- Kyiv School of Economics

- About the School

- News

- 71st issue of the regular digest on impact of foreign companies’ exit on RF economy

71st issue of the regular digest on impact of foreign companies’ exit on RF economy

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 07.11.2024-05.12.2024.

We will continue to provide updated information on a monthly basis.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine.

The database contains a lot of information; we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from our Telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce that we have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store, which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

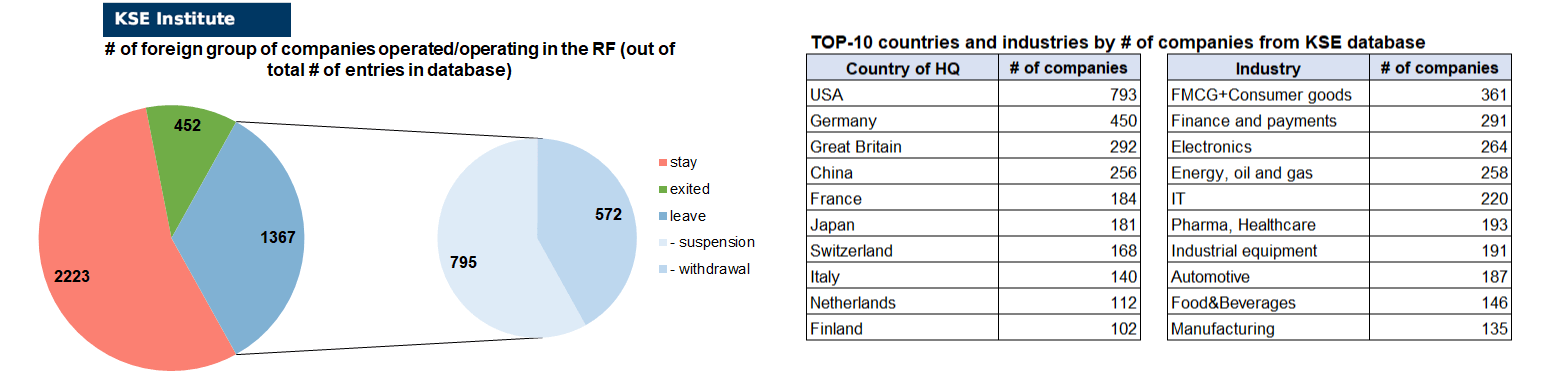

KSE DATABASE SNAPSHOT as of 05.12.2024

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 223² (+26 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 367 (+2 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 452 (+12 per month)

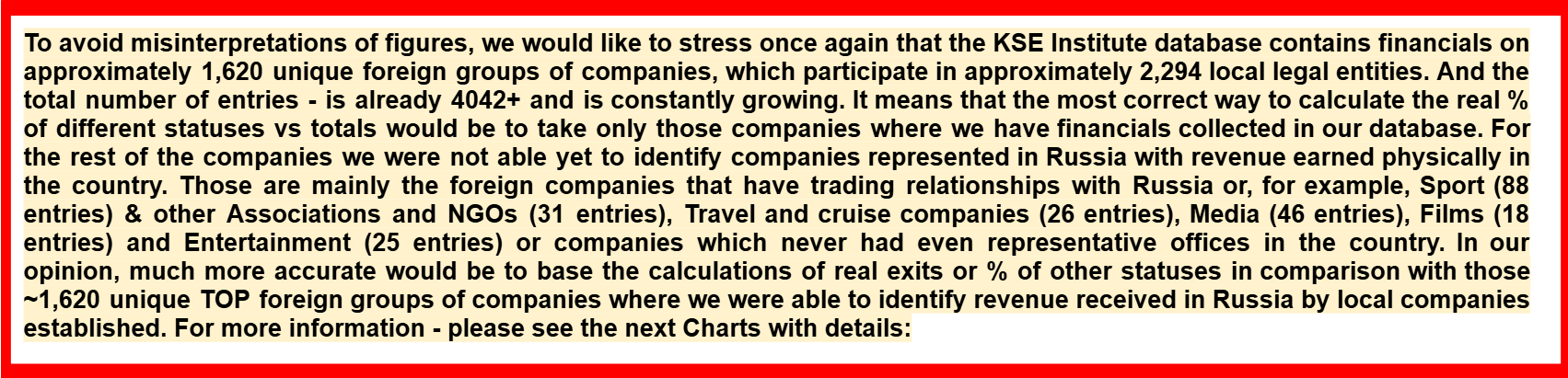

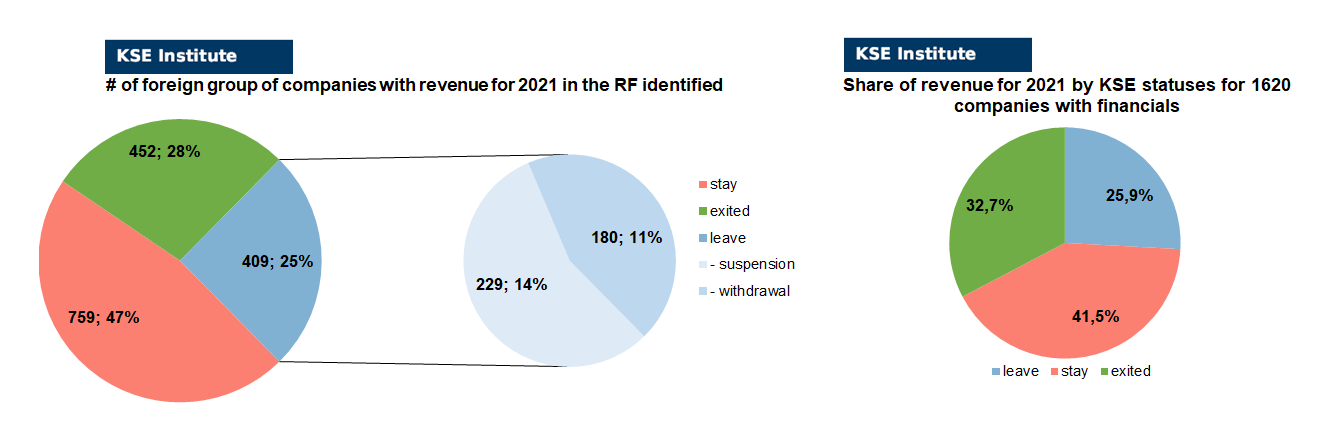

As of December 5, 2024, we have identified about 4,042 companies, organizations and their brands from 108 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1’620 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $194.4 billion), local revenue (about $319.8 billion), local assets (about $343.9 billion) as well as staff (about 1.453 million people) and taxes paid (about $25.7 billion). 1,367 foreign companies have suspended or ceased operations in Russia. Also, we added information about 452 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (7 business sales and 5 full business liquidations took place in November 2024).

