- Kyiv School of Economics

- About the School

- News

- 72nd issue of the regular digest on impact of foreign companies’ exit on RF economy

72nd issue of the regular digest on impact of foreign companies’ exit on RF economy

7 January 2025

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 06.12.2024-06.01.2025.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

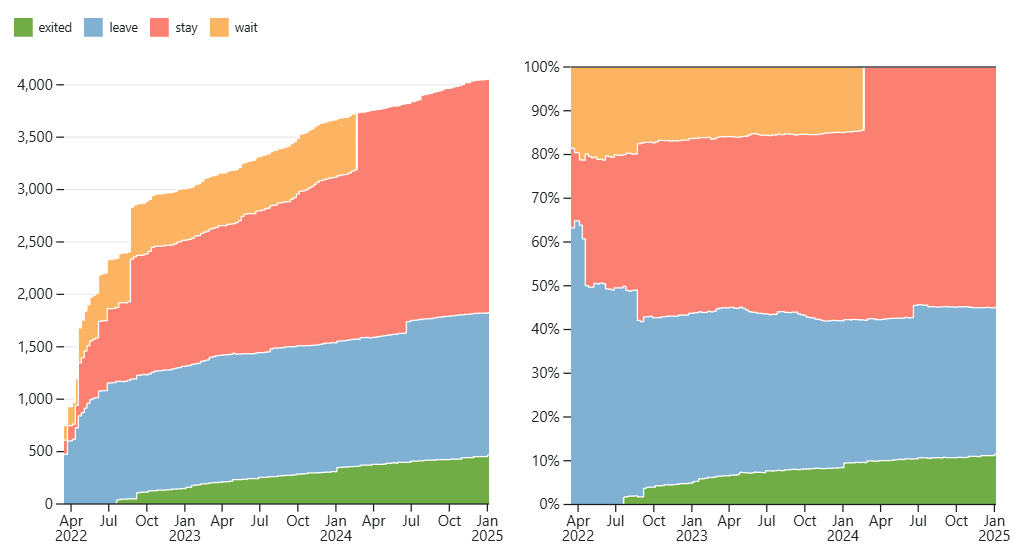

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

KSE DATABASE SNAPSHOT as of 06.01.2025

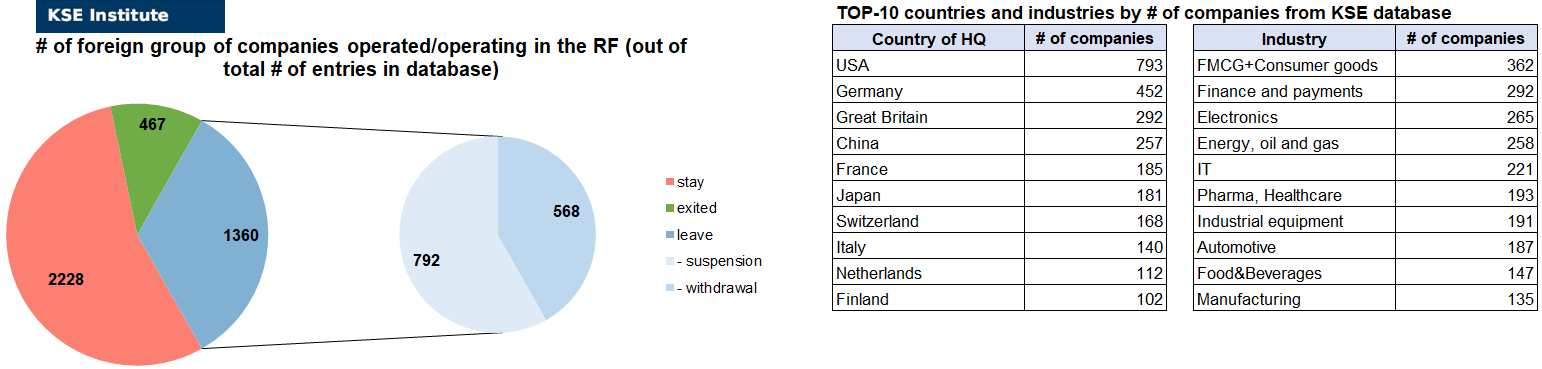

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 228² (+5 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 360 (-7 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 467 (+15 per month)

