- Kyiv School of Economics

- About the School

- News

- 70th issue of the regular digest on impact of foreign companies’ exit on RF economy

70th issue of the regular digest on impact of foreign companies’ exit on RF economy

6 November 2024

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 07.10.2024-06.11.2024.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

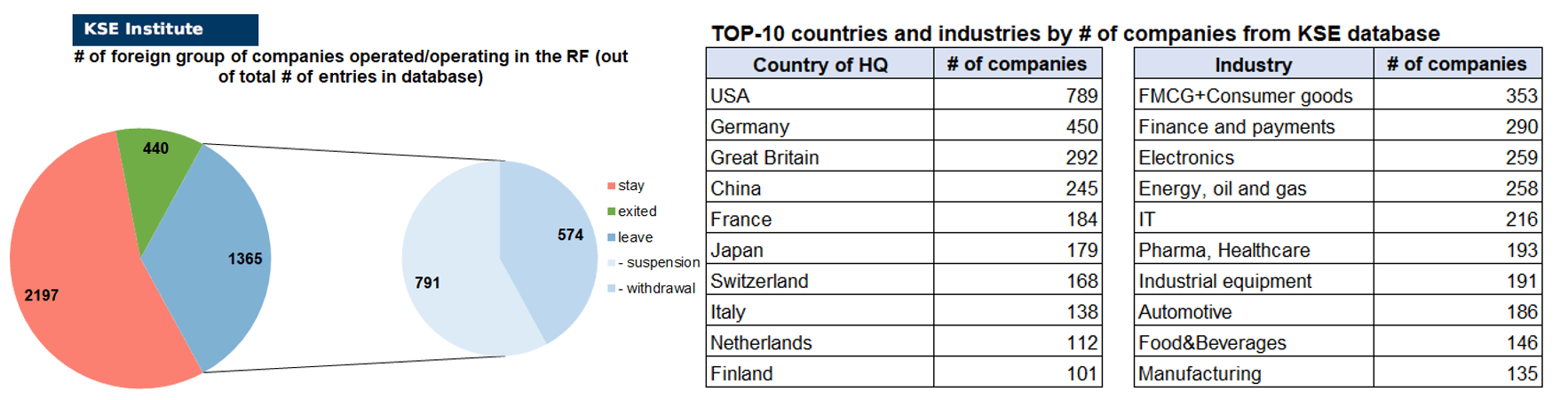

KSE DATABASE SNAPSHOT as of 06.11.2024

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 197² (+21 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 365 (-2 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 440 (+13 per month)