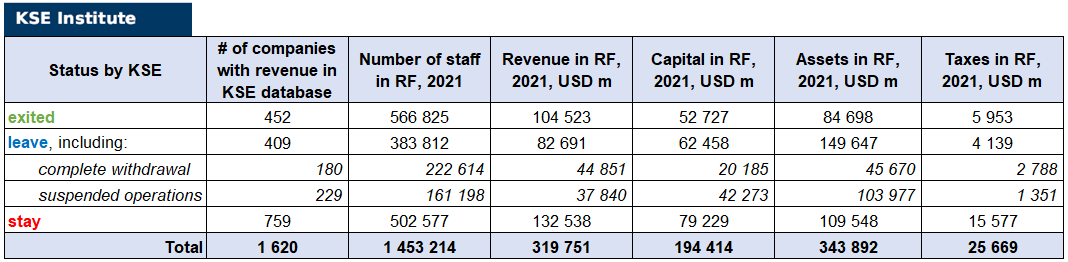

As can be seen from the tables below, as of December 5, 2024, 452 companies which had already completely exited from the Russian Federation, in 2021 had at least 566,800 personnel, $104.5 bn in annual revenue, $52.7bn in capital and $84.7bn in assets; companies, that declared a complete withdrawal from Russia had 222,600 personnel, $44.9bn in revenues, $20.2bn in capital and $45.7bn in assets; companies that suspended operations on the Russian market had 161,200 personnel, annual revenue of $37.8bn, $42.3bn in capital and $104.0bn in assets.

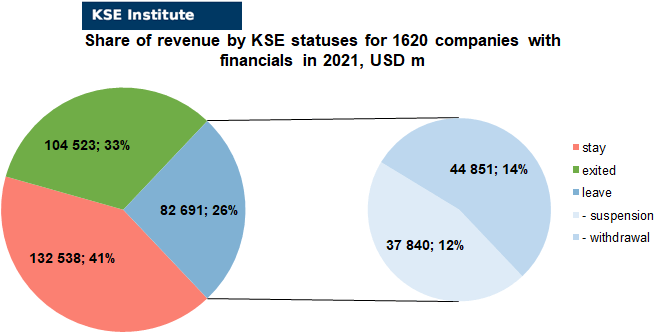

The following table is based on 2021 data available for 1 620 TOP public companies operated/operating in RF³:

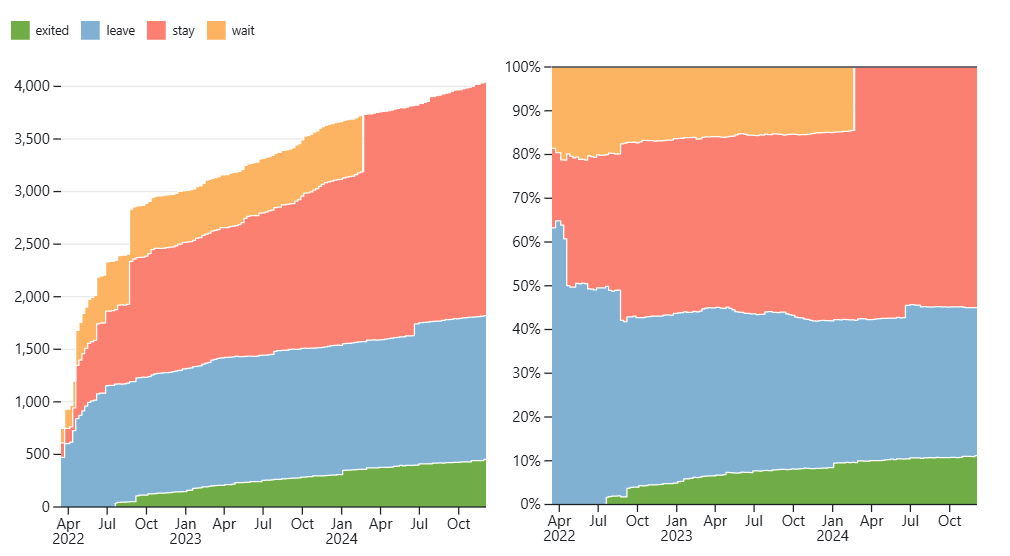

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 27 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 40 were added in November 2024). However, if to operate with the total numbers in KSE database, about 33.8% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 55.0% are still remaining in the country and only 11.2% made a complete exit⁴.

