status by KSE – leave

Russian state nuclear energy company Rosatom plans to sue German industrial giant Siemens over undelivered equipment for the construction of the Akkuyu nuclear power plant in southern Turkey.

08.01.2025

*De Beers (Great Britain, Luxury) Status by KSE – stay

Some of the most incompetent sanctions imposed by Western officials against Russian diamonds were.

https://wallstreettraderpro.com/ru/360426

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

Three participants of the TOP program, which unites key IOC sponsors, have refused to cooperate with the Olympic governing body.

https://www.kommersant.ru/doc/7361190

09.01.2025

*KazMunayGas (Kazakhstan, Energy, oil and gas) Status by KSE – stay

*Lukoil Neftohim Burgas (Bulgaria, Energy, oil and gas) Status by KSE – leave

Kazakhstan offers $1 billion for Russian Lukoil refinery in Bulgaria

*Space Exploration Technologies Corp. (SpaceX) (USA, Aerospace) Status by KSE – stay

Kyivstar signed an agreement with Elon Musk’s Starlink.

https://suspilne.media/914215-kiivstar-pidpisav-ugodu-zi-starlink-ilona-maska-pro-so-jdetsa/

10.01.2025

*Oracle (USA, IT) Status by KSE – exited

Oracle’s Russian branch wants to recover almost 173 million rubles from bankruptcy participants

https://www.kommersant.ru/doc/7422525

*Teltonika (Lithuania, IT) Status by KSE – leave

The owner of Lithuanian high-tech group Teltonika has rejected allegations that its products could be sent to Russia via third countries and used in the war against Ukraine, saying he severed all business ties with Russia back in 2022.

12.01.2025

*YouTube (USA, Online Services) Status by KSE – stay

YouTube Blocking in Russia Explodes Video Views in the Netherlands

13.01.2025

*Enagas (Spain, Energy, oil and gas) Status by KSE – stay

Russia took second place in terms of liquefied natural gas (LNG) supplies to Spain in the period from January to December 2024.

*NASA (USA, Aerospace) Status by KSE – stay

The third supplement to the agreement between Roscosmos and NASA on cross-flights to the International Space Station (ISS) has been signed. https://www.kommersant.ru/doc/7430049

14.01.2025

*Damen Group (Netherlands, Defense) Status by KSE – stay

*Fayard A/S (Denmark, Defense) Status by KSE – stay

EU shipyards are fixing Russia’s Arctic LNG tankers

https://www.ft.com/content/1604de31-5c3e-4d91-9237-7ef63dc887cc

15.01.2025

*Sitrak | SINOTRUK (Hong Kong) Limited ( Hong Kong, Automotive) Status by KSE – stay

KAMAZ has lost its leadership in the Russian truck market for the first time

*Schlumberger (SLB) (USA, Energy, oil and gas) Status by KSE – stay

The world’s largest oilfield services company may leave Russia due to new US sanctions

16.01.2025

*Shenyang Machine Tools Company (China, Defense) Status by KSE – stay

New information about Shenyang Machine Tool Company’s illegal sales to North Korea and Russia

*FlyDubai (United Arab Emirates, Air transportation) Status by KSE – stay

Flydubai plans to restore flights from Dubai to Mineralnye Vody and Sochi, which were cancelled at the end of December 2024.

https://www.kommersant.ru/doc/7432647

*LVMH (France, Consumer goods and clothing) Status by KSE – leave

LVMH says ‘impossible’ to control final sales point after report of champagne shipments to Russia

18.01.2025

*Philip Morris (USA, Alcohol & Tobacco) Status by KSE – stay

*Japan Tobacco International (Switzerland, Alcohol&Tobacco) Status by KSE – stay

The world’s largest tobacco producers – American Philip Morris (brands Marlboro, L&M, Parliament, Chesterfield) and Japanese Japan Tobacco (Winston, Camel, LD), which continue to operate in Russia despite the war in Ukraine, are doing business with structures linked to the FSB and its former director Nikolai Patrushev

https://www.proekt.media/narrative/igor-kesaev/

20.01.2025

*Banque Cramer & Cie SA (Switzerland, Finance and payments) Status by KSE – exited