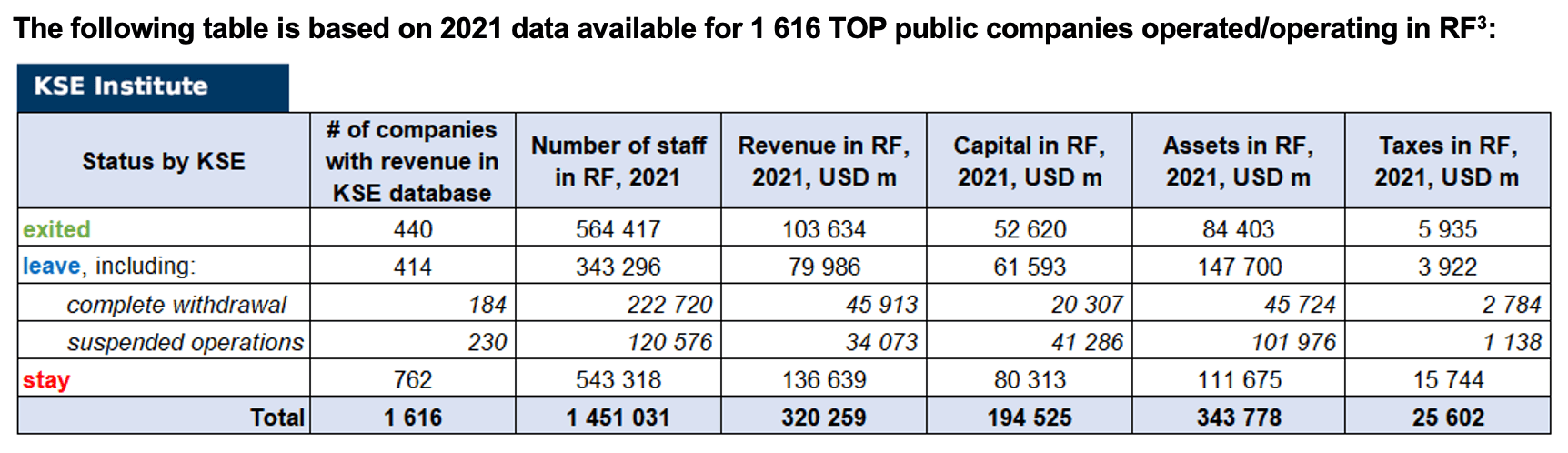

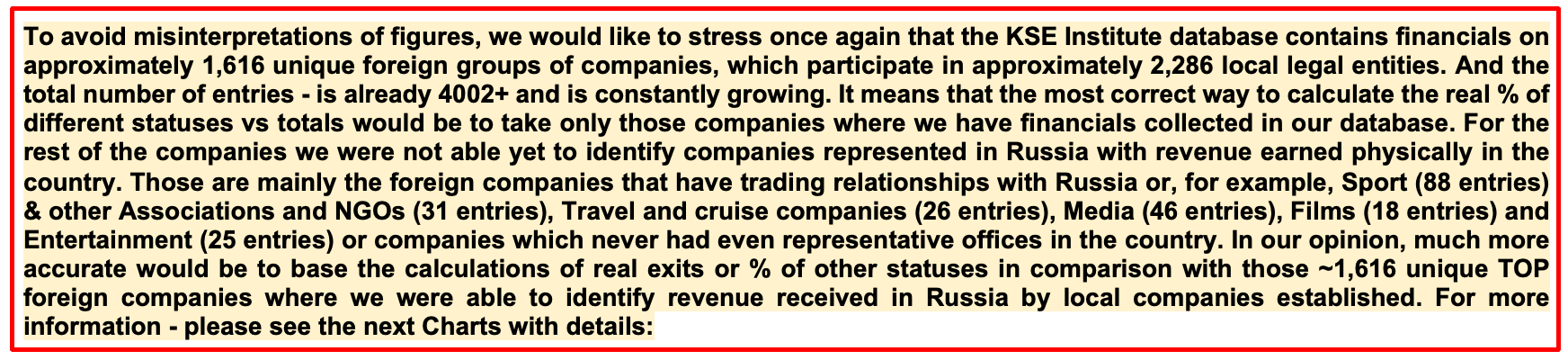

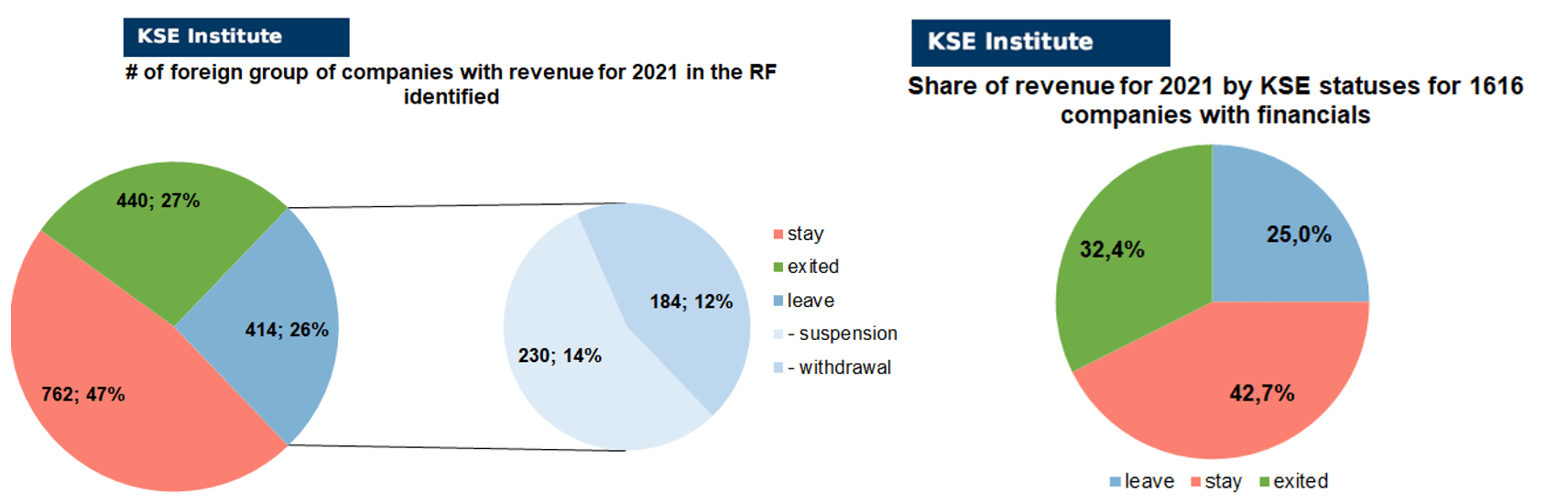

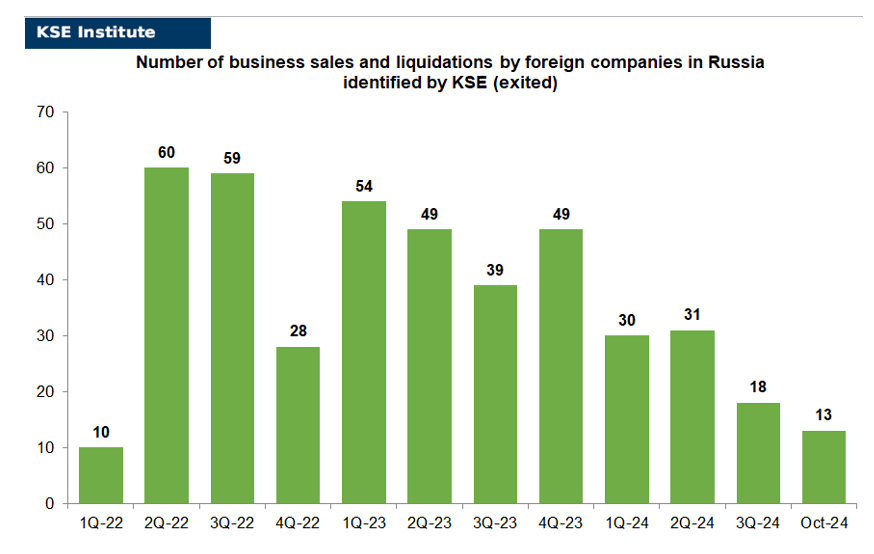

As of November 6, 2024, we have identified about 4,002 companies, organizations and their brands from 108 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1’616 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $194.5 billion), local revenue (about $320.3 billion), local assets (about $343.8 billion) as well as staff (about 1.451 million people) and taxes paid (about $25.6 billion). 1,365 foreign companies have suspended or ceased operations in Russia. Also, we added information about 440 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (8 business sales and 4 full business liquidations took place in October 2024).