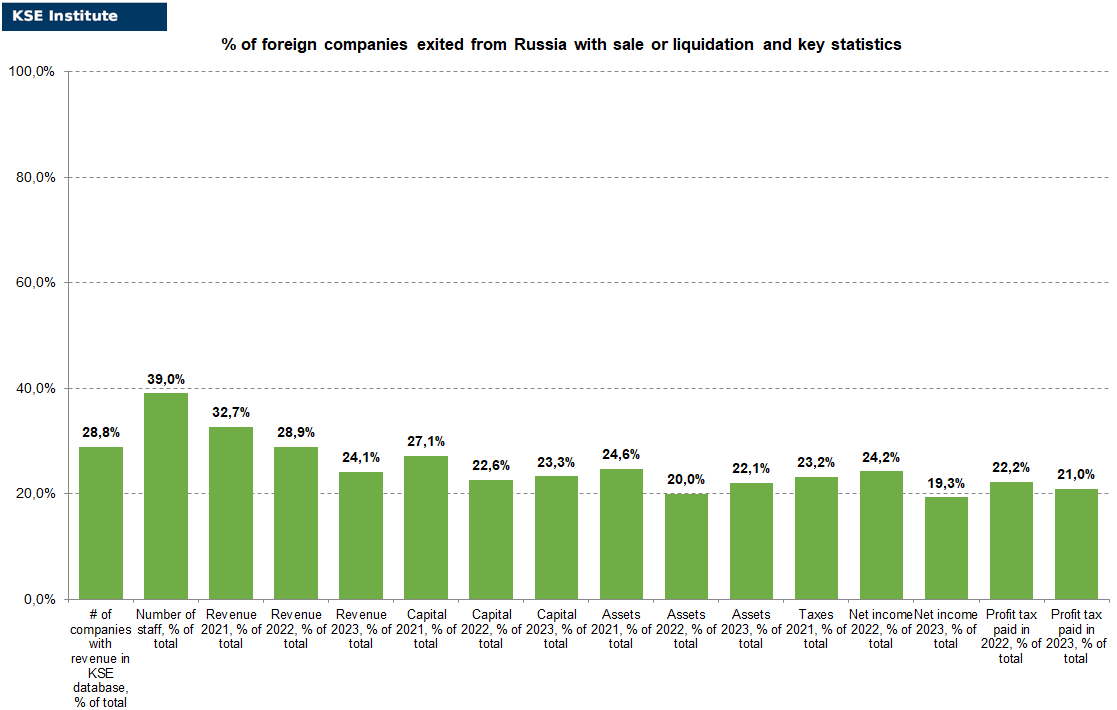

At the same time, it is difficult not to overestimate the impact on the Russian economy of 452 companies that completely left the country, since in 2021 they employed 39.0% of the personnel employed in foreign companies, the companies owned about 24.6% of the assets, had 27.1% of capital invested by foreign companies, and in 2021 they generated revenue of $104.5 billion or 32.7% of total revenue and paid ~$6.0 billion of taxes or 23.2% of total taxes paid by the companies observed. Data on 1,620 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (28%) and on share of revenue withdrawn (32.7%). At the same time, a bit different picture is for those who are still staying – 47% of companies represent 41.5% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit). Also, migration of statuses in June 2024 made its effect as well as adding quite a lot of new companies in July 2024 and each month.

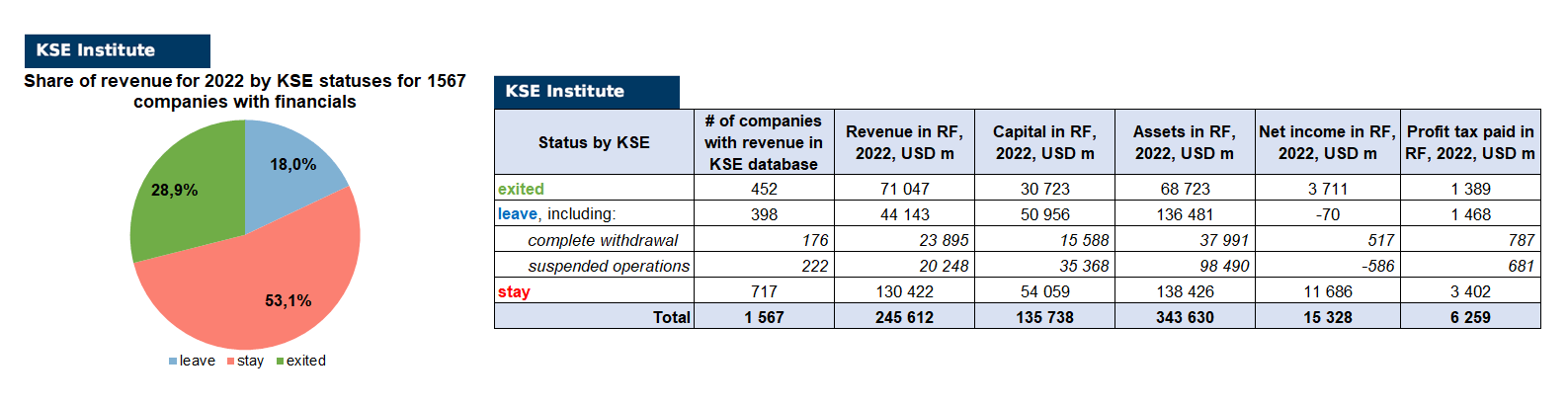

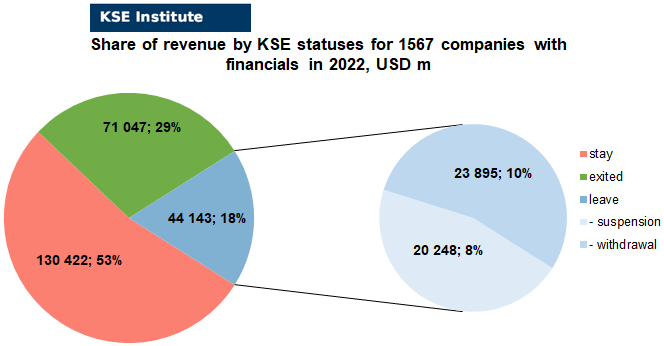

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1567 companies (about 50 companies the data of which we have collected previously have not provided their reporting, we also added revenue data for about 30 banks) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 3.8% less of revenue in 2022 (28.9% from total volume) than in 2021 (32.7% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-7.9%) revenue in 2022 (18.0% from total volume) than in 2021 (25.9% from total volume). At the same time, staying companies were able to generate much (+11.6%) more revenue in 2022 (53.1% from total volume) than in 2021 (41.5% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($343.6bn in 2022 vs $343.9bn in 2021) and would even probably increase if the remaining reporting for ~70-80 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, in September 2024, the KSE Institute published the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

Current progress of Exiters vs others is the following:

Analysis of data for 2023

KSE Institute has already collected and preliminarily analyzed data on revenue, capital, assets and net income (profit or loss) in 2023 for ~1448 companies (after it was allowed legally in 2023 about 200 companies the data of which we have collected previously have not provided their reporting and also about 290 companies reported 0 values in revenues). Also, it should be noted that as we convert RUB to USD – the devaluation effect was quite significant, Ruble depreciated in 2023 by more than 24%, from 68.4869 RUB/USD in 2022 to 85.163 RUB/USD in 2023). Please see below charts with the detailed analysis:

As you can see, there is a significant redistribution in revenue allocation based on KSE statuses happened in 2023: share of “exited” has dropped by -8.6% vs 2021 and -4.8% vs 2022 (from 32.7% in 2021 and from 28.9% in 2022 to 24.1% in 2023) which is explained by the fact that more and more companies are being liquidated and those one which were sold are usually not able to generate the previous level of revenue.

Share of companies with status “leave” has dropped even more, by -15.3% vs 2021 and -7.4% vs 2022 (from 25.9% in 2021 and from 18.0% in 2022 to 10.6% in 2023) which is explained by the fact that those companies which are leaving are not concentrated in revenue generation on the Russian market anymore.