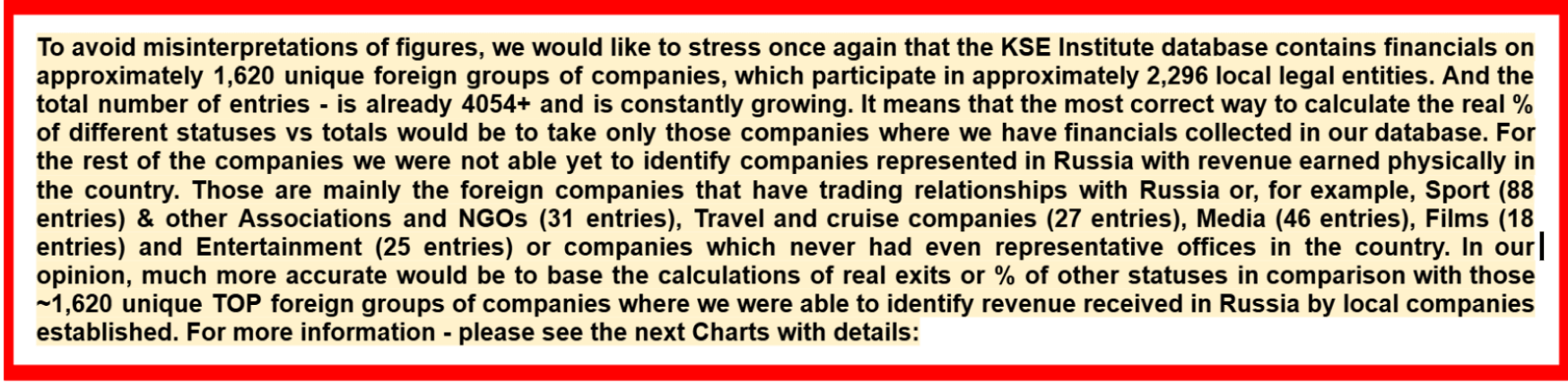

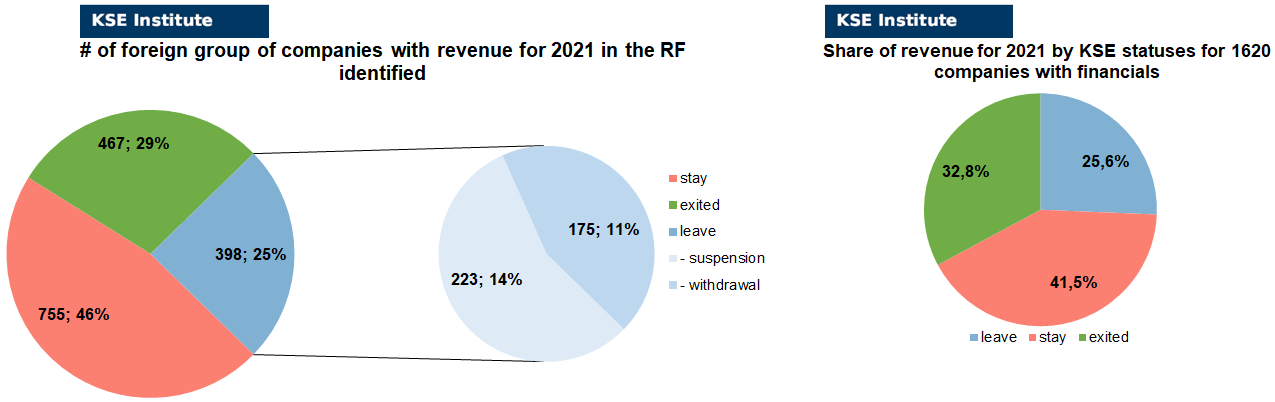

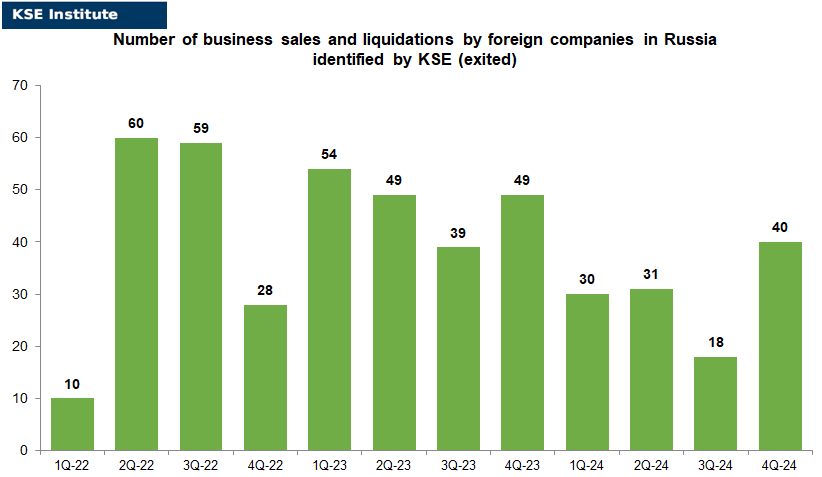

As of January 6, 2025, we have identified about 4,054 companies, organizations and their brands from 108 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1’620 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $194.4 billion), local revenue (about $319.8 billion), local assets (about $343.9 billion) as well as staff (about 1.453 million people) and taxes paid (about $25.7 billion). 1,360 foreign companies have suspended or ceased operations in Russia. Also, we added information about 467 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (8 business sales and 7 business liquidations took place in December 2024).

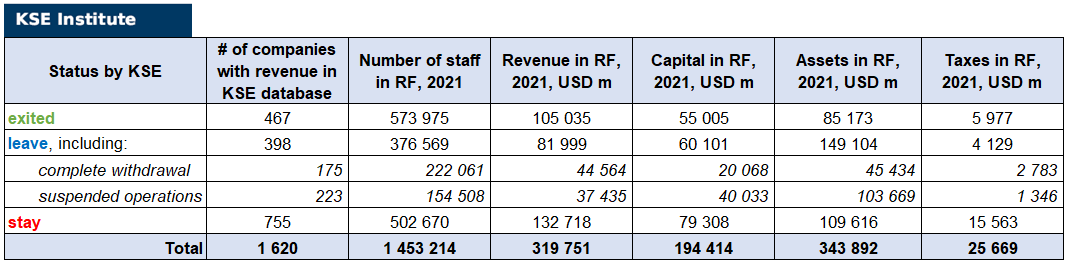

As can be seen from the tables below, as of January 6, 2025, 467 companies which had already completely exited from the Russian Federation, in 2021 had at least 574,000 personnel, $105.0 bn in annual revenue, $55.0bn in capital and $85.2bn in assets; companies, that declared a complete withdrawal from Russia had 222,100 personnel, $44.6bn in revenues, $20.1bn in capital and $45.4bn in assets; companies that suspended operations on the Russian market had 154,500 personnel, annual revenue of $37.4bn, $40.0bn in capital and $103.7bn in assets.