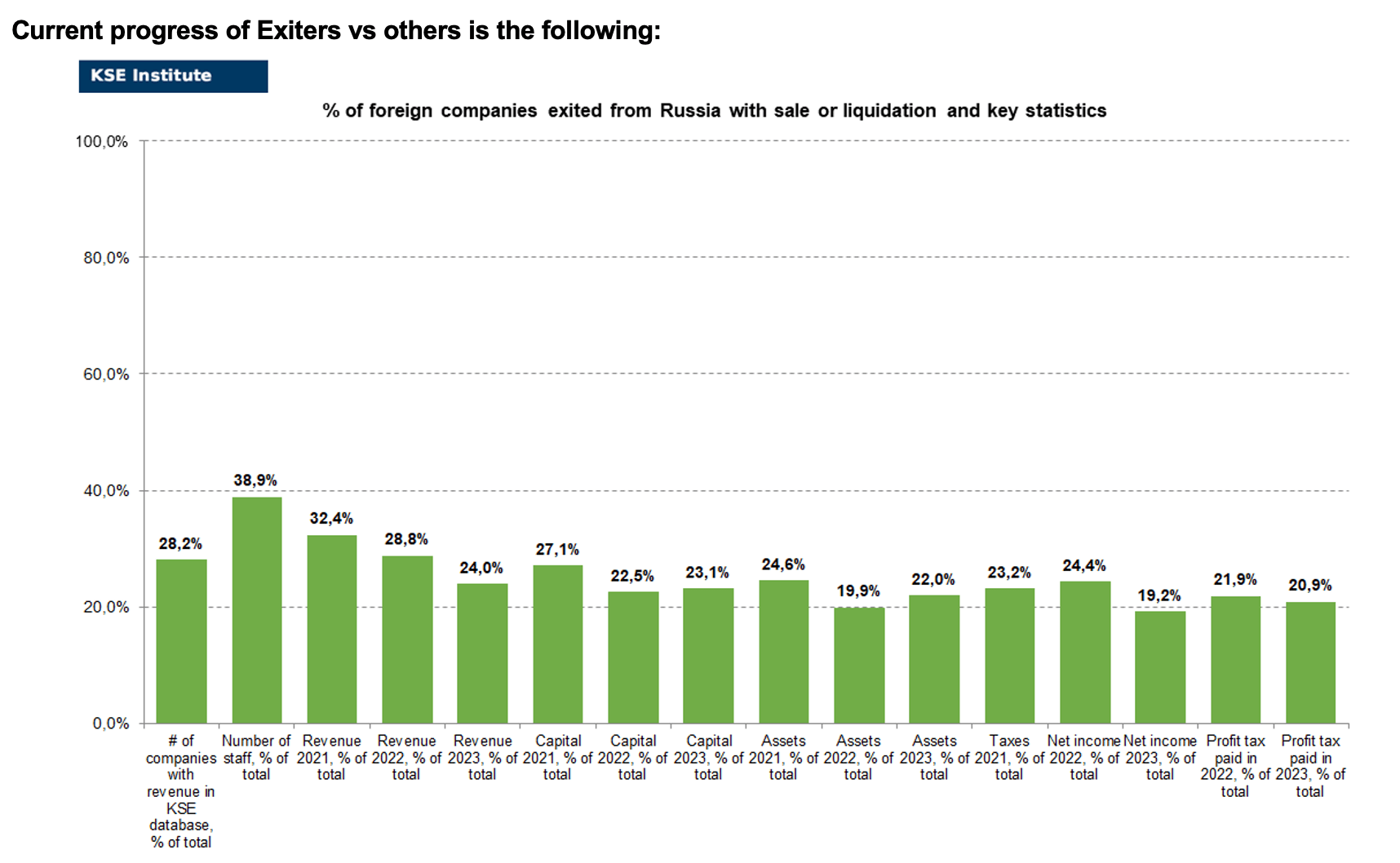

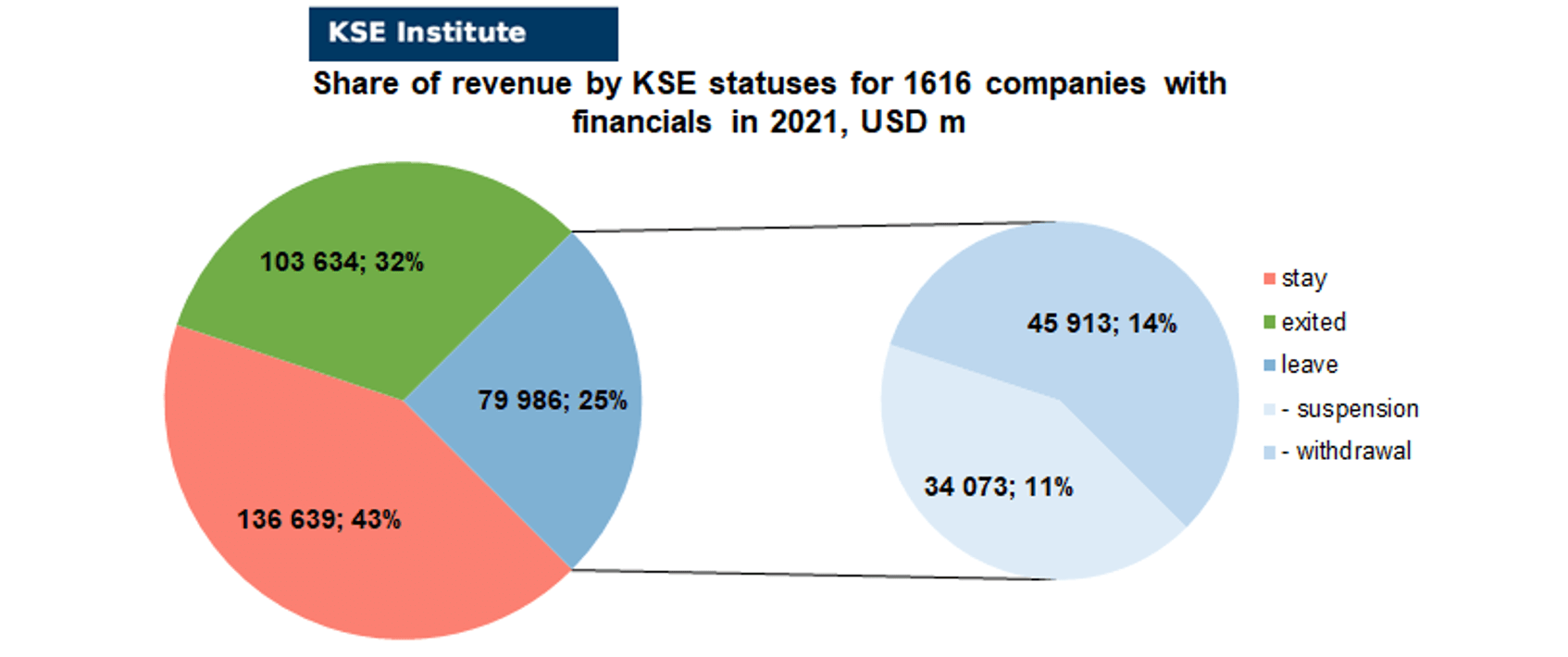

As can be seen from the tables below, as of November 6, 2024, 440 companies which had already completely exited from the Russian Federation, in 2021 had at least 564,400 personnel, $103.6 bn in annual revenue, $52.6bn in capital and $84.4bn in assets; companies, that declared a complete withdrawal from Russia had 222,700 personnel, $45.9bn in revenues, $20.3bn in capital and $45.7bn in assets; companies that suspended operations on the Russian market had 120,600 personnel, annual revenue of $34.1bn, $41.3bn in capital and $102.0bn in assets.