The number of banks with foreign participation in Russia has fallen to a minimum

https://lenta.ru/news/2025/01/20/chislo-bankov-s-inostrannym-uchastiem-v-rossii-upalo-do-minimuma/

*J&T Finance Group (Slovakia, Finance and payments) Status by KSE – leave

Slovakia’s J&T Real Estate has found a buyer for its only asset in Russia, the five-star Baltschug Kempinski Hotel opposite the Kremlin in central Moscow.

21.01.2025

*International Ski Federation (Switzerland, Sport) Status by KSE – stay

The President of the International Ski Federation (FIS), Johann Elias, supported the option of returning Russian and Belarusian athletes to the competition in neutral status.

*Don Agro International Limited (Singapore, Agriculture) Status by KSE – stay

Don Agro receives SGX-ST approval to acquire Russian medical business

*Cividale spa (Italy, Metals and Mining) Status by KSE – stay

The Italian company Cividale turned out to be a minority shareholder in the Russian foundry BVK, which fell under US sanctions.

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

*Strabag (Austria, Construction & Architecture) Status by KSE – leave

A Russian court awarded more than 2 billion euros ($2.1 billion) of damages against the biggest Western bank in Russia, Austria’s Raiffeisen Bank International, in a landmark ruling underscoring the perils of doing business in Russia.

22.01.2025

*Petroleum Oil and Gas Corporation of South Africa (PetroSA) (South Africa, Energy, oil and gas) Status by KSE – stay

PetroSA’s deal with Russia implodes

https://www.news24.com/fin24/companies/amabhungane-petrosas-deal-with-russia-implodes-20250122

*BrahMos Aerospace (India, Aerospace) yStatus by KSE – stay

India is considering a $450 million deal to sell Russian-backed supersonic cruise missiles to Indonesia as the Southeast Asian country looks to bolster defenses, according to people familiar with the matter.

*State Bank of India (SBI) (India, Finance and payments) Status by KSE – stay

Indian banks have begun blocking payments for “black gold” of Russian origin after the tightening of US sanctions

23.01.2025

*Bharat Petroleum (BPCL) (India, Energy, oil and gas) Status by KSE – stay

BPCL sees March Russian oil intake down 20% as it awaits traders’ offers

*Mondelez (USA, Food & Beverages) Status by KSE – stay

Oreo-Maker Mondelez’s Apparent Backtrack on Russia Prompts Transparency Concern

25.01.2025

*Indian Oil Corporation (India, Energy, oil and gas) Status by KSE – stay

Indian state-owned oil refining company Indian Oil Corporation (IOC) is busy looking for alternative sources of crude oil after the US imposed a major package of sanctions that affected the supply of “black gold” from Russia.

26.01.2025

*Bergkamp Investments (Ireland, Finance and payments) Status by KSE – leave

Bergkamp Investments, part of Irish Bank Resolution Corporation, is set to sell its Russian property to Kama Capital

https://www.kommersant.ru/doc/7459338

*UniCredit Bank (Italy, Finance and payments) Status by KSE – leave

Italy’s UniCredit tightens restrictions in Russia, suspends euro transfers

*FIDE (International Chess Federation) (Switzerland, Sport) Status by KSE – stay

Russian and Belarusian teams will once again be allowed to compete in youth and disabled team events, the International Chess Federation (FIDE) announced today.

https://www.chess.com/news/view/fide-eases-restrictions-on-russian-and-belarusian-teams

*UniCredit Bank (Italy, Finance and payments) Status by KSE – leave

Italian bank UniCredit, one of the last Western banks still operating in Russia, has stopped outgoing euro money transfers for individuals

https://www.rbc.ru/finances/23/01/2025/6792511a9a794712c076d029

27.01.2025

*ING Bank (Netherlands, Finance and payments) Status by KSE – leave

ING Bank said it had agreed to sell its Russian business to Global Development JSC, a “Russian company owned by a Moscow-based financial investor providing factoring services.”