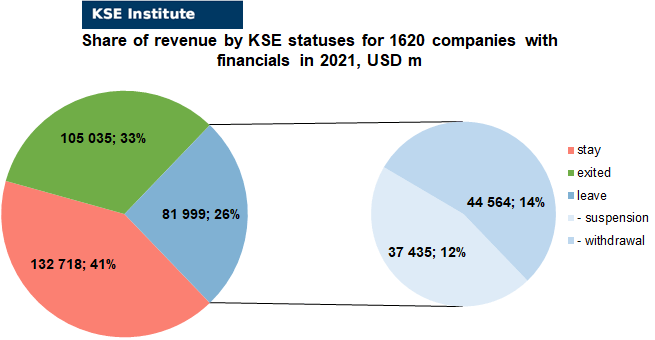

The following table is based on 2021 data available for 1 620 TOP public companies operated/operating in RF³:

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 28 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 13 were added in December 2024). However, if to operate with the total numbers in KSE database, about 33.5% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 55.0% are still remaining in the country and only 11.5% made a complete exit.

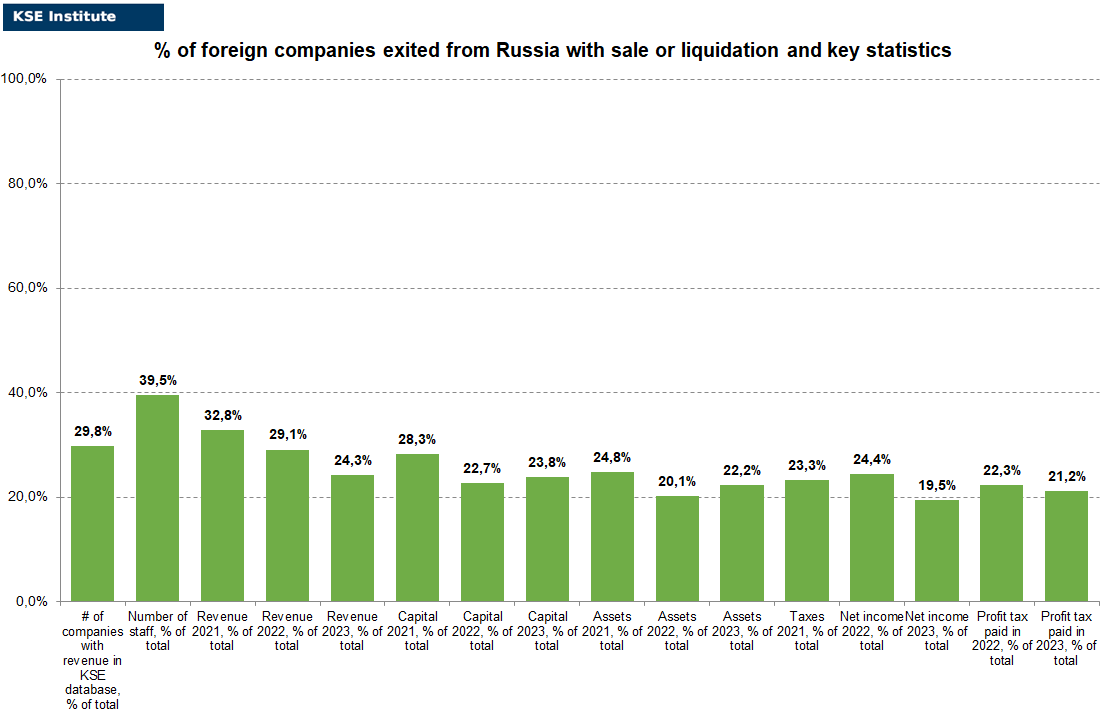

At the same time, it is difficult not to overestimate the impact on the Russian economy of 467 companies that completely left the country, since in 2021 they employed 39.5% of the personnel employed in foreign companies, the companies owned about 24.8% of the assets, had 28.3% of capital invested by foreign companies, and in 2021 they generated revenue of $105.0 billion or 32.8% of total revenue and paid ~$6.0 billion of taxes or 23.3% of total taxes paid by the companies observed. Data on 1,620 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (29%) and on share of revenue withdrawn (32.8%). At the same time, a bit different picture is for those who are still staying – 46% of companies represent 41.5% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit). Also, migration of statuses in June 2024 made its effect as well as adding quite a lot of new companies in July 2024 and each month.