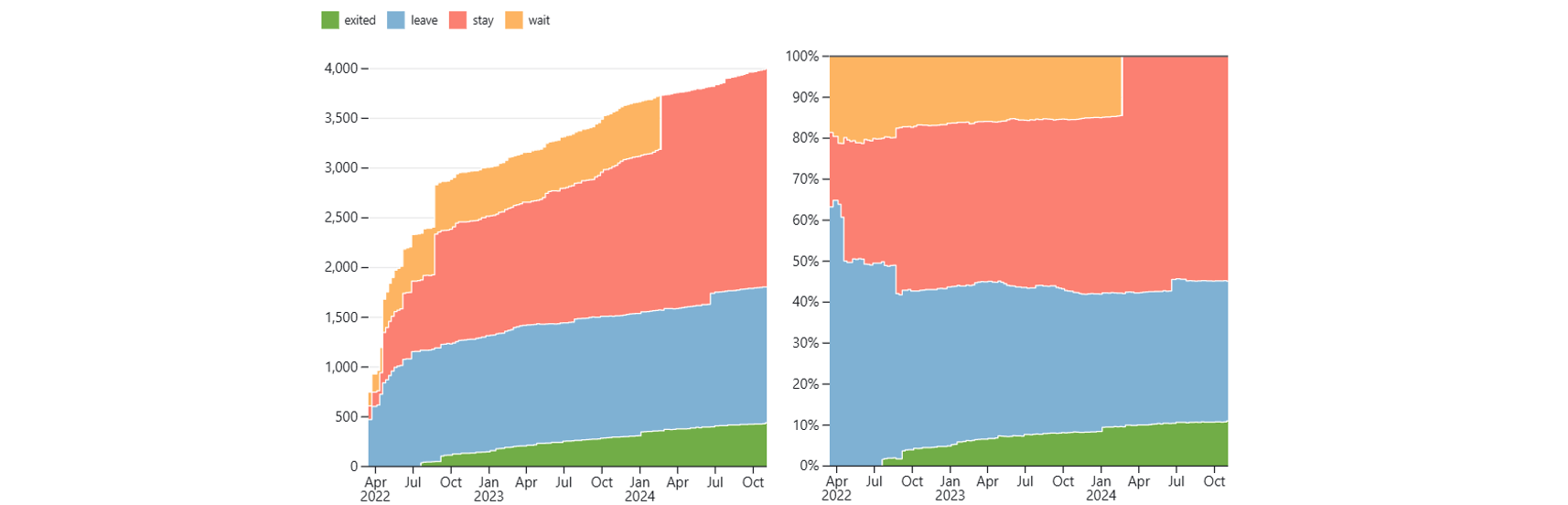

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 26 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 34 were added in October 2024). However, if to operate with the total numbers in KSE database, about 34.1% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 54.9% are still remaining in the country and only 11.0% made a complete exit.⁴

At the same time, it is difficult not to overestimate the impact on the Russian economy of 440 companies that completely left the country, since in 2021 they employed 38.9% of the personnel employed in foreign companies, the companies owned about 24.6% of the assets, had 27.1% of capital invested by foreign companies, and in 2021 they generated revenue of $103.6 billion or 32.4% of total revenue and paid ~$5.9 billion of taxes or 23.2% of total taxes paid by the companies observed. Data on 1,616 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (27%) and on share of revenue withdrawn (32.4%). At the same time, a bit different picture is for those who are still staying – 47% of companies represent 42.7% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit). Also, migration of statuses in June 2024 made its effect as well as adding quite a lot of new companies in July 2024.