As for companies with status “stay” – we see the opposite picture there, they are using momentum to take market share of those who are leaving or left (especially in automotive sector) and are generating comparable with previous years level of revenue: +23.8% vs 2021 and +12.2% vs 2022 (from 41.5% in 2021 and from 53.1% in 2022 to 65.3% in 2023).

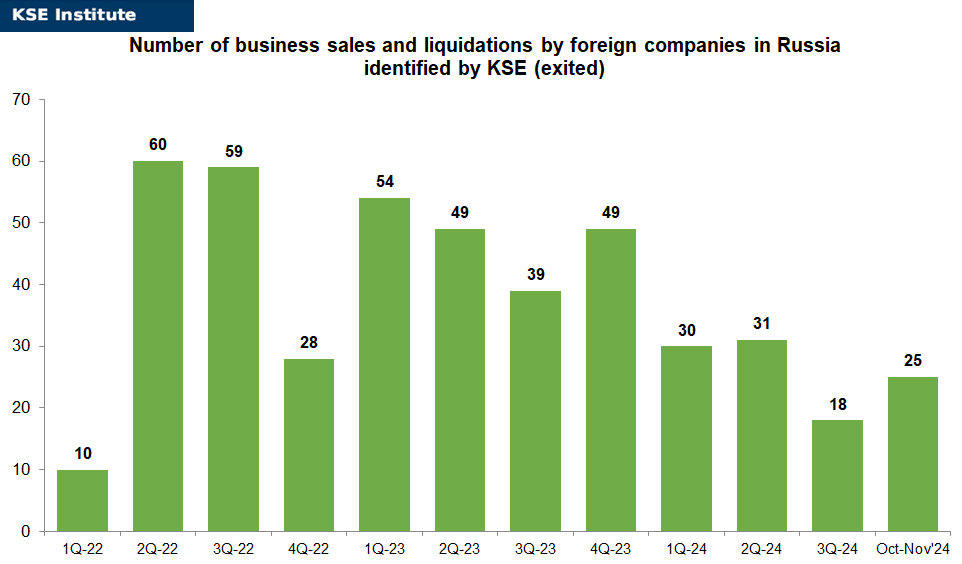

MONTHLY FOCUS: On leaving the Russian Federation. Results of November 2024

In this digest, we will summarize the results of November 2024 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’620 companies identified in the KSE database with revenue data available of about $320 billion in 2021 and $245.6 billion in 2022 (which dropped to ~$197.6 billion in 2023). And at least 452 of them have already been sold by local companies or were liquidated and left the Russian market. In November 2024 KSE Institute identified +12 new exits (and status “exited” was reconfirmed for Carlsberg as even it was seized before russian authorities approves $320 mln sale of Carlsberg assets to local company VG Invest. Also, 7 business sales and 5 liquidations, 3 of which were just initiated, took place in November 2024), total number of exits observed since the beginning of Russia’s invasion reached 452. Companies which moved to status “exited” in November 2024 generated about $1 billion of revenues in 2021.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 33% based on revenue allocation, those who are leaving represent 26% of total revenue (with 46% share of suspensions and 54% of withdrawals sub-statuses), % of staying companies represent 41% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is less than % of leaving ones (which means that about 59% (!) of pre-invasion revenue generated by foreigners is leaving or already left Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 29% based on revenue allocation, those who are leaving represent only 18% of total revenue (with 46% share of suspensions and 54% of withdrawals sub-statuses), % of staying companies represent 53% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022-2023 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