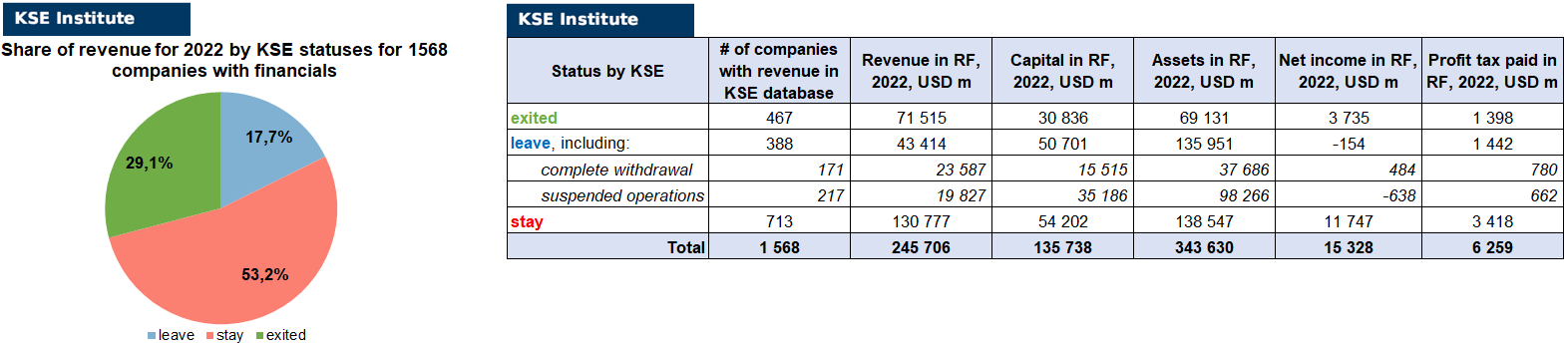

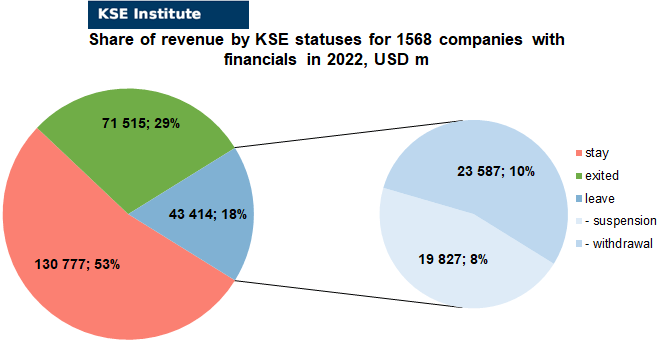

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1568 companies (about 50 companies the data of which we have collected previously have not provided their reporting, we also added revenue data for about 30 banks) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 3.7% less of revenue in 2022 (29.1% from total volume) than in 2021 (32.8% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-7.9%) revenue in 2022 (17.7% from total volume) than in 2021 (25.6% from total volume). At the same time, staying companies were able to generate much (+11.7%) more revenue in 2022 (53.2% from total volume) than in 2021 (41.5% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($343.6bn in 2022 vs $343.9bn in 2021) and would even probably increase if the remaining reporting for ~70-80 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, in September 2024, the KSE Institute published the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

Current progress of Exiters vs others is the following:

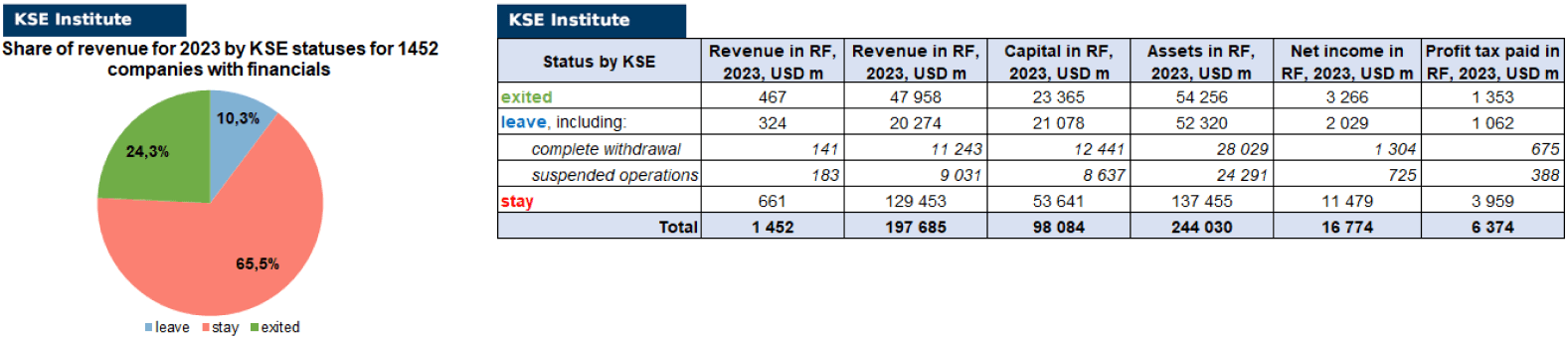

Analysis of data for 2023

KSE Institute has already collected and preliminarily analyzed data on revenue, capital, assets and net income (profit or loss) in 2023 for ~1452 companies (after it was allowed legally in 2023 about 200 companies the data of which we have collected previously have not provided their reporting and also about 290 companies reported 0 values in revenues). Also, it should be noted that as we convert RUB to USD – the devaluation effect was quite significant, Ruble depreciated in 2023 by more than 24%, from 68.4869 RUB/USD in 2022 to 85.163 RUB/USD in 2023). Please see below charts with the detailed analysis:

As you can see, there is a significant redistribution in revenue allocation based on KSE statuses happened in 2023: share of “exited” has dropped by -8.5% vs 2021 and -4.8% vs 2022 (from 32.8% in 2021 and from 29.1% in 2022 to 24.3% in 2023) which is explained by the fact that more and more companies are being liquidated and those one which were sold are usually not able to generate the previous level of revenue.