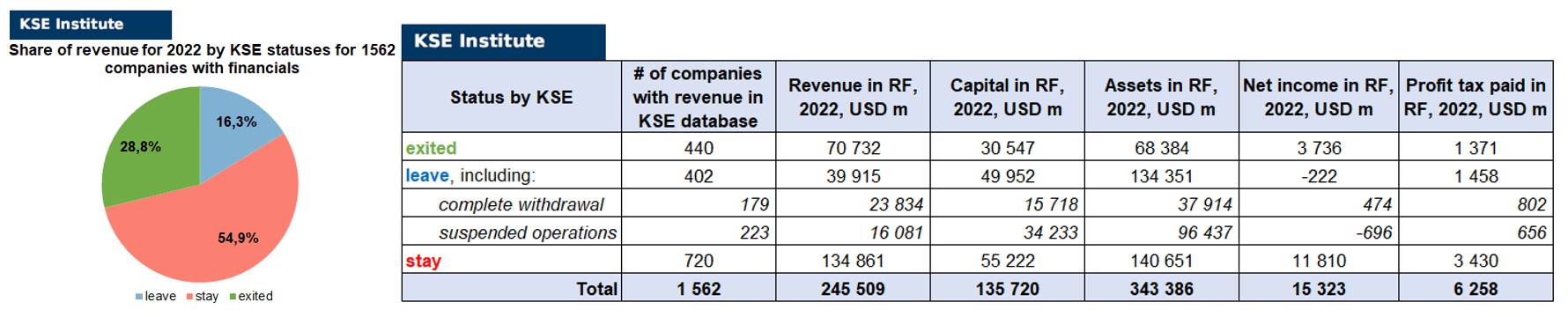

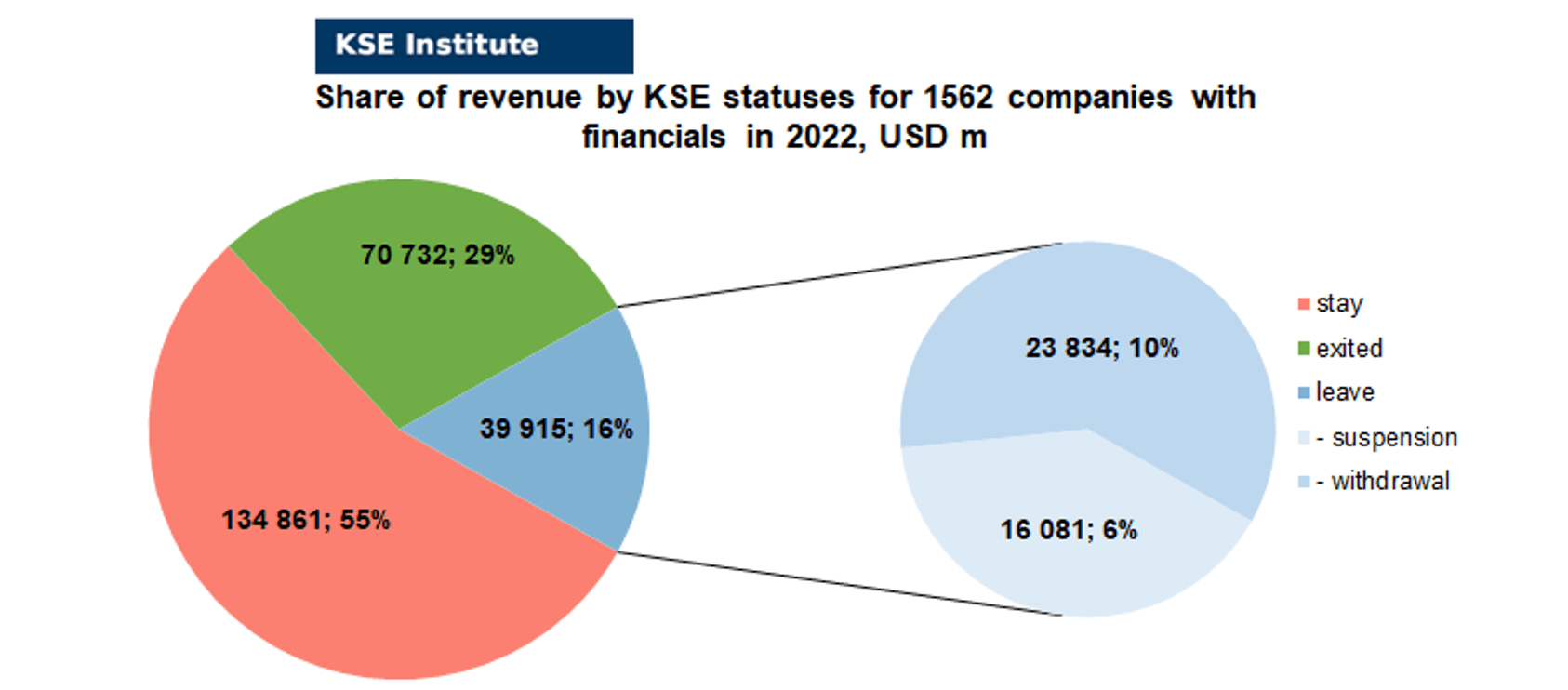

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1562 companies (about 50 companies the data of which we have collected previously have not provided their reporting, we also added revenue data for about 30 banks) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 3.6% less of revenue in 2022 (28.8% from total volume) than in 2021 (32.4% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-8.7%) revenue in 2022 (16.3% from total volume) than in 2021 (25.0% from total volume). At the same time, staying companies were able to generate much (+12.2%) more revenue in 2022 (54.9% from total volume) than in 2021 (42.7% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($343.4bn⁵ in 2022 vs $343.8bn in 2021) and would even probably increase if the remaining reporting for ~70-80 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, in September 2024, the KSE Institute published the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

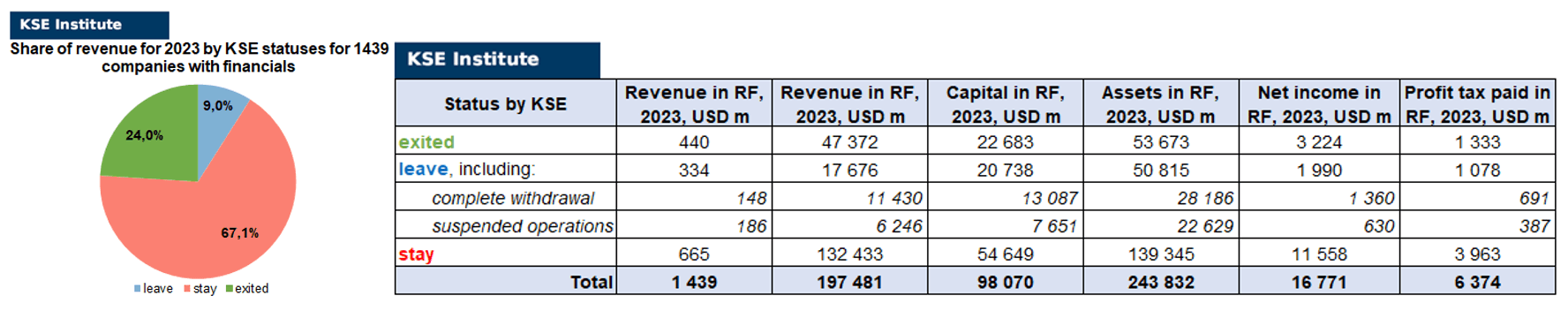

Analysis of data for 2023

KSE Institute has already collected and preliminarily analyzed data on revenue, capital, assets and net income (profit or loss) in 2023 for ~1439 companies (after it was allowed legally in 2023 about 200 companies the data of which we have collected previously have not provided their reporting and also about 260 companies reported 0 values in revenues). Also, it should be noted that as we convert RUB to USD – the devaluation effect was quite significant, Ruble depreciated in 2023 by more than 24%, from 68.4869 RUB/USD in 2022 to 85.163 RUB/USD in 2023). Please see below charts with the detailed analysis:

As you can see, there is a significant redistribution in revenue allocation based on KSE statuses happened in 2023: share of “exited” has dropped by -8.4% vs 2021 and -4.8% vs 2022 (from 32.4% in 2021 and from 28.8% in 2022 to 24.0% in 2023) which is explained by the fact that more and more companies are being liquidated and those one which were sold are usually not able to generate the previous level of revenue.

Share of companies with status “leave” has dropped even more, by -16.0% vs 2021 and -7.3% vs 2022 (from 25.0% in 2021 and from 16.3% in 2022 to 9.0% in 2023) which is explained by the fact that those companies which are leaving are not concentrated in revenue generation on the Russian market anymore.

As for companies with status “stay” – we see the opposite picture there, they are using momentum to take market share of those who are leaving or left (especially in automotive sector) and are generating comparable with previous years level of revenue: +24.4% vs 2021 and +12.2% vs 2022 (from 42.7% in 2021 and from 54.9% in 2022 to 67.1% in 2023).

MONTHLY FOCUS: On leaving the Russian Federation. Results of October 2024

In this digest, we will summarize the results of October 2024 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’616 companies identified in the KSE database with revenue data available of more than $320.3 billion in 2021 and $245.5 billion in 2022 (which dropped to ~$197.5 billion in 2023). And at least 440 of them have already been sold by local companies or were liquidated and left the Russian market. In October 2024 KSE Institute identified +13 new exits (in reality +11 as one exit, Lindström Group, was missed earlier and we decided to mark Fortum as “exited” as it was seized before and there is lack of company’s possibility to get back their assets in Russia. Also, 7 business sales and 4 liquidations took place in October 2024), total number of exits observed since the beginning of Russia’s invasion reached 440. Companies which moved to status “exited” in October 2024 generated $2.7 billion of revenues in 2021 so it’s quite a significant hit on the Russian economy this time.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 32% based on revenue allocation, those who are leaving represent 25% of total revenue (with 43% share of suspensions and 57% of withdrawals sub-statuses), % of staying companies represent 43% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is less than % of leaving ones (which means that about 57% (!) of pre-invasion revenue generated by foreigners is leaving or already left Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 29% based on revenue allocation, those who are leaving represent only 16% of total revenue (with 40% share of suspensions and 60% of withdrawals sub-statuses), % of staying companies represent 55% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022-2023 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