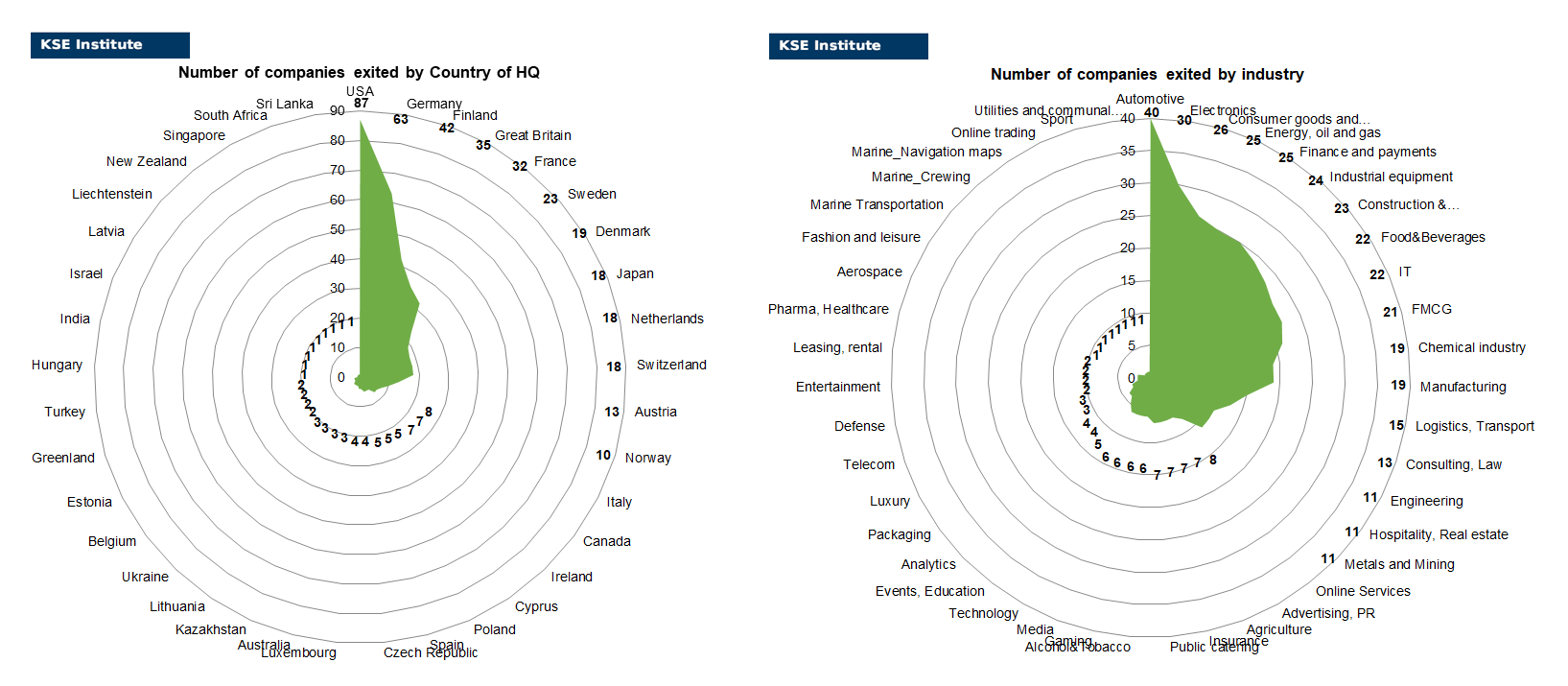

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of November 2024, companies from 37 countries and 43 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain, France and Sweden and operated in the “Automotive”, “Electronics”, “Consumer goods and closing”, “Energy, oil and gas”, “Finance and payments”, “Construction & Architecture” and “Industrial equipment” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Foss A/S (liquidated), Kemppi (initiated liquidation), Mitutoyo (initiated liquidation), Nurminen Logistics (initiated liquidation) and Spectrum Brands (liquidated) and we reconfirm status “exited” for Carlsberg as even it was seized before Russia approves $320 mln sale (~⅓ of assets value) of Carlsberg assets to local company VG Invest. Also, 7 business sales took place in November 2024: Constantia Flexibles, Digital Agency, EVN AG, GXO Logistics, Jaguar as part of Jaguar Land Rover and PPF Life insurance, LLC.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: Four Season hotels (The Meshchansky Court of Moscow nationalized the entire building of the Hotel Moskva, including the five-star Four Seasons Hotel Moscow located in the building), Louis Dreyfus (Putin approves sale of Louis Dreyfus elevator unit in Russia to unnamed buyer) and Selgros (Retail chain Selgros is ready to sell its assets in Russia to the Arosa group).

The next review of deals for December 2024 will be available in a month.