Share of companies with status “leave” has dropped even more, by -15.3% vs 2021 and -7.4% vs 2022 (from 25.6% in 2021 and from 17.7% in 2022 to 10.3% in 2023) which is explained by the fact that those companies which are leaving are not concentrated in revenue generation on the Russian market anymore.

As for companies with status “stay” – we see the opposite picture there, they are using momentum to take market share of those who are leaving or left (especially in automotive sector) and are generating comparable with previous years level of revenue: +24.0% vs 2021 and +12.3% vs 2022 (from 41.5% in 2021 and from 53.2% in 2022 to 65.5% in 2023).

MONTHLY FOCUS: On leaving the Russian Federation. Results of December 2024

In this digest, we will summarize the results of December 2024 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’620 companies identified in the KSE database with revenue data available of about $320 billion in 2021 and $245.7 billion in 2022 (which dropped to ~$197.7 billion in 2023). And at least 467 of them have already been sold by local companies or were liquidated and left the Russian market. In December 2024 KSE Institute identified +15 new exits (8 business sales and 7 liquidations, 5 of which were just initiated, took place in December 2024), total number of exits observed since the beginning of Russia’s invasion reached 467. Companies which moved to status “exited” in December 2024 generated about $500 million of revenues in 2021.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 33% based on revenue allocation, those who are leaving represent 26% of total revenue (with 46% share of suspensions and 54% of withdrawals sub-statuses), % of staying companies represent 41% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is less than % of leaving ones (which means that about 59% (!) of pre-invasion revenue generated by foreigners is leaving or already left Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 29% based on revenue allocation, those who are leaving represent only 18% of total revenue (with 46% share of suspensions and 54% of withdrawals sub-statuses), % of staying companies represent 53% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022-2023 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