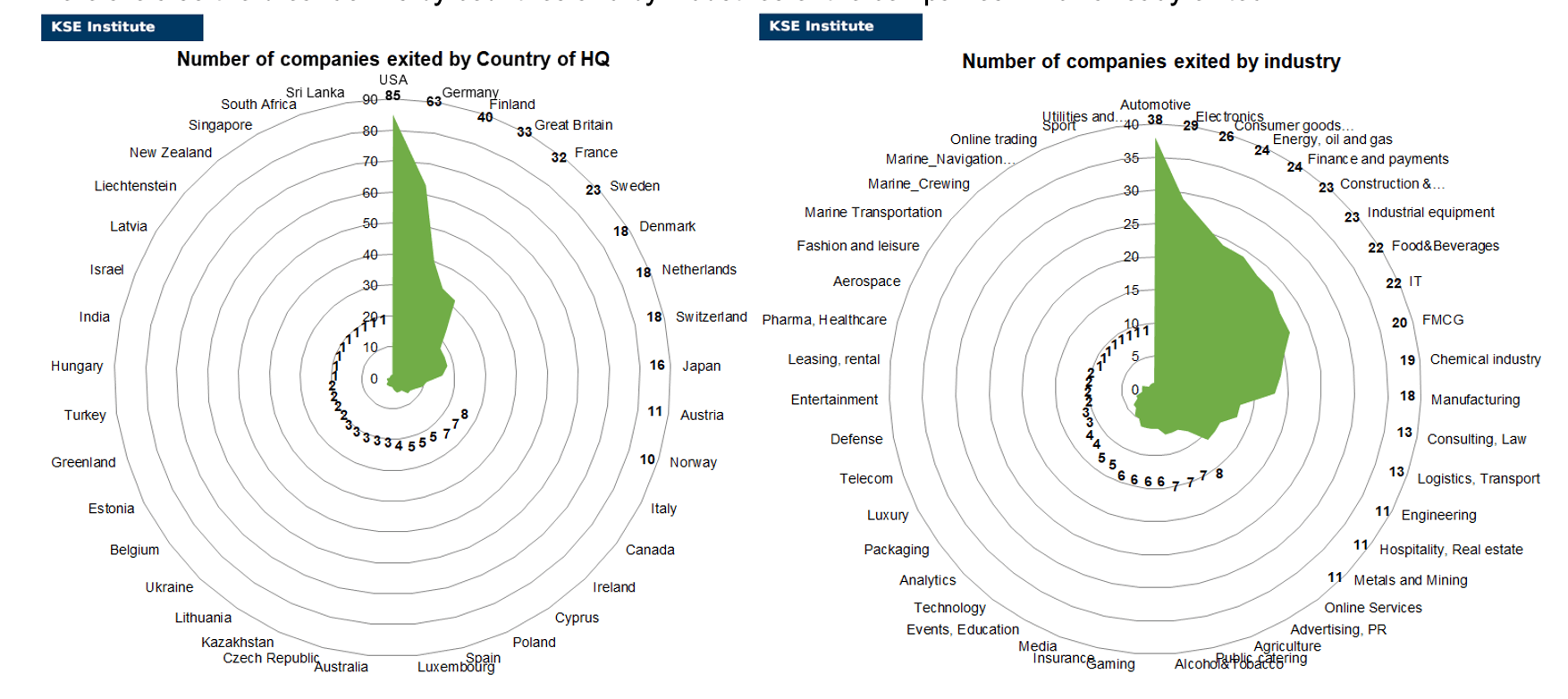

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of October 2024, companies from 37 countries and 43 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain, France and Sweden and operated in the “Automotive”, “Electronics”, “Consumer goods and closing”, “Energy, oil and gas”, “Finance and payments”, “Construction & Architecture” and “Industrial equipment” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Abloy LLC (liquidation), Ishida (liquidation), Kongsberg Maritime (liquidation), Moncler (liquidation) and Lindström Group (sale was missed earlier) and we decided to mark Fortum as “exited” as it was seized before and there is lack of company’s possibility to get back their assets in Russia. Also, 7 business sales took place in October 2024: A.Raymond Group, ANAS, Benteler International, GRAITEC, Magneti Marelli, Unilever and UNIQA.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: Sony Mobile Communications (Sony has filed an application to liquidate a Russian legal entity. At the end of 2023, the company had only one employee – the CEO, Belarusian citizen Anatoly Mashkov. The organization had already tried to liquidate itself in December 2023, but was denied), Universal Beverage (The holding company Glavprodukt, which belongs to the American Universal Beverage and produces canned goods, including stewed meat, is being transferred to the temporary management of the Federal Property Management Agency by decree of the Russian president. This is another case of the de facto nationalization of a private company) and Fraport (Orbit Aviation LCC is allowed to acquire 25% of the German Fraport AG in the authorized capital of the management company of Pulkovo Airport. The order to this effect was signed by President Vladimir Putin on October 25, 2024).

The next review of deals for November 2024 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a monthly basis) ⁷

01.10.2024

*Nukem Technologies (Germany, Energy, oil and gas) Status by KSE – leave

Germany based radioactive waste management and nuclear decommissioning company Nukem Technologies Engineering Services has been acquired by Tokyo-based IT company Muroosystems, marking a new chapter free from Russian ownership.

https://www.nucnet.org/news/german-company-begins-new-chapter-free-from-russian-ownership-9-1-2024

02.10.2024

*BNY Mellon (USA, Finance and payments) Status by KSE – stay

*JPMorgan (USA, Finance and payments) Status by KSE – stay

The Prosecutor General’s Office wants to recover damages from Ukraine for the expropriation of a Sberbank subsidiary

*Odgers Berndtson (Great Britain, Consulting, Law) Status by KSE – leave

Executive search specialist Odgers Berndtson has rebranded itself in Russia as The Edgers. Having separated from its global “mother,” the company will expand its range of services and actively expand abroad

https://www.rbc.ru/technology_and_media/01/10/2024/66fad1d39a7947ba68b39001?from=newsfeed

03.10.2024

*ABBYY (USA, IT) Status by KSE – leave

ABBYY has fired almost all key developers of Vantage 3.0 ahead of its release, according to a company source

*Silicon Labs (USA, Electronics) Status by KSE – stay

*Analog Devices (USA, Electronics) Status by KSE – stay

*Infineon (Germany, Electronics) Status by KSE – exited

RUSSIAN MISSILES, AMERICAN CHIPS

https://www.bloomberg.com/features/2024-russian-missiles-us-tech-ukraine/

*Wintershall Dea AG (Germany, Energy, oil and gas) Status by KSE – exited

One of Gazprom’s former key partners in Europe, Wintershall Dea, has initiated two arbitration proceedings against Russia, citing expropriation of assets.

04.10.2024

*UNIQA (Austria, Insurance) Status by KSE – exited

The Austrian insurance group UNIQA has completed the sale of its Russian subsidiary Raiffeisen Life to the Russian insurer Renaissance Life, fully exiting the Russian market. The insurance company announced this on Friday, October 4, 2024.

https://interfax.com/newsroom/top-stories/106303/

*UzAuto Trailer (Uzbekistan, Automotive) Status by KSE – stay

UzAuto Trailer, a semi-trailer manufacturer from Uzbekistan and controlled by the government of Tatarstan, may organize production in the Russian Federation.

https://www.kommersant.ru/doc/7199276

*Keysight Technologies (USA, IT) Status by KSE – stay

*Rohde & Schwarz (Germany, Technology) Status by KSE – leave

*AnaPico (Switzerland, Electronics) Status by KSE – stay

A stunning success. High-precision electronic warfare equipment is coming to Russia from the West despite sanctions

https://theins.ru/politika/274992

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Number of contenders for Raiffeisenbank reduced to two

05.10.2024

*Bank of Cyprus (Cyprus, Finance and payments) Status by KSE – exited

According to the Bank of Cyprus, the country’s largest bank, since February 2022, it has closed more than 20,000 accounts belonging to about 7,000 Russians.