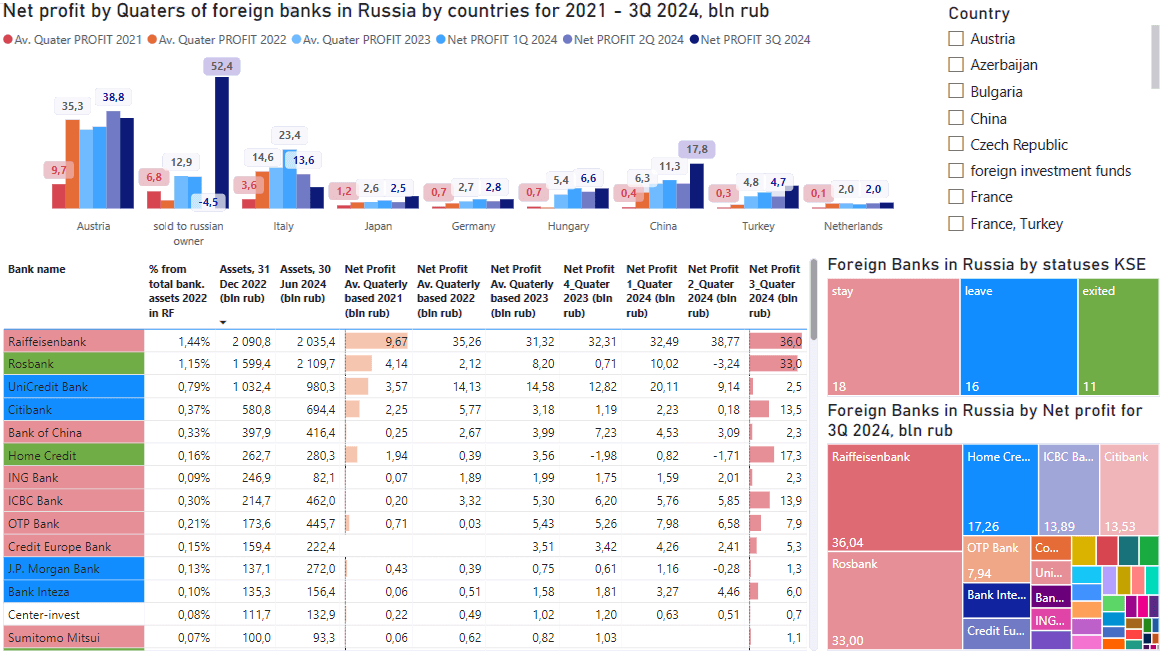

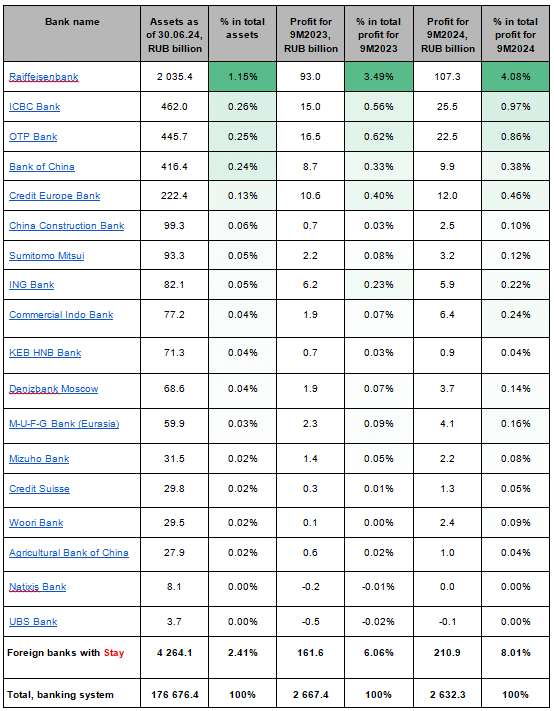

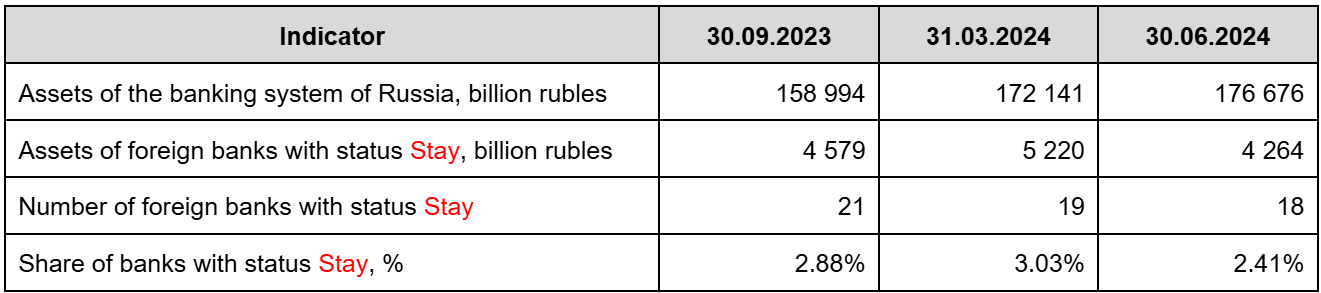

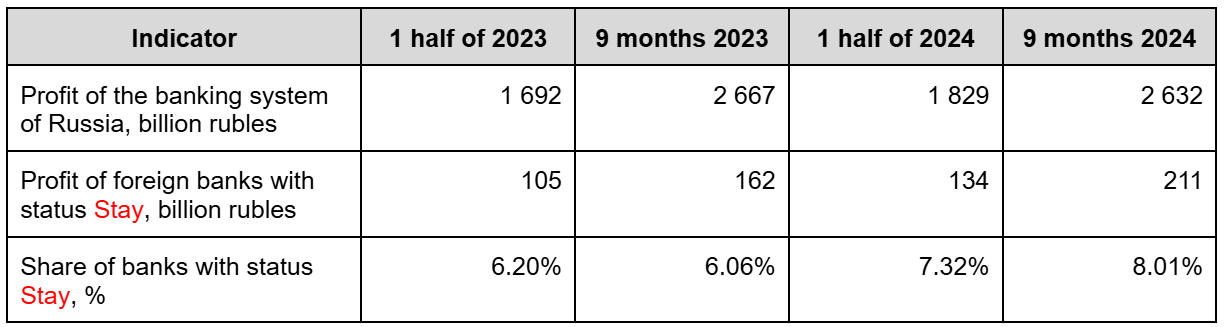

SPECIAL EDITION: Reporting update on the foreign banks in Russia for 9M2024

KSE Institute collected and pre-processed the available reporting data for 9M2024 of foreign banks in Russia.

For the convenience of users, aggregated data are presented in new dashboard on the site https://leave-russia.org/banks:

Data on Net profit as of 30.09.2024 and Assets as of 30.06.2024:

As you can see from the above information:

- – Banks with status Stay as of 30.06.2024 occupy about 2.41% (vs 3.03% as of 31.03.2024) of all assets of the banking system (Raiffeisenbank – 1.15%, ICBC – 0.26%, OTP Bank – 0.25%, Bank of China – 0.24%);

- – Banks with status Stay earned 30.47% more net profit in 9 months of 2024 than in 9 months of 2023. At the same time, the share of profit compared to all banks increased from 6.06% in 9 months of 2023 to 8.01% in 9 months of 2024 with a share of 2.41% in all assets.

- – Comparison of the growth of assets of banks with status Stay with the entire banking system:

- – Over the past 9 months, at least 3 large foreign banks have changed their statuses from Stay to Leave: UniCredit, Citigroup and JPMorgan Chase. Thus, the assets of foreign banks with status Stay have decreased, primarily due to bank exits.

- – Comparison of the net profit of banks with status Stay with the entire banking system:

- – As we can see, the share of net profit of foreign banks with status Stay increased in 9 months of 2024 to 8.01% compared to the 1st half of 2024 (up to RUB 211 billion) – even with the exit of Citigroup and UniCredit from this group.

- – At the same time, overall, the profit of the Russian banking system slightly decreased in the 9 months of 2024 (2,632 billion rubles) compared to the 9 months of 2023 (2,667 billion rubles) – so foreign banks, in average, are still more profitable than the local ones.

You will find more details in the dashboards from KSE Institute: https://leave-russia.org/banks

What’s new last month – key news from Daily monitoring (updated on a monthly basis)⁷

01.11.2024

*Warimpex (Austria, Hospitality, Real estate) Status by KSE – leave

Warimpex Finanz- und Beteiligungs has sold its last remaining project in Russia, the Airportcity St. Petersburg, and is therefore no longer active in the Russian market.

https://eurobuildcee.com/en/news/34771-warimpex-withdraws-from-russia

*El Al (Israel, Air transportation) Status by KSE – leave

Israeli carrier El Al has abruptly suspended all of its flights to Russia, with the airline due to make a decision about reinstating service at the end of the week.

https://simpleflying.com/el-al-suspends-flights-tel-aviv-russia-operational-constraints/

*MVM CEEnergy Zrt. (Hungary, Energy, oil and gas) Status by KSE – stay

*Slovenský plynárenský priemysel (SPP) (Slovakia, Energy, oil and gas) Status by KSE – stay

Europe Gas Buyers Near Azeri Deal to Maintain Ukraine Flows

02.11.2024

*YPO (Young Presidents Organization) (USA, Association, NGO) Status by KSE – leave

The Russian Prosecutor General’s Office has declared the international non-governmental organization Young Presidents Organization, registered in the United States, “undesirable” in the Russian Federation.

*Win Key Limited (China, Electronics) Status by KSE – stay

*Guhring KG (Germany, Industrial equipment) Status by KSE – stay

The US imposed sanctions on three companies that were the subject of The Insider’s investigations

03.11.2024

*Emirates (United Arab Emirates, Air transportation) Status by KSE – stay

Russia Airspace Restrictions Prove Beneficial to Emirates as it Plans to Ramp Up Capacity On China Flights By 40%

04.11.2024

*Jaguar (Great Britain, Automotive) Status by KSE – exited

The British automaker Jaguar Land Rover (JLR) is the leader in the Russian market.

https://ain.ua/2024/11/04/jaguar-land-rover-out-of-russia/

*Apple (USA, Electronics) Status by KSE – leave

The State Duma planned to sharply raise the prices of iPhones for Russians in order to punish Apple

05.11.2024

*Uniper SE (Germany, Energy, oil and gas) Status by KSE – leave

Germany received the first compensation for gas that Gazprom did not deliver

https://www.uniper.energy/news/uniper-reaffirms-outlook-for-full-year-2024-after-nine-months

*Eleview International Inc (USA, IT) Status by KSE – stay

Virginia Company and Two Senior Executives Charged with Illegally Exporting Millions of Dollars of U.S. Technology to Russia