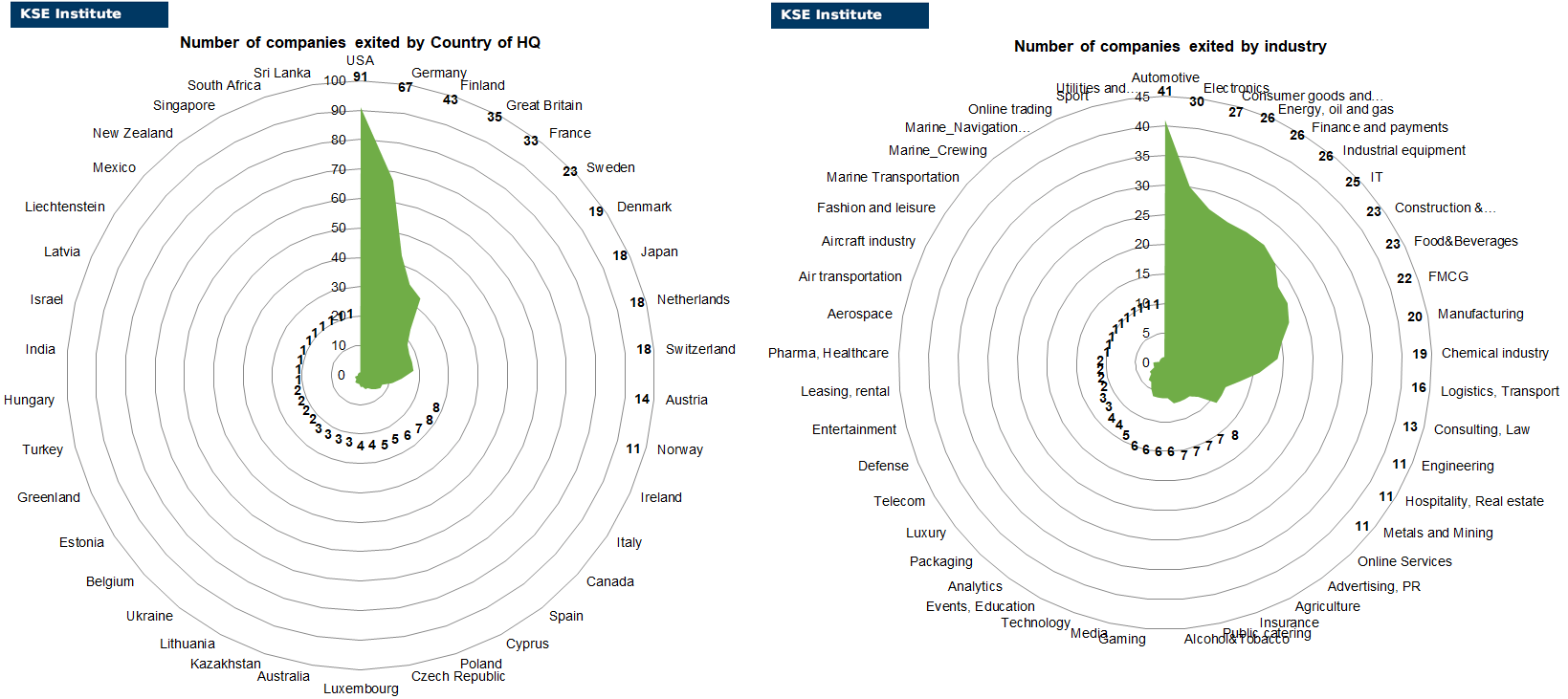

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of December 2024, companies from 38 countries and 45 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain, France and Sweden and operated in the “Automotive”, “Electronics”, “Consumer goods and closing”, “Energy, oil and gas”, “Finance and payments”, “Industrial equipment” and “IT” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Engel Austria (initiated liquidation), FedEx (liquidated), Glanbia (initiated liquidation), Juniper Networks (initiated liquidation), Lufthansa Technik (initiated liquidation) and Open Cascade (liquidated). Also, 8 business sales took place in December 2024: Crayon Group AS (it took about 2 years to finalize exit process), EMAG, Exterran Corporation, Fraport (After Orbit Aviation LCC was allowed to acquire share of the German Fraport AG in the authorized capital of the management company of Pulkovo Airport, In December 2025, Orbit Aviation bought 25% of the German Fraport, which decided to leave Russia), Nemak, Peikko Group, Roca and Selgros.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: Anheuser-Busch (New business seizure – Putin placed shares in InBev’s Russian entity in temporary management, decree says), Fishman Group / Mirland Development (Israeli Mirland Development sold the Yaroslavsky Vernisazh shopping center with an area of 65 thousand square meters, the cost of which could have reached 5 billion rubles) and Natixis Bank (Russian President Vladimir Putin has given permission to the Bureaucrat company, which owns Realist Bank, to acquire 100% of the shares of Natixis Bank from the Natixis group).

The next review of deals for January 2025 will be available in a month.

SPECIAL EDITION: Summary of our work results for the last 12 months

In this digest, we will summarize our work results during the last year since December 2023 and, in general, since the beginning of the project, which began in the first days of the war.

• Key achievement which was possible to implement jointly with our colleagues from Coalition B4Ukraine – over the year more than 160 companies exited Russia (as of 18/12/2023 there were 304, and as of 01/01/2025 – already 467). During the same period, about 500 new records were added to the KSE database, the number of companies in the database increased to 4055.

• Several new studies were prepared (including 2 with partners from the B4Ukraine coalition and one more, Tax Report, to be published soon), namely:

• The Business of Leaving: How multinationals can responsibly exit Russia: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

• 2024 is The Year to Defund Russia’s War: The West Holds the Key: https://b4ukraine.org/pdf/b4u_report_2024.pdf

• Analysis of foreign business exits from Russia: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

• What Are the Financial Results of Foreign Business in Russia in 2023, and Have Exit Rates Slowed Down? https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

• 12 regular monthly digests were issued, see archive here: https://kse.ua/selfsanctions-kse-institute/

• Constant publications in the media (including publications in The Economist, Financial Times, WSJ, Bloomberg, Fortune, The Telegraph, Le Monde, The Times & The Sunday Times, Follow the Money, VOXPOT, Domani, BNE IntelliNews, rts.ch – Suisse, Aktuálně.cz), there were more than 130+ citations of the KSE Institute on the topic of the project, the team gave 10+ live interviews.

• The audience of the website https://leave-russia.org/ has reached about 2,000 active users / day from different parts of the world, and the main page of the project on the social network Twitter has reached about 2,100 followers + hundreds of followers are on the Twitter of website and on the project’s LinkedIn and YouTube. Also, the audience that reads Company News @ Leave-russia.org and uses the Telegram bot of the project is constantly growing.

• The dashboards on the project website https://leave-russia.org/bi-analytics and https://leave-russia.org/banks were constantly updated and filled with new information, the Telegram bot https://t.me/exit_ru_bot was improved, and a barcode scanner was developed that allows to find any brand or company operating in Russia by simply scanning the barcode using artificial intelligence tools https://leaverussia.kse.ua/ + an application was developed in the Apple Store.

• Since the beginning of the project, our team has given dozens of interviews to TV channels and radio stations, many blogs and articles have been published in the mass media, and our work has been cited in more than 900 articles of the best Ukrainian and foreign media.

• We would like to say “Thank you!” to all our readers who have stayed with us since the beginning of the project or joined recently. The next review of “exited” companies and their deals for January 2025 will be available in the beginning of February. Also, please stay tuned to see the new interesting insights with data for 2024!

You can find more details about our project here: https://kse.ua/selfsanctions-kse-institute/

What’s new last month – key news from Daily monitoring

(updated on a monthly basis) ⁷

04.12.2024

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Baltika factories were sold to Putin’s judo partner for half price

https://charter97.org/ru/news/2024/12/3/621217/

*International Fencing Federation (Switzerland, Sport) Status by KSE – stay

Sanctioned Russian billionaire resigns as president of International Fencing Federation

https://www.radiosvoboda.org/a/news-usmanov-vidmovyvsja-vid-posady-prezydenta-fie/33227031.html

*TGR Group (Multinational, IT) Status by KSE – stay

The U.S. Treasury Department has imposed sanctions on individuals associated with the TGR Group, an international network of companies and employees that facilitated sanctions evasion on behalf of the Russian elite.

https://www.eurointegration.com.ua/news/2024/12/4/7199927/

*Daimler (Germany, Automotive) Status by KSE – exited

*Volvo Cars (Sweden, Automotive)Status by KSE – exited

*MAN (Germany, Automotive) Status by KSE – exited

*Scania (Sweden, Automotive) Status by KSE – exited

Russian boom in Mercedes trucks

05.12.2024

*Norwegian Sovereign Wealth Fund (Norway, Finance and payments) Status by KSE – leave