06.10.2024

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

The Prosecutor General’s Office filed a lawsuit against Shell

https://www.rbc.ru/business/04/10/2024/66ff91bf9a7947fb84b7c9c0

07.10.2024

*Discord (USA, IT) Status by KSE – leave

Roskomnadzor (RKN) has blocked the Discord platform in Russia for violating legal requirements.

https://tass.ru/ekonomika/22073811

https://mil.in.ua/uk/news/u-rf-zablokuvaly-discord-yakyj-takozh-vykorystovuvaly-rosijski-vijskovi/

09.10.2024

*Oversea-Chinese Banking Corp (OCBC) (Singapore, Finance and payments) Status by KSE – leave

Oversea-Chinese Banking Corp (OCBC) will stop handling any transactions involving Russia as it moves to cut exposure to the nation hit with global sanctions.

10.10.2024

*Wikimedia Foundation Inc. (USA, Online Services) Status by KSE – leave

Wikipedia shuts down in Russia: Teaches you how to grow hashish

https://telegrafi.com/en/mbyllet-wikipedia-ne-rusi-te-meson-si-te-kultivosh-hashash/

*Unilever (Great Britain, FMCG) Status by KSE – leave

The British conglomerate Unilever, which produces household chemicals and food products, announced its exit from the Russian market. “Today, Unilever completed the sale of its Russian subsidiary, Arnest Group, to a Russian manufacturer of perfumes, cosmetics and household goods,” Schumacher noted.

https://www.epravda.com.ua/news/2024/10/10/720406/

https://www.unilever.com/news/press-and-media/press-releases/2024/unilever-statement-oct-2024/

*CERN (European Organization for Nuclear Research) (Switzerland, Energy, oil and gas) Status by KSE – leave

The European Organization for Nuclear Research (CERN) will end cooperation with up to 500 scientists affiliated with Russian institutions, it said on Sept. 30, because of Russia’s invasion of Ukraine.

https://japannews.yomiuri.co.jp/science-nature/science/20241009-215783/

11.10.2024

*MVM CEEnergy Zrt. (Hungary, Energy, oil and gas) Status by KSE – stay

On October 10, the Hungarian state energy company MVM and Gazprom signed an agreement on continued cooperation in the energy sector

https://www.pravda.com.ua/eng/news/2024/10/10/7479119/

*Fortum (Finland, Energy, oil and gas) Status by KSE – leave

*Vestas (Denmark, Energy, oil and gas) Status by KSE – exited

Vestas and Fortum settle dispute over Russian wind projects

https://esdnews.com.au/vestas-and-fortum-settle-dispute-over-russian-wind-projects/

*Chery Automobile (China, Automotive) Status by KSE – stay

China’s Chery assembles cars in Russian plants vacated by Western rivals

*Kazakhstan Stock Exchange (Kazakhstan, Finance and payments) Status by KSE – stay

PJSC Moscow Exchange withdrew from the shareholders of the Kazakhstan Stock Exchange (KASE)

https://www.interfax.ru/business/986322

*Litasco (Switzerland, Energy, oil and gas) Status by KSE – stay

*Eiger Shipping DMCC (United Arab Emirates, Marine Transportation) Status by KSE – stay

Lukoil has added 25 old tankers to its shadow fleet.

https://www.blackseanews.net/read/222960

*Steam (USA, Gaming) Status by KSE – stay

Roskomnadzor currently does not plan to introduce any restrictions regarding the Steam gaming platform

12.10.2024

*Vollmer (Germany, Industrial equipment) Status by KSE – stay

*Walter Maschinenbau (Germany, Industrial equipment) Status by KSE – stay

*Fein GmbH (Germany, Industrial equipment) Status by KSE – stay

*Heller (Germany, Industrial equipment) Status by KSE – stay

German cars for the Russian army

https://www.tagesschau.de/investigativ/swr/embargo-russland-maschinen-100.html

*Sony Mobile Communications (Sweden, Electronics) Status by KSE – leave

The company “Sony Mobile Communications Rus” – the Russian division of Sony Mobile Communications – has filed an application for self-liquidation, according to the database of the Federal Tax Service of Russia. Sony Mobile Communications, which operates in the field of portable electronics, is a subsidiary of Sony.

14.10.2024

*Coral Energy DMCC (United Arab Emirates, Energy, oil and gas) Status by KSE – stay

Dubai traders Coral Energy and Demex in Washington’s sights over sale of Russian oil

*Xiaomi (China, Electronics) Status by KSE – stay

Xiaomi has become the leader in Russia in terms of tablet sales in physical terms in nine months, displacing Samsung

14.09.2024

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

Citibank closes its last branch in Russia

15.10.2024

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

The Russian Prosecutor General’s Office has demanded €1 billion in damages from Shell

16.10.2024

*Steam (USA, Gaming) Status by KSE – stay

The Russian state media regulator Roskomnadzor, stating that the popular video platform Steam has decided to remove all restricted content from its Russian store

*Universal Beverage (USA, Food & Beverages) Status by KSE – leave

The Glavprodukt holding company, which is owned by the American Universal Beverage and produces canned goods, including stewed meat, is being transferred to the temporary management of the Federal Property Management Agency by decree of the Russian President.

https://www.kommersant.ru/doc/7232121

*FATF (France, Association, NGO) Status by KSE – stay

Global money laundering body to consider blacklisting Russia

https://www.politico.eu/article/money-laundering-blacklist-russia-fatf-ukraine-weapons/

17.10.2024

*Passenger Drone Research Ltd. (PDRL) (India, Defense) Status by KSE – stay

PDRL, a leading innovator in drone technology, signed a Memorandum of Understanding (MoU) with Russia’s top-tier software powerhouse, Stratus LLC, specializing in unmanned aviation technology.

18.10.2024

*Matias Ship Management (United Arab Emirates, Marine Transportation) Status by KSE – stay

Russia Adds LNG Shadow Fleet Tankers With New Dubai-Based Firm

20.10.2024

*Nebius Group NV (Netherlands, IT) Status by KSE – leave

Nebius to resume Nasdaq trading after severing ties with Russia and Yandex

21.10.2024

*Apple (USA, Electronics) Status by KSE – leave

The volume of government purchases of iPhones in Russia has increased dramatically

*ExxonMobil (USA, Energy, oil and gas) Status by KSE – exited

American oil company that left Russia starts litigation over brand

https://www.kommersant.ru/doc/7247356

*A.Raymond Group (France, Automotive) Status by KSE – exited

French automobile components manufacturer A.Raymond Group has sold its Russian business to the holding company Cordiant, according to the Unified State Register of Legal Entities.