06.11.2024

*TikTok (China, Online Services) Status by KSE – leave

The Tagansky District Court of Moscow brought TikTok to administrative responsibility for refusing to provide data to Roskomnadzor as ordered. According to Article 19.7.10 of the Code of Administrative Offenses of the Russian Federation, the court imposed a fine on TikTok Pte. Ltd in the amount of 4 million rubles.

https://www.vedomosti.ru/society/news/2024/11/05/1073131-sud-oshtrafoval

07.11.2024

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

*Total Energies (France, Energy, oil and gas) Status by KSE – exited

*British Petroleum (BP) (Great Britain, Energy, oil and gas) Status by KSE – leave

Why the impact of sanctions on Russian oil is weakening every day

*Nokian Tyres (Finland, Automotive) Status by KSE – exited

Russian winter tyre buyers favouring Nokian Tyres

https://www.tyrepress.com/2024/11/russian-winter-tyre-buyers-favouring-nokian-tyres-triangle/

*Gulf Air (Bahrain, Air transportation) Status by KSE – stay

Gulf Air celebrates 10th anniversary of services between Bahrain and Russia

*Lukoil Neftohim Burgas (Bulgaria, Energy, oil and gas) Status by KSE – stay

Russian energy group Lukoil plans to sell Bulgarian refinery to Qatari-British consortium

https://www.ft.com/content/b77822f6-e2a7-420a-bb23-43a8d21548f2

*Samsung (South Korea, Electronics) Status by KSE – stay

Why does Samsung still operate in Russia? Diplomat explained the position of the official Seoul

https://112.ua/en/comu-samsung-dosi-pracue-v-rosii-diplomat-poasniv-poziciu-oficijnogo-seula-45497

*International Cycling Union (France, Sport) Status by KSE – leave

International Cyclists’ Union banned Russian athletes representing CSKA.

08.11.2024

*China Export & Credit Insurance Corporation (Sinosure) (China, Insurance) Status by KSE – stay

China has begun to refuse to insure exports to Russia

09.11.2024

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

*UniCredit Bank (Italy, Finance and payments) Status by KSE – leave

ECB pushes Raiffeisen, UniCredit to hold capital for Russia risk, sources say

*Bank of China (China, Finance and payments) Status by KSE – stay

Yuan leaves Moscow Exchange: Chinese currency trading turnover falls to almost two-year low

11.11.2024

*Shetab (Iran, Finance and payments) Status by KSE – stay

Russian payment system Mir connected to Iranian Shetab

12.11.2024

*Slovenský plynárenský priemysel (SPP) (Slovakia, Energy, oil and gas) Status by KSE – stay

Slovakia’s main gas buyer, SPP, has signed a short-term pilot contract to purchase natural gas from Azerbaijan and is considering a long-term deal in preparation for a potential halt to Russian supplies via Ukraine.

https://www.epravda.com.ua/news/2024/11/13/721777/

*Fraport (Germany, Air transportation) Status by KSE – leave

Russian government authorises sale of Fraport’s 25% stake in operator of Saint Petersburg airport

*Cloudflare (USA, Online Services) Status by KSE – stay

Roskomnadzor Blocked Thousands of Websites Using ECH Encryption Overnight

*Oppo (China, Electronics) Status by KSE – stay

China has begun to massively block Russians’ phones

https://charter97.org/ru/news/2024/11/11/618376/

*Raven Property Group Limited (Great Britain, Hospitality, Real estate) Status by KSE – leave

Raven Russia sees risks in recognizing warehouses as natural monopolies

https://www.rbc.ru/business/11/11/2024/673255689a7947708a2e86d2

*Pepsi (USA, Food & Beverages) Status by KSE – stay

The largest producer of drinking milk reported a 3.4% increase in selling prices

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Zatecky Gus moved to Russia

13.11.2024

*GSC Game World (Ukraine, Gaming) Status by KSE – leave

Russian authorities are considering banning STALKER 2: Heart of Chornobyl.

14.11.2024

*VEON (Netherlands, Telecom) Status by KSE – exited

Owner of Ukraine’s Largest Mobile Operator Calls for End to War

*Four Season hotels (Canada, Hospitality, Real estate) Status by KSE – leave

The Meshchansky Court of Moscow nationalized the entire building of the Hotel Moskva, including the five-star Four Seasons Hotel Moscow located in the building.

https://www.rbc.ru/business/12/11/2024/6733afda9a79477ebafa5ee9

*OMV (Austria, Energy, oil and gas) Status by KSE – exited

Austrian company sues Gazprom for 230 million euros for disruption of gas supply

15.11.2024

*Bharat Dynamics Limited (India, Defense) Status by KSE – stay

India’s Bharat Dynamics signs Pantsir agreement with Russia

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

Citigroup Probed by US Over Ties to Sanctioned Russian Billionaire

*Solgar (USA, Pharma, Healthcare) Status by KSE – stay

Solgar Remains in Russia Amid Ukraine War: Unveiling Their Controversial Choice

16.11.2024

*OMV (Austria, Energy, oil and gas) Status by KSE – exited

Russia’s Gazprom has cut off gas supplies to Austrian energy company OMV, hours after Vienna said Russia had warned it would cut off flows.

https://www.epravda.com.ua/news/2024/11/16/721916/

*Apple (USA, Electronics) Status by KSE – leave

Apple Removes Russian-Language RFE/RL App Following Pressure from Russian Authorities

17.11.2024

*Chakra (Turkey, Consumer goods and clothing) Status by KSE – stay

*Mai Collection (Turkey, Consumer goods and clothing) Status by KSE – stay

*HEA (China, Consumer goods and clothing) Status by KSE – stay

The share of brands from China has grown significantly in the Russian market

18.11.2024

*Bank of China (China, Finance and payments) Status by KSE – stay

Bank of China said to block Russia-suspected transactions

19.11.2024

*OMV (Austria, Energy, oil and gas) Status by KSE – exited

Gas continues to flow to Austria via the same route that it usually uses for deliveries from Russia

*FIFA (Switzerland, Sport) Status by KSE – leave

FIFA decided to exclude Russia’s national football team from the draw for the 2026 World Cup qualifiers, set to take place on Dec. 13 in Zurich, Switzerland, over security concerns

*Centrus Energy (USA, Energy, oil and gas) Status by KSE – stay

Nuclear fuel supplier Centrus Energy said on Monday it has received a notice from Russia’s TENEX that its government passed an order, which canceled its license to export low-enriched uranium to the U.S., effective through Dec. 31, 2025.