Norway should begin process of divesting Russian assets, central bank says

06.12.2024

*International Automobile Federation (France, Association, NGO) Status by KSE – leave

The FIA may ease its restrictions on Russian drivers participating in international motorsport events, potentially paving the way for their return in 2025

*Damen Group (Netherlands, Defense) Status by KSE – stay

Dutch shipbuilder Damen accused of trading with Russia despite sanctions

https://nltimes.nl/2024/12/06/dutch-shipbuilder-damen-accused-trading-russia-despite-sanctions

*Raiffeisen ( Austria ,Finance and payments) Status by KSE – stay

Russian court rejects Raiffeisen appeal against share freeze

09.12.2024

*Fraport (Germany, Air transportation) Status by KSE – leave

*Orbit Aviation (United Arab Emirates, Logistics, Transport) Status by KSE – stay

In December, Orbit Aviation bought 25% of the German Fraport, which decided to leave Russia.

*Danone (France, FMCG) Status by KSE – exited

The owner of Danone’s former assets in Russia is the former deputy head of the Chechen Ministry of Agriculture, Ruslan Alisultanov

*Fishman Group / Mirland Development (Israel, Hospitality, Real estate) Status by KSE – leave

Israeli Mirland Development, which began operating in Russia more than 20 years ago, has found a new owner for the Yaroslavsky Vernisazh shopping center

10.12.2024

*Intel (USA, IT) Status by KSE – leave

*Analog Devices (USA, Electronics) Status by KSE – stay

*Texas Instruments (USA, Electronics) Status by KSE – exited

Russia’s Military Found a Surprisingly Simple Way to Buy US Chips

12.12.2024

*Nurbank (Kazakhstan, Finance and payments) Status by KSE – stay

Kazakhstani Nurbank joins new Russian money transfer system

*Reliance (India, Energy, oil and gas) Status by KSE – stay

Reliance Industries, Rosneft sign biggest ever India-Russia oil supply deal

13.12.2024

*Rakuten Group. Inc (Japan, Online Services) Status by KSE – leave

Roskomnadzor reported that the Viber messenger has been blocked in Russia for failure to comply with Russian legislation.

14.12.2024

*Exeed (China, Automotive) Status by KSE – stay

Exeed Exlantix ET was introduced in Russia on September 24 and will officially go on sale in the first quarter of 2025.

16.12.2024

*NIS Serbia (Serbia, Energy, oil and gas) Status by KSE – stay

Serbia expects US sanctions against local Gazprom Neft structure

17.12.2024

*Hans Wrage (Germany, Defense) Status by KSE – stay

*Beretta Holding (Italy, Defense) Status by KSE – stay

*Česká Zbrojovka (Czech Republic, Defense) Status by KSE – stay

Sniper rifles and ammunition from the EU and the US are supplied to Russia despite sanctions

*Bolero & Company (Georgia, Alcohol & Tobacco) Status by KSE – stay

Georgian alcohol producer Bolero & Company Ltd will begin producing Daliani cognac specifically for the Russian market.

https://www.kommersant.ru/doc/7380654

*Halliburton (USA, Energy, oil and gas) Status by KSE – exited

Halliburton’s successor in Russia plans to expand business

18.12.2024

*KFC (USA, Public catering) Status by KSE – exited

Owner of Rostic’s brand buys out business of major KFC franchisee in Russia

https://www.rbc.ru/business/13/12/2024/675ae08c9a7947c00bcd90e3

19.12.2024

*Air Arabia (United Arab Emirates, Air transportation) Status by KSE – stay

Air Arabia Expands Russian Network with Sharjah – Sochi Direct Flights

*Espersen (Denmark, Food & Beverages) Status by KSE – exited

*Kangamiut Seafood (Denmark, Food & Beverages) Status by KSE – stay

Danish companies buy fish worth millions from Russian oligarch

https://danwatch.dk/en/danish-companies-buy-fish-for-millions-from-russian-oligarch/

20.12.2024

*Uranium One (Canada, Metals and Mining) Status by KSE – stay

Uranium One Group, part of Rosatom, has sold its 49.979% stake in the Zarichne JV to SNURDC Astana Mining Company Limited, the ultimate beneficiary of which is a Chinese company.

https://epravda.com.ua/svit/kitay-kupuye-chastki-rosatomu-v-uranovih-proyektah-u-kazahstani-801009/

*OMV (Austria, Energy, oil and gas) Status by KSE – exited

Austrian company OMV Gas Marketing & Trading GmbH has terminated a contract with Russian Gazprom Export for gas supplies, which was concluded in 2006 and was supposed to be valid until 2040.

https://biz.nv.ua/markets/avstriyskaya-omv-rastorgla-kontrakt-s-gazpromom-50473605.html

*Xiamen C&D (China, Conglomerate) Status by KSE – stay

The Chinese conglomerate Xiamen C&D and the Russian Norilsk Nickel are negotiating the creation of a full-scale enterprise in China from the processing of Norilsk Nickel copper ore into metal.