22.10.2024

*YouTube (USA, Online Services) Status by KSE – stay

Russians Find Record Anxiety Over YouTube Slowdown

*Schlumberger (SLB) (USA, Energy, oil and gas) Status by KSE – stay

The US Congress demands stronger sanctions against the oil service industry of the Russian Federation, because one of the American companies continues deliveries to Russia

https://www.ukr.net/news/details/politics/107446279.html

*Oracle (USA, IT) Status by KSE – exited

Only ₽83 million has been found for Oracle’s subsidiary creditors in Russia

https://www.rbc.ru/technology_and_media/22/10/2024/67165f4d9a79473d81933b7d

23.10.2024

*Deutsche Bank (Germany, Finance and payments) Status by KSE – leave

Russian court injuncts Deutsche Bank’s ICC claim against Gazprom venture

*United Nations (UN) (USA, Association, NGO) Status by KSE – stay

UN Secretary-General Antonio Guterres arrived in Kazan, Russia, on an unannounced visit on the first day of the three-day BRICS summit.

https://www.pravda.com.ua/eng/news/2024/10/23/7480922/

*Fortum (Finland, Energy, oil and gas) Status by KSE – leave

The Finnish energy company Fortum filed a lawsuit in a civil court in the Netherlands against the Russian PJSC “Forward Energo” (formerly PJSC “Fortum”).

24.10.2024

*Tresmontes Lucchetti (Chile, Food&Beverages) Status by KSE – stay

Moscow court returns rights to Zuko and Yupi beverage brands to Chilean company

https://www.kommersant.ru/doc/7249200

*Hugo Boss (Germany, Luxury) Status by KSE – exited

*Brunello Cucinelli (Italy, Consumer goods and clothing) Status by KSE – stay

*Paul Smith (Great Britain, Consumer goods and clothing) Status by KSE – stay

What Russian boycott? How a Mail investigation discovered British brands from Barbour to Burberry, Mothercare, Rolls-Royce and Land Rover are still being sold in Russia

*FATF (France, Association, NGO) Status by KSE – stay

On October 22, the International Anti-Money Laundering Group (FATF) once again failed to include Russia in the “black” list

https://www.epravda.com.ua/news/2024/10/23/720949/

*Auchan (France, FMCG) Status by KSE – stay

Auchan is preparing to sell its daughter in Russia

https://www.epravda.com.ua/news/2024/10/24/720984/

https://www.lefigaro.fr/societes/auchan-met-en-vente-sa-filiale-en-russie-20241024

25.10.2024

*Anheuser-Busch (Belgium, Alcohol&Tobacco) Status by KSE – leave

*Anadolu Efes (Turkey, Alcohol&Tobacco) Status by KSE – stay

Anheuser-Busch InBev revises Russia exit transaction

https://drinks-intel.com/beer/anheuser-busch-inbev-revises-russia-exit-transaction/

*Haval Motor (China, Automotive) Status by KSE – stay

Chinese automaker expands plant near Tula

26.10.2024

*DP World (United Arab Emirates, Logistics, Transport) Status by KSE – stay

The government is facing calls to cease trading with DP World because of its partnership with Putin’s northern sea route

https://www.theguardian.com/business/2024/oct/26/p-and-o-ferries-owner-dp-world-russia-links

*Fraport (Germany, Air transportation) Status by KSE – leave

Orbit Aviation LCC is allowed to acquire 25% of the German Fraport AG in the authorized capital of the management company of Pulkovo Airport. The order to this effect was signed by President Vladimir Putin on October 25, 2024.

https://www.kommersant.ru/doc/7263977

https://tass.ru/ekonomika/22230113

*UniCredit Bank (Italy, Finance and payments) Status by KSE – leave

Subsidiaries of foreign banks diverge in profits and losses

27.10.2024

*Great Wall Motor Co. (China, Automotive) Status by KSE – stay

Great Wall Motors Boosts Production in Russia Amid Expanding Market

*Don Agro International Limited (Singapore, Agriculture) Status by KSE – stay

Don Agro Secures Strategic Loan with Russian Firm

https://www.tipranks.com/news/company-announcements/don-agro-secures-strategic-loan-with-russian-firm

28.10.2024

*Total Energies (France, Energy, oil and gas) Status by KSE – exited

The owner of GEM Invest, Vladimir Paliy, invested in the former oil plant of the French TotalEnergies and could have become the owner of this asset

https://www.kommersant.ru/doc/7264946

*Ericsson (Sweden, Telecom) Status by KSE – leave

Court overturns Ericsson brand protection in Russia following lawsuit by air conditioner manufacturer

https://www.kommersant.ru/doc/7264959

*The World Bank (USA, Finance and payments) Status by KSE – leave

Russia will start representing Belarus’ interests in the World Bank (WB) next month.

29.10.2024

*Google (USA, Online Services) Status by KSE – exited

Russian TV channels’ demands to Google reach ₽2 undecillion

https://www.rbc.ru/technology_and_media/29/10/2024/671fd2389a794726b01d3af3

*Shreya (India, Pharma, Healthcare) Status by KSE – stay

How a Mumbai Drugmaker Is Helping Putin Get Nvidia AI Chips

30.10.2024

*Rheinmetall (Germany, Defense) Status by KSE – leave

German Rheinmetall plant in Ukraine is ‘legitimate’ target for Russia, Kremlin says

*TAL (Italy, Energy, oil and gas) Status by KSE – leave

TAL pipeline expansion nears finish, offering Czech Republic a future free of Russian oil

*MOLGroup (Hungary, Energy, oil and gas) Status by KSE – stay

Hungary and Slovakia Restore Russian Oil Supplies via Ukraine

https://www.kommersant.ru/doc/7266597

*Auchan (France, FMCG) Status by KSE – stay

Auchan filed an application to register a new trademark

https://www.kommersant.ru/doc/7266346

31.10.2024

*Google (USA, Online Services) Status by KSE – exited

Kremlin confirms plans to sue Google for more than the size of the global economy

*MOLGroup (Hungary, Energy, oil and gas) Status by KSE – stay

MOL set to renegotiate Russian gas vessel charters and may resell ships as sanctions bite

*Euroclear (Belgium, Finance and payments) Status by KSE – stay

At the end of September, the international depository Euroclear held Russian assets worth €176 billion

31.10.2024

*Google (USA, Online Services) Status by KSE – exited

Kremlin confirms plans to sue Google for more than the size of the global economy

*MOLGroup (Hungary, Energy, oil and gas) Status by KSE – stay

MOL set to renegotiate Russian gas vessel charters and may resell ships as sanctions bite

*Euroclear (Belgium, Finance and payments) Status by KSE – stay

At the end of September, the international depository Euroclear held Russian assets worth €176 billion

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

In September 2024, the KSE Institute published the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP“. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² In June 2024 KSE Institute reviewed statuses of companies based on new revenue data for 2023, about 100 companies moved from status “stay” to status “leave” due to significant drop of revenue (60%+), usually the same trend took place in 2022 as well

³ When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

⁴ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁶ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website