*TOS Varnsdorf (Czech Republic, Engineering) Status by KSE – stay

*Esa Plating En SRO (Czech Republic, Industrial equipment) Status by KSE – stay

*Labara (Czech Republic, Electronics) Status by KSE – stay

*Egyptian German For Engineering Works (Egypt, Industrial equipment) Status by KSE – stay

Nine European industrial companies continue to operate in Russia. At least two of them work with military factories

*Wison New Energies (China, Energy, oil and gas) Status by KSE – stay

In March 2024, Chinese gas liquefaction plant manufacturer Wison New Energies shipped two units it produced for the third stage of Arctic LNG 2.

28.01.2025

*Auchan (France, FMCG) Status by KSE – stay

Auchan’s Russia Unit Dismisses Sale Rumours

29.01.2025

*Sony PlayStation (Japan ,Gaming) Status by KSE – leave

*Xbox (USA, Gaming) Status by KSE – stay

The EU plans to ban the sale of gaming equipment in the Russian Federation in order to hit its drones

30.01.2025

*LTG Cargo (Lithuania, Logistics, Transport) Status by KSE – leave

LTG Cargo takes a step closer to Europe and further from Russia

*Discord (USA, IT) Status by KSE – leave

Roskomnadzor (RKN) for the first time issued a protocol to the Discord messenger for refusing to localize the personal data of Russians. https://www.kommersant.ru/doc/7461879

31.01.2025

*Space Exploration Technologies Corp. (SpaceX) (USA, Aerospace) Status by KSE – stay

Russian senator owned a stake in SpaceX while he was under sanctions

*Tigers Realm Coal (Australia, Metals and Mining) Status by KSE – leave

Tigers Realm Coal Nears Completion of Russian Subsidiary Sale Amid Legislative Delays

*Binggrae Co (South Korea, Food & Beverages) Status by KSE – stay

Binggrae, South Korea’s leading food company, has announced its participation in the ‘2025 PRODEXPO (Moscow International Food Expo)’ as part of its efforts to expand into the Russian market.

*Mitsui & Co. (Japan, Conglomerate) Status by KSE – leave

Japanese Mitsui’s LNG Carrier Stops Loading LNG from Putin’s Friend’s Company

*Goldman Sachs (USA, Finance and payments) Status by KSE – leave

Russian President Vladimir Putin has authorized the Balchug Capital company to acquire 100% of the shares of Goldman Sachs Bank LLC, which belongs to the Goldman Sachs Group. https://www.kommersant.ru/doc/7476571

01.02.2025

*Framatome (France, Energy, oil and gas) Status by KSE – stay

French nuclear company Framatome has signed a contract with Rosatom for the joint production of nuclear fuel for water-water power reactors (WWER or VVER). https://www.kyivpost.com/post/46395

02.02.2025

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen Bank Clients in Russia Help Supply Putin’s War Machine

*Linux Foundation (USA, IT) Status by KSE – leave

The Linux Foundation, a non-profit consortium dedicated to the development of the Linux operating system, published new guidelines for interacting with programmers from countries subject to international sanctions in late January 2025.

https://dzen.ru/a/Z6B0adZRjhRfN9Zh

*JPMorgan (USA, Finance and payments) Status by KSE – leave

JPMorgan Blocks $2 Billion from Russia

https://www.dw.com/ru/wsj-jpmorgan-zablokiroval-2-mlrd-dollarov-iz-rossii/a-71486229

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

In September 2024, the KSE Institute published the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP“. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² In June 2024 KSE Institute reviewed statuses of companies based on new revenue data for 2023, about 100 companies moved from status “stay” to status “leave” due to significant drop of revenue (60%+), usually the same trend took place in 2022 as well

³ When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

⁴ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁶ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website