*TCL Technology (China, Electronics) Status by KSE – stay

The leaders of the Russian TV market, Chinese Haier, TCL and Huawei, are in talks with Yandex

https://www.kommersant.ru/doc/7383757

*MVM CEEnergy Zrt. (Hungary, Energy, oil and gas) Status by KSE – stay

*MOLGroup (Hungary, Energy, oil and gas) Status by KSE – stay

*Slovenský plynárenský priemysel (SPP) (Slovakia, Energy, oil and gas) Status by KSE – stay

EU gas companies are seeking transit through Ukraine as time for a deal runs out.

21.12.2024

*International Skating Union (Switzerland, Sport) Status by KSE – stay

International Skating Union Allows Russians to Qualify for 2026 Olympics

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Sale of Shell’s stake in Russian-owned PCK refinery falls through

https://finance.yahoo.com/news/sale-shells-stake-russian-owned-121614605.html

*Anheuser-Busch (Belgium, Alcohol&Tobacco) Status by KSE – leave

AB InBev and Anadolu Efes split assets: AMCU approval available

23.12.2024

*BMW (Germany, Automotive) Status by KSE – leave

BMW finds irregularities in Russia car sales, despite sanctions

https://www.yahoo.com/news/bmw-finds-irregularities-russia-car-114809746.html

24.12.2024

*MOLGroup (Hungary, Energy, oil and gas) Status by KSE – stay

Orban: Hungarian company wants to buy Lukoil refinery in Bulgaria

https://tass.ru/ekonomika/22745729

*Naegohyang (North Korea, Consumer goods and clothing) Status by KSE – stay

North Korean company Naegohyang has filed an application to register its trademark in Russia. The corresponding information has appeared in the Rospatent database

https://www.moscowtimes.ru/2024/12/20/v-rossii-poyavitsya-severokoreiskii-adidas-a151045

*Natixis Bank (France, Finance and payments) Status by KSE – leave

The Russian subsidiary bank of the Natixis group, one of the largest in France, has received permission to be sold to the owner of Realist Bank, who had previously bought the subsidiary of J&T Finance Group SE and had already merged it with his Russian credit institution.

25.12.2024

*JPMorgan (USA, Finance and payments) Status by KSE – leave

JPMorgan gets Russia appeal date but JEMA trust assets remain frozen

26.12.2024

*Azerbaijan Airlines (Azerbaijan, Air transportation) Status by KSE – leave

Azerbaijan’s AZAL suspends Russian routes after crash

https://www.ch-aviation.com/news/148689-azerbaijans-azal-suspends-russian-routes-after-crash

*SAIC Motor | MG Motor (China, Automotive) Status by KSE – stay

The MG4 EV will be launched in Russia. According to reports, the launched model will be the all-wheel drive version of the top-end XPower configuration with a selling price of 5,300,000 rubles (approximately 389,000 yuan).

https://www.bitauto.com/en-ae/news/100197153739.html

*Hines (USA, Hospitality, Real estate) Status by KSE – exited

American investment fund sells its assets in Russia

https://www.kommersant.ru/doc/7403720

*Bombardier (Canada, Aircraft industry) Status by KSE – leave

Almost 30 aircraft imported into Russia in a year in circumvention of sanctions

*Apple (USA, Electronics) Status by KSE – leave

Apple explains removal of anti-Putin media apps by concern for democratic principles

27.12.2024

*Qazaq Air (Kazakhstan, Air transportation) Status by KSE – stay

Kazakh airline Qazaq Air has decided to suspend Astana-Yekaterinburg flights until January 27, 2025.

https://news.az/news/qazaq-air-suspends-flights-to-russia-s-yekaterinburg-for-safety-reasons

*AstraZeneca (Great Britain, Pharma, Healthcare) Status by KSE – stay

AstraZeneca paid £45m to doctors in Russia since war began

30.12.2024

*Slovenský plynárenský priemysel (SPP) (Slovakia, Energy, oil and gas) Status by KSE – stay

*SOCAR (Azerbaijan, Energy, oil and gas) Status by KSE – stay

Slovakia’s Slovenský Plynárenský Priemysel (SPP) is in talks with Azerbaijan’s state oil company SOCAR on gas purchases

https://www.rbc.ru/politics/29/12/2024/677065bd9a7947729cb61ded

31.12.2024

*MyHeritage (Israel, Online Services) Status by KSE – leave

Genealogy platform MyHeritage will exit Russia and delete Russian user data

*Air India (India, Air transportation) Status by KSE – stay

Air India, the only Indian airline with flight routes over Russia, has indicated it will continue to use Russian airspace

*Anheuser-Busch (Belgium, Alcohol&Tobacco) Status by KSE – leave

Putin places shares in InBev’s Russian entity in temporary management, decree says

https://bottleraiders.com/beer/putin-hands-off-ab-inbevs-russian-unit-to-local-company/

*The World Bank (USA, Finance and payments) Status by KSE – leave

Kyiv signs agreement with World Bank on receiving loan from US at expense of Russian assets

01.01.2025

*Air China (China, Air transportation) Status by KSE – stay

*China Southern Airlines (China, Air transportation) Status by KSE – stay

Air China, China Southern appear to avoid south Russia after deadly Azerbaijani crash

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

In September 2024, the KSE Institute published the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP“. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

Get more details on a daily basis:

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² In July 2024 KSE Institute added about 30 new TOP companies with status “stay” based on data received from YouControl on companies with foreign shareholders have been registered in Russia for the last 2.5 years

³ When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

⁴ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁶ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.