*Raven Property Group Limited (Great Britain, Hospitality, Real estate) Status by KSE – leave

Developer Sells Business Center in St. Petersburg

https://www.kommersant.ru/doc/7310380

*Novo Nordisk (Denmark, Pharma, Healthcare) Status by KSE – stay

PSK Pharma received government permission to produce an analogue of Ozempic

20.11.2024

*FIDE (International Chess Federation) (Switzerland, Sport) Status by KSE – stay

DeFIDEzation: Russian influence in chess is threatened not so much by sanctions as by internet platforms

21.11.2024

*Airbus (Netherlands, Aircraft industry) Status by KSE – stay

In Russia, every second Airbus neo has stopped flying due to technical reasons

22.11.2024

*HSBC (Great Britain, Finance and payments) Status by KSE – exited

HSBC has stopped processing all payments from Russia or Belarus for personal banking customers

*UnionPay (China, Finance and payments) Status by KSE – leave

Russian state banks have problems with Chinese UnionPay cards after US sanctions

Banks in Five Countries Stop Servicing UnionPay Cards from Gazprombank

https://www.svoboda.org/a/inostrannye-banki-prekratili-rabotatj-s-kartami-gazprombanka/33213189.html

23.11.2024

*Topotek (China, Defense) Status by KSE – stay

*Xingkai Tech (China, Defense) Status by KSE – stay

*Mile Hao Xiang Technology (China, Defense) Status by KSE – stay

*Yiwu City Duniang Trading (China, Defense) Status by KSE – stay

Chinese companies sold $8 million worth of components to Russia for the production of fake drones

25.11.2024

*UniCredit Bank (Italy, Finance and payments) Status by KSE – leave

EU court rejects UniCredit’s request to suspend ECB’s Russian demands

*OMV (Austria, Energy, oil and gas) Status by KSE – exited

Austrian OMV confiscated gas worth €230 million from Gazprom. Reuters learned why the Russian monopolist stopped supplies

26.11.2024

*UnionPay (China, Finance and payments) Status by KSE – leave

There are only two large banks left in Russia, Rosselkhozbank and Asiatic-Pacific Bank

27.11.2024

*Eutelsat (France, Telecom) Status by KSE – stay

French campaigners and Ukrainian activists have demanded Eutelsat, a Paris-listed satellite business in which the UK holds a 10pc stake, immediately halt transmissions of dozens of Russian channels.

*Barclays (Great Britain, Finance and payments) Status by KSE – stay

Barclays challenges Russian bank’s LCIA claim

https://globalarbitrationreview.com/article/barclays-challenges-russian-banks-lcia-claim

*Airbus (Netherlands, Aircraft industry) Status by KSE – stay

Half of Russia’s Airbus A320/321neo Fleet Grounded Due To Lack Of Engine Parts

*Unilever (Great Britain, FMCG) Status by KSE – exited

Unilever Left Russia Because It Was Losing Control, CEO Says

28.11.2024

*Hongqi (China, Automotive) Status by KSE – stay

The Chinese concern FAW Hongqi decided to select premium cars from a factory in the Russian Federation.

*Selgros (Germany, FMCG) Status by KSE – leave

The Austrian owners of the Selgros retail chain have managed to find a buyer for the Russian business.

29.11.2024

*Louis Dreyfus (France, Agriculture) Status by KSE – leave

Russian President Vladimir Putin has approved the acquisition of 100% of the shares in a elevator company owned by trading and food processing firm Louis Dreyfus Company (LDC) to an unnamed buyer, a government document showed.

*China (Automotive) Status by KSE – stay

China’s Haval is preparing to expand its lineup in Russia by launching serial production of hybrid vehicles at its plant near Tula.

30.11.2024

*Omax Corporation (USA, Defense) Status by KSE – stay

Waterjets used in the production of military equipment continue to be shipped to Russia, despite the fact that both the machines themselves and their spare parts are under a US embargo.

01.12.2024

*CERN (European Organization for Nuclear Research) (Switzerland, Energy, oil and gas) Status by KSE – leave

The European Organization for Nuclear Research (CERN) on Nov. 30 officially cut ties with research institutes in Russia, in accordance with a decision to allow the cooperation agreement to expire due to the full-scale invasion of Ukraine.

https://kyivindependent.com/cern-ends-cooperation-with-russian-institutes/

*MOLGroup (Hungary, Energy, oil and gas) Status by KSE – stay

In October, the Hungarian MOL trader Moltrade-Mineralimpex Zrt delivered about 300 thousand tons of Russian oil via the Druzhba pipeline in transit through Ukraine.

02.12.2024

*BNP Paribas (France, Finance and payments) Status by KSE – stay

BNP Paribas Agrees to Plead Guilty and to Pay $8.9 Billion for Illegally Processing Financial Transactions for Countries Subject to U.S. Economic Sanctions

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen Bank International AG (RBI) has closed a deal to sell a stake in the Belarusian Priorbank to UAE-based Soven 1 Holding

03.12.2024

*DBS Bank (Singapore, Finance and payments) Status by KSE – stay

DBS Hires Private Bankers for Rich Russians as Rivals Balk

*Stoli Group (USA, Alcohol & Tobacco) Status by KSE – leave

Stolichnaya vodka maker has filed for bankruptcy following a devastating cyberattack in September and an ongoing legal battle with Russia over who owns the brand.

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Russia approves $320 mln sale of Carlsberg assets to local businessmen, document shows

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

In September 2024, the KSE Institute published the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP“. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

Get more details on a daily basis:

KSE’s Barcode Scanner (mobile devices only)

KSE’s application in the Apple Store

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

BI analytics @ Leave-russia.org

Company news @ Leave-russia.org

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing, while continuing their core business. On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold their business/assets or its part of the business to a local partner/terminated relations and left the market. Also, for companies that are being liquidated this status is being assigned

___

² – In July 2024 KSE Institute added about 30 new TOP companies with status “stay” based on data received from YouControl on companies with foreign shareholders have been registered in Russia for the last 2.5 years

___

³ – When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

___

⁴ – On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalize the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/.

___

⁵ – Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

___

⁶ – It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits before but we found the new solution allowing us to get the proper access to the registers in the future.

___

⁷ – “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website